Economics Ch 5 - Market Failure Yr 11 ATAR

1/104

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

105 Terms

What is market failure?

A situation when freely functioning markets, operating without government intervention, fail to deliver an efficient or optimal allocation of resources (surplus isn’t maximised).

How is market failure measured?

. market failure results in an inefficient allocation of resources in market = measured as DWL

—> greater the over/under production/consumption = the larger the DWL

Results of market failure in general

. economic and social welfare will not be maximised = loss of economic efficiency

—> leads to gov intervention to improve the market outcomes, and thus improving economic surplus

When annotating diagrams showing market failure, what MUST you clearly identify?

. the over/under production and/or consumption

. the DWL that results

Causes of market failure 1

Resulting from the characteristics/structure of the market:

—> uncompetitive markets

. monopolies

. duopolies

. oligopolies

Causes of market failure 2

Resulting from the characteristics of the product itself:

—> unpriced externalities

. positive externalities

. negative externalities

. underproduction of public goods

. overconsumption of common property goods

Describe the 9 types of market failure - PIMM FACED

Public good: goods which are non-rival + non-excludable (police, national defence)

Inequality: unfair distribution of resources in free market

Monopoly: a firm dominates market + can set higher prices

Merit good: people underestimate the benefit of good (education)

Factor Immobility: occurs when a factor of production cannot move easily from one region of an economy to another (geographical unemployment where people find it difficult to move to areas of jobs)

Agriculture: volatile prices, fluctuating weather and externalities

Cyclical instability: macroeconomy enters recession or experiences inflationary boom

Externalities: when consuming or producing a good causes a cost/benefit to a 3rd party

Demerit good: people underestimate the costs of a good (smoking)

Describe how a government can respond to market failure and the risks associated with this

. gov can use a variety of approaches to correct market failure —> can deal with the underlying causes or try to correct the symptoms (DWL)

. risk: gov intervention creates more problems than it solves due to:

—> cost of enforcing the intervention (costs may outweigh benefits)

—> DWL resulting from intervention (if intervention overcorrects + ends up creating more DWL)

—> other unintended side effects (creation of black markets)

. often these responses are things that in a properly functioning market, would result in DWL (taxes, subsidies)

. if used correctly in markets experiencing market failure, these same interventions can eliminate DWL

Market Power

. ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit

Outline when imperfect markets exist?

. relatively small number of firms

. firms have market power

. firms use product differentiation

. barriers to entry are used to restrict competition

What are the best examples of imperfect competition?

. monopolies and oligopolies

Describe what a monopoly is

. a market structure where a single seller or producer dominates the market, controlling the supply of a particular good or service with no close substitutes

—> are the sole supplier of a product in market

. EG: synergy + Aus post

How can monopolies form?

. the gov grants a company the right to act as a monopoly (eg Aus post)

. generally, the company has intellectual property rights (eg. patent on a certain tech) or a company solely owns a resource

. the gov itself takes over an industry + becomes a monopoly power

. mergers + acquisitions (one bigger company buying out competitors to thus control an industry)

Describe what an oligopoly is

. A market structure with a small number of companies controlling a significant portion of the market

. a few large firms dominate the market

. a small number of relatively large companies produce similar but slightly different goods.

. EG: banks, supermarket, airlines

—> coles + Woolworths dominate grocery market

—> qantas + virgin dominate domestic aviation market

How do monopolies lead to economic inefficiency

. compared with a perfectly competitive industry, monopolies charge a higher price and produce less, which reduces consumer surplus + economic efficiency

What are barriers to entry?

. anything that restricts or blocks the entry of new firms into an industry or market

What are the 7 barriers to entry - PET CCOG

Patent on an invention: eg-on a certain technology meaning other people cannot use or replicate it

Economies of scale: only a few firms can compete because of the large set up (fixed) costs

Technological advantage: eg-microsoft supplying the operating system used in most computers (windows)

Controlling a scarce resource: eg-mining company owning the only diamond mine in the country

Collusive behaviour: when firms agree to share markets or to fix prices or quantities

Other: extensive product differentiation, brand proliferation, large advertising budget, controlling retail outlets

Government licencing granting a legal monopoly: eg- Aus post

Explain the effect of market power on a competitive market

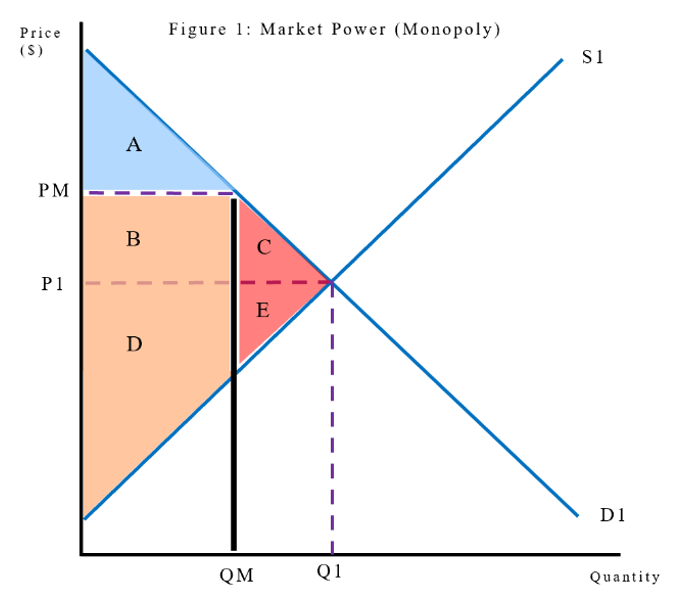

In Figure 1, a free competitive market would be at S1, D1 at equilibrium Q1, P1.

At this point, total surplus is maximised with consumer surplus equal to ABC and producer surplus equal to DE.

If a firm gains market power and becomes a monopoly, quantity is restricted (contracts) from Q1 to QM. This therefore increases price from P1 to PM.

As a result, consumer surplus decreases to A due to consumers paying a higher price for a lower quantity and producer surplus change is indeterminate at BD as though the firm receives a higher price, they are selling a lower quantity.

The idea would be for the restricted quantity, and therefore higher price, to increase PS (profits for producers); however, if not done correctly, it may actually decrease PS due to too little demand (depends on how much output is reduced + resulting price).

As there is underproduction and consumption in the market, DWL (loss of potential total surplus) occurs equal to CE (the market is not operating efficiently and society is worse off).

On a market power diagram, what do you label between Q2 and Q1

. underproduction/consumption

For a market power diagram, describe the changes in equilibrium point, CS, PS, and DWL

initial market:

. P1, Q1

. CS: ABC

. PS: DE

Market Power:

. P2,Q2 (market power restricting output to increase price)

. CS: change from ABC to A

. PS: change from DE to BD

DWL: CE

—> result of underproduction

Why would firms with market power participate in anti-competitive behaviour

. firms with market power have the incentive to reduce competition, either reducing price competition or by reducing the number of firms competing

What is anti competitive behaviour and what impact does this have on competition?

. any agreements or arrangements between firms that seek to restrain competition + thereby remove the automatic regulation that competitive markets achieve

—> competition provides incentive to improve performance, develop new products and respond to changes

—> it promises lower prices + more consumer options

—> agreements between firms means they can collectively act as a monopoly or oligopoly

What are 9 business practices that reduce competition?

Cartel: when firms agree to act or collude together instead of competing with each other (includes both price fixing + market sharing)

Collusion: general term describing agreements between firms (either price or market sharing to reduce competition + increase profits)

Market sharing: a market is divided into a series of smaller markets, each supplied by 1 of the firms, thus reducing competition

Misuse of market power: practices such as refusal to deal, restricting access to an essential input, predatory pricing, margin or price squeezing and tying or bundling

Collusive tendering: firms agree to submit exorbitant tenders which ensure high profits are the sharing of work between the collusive members

Predatory pricing: when a company with substantial market power sets its prices at a sufficiently low level with purpose of eliminating or substantially damaging competitor

Resale price maintenance: if a supplier or manufacturer tries to specify a min price below which products may not be resold or advertised for resale

Exclusive dealing: when 1 firm trading with another imposes some restrictions on other’s freedom to choose with whom or where they deal

Merger: 2 or more firms join together to form 1 larger firm

Describe how Australia attempts to prevent market power

. Aus attempts to prevent market power through the competition and consumer act 2010

. this act is administered by the Aus competition and consumer commission (ACCC)

—> it contains rules against anti-competitive conduct to ensure that there is fair + effective competition within Aus

—> also contains consumer protection rules (Aus consumer law)

Describe what the ACCC does

. tries to ensure that the benefits of increased competition flow through to consumers in the form of lower prices + better service

—> does this by prohibiting anti-competitive conduct by firms with market power such as price fixing + collusion

—> do this by taking firms engaged in anti-competitive behaviour to court to face potential penalties and/or to cease their anti-competitive behaviour

Give 3 examples where the ACCC has performed its role

Visy (2008):

. fined $36 million for its role in the cardboard packaging cartel which led to overcharging for firms + consumers

Colgate-Palmolive (2016):

. fined $18 million for colluding with rival companies to fix price of detergents

Blue scope steel (2023)

. penalty of $57.5 million for attempting to price fix

What are the 3 types of ways to classify barriers to entry?

Barriers that the gov arguably should remove/intervene:

—> complete control of a scarce resource

—> collusive behaviour

Barriers that gov. could intervene but arguably shouldn’t:

—> tend to be where the cost of intervening outweigh benefits

—> removal of patents on inventions/tech: gov can remove these but overall the general costs to society are higher than benefits - if removed = allows lower production costs/access to improved tech for all HOWEVER discourages research as no incentive to put money into it when everyone can benefit and not just the firm financially = less research + innovation = cost to society especially in long run

Barriers that the gov cannot remove (intrinsic):

—> not enough customers to sustain more than 1 firm

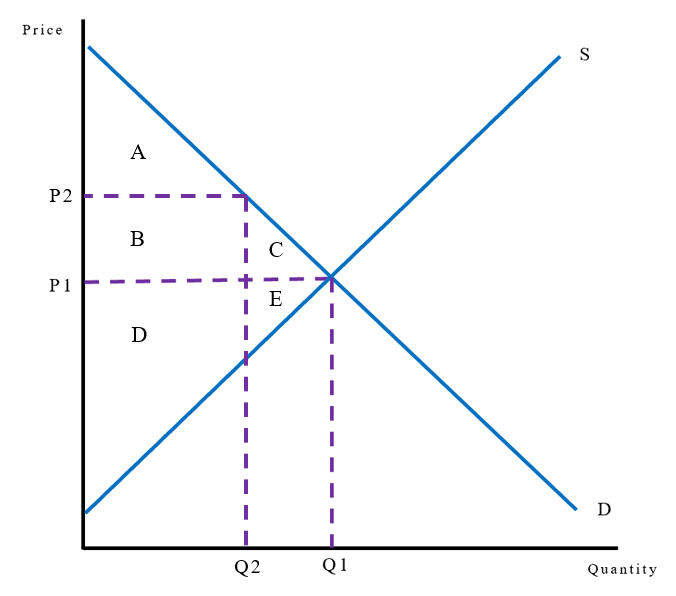

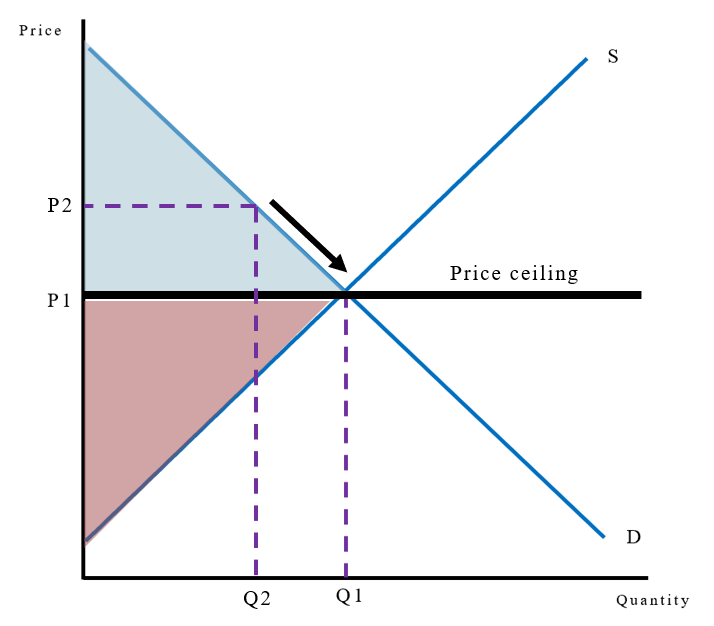

Demonstrate how a price ceiling can correct a market with market power

. gov could introduce a price ceiling which thus forces those with market power to not be able to charge the high price as a result of restricted quantity

—> ideally, this price ceiling would be price where the market is at equilibrium as seen in figure 2, though this is hard to assess in real world

—> thus, in reality the gov will set it at a level that reduces DWL though it may not remove it entirely

Describe what the government intervention of regulation is

involves establishing rules and guidelines, often enforced by agencies, to control behavior and address market failures

—> aims to protect consumers

—> eg: laws enforced by governments that influence the supply and consumption of specific goods and services

Describe where and how the government intervention of regulation occurs

. price regulation = important in industries where there is a ‘natural monopoly’ (a market where it’s beneficial to only have 1 firm to achieve economies of scale

—> tends to be in industries such as utilities (gas, electricity, water)

. can also come in the form of min safety + environmental standards as well as protecting consumer rights

When can there be issues with regulation?

can be issues with regulation if:

. it actually limits the number or types of businesses

. it limits the ability of businesses to compete

. it reduces the incentive for businesses to compete

. it limits the choices + information available to consumers

—> EG: occurred in the taxi market (in Aus, gov regulates the number of taxi permits granted, regulations on surcharges taxis can charge)

What is the government intervention of deregulation and what effects has this had?

. the removal of unnecessary restrictions on the market which allows for increased competition

—> has been beneficial in telecommunications market in Aus

—> allowed consumers to benefit from lower prices

Externalities and their effects on markets

. unintended effects (benefits or costs) of private actions on a 3rd party as a whole which are not reflected in market prices

—> when exist, market outcome will not be efficient - social optimal quantity will not be produced/consumed

—> will be either over/underconsumption/production

—> cost or benefit caused by an economic actor that’s not suffered/enjoyed by that same actor

Negative externalities

. when economic actions from either production or consumption create an external cost

. causes the market quantity to be greater than the optimal quantity = overproduction or consumption

Negative production externalities

. production imposes external costs on people not directly involved in making that production decision

Negative production externality examples

. using fossil fuels: contributes to global warming + climate change

. music festivals

Result of negative production externality if not corrected

. social costs more than private costs

. supply curve is too far to the right

. product is over-produced

Role of the government with negative production externality

. reduce production to correct social level

. internalise the externality

. make polluters pay for socially bad behaviour

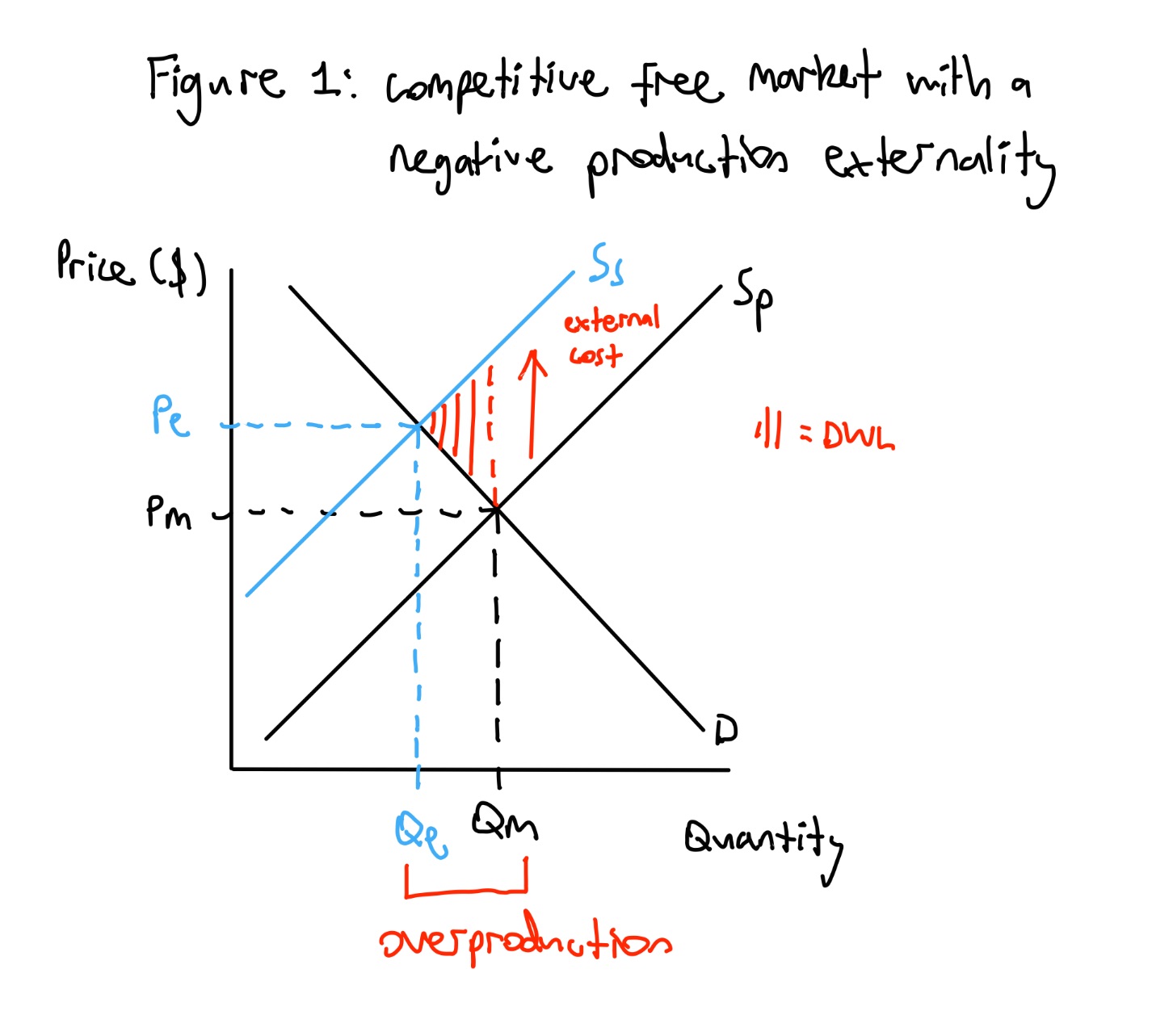

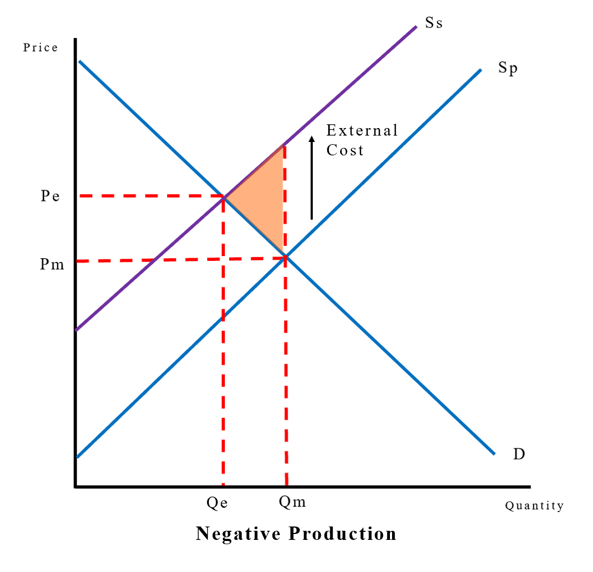

Explain the effect of a negative production externality on a market

In the market seen in figure 1, a pharmaceutical factory is producing syringes that will eventually be incinerated or thrown into environment.

The market is functioning at Sp, D with quantity at Qm and price at Pm.

At the price and quantity, only private cost of production (Sp) or what it’s costing the firm to produce is being taken into consideration and not social costs of production (Ss).

In this case, social costs are more than that of private costs (there is an external cost in production, which is environmental pollution) therefore there is overproduction in the market (equal to Qe-Qm) resulting in DWL (avoidable loss in potential total surplus).

The efficient output is to take into account the external costs (added to private costs) meaning equilibrium should be at Ss and D with equilibrium points at Pe, Qe to result in an efficient outcome (no DWL).

Negative consumption externality

. consumption imposes loss of benefits/external cost for people not directly involved in making that consumption decision

Negative consumption externality examples

. driving cars increasing air pollution

. lawnmowers producing noise pollution

. smoking in public + second-hand smoke

. using mobile phone when driving

Result of negative consumption externality if not corrected

. social benefit less than private benefit

. demand curve is too far to the right

. product is over-consumed

Role of government with negative consumption externalities

. reduce consumption to correct social level

. internalise the externality

. make consumers pay for socially bad behaviour

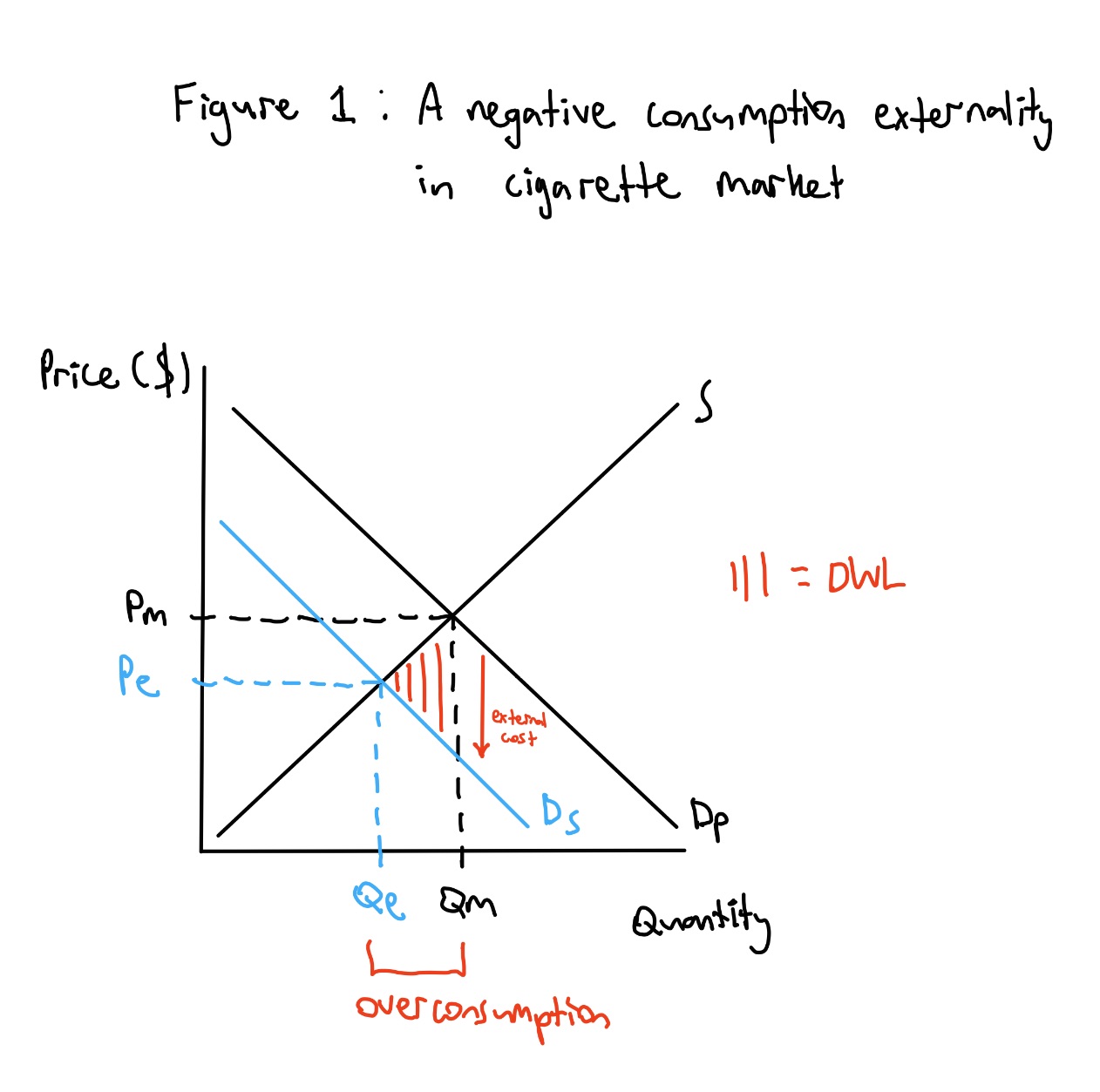

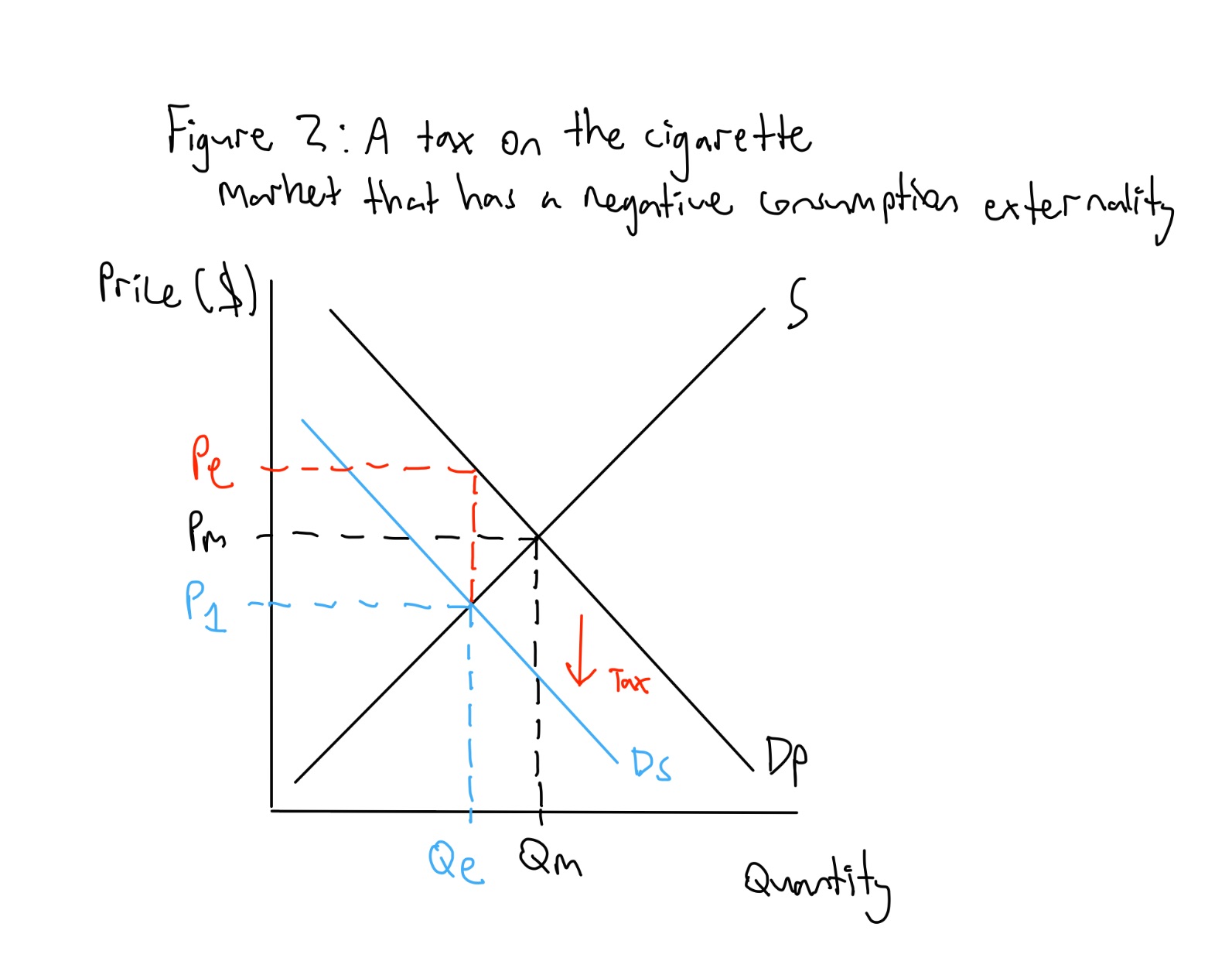

Explain the effect of a negative consumption externality on a market

. as seen in figure 1, the cigarette market is functioning at S, Dp with quantity at Qm and price at Pm

. means only private benefits of consumption (Dp) are being taken into consideration and not the social benefits of consumption (Ds)

. Here, social benefits are less than private benefits (there’s an external cost of consumption), therefore there’s overconsumption resulting in DWL

. The efficient outcome is to consider the external costs (added to private benefits), thus equilibrium should be at Pe, Qe to result in an efficient outcome (no DWL)

. The gov has policy options to correct externality, two being a tax (figure 2) and negative advertising

Positive externalities

. when economic actions from either production or consumption create an external benefit

. causes the market quantity to be less than optimal quantity (underproduction/consumption)

Positive production externalities

. production reduces costs/creates an external benefit for people not directly involved in making that production decision

Positive production externality examples

. training workers

. renewable resources for energy

. tech company producing a new free software benefiting others in the business field

. people keeping their gardens nice in a neighbourhood increasing property value

Result if positive production externality not corrected

. social costs lower than private costs

. supply curve is too far to the left

. products are under-produced

Role of government with positive production externalities

. increase production to correct social level

. internalise the externality

. reward producers for social good behaviour

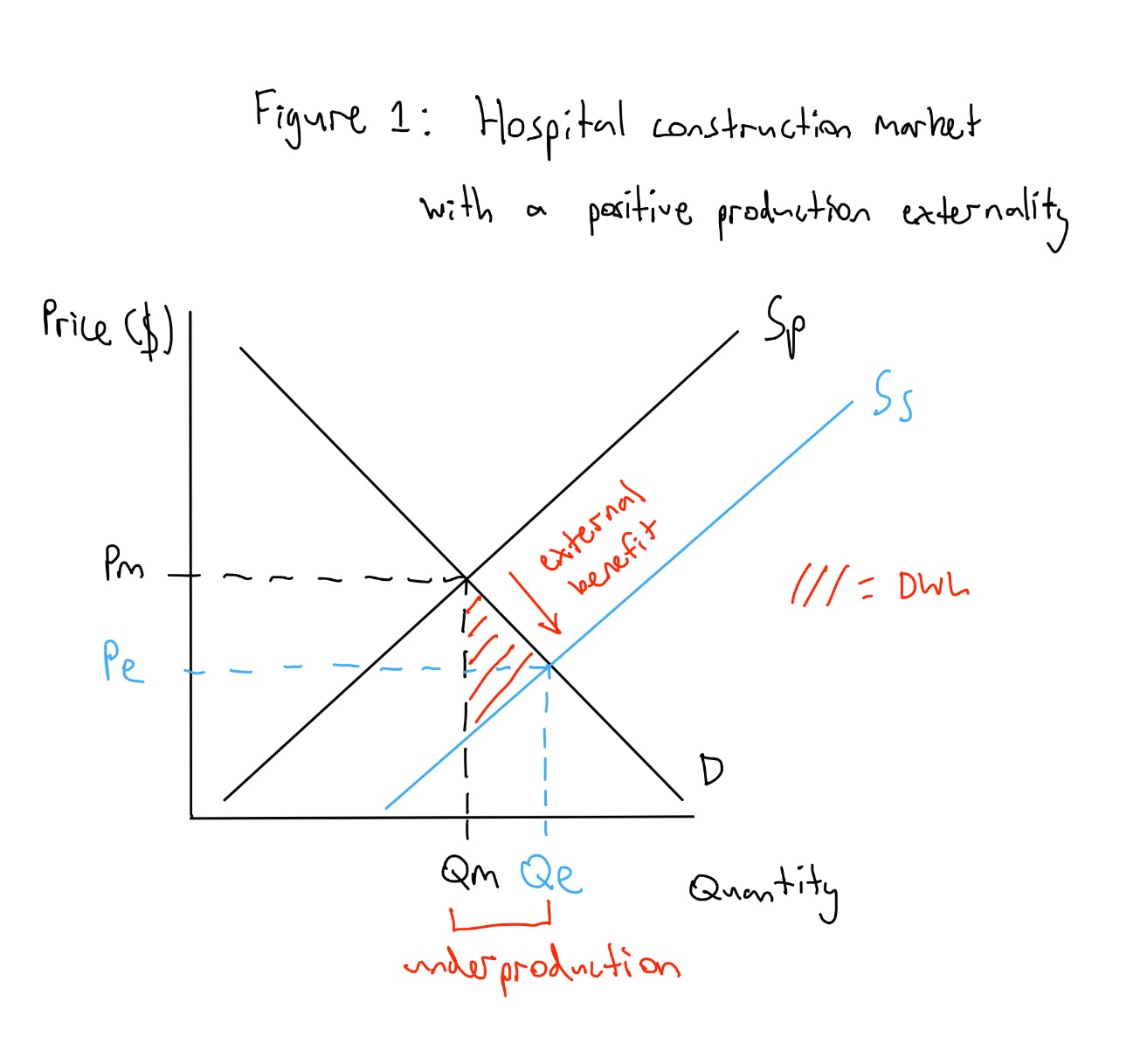

Explain the effect of a positive production externality on a market

. in the market shown in figure 1, people are producing hospitals

. currently, the market is reflecting only the private cost of production (Sp) or what it’s costing the individual to produce

. thus, the market is functioning at points Pm and Qm at Sp, D

. this doesn’t account for the external benefits as a result of the production of hospitals

. the actual efficient/optimal output needs to consider all costs of production (both private + external) called the social cost (Ss: private cost + external cost)

. thus, the efficient equilibrium point is actually Pe and Qe

. as a result of the market not being at this efficient point, there’s DWL (there’s underproduction in market equal to Qe-Qm)

Positive consumption externality

. consumption creates external benefits for people not directly involved in making that consumption decision

Positive consumption externality examples

. flu and covid vaccinations = herd immunity

. education (eg students completing their bachelor’s degree meaning the workforce is more skilled

Result of positive consumption externalities if not corrected

. social benefit is greater than private benefit

. demand curve is too far to the left

. products are under-consumed

Role of government with positive consumption externalities

. raise consumption to correct social level

. internalise the externality

. reward consumers for socially good behaviour

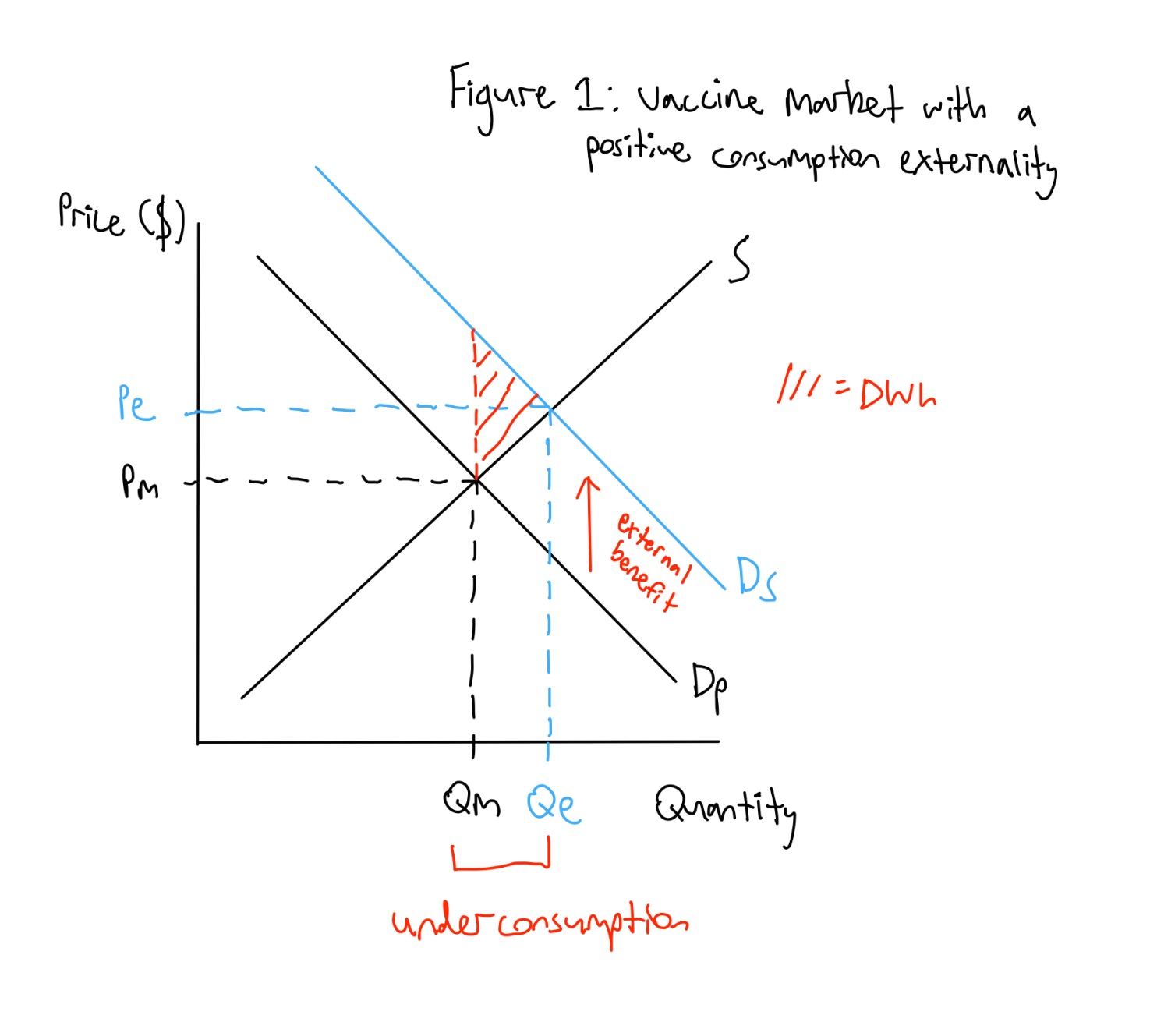

Explain the effect of a positive consumption externality in a free competitive market

. in the market, people are consuming Covid-19 vaccines

. The market is reflecting only the private benefit of consumption (Dp) or what is benefitting the individual to consume the product

. Therefore the market is functioning at Dp, S, at points Pm and Qm, as seen in figure 1

. Hence the current market doesn’t account for the external benefits as a result of the consumption of vaccines such as herd immunity

. The actual efficient output (no DWL) needs to consider all benefits of consumption (both private and external), known as the social benefit (Ds: Ds=private benefit + external benefit)

. Thus the efficient equilibrium point is Pe and Qe, and as a result of the market not being at this efficient point, there’s DWL (avoidable loss in potential total surplus) due to underconsumption of vaccines in market, equal to Qe-Qm.

How does the government internalise an externality?

. forces the market to recognise + include the external cost or benefit in the market price

What are 4 general policies the government can employ to try and correct externalities?

Regulation: eg- for positive consumption externality of education = making education compulsory for certain ages AND banning of goods that cause negative externalities

Campaigns to promote the consumption of a good or trying to decrease consumption (information dissemination)

Encouraging research into goods that can then be more easily produced (at the level where social benefits are accounted for)

The removal of patents on products meaning all producers have access to the tech/information to produce goods

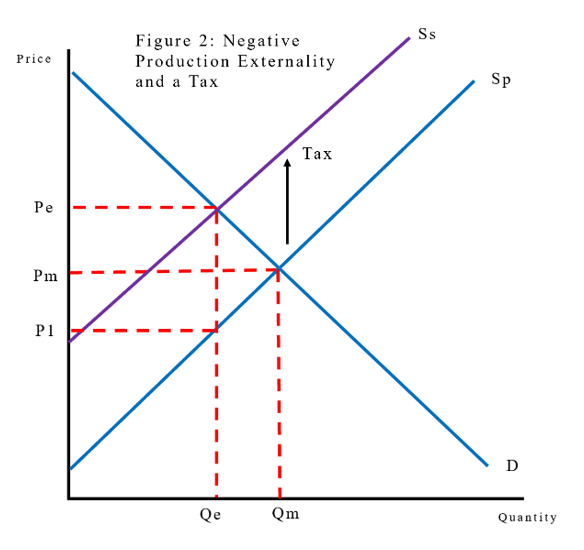

Explain how a tax can be placed on a negative production externality to correct the market failure

. The government has policy options to correct or ‘internalise’ the externality, one being a tax placed on the producer to reduce output.

Since there’s pollution occurring due to production, the tax forces the polluter to pay.

This is shown in Figure 2. In Figure 2, the market is at Sp and D with quantity at Qm and price at Pm, the same as in Figure 1, which results in DWL.

The government can impose a tax, which is a compulsory financial levy on a good paid by, in this case, producers which increases their cost of production.

The tax in this case should be equal to the external cost (difference between Sp and Ss) which decreases supply from Sp (private cost curve) to Ss (the social cost curve that reflects private cost plus the external cost).

This causes quantity to decrease from Qm to Qe with the price consumers pay to increasing from Pm to Pe and price producers receive decreasing from Pm to P1.

As Pe, Qe takes into account the external cost of production/social cost, it therefore is the efficient outcome (there is no DWL as the externality is ‘internalised’).

This is also beneficial as it raises taxation revenue for the government which can be used to correct other market failure (e.g. providing merit goods).

Explain how a tax can be placed on a negative consumption externality to correct the market failure

. in the case of negative consumption externality such as smoking in public, a tax should be placed on the product to reduce consumption, seen in figure 2

. A tax is a compulsory financial charge or some other type of levy imposed, in this case, on a consumer by a governmental organisation

. Tax imposed should be equal to the external cost or the difference between Dp and Ds

. Tax then forces consumer to pay more for the product, so the consumer’s private benefit curve shifts to become the social benefit curve

. Price consumer’s pay increases to Pe while quantity decreases to Qe and producers receive P1

. There’s now no DWL, as the external cost is taken into account

. This is also beneficial as it raises taxation revenue for the government which can be used to correct other market failure (e.g. providing merit goods) - eg. in the 2022-2023 financial year, the Australian government received $12.7 billion in revenue from tobacco excise

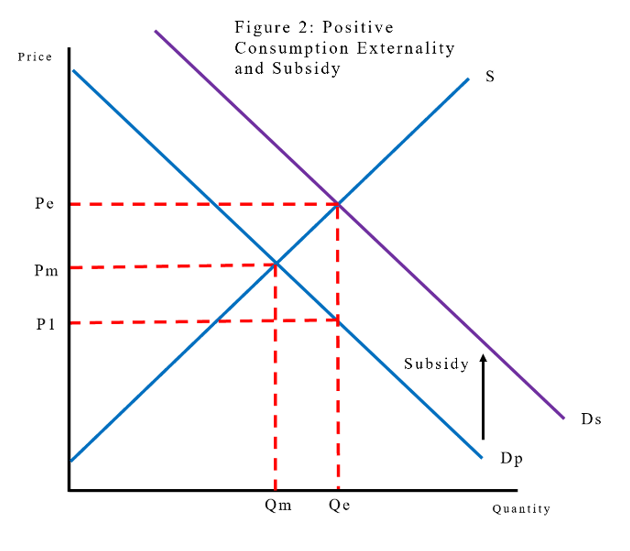

Explain how a subsidy can be placed on a positive consumption externality to correct the market failure

The government has policy options to correct the externality, one being a subsidy given to the consumer to increase consumption.

Since there’s external benefits from the consumption of penicillin, the subsidy causes all benefits to be included. This is shown in Figure 2.

In Figure 2, the market is at Dp and S with quantity at Qm and price at Pm, the same as in Figure 1, which results in DWL.

The government can impose a subsidy, which is a direct or indirect payment granted to private firms or households with the aim of increasing production or consumption. In the case of a positive consumption externality, a subsidy would be given to the consumer.

The subsidy in this case should be equal to the external benefit (difference between Dp and Ds) which increases demand from Dp (private benefit curve) to Ds (the social benefit curve that reflects private benefit plus the external benefit).

This causes quantity to increase from Qm to Qe with the price consumers pay to decreasing from Pm to P1 and price producers receive increasing from Pm to Pe.

As Pe, Qe takes into account the external benefit of consumption, it therefore is the efficient outcome (there is no DWL as the externality is ‘internalised’).

Though there is a cost to the government, it corrects the market failure, which is overall beneficial to society.

What is the flaw with the price system in examining goods?

. price system normally enables markets to provide the efficient quantity of a good as prices send the right signals to both consumers + producers

. EG: essential good of bread and milk

—> if there’s a shortage of a good:

. price will rise = lower consumption/looking for a substitute

. producers have the incentive to produce more

—> thus, this corrects the shortage which is done automatically

. HOWEVER, there are some products that don’t have prices meaning that they will not usually be produced by markets

. To examine ALL goods, they need to be separated into goods that have prices and those that don’t

What are the 2 main criteria an economy uses to classify goods (the 4 different types)?

Whether good is rival in its consumption:

. whether the consumption by 1 person reduce the supply available to others

Whether the good is excludable:

. whether it’s possible to exclude a non-payer from consuming good

Which types of goods suffer from and are examples of market failure and why?

Public good:

. those that consume the good don’t necessarily have to pay for the good

. EG: a tourist using national defence without having paid any taxes towards it

Common good:

. there can be an inefficient allocation of the resources

Private goods

. rival and excludable

. characterised by the exclusion principle: consumers who are willing + able to purchase a product gain exclusive ownership + benefits that can be derived from that ownership

. property rights are easily identified + enforced (non-paying customers can be prevented from consuming the private good)

. the free market will usually provide an adequate amount as consumers are willing to pay for their use, creating a profit for producers

. EG: phones, food, clothing, computer

Club Goods

. non-rival and excludable

—> can be consumed collectively by many at same time but price is used to exclude people who don’t pay for product

. Characteristics: those that don’t pay the price to receive the good aren’t able to, however an individual’s consumption doesn’t stop the consumption of another

. millions of people can consume these products at same time, but they must pay a subscription fee to receive the good

. EG: streaming services (netflix)

Common resources/goods

. rival and non-excludable

. ownership of these goods is universal = no clearly defined private property rights

. cannot be priced = people encouraged to consume as much as they can

—> stock of a renewable resource will decline over time if consumption of resource exceeds its replenishment

. difficult to prevent overconsumption because non-excludable

. Thus people pursue their own self-interest to the detriment of others = tragedy of the commons

. require the gov to act as protector + regulator, to manage + help control the use + overconsumption of these goods

. EG: road systems (congestion), clean water, fish in the ocean

What is the tragedy of the commons?

. a situation where individuals, acting in their own self-interest, exploit a shared resource, ultimately leading to its depletion or destruction, despite the fact that this action harms the common good

Public goods

. non-rival and non-excludable

. Characteristics: exclusion principle doesn’t apply (impossible to prevent non-paying customers from consuming) AND its consumption by 1 person doesn’t lower the potential consumption of others

. many are essential for societal welfare + are generally provided by gov and financed by general taxation revenue

—> because private enterprises have no incentive to provide as they cannot be priced + sold in a market, hence cannot be profitable

. EG: national defence, lighthouse/street lighting, clean air, national park

What are free riders?

. Consumers who enjoy the benefits of consumption without paying the cost of provision

—> free riders can’t be excluded from public goods

What are examples of public goods that are provided by private firms

. radio and free to air TV

—> cost for these services is paid for by advertising

What are examples of some goods that are supplied by the government but are NOT public goods?

. public education, public health, public transport

—> are excludable (can be priced)

—> while these goods can be consumed collectively they can be subject to congestion

—> governments supply because they have large external benefits for society

—> called merit goods (there’s an incentive for gov to supply as there’s a benefit for doing so)

Explain how education and health are merit goods?

. both supplied (at a price) in private markets

. if supply was left completely to the free market, likely would be significant underconsumption

—> because the value some individuals place on these services is less than the value society places on them (not everyone can afford)

—> the substantial social benefits associated with these goods often results in gov intervening to supply them at a heavily subsidised price to encourage greater community consumption

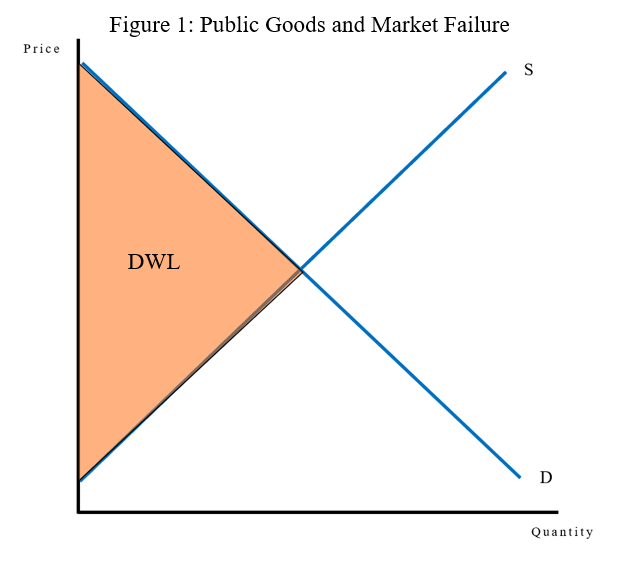

Describe the market failure in public goods

. happens because no-one will pay for the good, so producers can’t make money

—> like price ceiling set at $0

—> means goods are underproduced (none will be produced)

—> the whole economy is DWL

Describe the market failure in common resources

. the problem is overproduction of products that require the resource to be manufactured

. in effect, the damage to the common property resource that results from overuse is a negative externality

. the market shown isn’t the market for the resource, it’s the market for a product that requires the resource in order to manufacture

Explain whether the government should provide public goods

. Yes: these goods contribute to the overall welfare of society + thus the gov providing them means that underconsumption (and its associated market failure) is prevented from occurring

. many goods are provided free at the point of use however are ‘paid’ for by taxation money collected from people who then use the goods

. governments may also be able to provide the good more efficiently due to economies of scale, however there may be inefficiency as a result of the gov acting as a monopoly

Outline the 3 ways to overcome common resource market failure

Assign property rights:

. means someone has ownership over the resource

. gives owner an incentive to maintain + conserve the resource

. EG: a river

—> owner can impose permits + quotas on the amount of fish that can be caught

—> owner can dictate to polluters how much pollution they can place in the water

Regulation:

. gov imposes regulations that help protect the resource

. EG: fishing = restricted fishing season, bag/size limits + licences

. gov assigning property rights to themselves

Voluntary persuasion:

. gov + other organisations can attempt to promote the preservation of the resource through persuasive means

. EG: FOGO bin system (trying to remove the negative externality that results from the use of the resource)

What does the PPF model show?

. an economic model showing how an economic actor, such as a company or a nation, could make tradeoffs in the production of different commodities

—> used to illustrate the economic problem + concept of OC

—> shows all the combinations of products that can be produced by an economy

What are the 5 initial assumptions for the PPF?

Resources are finite + fixed

Technology is fixed (how resources are turned into products)

The economy is only capable of producing 2 alternative products

All resources are equally useful for producing each product = simple PPF

There’s no trade between economies

In a simple PPF, why is the frontier a straight line

. frontier is a straight line as OC is constant

. law of increasing OC doesn’t apply

Will PPF always be a straight line?

. No: only occurs if the OC between the 2 goods is constant

. normal shape for PPF is to be bowed outwards

What is the reason that the PPF has a negative slope?

. scarcity

—> resources are limited, so to produce more quantity of one good the economy must produce less quantity of the other good.

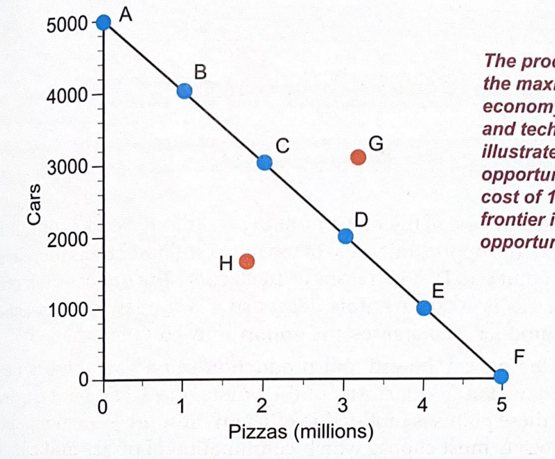

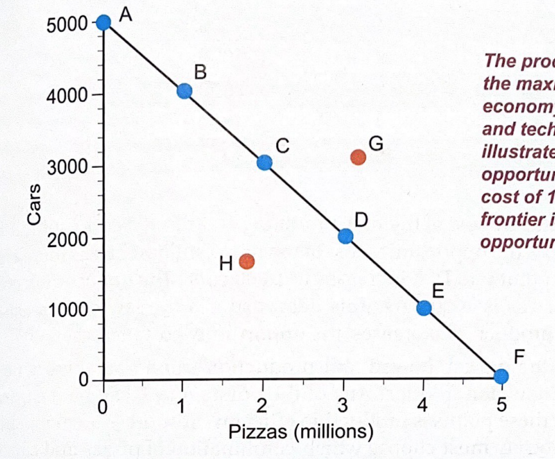

Describe what is seen in a simple PPF

. shows the trade off between producing 2 goods

. frontier is straight line as OC is constant

. shows the max output for an economy given fixed resources + technology

. illustrates scarcity, trade-offs, and OC

. to increase the production of 1 good, the economy must decrease some production of the other (scarcity)

How can you calculate OC from the PPF

OC (product 1) = max production 2/max production 1

On the simple PPF, can the economy produce at point H?

. Yes, however it’s inefficient as it’s possible to increase the production of both goods

—> every point on the PPF is efficient

On the simple PPF, can the economy produce at point G?

. no, under the current assumptions

—> as there’s not enough resources to produce that level of goods

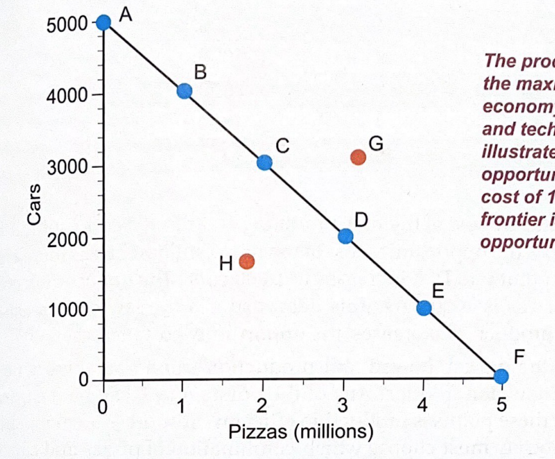

Why will the PPF usually be bowed outwards?

. relaxing of assumption 4, that all resources are equally useful for producing each product

. in reality, most resources are better suited to producing some goods and not others

. the OC of increasing the production of 1 good in an economy with scarce resources normally increases (law of increasing OC)

EG: a worker might be trained in explosives + mining equipment

—> doesn’t mean they cannot produce wheat, but they would just be more productive at producing iron ore

—> thus, if this economy wanted to increase iron ore production, it must transfer some resources from wheat to iron ore production

—> makes sense rationally to do this, as only a small amount of wheat will be sacrificed for a larger gain in iron ore production

The law of increasing opportunity cost

. each additional unit of production of product A has a higher OC as resources are transferred across that are increasingly suited for producing product B and decreasingly suitable for producing A

—> for example an economy could produce 2 goods, X and Y, and as the production of X increases, the OC of Y increases

—> for the first unit of X, the OC is 1 unit of Y, but for the second unit of X, it’s 3 units of Y

—> is because not all resources are as equally productive for producing both products

In a PPF with relaxed assumptions, the law of increasing opportunity cost applies.

This law is where, in economy with good X and Y produced only, the opportunity cost of good Y increases as production of good X increases.

This is because, as per the bowed out PPF, not all resources are equally suited to producing both goods.

As such, as more resources are employed in making X, better suited resources for Y are reallocated to X and therefore the opportunity cost rises at an increasing rate.

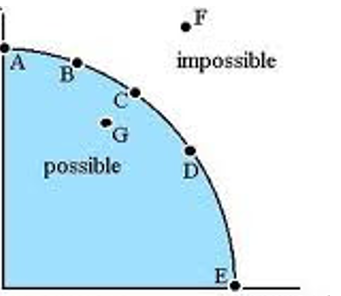

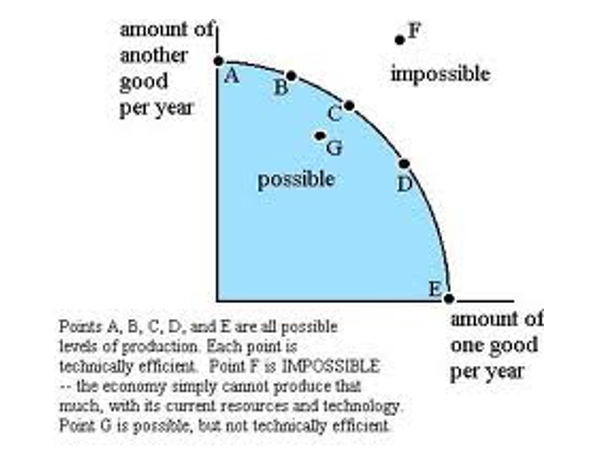

Describe the nature of the points on a bowed PPF

. points A,B,C,D,E are all possible levels of production + each point is technically efficient

. point F is impossible (economy cannot produce that much, with its current resources + technology)

. point G is possible, but not technically efficient

Opportunity cost

. the value of the next best alternative when a decision is made

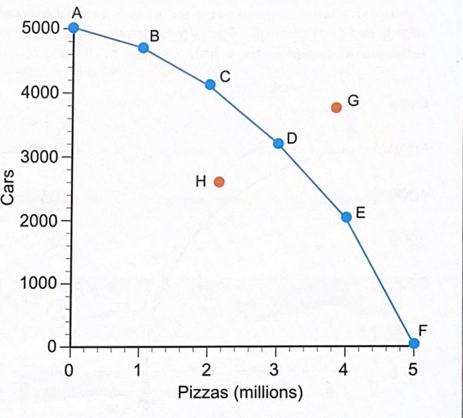

Describe what can be seen from a PPF example showing the law of increasing OC

. PPF is bowed outwards because of law of increasing OC

. as more pizzas are produced, the OC increases since resources aren’t equally productive at producing both cars + pizzas

. any points between A and F are efficient

. H=inefficient, G=unattainable

—> it’s thus society’s choice as to which combination of pizzas and cars that are produced + then consumed

Explain why the PPF can be drawn to shift

. it’s always assumed that resources are finite, however the amount of resources that an economy has can change over time

—> relaxing assumption 1: resources are finite (still true) and fixed (changes)

. Economies usually grow (though may contract eg-war in Ukraine)

. a PPF shows the economy at a particular point in time and a SECOND PPF can be drawn to then show a later point in time (after a change in resources or growth/contraction in an economy)

. this measures that amount of resources available not whether the resources are being wasted/not used

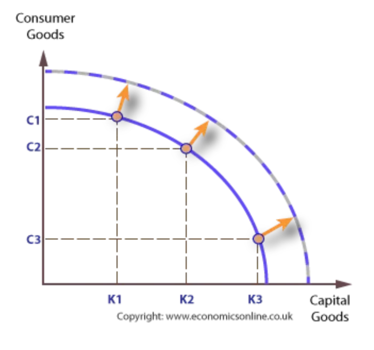

What does outward movement of the PPF mean?

. economic growth

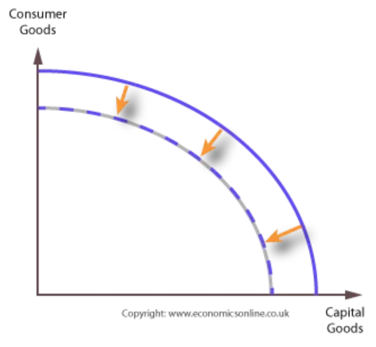

What does inward movement of the PPF mean?

. economic contraction

What is economic growth and how does this occur?

. an increase in the capacity of an economy to produce products OR an increase in the production of economic products, compared from one period of time to another

—> occurs due to increase in quantity or quality of resources

How does an economy grow in relation to quantity in general?

. relaxing assumption 1 - resources are fixed

. increase in labour force

. increase in the stock of capital equipment (eg-investment in machinery)

How does an economy grow in relation to quality in general?

. relaxing of assumption 2 - tech is fixed

. increase in productivity (how much output is produced from a given set of inputs)

—> labour productivity: output per worker - eg increase in skill set, education initiative (higher levels of education + training)

—> capital productivity: output per capital good - eg better tech (application of technology)

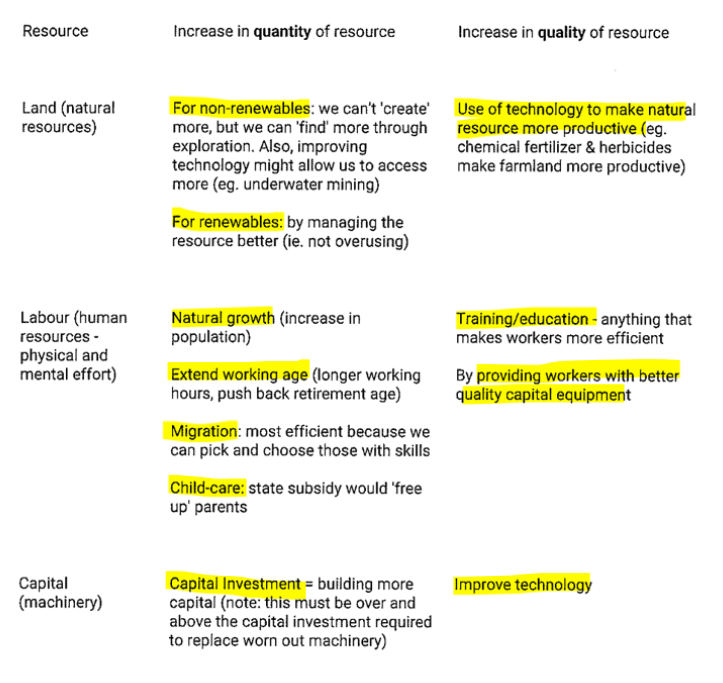

How is economic growth in the sense of increasing the quantity or quality of the 3 types of resources possible?

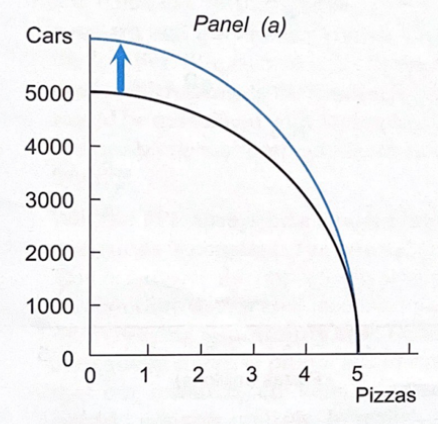

Describe what panel A reflects

. frontier shifts outward along car (Y) axis only

. reflects either an increase in the quantity of resources or improved technology for car production

—> opposite would happen if there was just a change in factors relating to pizza production

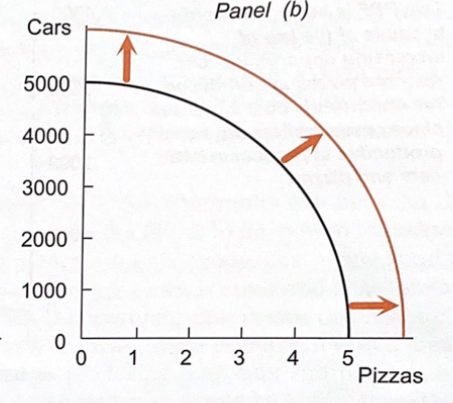

Describe what panel B reflects

. whole frontier shifts outward to right = more of both goods being produced

. reflects an increase in the quantity or quality of resources (labour + capital) used to produce BOTH goods

—> is normal to see for example due to increases in the number in the labour force

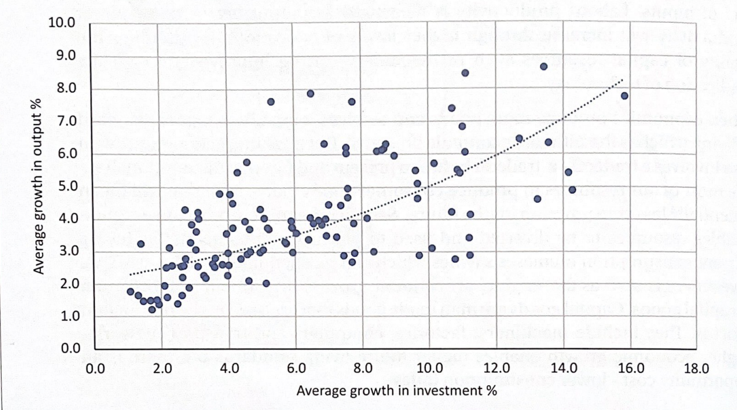

What conclusions are drawn from the figure that compares the economic growth rate of countries and their rate of investment

. there’s a strong positive correlation between economic growth rate and rate of investment

—> countries that invest in capital resources have higher rates of economic growth

—> thus, as investment increases, so does economic growth

—> economies thus face the choice between producing capital goods or consumption goods