Ch. 12 - Mutual Funds and ETFS

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

33 Terms

Mutual Fund

A type of financial services organization that receives money from a group of investors and then uses those funds to purchase a portfolio of securities

Investors own a share of the fund proportionate to the amount of the investment

Actively Managed Fund

Manager’s goals is to identify and invest in securities that will achieve superior performance

Passively Managed Fund

Managers make no attempt to select a portfolio that will outperform a benchmark

Designed to mimic the performance of particular benchmark or stock index

Mutual Fund Ownership Benefits

Portfolio diversification

Full time professional management

Ability to invest small amounts

Service

Automatic reinvesting of dividends & capital gains

Exchange privileges

Convenience

Mutual Fund Ownership Drawbacks

Transaction costs

Spotty performance record

Mutual Fund Operations:

Management Company

Run the fund’s daily operations

Mutual Fund Operations:

Investment Advisor

Buys and sells securities and oversees portfolio

Includes participants such as: money manager, securities analysts, traders

Mutual Fund Operations:

Distributor

Sells the fund shares

Directly to public or through dealers

Mutual Fund Operations:

Custodian

Physically safeguards the securities

Mutual Fund Operations:

Transfer Agent

Keeps track of purchase and redemption requests from shareholders

Load Fund

Mutual fund that charges a commission when investors buy shares

No-Load Fund

Fund that levies no sales charges

12(b)-1 Fee (“hidden loads”)

Fee charged by some mutual funds to cover management and other operating costs

Amounts to as much as 1% of the average net assets

Low-Load Funds

Fund that offers discounts for large investments

Back-End Load

Fund that levies commissions when shares are sold

Open-End Funds

Mutual fund that regularly receives cash from investors and use that money to purchase more securities

Investors buy/sell shares directly with mutual fund company without a secondary market

Funds can issue unlimited number of shares

Greater liquidity

Net Asset Value (NAV)

The total market value of securities held in the fund dividend by the fund’s outstanding shares

Closed-End Funds

Operate with a fixed number of shares outstanding

Do not regularly issue new shares

Sell shares in the fund only at the initial offering

Subsequent trades done in a secondary market

Price of fund shares determined by supply & demand

Sell at a premium or discount to NAV

Brokerage commissions apply

Types of Mutual Funds:

Growth Fund

Objective is capital appreciation

Types of Mutual Funds:

Value Funds

Buy stocks with low prices relative to some measure of intrinsic value like earnings or dividends

Types of Mutual Funds:

Equity-Income Funds

Purchase stocks with high dividend yields

Types of Mutual Funds:

Balanced Funds

Tend to hold a balanced portfolio of both stocks and bonds for the purpose of generating a balanced return of both current income and long-term capital gains

Types of Mutual Funds:

Bond Funds

Invest exclusively in various types and grades of bonds, with income as the primary investment objective

Types of Mutual Funds:

International Funds

Funds that invest primarily in foreign securities

Types of Mutual Funds:

Sector Funds

Investments are restricted to a particular sector or industry

Types of Mutual Funds:

Asset Allocation Funds

Funds that spread investors’ money across different types of asset classes: stocks, bonds, and money market securities

Exchange-Traded Fund (ETF)

Type of open-end fund that trades as a listed security on one of the stock exchanges

Created when a portfolio of securities is purchased and placed in a trust, and then shares are issued that represent claims against the trust.

Low management expenses

Real Estate Investment Trust (REIT)

A type of close-end investment company that invests money in mortgages and various types of real estate investments

Investors receive both the capital appreciation ¤t income from real estate ownership without having to deal with property management

3 Types: Property/Equity, Mortgage, Hybrid

Hedge Funds

Pooled investment fund that accepts investors’ money and invests those funds on a collective basis

Not mutual funds

Not regulated by mutual fund regulations

Private limited partnerships

Only sold to “accredited investors”

Measuring Performance:

Dividend Income

Derived from the dividend and interest income earned on the security holdings of the mutual fund

Measuring Performance:

Capital Gains Distributions

Payments derived from the capital gains earned by the fund

Measuring Performance:

Unrealized Capital Gain (paper profits)

Change in the fund’s price (or NAV)

Capital gain that has not been realized since fund’s holding have not been sold.

For closed-end companies:

Changes in the price discounts/premiums are important

Measuring Performance:

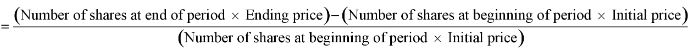

Holding Period Return (HPR)

Include distributions of dividends/capital gains, or NAV appreciation