Unit 5.4 - Improving Cash Flow and Profits

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Payables

the amount of time taken by a business to pay its suppliers and other creditors i.e a supplier may give trade credit of 50 days

Receivables

the amount of time taken by debtors (businesses customers) to pay for the products that has been supplied i.e a business may offer trade credit to a customer of 50 days

Current assets

Assets that companies expect to convert to cash or use within one year.

Non-current assets

Items owned by the business for more than one year

Current liabilities

Debts that a business will have to pay back within a year

Non-current liabilities

Debts a business pay back for more than a year

Balance sheet

Financial statement recording the assets and liabilities of a business on a particular day at the end of an accounting period (a snapshot). May also be called a statement of financial position

Main features on a balance sheet (in order typical order)

Non-current assets

Current assets

Current liabilities

working capital

non-current liabilities

net assets

total equity

can also calculate capital employed by adding total equity and non-current liabilities

Working capital

current assets - current liabilities (sometimes called net current assets)

net assets

total assets - total liabilities

capital employed

Total equity + non current liabilities

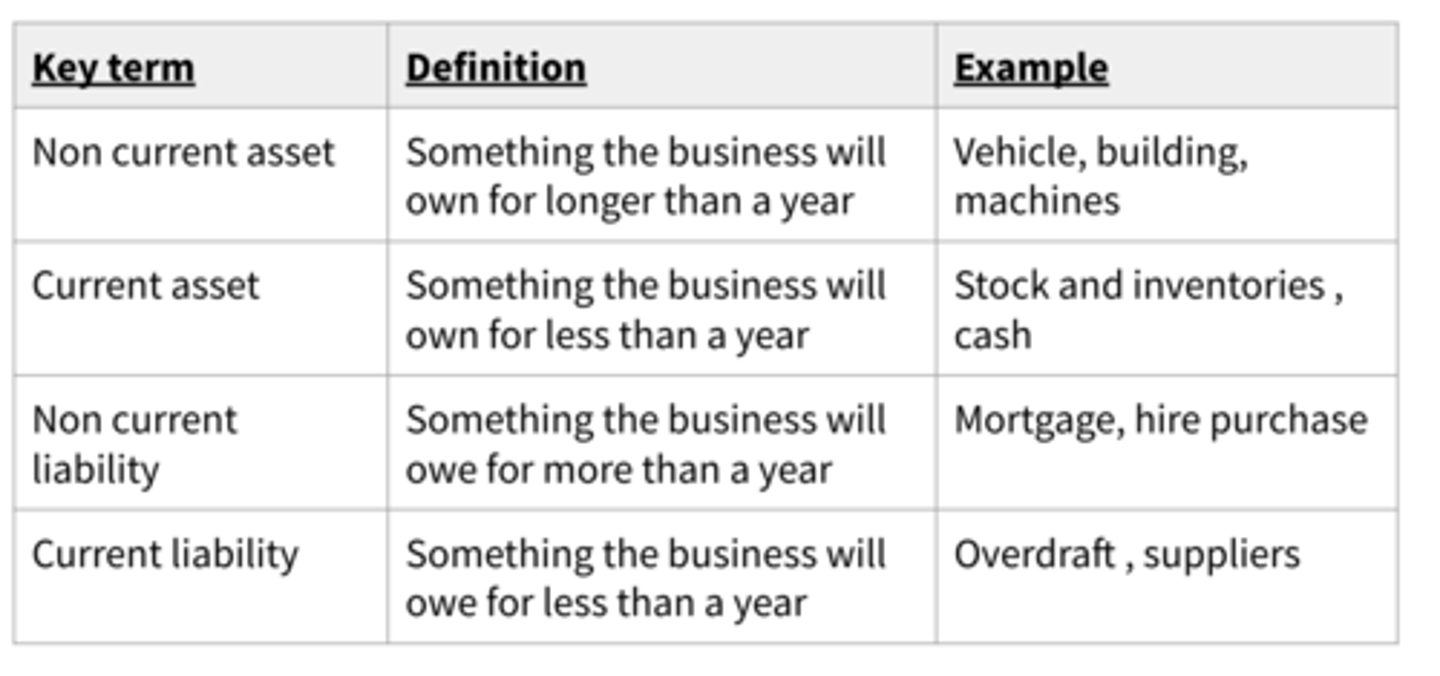

Different types of assets and liabilities (table)

Causes of cash flow issues

Overtrading - business expands quickly without organising funds to finance the expansion

Allowing too much trade credit

Poor credit control - getting customers to pay on time

Inaccurate cash flow forecasting

Trade credit

Periods of time given by suppliers before being paid for the good or service provided

Methods to improve cash flow

Bank overdraft

Debt factoring

Sale and lease back

Leasing non current assets

Improved working capital

Bank overdraft to improve cash flow

- Allows a business to overdraw its current account

- A negative bank balance is held

- A cash flow forecast is needed to support the request, to prove the cash flow problem isn't permanent

- Usually a low rate of interest, if anything at all

- Allows a business to spend money even with no cash so can pay suppliers, employee etc

debt factoring to improve cash flow

Coverts the value of receivables into immediate cash

The receipt of cash helps a business to survive

Sale and lease back to improve cash flow

Selling assets, injection of cash

The business then rents it back i.e a building

Gives flexibility to the business

Leasing non-current assets to improve cash flow

Kept longer than a year

Renting instead of buying i.e vehicles

No large outflow of cash

Four ways to improve working capital

Cash management

Debt management

Inventory management

Management of payables

Importance of working capital

Needed to fund the day-to-day finance available for

running a business. If there is not enough cash for the

business then it may not be able to pay its bills on time.

pay for raw materials and running costs.

•

Working capital is also needed to fund the credit

offered to customers (debtors) when making a

sale. Customers may go to a competitor if a business

cannot offer credit.

•

If a business has too little working capital it may

struggle to finance increased production without

straining its liquidity position.

Improving working capital - cash management

- Agree an overdraft with the bank

- Set aside a contingency fund to allow the company to meet unexpected payments or cope with a loss of income

- Retain profits as reserves

Improving working capital - debt management

Largely managing receivables/trade credit a business must decide whether to offer credit to customers - it may consider

- Obtaining a credit rating - testify to ability to pay

- Controlling product quality - more likely to pay if they are happy

- Scrutinising the offer of credit - costs do not outweigh the profit gained

- Managing credit control - monitor and chase customers

Why businesses offer credit to customers

Giving customers credit encourages them to buy products (helps profits)

However this adds to short term cash flow issues

This is because wages and materials have to be paid before cash is received

Must evaluate the benefits (more sales and profit) against the risks (late or non payment)

Offering credit makes a business more competitive -its depend on the product

Improving working capital - inventory management

Operating JIT systems is more efficient and reduce holding costs, overall having efficient inventory management reduces the level of working capital required within a business

Improving working capital - managing payables

- Get extended credit from suppliers

- Moving payment dates to avoid times of significant outflows

- Balancing payables and receivables to ensure inflows occur before outflows

Benefits of effective cash flow management

- Avoid being unable to find day to day operations, which could lead to employees leaving if they go unpaid

- ensure production is not halted

- Reduce borrowing costs as if managed well borrowing can be minimised

- Good relations with suppliers as they will be paid on time

- Public relation, customers will be confident of the businesses ability to continue supplying goods

Difficulties with improving cash flow

- Seasonal demand and supply

- Overtrading can happen quickly as it will be when the business is in a period of success

- Over investment in long term assets

- Unforeseen changes i.e Machinery breaking down (internal) or new H+S laws (external)

- Losses or low profits will lead to lower cash also Creditors/investors may be reluctant to put money into a business that isn't expected to make profit

Profitability

A measure of financial performance that compares a business's profits to some other factors such as revenue

Profits

Revenue - total costs

Methods of improving profits and profitability

Increase the price - decreasing costs - increasing sales volume

Increasing prices to improve profits and profitability

Works only when a product has price elasticity of demand that is inelastic

Reducing costs to improve profits and profitability

Variable:

- Raw material cost through different suppliers

- Any variable wages by cutting working hours

- Improve production efficiency reducing errors and defects

- Cut products that are low margin (i.e dog products)

- Improve labour productivity reducing unit costs

Fixed:

- Reduce wage bill with redundancies or lowering wages

- Use full capacity therefore spreading fixed costs

- Change location to cheaper site

- Reduce marketing budget i.e less advertising

- Shut down stores or operations in less successful areas

Increasing sales volume to improve profits

Any methods that lead to customer buying more:

- Create a new tv advert

- Promotion i.e tasters

- Accessories to products

- Define a USP

- Reduce price if demand is elastic

- HR to improve training or motivation of staff

- Product development

Internal issues when trying to improve profits and profitability

- Changing the price - difficult to predict, depends on elasticity

- Decreasing costs:

Reducing wages - impact on morale

Cutting raw material costs - loss in quality

Cutting marketing budget - lower sales

- Increasing sales volume - requires good quality products and effective coordination, could increase costs

- Changing production can lead to the need to invest in technology or upsetting labour causing higher costs and worse productivity

External issues when trying to improve profits and profitability

PESTLE-C - could include:

Competition - price war could lead to less revenue for all

Market conditions - with less competition comes regulation issues (competition and markets authority) (CMA)

Consumer incomes - less likely to increase sales

Interest rates - high interest rates could reduce sales when using credit (especially relevant at the moment 2023)

Demographic factors - changes in population can alter demand patterns

Environmental issues - can lead to greater costs