Basic Consideration and Concepts of partnership

1/87

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

88 Terms

Work or services that may either be personal manual efforts or intellectual may also be contributed to a partnership.

True

Ownership is easily transferred in a partnerhsip.

False

A partnership cannot be established for religious purposes.

True

A partnership must always have at least two owners.

True

A proprietorship has a limited life whereas a partnership may have an unlimited life.

False

A dormant partner is one who does not take active part in the partnership business and is not known as a partner.

True

Not all partners in a general partnership are personally liable for all debts incurred by the partnership.

False

Accounting for a partnership comes closer to accounting for sole proprietorship than accounting for a corporation.

True

Partner's drawing accounts have a normal credit balance.

False

The manner in which profits are to be shared should be specified in the articles of partnership.

True

A partnership should always be constituted in writing.

False

A public instrument needs to be executed when immovable property or real rights are contributed to the partnership.

True

Mutual agency means that each partner has the right to bind the partnership to contracts.

True

As long as the action is within the scope of the partnership, any partner can bind the partnership.

True

When partnership capital is P3,000 or more, the public instrument must be recorded with the SEC.

True

Two or more persons may form a partnership for the exercise of a profession.

True

There can never be a partnership without contribution of money, property, or industry to a common fund.

True

Bankruptcy of a partner will dissolve the partnership.

True

A partnership involves mutual agency, unlimited liability for general partners and limited life.

True

A de jure partnership is one which has complied with all legal requirements for its establishment.

True

In a limited partnership, the general partner's liability is limited to his investments.

False

The limited partners are liable only to the extent of their personal contributions.

True

One of the partners in a proposed partnership is a multi-millionaire. The stipulation in the articles of partnership that this partner shall be excluded from sharing in the profits of the partnership is valid.

False

Under the partnership form of business, large amounts of capital can be raised easily compared to corporation.

False

All partners in a general partnership are personally liable for all debts incurred by the partnership.

True

An advantage of the partnership form of business is that each partner's potential loss is limited to that partner's investment in the partnership.

False

A partnership is a legal entity separate and apart from its owners.

True

A partnership is a legal entity separate and apart from its owners.

True

When a partners invests assets in a partnership, the assets are recorded at the partner's book value.

False

Liabilities related to assets invested in a partnership by a new partner cannot be transferred to the partnership.

False

In a contract of partnership, two or more persons bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing the profit among themselves.

True

In a limited partnership, none of the partners has unlimited liability for the business debts.

False

A silent partner takes active part in the business of the partnership and is not known by outsiders to be a partner.

False

A partner's capital account is debited to reflect assets permanently withdrawn.

True

A limited partnership must have at least one general partner.

True

A partnership may be established for charity.

False

Assets invested in the partnership should be recorded at their cost to the partner.

False

All partnerships have a limited life and assets are co-owned by the partners.

True

A disadvantage of partnerships over corporations is the partners' unlimited liability.

True

There is no income tax imposed on a partnership.

False

A partnership has a juridical personality separate and distinct from that of each of the partners.

True

All partnerships are subject to tax at the rate of 30% of taxable income.

False

A partner usually retains title to assets contributed to a partnership, so that certain assets may be identified as belonging to a given partner.

False

In a general partnership, each partner's liability for losses is limited to his investment in the firm.

False

The basis of valuation for non-cash investments to the partnership should be at their historical costs.

False

A partnership has a limited life because any change in the relationship of the partners dissolves the partnership.

True

The essence of partnership is that each partner must share in the profits or losses of the venture.

True

A partnership with a capital of P3,000 or more is valid even if it is unregistered with the SEC.

True

The partner's capital account is debited for the debit balance of the drawing account at the end of the period.

True

A partnership agreement should include the procedure for the ending of the business.

True

A general partner has unlimited liability which is an advantage from the prespective of partnership's creditors.

True

One advantage of a partnership over a corporate form of organization is the unlimited liability of partners.

False

A partner by estoppel is one who is actually not a partner but who represents himself as one.

True

A partner's capital account is debited for additional investments and credited for his share in profit.

False

A secret partner is one who does not take active part in the partnership business and is not known as a partner

False

A partnership is created by mere agreement of the partners.

True

Adjustments prior to formation may be omitted since these will not affect the partner's capital credits.

False

In a universal partnership of profit, all contributions become part of the partnership fund.

False

General professional partnership is a particular partnership with determinate object which is the exercise of a profession,

True

General professional partnership just like other partnerships is subject to income tax of 30%.

False

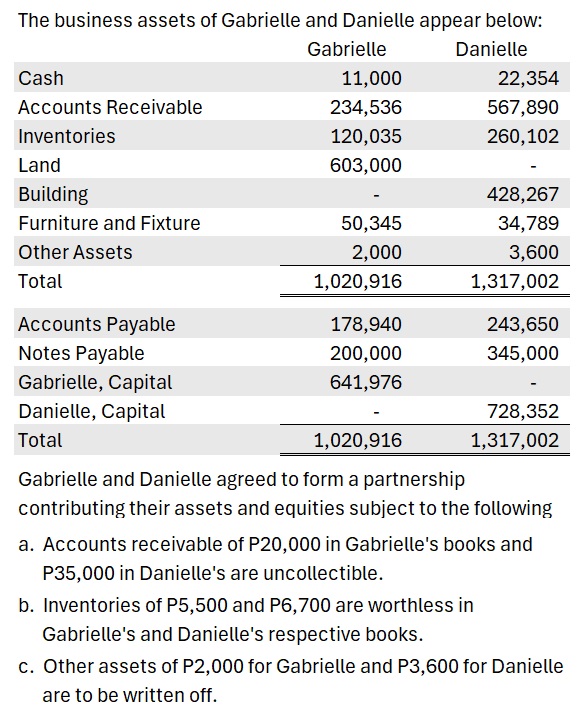

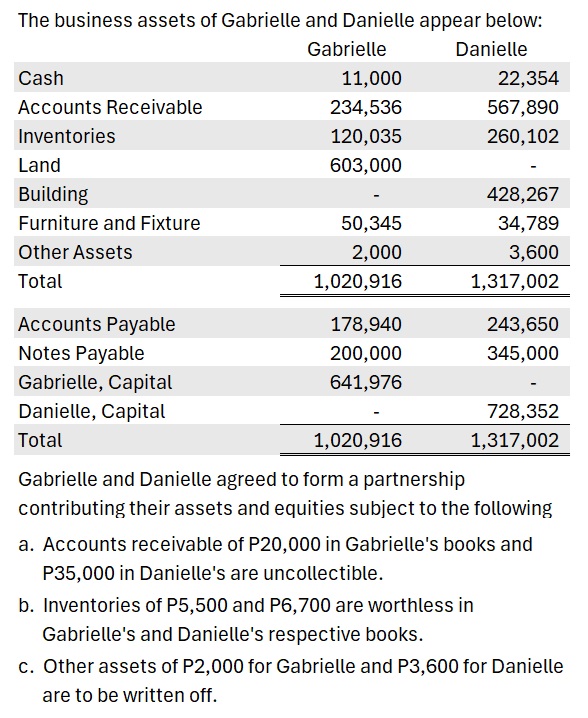

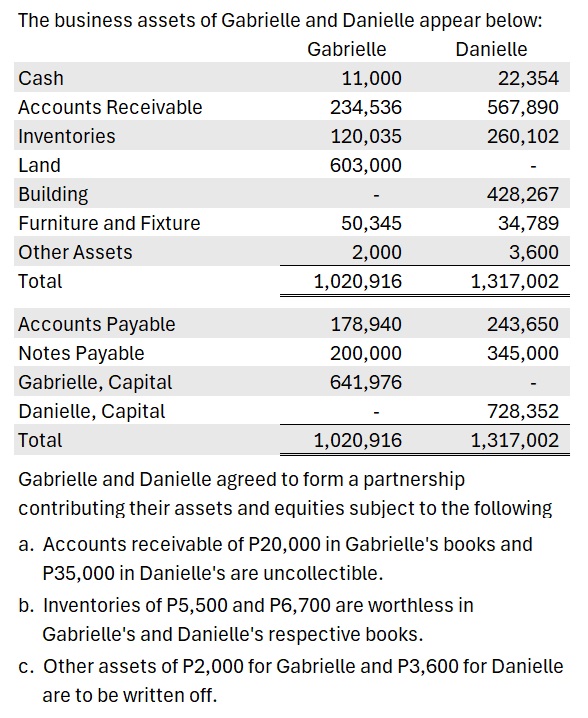

How much is the adjusted capital of Danielle to be credited in the books of partnership?

683,052

How much is the adjusted capital of Gabrielle to be credited in the books of partnership?

614,476

How much is the total capital to be credited in the books of partnership?

1,297,528

Princess and Madeleine have just formed a partnership. Princess contributed cash of P1,260,000 and computer equipment that cost P540,000. The fair value of the computer is P360,000. Princess has notes payable on the computer of P120,000 to be assumed by the partnership. Madeleine contributed only P900,000. The partners agreed to share profit and loss equally.

If Princess is to have 60% capital interest in the partnership, how much should Princess make as additional investment or (withdrawal)?

Use negative sign if withdrawal.

-150,000