IB Business paper 1- terminology that relates most to pre-seen case

1/117

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

118 Terms

private limited company

owned by shareholders

can not raise finance from general public

shares are typically sold to family, or friends

Advantages

Limited liability – when the company is sued or incurs losses, all a shareholder will lose is his stock in the business.

Higher capital, higher capacity for expansion

Disadvantages

More restrictions

Corporate taxes (higher)

public limited company

owned by shareholders

Able to sell shares to the public

Required by law to publish their complete and true financial position

flotation(when the business sells part or all of itself to the public) or an initial public offering (IPO)

Advantages

More capital raised from selling stock

Limited liability

Continuity after death, freely transferable

Higher capacity for expansion

Disadvantages

Possibility of a hostile take-over through shares, control can change unexpectedly and be lost by the original owner

Much more restrictions

Corporate tax

expansion

the growth of a business due to an increase in the size of the organisation itself or/and growth in the market

usually measured by an increase in sales revenue, market share, or profits

Average cost

the cost per unit of production

derived from total cost of output/ number of units produced

this tends to decrease as business increases due to economies of scale

Greenwashing

misleading marketing tactic that falsely portrays sustainable practices or describe products to be more environmentally friendly than they actually are

permanent employees

these workers have an employment contract on a continual basis

contract only ends if workers resign or the employer terminates the contract

Temporary workers

employees hired for a limited period of time or until the completion of a project

freelancer

a self-employed individual who provides services to their clients rather than work for an employer

work on specific projects instead of long-term employment commitments

mission statement

a simple declaration of the company’s underlying purpose and its core values

aims

general and long-term goals of the organisation

objectives

short-to- medium term specific targets to achieve the aims

strategies

medium-to-long-term plans of action to achieve the strategic goals of the organisation

business strategies

operational strategies-

day to day methods to improve efficiency

genetic strategies-

affect business as a whole

to gain competitive advantage

corporate strategies-

long term goals

tactical objectives

survival-

to establish the business

to recover and get back to profitability

prevent hostile takeover

sales revenue maximisation -

grow and achieve recognition

become more efficient through economies of scale

not profitability

strategic objectives

profit maximisation-

maximising profits tends to be the main goal of all businesses

growth-

market share/sales revenues/helps achieving EOS

market standing-

presence in an industry

image and reputation-

Good image helps grow the business, attracts new customers, make employees proud

the need for changing objectives

Companies change objectives when responding to internal and external changes

Internal factors

Corporate culture – way the organisation works

Type and size of organisation – small or big businesses run differently

Age of organisation – change must be consistent with times

Financial status – profit goals, how much money the business has to use

Risk profile of shareholders – If investors are risk-averse or risk-loving

Private/Public sector

External

State of economy – strong or depressed economy affects the company too

Government constraints – government telling you not to expand somewhere

Presence and power of pressure groups – (e.g. not to expand in the endangered locations)

CSR

Concept whereby organizations consider the interests of society by taking responsibility for the impact of their activities on various stakeholders

Benefits:

Better employee recruitment and retention

Boosts company’s image/reputation

Risk management against scandals, accidents, etc.

Brand differentiation and smoother operations

Customer loyalty & goodwill

Disincentives:

High compliance costs can lower profits

Forced to use materials that are specialised and may reduce profit

Ethics are not universal or unchanging anyway

Attitudes change over time; acceptable practices before are unacceptable today.

CSR objectives adapt to changes in social norms

SWOT analysis

Guides management for future strategies- useful decision making tool

assesses current situations

considers internal and external factors

Strengths – advantages that are basis for developing competitive advantage e.g. highly skilled employees, brand awareness

Weakness- negative factors e.g. low quality products, bad reputation

Opportunities- potential areas for expansion of the business and future profits e.g. political/economical policies, social statistics & trends

Threats- hindrances to the business e.g. economic environment, market condition competitors.

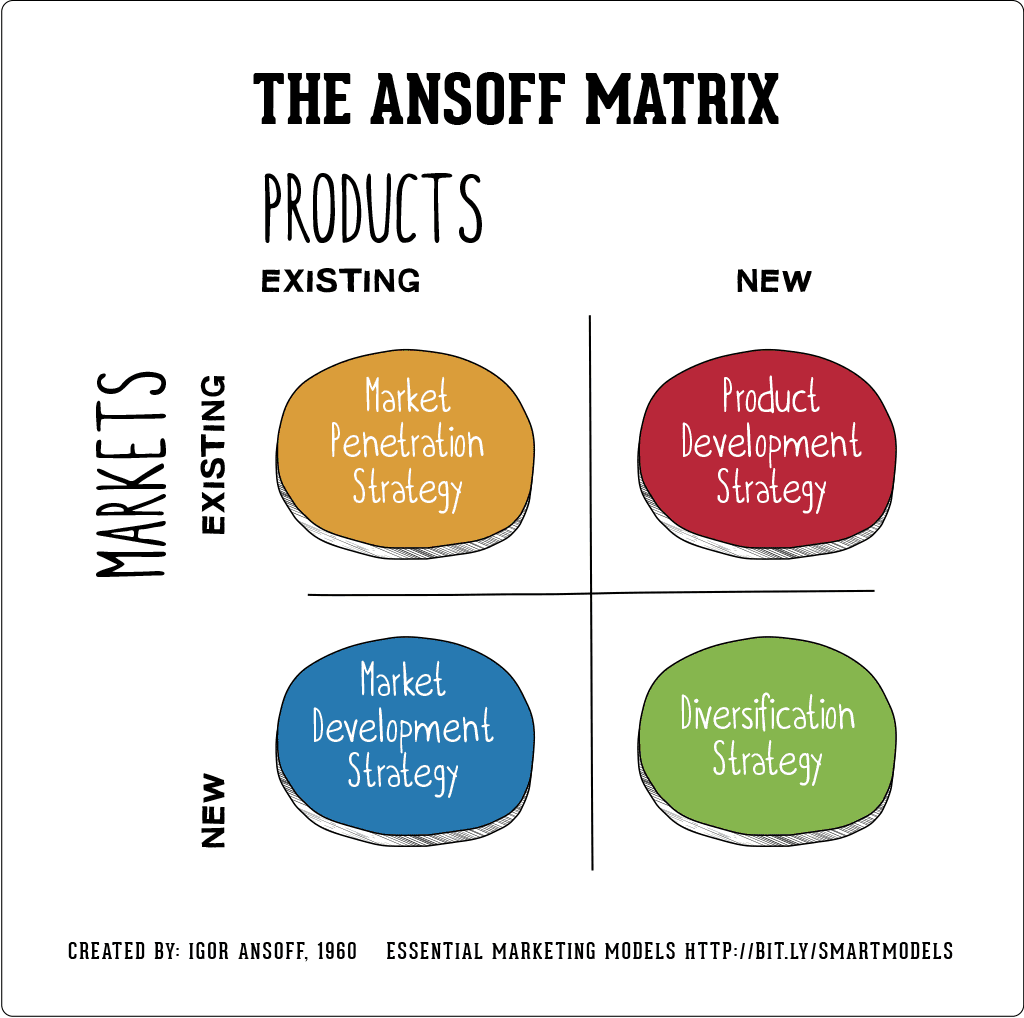

Ansoff matrix

Analytic tool to determine growth strategy by focusing on product/market combination

Growth strategies

Existing product + existing market = Market Penetration (low risk)

price adjustment

increase of market promotion

New product + existing market = Product Development (medium risk)

Innovation to replace existing products

Focusing on consumer needs

Brand extension

Capitalize on technology

Consumers in existing market may not like the new product

Existing product + new market = Market Development (medium risk)

New distribution channel

Expanding geographically

Attract new market segments

New consumers may not like the product

New product + new market = Diversification (high risk)

If successful, higher gains can be reaped from various industries

Spreads out risks and safeguards against economic shocks over diverse product portfolio

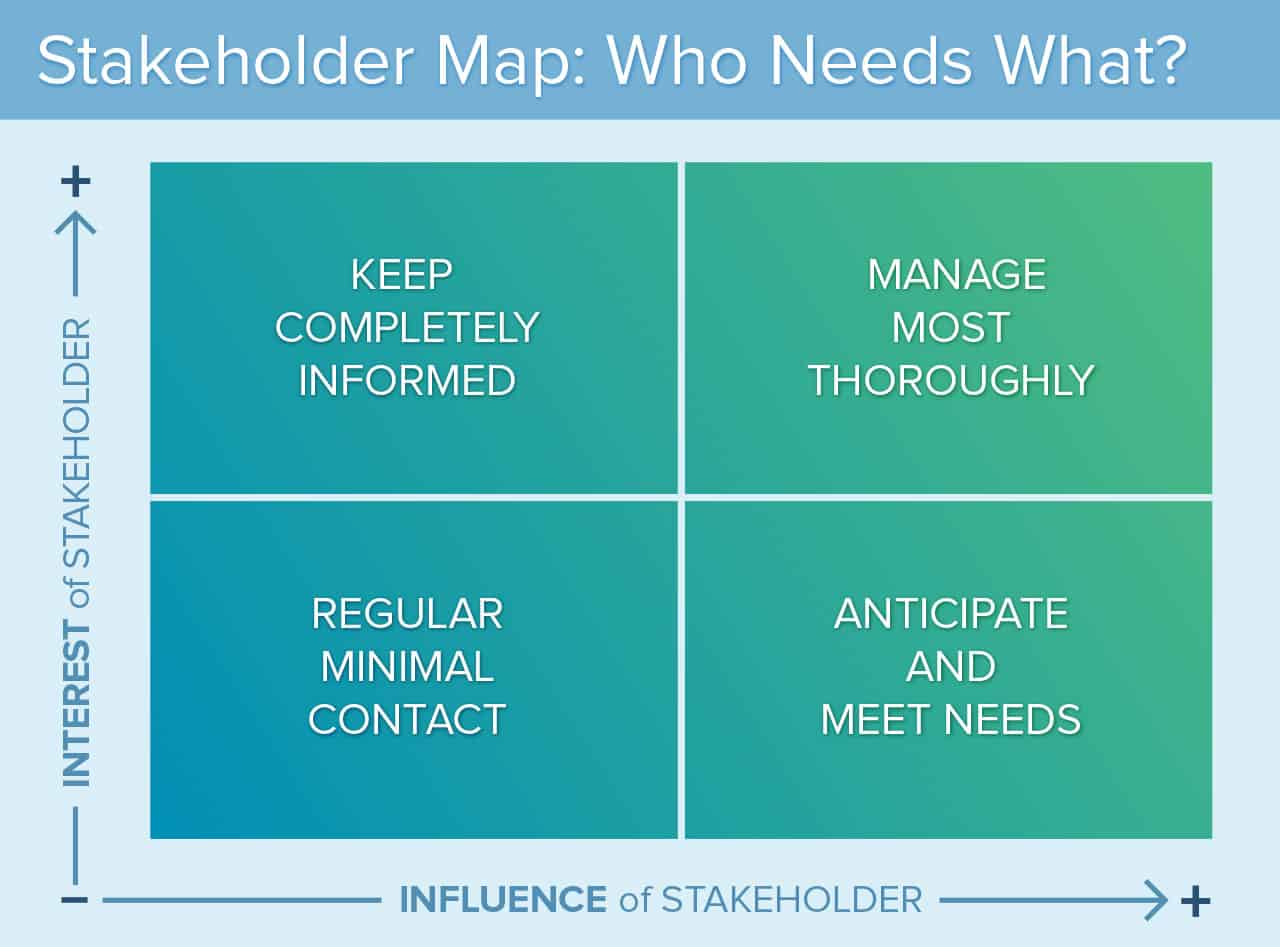

stakeholders

People who can be affected by and therefore have interest or stake in actions of the business

there are internal and external stakeholders

internal stakeholders

employees

shareholders

managers/directors

external stakeholders

customers

suppliers

pressure groups

competitors

Government

stakeholder conflict

inability of organisation to meet all stakeholders competing interests

STEEPLE

Business tool for understanding a business’ external environment (opportunities and threats)

Stands for Social, Technological, Economic, Environmental, Political, Legal, and Ethical analysis (of the industry)

External environmental factors are analysed in decision making and strategy development because they can heavily influence the business

Social

Attitude of society towards wide range of issues

Population demographics (more young/old, more women/men, etc.)

Roles and attitudes of people

Cultural and religious beliefs

Security and education

Technological

Use of tools and machines

Information technology

Innovations in technology

Economic

State of the economy

Interest and tax rates

Exchange rates and foreign relations

Inflation rates, unemployment rates

Environmental

Abundance of natural resources or raw materials

Threats from nature (or natural disasters)

Waste disposal/recycling

political

Laws (employment, consumer, business) & policies (fiscal and monetary)

Changes brought about by new government

Possible effects of political unrest

Legal

Employment or contract laws

Trade unions

Environmental protection regulations

Ethics

Client confidentiality

Bribery and other forms unethical (and possibly illegal) business transactions

Fair competition

How changes in STEEPLE factors affect a business’s objective and strategy

Changes in trends, social norms, public opinion, views on ethics can affect the company’s products, business activities, and the way they market their products

Changes to legal or political factors may force businesses to change the way they operate to comply with new laws or regulations

Changes to technological factors could result to the company adopting newer technology or machinery to increase efficiency or keep up with industry standards

Changes to environmental factors could force companies to adapt to scarce raw materials, frequent natural disasters, etc.

Changes to economic factors (economic growth, interest rates, etc.) could affect the costs of operations of the business, spending attitude of consumers, etc.

economies of scale

Increase in efficiency of production as the number of output increases

Average cost per unit decreases through increased production

Fixed costs decline and there is an increased number of output

internal economies of scale

achieved by the organisation itself

Purchasing economies

Wholesale discounts

Technical economies

Investing in technology to reduce costs

Financial economies

Easier for large companies to receive loans from banks

Marketing economies

More efficient to advertise a large number of products

Managerial economies

Larger firms are able to hire specialists who help improve efficiency

external economies of scale

External

Improved infrastructure (e.g. transportation)

Advances in the industrial efficiency due to better training, innovations in processes/machinery, etc.

Growth of other industries that support the organisation

internal (organic) growth

internal (organic) growth - the business grows through its own capabilities and resources

Methods used to achieve internal growth:

Change of pricing strategies

Increase advertising and promotions

Offer flexible financing schemes

Improve and innovate the product or service

Sell in different locations

Increase capital expenditure on production and technologies

Train and develop staff

advantages

control and coordination

inexpensive

corporate culture

less risky

disadvantages

diseconomies of scale

need to restructure

dilution of control and ownership

slower growth

external (inorganic) growth

The business grows through dealings with outside organisations

ways to grow:

horizontal integration - companies in the same industry

vertical integration- businesses in a different stage of production

lateral integration- firms with similar operations but not in direct competition

conglomerate- businesses are in different industries

advantages

faster

reduces competition

greater market share

sharing ideas

firm evolves- risk is spread across more markets

disadvantages

costly

M&A

merger- two or more firms agree to join together

acquisition(or takeover) - a company buys controlling interest in another company

could be hostile takeover when unwanted

Joint-venture

Two or more businesses split the costs, risks, rewards of a business project

two or more business becoming a new legal entity

advantages

spreading costs and risks

entry into foreign markets

relatively cheap

competitive advantage

exploitation of local knowledge

high success rates

disadvantages

rely on goodwill and resources of other organisations

culture clashes

strategic alliances

Like a joint venture, but NO new legal entity is created (only for a specific project or product)

Profit is split between the two companies

franchise

An original business, known as the franchisor, that developed the business concept and product, then sells to other businesses (franchisees) the right to offer the concept and sell the product

HR planning

Process of anticipating current and future demand for workers in both the short and long term

A workforce plan includes

Careful consideration of current abilities and what will be needed in the future (short-term or long-term)

Identifying gaps and considering ways of addressing them

Noting any training needs

Developing training, recruitment and other personnel policies

CLAMPS

why people tend to leave their jobs

Challenges

Location

Advancement

Money

Pride

Security (job security)

Internal/external factors that influence HR planning

Internal: organisation size, strategies, structure, finances, motivation, corporate culture

External: demographic change, change in labour mobility, immigration, flexi-time, gig economy

Gig economy*

Labour market in which workers are given short-term contracts, paid for each individual job (freelancers)

a market system in which temporary positions are common and organisations hire independent workers for short-term commitments

+ work and life balance, reduced costs for businesses

- lack of job security, limitations in career development, lack of social benefits

Centralisation and decentralisation

Centralisation: decision making is predominately made by a very small group of senior managers at the top of the organisational hierarchy

Decentralisation: decision making authority is delegated throughout

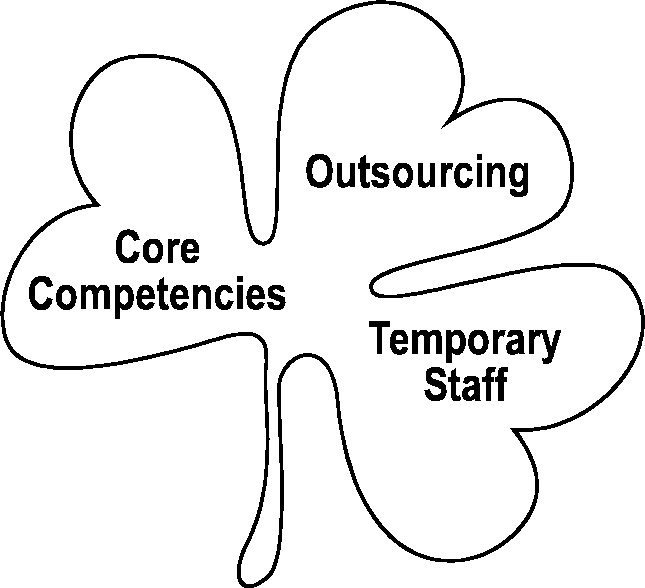

handy shamrock organisational structure

People – important resource

Have to be satisfied through job enrichment and flexible practices

3 main groups of staff

Core staff (full time)

Managers, technicians

E-commerce and teleworking have reduced core staff – implies downsizing

Peripheral workers (part time, contractual)

Employed only when required

Less job security and morale but offer more flexibility

Outsourced workers (subcontracting)

Paid to do specialised tasks e.g IT, accounting

Leadership style

The ways in which a manager and leaders provide direction for others

job security

The assurance given to employees that they will keep their current jobs for the foreseeable future

Sources of conflict in the workplace (& impacts)

Conflict occurs as a result of opposing goals between two or more parties

- can cause miscommunications, misunderstandings, stress, grievances, and power struggles

collective bargaining

The process of negotiation of working conditions and pay between employees and employers

internal sources of finance

personal funds- personal savings of owners and risk for owners

Retained profits- Value of profit kept by the business after paying off the tax, interest, and dividends (to the shareholders) to use within the business

Often used for purchasing and/or upgrading fixed assets which will increase returns

advantages- cheap, permanent source, flexible, controlled by owners

Disadvantages- start ups are rarely profitable at first, might be insufficient for expansion, might be used up

Sale of assests- Businesses can sell their unused assets, such as selling old machinery and computer equipments that have been replaced

advantages- no interest or borrowing costs

disadvantage- available to established businesses only

External sources of finance

share capital- money raised from selling shares in a company

Loan

Overdrafts

Grants

Debt factoring

Trade credit- payment made a later stage agreed upon between seller and buyer

Leasing- the lessee pays rental income to hire assets from the lessor, who is the legal owner of the assets.

venture capital- a form of high-risk capital, usually in the form of loans or shares, invested by venture capital firms, usually at the start of a business idea

overdrafts

When a lending institution allows a firm to withdraw more money than it currently has in its account

grants

Funds usually provided by a government, foundation, trust, or other agency to businesses which does not need to be repaid.

subsidies

Financial Assistance granted by a government, NGO, or an individual to support businesses that are in the public interest

loan

Money sourced from financial institutions such as banks, with interest charged on the loan to be repaid

short-term finance

Day to day running of business

one year or less

examples- overdrafts, trade crediting, debt factoring

medium- term finance

1-5 years

equipment, machinery, vehicles

examples - leasing, grants, loans

long-term finance

expansion of business

5-30 years

examples - loans, share capital

fixed cost

costs of production which have to be paid regardless of output level

Examples- rent, interests, lease payments

independent of output level

variable cost

cost of production which change in proportion to output level

Examples- raw materials, packaging

revenue stream

Revenue streams are the sources of revenues or incomes for a company or a business

Firms utilising different sources/methods to generate income

revenue streams examples

Advertising revenue: this is when an organisation is offering advertising space and charges other organisations for posting ads in this space

Royalties/franchisor: royalty payments are made to artists for the use of their artworks or to franchisors for the use of franchise

Sponsorship deals: the way it usually works is sponsor gives you financial support in exchange for an extra advertising space and publicity.

Subscriptions: use or access goods or services

Merchandise: in addition to the main trading activity, some organisations sell their souvenirs or clothes to get extra revenues

Dividends: companies that own stock/shares within another business can also get dividends

Donations: charities and non-profit

Interest earnings: on cash deposits in banks

Subversions: Government subsidies- aimed at benefiting society

wholesale market

a market where a trader buys goods from a manufacturer in bulk and re-sells the goods to business houses or retailers to further sell the goods to end consumers

Dividends

A sum of the money paid to shareholders which is decided by the board of directors

Balance Sheet

a statement of the financial position of a business in terms of assets, liabilities and owner's equity at a particular point in time

Assets

all items of value that are owned by the firm, such as cash or buildings

Profitability Ratios

show a company's overall efficiency, performance and financial position

liquidity ratio

ability of firm to pay its short-term liabilities

For BON issues may occur because of the absence of sales revenue between the months April - September

current ratio

looks at whether a company can pay/cover its short-term debts

current assets/current liabilities

short-term liquidity problems

occur due to-

poor credit control

expanding too quickly

hence cashflow management is key

cash flow

Financial document that shows expected movement of cash inside and outside of a business per time period

Cash inflows – usually from sales revenues when cash payment is received

Cash outflows – payment of bills, usually itemised expenses

Net cash flow – the differences between cash inflow and outflow

reasons for cashflow

business planning

is the business financially healthy

plan for and alleviate liquidity crisis

causes of cashflow problems

overtrading

over borrowing

overstocking

poor credit control

unforeseen changes

strategies to deal with cash flow problems

reducing cash outflows

improving cash inflows

seeking alternative sources of finance

marketing goods and service

Promotion- to build brand recognition, awareness and trust

use physical environment

make it easy to visualise service quality

branding, logos, celebrity endorsement, slogans

Product strategy - a tangible good or intangible services that satisfies the needs and wants of a customer (attracts more customers)

Price strategy- The amount paid for a particular good or service that should entice customer yet allow the firm to be profitable

source of value to customer- used to price product

Place strategy- Distribution channels that enable customers to conveniently buy the product

online

customers would not go to inconvenient and remote location

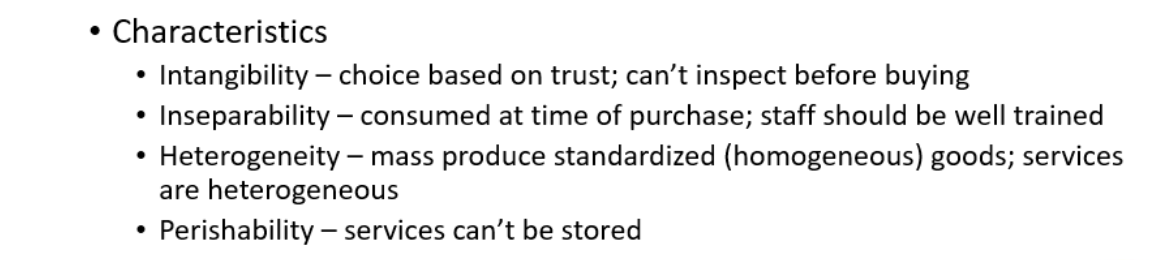

marketing goods vs service

Goods: Use of the 4Ps (place, price, product, promotion)

- Services: Use of the 7Ps (place, price, product, promotion, process, people, physical evidence)

Market research

Market research is essential in helping businesses to identify products/services they can develop in response to the needs and wants that their customers have

Market research is the process of systematically gathering data from consumers which can be used to influence the business decisions

marketing plan

The process of formulating the marketing strategies and tactics that will help a business to achieve its marketing objectives

Three tools of marketing planning include

Market segmentation

Market mapping

Market positioning

marketing audit- review of current position of an organisation’s marketing- once completed marketing plan is prepared

Marketing objectives

These are specific SMART (specific, measurable, achievable, relevant, time bound)

Research

Marketing research identifies the factors expected to impact upon the marketing plan such as

Market size and growth

Market segments

Competitor positioning- SWOT

Customer tastes, preferences and views

The nature of distribution channels

The marketing mix

This involves planning the medium- and short-term marketing activities the business intends to undertake

Pricing strategies and tactics

Promotional activity

Distribution and logistical plans

Product specifications, features and packaging

Physical evidence such as branding

How people and process are developed to support delivery of the rest of the marketing mix

advantage and disadvantages of market planning

advantages-

improves chances of success

clearer idea of objectives

disadvantages-

no time

inflexible

Quickly outdated

Marketing objectives

Targets the marketing departments aims to achieve

These are specific SMART (specific, measurable, achievable, relevant, time bound)

Ansoff matrix

Market development-

selling existing products in new markets

e-commerce- selling over the internet

internationally

Product development-

new products in existing markets

Diversification-

new products in new markets

high risk

stable businesses looking for growth

Product innovation-

original or new product launch

first mover advantage

Unique selling point

A unique selling point (USP) is a distinguishing factor or characteristic of a product, service or brand that sets it apart from its competitors

The USP helps a business to differentiate itself and give customers a reason to choose one product or service over others because it offers something distinct and valuable

There are a range of reasons why businesses develop a USP which can include

Developing a brand identity

Achieving a competitive advantage over rivals

Effective communication with customers

The attraction and retention of customers

Achieving power over pricing

Encouraging innovation and adaption

Differentiation

Product differentiation is an attempt by a business to distinguish its products from those of competitors

reasons for differentiation

Strong product differentiation helps the firm to develop its competitive advantage

The development of product differentiation often helps a firm to create a unique selling point for its product which can be used in marketing

Common methods used by businesses to differentiate products include

Marketing and branding activities

Eye-catching packaging

Attractive functions and features

Product customisation

Excellent customer service

Commercial marketing

marking strategies that focus on meeting the demands of customers in a profitable way

the main purpose is to generate benefits for the owners of the business

Four P's of marketing mix

Marketing mix: Key elements of a marketing strategy that ensure the successful marketing of a product

Product: a tangible good or intangible services that satisfies the needs and wants of a customer

Price: The amount paid for a particular good or service that should entice customer yet allow the firm to be profitable

Promotion: communicating relevant products information to inform and persuade customers to buy the good or service

Place: distribution channels that enable the customers to conveniently buy the product

Market segment

A distinct group of customers with similar characteristics, tastes, preference

Targeting

Targeting is the marketing practice of creating and using an appropriate marketing mix and marketing strategies to cater for different marketing segments

Target market

The group of customers that an organisation focuses on selling its product to

Niche market

marketing approach that focuses on supplying highly specialised products to cater to a small and select target market

Mass market

industries that buy and sell mass market products, catering for a broad range of target markets

people

the employees who deliver the customer service element of the extended marketing mix

physical evidence

the observable and tangible aspects of a service

psychographic segmentation

segmentation that involves characterising consumers according to people’s lifestyle choices and personal values

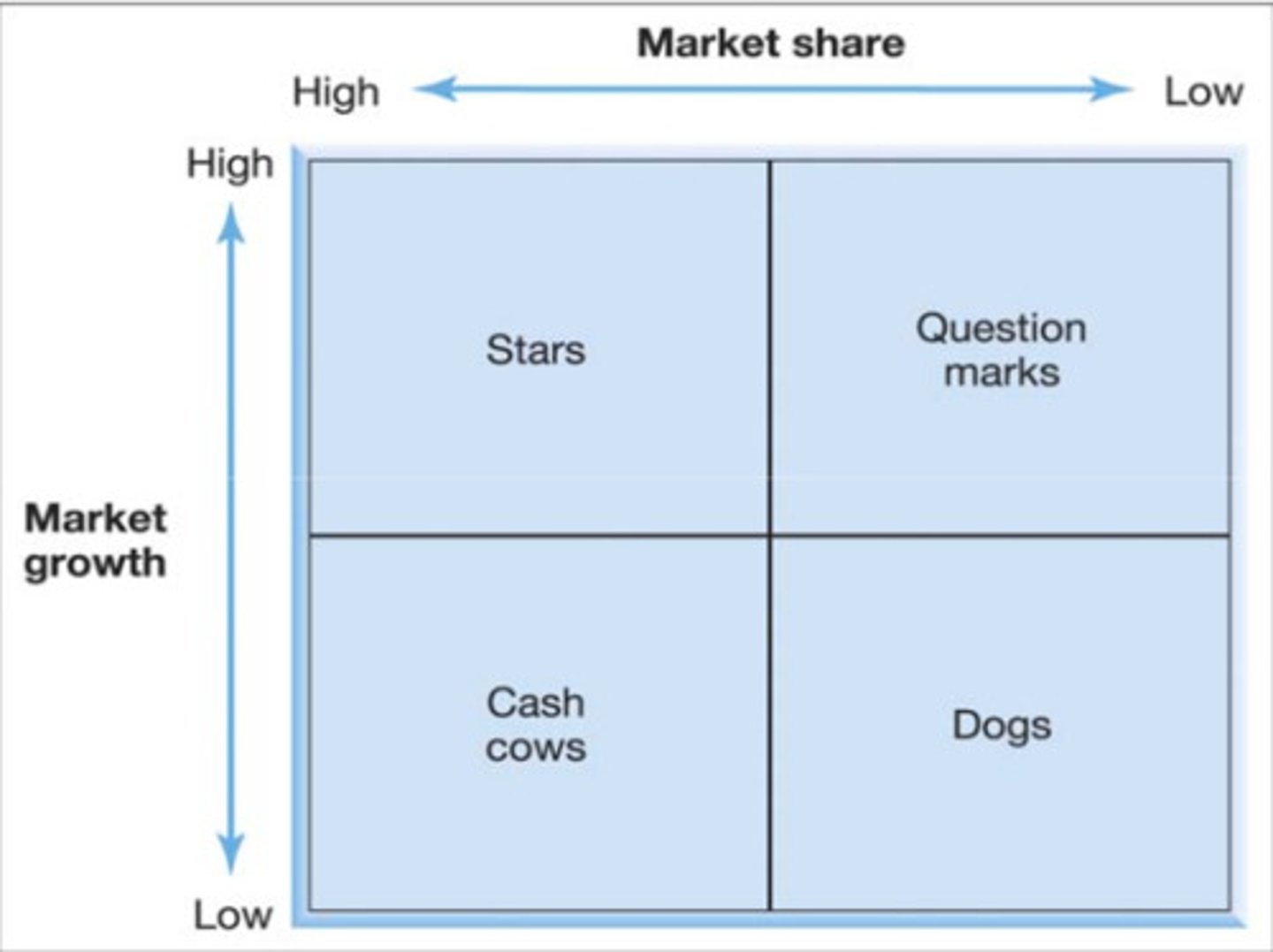

BCG matrix

Visual marketing management tool used to analyse a firm’s product portfolio

Stars: High market growth and high market share

Cash cows: Low market growth and high market share

Question mark: High market growth and low market share

Dogs: Low market share and low market growth

Cost plus pricing

Adding a percentage or predetermined amount (markup) to average cost per unit to set the selling price

Ensures a product will produce contribution