Module 3 (Week 4) - Chapter 7: Adding Government and Trade to the Simple Macro Model

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

51 Terms

True or False: A government’s fiscal policy is defined by its plans for taxes and spending.

True

In the macro model, the level of government purchases (G) is ______ with respect to national income. That is, G does not automatically change in response to GDP changes.

In the macro model, the level of government purchases (G) is autonomous with respect to national income. That is, G does not automatically change in response to GDP changes.

______ (a type of government spending) generally change as GDP rises or falls, but it is ______ that are part of desired aggregate expenditure.

Transfer payments (a type of government spending) generally change as GDP rises or falls, but it is government purchases (G) that are part of desired aggregate expenditure.

Define net tax revenue (T ).

Total tax received by the government minus total transfer payments made by the government

As GDP rises, a tax system with given tax rates will yield ______ net revenue.

As GDP rises, a tax system with given tax rates will yield more net revenue.

What is the formula for calculating government net tax revenues?

T = tY

Net Tax Revenue = (Net Tax Rate)(GDP)

Define net tax rate (t ).

The increase in net tax revenue generated when GDP increases by $1

The amount by which total government tax revenues (net of transfers) change when national income changes

What is the formula for calculating disposable income?

YD = Y — T

Disposable Income = National Income — Net Tax Revenue

YD = (1 — t )Y

Disposable Income = (1 — Net Tax Rate)(National Income)

Define budget balance.

The difference between total government revenue and total government expenditure

What is the formula for calculating budget balance?

Budget Balance = T — G

Budget Balance = Net Tax Revenue — Government Purchases

When net revenues exceed government purchases (T > G), the government has a budget ______. When government purchases exceed net revenues (T < G), the government has a budget ______. When the two amounts are equal, the government has a ______.

When net revenues exceed government purchases (T > G), the government has a budget surplus. When government purchases exceed net revenues (T < G), the government has a budget deficit. When the two amounts are equal, the government has a balanced budget.

True or False: When measuring the overall contribution of government purchases to desired aggregate expenditure, all levels of government must be included.

True

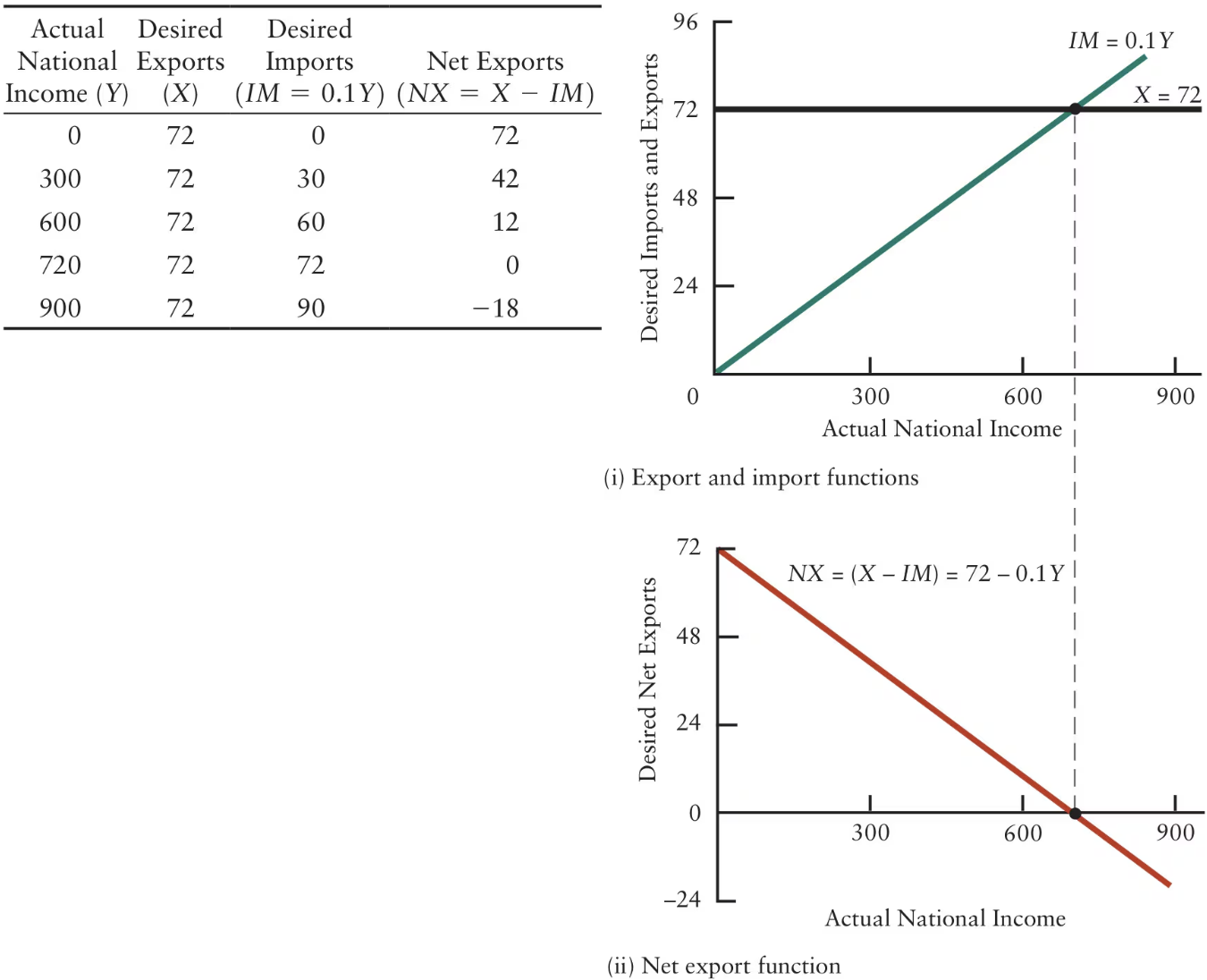

Exports, X, depend on the spending decisions of foreign households and firms. Therefore, exports are an ______ expenditure and ______ change in response to changes in Canadian national income.

Exports, X, depend on the spending decisions of foreign households and firms. Therefore, exports are an autonomous expenditure and do not change in response to changes in Canadian national income.

What is the formula for calculating desired imports?

IM = mY

Desired Imports = (Marginal Propensity to Import)(National Income)

Define marginal propensity to import (m).

The amount that desired imports rise when national income rises by $1

What is the formula for calculating net exports?

NX = X — mY

Net Exports = Exports — (Marginal Propensity to Import)(National Income)

NX = X — IM

Net Exports = Exports — Imports

Since exports are ______ with respect to national income but imports are ______ related to national income, net exports are ______ related to national income. This relationship is called the ______.

Since exports are autonomous with respect to national income but imports are positively related to national income, net exports are negatively related to national income. This relationship is called the net export function.

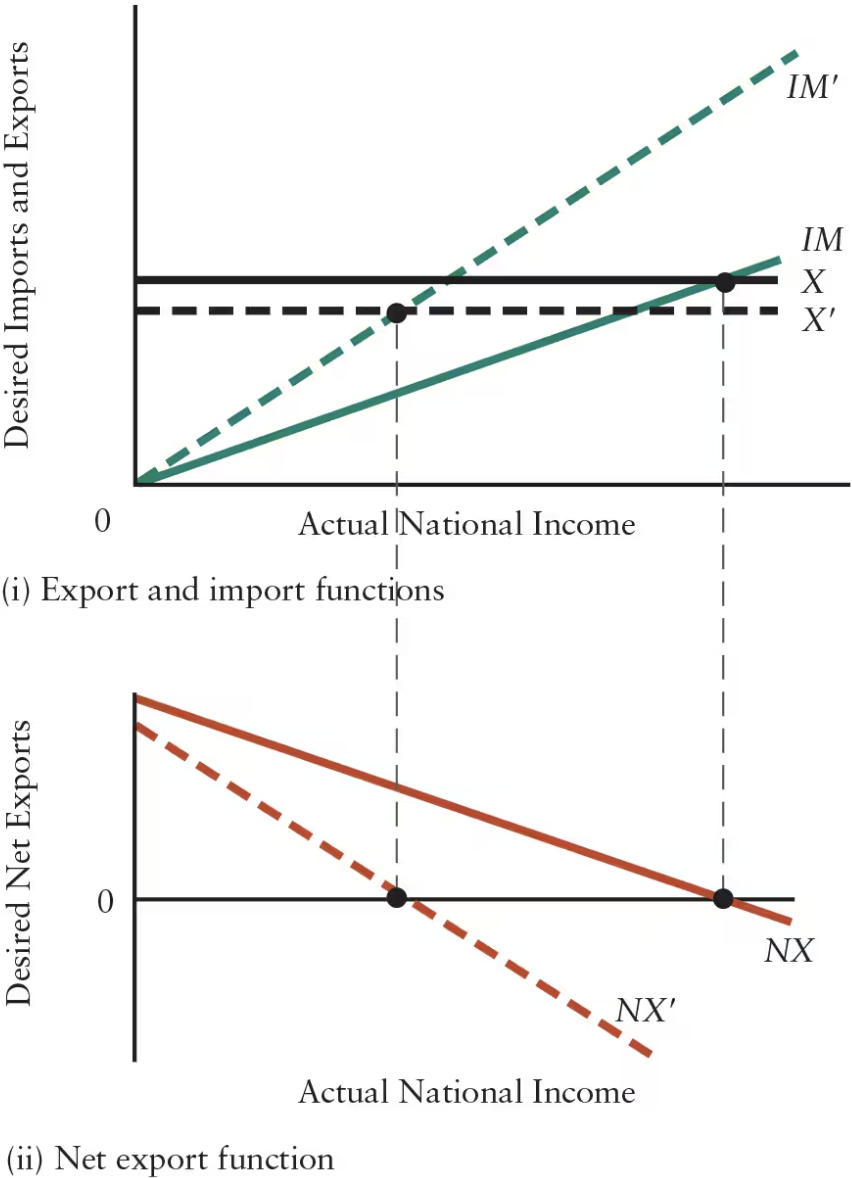

What are the 2 major influences that cause shifts in the net export function?

Changes in foreign income

Changes in international relative prices

Explain the relationship between the net export function and changes in foreign income.

Rise in Foreign Income: NX function shifts upward (parallel to its original position)

When foreign income increases, Canadian exports increase (due to increase in quantity demanded)

Fall in Foreign Income: NX function shifts downward

Explain the relationship between the net export function and a rise in Canadian prices (change in international relative prices).

Rise in Canadian Prices (Relative to Foreign Prices): NX function shifts downward

Foreigners will purchase fewer Canadian products (fall in Canadian exports)

Import Function: shifts upward, rotating the NX function down

Increase in marginal propensity to import

Explain the relationship between the net export function and a fall in Canadian prices (change in international relative prices).

Fall in Canadian Prices (Relative to Foreign Prices): NX function shifts upward

Import Function: shifts downward, rotating the NX function up

Decrease in marginal propensity to import

The most important cause of a change in international relative prices is a change in the ______. Depreciation of the Canadian dollar means that foreigners must pay ______ of their money to buy one Canadian dollar, and Canadians must pay ______ Canadian dollars to buy one unit of foreign currency.

The most important cause of a change in international relative prices is a change in the exchange rate. Depreciation of the Canadian dollar means that foreigners must pay less of their money to buy one Canadian dollar, and Canadians must pay more Canadian dollars to buy one unit of foreign currency.

With the depreciation of the Canadian dollar, Canadians will import ______ at each level of national income, and foreigners will buy ______ Canadian exports. Thus, the net export function shifts ______.

With the depreciation of the Canadian dollar, Canadians will import less at each level of national income, and foreigners will buy more Canadian exports. Thus, the net export function shifts upward.

In the presence of taxes, the marginal propensity to consume out of national income is ______ than the marginal propensity to consume out of disposable income.

In the presence of taxes, the marginal propensity to consume out of national income is less than the marginal propensity to consume out of disposable income.

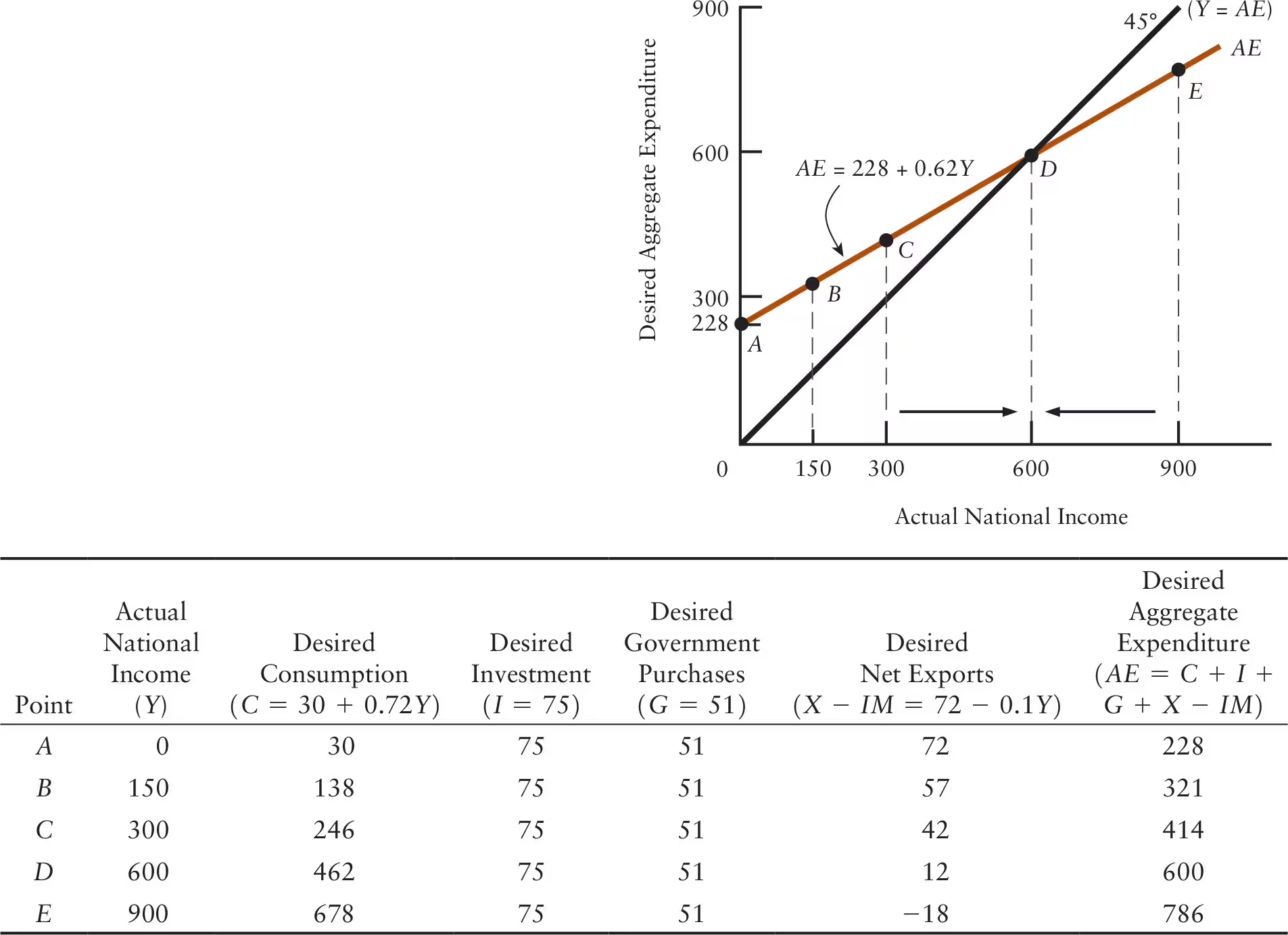

What is the equation for the aggregate expenditure (AE) function (including government purchases and net exports)?

AE = C + I + G + (X — IM )

AE = Equilibrium Level of National Income (Y )

AE = [ C + I + G + X ] + [ MPC (1 — t ) — m ] Y

AE = [ Autonomous Consumption + Investment + Government Purchases + Exports ] + [ Marginal Propensity to Consume (1 — Net Tax Rate) — Marginal Propensity to Import) GDP

![<p>AE =<em> C</em> +<em> I</em> +<em> G</em> + (<em>X</em> —<em> IM </em>)</p><ul><li><p>AE = Equilibrium Level of National Income (<em>Y </em>)</p></li></ul><p>AE = [ <em>C</em> +<em> I</em> +<em> G</em> +<em> X </em>] + [ MPC (1 —<em> t </em>) —<em> m</em> ] <em>Y</em></p><ul><li><p>AE = [ Autonomous Consumption + Investment + Government Purchases + Exports ] + [ Marginal Propensity to Consume (1 — Net Tax Rate) — Marginal Propensity to Import) GDP</p></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/4d18999d-9a05-4b56-8de7-c8f6ff2b2a48.png)

What is the formula for calculating marginal propensity to spend (slope of the aggregate expenditure (AE) function)?

z = MPC (1 — t ) — m

Marginal Propensity to Spend = Marginal Propensity to Consume (1 — Net Tax Rate) — Marginal Propensity to Import

Slope = Marginal Propensity to Spend

The slope of the AE function is represented by the ______ out of national income.

The slope of the AE function is represented by the marginal propensity to spend out of national income.

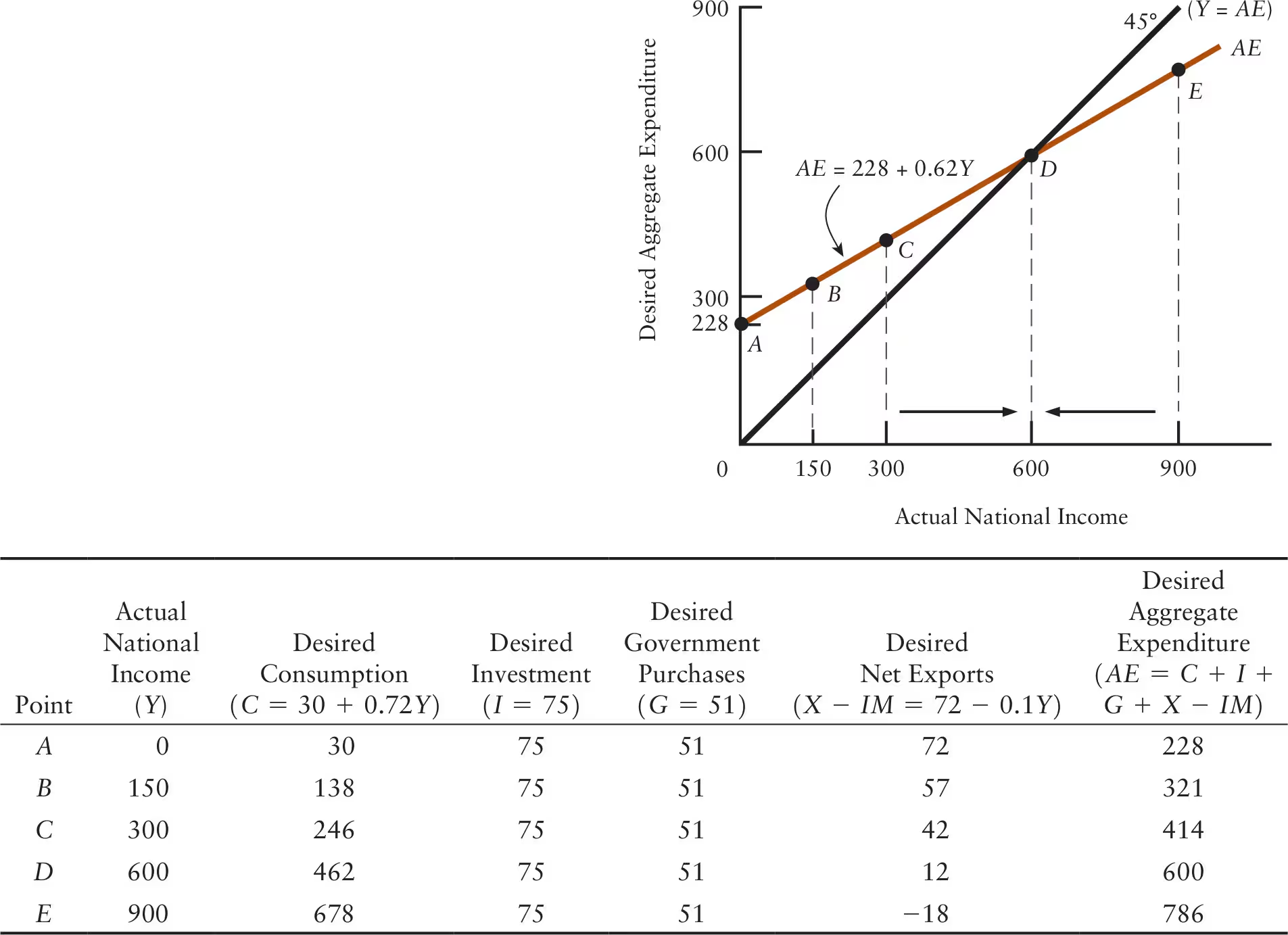

The equation for the AE function is AE = 228 + 0.62Y. The slope of the AE function (Δ AE / Δ Y) is ______, indicating that a $1 increase in Y leads to a ______ increase in desired expenditure. This is the ______ out of national income.

The equation for the AE function is AE = 228 + 0.62Y. The slope of the AE function (Δ AE / Δ Y) is 0.62, indicating that a $1 increase in Y leads to a $0.62 increase in desired expenditure. This is the marginal propensity to spend out of national income.

The equilibrium level of national income is ______, the level of Y where the AE function intersects the 45° line.

The equilibrium level of national income is $600 billion, the level of Y where the AE function intersects the 45° line.

True or False: Marginal propensity to spend (z) is not equal to marginal propensity to consume (MPC).

True

Suppose national income rises by $1, 10 cents is collected by the government as net taxes, 90 cents becomes disposable income, and 80% of this amount (72 cents) is spent on consumption. However, 10 cents of all expenditure is spent on imports. What is the marginal propensity to spend (z)?

z = MPC (1 — t) — m

z = (0.80)(1 — 0.10) — 0.10

z = 0.62

When national income is less than its equilibrium amount, inventories will be depleted and firms will ______ production, thereby ______ the level of national income.

When national income is less than its equilibrium amount, inventories will be depleted and firms will increase production, thereby increasing the level of national income.

When national income is greater than its equilibrium amount, inventories will be rising and firms will ______ production, thereby ______ the level of national income.

When national income is greater than its equilibrium amount, inventories will be rising and firms will reduce production, thereby lowering the level of national income.

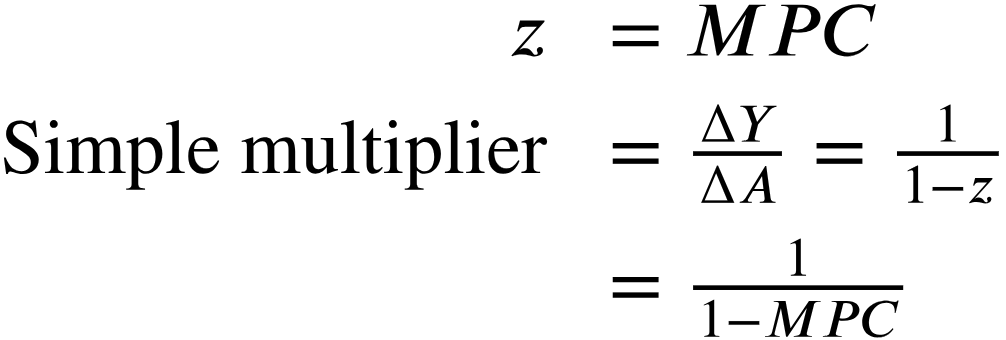

The presence of imports and taxes ______ the marginal propensity to spend, thereby ______ the value of the simple multiplier.

The presence of imports and taxes reduces the marginal propensity to spend, thereby reducing the value of the simple multiplier.

What is the formula for calculating the simple multiplier (without government and foreign trade)?

Simple Multiplier = 1 / (1 — MPC)

Simple Multiplier = 1 / (1 — z)

Simple Multiplier = Δ Y / Δ A

What is the expanded formula for calculating the simple multiplier (with government and foreign trade)?

Simple Multiplier = 1 / [ 1 — [ MPC (1 — t) — m ]]

Simple Multiplier = 1 / [ 1 — [ Marginal Propensity to Consume (1 — Net Tax Rate) — Marginal Propensity to Import ]]

![<p>Simple Multiplier = 1 / [ 1 — [ MPC (1 —<em> t</em>) —<em> m </em>]]</p><ul><li><p>Simple Multiplier = 1 / [ 1 — [ Marginal Propensity to Consume (1 — Net Tax Rate) — Marginal Propensity to Import ]]</p></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/168ed961-1e52-4c4e-982f-0982e551f243.png)

The higher the marginal propensity to import (m ), the ______ the simple multiplier. The higher the net tax rate (t ), the ______ the simple multiplier.

The higher the marginal propensity to import (m ), the lower the simple multiplier. The higher the net tax rate (t ), the lower the simple multiplier.

What are the 4 factors that influence foreign demand for Canadian exports?

Foreign income

Foreign and Canadian prices

Exchange rate

Foreigners’ preferences

True or False: Foreign demand for Canadian exports is not dependent on Canadian income.

True

What are the 3 factors that influence Canadian imports of foreign products?

Canadian income

International relative prices (including the exchange rate)

Canadian firms’ and households’ preferences for foreign products

Define potential GDP.

The level of GDP that would exist if all factors of production were fully employed

When Y < Y* (actual GDP < potential GDP), factor incomes are ______ and unemployment is ______.

When Y < Y* (actual GDP < potential GDP), factor incomes are low and unemployment is high.

When Y > Y* (actual GDP > potential GDP), rising costs lead to ______.

When Y > Y* (actual GDP > potential GDP), rising costs lead to inflation.

Define stabilization policy.

Any policy designed to reduce the economy’s cyclical fluctuations and stabilize national income

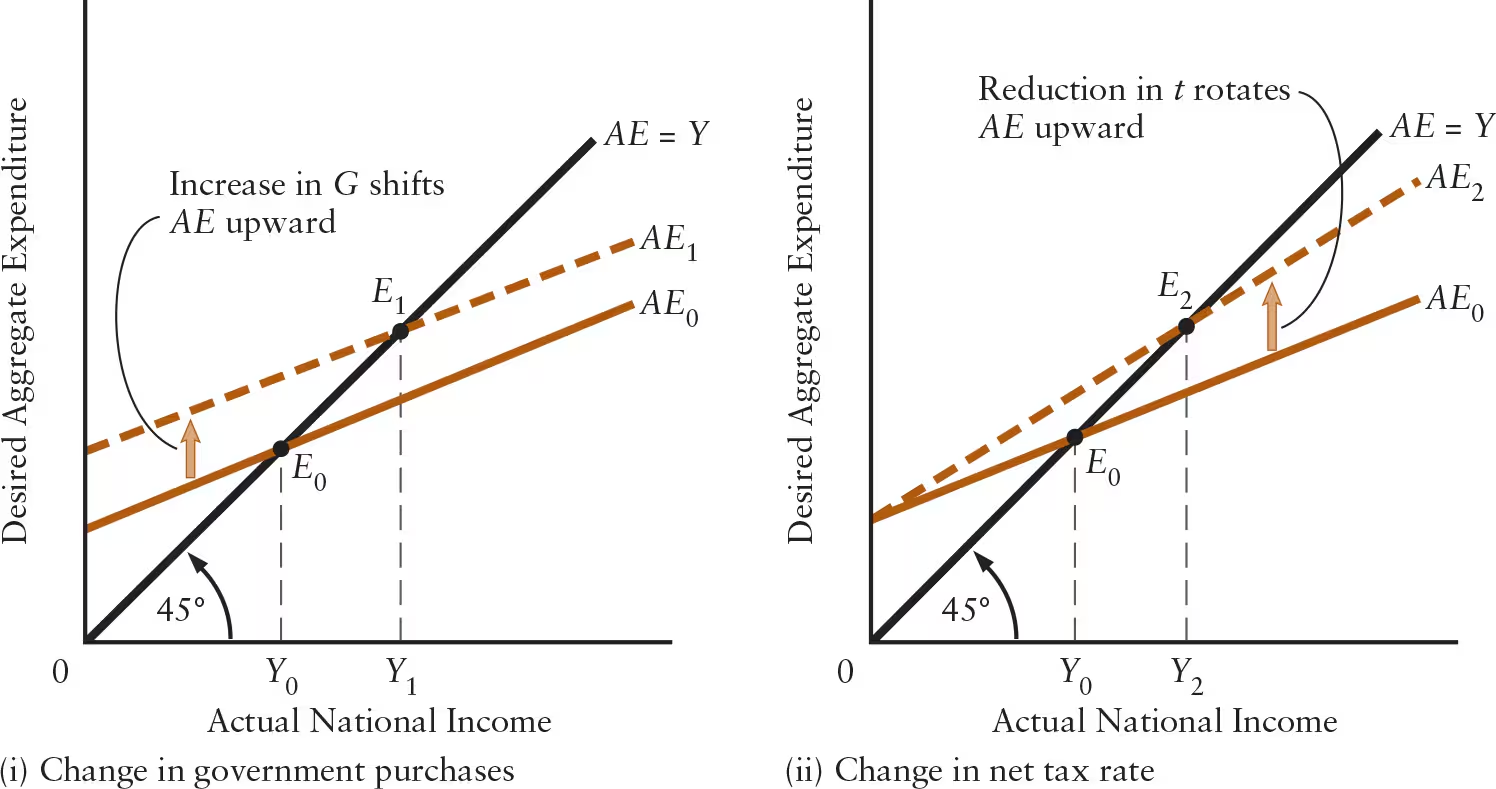

What are the 2 fiscal policy tools available to government policymakers?

Net tax rate (t )

Government purchases (G )

A reduction in the net tax rate or an increase in government purchases shifts the AE curve ______, ______ equilibrium national income.

A reduction in the net tax rate or an increase in government purchases shifts the AE curve upward, increasing equilibrium national income.

An increase in the net tax rate or a decrease in government purchases shifts the AE curve ______, ______ equilibrium national income.

An increase in the net tax rate or a decrease in government purchases shifts the AE curve downward, decreasing equilibrium national income.

What is the equation for the change in equilibrium national income resulting from a change in government purchases?

Δ Y = (Δ G) (Simple Multiplier)

Change in Equilibrium National Income = (Change in Government Purchases) (Simple Multiplier)

The simple multiplier only represents how much equilibrium national income changes in response to a change in ______ desired spending—that is, in response to a ______ shift in the AE function.

The simple multiplier only represents how much equilibrium national income changes in response to a change in autonomous desired spending—that is, in response to a parallel shift in the AE function.

In the simple model of national income determination, the price level is assumed to be ______, and national income is ______ determined.

In the simple model of national income determination, the price level is assumed to be constant, and national income is demand determined.

What are the 2 situations in which we might expect national income to be demand determined?

1st Situation: when there are unemployed resources and firms have excess capacity

Increase in output is possible without increasing prices

2nd Situation: when firms are price setters

Firm controls the price of its product, either because the firm is large (relative to the market), or because the product is differentiated from its competitors

Instead, firms respond to changes in demand by altering production and sales