HL ECON, subsidies, indirect taxes, price cellings, price floors

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

Subsides def

Support provided by the government to encourage the production or consumption of a good

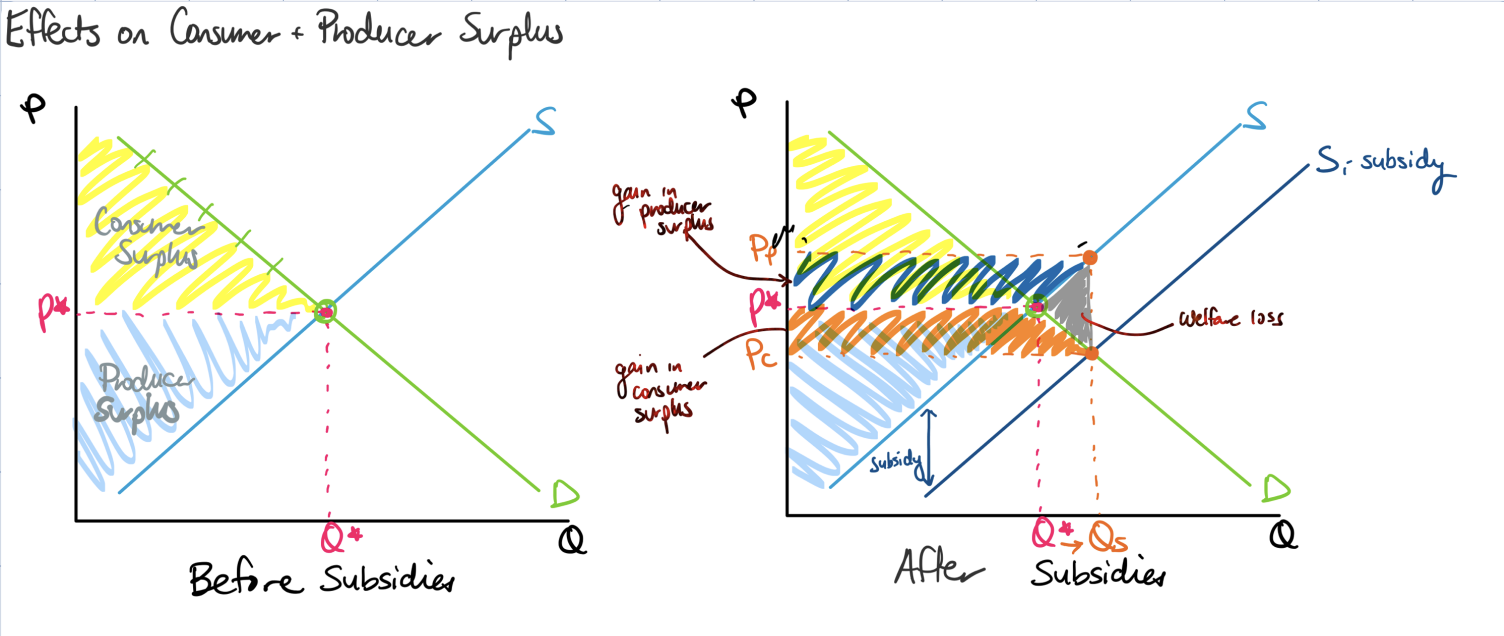

The effect of subsidies on the market:

Subsidies lower the cost of production, therefore motivating producers to produce more, so S1 moves to the right and increases

Subsidies graph

Stakeholders Subsidies - Consumers

benefit, because they consume more (Q with subsidy) at a lower price (Pp - price producers recive)

Stakeholders Subsidies - Producers

benefit, because they sell more (Q with subsidy) and receive a higher price (Pp - price producers receive) so more revenue

Stakeholders Subsidies - Government

Worse off, because it costs them money that they could have spent on other things like health care (opportunity cost)

Stakeholders Subsidies - Workers

better off, because firms are likely to have more workers to produce more output

Stakeholders Subsidies - Society

better off, as more of a good thing for people, environment, society is consumed or produced. (increase in consumer + producer surplus.)

reasons to grant subsidies

to increase revenue of products ( they want to protect certain industries, eg: agricultural goods)

to make basic necessities and merit goods affordable. ( to encourage the good/service consumption for low income consumers. ex: health care, education)

to support growth of specific industry ( lower cost of production allows infant industries to grow. ex: electric cars, wind energy. )

to encourage exports + protect national industry from foreign competition. ( allows companies to be competitive abroad because they can make their goods cheaper )

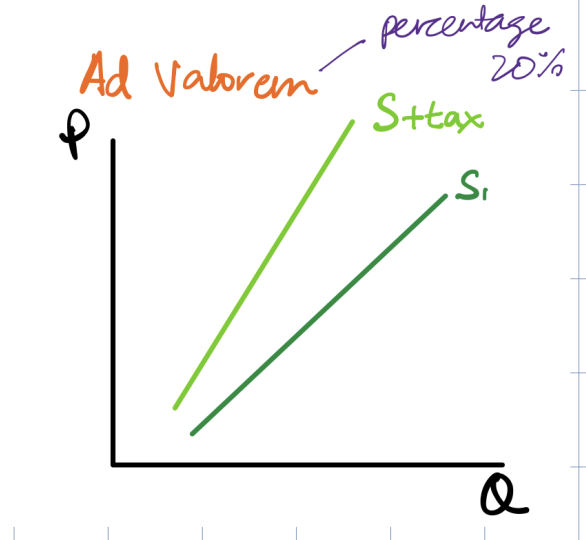

subsidy graph explanation

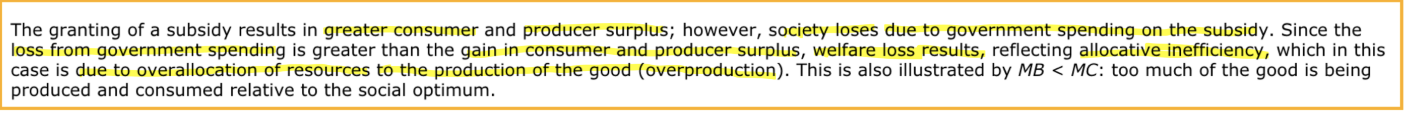

Indirect def

tax placed on a good or service, raising the production cost of the business. It is a tax on expenditure rather than a tax on income. Therefore, shifting the supply curve upwards by the amount of the tax.

The indirect taxes are already included in the price of the good so they are not charged directly on peoples income or wealth.

specific tax def

this is a fixed amount placed upon a good or service, ex: a goveremnt may impose a specific tax of say 4$ on each pack of cigg sold

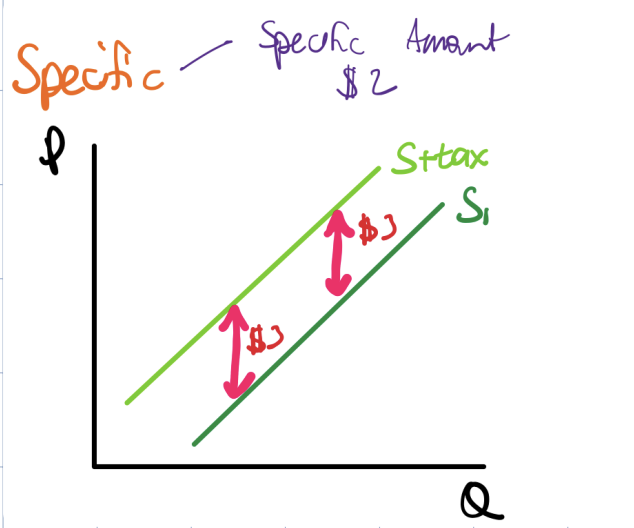

Ad valorem tax def

a tax placed on a range of goods and services which is a percentage of the total selling price.

specific tax graph

Ad valorem tax graph

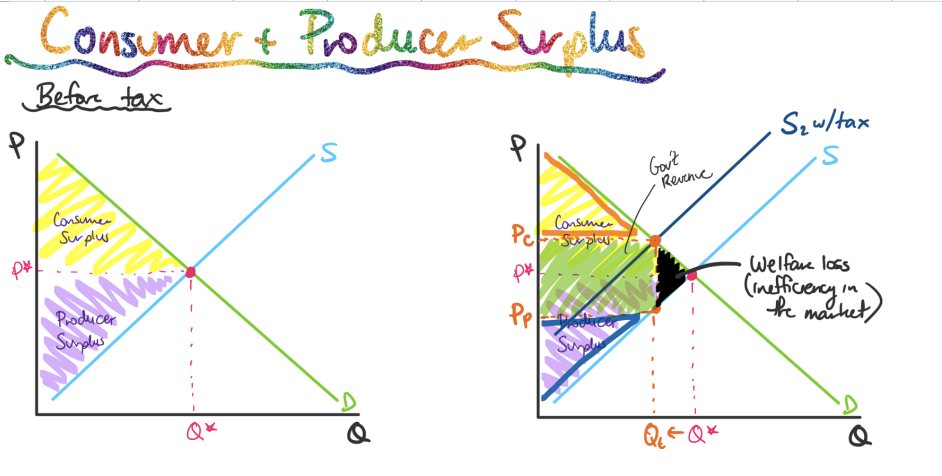

The effect of subsidies on the market:

tax shifts supply to the left because of increase cost of production

Stakeholders Indirect taxes - Consumers

hurt because they pay more (Pc - price consumers pay) and buy less (Qt - new quantity with tax)

Stakeholders Indirect taxes - Producers

hurt because they sell less (Qt - new quantity with tax) and make less money (Pp - price producers receive)

Stakeholders Indirect taxes - Government

benefit because they make revenue to spend in the economy

Stakeholders Indirect taxes - Workers

hurt because if the company makes less they will hire less workers so unemployment might rise

reasons governments put taxes on goods

collect government revenue (taxes are a way for the government to make money that they need to spend on goods + services for the country)

discourage the consumption of demeret goods - goods that are harmful to the individual or society. (Raising prices of goods help consumers not want to consume as much of the demerit goods. ex:vaping tax )

redistribution of wealth ( the government uses the money collected by taxes to then provide goods + services for everyone in society (schools, hospitals, roads)

helps solve negative externalities - things that affect a third party negatively ( discourages companies + individuals from consuming a good or service that hurts themselves or others (pollution, second-hand smoking)

Indirect tax graph

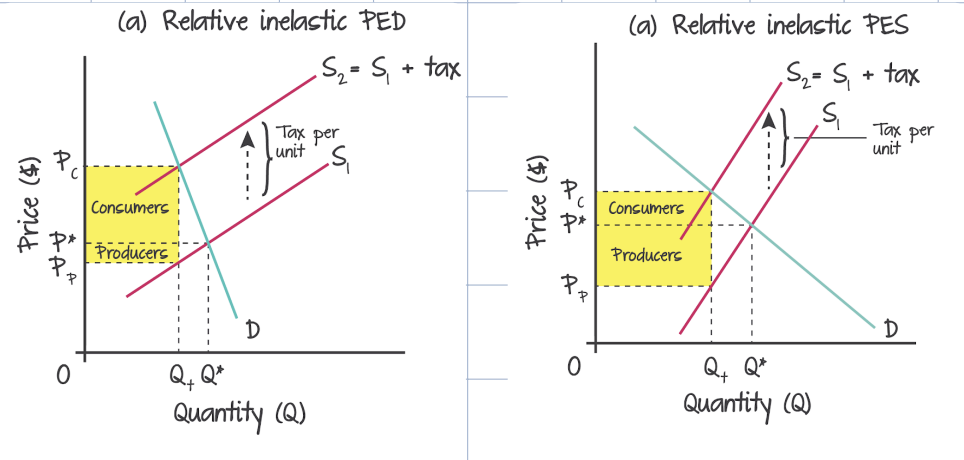

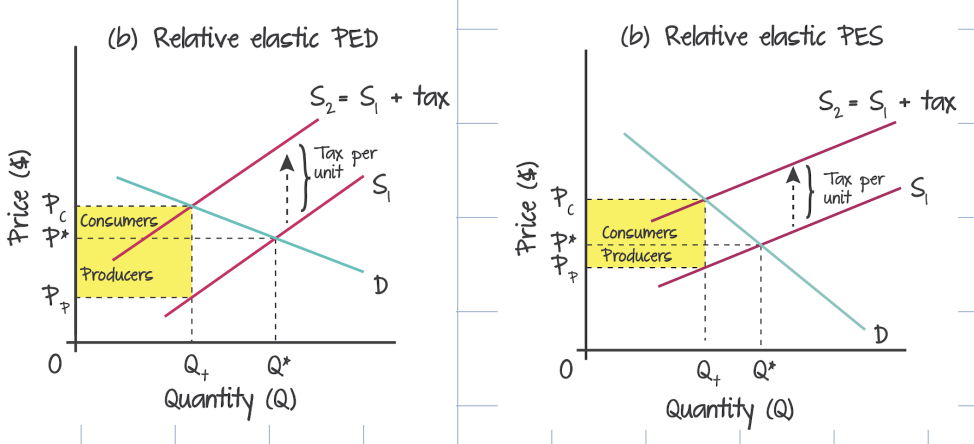

Tax Incidence + Elasticity def

how the burden of an indirect tax is shared between consumers and producers, and it depends on the relative price elasticities of demand and supply.

The more inelastic you are the more burden you are of the tax

Tax Incidence + Elasticity relative inelastic PED

Tax Incidence + Elasticity relative elastic PED

Price controls def

a form of government intervention in the market of a good or service, where the price is set above or below the equilibrium price, preventing the market to clear, creating surpluses or shortages.

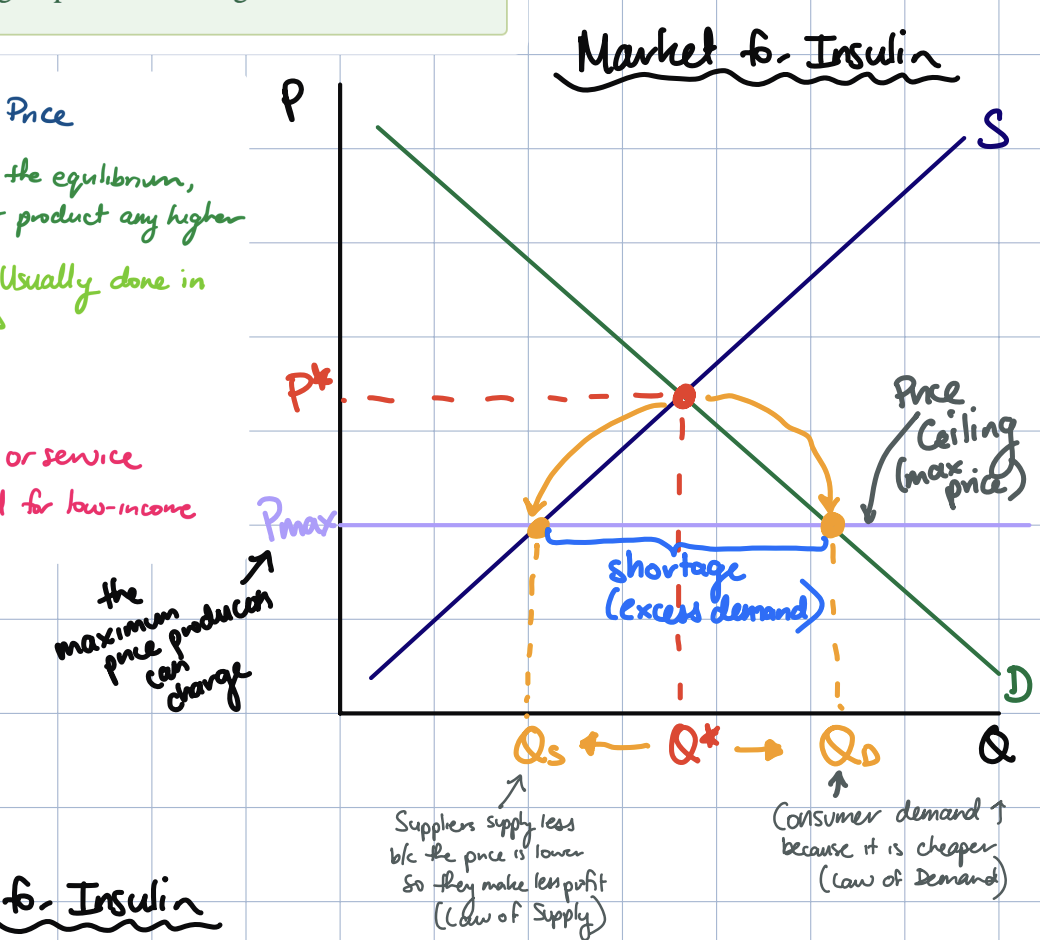

price cellings def

the government sets a maximum price below the equilibrium, preventing producers from selling their product any higher.

this is done to help consumers usually done in the case of necessities/ merit goods

why? for price cellings

to increase consumption of a good or service

to reduce the price of the good fo rlow income consumers

price cellings graph

price cellings consequences

it creates a shortage - excess demand. ( not all all intended consumers will get the good or service )

it generates a rationing problem. (there is a problem in deciding who actually gets it and how to ration it.)

it promotes the creation of black markets ( because there is not enough product, people turn to other markets to find the product )

it eliminates allocative efficiency and generates welfare loss. (There is an underallocation of resources in the production of a good from society’s point of veiw. view

Stakeholders Price cellings - Consumers

those who get the product benefit and are better off. those who dont get the product are worse off.

Stakeholders Price cellings - Producers

now sell at lower price (so less profit) and they sell less. their total revenue falls so they are worse off

Stakeholders Price cellings - goverment

so government make or give out money. But politically gain popularity from consumers and dislike from producers.

Stakeholders Price cellings - Workers

as producers struggle with lower prices, less workers will be hired so they are worse off.

Price cellings: solutions

sometimes the goveremnt wants to help solve the shortage thats created

grant subsidies to profers to compensate for the lower price so they will produce more

the goveremnt could produce the good or service themselves to help cover the increased demand

the goverment could release some of its stock if they have stored that product ( only works for non perishable goods)

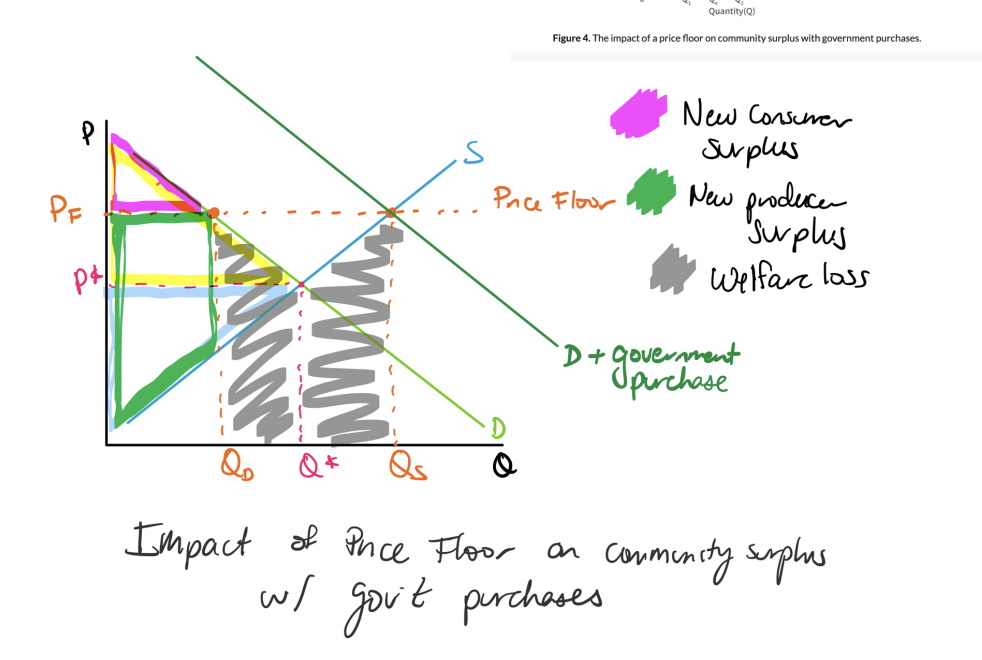

Price floors def

goverment sets a minumum price above the equillibrium price preventing producers to sell their product below it

done to protect producers. usually done with commodities and in the labour market

Why? - price floors

to increase the income of producers of goods + services that the goverment considers important. eg: agricultural goods

to protect workers by setting a wage that would ensure them an earning that could allow them to have a reasonable standard of living.

Consequences: price floors

produceses a surplus so the producers wont be able to sell all of their products

it promotes the creation of black market ( producers might try to sell at a lower price in the informal market)

it might create firm inefficiency ( firms know they will receive a higher price, no matter low efficent, so there is no motivation to reduce costs and be more efficient)

it eliminates allocative efficiency and generates welfare loss ( producers are producing more than what society wants so there is an overallocation of resources )

the government needs to get rid of the surplus ( store the good, sell it abroad, sent it to developing countries as aid, burn it )

Stakeholders Price floors - Consumers

worse off, they pay a higher price and buy less

Stakeholders Price floors - Producers

better off, they receive more money + revenue but its worse for firms who cant sell all their product

Stakeholders Price floors - Workers

better off, because if firms make more revenue, they will hire more people

Stakeholders Price floors - Goverment

not impacted financially (dosent make or lose money), if they have to buy the surplus, it costs them and they cant spend on other things (opportunity cost)

Price cellings graph

when demand is inelastic and elastic most of tax incidence on…

demand inelastic = most of tax incidence on consumers

demand elastic = most of tax incidence on producers