IB Economics II Partial I

0.0(0)

Card Sorting

1/114

Earn XP

Description and Tags

Last updated 3:40 AM on 3/27/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

115 Terms

1

New cards

Excludability

Not available to everybody so some people are exluded from accesing it.

2

New cards

Rivalry

People need to compete for a good due to its consumption by one reduces the amount available for others.

3

New cards

Non-excludable

Public acess goods, common access goods.

4

New cards

Excludable

Quasi-public goods, private goods.

5

New cards

Non-rivalrous

Public goods quasi-public goods.

6

New cards

Rivalrous

Common acces goods, private goods

7

New cards

Public Goods

This are non-excludable and non-rivalrous, usually goods offered by the government. Like the police force and fire protection.

8

New cards

Quasi-Public Goods

This are excludable and non-rivalrous. Meaning most people can use them but can be restricted if beccesary. Like museums and roads.

9

New cards

Common acces goods

They are non exludable and rivalrous. Meaning virtually anyone can use them this may lead to exploitation and overuse which can be a threat to sustainability. Like water and fish.

10

New cards

Private Goods

They are excludable and rivalrous. Meaning the ownership is restricted to the person who bought the good. Like cars and computers.

11

New cards

Sustainability

The ability of something to be maintained ore preserved.

12

New cards

Sustainability in Economics

Refers to the preservation of humankind’s ability. to provide goods and services to satisfy needs and wants into the future.

13

New cards

Sustainable Development

Development that meets the need of the present without compromising the ability of future generations to mmet their own needs.

14

New cards

Sustainable Resource Use

When resources are used at a rate that allows them to reproduce themselves, so that they don’t become degrated or depleted.

15

New cards

Pollution of Affluence

Environmental degradation as the result of production and consumption activities from economic growth. Main causes are industrial production and high-income consumption patterns that use fosil fuels or common access resources.

16

New cards

Pollution of Poverty

Arises from production and consumption activiries that are due to poverty like through over-exploitation of land for agriculture creating a threat to sustainability.

17

New cards

Overuse of Common Access Resources

The exploitation of common acces resources and their degradatiin are the external costs of industrial production and high-income consumption activities. This negative externality results in the overallocation of resources.

18

New cards

Pverty as Threat to Sustainability

* Important cause of environmental destruction due to overuse of scarce environmental resources by poor people.

* Lack of modern agricultural inputs depleting soil.

* Higher birth rates creates more pressure to open lands for agriculture.

* Deforestation in search of new farmland causing soil erosion and overgrazing of animal depleteing soil as well.

* Lack of modern energy sources

* Lack of modern agricultural inputs depleting soil.

* Higher birth rates creates more pressure to open lands for agriculture.

* Deforestation in search of new farmland causing soil erosion and overgrazing of animal depleteing soil as well.

* Lack of modern energy sources

19

New cards

Government Responses to Threats to \n Sustainability

* Legislation

* Carbon taxes

* Cap & trade schemes

* Funding for clean technologies

* Carbon taxes

* Cap & trade schemes

* Funding for clean technologies

20

New cards

Legislation

Laws and regulations that limit emissions and pollutants. Ex. Hunting permits or licenses.

21

New cards

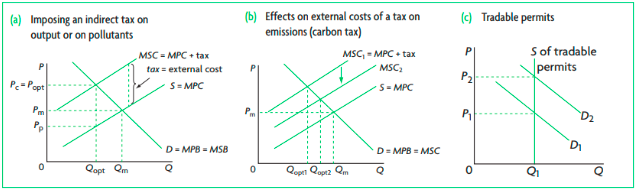

Carbon Taxes

This are implemented to control the use of fossil fuels the more carbon they emit the higher the tax.

22

New cards

Cap & Trade Schems

They are tradable permits as they sound caps to the amount of emissions a producer can emit. This permits can be bought or sold.

23

New cards

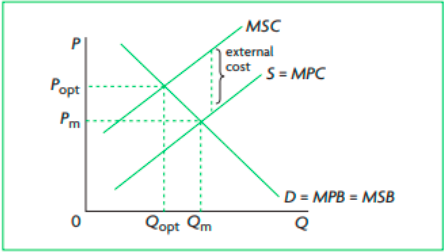

Taxes and Tradable Permits

Market based policies to correct negative production externalities.

24

New cards

Funding for Clean Technologies

When the government invests in research, development, demonstration and deployment for clean energies

25

New cards

Carbon Taxes vs. Cap & Trade Schemes

Economist prefer taxes because they make nergy prices more predictable, easir to implement, can be applied to all users of fossil fuels, no manipulation by the government and others, less likely to restrict competition. Trade schemes are more likely to be pressured into being set higher. But also taxes may be too low, cannot target a particular level of carbon reduction, regressive and need adjusting for inflation.

26

New cards

Assymmetric Information

Situations where buyers and sellers don’t have equal acces to information resulting in an under or over allocation of resources.

27

New cards

Government Responses to Asymmetric Information

* Regulations. Ex. Food quality standards.

* Provision of Information Ex. Nutriotinal labellng

* Provision of Information Ex. Nutriotinal labellng

28

New cards

Moral Hazard Problem

Buyers not disclosing your future intentions when buying. Resulting in the underallocation of resources.

29

New cards

Adverse Selection Problem

Buyers not disclosing pre existing conditions to the sellers. Sellers will try to counteract by setting policies against this.

30

New cards

Labour Market (Safety in the workplace?

Sellers/producers not disclosing all the risks of working for them or in a place.

31

New cards

Monopoly

Type of market structure where there is a single firm dominating the market with little possibility for others to enter preserving the monopoly position.

32

New cards

Monopoly Power

The ability of a firm or groups of firms to control the price of the product they sell.

33

New cards

Is Monopoly Power Desirable?

* Welfare loss

* Allocative inefficiency

* Productive inefficiency

* Lower output and igher prices

* Allocative inefficiency

* Productive inefficiency

* Lower output and igher prices

34

New cards

Government Responses to Monopoly Power

* Legislation- anti-monopoly laws

* Regulations- regulation of natural monopolies that can satisfy the entire market at a lower costs

* Nationalisation- transfering a firm form the private sector to the government.

* Trade liberasation- removal of barriers for international trade, increasing competition to domestic firms.

* Regulations- regulation of natural monopolies that can satisfy the entire market at a lower costs

* Nationalisation- transfering a firm form the private sector to the government.

* Trade liberasation- removal of barriers for international trade, increasing competition to domestic firms.

35

New cards

Negative Production Externality

Overallocates resources

36

New cards

Negative Consumption Externality

Overallocates resources

37

New cards

Positive Production Externality

Underallocates resources

38

New cards

Positive Consumption Externality

Underallocates resources

39

New cards

Merit Goods

Underallocates resources

40

New cards

Demerit Goods

Overallocates resources

41

New cards

Public goods

Underallocates resources or allocates no resources.

42

New cards

Overuse of Common Access Resources

Overallocates resources

43

New cards

Assymmetric reosurces

Usually underallocates resources

44

New cards

Monopoly Power

Underallocates resources

45

New cards

Government Failure

Occurs when government intervention in markets results in less efficient outcomes than those that would have resulted without the intervention.

46

New cards

Short Run

The short run is a time period during which at least one input is fixed and cannot be changed by the firm.

47

New cards

Long Run

The long run is a time period when all inputs can be changed.

48

New cards

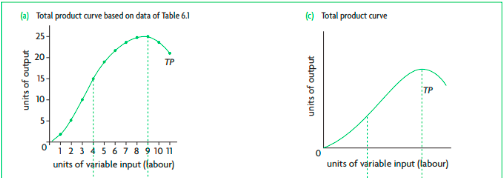

Total Product (*TP* or *Q*)

The total amount of product (output) produced by a firm.

49

New cards

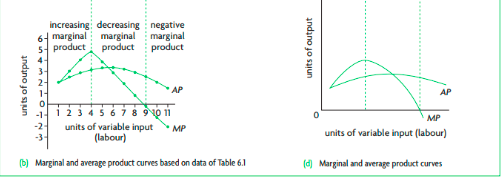

Marginal Product (*MP*)

The additional product produced by one additional unit of variable input.

MP= ΔTP / Δ units of variable input

MP= ΔTP / Δ units of variable input

50

New cards

Average Product (*AP*)

Product per unit of variable input.

AP= TP/units of variable input

AP= TP/units of variable input

51

New cards

Law of Diminishing Returns

In the short run as more and more units of a variable input are added to one or more fixed inputs, the marginal product of the variable input at first increases, but there comes a point when it begins to decrease.

52

New cards

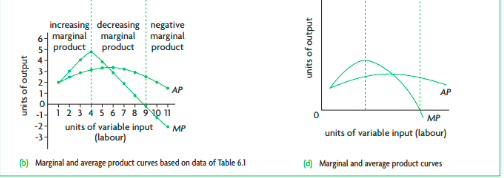

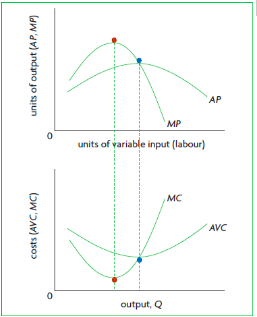

Relationship betwen the Marginal and Average Product Curves

When the marginal product curve lies above the average product curve (MP > AP), average product is increasing; and when the marginal product curve lies below the average product curve (MP < AP), average product is decreasing. This means the marginal product curve always intersects the average product curve when this is at its maximum.

53

New cards

Economic Costs

All production costs are opportunity costs. There are teo types explicit and implicit and added are the economic costs.

54

New cards

Explicit Costs

Payment from a firm to an outsider for a resouce needed in production. Also known as accounting costs but are alsso opportunity costs. The opportunity cost of using resources not owned by the firm is equal to the amount paid to acquire them.

55

New cards

Implicit Costs

is the sacrificed income or opportunity cost arising from the use of self \n -owned resources by a firm.

56

New cards

Factors of Production

* Land- natural resources and land

* Labour- workers physical and mental effort

* Capital- manmade factor of production

* Entrepreneurship- innovation in development as well as the organing of the other 3 factors

* Labour- workers physical and mental effort

* Capital- manmade factor of production

* Entrepreneurship- innovation in development as well as the organing of the other 3 factors

57

New cards

Fixed Costs

Come from the use of fixed inputs and don‘t change as output changes.

58

New cards

Variable Costs

Come from the use of variable inputs and vary as output increases or decreases.

59

New cards

Fixed and Variable Costs in the Short and Long Run

Short Run: Total costs= Fixed costs + Variable costs \n Long Run: Total costs= Variable costs

60

New cards

Average Costs

Costs per unit of output, or total cost divided by the number of units of output. They tell us how much each unit of output produced costs on average.

61

New cards

Total Fixed Cost (*TFC*)

Costs that do not change as output changes.

62

New cards

Total Variable Cost (*TVC*)

Costs that vary (change) as output changes; arise from the use of variable inputs.

63

New cards

Total Cost (*TC*)

The sum of the fixed and variable costs.

TC= TFC+TVC

TC= TFC+TVC

64

New cards

Average Fixed Cost (*AFC*)

Fixed costs per unit of output.

AFC= TFC/Q

AFC= TFC/Q

65

New cards

Average Variable Cost (*AVC*)

Variable cost per unit of output.

AVC= TVC/Q

AVC= TVC/Q

66

New cards

Average Total Cost (*ATC*)

Total cost per unit of variable.

ATC= AFC+AVC

ATC= AFC+AVC

67

New cards

Marginal Cost (*MC*)

The change in the cost arising from one additional unit of output.

MC= ΔTC/ΔQ = ΔTVC/ΔQ

MC= ΔTC/ΔQ = ΔTVC/ΔQ

68

New cards

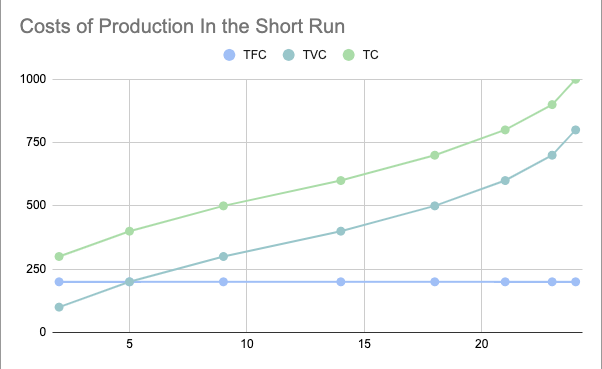

Graphs Costs (TFC, TVC, TC)

* TFC parallel to x axis

* TVC doesn’t increase at constant rate as the output.

* TC is the vertical sum of TFC and TVC so the difference is TFC

* TVC doesn’t increase at constant rate as the output.

* TC is the vertical sum of TFC and TVC so the difference is TFC

69

New cards

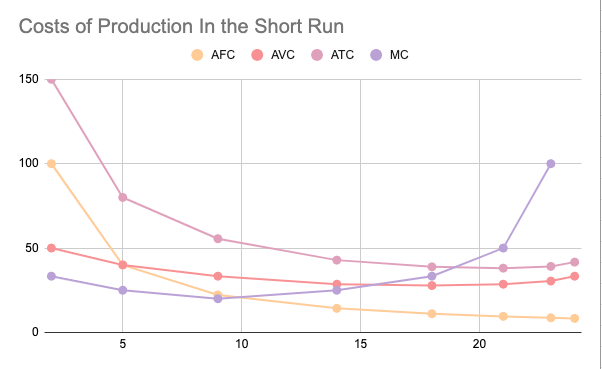

Graphs Costs (AFC, AVC, ATC, MC)

* AFC falls continously as output increases

* AVC, ATC, MC all follow the pattern of falling then they reach a minimum and they start to rise.

* MC intersects with AVC and ATC at their minimum.

* MC

* AVC, ATC, MC all follow the pattern of falling then they reach a minimum and they start to rise.

* MC intersects with AVC and ATC at their minimum.

* MC

70

New cards

Relating Costs and Product Curves

Product curves and cost curves are mirror \n images due to the law of diminishing returns.

71

New cards

Shifts in the Cost Curves

* Change in resource prices

* Change in technology

* Change in technology

72

New cards

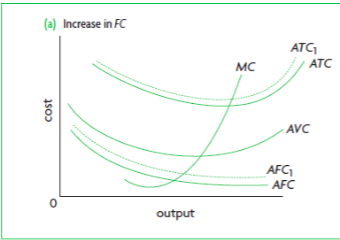

Increase in Fixed Costs

Affects TFC, TC, AFC, ATC, all of which shift \n upward. Variable costs and marginal cost remain unaffected.

73

New cards

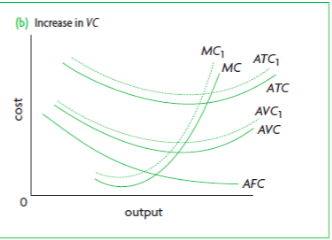

Increase in Variable Costs

Affects TVC, TC, AVC, ATC and MC, all \n of which shift upward.

74

New cards

Output in the Long Run

* Constant return to scale

* Increasing return to scale

* Decreasing return to scale

* Increasing return to scale

* Decreasing return to scale

75

New cards

Constant Return to Scale

Output increases in the same proportion as all inputs.

76

New cards

Increasing Return to Scale

Output increases more than in proportion to the increase in all inputs: given a percentage increase in all inputs, output increases by a larger percentage.

77

New cards

Decreasing Return to Scale

Output increases less than in proportion to the increase in all inputs: given a percentage increase in all inputs, output increases by a smaller percentage.

78

New cards

Diminishing returns vs. Decreasing Return to Scale

* Diminishing Returns- Short run, it shows what happens to output as a variable input is added to a fixed input.

* Decreasing Returns to Scale- Long run, it shows what happens to output when all inputs are variable.

* Decreasing Returns to Scale- Long run, it shows what happens to output when all inputs are variable.

79

New cards

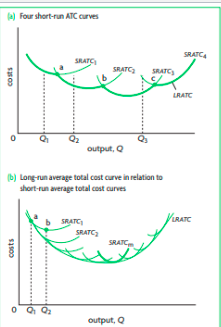

Production Expansion

If a firm wants to expand it has to avoid diminishing returns so it has to increase fixed inputs. The particular size it selects will be the one that minimises costs for that level of output.

80

New cards

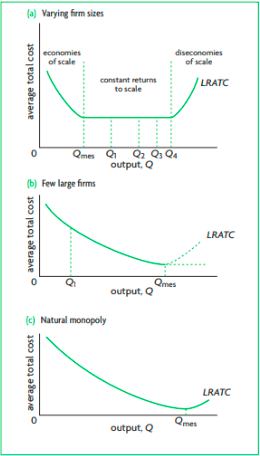

Long Run Average Total Cost

A curve showing the lowest possible average cost that can be attained for any level of output when all of the firm’s inputs are variable. It wil be on the point where the Short Run Average Total Cost touches the Long Run curve

81

New cards

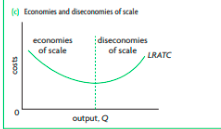

Economies and Diseconomies of Scale Long Run

The U-shape of the LRATC curve can be found in economies and diseconomies of scale relate tu increasing or decreasing returns to scale.

82

New cards

Economies of Scale

They are decreases in the average costs of production over the long run as a firm increases all its inputs. (Downward slope). This means increasing returns to scale.

83

New cards

Diseconomies of Scale

They are increases in the average costs of production as a firm increases its output by increasing all its inputs. (Upward slope). This means decreasing returns to scale.

84

New cards

Reasons for Economies of Scale

Specialisation of labour, specialisation of management, efficiency of capital equipment, indivisibilities of capital equipment, indivisibilities of efficient processes, spreading of certain costs, such as marketing, over larger volumes of output.

85

New cards

Reasons for Diseconomies of Scale

Co-ordination and monitoring difficulties, communication difficulties, poor worker motivation.

86

New cards

Constant Returns to Scale

May appear in a LRATC curve if there is a horizontal segment between the upward and downward sloping. In this range, as output increases (with all inputs increasing), average costs do not change.

87

New cards

Minimum Efficient Scale

The level of output at which economies of scale are exhausted. Where average costs will be constant or decrease.

88

New cards

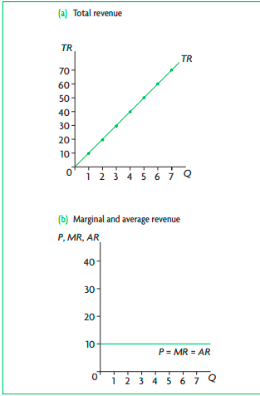

Revenue

Payments firms receive when they sell goods and services they produce over a given time period.

89

New cards

Total Revenue

The total earnings of a firm from the sale of its output.

TR= P x Q

TR= P x Q

90

New cards

Marginal Revenue

The additional revenue of a firm arising from the sale of an additional unit of output.

MR=ΔTR/ΔTQ

MR=ΔTR/ΔTQ

91

New cards

Average Revenue

Revenue per unit of output.

AR= TR/Q

AR= P

AR= TR/Q

AR= P

92

New cards

Analysis of Revenue Cosniderations

* The firm has no control over price, and price is constant as output varies.

* The firm has some degree of control over price, and price varies with output.

* The firm has some degree of control over price, and price varies with output.

93

New cards

Revenue Curve when a Firm has no Control over Price

Constant price, perfect competition.

94

New cards

Revenue Curve when a Firm has some Control over Price

Variable price, all market model except perfect competition.

95

New cards

Economic Profit

It considers economic costs.

Profit = TR- (Explicit + Implict costs)

Profit = TR- (Explicit + Implict costs)

96

New cards

Normal Profit

Also known as break-even point. Mimimum amount of revenue to keep the firm running. Covers economic costs.

When total revenue = economic costs. It is not profit per say is more a cost of production.

When total revenue = economic costs. It is not profit per say is more a cost of production.

97

New cards

Continue Operating when Normal Profit

When a firm is earning normal profit, it is earning just the \n necessary revenues to cover payment for entrepreneurship (a cost) and all other implicit costs of self-owned resources, after revenues have also covered explicit costs. The firm has covered all its opportunity costs and will continue to operate.

98

New cards

Positive Economic Profit

When the TR > economic cost; The firm earns supernormal profit (or abnormal profit).

99

New cards

Zero Economic Profit

TR = economic cost; The firm earns normal profit.

100

New cards

Negative Economic Profit

TR < economic cost; The firm makes a loss.