Acc312 Exam 1

1/62

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

63 Terms

What is Managerial Accounting?

Process of identifying, measuring, analyzing, interpreting, and communicating information in pursuit of an organizations goals

What is a cost?

Any Sacrifice made to achieve a goal

What is an expense?

the cost incurred when a resource is used up for the purpose of generating revenue

Product Cost

The total expenses incurred to create a product, including direct materials, labor, and overhead costs

Period Cost

Expenses that are not directly tied to the production of goods or services, such as rent and administrative salaries. They are incurred over a specific time period and are not included in the cost of goods sold. Basically, all costs that are not product costs

Examples: R&D, Admin, Selling, Salaries of Sales/Corporate, Commissions,

Gross Profit (Gross Margin)

the amount of revenue left after deducting just the costs that have been classified as cost of sales or COGS

Operating Income (Operating Profit)

Profit remaining after deducting both COGS and period costs

Direct Materials

material that is consumed in the manufacturing process, is physically incorporated in the finished product, and can be traced to products relatively easily

Direct Labor

salaries, wages, and fringe benefits for people who work directly on the manufactured products

Fringe Benefits

health insurance, pension, SS, other non salary benefits

Manufacturing Overhead

Costs not directly tied to production of a specific product, like rent and utilities for the factory. Considered indirect costs in manufacturing

Examples: Indirect Material, Indirect Labor, Other Manufacturing or Production Costs, Overtime, Idletime, depreciation, taxes, insurance, utiltiies, rent,

Prime Costs

direct materials + direct labor

Conversion Costs

Costs incurred to convert raw materials into finished goods, including direct labor and overhead costs. Excludes direct materials.

Three Types of Inventory

Raw/Beginning Materials

WIP

Finished Goods

The Big Ass Inventory Account Equation/Cash Flows….Is Split into 3 Sections

Materials, WIP, Finished Goods

Equation for Materials

Beginning Materials + Materials Purchased = Materials Available - Ending Materials = Materials Used

Equation for WIP

Beginning WIP + Materials Used + Direct Labor + Manufacturing Overhead = WIP Available - Ending WIP = COG Manufactured

Equation for Finished Goods

Beginning FG + COG Manufactured = Goods Available for Sale - Ending FG = COGS

Net Income Equation

Revenue - COGS = Gross Profit - OPEX = Pre Tax Income - Tax = Net Income

Variable Costs

Costs that change based on level of activity. They fluctuate as the quantity of output changes

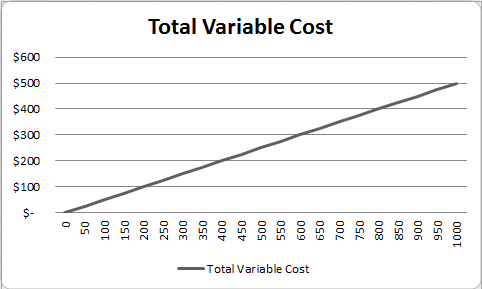

Total Variable Costs

Total Variable Costs change in Direct Proportion to Changes in Levels of Activity

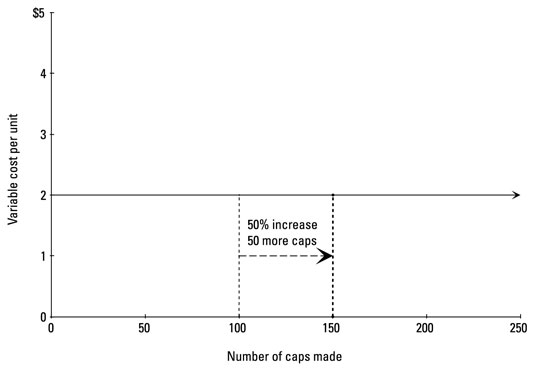

Unit Variable Costs

Remain the Same as Activity Increases

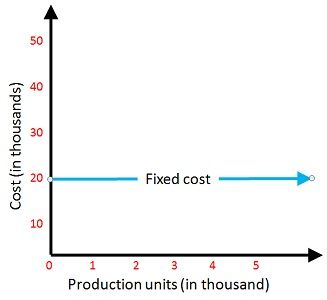

Fixed Costs

Costs that remain unchanged based on the level of activity

Total Fixed Costs

Remain the same as level of output varies

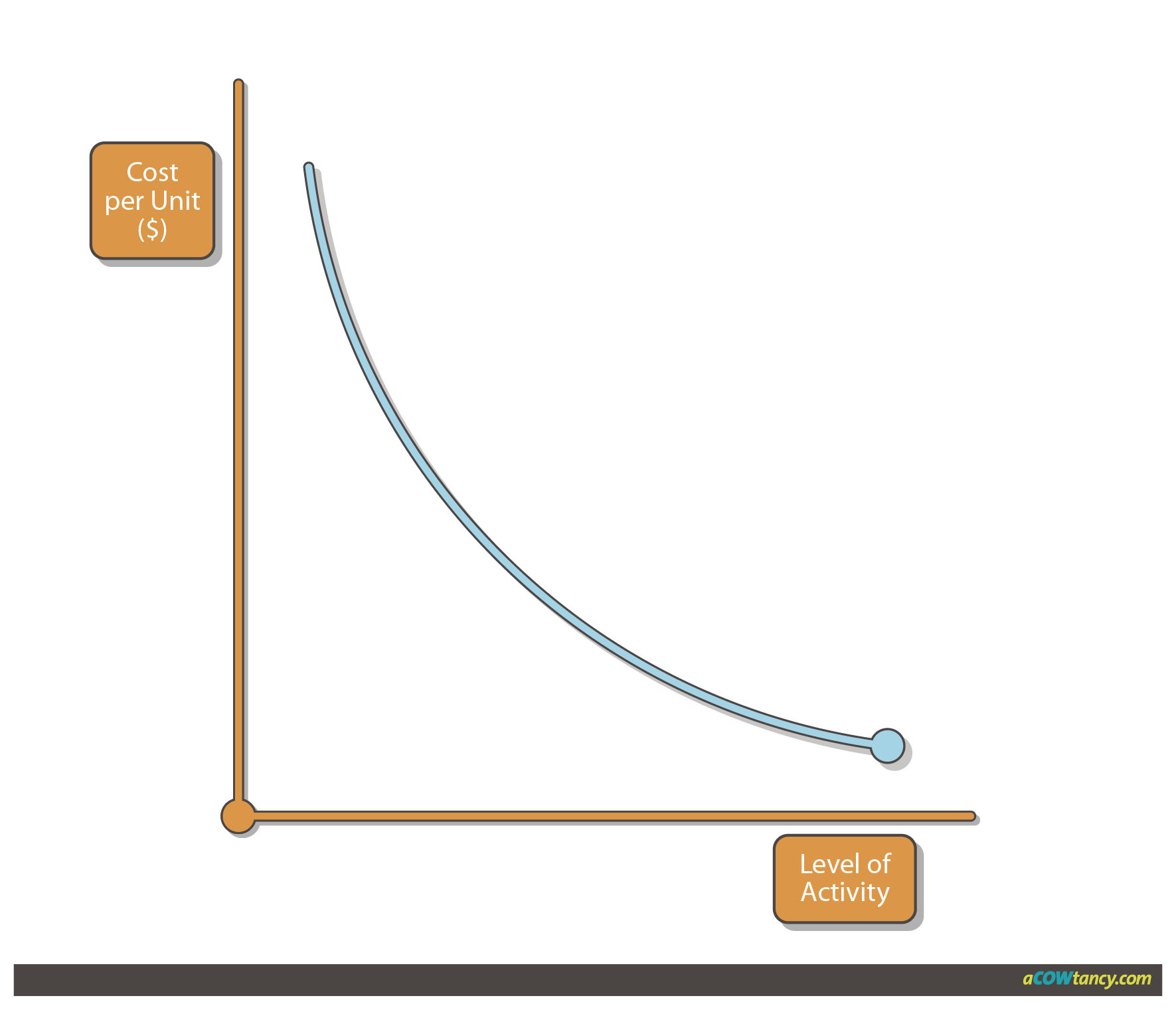

Unit Fixed Costs

Decreases with output getting higher

Opportunity Costs

benefit that is sacrificed when choosing one alternative over another

Sunk Costs

costs that have already been incurred, nothing can be done about them, they are not important to any decision

Differential Costs

The difference in cost between two alternative courses of action. It helps in decision-making by comparing the costs of different options.

Marginal Costs

The additional cost incurred when producing one more unit of a good or service.

Average Costs

Total Costs/Total Units

Methods for estimating fixed and variable costs

Account Analysis

Visual Fit

High-Low Method

Least-Squares + Multiple Regression

Account Analysis

Closely examining ledger, an analyst will estimate cost amounts

BEST WHEN HISTORICAL PATTERNS MAY NOT CONTINUE

Visual Fit Method

Plotting of a Graph

Helpful for semi-variable costs

BEST FOR QUICK AND SIMPLE ESTIMATES

High-Low Method

Semi Variable Approximation by using a high and low point

Y2-Y1/X2-X1 = Variable Cost

BEST FOR QUICK AND SIMPLE ESTIMATES

Regression

B + Ax = Y

CALLED FOR WHEN PATTERNS ARE COMPLEX AND WE EXPECT HISTORICAL RELATIONS TO CONTINUE

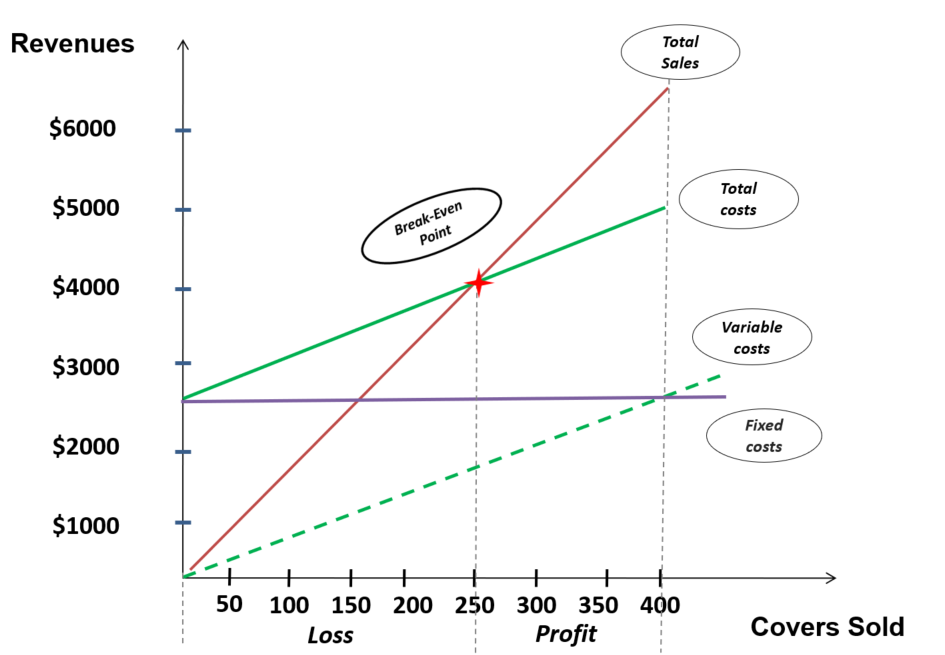

Cost-Volume-Profit (CVP)

CVP analysis examines how changes in sales volume, costs, and prices affect a company's profit. It helps in making decisions to maximize profitability.

Break-even Point

The level of sales at which total revenue equals total costs, resulting in neither profit nor loss. It helps determine the minimum sales needed to cover all expenses.

Total Contribution Margin

Total Sales Revenue - Total Variable Expenses

The amount of revenue available to contribute to covering fixed expenses after all variable expenses have been covered

Data we use for our decisions needs to be

Relevant, Timely, and Accurate

Relevant Data

Must Affect the Future and Differ Among Alternatives

Sometimes its more useful to look at data in terms of variable costs and fixed costs

Equation for CVP

Sales - Variable Costs = Contribution Margin - Fixed Expenses = Income - Tax = Net Income

Breakeven Point Equation (In UNITS)

Fixed Expenses/CM per Unit

Breakeven Point Equation (In DOLLARS)

Fixed Expense/CMR

Contribution Margin Ratio Equation

CM per Unit/Selling Price per Unit

Desired Sales Equation (In UNITS)

FE + Income/CM per Unit

Desired Sales Equation (In DOLLARS)

FE + Income/ CMR

Desired Sales with Tax Equation (In UNITS)

Fe + (Income/1-Tax Rate)/CM per Unit

Desired Sales with Tax Equation (In DOLLARS)

Fe + (Income/1-Tax Rate)/CMR

When it comes to Decision Making….IF there is any Monetary benefit….

You Likely Say Yes

Accepting a Special Order

You Accept it with any Benefit because you assume that if you dont you will lose that demand

UNLESS THEY SAY OTHERWISE

Make or Buy

Never incorporate Fixed Costs UNLESS the question says they are unavoidable

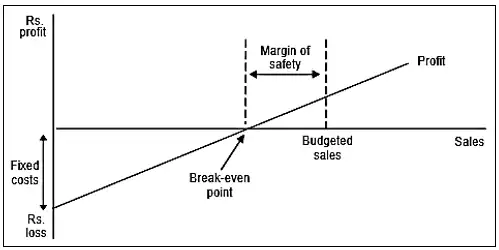

Margin of Safety

Difference between the budgeted sales revenue and the break-even sales revenue

Steps in the Decision Process

Clarify the decision problem

Specify the Criterion

Identify the Alternatives

Develop a Decision Model

Collect Data

Select an Alternative

Evaluate decision effectiveness

Relevant Range

Where management expects the firm to operate

Activities supported by managerial accounting

Decision Making

Planning

Directing Operations

Controlling

3 Ways to Categorize Behavior

Timing

Assignment

Behavior

Timing

Product Cost vs. Period Cost

Assignment

Direct or Indirect?

Manufacturing Inventory and Cost Flows

Prime Costs and Conversion Costs

Behavior

How does the cost behave?

VC or FC

Relevant Change

Mixed Costs (Semi-variable)

A cost with both a fixed and a variable component.

CVP Graph

Profit Graph