ACC333 Exam 1

5.0(1)

5.0(1)

Card Sorting

1/101

Earn XP

Description and Tags

Last updated 7:47 PM on 3/1/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

102 Terms

1

New cards

we need nonfinancial measures to evaluate:

* quality assessment

* employee statistics

* customer relationships

* supplier relationships

* employee statistics

* customer relationships

* supplier relationships

2

New cards

benefits of nonfinancial performance measures

* relate to true drivers of business profitability

* limitless potential to measure different aspects of the business, especially with big data, and not constrained by GAAP

* facilitate business experiments where companies can get a broad view of the effect of business initiatives

* less prone to management manipulation due to broad use throughout the organization

* limitless potential to measure different aspects of the business, especially with big data, and not constrained by GAAP

* facilitate business experiments where companies can get a broad view of the effect of business initiatives

* less prone to management manipulation due to broad use throughout the organization

3

New cards

consistently creating long-term organizational value requires that stakeholder issues be:

* identified and understood clearly

* measured qualitatively and quantitatively

* communicated internally and externally

* measured qualitatively and quantitatively

* communicated internally and externally

4

New cards

balanced scorecards

* multi-level performance strategy

* used for detailing strategy and aligning everyone with the details

* used for detailing strategy and aligning everyone with the details

5

New cards

typical categories of balanced scorecards:

* financial perspective

* customer perspective

* internal operations perspective

* learning and growth

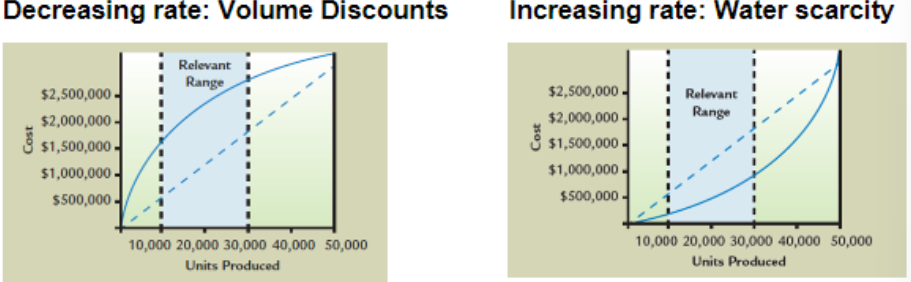

* customer perspective

* internal operations perspective

* learning and growth

6

New cards

“enterprise business processes” are;

customer service driven model for value creation

7

New cards

for a manufacturer, distributor, or seller of tangible products, common processes include:

* inbound logistics (procuring inputs)

* operations (inputs→ products)

* marketing and sales (selling products)

* outbound logistics (products→ customers)

* service (keeping customers happy after the sale)

* financial management

* human resource management

* technology and information management

non-process organizations: geographic regions, product divisions, etc.

* operations (inputs→ products)

* marketing and sales (selling products)

* outbound logistics (products→ customers)

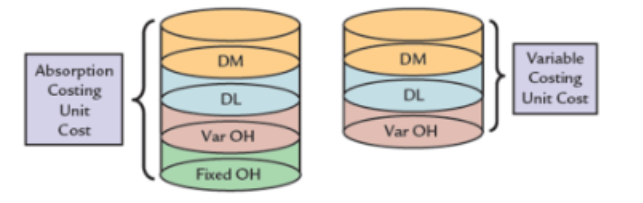

* service (keeping customers happy after the sale)

* financial management

* human resource management

* technology and information management

non-process organizations: geographic regions, product divisions, etc.

8

New cards

process owner

has end-to-end responsibility for each process (i.e., manages the process)

9

New cards

process owners vs unit owners

* process owners manages the process, monitors performance of the process and motivates the frontline workers who perform the process

* unit owners (regional mangers, vps, etc.) continue to manage their own workforces who perform the process

* most employees will be happy with change; unit owners will not

* critically important to manage unit owners properly

* unit owners (regional mangers, vps, etc.) continue to manage their own workforces who perform the process

* most employees will be happy with change; unit owners will not

* critically important to manage unit owners properly

10

New cards

what’s it going to take?

* leadership and teamwork

* “buy in,” communication skills, shared workspace

* performance measurement

* with processes to measure and how to measure them, tie measures to strategic objectives

* links to compensation

* share measures with employees to reinforce process culture, reward/punish employees based on measures

* training

* employees must understand entire process and how their individual actions contribute to (or detract from) its success

* “buy in,” communication skills, shared workspace

* performance measurement

* with processes to measure and how to measure them, tie measures to strategic objectives

* links to compensation

* share measures with employees to reinforce process culture, reward/punish employees based on measures

* training

* employees must understand entire process and how their individual actions contribute to (or detract from) its success

11

New cards

potential benefits on focusing on business processes

* enhanced flexibility, efficiency and customer focus

* decreased product launch time

* improved customer service

* increased cost savings

* decreased product launch time

* improved customer service

* increased cost savings

12

New cards

potential costs on focusing on business processes

* being different from other companies could hurt attractiveness to employees and investors, or attract regulatory scrutiny

* internal resistance to change

* blurred/changing lines of authority or accountability

* internal resistance to change

* blurred/changing lines of authority or accountability

13

New cards

what must you think carefully about when dealing with the cost from focusing on business processes and there are blurry lines of authority or accountability?

* which measure(s) will capture success or failure of our core business processes

* how to capture such measures

* to whom we should communicate such measures

* motivating each employee with such measures

* how to capture such measures

* to whom we should communicate such measures

* motivating each employee with such measures

14

New cards

financial perspective- balanced scorecard

describes the economic consequences of actions taken in the other three perspectives

15

New cards

the customer perspective- balanced scorecard

defines the customer and market segments in which the business unit will compete

16

New cards

the internal business process perspective

describes the internal processes needed to provide value for customer owners

17

New cards

learning and growth (infrastructure) perspective

defines the capabilities that an organization needs to create long-term growth and improvement

18

New cards

strategy

specifies management’s desired relationships among the four perspectives

19

New cards

strategy translation means

specifying objects, measures, targets, and initiatives for each perspective

20

New cards

performance measures are derived from

a company’s vision, strategy, and objectives

21

New cards

these performance measures must be balanced between the following measures:

* performance driver measures and outcome measures

* objective and subjective measures

* external and internal measures

* financial and nonfinancial measures

* objective and subjective measures

* external and internal measures

* financial and nonfinancial measures

22

New cards

the framework needed for internal (process) perspective

process value chain

23

New cards

process value chain is made up of these three processes:

* the innovation process anticipates the emerging and potential needs of customers and creates new produces and services to satisfy those needs

* the operations process produces and delivers existing products and services to customers. it begins with a customer order and ends with the delivery of the product or service

* the post-sales service process provides critical and responsive services to customers after the product or service has been delivered

* the operations process produces and delivers existing products and services to customers. it begins with a customer order and ends with the delivery of the product or service

* the post-sales service process provides critical and responsive services to customers after the product or service has been delivered

24

New cards

learning and growth perspective has three major objectives:

* increase employee capabilities- have the requisite knowledge, skills, and abilities

* increase motivation, empowerment, and alignment- have the freedom, motivation, and initiative to use skills effectively

* increase information systems capabilities- so that employees can improve processes and effectively execute new processes

* increase motivation, empowerment, and alignment- have the freedom, motivation, and initiative to use skills effectively

* increase information systems capabilities- so that employees can improve processes and effectively execute new processes

25

New cards

cost

the amount of cash or cash equivalent scarified for goods and/or services that bring a current or future benefit to the organization

26

New cards

expired costs

aka expenses- as costs are used up in the production of revenues, they are said to expire

27

New cards

cost object

any item such as a product, customer, department, project, geographic region or plant, for which costs are measured and assigned

28

New cards

______ is the way that a cost is linked to some cost object

assigning costs

29

New cards

direct costs

costs that can be easily and accurately traced a cost object

30

New cards

indirect costs

costs that cannot be easily and accurately traced to a cost object

31

New cards

allocation

means that an indirect cost is assigned to a cost object by using a reasonable and convenient method

32

New cards

variable cost

one that increases in total as output decreases

33

New cards

fixed cost

cost that does not increase in total as output increases and does not decrease in total as output decreases

34

New cards

opportunity cost

the benefit given up or sacrificed when one alternative is chosen over another

35

New cards

products

goods produced by converting raw materials through the use of labor and indirect manufacturing resources, such as the manufacturing plant, land, and machinery

36

New cards

services

tasks or activities performed for a customer or an activity performed using an organization’s products or facilities

37

New cards

services differ from from products in many ways

* services are intangible

* services are perishable

* services require direct contact between providers and buyers

* services are perishable

* services require direct contact between providers and buyers

38

New cards

product costs

both direct and indirect, of producing or acquiring a product and preparing it for sale--only costs in the production section of the value chain are included in product costs, inventoried

39

New cards

period costs

everything that is not product cost, not carried in inventory

40

New cards

product costs have three components

* direct materials

* direct labor

* overhead

* direct labor

* overhead

41

New cards

direct material

materials that are a part of the final product and can be directly traced to the goods being produced

42

New cards

direct labor

the labor that can be directly traced to the goods being produced

43

New cards

manufacturing overhead

all product costs other than direct materials and direct labor, also known as factory burden, support, or indirect manufacturing costs

44

New cards

per unit product cost=

total product cost/ number of units produced

45

New cards

prime cost=

dm+dl

46

New cards

conversion cost=

dl+moh

47

New cards

period costs are expensed

in the period in which they are incurred

48

New cards

common period costs

* selling costs

* administrative costs

* non-production pp&e

* administrative costs

* non-production pp&e

49

New cards

selling costs

those costs necessary to market, distribute, and service a product or service

50

New cards

administrative costs

include research, development, and general administration of the organization and cannot be assigned to either selling or production

51

New cards

enon-production pp

delivery trucks, corporate headquarters- depreciated over estimated useful life

52

New cards

uses of cost information

* cost volume profit analysis

* responsibility accounting (cost management)

* pricing decisions

* evaluating alternative choice decisions

* litigating or defending cost-related legal issues

* responsibility accounting (cost management)

* pricing decisions

* evaluating alternative choice decisions

* litigating or defending cost-related legal issues

53

New cards

cost behavior

describes whether a cost changes when the level of output changes, it is the foundation upon which managerial accounting is built

54

New cards

fixed cost

a cost that does not change in total as output changes

55

New cards

variable cost

increases/decreases in total with an increase/decrease in output

56

New cards

mixed cost

has both fixed and variable components (ex. renting a car with a flat fee and a rate per mile)

57

New cards

cost driver

a causal factor that measures the output of the activity that leads (or causes) costs to change. identifying and managing drivers helps mangers better predict and control costs

58

New cards

relevant range

range of output over which the assumed cost relationship is valid for the normal operations of a firm

59

New cards

two types of fixed costs

1. discretionary fixed costs

2. committed fixed costs

60

New cards

discretionary fixed costs

fixed costs that can be changed or avoided relatively easily in the short run at management discretion (ex. advertising)

61

New cards

committed fixed costs

fixed costs that cannot be easily changed (ex. lease)

62

New cards

semi-variable costs

variable costs that increase/decrease with output, but not at a constant/linear rate

63

New cards

step costs

discontinuous cost functions, display a constant level of total cost for a range of output and then jump to a higher level (or step) of total cost at some point, where they remain for a similar range of output before jumping/stepping again

64

New cards

purpose of a cost formula

provide a quantitative estimate of both total fcs and the vc per unit of the cost driver(s), with the cost formula, managers can predict total costs at variable levels of output

65

New cards

the three commonly used methods of separating a mixed cost into its fixed and variable components

* the high low method

* the scatter graph method (eyeballing)

* the method of least squares (regression)

* the scatter graph method (eyeballing)

* the method of least squares (regression)

66

New cards

the simplifying assumption of a linear cost relationship

total cost= total fixed cost + (variable rate x units of output)

67

New cards

high low method

method of separating mixed costs into fixed and variable components by using just the high and low data points, provides managers with a quick way to estimate cost behavior

68

New cards

high low method equation for variable rate

variable rate= (high point cost- low point cost)/ (high point output- low point output)

69

New cards

calculation to find the fixed cost using the variable rate found with the high low equation

fixed cost= total cost at high point- (variable rate x output at high point) (essentially y=mx+b reframed to b=y-mx)

70

New cards

what does the goodness of fit test tell us

how well the independent variable (s) predict(s) the dependent variable on a 0.00- 1.00 scale

71

New cards

the percentage of variability in the dependent variable explained by an independent variable is called the

coefficient of determination (R squared)

72

New cards

what does a high R squared suggest?

your independent variable is a strong cost driver

73

New cards

what does a low R squared suggest?

your independent variable is not strongly associated with the costs you are trying to predict

74

New cards

the method of least squares (regression)

a statistical way to find the best-fitting line through a set of data points

75

New cards

what is managerial judgement used for

determining cost behavior and is by far the most widely used method in practice

76

New cards

absorption costing

* required by gaap

* assigns all manufacturing costs to the product

* dm, dl, vmoh & fmoh define the cost of a product

* fixed overhead is viewed as a product cost, assigned to the product, and not expensed until the product is sold- inventoriable

* assigns all manufacturing costs to the product

* dm, dl, vmoh & fmoh define the cost of a product

* fixed overhead is viewed as a product cost, assigned to the product, and not expensed until the product is sold- inventoriable

77

New cards

variable costing

* assigns only variable manufacturing costs to the product; these costs include dm, dl, & vmoh

* rationale that fmoh is a cost of capacity, seen as expiring that period, charged in total against the revenues of the period

* rationale that fmoh is a cost of capacity, seen as expiring that period, charged in total against the revenues of the period

78

New cards

main difference between variable & absorption costing

treatment of fixed factory overhead

79

New cards

if production > sales

absorption income > variable income

80

New cards

production < sales

absorption income < variable income

81

New cards

if production = sales

absorption income = variable income

82

New cards

cost-volume-profit (cvp) analysis

estimates how changes in the following three factors affect a company’s profit:

* costs (both variable and fixed)

* sales volume

* price

* costs (both variable and fixed)

* sales volume

* price

83

New cards

what do companies use cvp for?

to help them calculate and reach important benchmarks, such as breakeven point

84

New cards

breakeven point

where total rev= total costs (the pt of 0 profit), level of sales at which cm just covers fixed costs so net income is 0

85

New cards

contribution margin

the difference between sales and variable expense, the amt of sales revenue left over after all the variable expenses are covered that can be used to contribute to fixed expense and op income

86

New cards

two options for calculating break even point in units:

* op income= (price *# of units sold) - (variable cost per unit* number of units sold) - total fixed cost

* break even units= fixed costs/ unit cm

* break even units= fixed costs/ unit cm

87

New cards

to find breakeven revenue

multiply breakeven units by selling price (because price \* units sold is sales rev)

OR

break even sales= total fixed expenses/ cm ratio

OR

break even sales= total fixed expenses/ cm ratio

88

New cards

variable cost ratio

variable cost per unit/ selling price per unit

89

New cards

cm ratio

total contribution margin/ total sales

OR

cm per unit/ selling price per unit

OR

cm per unit/ selling price per unit

90

New cards

why would we want to solve for break even point in sales dollars?

sales are typically recorded immediately, so the manager does not have to wait to have an income statement prepared in order to see how close the company is to breaking even

91

New cards

to find target income

same equations as breakeven, but we add the target income to the numerator (+ fixed costs)

92

New cards

what are the benefits of graphing cvp

* helps managers clearly see the difference between vc and revenue

* also helps them to understand quickly what impact an increase or decrease in sales will have on the breakeven point/ profit

* also helps them to understand quickly what impact an increase or decrease in sales will have on the breakeven point/ profit

93

New cards

cvp analysis assumptions

1. linear revenue and cost functions remain constant over the relevant range

2. selling prices and costs are known with certainty

3. all units produced are sold; there are not finished goods inventories

4. sales mix is known with certainty for multiple product break even settings

94

New cards

sales mix

the relative combination of products being sold by a firm

95

New cards

break-even packages =

total fc/ package cm

96

New cards

cvp analysis is a tool that managers use to handle:

risk and uncertainty

97

New cards

sensitivity analysis

a “what-if” technique that examines the impact of changes in underlying assumptions on an answer

98

New cards

margin of safety

the units sold or revenue earned above the break-even volume aka sales- break even units

99

New cards

operating leverage

the use of fixed costs to extract higher percentage changes in profits as sales activity changes, the measure of the proportion of fixed costs in a company’s cost structure, used as an indicator of how sensitive profit changes in sales volume

100

New cards

degree of operating leverage=

total cm/ op income