Chapter 3 Quiz Flashcards

1/71

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

72 Terms

Figure 3.1

Your first encounter with differences across states may have come from visiting relatives or going on a cross-country trip with your parents during vacation. The distinct postcard images of different states that come to your mind are symbolic of American federalism. (credit: modification of work by Boston Public Library)

Federalism figures prominently in the U.S. political system. Explain.

Specifically, the federal design spelled out in the Constitution divides powers between two levels of government—the states and the federal government—and creates a mechanism for them to check and balance one another.

As an institutional design, federalism both safeguards state interests and creates a strong union led by a capable central government.

American federalism also seeks to balance the forces of decentralization and centralization.

We see decentralization when we cross state lines and encounter different taxation levels, welfare eligibility requirements, and voting regulations.

Centralization is apparent in the fact that the federal government is the only entity permitted to print money, to challenge the legality of state laws, or to employ money grants and mandates to shape state actions.

Colorful billboards with simple messages may greet us at state borders (Figure 3.1), but behind them lies a complex and evolving federal design that has structured relationships between states and the federal government since the late 1700s.

What specific powers and responsibilities are granted to the federal and state governments? How does our process of government keep these separate governing entities in balance? To answer these questions and more, __________________________________________________________________.

this chapter traces the origins, evolution, and functioning of the American system of federalism, as well as its advantages and disadvantages for citizens

Modern democracies divide governmental power in two general ways; some, like the United States, use a combination of both structures. Explain.

The first and more common mechanism shares power among three branches of government—the legislature, the executive, and the judiciary.

The second, federalism, apportions power between two levels of government: national and subnational.

In the United States, the term federal government refers to the government at the national level, while the term states means governments at the subnational level.

Federalism is an institutional arrangement that creates two relatively autonomous levels of government, each possessing the capacity to act directly on behalf of the people with the authority granted to it by the national constitution. Although today’s federal systems vary in design,

five structural characteristics are common to the United States and other federal systems around the world, including Germany and Mexico.

Explain the first structural characteristic that are common to the United State’s federal systems and other federal systems around the world, including Germany and Mexico.

First, all federal systems establish two levels of government, with both levels being elected by the people and each level assigned different functions.

The national government is responsible for handling matters that affect the country as a whole, for example, defending the nation against foreign threats and promoting national economic prosperity.

Subnational, or state governments, are responsible for matters that lie within their regions, which include ensuring the well-being of their people by administering education, health care, public safety, and other public services.

By definition, a system like this requires that different levels of government cooperate, because the institutions at each level form an interacting network.

In the U.S. federal system, all national matters are handled by the federal government, which is led by the president and members of Congress, all of whom are elected by voters across the country.

All matters at the subnational level are the responsibility of the fifty states, each headed by an elected governor and legislature.

Thus, there is a separation of functions between the federal and state governments, and voters choose the leader at each level.

Explain the second structural characteristic that are common to the United State’s federal systems and other federal systems around the world, including Germany and Mexico.

The second characteristic common to all federal systems is a written national constitution that cannot be changed without the substantial consent of subnational governments.

In the American federal system, the twenty-seven amendments added to the Constitution since its adoption were the result of an arduous process that required approval by two-thirds of both houses of Congress and three-fourths of the states.

The main advantage of this supermajority requirement is that no changes to the Constitution can occur unless there is broad support within Congress and among states.

The potential drawback is that numerous national amendment initiatives—such as the Equal Rights Amendment (ERA), which aims to guarantee equal rights regardless of sex—have failed because they cannot garner sufficient consent among members of Congress or, in the case of the ERA, the states.

The ERA appeared to gain new life in 2020 as a thirty-eighth state (Virginia) formally voted to ratify the amendment.

However, the amendment's original ratification deadline of 1982 had long since passed, and hence the amendment did not take effect.

The U.S. House of Representatives passed legislation in the 117th Congress (2021) to extend the deadline; however, a similar measure introduced in the Senate, while garnering 51 co-sponsors, did not pass.

Explain the third structural characteristic that are common to the United State’s federal systems and other federal systems around the world, including Germany and Mexico.

Third, the constitutions of countries with federal systems formally allocate legislative, judicial, and executive authority to the two levels of government in such a way as to ensure each level some degree of autonomy from the other.

Under the U.S. Constitution, the president assumes executive power, Congress exercises legislative powers, and the federal courts (e.g., U.S. district courts, appellate courts, and the Supreme Court) assume judicial powers.

In each of the fifty states, a governor assumes executive authority, a state legislature makes laws, and state-level courts (e.g., trial courts, intermediate appellate courts, and supreme courts) possess judicial authority.

While each level of government is somewhat independent of the others, a great deal of interaction occurs among them. Explain.

In fact, the ability of the federal and state governments to achieve their objectives often depends on the cooperation of the other level of government.

For example, the federal government’s efforts to ensure homeland security are bolstered by the involvement of law enforcement agents working at local and state levels.

On the other hand, the ability of states to provide their residents with public education and health care is enhanced by the federal government’s financial assistance.

Another common characteristic of federalism around the world is that national courts commonly resolve disputes between levels and departments of government. Explain.

In the United States, conflicts between states and the federal government are adjudicated by federal courts, with the U.S. Supreme Court being the final arbiter.

The resolution of such disputes can preserve the autonomy of one level of government, as illustrated recently when the Supreme Court ruled that states cannot interfere with the federal government’s actions relating to immigration.

In other instances, a Supreme Court ruling can erode that autonomy, as demonstrated in the 1940s when, in United States v. Wrightwood Dairy Co., the Court enabled the federal government to regulate commercial activities that occurred within states, a function previously handled exclusively by the states.

Finally, subnational governments are always represented in the upper house of the national legislature, enabling regional interests to influence national lawmaking. Explain.

In the American federal system, the U.S. Senate functions as a territorial body by representing the fifty states: Each state elects two senators to ensure equal representation regardless of state population differences.

Thus, federal laws are shaped in part by state interests, which senators convey to the federal policymaking process.

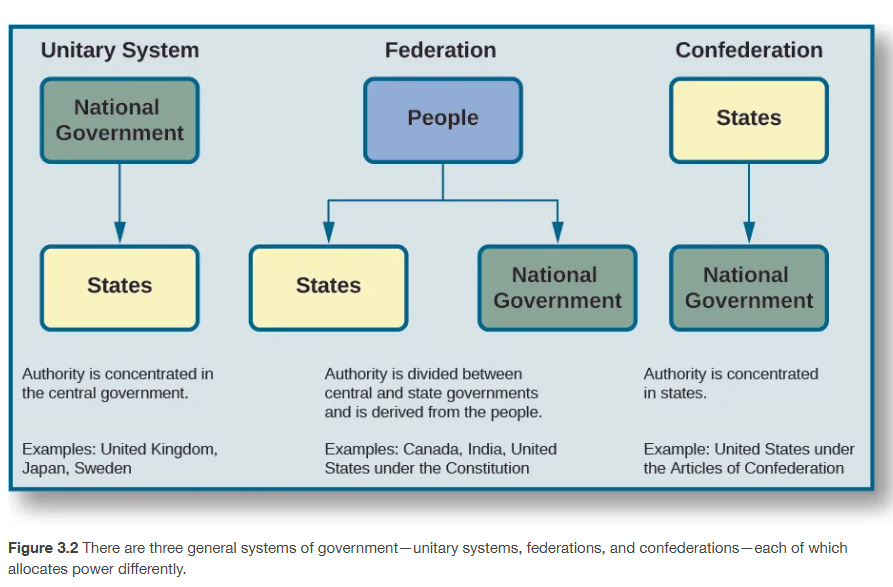

Division of power can also occur via a unitary structure or confederation (Figure 3.2). Explain.

In contrast to federalism, a unitary system makes subnational governments dependent on the national government, where significant authority is concentrated.

Before the late 1990s, the United Kingdom’s unitary system was centralized to the extent that the national government held the most important levers of power.

Since then, power has been gradually decentralized through a process of devolution, leading to the creation of regional governments in Scotland, Wales, and Northern Ireland as well as the delegation of specific responsibilities to them.

Other democratic countries with unitary systems, such as France, Japan, and Sweden, have followed a similar path of decentralization.

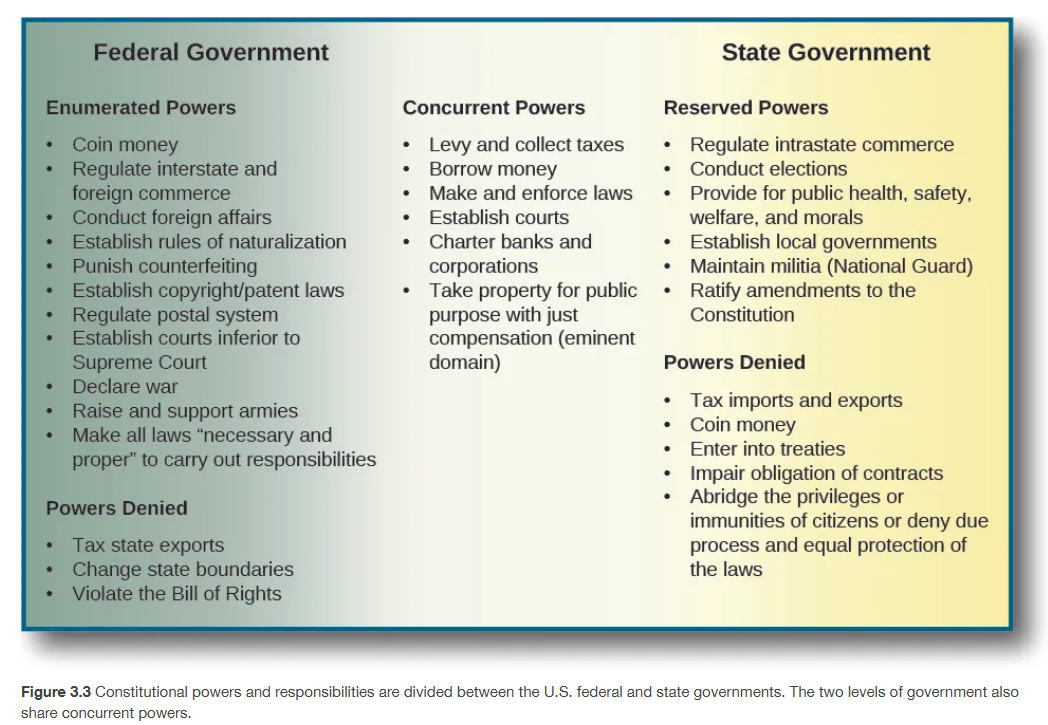

The Constitution contains several provisions that direct the functioning of U.S. federalism.

Some delineate the scope of national and state power, while others restrict it.

The remaining provisions shape relationships among the states and between the states and the federal government.

The enumerated powers of the national legislature are found in Article I, Section 8. Explain.

These powers define the jurisdictional boundaries within which the federal government has authority.

In seeking not to replay the problems that plagued the young country under the Articles of Confederation, the Constitution’s framers granted Congress specific powers that ensured its authority over national and foreign affairs.

To provide for the general welfare of the populace, it can tax, borrow money, regulate interstate and foreign commerce, and protect property rights, for example.

To provide for the common defense of the people, the federal government can raise and support armies and declare war.

Furthermore, national integration and unity are fostered with the government’s powers over the coining of money, naturalization, postal services, and other responsibilities.

The last clause of Article I, Section 8, commonly referred to as the elastic clause or the necessary and proper clause, enables Congress “to make all Laws which shall be necessary and proper for carrying” out its constitutional responsibilities. Explain.

While the enumerated powers define the policy areas in which the national government has authority, the elastic clause allows it to create the legal means to fulfill those responsibilities.

However, the open-ended construction of this clause has enabled the national government to expand its authority beyond what is specified in the Constitution, a development also motivated by the expansive interpretation of the commerce clause, which empowers the federal government to regulate interstate economic transactions.

The powers of the state governments were never listed in the original Constitution. Explain.

The consensus among the framers was that states would retain any powers not prohibited by the Constitution or delegated to the national government.7

However, when it came time to ratify the Constitution, a number of states requested that an amendment be added explicitly identifying the reserved powers of the states.

What these Anti-Federalists sought was further assurance that the national government’s capacity to act directly on behalf of the people would be restricted, which the first ten amendments (Bill of Rights) provided.

The Tenth Amendment affirms the states’ reserved powers: “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

Indeed, state constitutions had bills of rights, which the first Congress used as the source for the first ten amendments to the Constitution.

Some of the states’ reserved powers are no longer exclusively within state domain, however. Explain.

For example, since the 1940s, the federal government has also engaged in administering health, safety, income security, education, and welfare to state residents.

The boundary between intrastate and interstate commerce has become indefinable as a result of broad interpretation of the commerce clause.

Shared and overlapping powers have become an integral part of contemporary U.S. federalism.

These concurrent powers range from taxing, borrowing, and making and enforcing laws to establishing court systems (Figure 3.3).

Article I, Sections 9 and 10, along with several constitutional amendments, lay out the restrictions on federal and state authority. Explain Article I, Section 9.

The most important restriction Section 9 places on the national government prevents measures that cause the deprivation of personal liberty.

Specifically, the government cannot suspend the writ of habeas corpus, which enables someone in custody to petition a judge to determine whether that person’s detention is legal; pass a bill of attainder, a legislative action declaring someone guilty without a trial; or enact an ex post facto law, which criminalizes an act retroactively.

The Bill of Rights affirms and expands these constitutional restrictions, ensuring that the government cannot encroach on personal freedoms.

The states are also constrained by the Constitution. Explain.

Article I, Section 10, prohibits the states from entering into treaties with other countries, coining money, and levying taxes on imports and exports.

Like the federal government, the states cannot violate personal freedoms by suspending the writ of habeas corpus, passing bills of attainder, or enacting ex post facto laws.

Furthermore, the Fourteenth Amendment, ratified in 1868, prohibits the states from denying citizens the rights to which they are entitled by the Constitution, due process of law, or the equal protection of the laws.

Lastly, three civil rights amendments—the Fifteenth, Nineteenth, and Twenty-Sixth—prevent both the states and the federal government from abridging citizens’ right to vote based on race, sex, and age.

This topic remains controversial because states have not always ensured equal protection.

Various constitutional provisions govern state-to-state relations. Explain.

Article IV, Section 1, referred to as the full faith and credit clause, requires the states to accept court decisions, public acts, and contracts of other states.

Thus, an adoption certificate or driver’s license issued in one state is valid in any other state.

The movement for marriage equality has put the full faith and credit clause to the test in recent decades.

In light of Baehr v. Lewin, a 1993 ruling in which the Hawaii Supreme Court asserted that the state’s ban on same-sex marriage was unconstitutional, a number of states became worried that they would be required to recognize those marriage certificates.

To address this concern, Congress passed and President Clinton signed the Defense of Marriage Act (DOMA) in 1996.

The law declared that “No state (or other political subdivision within the United States) need recognize a marriage between persons of the same sex, even if the marriage was concluded or recognized in another state.”

The law also barred federal benefits for same-sex partners.

The privileges and immunities clause of Article IV, also called the comity clause, asserts that states are prohibited from discriminating against out-of-staters by denying them such guarantees as access to courts, legal protection, property rights, and travel rights. The clause has not been interpreted to mean there cannot be any difference in the way a state treats residents and non-residents. Explain.

For example, individuals cannot vote in a state in which they do not reside, tuition at state universities is higher for out-of-state residents, and in some cases individuals who have recently become residents of a state must wait a certain amount of time to be eligible for social welfare benefits.

Another constitutional provision prohibits states from establishing trade restrictions on goods produced in other states.

However, a state can tax out-of-state goods sold within its borders as long as state-made goods are taxed at the same level.

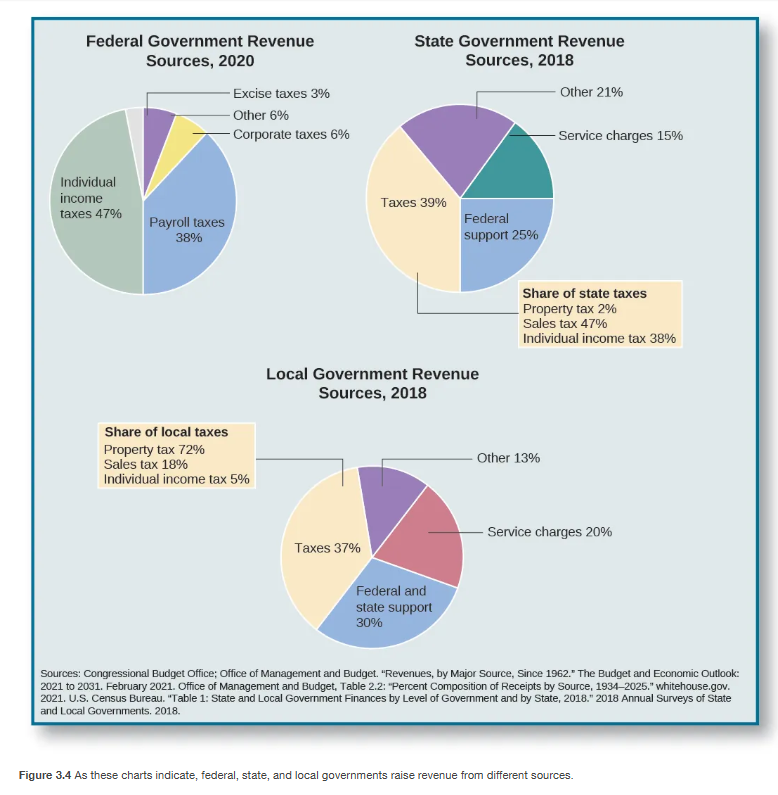

Federal, state, and local governments depend on different sources of revenue to finance their annual expenditures. Explain.

In 2021, total revenue (or receipts) reached $4.3 trillion for the federal government, $2.5 trillion for the states, and $1.6 trillion for local governments.

Two important developments have fundamentally changed the allocation of revenue since the early 1900s.

First, the ratification of the Sixteenth Amendment in 1913 authorized Congress to impose income taxes without apportioning it among the states on the basis of population, a burdensome provision that Article I, Section 9, had imposed on the national government.

With this change, the federal government’s ability to raise revenue significantly increased and so did its ability to spend.

The sources of revenue for federal, state, and local governments are detailed in Figure 3.4. Explain.

Although the data reflect 2020 results, the patterns we see in the figure give us a good idea of how governments have funded their activities in recent years.

For the federal government, 47 percent of 2020 revenue came from individual income taxes and 38 percent from payroll taxes, which combine Social Security tax and Medicare tax.

For state governments, 39 percent of revenue came from taxes, while 25 percent consisted of federal support. Explain.

Sales tax—which includes taxes on purchased food, clothing, alcohol, amusements, insurance, motor fuels, tobacco products, and public utilities, for example—accounted for about 47 percent of total tax revenue, and individual income taxes represented roughly 38 percent.

Revenue from service charges (e.g., tuition revenue from public universities and fees for hospital-related services) accounted for 15 percent.

The tax structure of states varies. Explain.

Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have individual income taxes.

Yet, such decisions on taxation reflect a classic tradeoff, as each state government must collect some mix of revenue in order to fund their chosen public services.

These states find revenue through higher property taxes and through tax revenues related to tourism.

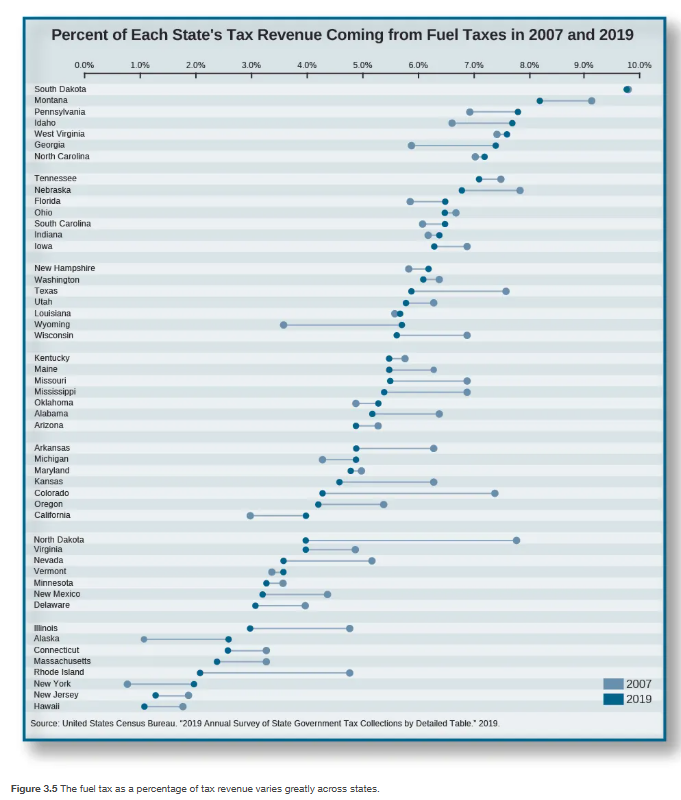

Figure 3.5 illustrates yet another difference: Fuel tax as a percentage of total tax revenue is much higher in South Dakota and West Virginia than in Alaska and Hawaii.

However, most states have done little to prevent the erosion of the fuel tax’s share of their total tax revenue between 2007 and 2019 (notice that for many states the dark blue dots for 2019 are to the left of the light blue numbers for 2007).

Fuel tax revenue is typically used to finance state highway transportation projects, although some states do use it to fund non-transportation projects.

The most important sources of revenue for local governments in 2018 were taxes, federal and state grants, and service charges. Explain.

For local governments the property tax, a levy on residential and commercial real estate, was the most important source of tax revenue, accounting for about 72 percent of the total.

Federal and state grants accounted for 30 percent of local government revenue.

Charges for hospital-related services, sewage and solid-waste management, public city university tuition, and airport services are important sources of general revenue for local governments.

The COVID-19 pandemic of 2020–2021 ushered in a massive mobilization of activity and coordination at and between various levels of U.S. government in the hope of defeating the deadly virus that overwhelmed hospitals and led to nearly 600,000 deaths nationwide as well as a bleeding of state and local government jobs. Explain.

The amount of federal funding to the states eclipsed the levels provided during the Great Recession.

The $1.9 trillion American Rescue Plan Act passed by Congress and signed by President Biden included $350 billion in direct aid to state, local, and tribal governments.

Furthermore, earlier in the pandemic, the CARES Act, signed by President Trump, established the $150 billion Coronavirus Relief Fund to aid these same governments.

Many other federal funding flows occurred outside these two packages, including support for vaccinations and the vaccine rollout across the nation.

How are the revenues generated by our tax dollars, fees we pay to use public services and obtain licenses, and monies from other sources put to use by the different levels of government? Explain.

A good starting point to gain insight on this question as it relates to the federal government is Article I, Section 8, of the Constitution.

Recall, for instance, that the Constitution assigns the federal government various powers that allow it to affect the nation as a whole.

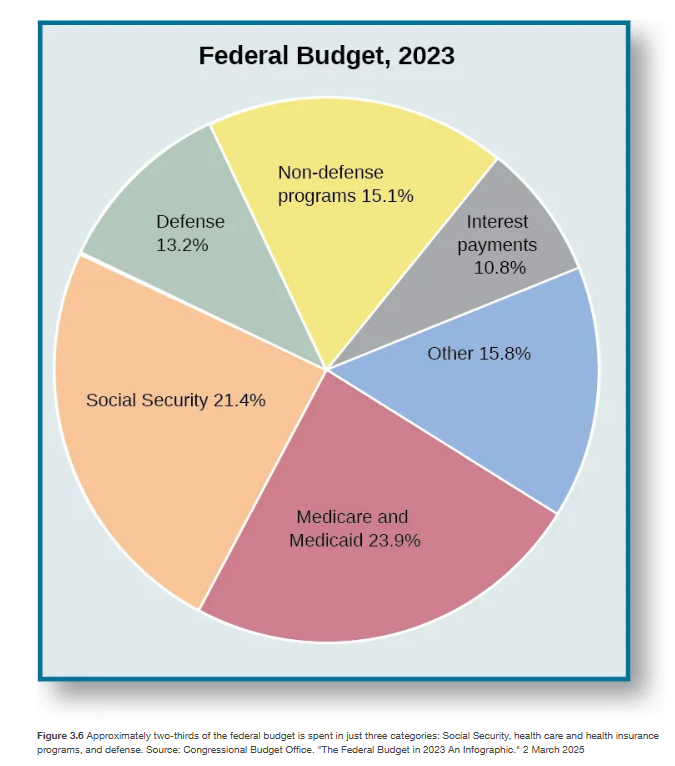

A look at the federal budget in 2023 (Figure 3.6) shows that the three largest spending categories were Social Security (22 percent of the total budget); Medicare, Medicaid, the Children’s Health Insurance Program, and marketplace subsidies under the Affordable Care Act (24 percent); and defense and international security assistance (13 percent).

The rest was divided among categories such as safety net programs (15 percent), including the Earned Income Tax Credit and Child Tax Credit, unemployment insurance, food stamps, and other low-income assistance programs; interest on federal debt (11 percent); and non-defense discretionary spending (15 percent).

It is clear from the 2023 federal budget that providing for the general welfare and national defense consumes much of the government’s resources—not just its revenue, but also its administrative capacity and labor power.

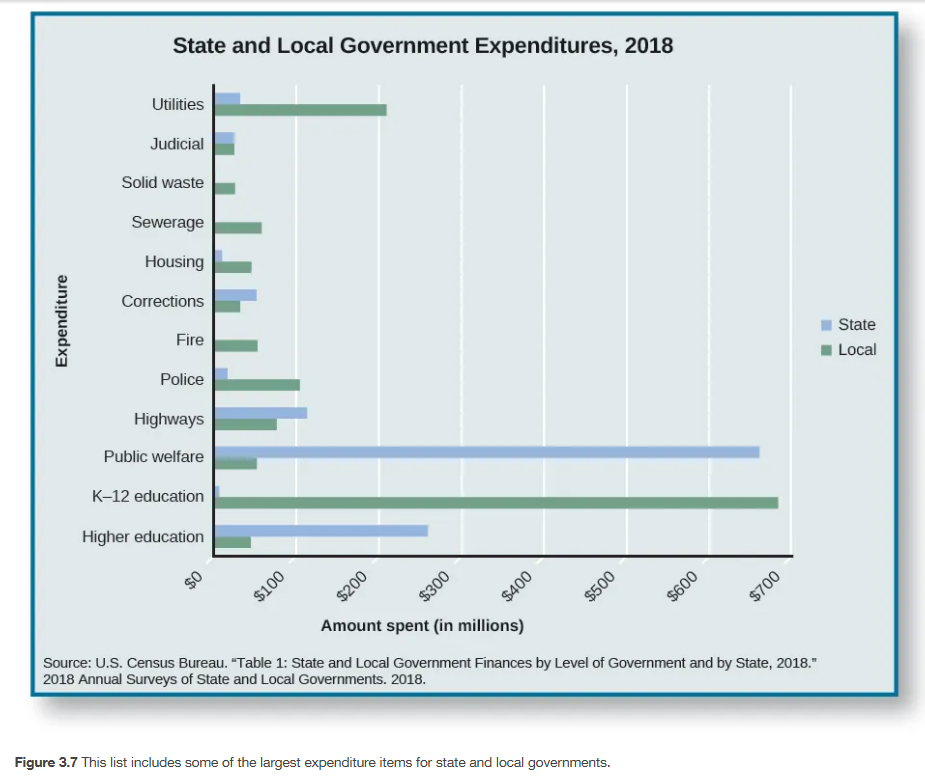

Figure 3.7 compares recent spending activities of local and state governments. Explain.

Educational expenditures constitute a major category for both.

However, whereas the states spend comparatively more than local governments on university education, local governments spend even more on elementary and secondary education.

That said, nationwide, state funding for public higher education has declined as a percentage of university revenues; this is primarily because states have taken in lower amounts of sales taxes as internet commerce has increased.

Local governments allocate more funds to police protection, fire protection, housing and community development, and public utilities such as water, sewage, and electricity.

And while state governments allocate comparatively more funds to public welfare programs, such as health care, income support, and highways, both local and state governments spend roughly similar amounts on judicial and legal services and correctional services.

The Constitution sketches a federal framework that aims to balance the forces of decentralized and centralized governance in general terms; it does not flesh out standard operating procedures that say precisely how the states and federal governments are to handle all policy contingencies imaginable. Explain.

Therefore, officials at the state and national levels have had some room to maneuver as they operate within the Constitution’s federal design.

This has led to changes in the configuration of federalism over time, changes corresponding to different historical phases that capture distinct balances between state and federal authority.

As George Washington’s secretary of the treasury from 1789 to 1795, Alexander Hamilton championed legislative efforts to create a publicly chartered bank. Explain.

For Hamilton, the establishment of the Bank of the United States was fully within Congress’s authority, and he hoped the bank would foster economic development, print and circulate paper money, and provide loans to the government.

Although Thomas Jefferson, Washington’s secretary of state, staunchly opposed Hamilton’s plan on the constitutional grounds that the national government had no authority to create such an instrument, Hamilton managed to convince the reluctant president to sign the legislation.

A political showdown between Maryland and the national government emerged when James McCulloch, an agent for the Baltimore branch of the Second Bank, refused to pay a tax that Maryland had imposed on all out-of-state chartered banks. Explain.

The standoff raised two constitutional questions: Did Congress have the authority to charter a national bank? Were states allowed to tax federal property?

In McCulloch v. Maryland, Chief Justice John Marshall (Figure 3.8) argued that Congress could create a national bank even though the Constitution did not expressly authorize it.

Under the necessary and proper clause of Article I, Section 8, the Supreme Court asserted that Congress could establish “all means which are appropriate” to fulfill “the legitimate ends” of the Constitution.

In other words, the bank was an appropriate instrument that enabled the national government to carry out several of its enumerated powers, such as regulating interstate commerce, collecting taxes, and borrowing money.

Defining the scope of national power was the subject of another landmark Supreme Court decision in 1824. Explain.

In Gibbons v. Ogden, the court had to interpret the commerce clause of Article I, Section 8; specifically, it had to determine whether the federal government had the sole authority to regulate the licensing of steamboats operating between New York and New Jersey.

Aaron Ogden, who had obtained an exclusive license from New York State to operate steamboat ferries between New York City and New Jersey, sued Thomas Gibbons, who was operating ferries along the same route under a coasting license issued by the federal government.

Gibbons lost in New York state courts and appealed.

Chief Justice Marshall delivered a two-part ruling in favor of Gibbons that strengthened the power of the national government.

First, interstate commerce was interpreted broadly to mean “commercial intercourse” among states, thus allowing Congress to regulate navigation.

Second, because the federal Licensing Act of 1793, which regulated coastal commerce, was a constitutional exercise of Congress’s authority under the commerce clause, federal law trumped the New York State license-monopoly law that had granted Ogden an exclusive steamboat operating license.

As Marshall pointed out, “the acts of New York must yield to the law of Congress.”

Various states railed against the nationalization of power that had been going on since the late 1700s. Explain.

When President John Adams signed the Sedition Act in 1798, which made it a crime to speak openly against the government, the Kentucky and Virginia legislatures passed resolutions declaring the act null on the grounds that they retained the discretion to follow national laws.

In effect, these resolutions articulated the legal reasoning underpinning the doctrine of nullification—that states had the right to reject national laws they deemed unconstitutional.

The ultimate showdown between national and state authority came during the Civil War. Explain.

Prior to the conflict, in Dred Scott v. Sandford, the Supreme Court ruled that the national government lacked the authority to ban slavery in the territories.

But the election of President Abraham Lincoln in 1860 led eleven southern states to secede from the United States because they believed the new president would challenge the institution of slavery.

What was initially a conflict to preserve the Union became a conflict to end slavery when Lincoln issued the Emancipation Proclamation in 1863, freeing all enslaved people in the rebellious states.

The defeat of the South had a huge impact on the balance of power between the states and the national government in two important ways.

First, the Union victory put an end to the right of states to secede and to challenge legitimate national laws.

Second, Congress imposed several conditions for readmitting former Confederate states into the Union; among them was ratification of the Fourteenth and Fifteenth Amendments.

In sum, after the Civil War the power balance shifted toward the national government, a movement that had begun several decades before with McCulloch v. Maryland (1819) and Gibbons v. Ogden (1824).

The late 1870s ushered in a new phase in the evolution of U.S. federalism. Explain.

Under dual federalism, the states and national government exercise exclusive authority in distinctly delineated spheres of jurisdiction.

Like the layers of a cake, the levels of government do not blend with one another but rather are clearly defined.

Two factors contributed to the emergence of this conception of federalism.

First, several Supreme Court rulings blocked attempts by both state and federal governments to step outside their jurisdictional boundaries.

Second, the prevailing economic philosophy at the time loathed government interference in the process of industrial development.

Industrialization changed the socioeconomic landscape of the United States. Explain.

One of its adverse effects was the concentration of market power.

Because there was no national regulatory supervision to ensure fairness in market practices, collusive behavior among powerful firms emerged in several industries.

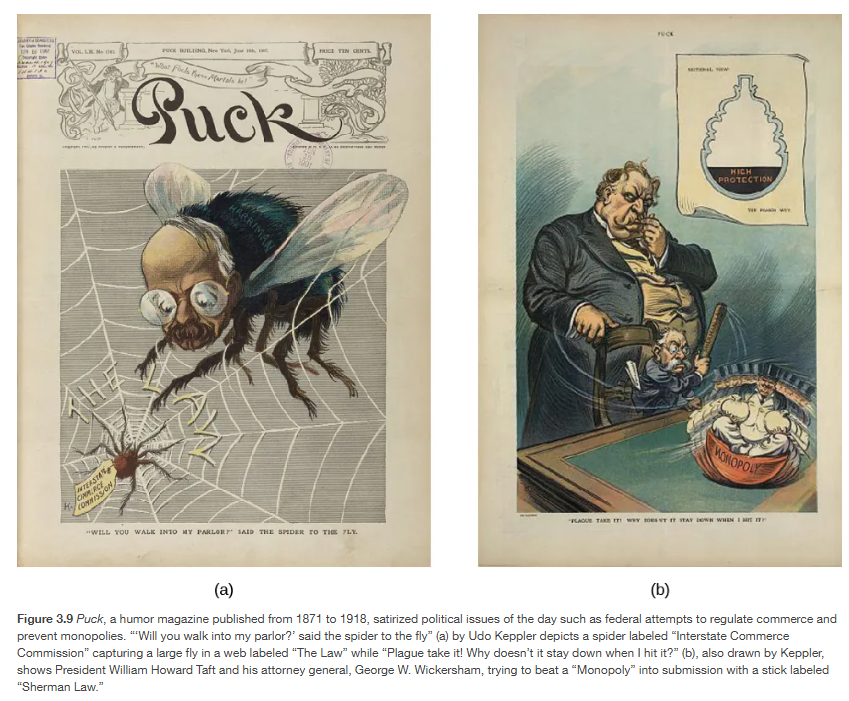

To curtail widespread anticompetitive practices in the railroad industry, Congress passed the Interstate Commerce Act in 1887, which created the Interstate Commerce Commission.

Three years later, national regulatory capacity was broadened by the Sherman Antitrust Act of 1890, which made it illegal to monopolize or attempt to monopolize and conspire in restraining commerce (Figure 3.9).

In the early stages of industrial capitalism, federal regulations were focused for the most part on promoting market competition rather than on addressing the social dislocations resulting from market operations, something the government began to tackle in the 1930s.

In the late 1800s, some states attempted to regulate working conditions. Explain.

For example, New York State passed the Bakeshop Act in 1897, which prohibited bakery employees from working more than sixty hours in a week.

In Lochner v. New York, the Supreme Court ruled this state regulation that capped work hours unconstitutional, on the grounds that it violated the due process clause of the Fourteenth Amendment.30

In other words, the right to sell and buy labor is a “liberty of the individual” safeguarded by the Constitution, the court asserted.

The federal government also took up the issue of working conditions, but that case resulted in the same outcome as in the Lochner case.

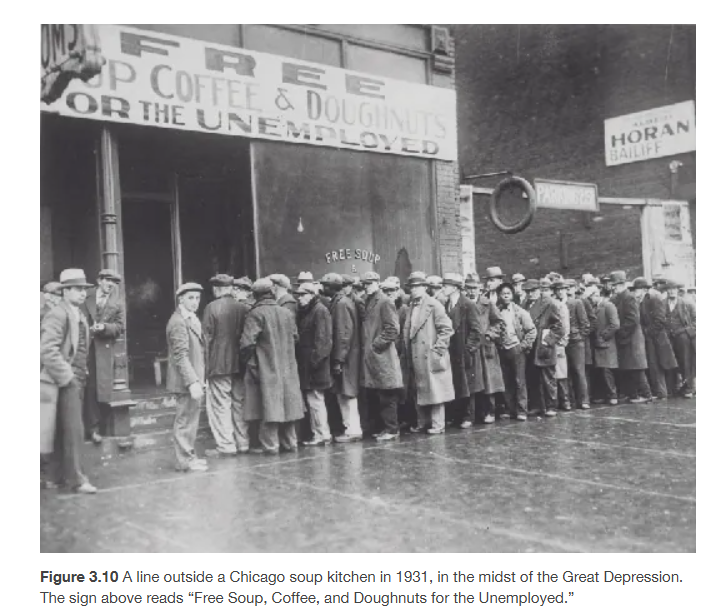

The Great Depression of the 1930s brought economic hardships the nation had never witnessed before (Figure 3.10).

Between 1929 and 1933, the national unemployment rate reached 25 percent, industrial output dropped by half, stock market assets lost more than half their value, thousands of banks went out of business, and the gross domestic product shrunk by one-quarter.

Given the magnitude of the economic depression, there was pressure on the national government to coordinate a robust national response along with the states.

Cooperative federalism was born of necessity and lasted well into the twentieth century as the national and state governments each found it beneficial. Explain.

Under this model, both levels of government coordinated their actions to solve national problems, such as the Great Depression and the civil rights struggle of the following decades.

In contrast to dual federalism, it erodes the jurisdictional boundaries between the states and national government, leading to a blending of layers as in a marble cake.

The era of cooperative federalism contributed to the gradual incursion of national authority into the jurisdictional domain of the states, as well as the expansion of the national government’s power in concurrent policy areas.

Figure 3.11

The use of layer and marble cakes for understanding federalism was popularized in the 1950s by political scientist Morton Grodzins.

In this metaphor, dual federalism is represented by the layer cake, showing the clearly defined jurisdictional divisions between national, state, and local governments.

The marble cake, with the mixing of authority across different governments, represented cooperative federalism.

In National Labor Relations Board (NLRB) v. Jones and Laughlin Steel, for instance, the Supreme Court ruled the National Labor Relations Act of 1935 constitutional, asserting that Congress can use its authority under the commerce clause to regulate both manufacturing activities and labor-management relations. Explain.

The New Deal changed the relationship Americans had with the national government.

Before the Great Depression, the government offered little in terms of financial aid, social benefits, and economic rights.

After the New Deal, it provided old-age pensions (Social Security), unemployment insurance, agricultural subsidies, protections for organizing in the workplace, and a variety of other public services created during Roosevelt’s administration.

While the era of cooperative federalism witnessed a broadening of federal powers in concurrent and state policy domains, it is also the era of a deepening coordination between the states and the federal government in Washington. Explain.

Nowhere is this clearer than with respect to the social welfare and social insurance programs created during the New Deal and Great Society eras, most of which are administered by both state and federal authorities and are jointly funded.

The Social Security Act of 1935, which created federal subsidies for state-administered programs for the elderly; people with disabilities; dependent mothers; and children, gave state and local officials wide discretion over eligibility and benefit levels.

The unemployment insurance program, also created by the Social Security Act, requires states to provide jobless benefits, but it allows them significant latitude to decide the level of tax to impose on businesses in order to fund the program as well as the duration and replacement rate of unemployment benefits.

A similar multilevel division of labor governs Medicaid and Children’s Health Insurance.

During the administrations of Presidents Richard Nixon (1969–1974) and Ronald Reagan (1981–1989), attempts were made to reverse the process of nationalization—that is, to restore states’ prominence in policy areas into which the federal government had moved in the past. Explain new federalism.

New federalism is premised on the idea that the decentralization of policies enhances administrative efficiency, reduces overall public spending, and improves policy outcomes.

During Nixon’s administration, general revenue sharing programs were created that distributed funds to the state and local governments with minimal restrictions on how the money was spent.

The election of Ronald Reagan heralded the advent of a “devolution revolution” in U.S. federalism, in which the president pledged to return authority to the states according to the Constitution.

In the Omnibus Budget Reconciliation Act of 1981, congressional leaders together with President Reagan consolidated numerous federal grant programs related to social welfare and reformulated them in order to give state and local administrators greater discretion in using federal funds.

Several Supreme Court rulings also promoted new federalism by hemming in the scope of the national government’s power, especially under the commerce clause. Explain with an example.

For example, in United States v. Lopez, the court struck down the Gun-Free School Zones Act of 1990, which banned gun possession in school zones.

It argued that the regulation in question did not “substantively affect interstate commerce.”

The ruling ended a nearly sixty-year period in which the court had used a broad interpretation of the commerce clause that by the 1960s allowed it to regulate numerous local commercial activities.

However, many would say that the years since the 9/11 attacks have swung the pendulum back in the direction of central federal power.

The creation of the Department of Homeland Security federalized disaster response power in Washington, and the Transportation Security Administration was created to federalize airport security.

Broad new federal policies and mandates have also been carried out in the form of the Faith-Based Initiative and No Child Left Behind (during the George W. Bush administration) and the Affordable Care Act (during Barack Obama’s administration).

Finding a Middle Ground-Cooperative Federalism versus New Federalism

The challenges of the 1930s led many to question the merits of dual federalism, where the states and the national governments exercised exclusive authority in distinctly delineated spheres of jurisdiction.

The result was the birth of cooperative federalism.

In this view of federalism, the jurisdictional boundaries between the national and state governments were eroded to allow for greater cooperation between both governments.

While this expansion of national government power was crucial in tackling the problems of the Great Depression, environmental degradation, and civil rights abuses, many resented the federal incursions into what had earlier been state matters.

These concerns led to the emergence of new federalism in the 1970s and '80s.

New federalism was premised on the idea that the decentralization of policies enhanced administrative efficiency and improved outcomes.

Rather than simply a return to the old dual federalism model, new federalism continued much of the federal spending but rolled back many of the restrictions on what states could do with their federal funds.

Cooperative federalism has several merits:

Because state and local governments have varying fiscal capacities, the national government’s involvement in state activities such as education, health, and social welfare is necessary to ensure some degree of uniformity in the provision of public services to citizens in richer and poorer states.

The problem of collective action, which dissuades state and local authorities from raising regulatory standards for fear they will be disadvantaged as others lower theirs, is resolved by requiring state and local authorities to meet minimum federal standards (e.g., minimum wage and air quality).

Federal assistance is necessary to ensure state and local programs that generate positive externalities are maintained. For example, one state’s environmental regulations impose higher fuel prices on its residents, but the externality of the cleaner air they produce benefits neighboring states. Without the federal government’s support, this state and others like it would underfund such programs.

New federalism has advantages as well:

Because of differences among states, one-size-fits-all features of federal laws are suboptimal. Decentralization accommodates the diversity that exists across states.

By virtue of being closer to citizens, state and local authorities are better than federal agencies at discerning the public’s needs.

Decentralized federalism fosters a marketplace of innovative policy ideas as states compete against each other to minimize administrative costs and maximize policy output.

The national government’s ability to achieve its objectives often requires the participation of state and local governments. Explain.

Intergovernmental grants offer positive financial inducements to get states to work toward selected national goals.

A grant is commonly likened to a “carrot” to the extent that it is designed to entice the recipient to do something.

On the other hand, unfunded mandates impose federal requirements on state and local authorities.

Mandates are typically backed by the threat of penalties for non-compliance and provide little to no compensation for the costs of implementation.

Thus, given its coercive nature, a mandate is commonly likened to a “stick.”

The national government has used grants to influence state actions as far back as the Articles of Confederation when it provided states with land grants. Explain.

In the first half of the 1800s, land grants were the primary means by which the federal government supported the states.

Millions of acres of federal land were donated to support road, railroad, bridge, and canal construction projects, all of which were instrumental in piecing together a national transportation system to facilitate migration, interstate commerce, postal mail service, and movement of military people and equipment.

Numerous universities and colleges across the country, such as Oklahoma State University and President Biden's alma mater, the University of Delaware, are land-grant institutions because their campuses were built on land donated by the federal government or by using funding secured by the sale of donated federal land.

In the segregated South, black land grant universities were established in 1890, including Florida A&M University and Prairie View A&M University (Texas).

At the turn of the twentieth century, cash grants replaced land grants as the main form of federal intergovernmental transfers and have become a central part of modern federalism.

Federal cash grants do come with strings attached; the national government has an interest in seeing that public monies are used for policy activities that advance national objectives. Explain.

Categorical grants are federal transfers formulated to limit recipients’ discretion in the use of funds and subject them to strict administrative criteria that guide project selection, performance, and financial oversight, among other things.

These grants also often require some commitment of matching funds.

Medicaid and the food stamp program are examples of categorical grants.

Block grants come with less stringent federal administrative conditions and provide recipients more flexibility over how to spend grant funds.

Examples of block grants include the Workforce Investment Act program, which provides state and local agencies money to help youths and adults obtain skill sets that will lead to better-paying jobs, and the Surface Transportation Program, which helps state and local governments maintain and improve highways, bridges, tunnels, sidewalks, and bicycle paths.

Finally, recipients of general revenue sharing faced the least restrictions on the use of federal grants.

From 1972 to 1986, when revenue sharing was abolished, upwards of $85 billion of federal money was distributed to states, cities, counties, towns, and villages.

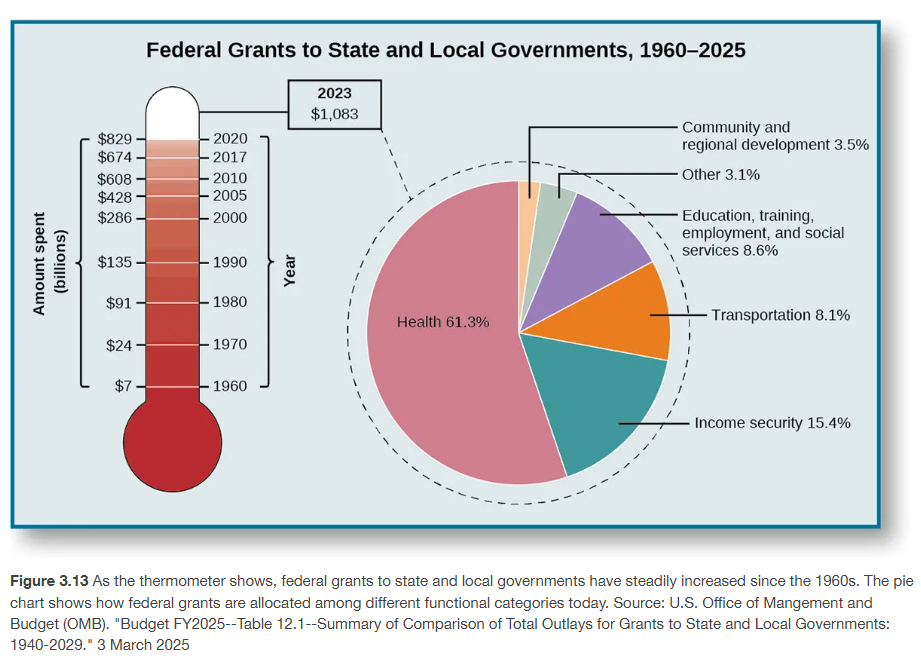

During the 1960s and 1970s, funding for federal grants grew significantly, as the graphic shows in Figure 3.13.

Growth picked up again in the 1990s and 2000s.

The increase since the 1990s is primarily due to the increase in federal grant money going to Medicaid.

Federally funded health-care programs jumped from $43.8 billion in 1990 to $320 billion in 2014.

Health-related grant programs such as Medicaid and the Children’s Health Insurance Program (CHIP) represented more than half of total federal grant expenses.

The national government has greatly preferred using categorical grants to transfer funds to state and local authorities because this type of grant gives them more control and discretion in how the money is spent. Explain.

In 2014, the federal government distributed 1,099 grants, 1,078 of which were categorical, while only 21 were block grants.

In response to the terrorist attack on the United States on September 11, 2001, more than a dozen new federal grant programs relating to homeland security were created, but as of 2011, only three were block grants.

Reagan’s “devolution revolution” contributed to raising the number of block grants from six in 1981 to fourteen in 1989. Explain.

Block grants increased to twenty-four in 1999 during the Clinton administration and to twenty-six during Obama’s presidency, but by 2014 the total had dropped to twenty-one, accounting for 10 percent of total federal grant outlay.

President Trump proposed eliminating four discretionary block grants in his "skinny" budget, although the budget was not passed.

In 1994, the Republican-controlled Congress passed legislation that called for block-granting Medicaid, which would have capped federal Medicaid spending. Explain what happened after.

President Clinton vetoed the legislation.

However, congressional efforts to convert Aid to Families with Dependent Children (AFDC) to a block grant succeeded.

The Temporary Assistance for Needy Families (TANF) block grant replaced the AFDC in 1996, marking the first time the federal government transformed an entitlement program (which guarantees individual rights to benefits) into a block grant.

Under the AFDC, the federal government had reimbursed states a portion of the costs they bore for running the program without placing a ceiling on the amount.

In contrast, the TANF block grant caps annual federal funding at $16.489 billion and provides a yearly lump sum to each state, which it can use to manage its own program.

Explain block grants.

Block grants have been championed for their cost-cutting effects.

By eliminating uncapped federal funding, as the TANF issue illustrates, the national government can reverse the escalating costs of federal grant programs.

This point was not lost on Paul Ryan (R-WI), former chair of the House Budget Committee and the House Ways and Means Committee, who, during his tenure as Speaker of the House from October 2015 to January 2019, tried multiple times but without success to convert Medicaid into a block grant, a reform he estimated could save the federal government upwards of $732 billion over ten years.

Another noteworthy characteristic of block grants is that their flexibility has been undermined over time as a result of creeping categorization, a process in which the national government places new administrative requirements on state and local governments or supplants block grants with new categorical grants.

Among the more common measures used to restrict block grants’ programmatic flexibility are set-asides (i.e., requiring a certain share of grant funds to be designated for a specific purpose) and cost ceilings (i.e., placing a cap on funding other purposes).

Unfunded mandates are federal laws and regulations that impose obligations on state and local governments without fully compensating them for the administrative costs they incur. Explain.

The federal government has used mandates increasingly since the 1960s to promote national objectives in policy areas such as the environment, civil rights, education, and homeland security.

One type of mandate threatens civil and criminal penalties for state and local authorities that fail to comply with them across the board in all programs, while another provides for the suspension of federal grant money if the mandate is not followed.

These types of mandates are commonly referred to as crosscutting mandates.

Failure to fully comply with crosscutting mandates can result in punishments that normally include reduction of or suspension of federal grants, prosecution of officials, fines, or some combination of these penalties.

If only one requirement is not met, state or local governments may not get any money at all.

The widespread use of federal mandates in the 1970s and 1980s provoked a backlash among state and local authorities, which culminated in the Unfunded Mandates Reform Act (UMRA) in 1995. Explain.

The UMRA’s main objective has been to restrain the national government’s use of mandates by subjecting rules that impose unfunded requirements on state and local governments to greater procedural scrutiny.

However, since the act’s implementation, states and local authorities have obtained limited relief.

A subsequent piece of legislation aimed to take this approach further.

The 2017 Unfunded Mandates and Information Transparency Act, HR 50, passed the House in July 2018 before being referred to the Senate, where it was placed on the legislative calendar but moved no further.

The continued use of unfunded mandates clearly contradicts new federalism’s call for giving states and local governments more flexibility in carrying out national goals. Explain.

The temptation to use them appears to be difficult for the federal government to resist, however, as the UMRA’s poor track record illustrates.

This is because mandates allow the federal government to fulfill its national priorities while passing most of the cost to the states, an especially attractive strategy for national lawmakers trying to cut federal spending.

Some leading federalism scholars have used the term coercive federalism to capture this aspect of contemporary U.S. federalism.

In other words, Washington has been as likely to use the stick of mandates as the carrot of grants to accomplish its national objectives.

As a result, there have been more instances of confrontational interactions between the states and the federal government.

Milestone: The Clery Act

The Clery Act of 1990, formally the Jeanne Clery Disclosure of Campus Security Policy and Campus Crime Statistics Act, requires public and private colleges and universities that participate in federal student aid programs to disclose information about campus crime.

The Act is named after Jeanne Clery, who in 1986 was raped and murdered by a fellow student in her Lehigh University dorm room.

The U.S. Department of Education’s Clery Act Compliance Division is responsible for enforcing the 1990 Act.

Specifically, to remain eligible for federal financial aid funds and avoid penalties, colleges and universities must comply with the following provisions:

Publish an annual security report and make it available to current and prospective students and employees;

Keep a public crime log that documents each crime on campus and is accessible to the public;

Disclose information about incidents of criminal homicide, sex offenses, robbery, aggravated assault, burglary, motor vehicle theft, arson, and hate crimes that occurred on or near campus;

Issue warnings about Clery Act crimes that pose a threat to students and employees;

Develop a campus community emergency response and notification strategy that is subject to annual testing;

Gather and report fire data to the federal government and publish an annual fire safety report;

Devise procedures to address reports of missing students living in on-campus housing.

For more about the Clery Act, see Clery Center for Security on Campus, http://clerycenter.org.

Certain functions clearly belong to the federal government, the state governments, and local governments. Explain.

National security is a federal matter, the issuance of licenses is a state matter, and garbage collection is a local matter.

One aspect of competitive federalism today is that some policy issues, such as immigration and the marital rights of LGBTQ people, have been redefined as the roles that states and the federal government play in them have changed.

Another aspect of competitive federalism is that interest groups seeking to change the status quo can take a policy issue up to the federal government or down to the states if they feel it is to their advantage.

Interest groups have used this strategy to promote their views on such issues as abortion, gun control, and the legal drinking age.

Immigration and marriage equality have not been the subject of much contention between states and the federal government until recent decades. Explain.

Before that, it was understood that the federal government handled immigration and states determined the legality of marriage, whether between people of different races or the same sex.

This understanding of exclusive responsibilities has changed; today both levels of government play roles in these two policy areas.

Explain immigration federalism.

Immigration federalism describes the gradual movement of states into the immigration policy domain.

Since the late 1990s, states have asserted a right to make immigration policy on the grounds that they are enforcing, not supplanting, the nation’s immigration laws, and they are exercising their jurisdictional authority by restricting undocumented immigrants’ access to education, health care, and welfare benefits, areas that fall under the states’ responsibilities.

In 2005, twenty-five states had enacted a total of thirty-nine laws related to immigration; by 2014, forty-three states and Washington, DC, had passed a total of 288 immigration-related laws and resolutions.

In 2020, thirty-two different states enacted a total of 206 new measures, including many related to COVID-19.

In 2012, in Arizona v. United States, the Supreme Court affirmed federal supremacy on immigration. Explain.

The court struck down three of the four central provisions of the Arizona law—namely, those allowing police officers to arrest an undocumented immigrant without a warrant if they had probable cause to think the immigrant had committed a crime that could lead to deportation, making it a crime to seek a job without proper immigration documentation, and making it a crime to be in Arizona without valid immigration papers.

The court upheld the “show me your papers” provision, which authorizes police officers to check the immigration status of anyone they stop or arrest who they suspect is an undocumented immigrant.

However, in letting this provision stand, the court warned Arizona and other states with similar laws that they could face civil rights lawsuits if police officers applied it based on racial profiling.

All in all, Justice Anthony Kennedy’s opinion embraced an expansive view of the U.S. government’s authority to regulate immigration, describing it as broad and undoubted.

That authority derived from the legislative power of Congress to “establish a uniform Rule of Naturalization,” enumerated in the Constitution.

During the COVID-19 pandemic, California moved in the opposite direction.

The California Immigrant Resilience Fund led to the provision of $75 million for undocumented Californians not eligible for other COVID-19 programs.

LGBTQ marital rights have also significantly changed in recent years. Explain.

By passing the Defense of Marriage Act (DOMA) in 1996, the federal government stepped into this policy issue.

Not only did DOMA allow states to choose whether to recognize same-sex marriages, it also defined marriage as a union between a man and a woman, which meant that same-sex couples were denied various federal provisions and benefits—such as the right to file joint tax returns and receive Social Security survivor benefits.

In 1997, more than half the states in the union had passed some form of legislation banning same-sex marriage.

By 2006, two years after Massachusetts became the first state to recognize marriage equality, twenty-seven states had passed constitutional bans on same-sex marriage.

In United States v. Windsor, the Supreme Court changed the dynamic established by DOMA by ruling that the federal government had no authority to define marriage.

The Court held that states possess the “historic and essential authority to define the marital relation,” and that the federal government’s involvement in this area “departs from this history and tradition of reliance on state law to define marriage.”

Insider Perspective: Edith Windsor: Icon of the Marriage Equality Movement

Edith Windsor, the plaintiff in the landmark Supreme Court case United States v. Windsor, became an icon of the marriage equality movement for her successful effort to force repeal the DOMA provision that denied married same-sex couples a host of federal provisions and protections.

In 2007, after having lived together since the late 1960s, Windsor and her partner Thea Spyer were married in Canada, where same-sex marriage was legal.

After Spyer died in 2009, Windsor received a $363,053 federal tax bill on the estate Spyer had left her.

Because her marriage was not valid under federal law, her request for the estate-tax exemption that applies to surviving spouses was denied.

With the counsel of her lawyer, Roberta Kaplan, Windsor sued the federal government and won (Figure 3.16).

Because of the Windsor decision, federal laws could no longer discriminate against same-sex married couples.

What is more, marriage equality became a reality in a growing number of states as federal court after federal court overturned state constitutional bans on same-sex marriage.

The Windsor case gave federal judges the moment of clarity from the U.S. Supreme Court that they needed.

James Esseks, director of the American Civil Liberties Union’s (ACLU) Lesbian Gay Bisexual Transgender & AIDS Project, summarizes the significance of the case as follows: “Part of what’s gotten us to this exciting moment in American culture is not just Edie’s lawsuit but the story of her life. The love at the core of that story, as well as the injustice at its end, is part of what has moved America on this issue so profoundly.”

In the final analysis, same-sex marriage is a protected constitutional right as decided by the U.S. Supreme Court, which took up the issue again when it heard Obergefell v. Hodges in 2015.

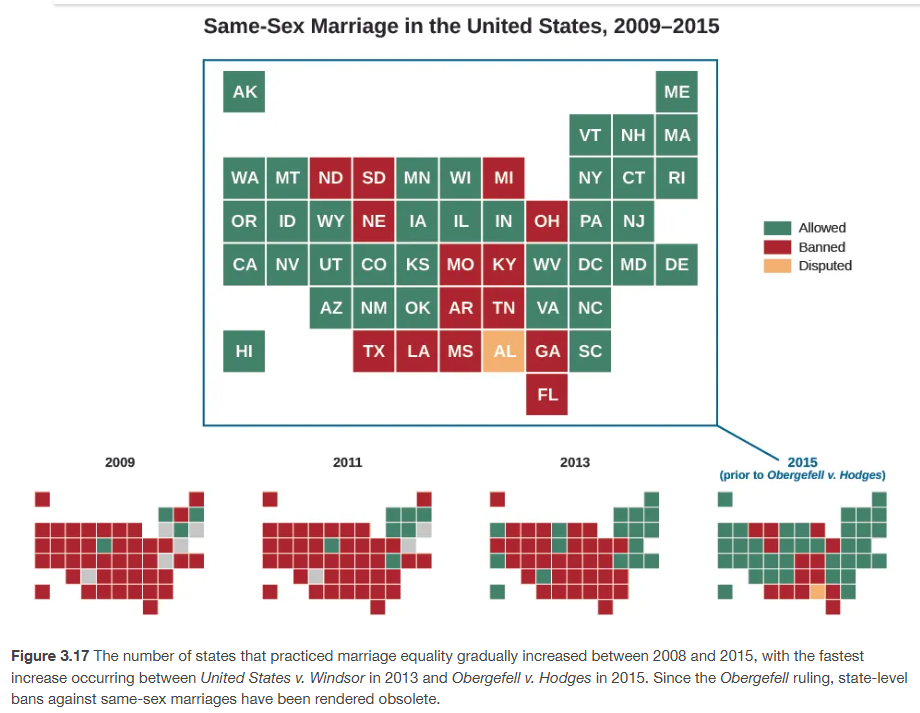

Following the Windsor decision, the number of states that recognized same-sex marriages increased rapidly, as illustrated in Figure 3.17. Explain.

In 2015, marriage equality was recognized in thirty-six states plus Washington, DC, up from seventeen in 2013.

The diffusion of marriage equality across states was driven in large part by federal district and appeals courts, which have used the rationale underpinning the Windsor case (i.e., laws cannot discriminate between same-sex and different-sex couples based on the equal protection clause of the Fourteenth Amendment) to invalidate state bans on same-sex marriage.

The 2014 court decision not to hear a collection of cases from four different states essentially affirmed same-sex marriage in thirty states.

And in 2015 the Supreme Court gave same-sex marriage a constitutional basis of right nationwide in Obergefell v. Hodges.

In sum, as the immigration and marriage equality examples illustrate, constitutional disputes have arisen as states and the federal government have sought to reposition themselves on certain policy issues, disputes that the federal courts have had to sort out.

Mothers Against Drunk Driving (MADD) was established in 1980 by a woman whose thirteen-year-old daughter had been killed by a drunk driver. Explain.

The organization lobbied state legislators to raise the drinking age and impose tougher penalties, but without success.

States with lower drinking ages had an economic interest in maintaining them because they lured youths from neighboring states with restricted consumption laws.

So MADD decided to redirect its lobbying efforts at Congress, hoping to find sympathetic representatives willing to take action.

In 1984, the federal government passed the National Minimum Drinking Age Act (NMDAA), a crosscutting mandate that gradually reduced federal highway grant money to any state that failed to increase the legal age for alcohol purchase and possession to twenty-one.

After losing a legal battle against the NMDAA, all states were in compliance by 1988.

The strategy anti-abortion advocates have used in recent years is another example of venue shopping. Explain.

In their attempts to limit abortion rights in the wake of the 1973 Roe v. Wade Supreme Court decision making abortion legal nationwide, anti-abortion advocates initially targeted Congress in hopes of obtaining restrictive legislation.69

Lack of progress at the national level prompted them to shift their focus to state legislators, where their advocacy efforts have been more successful.

By 2015, for example, thirty-eight states required some form of parental involvement in a minor’s decision to have an abortion, forty-six states allowed individual health-care providers to refuse to participate in abortions, and thirty-two states prohibited the use of public funds to carry out an abortion except when the pregnant person’s life is in danger or the pregnancy is the result of rape or incest.

The 2022 Dobbs v. Jackson Women's Health Organization decision, in which the Supreme Court ruled that abortion is not a right, did not stop venue shopping regarding abortion.

For example, anti-abortion groups sought a ban on abortion medications by selecting a district that they (correctly) believed would rule in their favor.

The court's action prompted a U.S. Representative to introduce legislation limiting the practice of venue shopping at the federal level.

(Several states have passed or considered similar legislation.)

Among the merits of federalism are that it promotes policy innovation and political participation and accommodates diversity of opinion. Explain.

On the subject of policy innovation, Supreme Court Justice Louis Brandeis observed in 1932 that “a single courageous state may, if its citizens choose, serve as a laboratory; and try novel social and economic experiments without risk to the rest of the country.”

What Brandeis meant was that states could harness their constitutional authority to engage in policy innovations that might eventually be diffused to other states and at the national level.

For example, a number of New Deal breakthroughs, such as child labor laws, were inspired by state policies.

Prior to the passage of the Nineteenth Amendment, women already had the right to vote in several states.

California has led the way in establishing standards for fuel emissions and other environmental policies (Figure 3.18).

Recently, the health insurance exchanges run by Connecticut, Kentucky, Rhode Island, and Washington have served as models for other states seeking to improve the performance of their exchanges.

Get Connected!-Federalism and Political Office.

Thinking of running for elected office?

Well, you have several options.

As Table 3.1 shows, there are a total of 510,682 elected offices at the federal, state, and local levels.

Elected representatives in municipal and township governments account for a little more than half the total number of elected officials in the United States.

Political careers rarely start at the national level.

In fact, a very small share of politicians at the subnational level transition to the national stage as representatives, senators, vice presidents, or presidents.

Elected Officials at the Federal, State, and Local Levels

Number of Elective Bodies | Number of Elected Officials | |

|---|---|---|

Federal Government | 1 | |

Executive branch | 2 | |

U.S. Senate | 100 | |

U.S. House of Representatives | 435 | |

State Government | 50 | |

State legislatures | 7,382 | |

Statewide offices | 1,036 | |

State boards | 1,331 | |

Local Government | ||

County governments | 3,034 | 58,818 |

Municipal governments | 19,429 | 135,531 |

Town governments | 16,504 | 126,958 |

School districts | 13,506 | 95,000 |

Special districts | 35,052 | 84,089 |

Total | 87,576 | 510,682 |

Table 3.1 This table lists the number of elected bodies and elected officials at the federal, state, and local levels.

If you are interested in serving the public as an elected official, there are more opportunities to do so at the local and state levels than at the national level.

As an added incentive for setting your sights at the subnational stage, consider the following.

Whereas only 32 percent of U.S. adults trusted Congress in 2023, according to Gallup, about 59 percent trusted their state governments and 57 percent had confidence in their local governments.

Federalism also comes with drawbacks. Explain.

Chief among them are economic disparities across states, race-to-the-bottom dynamics (i.e., states compete to attract business by lowering taxes and regulations), and the difficulty of taking action on issues of national importance.

The economic strategy of using race-to-the-bottom tactics in order to compete with other states in attracting new business growth also carries a social cost. Explain with an example.

For example, workers’ safety and pay can suffer as workplace regulations are lifted, and the reduction in payroll taxes for employers has led a number of states to end up with underfunded unemployment insurance programs.

As of March 2021, twelve states have also opted not to expand Medicaid, as encouraged by the Patient Protection and Affordable Care Act in 2010, for fear it will raise state public spending and increase employers’ cost of employee benefits, despite provisions that the federal government will pick up nearly all cost of the expansion.

More than half of these states are in the South.

The federal design of our Constitution and the system of checks and balances has jeopardized or outright blocked federal responses to important national issues. Explain.

President Roosevelt’s efforts to combat the scourge of the Great Depression were initially struck down by the Supreme Court.

More recently, President Obama’s effort to make health insurance accessible to more Americans under the Affordable Care Act immediately ran into legal challenges from some states, but it has been supported by the Supreme Court so far.

However, the federal government’s ability to defend the voting rights of citizens suffered a major setback when the Supreme Court in 2013 struck down a key provision of the Voting Rights Act of 1965.

No longer are the nine states with histories of racial discrimination in their voting processes required to submit plans for changes to the federal government for approval.

After a tumultuous 2020 election, many states in 2021 advanced legislation to make voting rules and processes more rigorous, a move many said was an effort to limit voting access.

For example, elected leaders in Georgia passed a law making voter ID requirements much stricter and also significantly limited options to vote outside of Election Day itself.

In 2023's Moore v. Harper, the Supreme Court affirmed that state legislatures were not able to pass these laws with complete autonomy.

Rejecting the theory of "independent state legislature," which asserted that states had the sole power to pass election laws, the Court ruled that voting laws passed by state governments were subject to judicial review.

In 2023, the Court also ruled in favor of a challenge—already upheld by district courts—to new voting maps drawn up in Alabama; the plaintiffs had asserted that the new maps violated the Voting Rights Act by diluting the votes of Black voters.

The Court agreed, and in the process held that the Voting Rights Act remained constitutional with regard to redistricting.