AP Macroeconomics: Aggregate Demand, Supply, and Fiscal Policy

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

In the long run, if aggregate demand decreases, real gross domestic product (GDP) and the price level will change in which of the following ways?

Real GDP: No change

Price Change: Decrease

Aggregate demand may be measured by adding

consumption, investment, government spending, and net exports

Assume the marginal propensity to consume is 0.8. How will a decrease in taxes of $100 billion and a decrease in government spending of $100 billion affect aggregate demand?

Aggregate demand will decrease by $100 billion.

All of the following explain why prices and wages are sticky EXCEPT

competition in the business sector

Assume the government reduces its spending and raises income taxes in an effort to reduce the budget deficit. The most likely short-run result will be an increase in

unemployment

Which of the following would cause the short-run aggregate supply curve to shift to the right?

A decrease in the expected price level

If a reduction in aggregate supply is followed by an increase in aggregate demand, which of the following will definitely occur?

Responses

The price level will increase.

Which of the following is an example of an automatic stabilizer?

Progressive income taxes

Which of the following statements is true about an expansionary fiscal policy?

It increases aggregate demand.

One explanation for the downward slope of the aggregate demand curve is that when the price level increases, which of the following will decrease?

Real value of assets

In a closed economy with only lump-sum taxation, if the marginal propensity to consume is equal to 0.75, a $70 billion increase in government spending could cause a maximum increase in output of

$280 billion

A high marginal propensity to consume implies which of the following?

A low marginal propensity to save

Which of the following statements about inflation is true in the short run?

The economy's real output increases when there is demand-pull inflation and decreases when there is cost-push inflation.

An increase in which of the following would cause the aggregate demand curve to shift to the left?

Income taxes

If an economy's aggregate supply curve is upward sloping, an increase in government spending will most likely result in a decrease in the

Responses

unemployment rate

An economy is currently in short-run equilibrium, and real output is below the full-employment level of output. Which of the following market adjustments is most likely to occur in the long run?

Nominal wages will fall, shifting the short-run aggregate supply curve to the right.

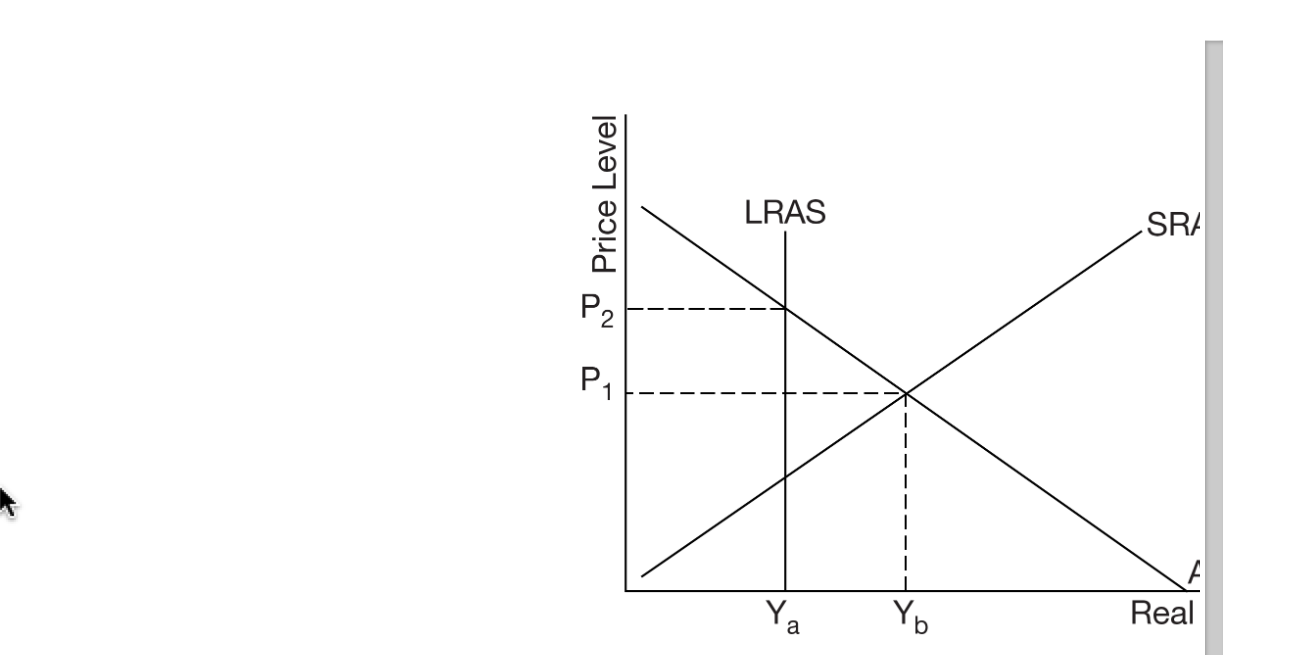

The diagram above shows a nation's short-run aggregate supply curve, long-run aggregate supply curve, and aggregate demand curve.

Based on the diagram above, which of the following describes what will happen in the long-run adjustment process?

Wages and input prices will increase

Recessions will most likely be less severe if tax revenues and transfer payments automatically change in which of the following ways?

Responses

Tax revenues decrease, and transfer payments increase.

In an economy the marginal propensity to consume is 0.90, and gross domestic product (GDP) is $100 billion. If gross private domestic investment declines by $2 billion, then GDP will

decrease by a maximum of $20 billion

If, at full employment, the government wants to increase its spending by $100 billion without increasing inflation in the short run, it must do which of the following?

Responses

Raise taxes by more than $100 billion.

The aggregate demand curve is downward sloping because as the price level increases the

purchasing power of wealth decreases

Investment in physical capital is most likely to occur as a result of an increase in

business confidence

Which of the following is an assumption underlying an upward-sloping short-run aggregate supply curve?

Wages are sticky

When an economy is in equilibrium at potential gross domestic product, the actual unemployment rate is

equal to the natural rate

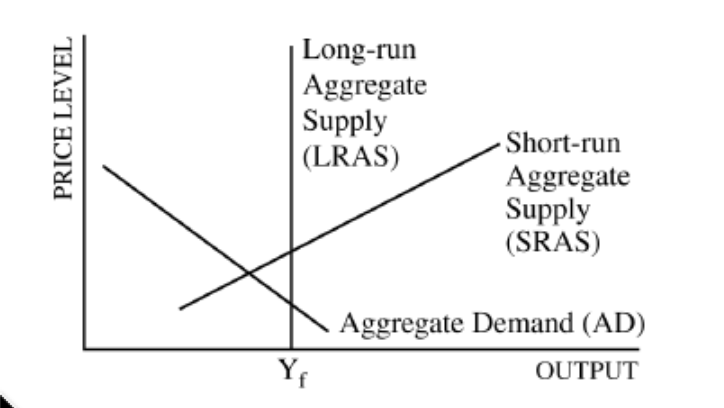

According to the graph above, which of the following statements about the economy is true?

Wages will eventually decrease, restoring full employment in the long run.

When an economy is at full employment, which of the following will most likely create demand-pull inflation in the short run?

A decrease in the real rate of interest

Which of the following will shift the aggregate demand curve to the right?

Increased spending by businesses on computers