Series 65: Unit 1

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

What is a security?

A security is a tradable investment that represents ownership (like stocks) or debt (like bonds).

What is common stock?

equity (ownership) in a corporation

What is preferred stock?

Equity that pays fixed dividends, has priority over common stock in bankruptcy, and usually lacks voting rights

True/False: All stockholders are owners of a corporation and all bondholders are creditors.

True

What is capital appreciation

An increase in the market price of securities

What is a property dividend?

An alternative to cash or stock dividends, where a company gives shareholders property in lieu of cash or cash equivalents.

What is a stock split?

When a company increases the number of its outstanding shares to boost the stock's liquidity.

What is liquidity?

How easily assets can be converted into cash.

What is limited liability?

Business owners (e.g., of a corporation or LLC) aren't personally liable for debts beyond their investment.

What is market risk?

The chance that a stock price will decline from fluctuations in the market.

What is business risk?

The chance that a stock price will decline from company earnings/news.

What are senior securities?

A company’s debt and preferred shares

Why is it called senior securities?

If a company enters bankruptcy, the holders of its bonds and preferred stock have priority over common stockholders.

What are residual rights?

Right of the company owners to claim the remaining assets. Common stockholders have residual rights.

Why would you include common stock in a client’s portfolio?

Potential capital appreciation

Income from dividends

Hedge against inflation

Common stock in a portfolio would incur what potential risks?

Market Risk

Business Risk

Low Priority at Dissolution

What are dividends in arrears?

Unpaid dividends on cumulative preferred stock that have not been paid in past periods and must be paid out before any dividends can be given to common shareholders.

For investors looking for fixed income through preferred stocks, what would be the least appropriate choice of preferred stock.

Adjustable-Rate Preferred, because the dividend will likely fluctuate.

Why would you include preferred stock in a client’s portfolio?

Fixed income from dividends

Prior claim ahead of common stock

Convertible preferred sacrifices income in exchange for potential appreciation

Preferred stock in a portfolio would incur what potential risks?

Market Risk - fear of maintaining dividend

Possible loss of purchasing power

Interest rate (money rate) risk

Business difficulties leading to possible reduction or elimination of the dividend and even bankrupty leading to loss of principal.

What are the different types of preferred stock?

Straight preferred stock

Cumulative preferred stock

Callable preferred stock

Convertible preferred stock

Adjustable-Rate preferred stock

Straight preferred stock

Has no special features beyond the stated dividend payment. Missed dividends are not paid to the stockholder.

Cumulative preferred stock

Accrues payments to shareholders if dividends are reduced or suspended.

Callable (redeemed) preferred stock

Generally higher dividends, but company can buy back from investors at a stated price after a specified date.

Convertible preferred stock

Owner can exchange their shares for a fixed number of shares of common stock of the issuing corporation. Often has lower dividend rate than non-convertible.

Adjustable-Rate preferred stock

Preferred stock with floating dividend rates. Stock price remains stable in exchange.

Restricted Securities

Securities that cannot be sold until having them for a certain period of time. (generally 6 months and sometimes volume restrictions as well).

Control person

A corporate director, an officer, a large stockholder, or the immediate family of any of the preceding residing in the same home.

Control stock

Stock held by a control person.

American depositary share (ADR)

A negotiable security that represents a receipt for shares of stock in a non-U.S. corporation. ADRs are bought and sold in the U.S. securities markets like any domestic stock.

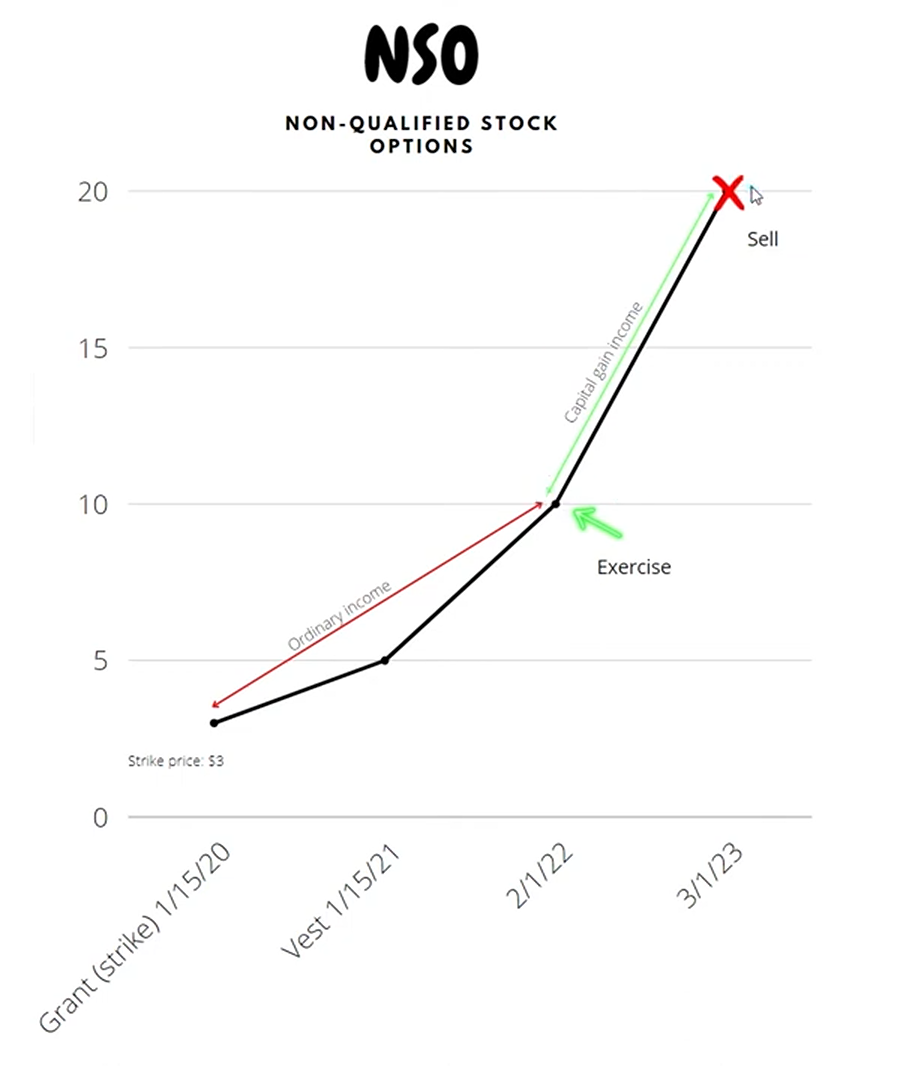

Nonqualified Stock Options (NSOs)

lets an employee buy company shares at a set (grant) price within a specific period. Upon exercise, the difference between the grant price and market price is taxed as ordinary income.

Incentive Stock Options (ISOs)

If ISO shares are held at least two years from grant and one year from exercise, profits are taxed as long-term capital gains. Otherwise, they’re taxed like NSOs as ordinary income.

ISOs must be exercised within 10 years. However, the difference between the market price at exercise and the strike price is a preference item for calculating the Alternative Minimum Tax (AMT).

Currency Risk

the chance that an investment in a foreign currency loses value if that currency weakens against the U.S. dollar.

Emerging Markets

Emerging markets typically have:

Low income levels (measured by GDP)

Low equity market capitalization

Limited market liquidity

Restrictions on foreign ownership and currency conversion

High volatility

Potential for economic growth and development

Stabilizing political and social institutions

High taxes and commission costs for foreign investors

Lower regulatory standards and reduced transparency

Developed Markets

Developed markets typically have:

Highly developed economies

Stable political and social institutions

Large equity market capitalization

Low commission rates

Few or no currency conversion restrictions

Highly liquid markets with many brokers and market makers

Many large-cap securities

Strong regulatory frameworks ensuring high transparency

Why would you include foreign securities in a client’s portfolio?

You’ve broadened the investment universe, allowing for greater diversification.

Foreign securities sometimes outperform domestic ones.

Foreign securities are usually not highly correlated with domestic ones, leading to reduced overall portfolio risk.

Risks of Investing in Foreign Markets

Country risk

Exchange controls

Currency risk

Withholding taxes and fees

Country Risk

the overall risk of investing in a specific country, including political instability, restrictive economic policies, and factors like interest rates and inflation.