Aggregate Demand and Supply in Macroeconomics

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

69 Terms

What is the formula for calculating GDP?

Total Expenditure = C + I + G + NX, where C is consumer spending, I is investment, G is government spending, and NX is net exports.

What causes changes in GDP?

Changes in expenditures, which are reflected in consumer spending (C), investment (I), government spending (G), and net exports (NX).

What are the three effects that explain the inverse relationship in the Aggregate Demand Curve?

1. Real balances effect 2. Interest rate effect 3. Foreign purchases effect.

What are the two components involved in changes in Aggregate Demand?

1. Change in one of the determinants (C, I, G, NX) 2. Multiplier effect.

What factors affect consumer spending?

1. Consumer wealth 2. Household borrowing 3. Consumer expectations 4. Personal taxes.

What factors influence investment spending?

1. Real interest rates 2. Expectations about future business conditions 3. Technology 4. Changes in excess capacity 5. Business taxes.

How does government spending affect Aggregate Demand?

Increases in government spending raise Aggregate Demand, while decreases lower it.

What are the determinants of net export spending?

1. National income abroad 2. Exchange rates, including dollar depreciation and appreciation.

What is Aggregate Supply?

Total real output produced at each price level, which depends on the time horizon (immediate short run, short run, long run).

What is the relationship between Aggregate Supply and price levels in the short run?

In the short run, the Aggregate Supply curve can shift based on changes in production costs and other factors.

What are the determinants of Aggregate Supply?

Factors that shift the Aggregate Supply curve, including input prices, productivity, and the legal-institutional environment.

How do input prices affect Aggregate Supply?

Changes in domestic resource prices (labor, capital, land) and prices of imported resources can raise or lower per-unit production costs.

What is productivity in the context of Aggregate Supply?

Real output per unit of input; increases in productivity reduce costs, while decreases increase costs.

How do legal changes impact Aggregate Supply?

Legal changes can alter per-unit costs of output through business taxes, subsidies, and government regulations.

What is the equilibrium price level in the AD-AS model?

The point where Aggregate Demand equals Aggregate Supply, determining the price level and real GDP.

What happens when Aggregate Demand increases?

It can lead to demand-pull inflation, raising the price level and real domestic output.

What occurs during a recession resulting from a leftward shift of Aggregate Demand?

It can lead to decreased real domestic output and increased cyclical unemployment.

What are the reasons for downward price inflexibility?

1. Fear of price wars 2. Menu costs 3. Wage contracts 4. Efficiency wages 5. Minimum wage laws.

What is the immediate short-run Aggregate Supply?

The Aggregate Supply curve that reflects the total output produced at each price level in the immediate short run.

What is the long-run Aggregate Supply?

The Aggregate Supply curve that reflects total output produced when all resources are fully utilized.

What is the multiplier effect in the context of Aggregate Demand?

The process by which an initial change in spending leads to a larger overall change in economic activity.

What is the significance of the Aggregate Demand Curve?

It shows the real GDP desired at each price level, illustrating the inverse relationship between price levels and output.

What is the role of expectations in investment spending?

Expectations about future business conditions can significantly influence the level of investment spending.

What causes cost-push inflation?

A decrease in aggregate supply.

What are the two main components of GDP that should be selected in a scenario without government spending and net exports?

Consumption (C) and Investment (I).

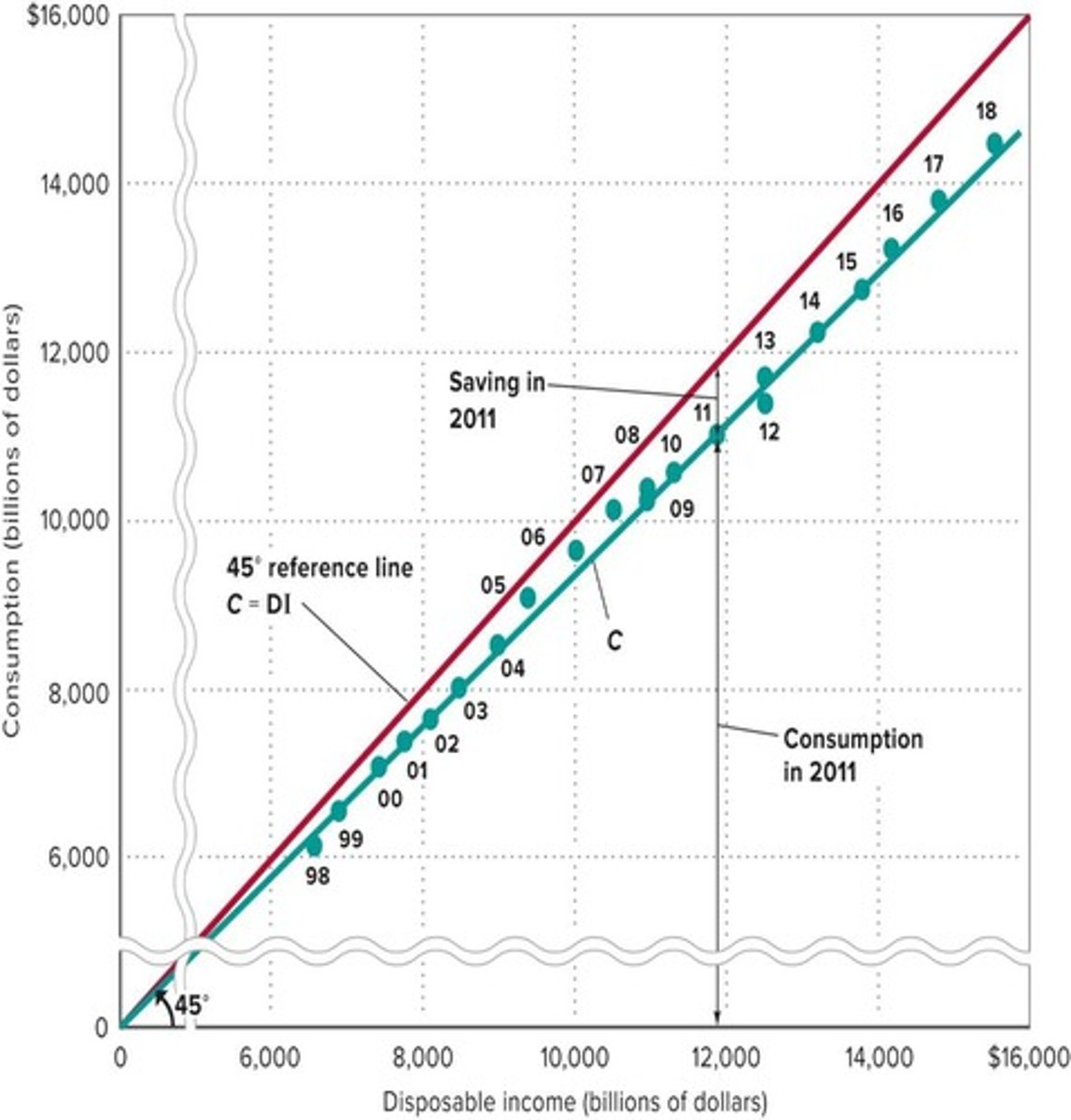

What does disposable income (DI) represent?

Personal income minus personal taxes, indicating what individuals have available for spending or saving.

How is disposable income (DI) calculated in the absence of government spending?

DI = Consumption (C) + Savings (S).

What is the relationship between disposable income (DI) and consumption (C)?

There is a direct relationship; as DI increases, C also increases.

What is dissaving?

Consuming in excess of disposable income.

What does the average propensity to consume (APC) represent?

The fraction of total income that is consumed.

What does the average propensity to save (APS) represent?

The fraction of total income that is saved.

What is the formula that relates average propensities to consume and save?

APC + APS = 1.

What is the marginal propensity to consume (MPC)?

The proportion of a change in income that is consumed.

What is the marginal propensity to save (MPS)?

The proportion of a change in income that is saved.

What is the formula that relates marginal propensities to consume and save?

MPC + MPS = 1.

What are some non-income determinants of consumption?

Wealth, borrowing, expectations, and real interest rates.

What economic event triggered the Great Recession?

The housing collapse.

What was one major action taken by the Federal Reserve during the Great Recession?

Lowering short-term interest rates.

What has been a consequence of the Federal government's response to the Great Recession?

A high debt load due to low interest rates.

What does the relationship between disposable income (DI) and savings (S) imply?

S = DI - C.

How do households typically behave regarding their disposable income?

They consume a large portion and save a smaller proportion.

What is the significance of the average and marginal propensities in macroeconomics?

They help understand consumer behavior in relation to income changes.

What does GDP stand for?

Gross Domestic Product.

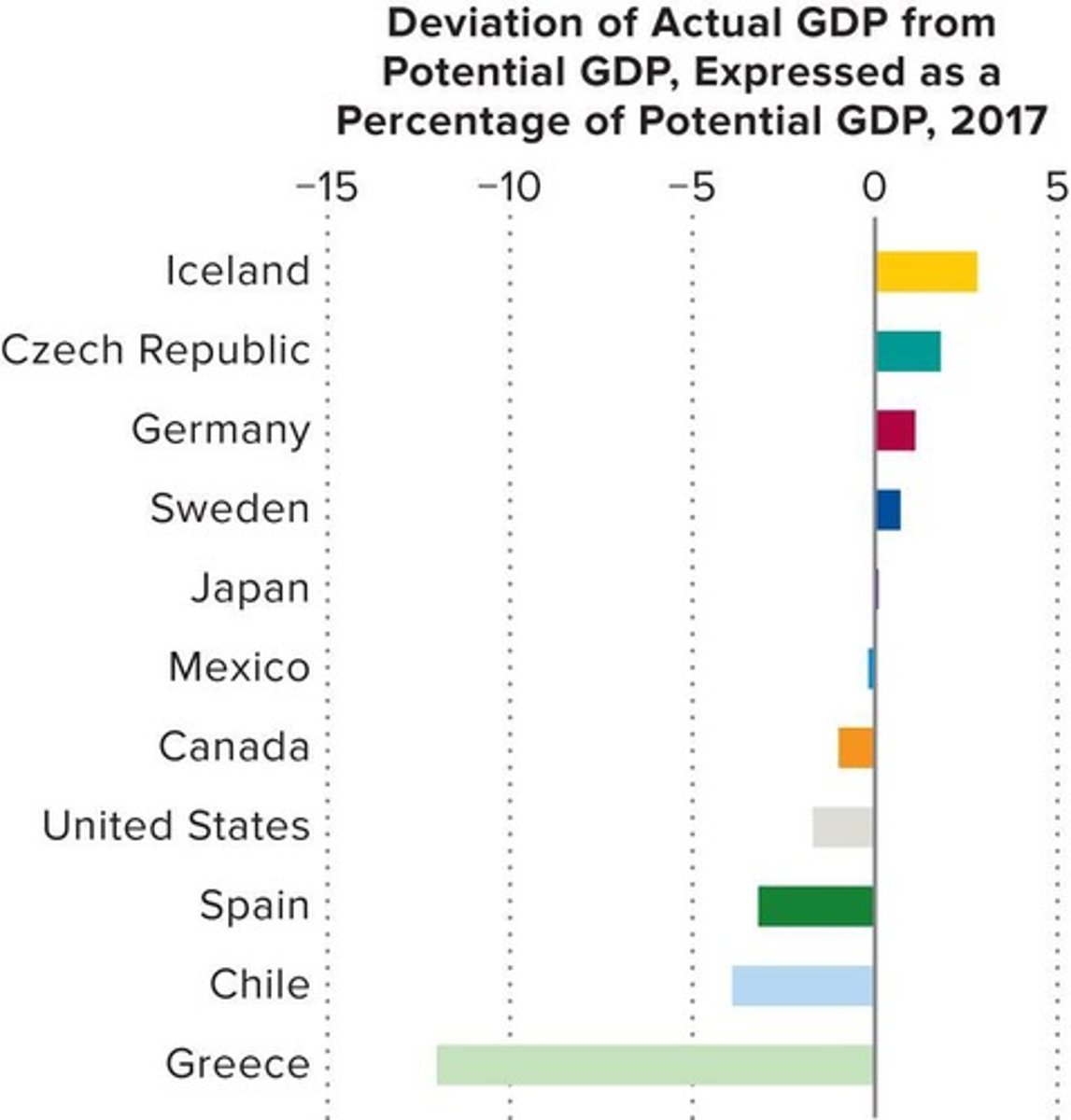

What is the impact of high savings rates on GDP growth?

It can lead to disappointing GDP growth and price increases rather than output gains.

What is the primary determinant of consumption according to the notes?

Disposable income (DI).

What does the term 'expenditure' refer to in the context of GDP?

The total spending in the economy, represented by C + I + G + NX.

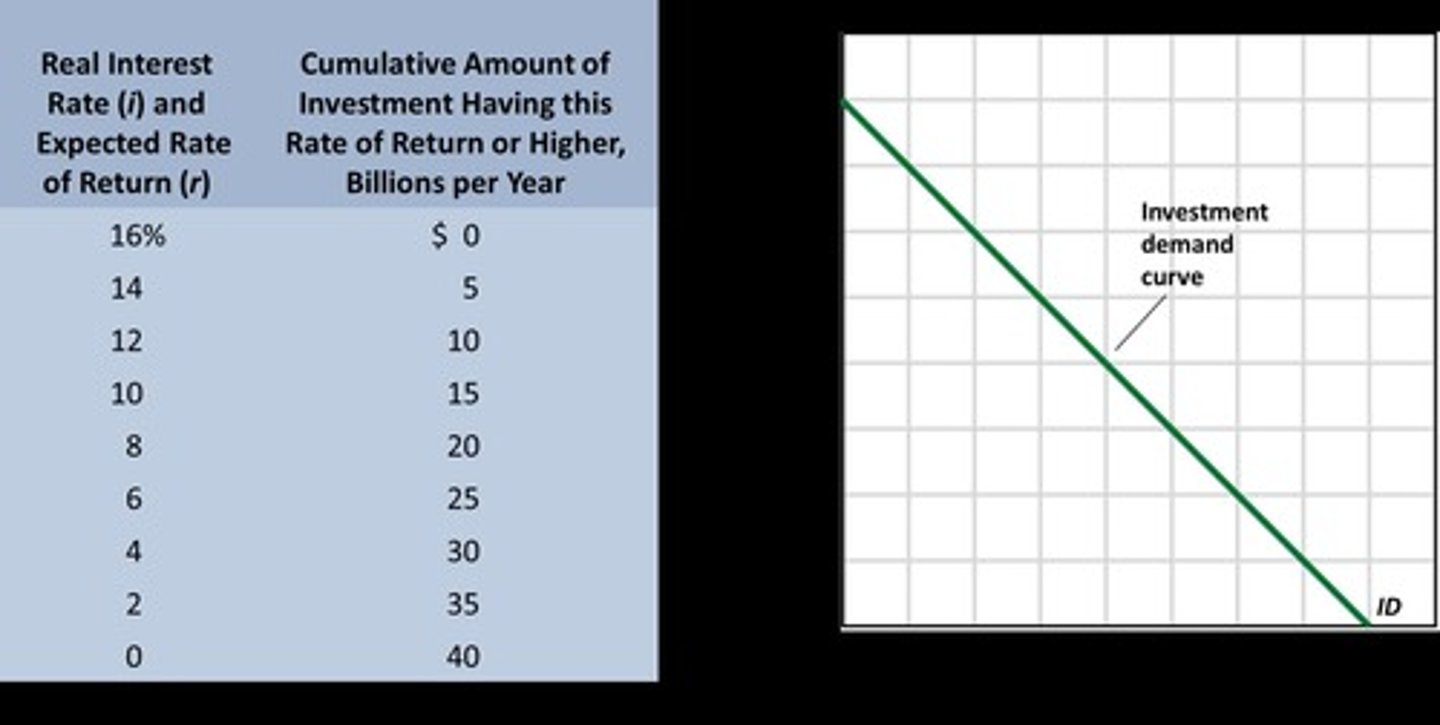

What is the expected rate of return in investment decisions?

The expected economic profit (total revenue minus total cost) as a percentage of the cost of investment.

What is the cost of investment represented by?

The real interest rate, which is the nominal rate corrected for expected inflation.

What should investors do if the expected rate of return is greater than the real interest rate?

Investment should be made.

What are some factors that could shift the Investment Demand Curve?

Acquisition, maintenance, and operating costs; business taxes; technological change; stock of capital goods on hand; planned inventory changes; expectations.

Why is investment considered unstable compared to consumption?

Due to variability of expectations, durability, irregularity of innovation, and variability of profits.

What is the relationship between changes in consumption, investment, government spending, and net exports to GDP?

ΔGDP = ΔC + ΔI + ΔG + ΔNX.

What does the multiplier effect indicate about changes in spending?

A change in spending changes real GDP more than the initial change in spending.

How is the multiplier calculated?

Multiplier = change in real GDP / initial change in spending.

What is the Marginal Propensity to Consume (MPC) if the multiplier is calculated as 4?

MPC = 0.75.

How does the multiplier relate to the Marginal Propensity to Save (MPS)?

Multiplier and MPS are inversely related: a larger MPS results in smaller increases in spending.

What factors could affect the actual multiplier effect?

The actual multiplier may be lower than the model assumes due to consumers buying imported products, households paying income taxes, and inflation.

What is the significance of the 'Dominoes' example in the context of economic interdependence?

It illustrates how one economic event can trigger a chain reaction affecting multiple individuals and businesses.

What happens when a consumer returns a purchased item, according to the 'Dominoes' example?

It can lead to a series of negative economic impacts on various businesses and individuals.

What is the relationship between investment and economic stability?

Investment levels and changes are crucial as they affect overall economic activity and can lead to broader economic implications.

What does a high Marginal Propensity to Consume (MPC) indicate about spending?

It results in larger increases in spending.

What is the formula for calculating the multiplier based on MPC?

Multiplier = 1 / (1 - MPC).

What is the impact of taxes on the multiplier effect?

Taxes can reduce the multiplier effect by limiting disposable income available for consumption.

How does inflation impact the multiplier?

Inflation can decrease the actual multiplier effect by eroding purchasing power.

What is the significance of the investment demand curve in macroeconomics?

It represents the relationship between the interest rate and the level of investment demanded.

What role do expectations play in investment decisions?

Expectations about future economic conditions significantly influence investment levels.

What is the relationship between investment and GDP growth?

Investment is a key component of GDP, and changes in investment can lead to significant changes in GDP.

Why might the actual multiplier be zero?

If consumers do not spend any additional income or if other economic factors negate the effects of spending.

What does the term 'instability of investment' refer to?

The unpredictable nature of investment levels due to various economic factors.