Topic 4 - Profit-maximising firms: price-takers (perfect competition firms) and price-makers (monopolies)

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

43 Terms

What do we mean by market power?

=unlike competitive markets, other market structures allow firms to charge a price above its marginal cost —> they determine prices differently than competitive firms

Apart from their prices, what do monopolies also choose to maximise profits?

Their products’ quality. advertisement, engagement in research and development

Why do governments sometimes regulate monopoly prices?

To prevent the welfare loss that accompanies monopoly pricing

Three types of markets

Monopoly market

Oligopoly market

Monopsony market

Monopoly market

=a single seller in the market

Oligopoly market

=a few sellers in the market

Monopsony market

=a single buyer in the market (e.g. the labour market)

How can you become a monopoly?

through government awards and patents

being the first firm to recognise an opportunity to produce a new product

being the first firm to produce a product successfully (e.g. Apple)

innovation and cost-cutting

owning the entirety of an essential input (e.g. diamond trade in South Africa)

natural monopolies (or all other firms exiting the market)

Characteristics of high monopolies

High Fixed Costs

Decreasing Average Costs

—> A good is produced most economically by a single firm

Three examples of natural monopolies

Utilities

Transport and infrastructure (e.g. subways, railways, etc.)

Telecommunications and digital networks

Utilities

Electricity distribution: high FC for power line and grid building; AC falls sharply as output rises

Water supply and sewage systems: expensive building and maintenance; cheap delivery of extra units once the system is in place (MC low and constant)

Natural gas pipelines: large upfront infrastructure, low MC

Telecommunications and digital networks

Fixed-line telephone networks: historically natural monopolies because laying parallel cables was inefficient

Broadband/fiber networks: in many regions, there is only a single provider who builds the infrastructure

Postal delivery: economies of scale in logistics and routing; duplication of delivery routes is costly

Why are natural monopolies particularly important for policymakers?

Because they require to be heavily regulated

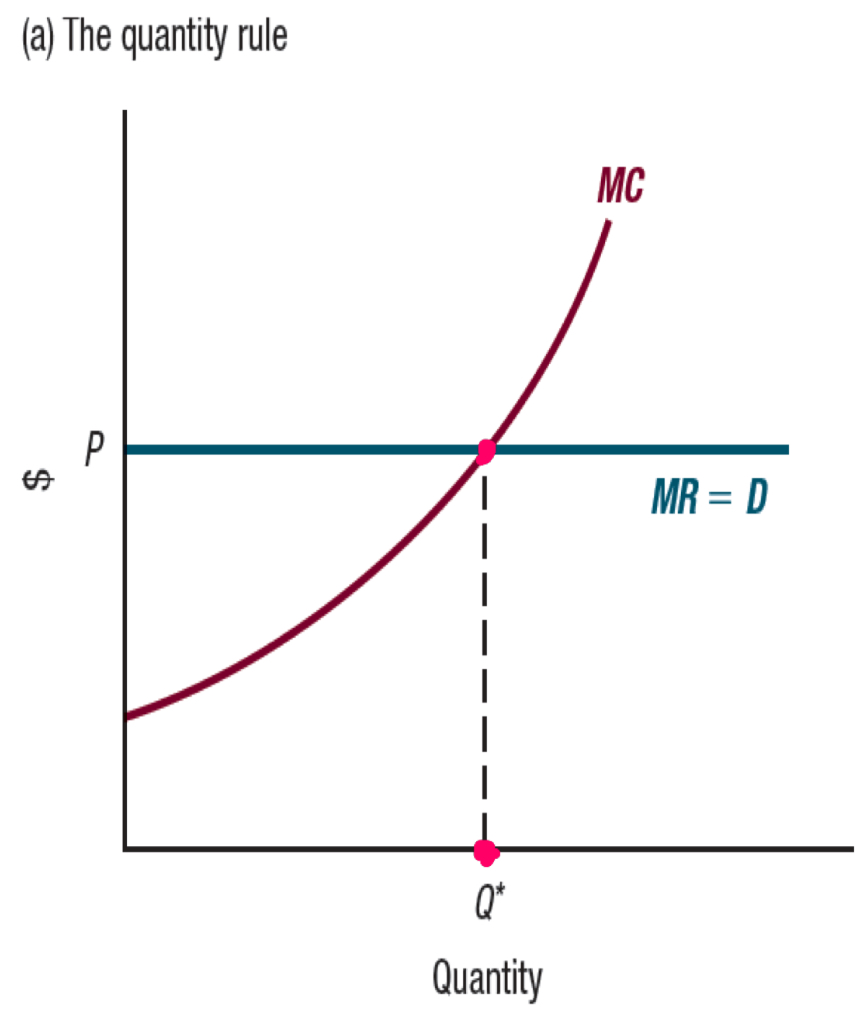

Recalling what we have learned about maximising profits

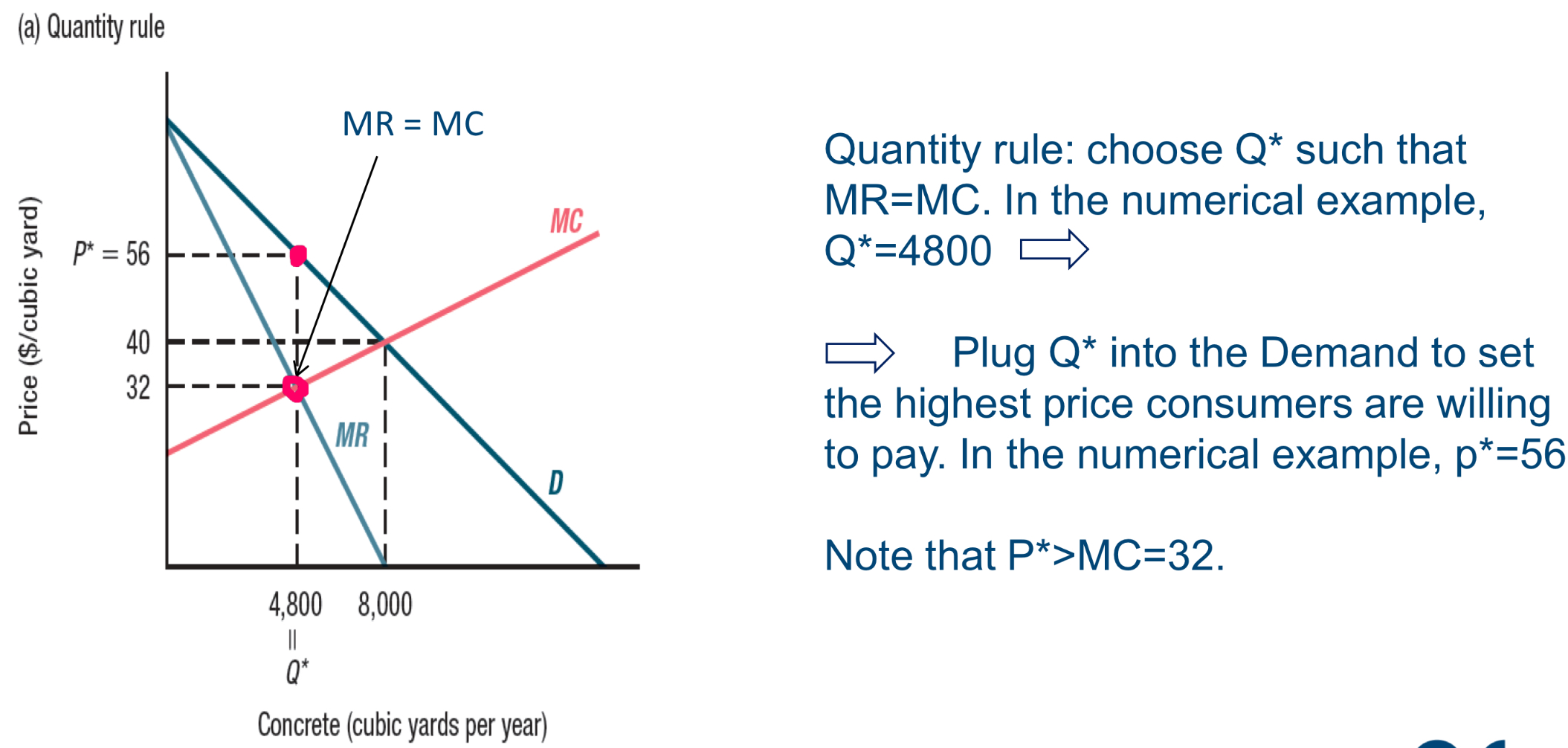

The quantity rule implies that the profit-maximising sales quantity Q*is where MR(Q*)=MC(Q*) —> the firm keeps producing as long as MR > MC, and it stops when MR = MC (however, there is a very big difference between the MR for a price-taking firm and a price-making firm)

Profit-maximising sales for a price-taking firm

For a price-taking firm, MR is constant and equal to the equilibrium price P* —> P=MR for all quantities

So how do we identify positive sales quantities? Quantity rule!

For any given price, the firm chooses the quantity such that MR=MC —> P=MC because the price is equal to the MR

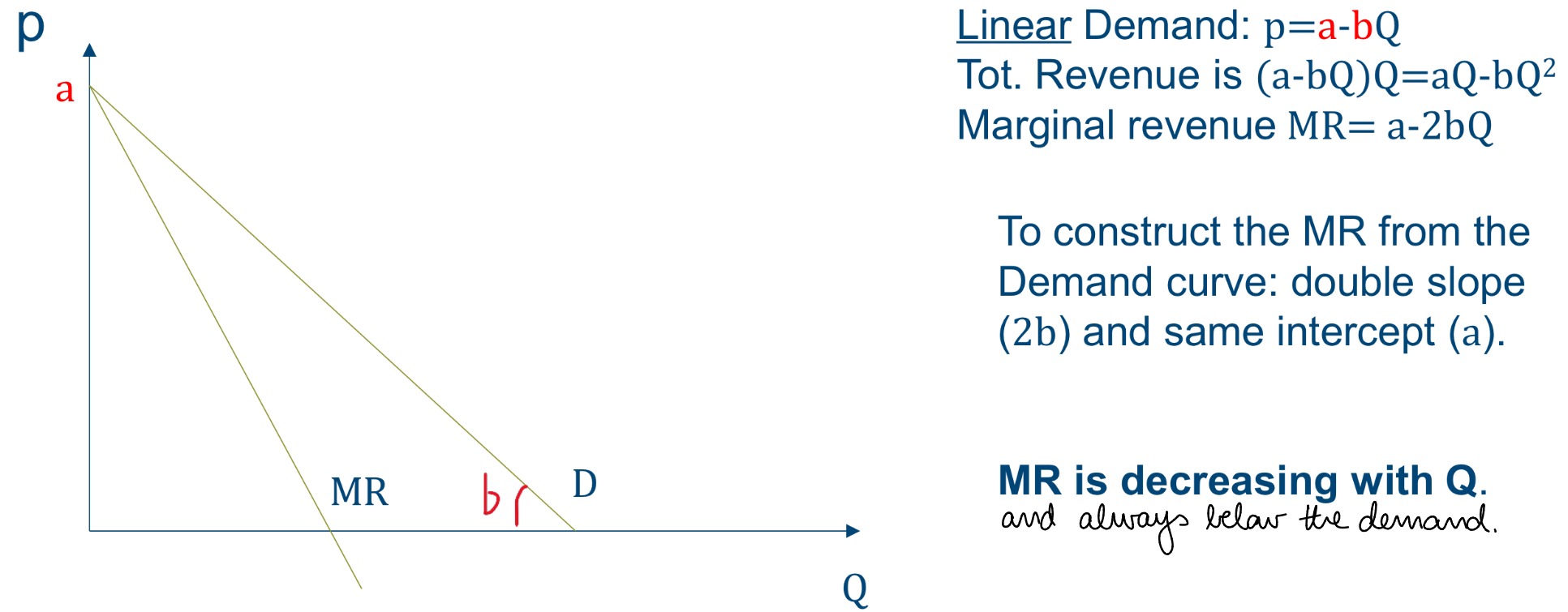

So how is this different for price-makers (i.e. monopolies)?

Monopolies are the only sellers and they set the highest price consumers are willing to pay.

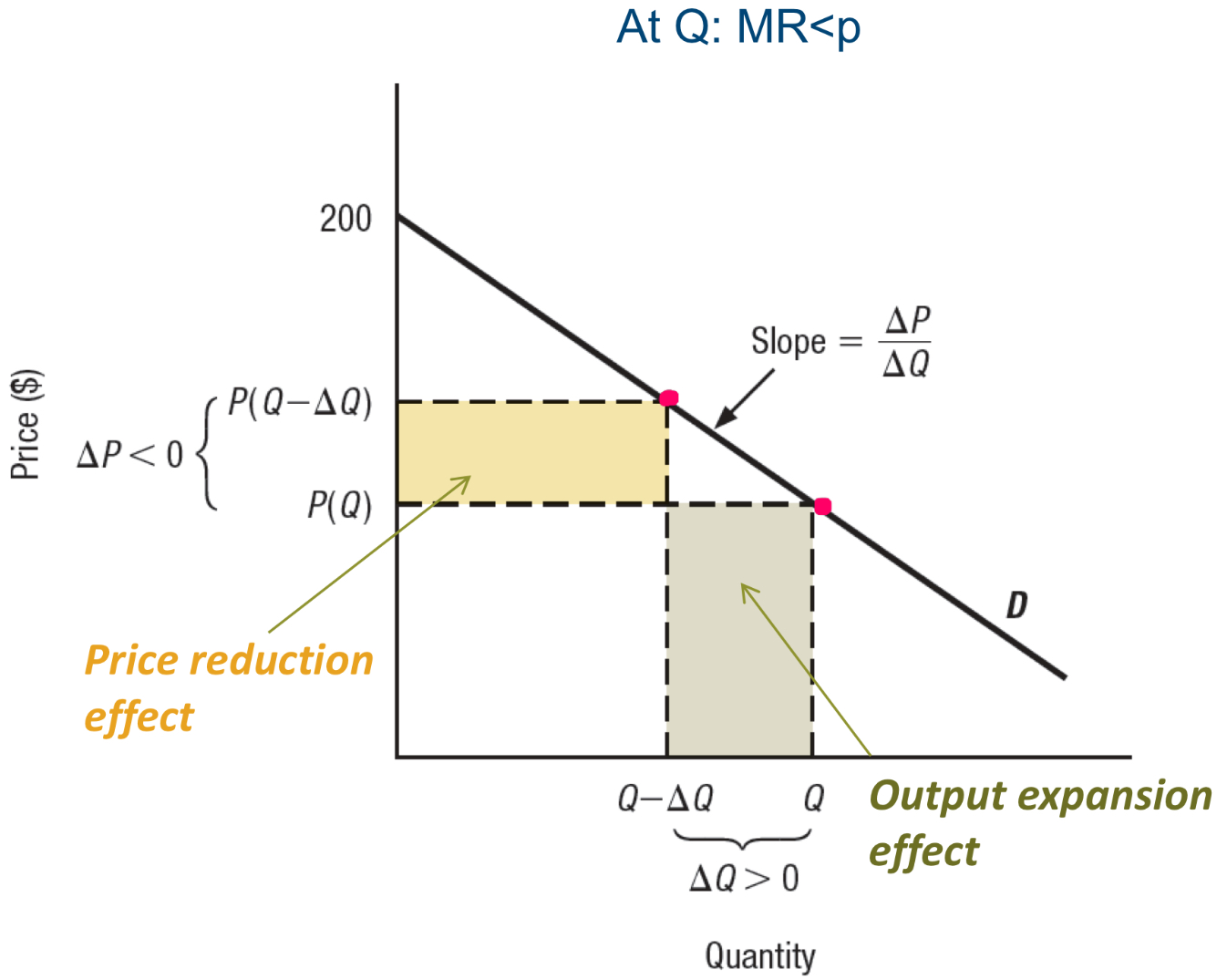

As quantity increases, consumers’ willingness to pay (WTP) decrease —> MR<P

MR and P in a monopoly

Profit-maximising price and sales Q for a monopoly

Markup: a measure of market power —> how is it calculated?

The degree of a monopolist’s market power is measured by the extent to which its price exceeds its marginal cost (typically measured as a %): (P-MC)/P

How else can this ratio be called?

The price-cost margin and the Lerner index

How does the market power ratio connect to elasticity?

It can be shown that: (P-MC)/P=-1/Ed

So what does this imply?

That the less elastic the demand curve is (the closer its E is to 0), the greater the firm’s markup over its marginal cost —> When demand is less elastic, raising the price is more attractive because fewer sales are lost

Let’s recall how elasticity works

When elasticity of demand is < -1 —> demand is elastic (the %change in the amount demanded is larger, in absolute value, than the %change in price)

When elasticity of demand is between -1 and 0 —> demand is inelastic (the %change in the amount demanded is smaller, in absolute value, than the %change in the price)

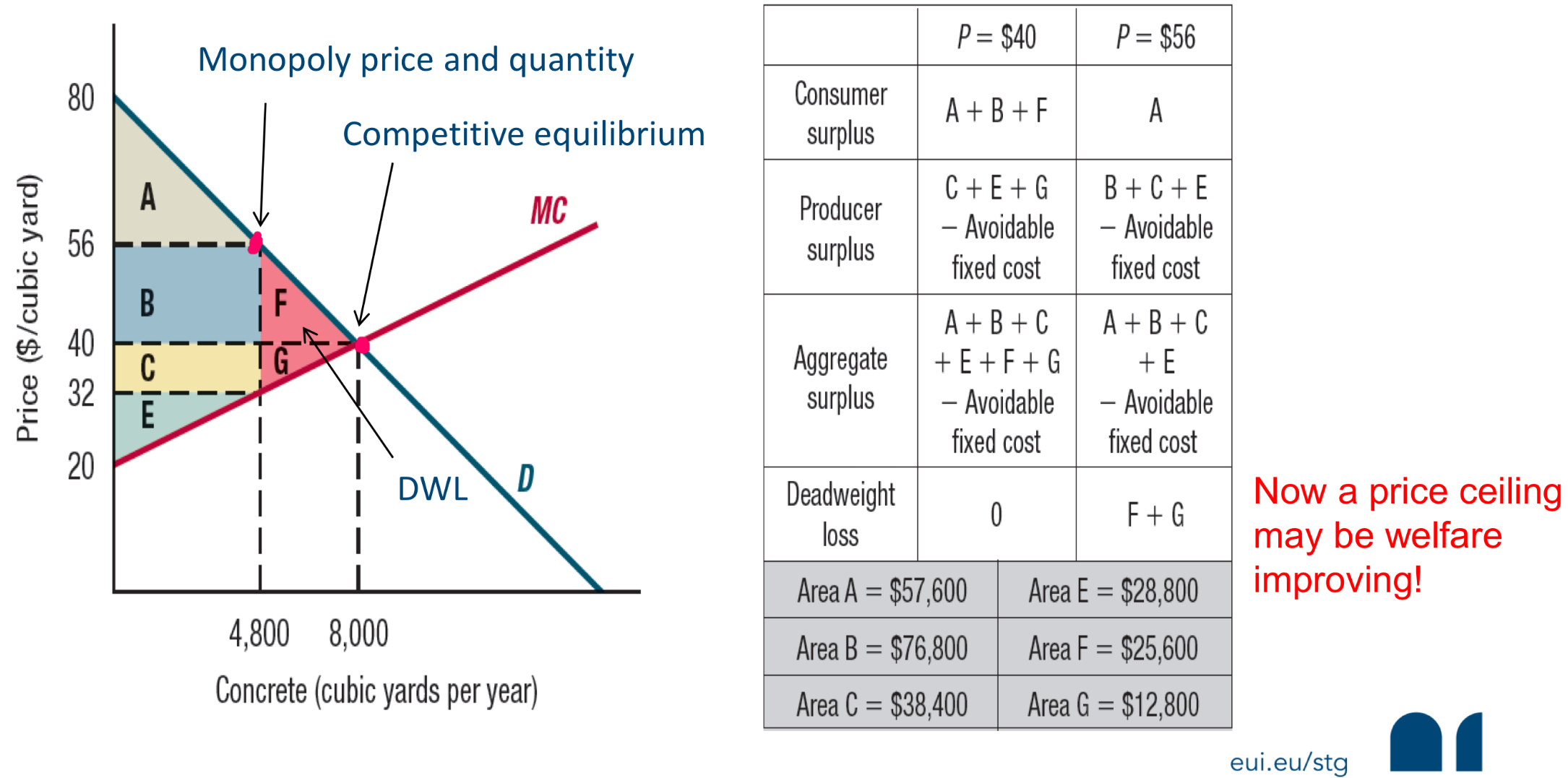

Visualising welfare effects of monopoly pricing

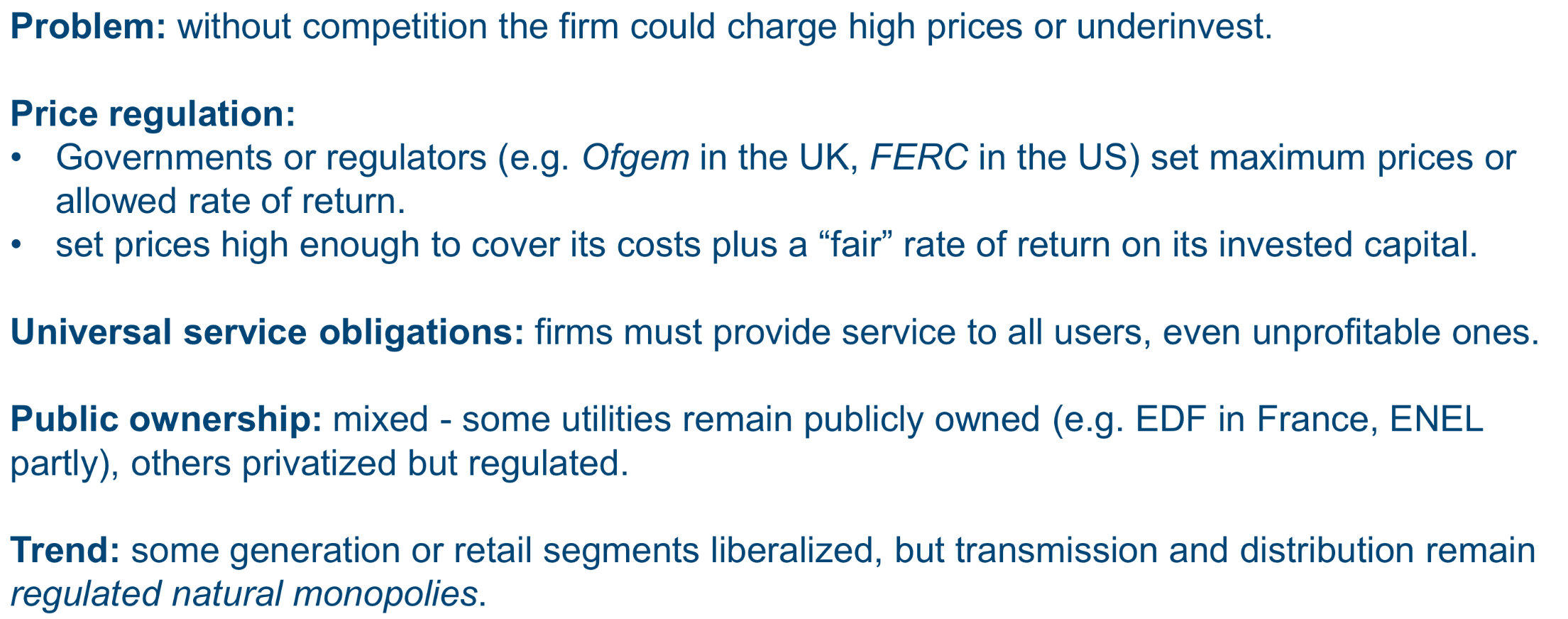

Regulation of monopolies

Governmental efforts to affect market prices in perfectly competitive markets generally lead to DWL

DWL from monopoly pricing justifies government intervention in markets in which firms enjoy market power

Government actions that keep prices closer to MC can:

protect consumers

increase aggregate surplus

What forms can government interventions to limit market power exercise take?

Antitrust legislation: which seeks to keep prices low by ensuring that a market is as competitive as possible

Direct regulation of prices

Examples: drugs, electricity, natural gas, and local telephone service

—> Need to take into account the firm’s cost-structure

Example 1 of monopoly regulation: utilities

Example 2 of monopoly regulation: telecommunications

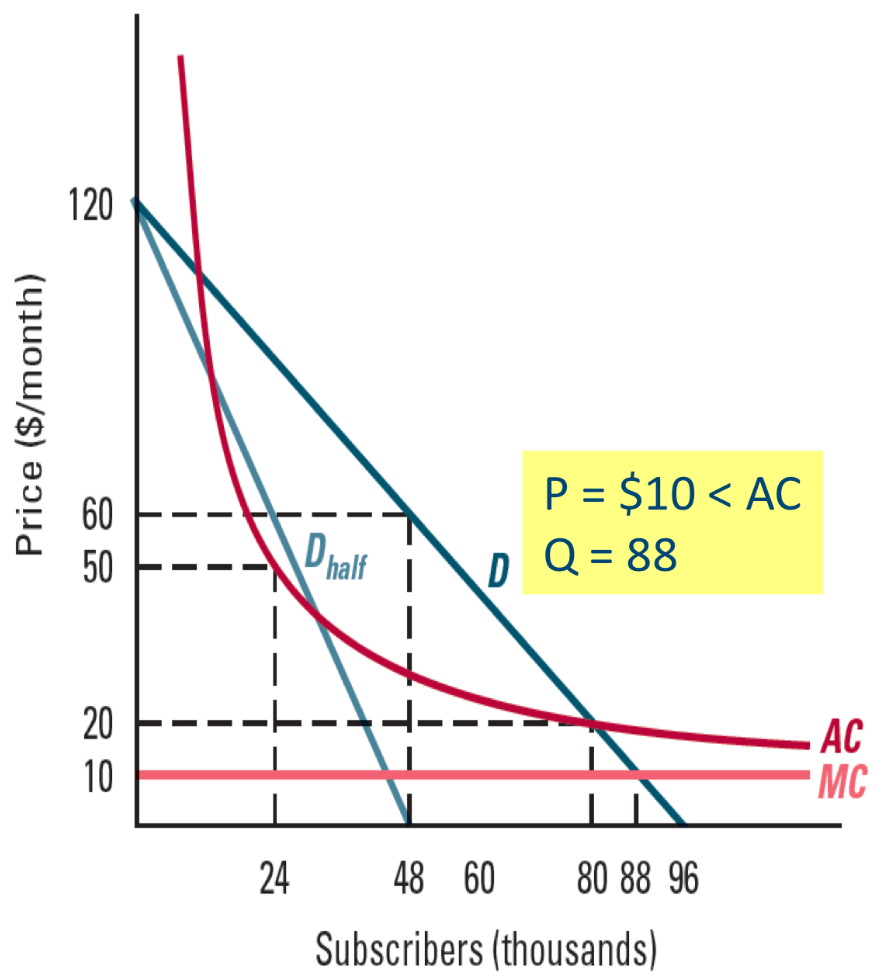

First-best price regulation (perfect competitive outcome)

=setting a competitive truce, at which the demand and MC curves intersect

What happens through the intersection of demand and MC?

Aggregate surplus is maximised

What may this regulation cause?

Might cause the regulated monopoly to lose money —> shut-down rule

When does this regulation typically occur?

When fixed costs are very high and average cost is decreasing

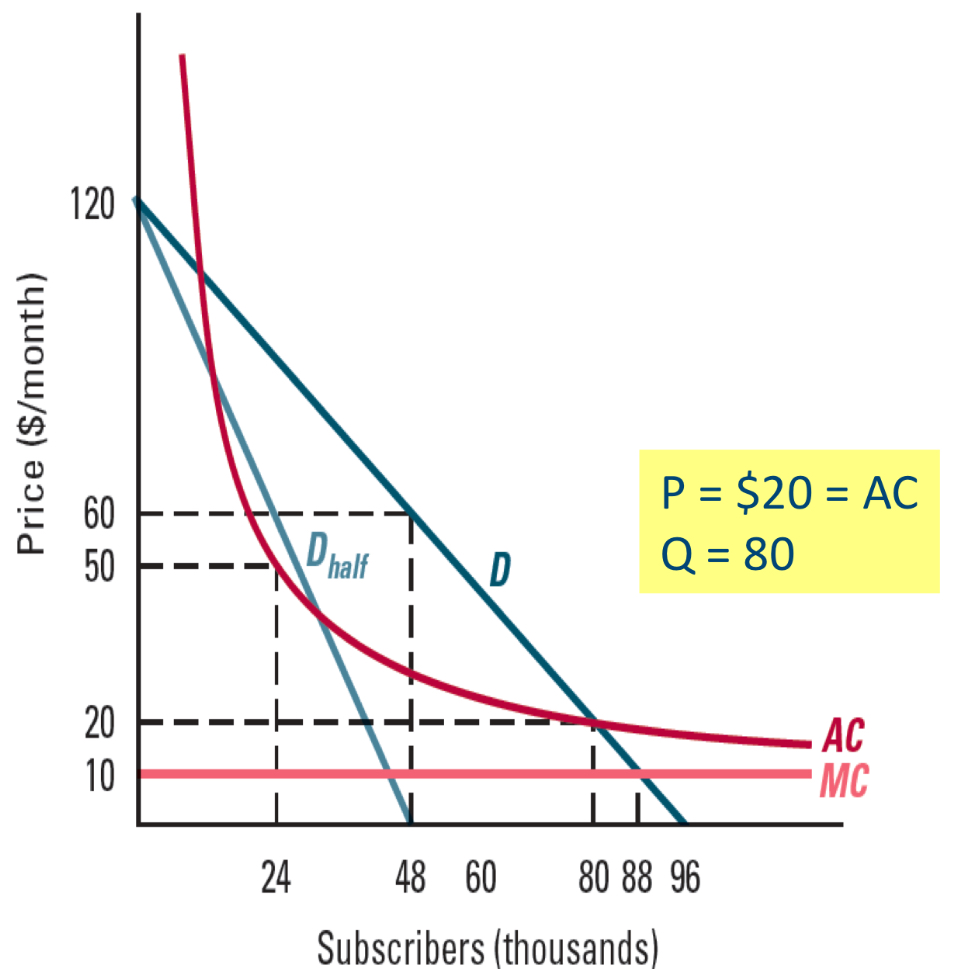

Second-best regulation

=setting the price that makes aggregate surplus as large as possible, while still allowing the firm to avoid losses (P=AC)

Example of second-best price regulation: prices and subscriptions

At that price, monopolists break even: it has 80000 subscribers at an AC of 20$ per subscriber —> at any lower price, it loses money —> at any higher price, aggregate surplus is not as large as with a price of 20$

Non-price effects of price regulation

Besides pricing, monopolists make decisions such as: mixing inputs, putting efforts to reduce costs, and introduce new and higher-quality products

If price regulation force monopolies’ profits to annulate, there would be not much incentive for innovation and lower costs (regulation leads to a distortion of monopolies’ choices) —> regulators can set prices so that current profit=0, while allowing the monopoly to keep future gains from cost reduction

Investments to become a monopolist: Rent-seeking

=efforts devoted to securing a monopoly position (DWL may be larger because many investments were made —> prices will initially be very high)

How are the welfare effects of rent-seeking?

Not necessarily bad; expenditures firms make to gain monopoly positions can be socially valuable (e.g. research and development spending)

What is an example of making investments to become monopolists?

Pharmaceutical firms: they invest billions of dollars each year in an attempt to make discoveries that will lead to patented drugs

Regulatory failure

Regulators may pursue different goals than maximising aggregate surplus (e.g. regulators that seek to behave in a way that allows their re-election)

Regulators have been captured when they promote the regulated firm’s agenda (=lobbying)

Regulation after the Industrial Revolution

Significant increase in regulation, due to:

more larger economies of scale

loss of faith in markets following business scandals post-Great depression

Regulation in the years between 1970-2000 —> why was there a dramatic reversal?

In part due to technological changes (less natural monopolies) —> increased faith in the benefits of competition + reduced faith in regulators

What has prompted calls for increased regulation?

The aftermath of the “Great Recession”

The loss of faith in markets that accompanied the recession

Review

A firm has market power if it can profitably charge a price above its MC

Because of the price-reduction effect, a monopolist’s MR < P (unlike in a competitive market)

Monopoly pricing results in DWL

Monopoly regulation aims at maximising aggregate surplus, subject to the constraints that the firm avoids losses and that it has the incentive to continue innovating and reducing costs