Year 11 Economics

1/124

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

125 Terms

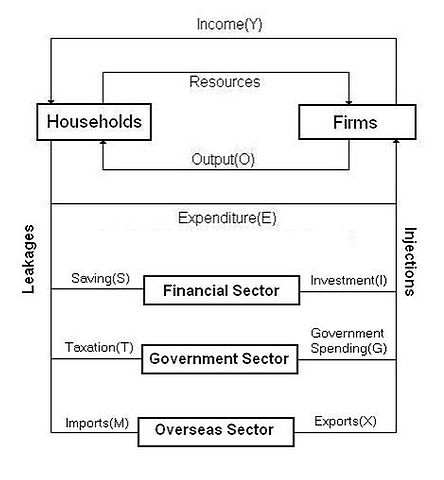

Circular Flow Model

How Goods, Services and Money flow through an economy

Qualitative Measures (Personal Preference)

Genuine progress indicator (GPI)

Total Quality of Life Index (TQLI)

Human Development Index (HDI)

Quantitive Measures (No./Stats)

Economic Growth

Level of Unemployment

Inflation

Need

Resource necessary for survival e.g. shelter

Want

Resource not needed for survival e.g. phone

Good

Tangible item/object e.g. pen

Service

act that someone performs e.g. gardener

Consumer

purchases and uses goods/services

Producer

creates/invents goods/services

Resources/Factors of Production

Capital - Tools

Enterprise - Idea

Land - Natural Resources

Labour - Human effort

Current Production

Production in the current period. GDP includes only income and expenditure that takes place in a specific interval of time.

Opportunity Cost

The missed choice/event when picking between things [or] next best thing that is forgone

Monetary Cost

Financial cost of choice/event

Economics

The study of how people, the government and businesses choose to use their scarce resources to satisfy their unlimited needs and wants.

Economic Systems

The structures that a country uses to make economic decisions; generally divided into capitalist (Producers Choice) and Socialist (Government Production)

Economic Problem

Unlimited needs and wants but limited resources.

Economic Growth

The ability of the economy to produce increasing quantities of goods and services. The key features are the factors of production.

Employed

Individuals over the working age of 15 that work at least one hour per week.

Final Goods/Services

GDP - new good/service which is the end product of the production process that is purchased by final user.

GDP (Gross Domestic Product)

The Market Value of all Final goods/services produced in a country during a period of time.

Inflation

Sustained increase in price for goods and services in an economy.

Labour Force

Individuals over the working age who are willing and able to work. (Employed + Unemployed)

Market Value

Production is valued in dollar terms as assigning monetary values provides a common measure for combining dissimilar goods.

Participation Rate (PR)

% of working age population in labour force

(Labour force/Working age Population) x 100 = PR

Scarcity

When wants are far greater than the available supply of time, goods, services, resources and income.

Surplus

Too much of a product/supply in the market.

Unemployment

% of population who aren’t working but are actively looking for work or work less than 1 hour per week. Target Rate - 4.5%. Current Rate - 4%

Unemployment Rate (UR)

% of Labour Force unemployed.

No. of unemployed/Labour force x 100 = UR

Economic Growth Importance/Effects

Population Growth

Improvement in product quality

Replace goods and services that have been consumed

Measuring GDP

Aggregate Demand = [C+I+G+X-M] (Consumer Expenditure + Investments + Government Expenditure + Export - Imports)

Less than 1 contracting, more than 1 expanding.

Limitations of GDP

Doesn’t measure other living factors such as the environment

Doesn’t include non-market production

Doesn’t provide info about distribution of products

Involves Estimation of production

Rates of Growth

3-4% is Australia’s ideal growth rate. Less than 3% is too slow for our growing population but 4% is unsustainable and will lead too our economy crashing.

Unemployment Causes

Cyclical

Structural

Seasonal

Frictional

Cyclical Unemployment

When the level of consumer expenditure falls. Reasons for this can be high interest rates, poor economic conditions overseas, reduction in income.

Structural Unemployment

Changes in ways goods/services are produced, e.g. machines take over jobs

Seasonal Unemployment

Termination of jobs at the same time each year due to seasons changing. e.g. farming

Frictional Unemployment

Occurs during the period when people finish one job and starts another.

Effects of Unemployment

Deteriorating living standards

Decreased national production

Changed government budget position.

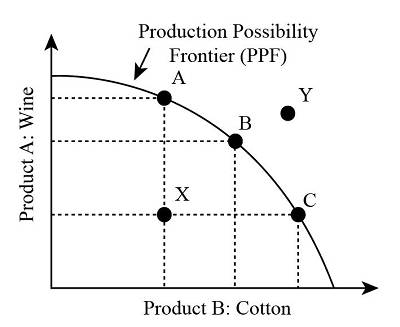

Production Possibility Frontier

Demonstrates concept of opportunity cost, scarcity and GDP

Simplifies real world economy

Demand Pull Inflation

Demand > Supply, Price increases

Causes of Demand Pull

Increase in income

Increase in business confidence

Increase in consumer optimism

Low interest rates

Increase in exports

Cost Push Inflation

Increase in price of goods and services due to increase in price of production

Causes of Cost Push

Increase in wages

Increase in resources

Increase in taxes

Increase in utilities

Trading partners experiencing inflation

Measuring Inflation

ABS (Australian Bureau of Stats) use Consumer Price Index (CPI). CPI measures average change in price levels of a market basket of goods and services purchased by a typical household

Basket of Goods Content

Food, Clothes, Housing, Transport, Recreation, Communication, Health, Education, Alcohol and Tobacco, Insurance, Furnishing

Effects of Inflation

Causes local producers to lose out to overseas competitors: raise in domestic prices leading others to choose overseas products instead.

Undermines Economic Growth: consumers spend less, producers make less, less investments.

Change in allocation of Resources: when inflation rises people tend to save money and/or spend it on unproductive resources such as houses. This is a bad thing as less money is being spent on goods and services.

Affects Income: purchasing declines, businesses have to let workers go to keep costs low or increase in price to survive causing less power in purchasing.

Government intervention into the economy

Redistributive, Allocative, Stabilisation (RAS)

Redistributive

Government measures redistributed income and provides support to various groups in society by ensuring a minimum level of income for all Australians. [Welfare, progressive tax brackets, provision of health services, compulsory superannuation.]

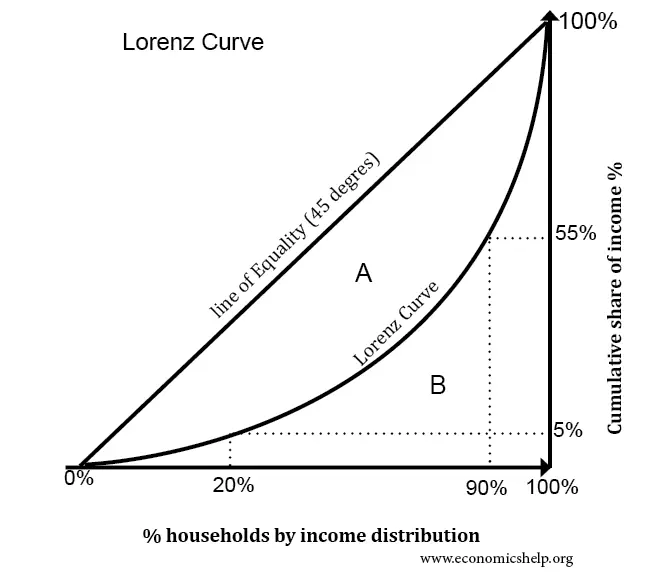

Lorenz Curve

used by governments around the world to measure income distribution in their country

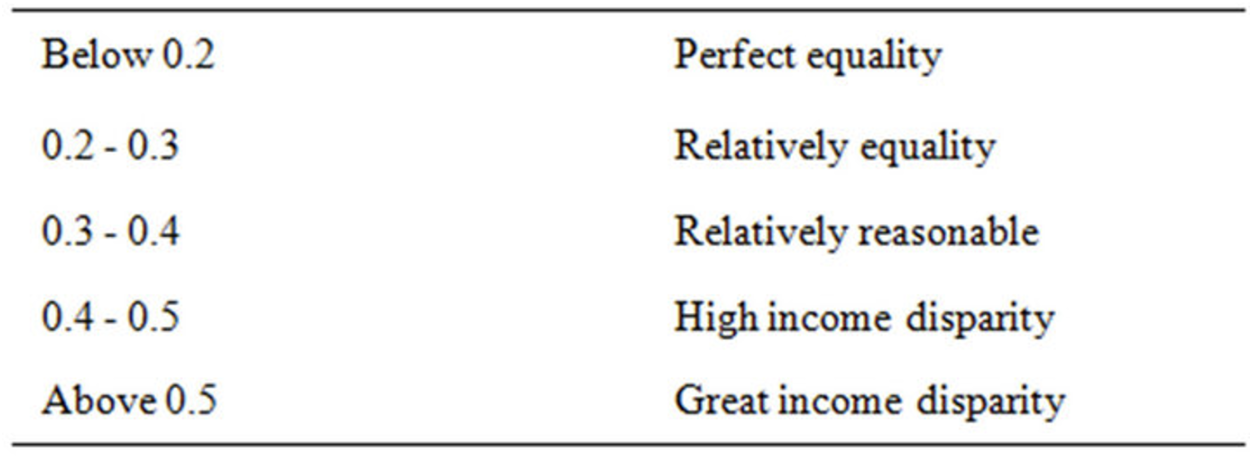

Gini Index

indicates the degree of curvature of the line [in Lorenz curve]. It’s the ratio of the area between the line of equality and the curve and the area of the triangle between the line and total population [on x-axis].

Allocative

when market inefficiency arise the government steps in to reallocate resources to stop market failure e.g. public schools, healthcare, lamp posts, ciggies.

Allocative: Reasons

Market may produce socially undesirable products

Market may not produce socially desirable items

Provide goods and services private sectors don’t

Making sure resources are allocated equitably

[inefficiency is not always a bad things]

Externality

External cost/repercussion of a choice/option or the benefits that come with it [unforeseen consequences (negative or positive)]. Cost or benefit imposed on a third party and not taken into account. Market is not efficient when there is and externality.

Private Cost

expenditure incurred by producers and consumers by producing/buying goods and services.

Private Benefits

profits made by producers and consumers through selling/consuming goods and services

Social Cost

total cost of producing goods/services (private + additional costs on society due to transaction)

Social Benefit

total benefit from consuming goods/services (private + additional benefit on society due to transaction)

Negative Externality

Cost on 3rd party due to economic transaction. When this is in play the government wants to reduce production and consumption [market based policies and command-and-control policies].

Positive Externality

Benefit on 3rd party due to economic transaction. Not always a good thing. The government wants more consumption and production (generally) when a positive externality exists [sometimes they put in subsides].

Market Based Policies

Taxing the final good or service

Command and Control Policies

Regulations such as no advertising certain things e.g. ciggies

Stabilisation

Keep growth steady and sustainability. It regulates economic growth/production/performance and it is shown in budgets.

Australia’s Stabilisation Points

Sustainable economic growth: 3-4%

Stable Inflation: 2-3%

Unemployment: 4-5%

Stabilisation is done because…

Inflation - economy is moving too quickly, demand price is rising and the cost of resources is rising.

Unemployment - economy moving to slowly, demand falls and businesses may lay off workers.

Government Revenue

Personal income 39.0%

State and local tax 19.0%

Company tax 19.0%

GST 12.0%

Other 11.0%

Government Spending

Social security and welfare 35.6%

Other purposes 18.9%

Health 16.7%

All other function 11.3%

Education 7.3%

Defence 5.8%

General public service 4.4%

Fiscal Policy

government intervenes in the economy using government spending to stabilise [depends on growth of economy]

Contractionary Fiscal Policy

Reduce governments spending and/or increase taxes if economy is growing too quickly.

Expansionary Fiscal Policy

increase government spending and/or reduce tax is economy if growing too slowly

Boom and Recession

Boom - growth strong, unemployment low, inflation high

Recession - growth weak, unemployment high, inflation low

Budget Deficit

Spending more than collecting (expansion effect). This increases inflation, decreases unemployment and increases GDP with their being more economic activity.

Budget Surplus

Spending less than collecting (contractionary effect). This decreases inflation, increases unemployment and decreases GDP as there is less economic activity.

Questions when selling

What to produce? [Consumers determine what is produced]

How much? [Level of demand]

How to produce? [Profit motive]

For Whom? [What audience are you reaching]

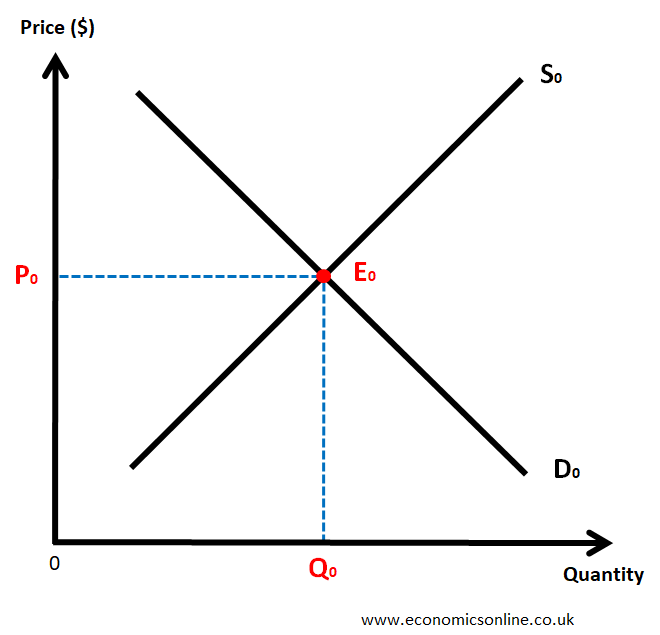

Price Mechanism

The process by which buyers and sellers interact to determine the goods and services [price, type, amount] in a market. Within a market the force of demand and supply dictates the market price.

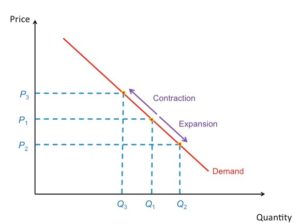

Law of Demand

As the price of a good/service decreases, the quantity demanded increases, vice versa. It shows a inverse relationship or a negative relationship.

Demand Movement

When price changes for a good. When price falls, quantity demanded rises [expansion]. When price rises, quantity demanded falls [contraction].

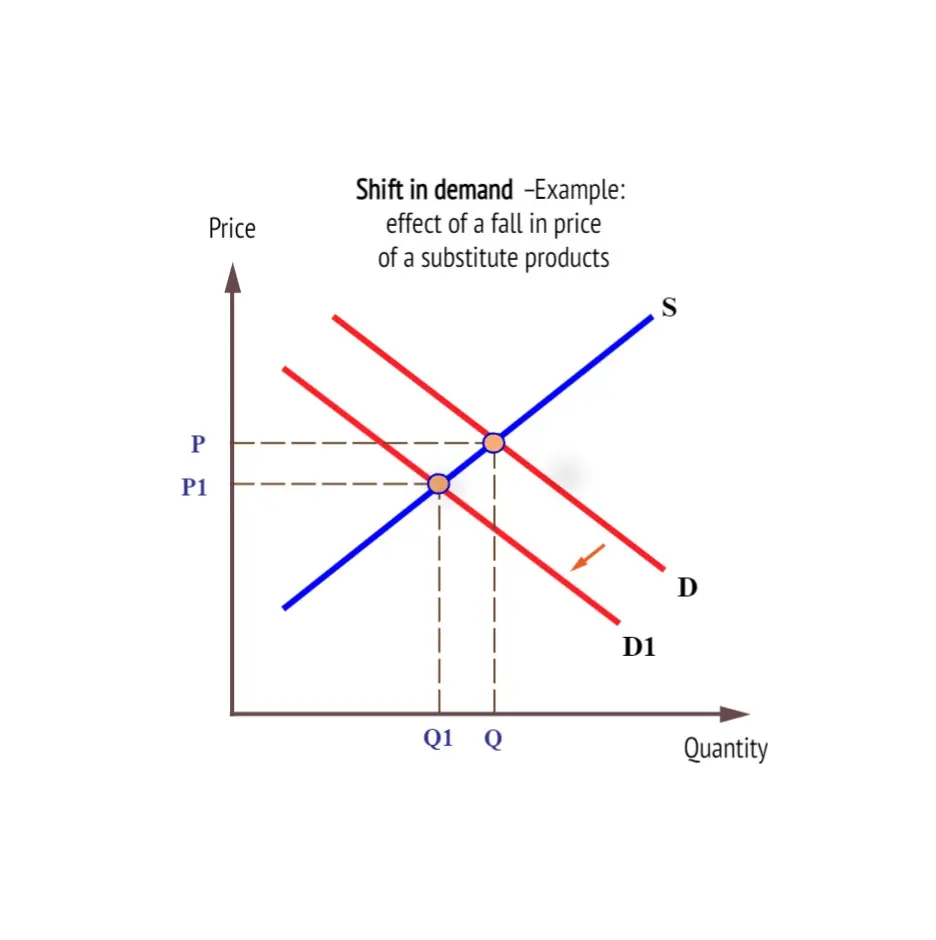

Demand Shift

Occurs when factors other than price, such as consumer preferences, competitors price or income change, leading to an increase or decrease in demand at all price levels.

Law of Supply

When price falls, quantity falls. When price rises, quantity rises. It has a positive relationship between price and quantity.

Price of Inputs

Resources used in production

Price of Substitutes

Alternative products a firm may produce based on profitability

Technology Change

Output increases due to improvements made by technology that increases efficiency of resources and time.

Supply Movement

A change in quantity supplied that is caused by a change in price.

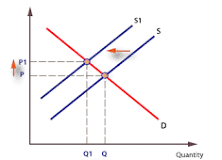

Supply Shift

A change in supply resulting from factors other than price, such as production costs or market conditions.

Equilibrium

The purpose of market is to bring buyers and sellers together hence the price that clears the market is the price that balances the buying intentions of the consumer with the selling intentions of the producer.

Surplus in Graph

Price of good/service is above equilibrium price.

Shortage

Price of good/service is below equilibrium price.

Market

The facilitated area that allows exchange of goods and services between buyer and seller.

Types of Markets

The Production Possibilities Frontier (PPF)

It is a graph that depicts all possible combinations of output from two items utilising existing resources and technology. The PPF encapsulates the ideas of choice, tradeoffs, and scarcity.

Economy Graph

Expansions happen above the equilibrium. Contractions happen below the equilibrium

Effects of Leakages

Money is leaving the economy which is decreasing the flow of income which could’ve help benefit the economy.

Effects of Injections

Increases the money in the economy, benefitting consumers and producers as there is a greater flow impacting buying and selling.

Demand Pull Effect

Due to the excess increase of demand it causes a rise in price to balance out the quantity supplied vs demanded which increases inflation.

Cost Push Effect

Due to the increase in price of resources it causes and decrease in supply and increase in final product. To balance the demand it causes an increase in inflation.

Reason Governments Intervene in the Economy

To help stabilise markets, regulate transactions, provide institutional frameworks, and enforce rules around contract law and property rights. Governments can also intervene when markets fail in the form of bailouts and other emergency measures.

Microeconomics

Study of decisions made by individuals, households, firms and industries and understanding how markets and prices work to allocate resources between competing industries. It focusses on the singular markets and segments of the economy.

Macroeconomics

Study of performance and decision making of the whole economy (Inflation, Unemployment).

Shortage vs Scarcity

Shortage is when supply is limited while Scarcity is when wants exceed resources.

Capital

The machinery, equipment and physical plant used to produce product e.g. tractors.

Enterprise

Creative ability and ideas individuals harness to seek profit through developing new/existing products.