3.8 Investment appraisal

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

Investment

Capital expenditure or the purchase of assets with the potential to yield future financial benefits

Eg upgrading computer equipment / purchase of a building

Investment appraisal

A financial decision-making tool

Helps managers determine whether certain investment projects should be undertaken based mainly on quantitative techniques

Evaluates costs + benefits of an investment decision

Qualitative investment appraisal

Judging whether an investment project is worthwhile thru non-numerical techniques

Eg determining whether the investment is consistent with the corporate culture

Quantitative investment appraisal

Judging whether an investment project is worthwhile based on numerical (financial) interpretations

PBP, ARR and NPV methods

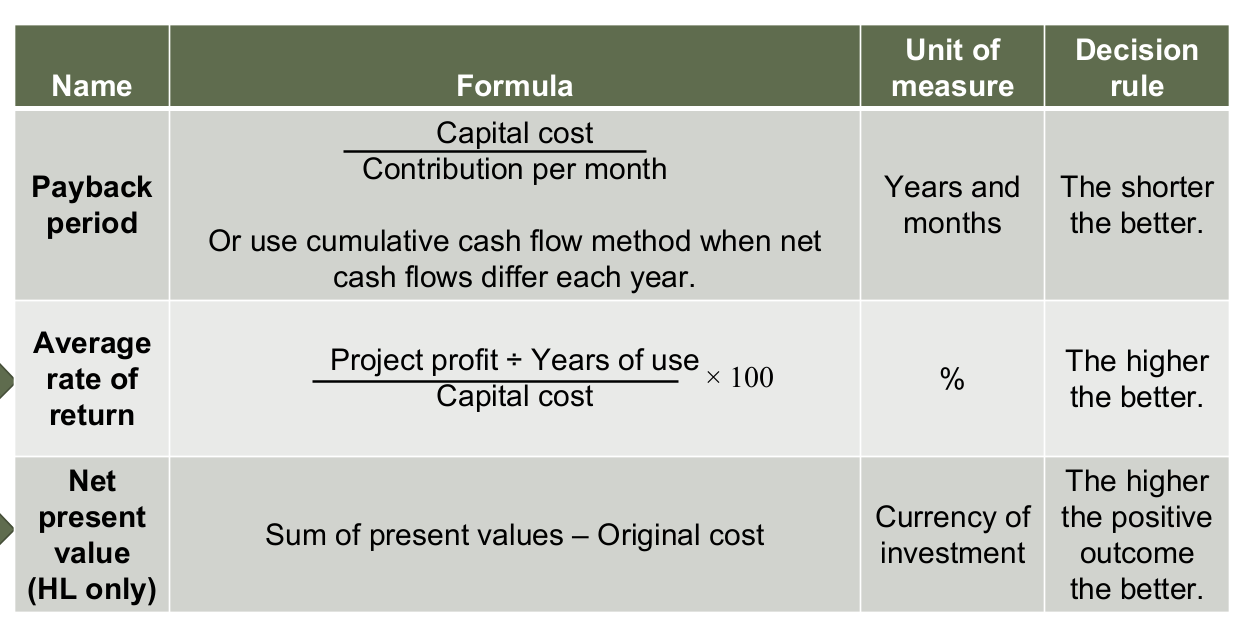

3 methods of investment appraisal

Payback period- PBP

Average rate of return- ARR

Net present value- NPV

Payback period PBP

An investment appraisal technique that calculates the length of time it takes to recoup (earn back) the initial expenditure on an investment project

Amt of time needed for an investment project to earn enough profits to repay the initial cost of the investment

2 methods to calculate payback period- PBP

PBP formula

Cumulative cash flow method

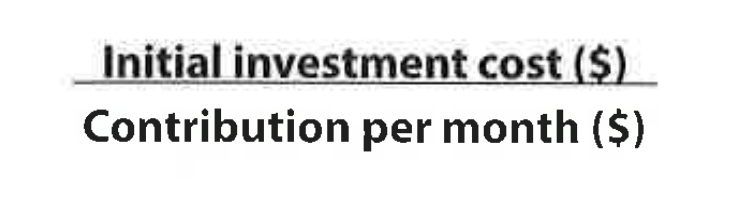

PBP equation

Initial investment cost / contribution per month

Cumulative net cash flow

Sum of an investment project's NCFs for a particular year plus the NCFs of all previous years

Betw the 2 methods to calculate PBP, which is more accurate + why?

Cumulative cash flow method

Bc income from investment differs each year

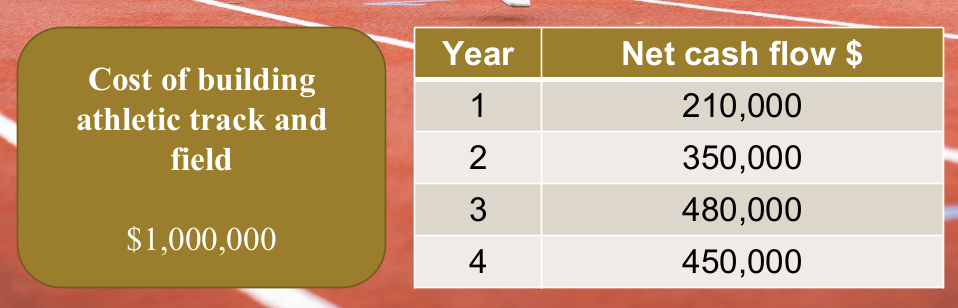

Cumulative cash flow method to calculate PBP

Make table with year, NCF, cumulative NCF (include Y0)

Identify betw which years the cost of investment will be paid back

Cost of investment - cumulative NCF for calendar year b4 the investment will be paid back

no need to do this if year 0 is included in the table

Calc avg monthly CF for calendar year in which the cost of investment is paid back

Amt left / monthly CF

Calculate PBP using cumulative CF method

PBP = (amt left / cash inflow) x 12

2 years 11 months

Calculate PBP using PBP formula:

Firm will purchase asset, cost = $10,000

Anticipated financial gain = $6,000 of revenue per year after maintenance costs are paid for

(10,000 / (6000/12)) = 20 months

Pros of using PBP

Simplest + quickest method

Useful for firms with CF problems → see how fast can recoup cash

Can see if business will break even on the purchase b4 it needs to be replaced

Can use tocompare diff investment projects

Assesses only ST → less prone to errors

Managers assess projects which yield a quick return for shareholders

Cons of using PBP

Not constant contribution per month → longer PBP

Focuses on time, not profit

ST approach to investment

PBP calculations prone to errors

PBP not suitable for some business

Why is contribution per month unlikely to be constant?

Bc demand is prone to seasonal fluctuations → PBP might take longer

The longer the PBP…

The more risky the investment is

Exam tip: just bc something is high risk, does it mean a business should avoid it?

No

Need to know if benefits of the risks are likely to outweigh the costs

Exam tip: when using PBP should you reject a project just bc it isn’t expected to pay off quickly + why?

No

Bc it may be v profitable in the LT

Consider context

Average rate of return- ARR

Calculates the average annual profit of an investment project as a percentage of the initial amt of money invested

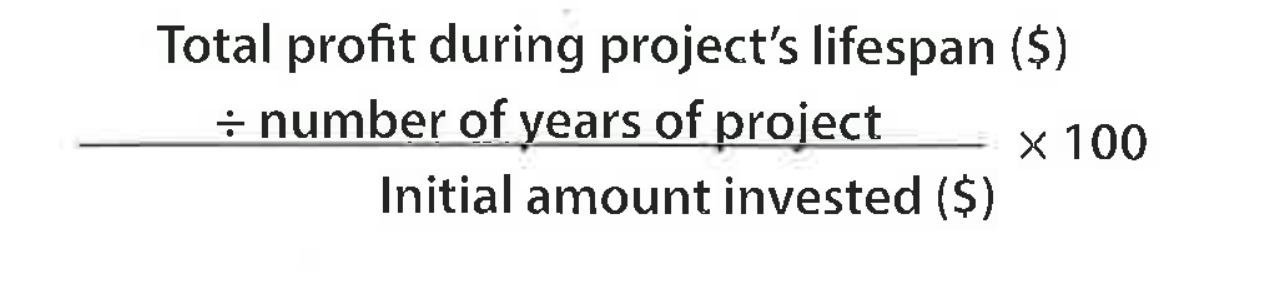

ARR equation

(((total returns - capital cost) / years of use) / capital cost)

x 100

aka (AAP / COI) x100

How to calculate ARR

Calc total net CF over years of project

Calc expected profit from the project

Project profit = total returns - capital cost

Basically total NCF - COI

Div by no. of years

Div by COI

x 100

Project profit equation

Total returns - capital cost

Or total NCF - COI

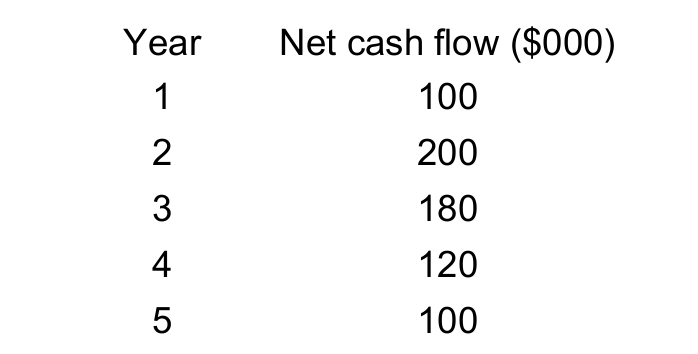

Calculate ARR practice question

Cost of investment = $400,000

15%

700 - 400 = 300

300 / 5 = 60

60 / 400 = 0.15

0.15 × 100 = 15%

What does ARR measure?

Profitability

Not cash flow

As a basic benchmark, what can ARR be compared with?

Base interest rate in the economy

So can assess rewards + risks involved in the investment

Pros of ARR

Easy to understand, calc, compare→ aids decision making

Focuses on profitability

Cons of ARR

Ignores NCF → prone to forecasting errors

Focuses on profit instead of cash flow

Figures are only estimates bc based on projects useful life (maybe pure guess)

Longer time = more errors

Net present value- NPV

Calculates the total discounted NCFs minus the initial cost of an investment project

Works out the present value of the return on an investment

What does it mean if NPV is positive?

Project is viable on financial grounds

Discounting

Reverse of calculating compound interest

Discount factor

The number used to reduce the value of a sum of money received in the future to determine its present (current) value

Used to convert the future NCF to its

present value today

Based on inflation / interest rates

Discounted cash flow

Uses a discount factor to reduce the value of money received in future years bc money loses its value over time

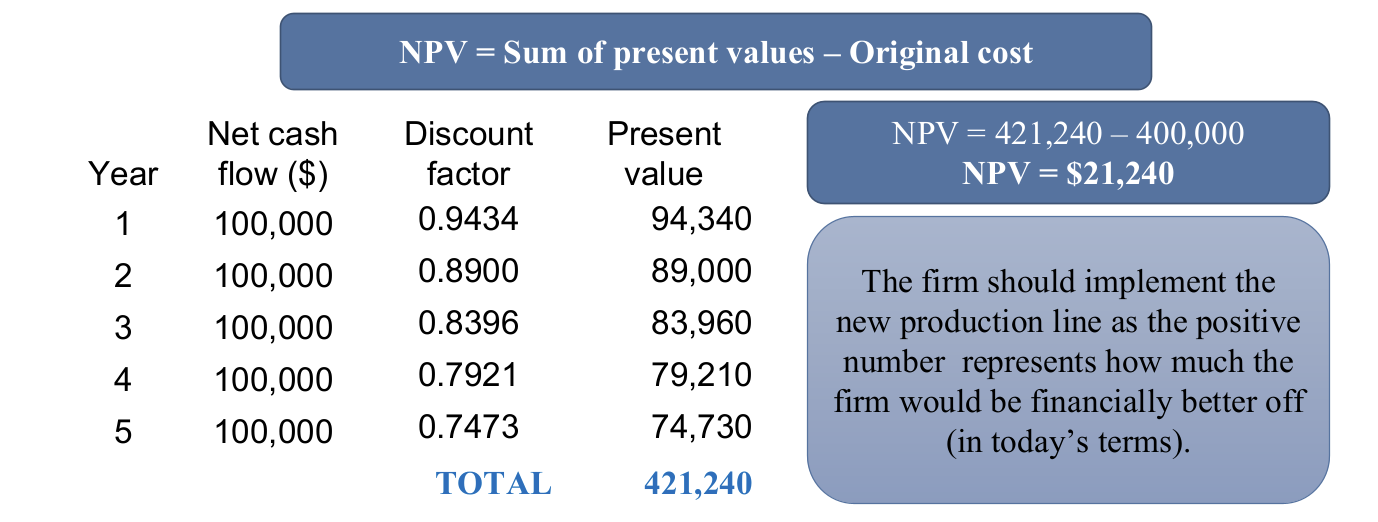

NPV equation

Sum of present values - original cost

Aka sum of all discounted cash flows - cost of investment

How to calculate NPV

Find NCF for each year

NCF x discount factor = present value

Add tog all present values

Sum of present values - og cost = NPV

Calculate the NPV for this investment project

Cost of investment = $400,000

$21,240

Pros of NPV

Cons of NPV

NPV value would be reduced if interest rates increase

NPV calculations are complex

NPV results are only comparable if the initial investment cost is the same between competing projects

Good value for NPV

Must be positive

Higher the better

Summary of quantitative investment appraisal methods

PBP- risk + time

ARR- profitability

The longer the time period of the project considered…

… the lower the present value of that future amt of money

Bc money received in the future is worth less than if it were received today

Principal (capital outlay)

The og amount spent on an investment project

What does it mean if NPV is positive + what does this mean?

It is greater than the principal

The value of the discounted (future) net CFs are enough to justify the initial cost of the investment

What does it mean if NPV is negative?

The investment project is not worth pursuing on financial grounds

Why is cash received in the future not the same value as if it were received today?

Bc:

The money could have been invested to generate financial returns

Inflation reduces the value of money in the future

How are PBP, ARR, NPV expressed?

PBP- time (years, months)

ARR- %

NPV- monetary value

Qualitative investment appraisal methods that affect investment decisions

PORSCHE

Projections

Objectives

Risk profiles

State of the economy

Corporate image

Human relations

External shocks