asynchronous 12: Microcredit &Ready-to-Use Therapeutic Food (RUTF)

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

6 Terms

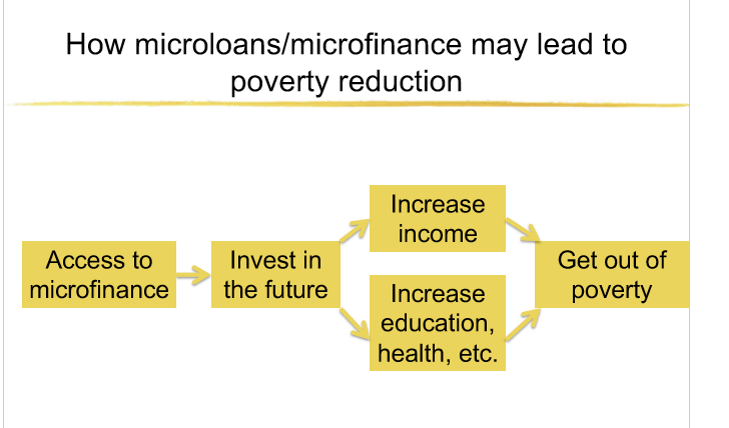

Indicate how microfinance (including microcredit)

could alleviate poverty and improve food security

small loans given to people in poverty in remote areas

enable people to invest in their small business, increase income and family’s living standards

increasing access to other services, training

improves meal QUALITY

increase meat and fish consumption

improvements observed if microcredit client was FEMALE

Describe the Grameen Bank (founded by

Muhammad Yunus in Bangladesh)

allows poor to bank with no collateral, full guarantee, no lawyers

mostly used by women for small businesses, hiring employees, more sewing machines

$100 million monthy lent out

higher education for students

Give specific examples of how the impact of

microcredit has been assessed – and what can be

learned from those evaluations

we need to understand when these strategies can be used and who can use it

studies in suh saharan africa

some poorer from microfinance → suggest to target entrepreneurs rather than unexperienced

positive on saving, mixed on income

negatively impact clients childrens education

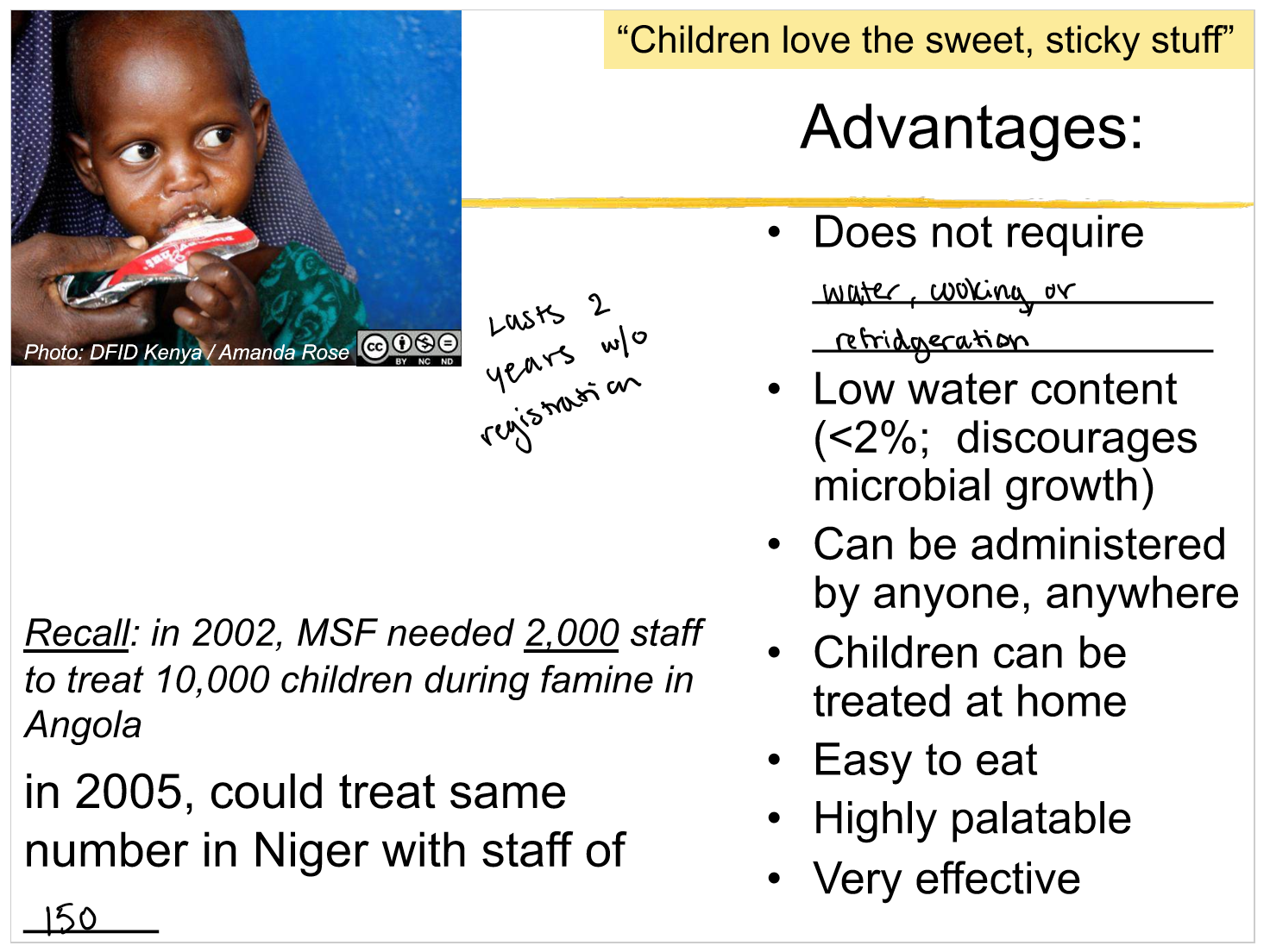

describe RUTF, their development, and their impact on the treatment of severe acute malnutrition

sache plumpy nut

oil, sugar, milk powder, peanut butter

lasts on shelf

easier to use because administered at home rather than the milk used in clinic

89% children with SAM recovered, no signs of allergy

identify and evaluate strengths and limitations of RUTF’s

limitations:

no evaluation of the vitamin and mineral status of children is done at the end of treatment

reliance on dairy is expensive and less sustainable, could other formulations work?

effects on mortality and relapse unknown

consider ethical and practical questions about the use of RUTF and identify useful directions future research

need a greater measurement of functional outcomes: learning, development, physical growth, etc