Applied econometrics lectures 7-8 - Cointegration

1/12

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

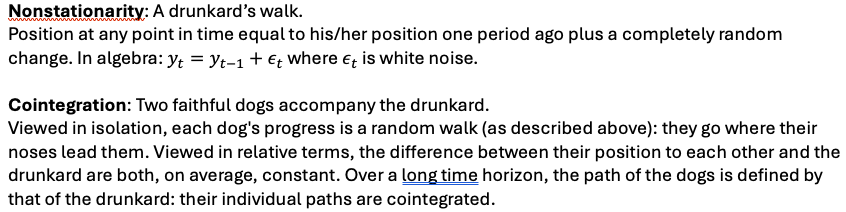

Non-stationarity vs cointegration

Cointegration defenition

two or more separate variables that by themselves they are non-stationary, but they tend to co-move

The concept of cointegration points to the existence of a long-run equilibrium to which an economic system converges over time

Which 2 conditions must be met for cointegration

Yt & Xt both nonstationary and integrated of order 1 I(1)

There exists a linear combination of the two variables (Yt - θXt ) that is stationary

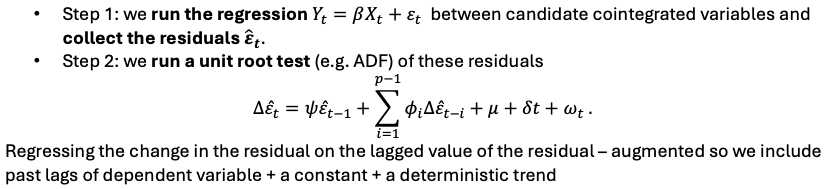

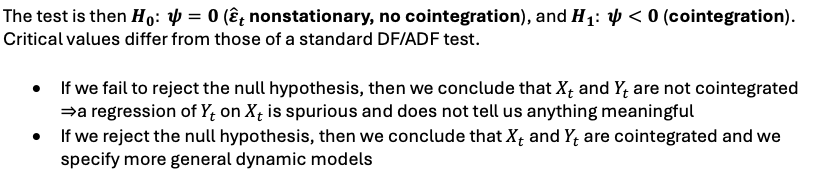

What is the Engle - Granger cointegration test looking for

cointegration → εt should be stationary

Cointegration implies that a linear combination of two integrated variables is stationary

EG test for cointegration steps

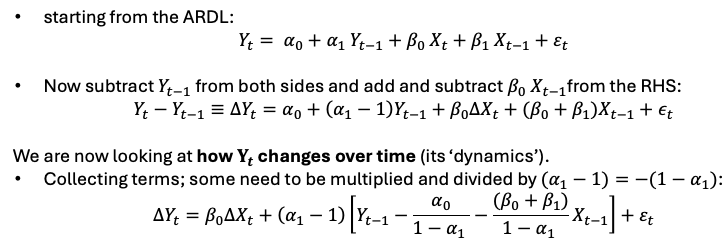

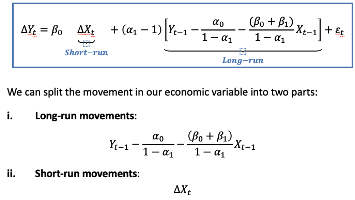

Error / Equilibrium correction model

a rearranged ARDL model, but with the long-run multiplier/effect already contained inside the model

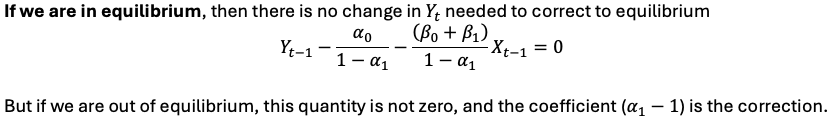

In the LR we correct (move towards) the equilbrium

How to form a Error correction model steps

Error correction model split

Error correction model LR

Error correction model SR

movements that bear no relation to the long-run equilibrium

e.g. some external shock

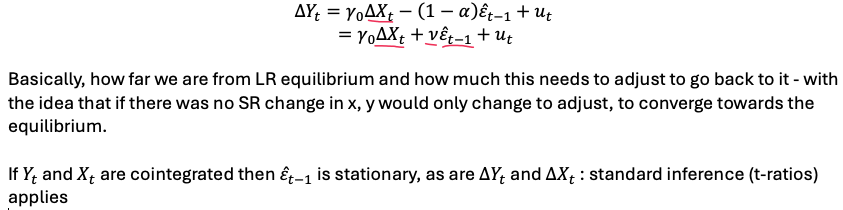

Engle-Granger Two-Step Procedure

Step 1a: estimate the long-run (equilibrium) equation using OLS and collect the residuals ̂εt Yt = βXt + εt

Step 1b: Use the residuals to do a test of cointegration (unit root test)

Step 2: Estimate the Error Correction Model by OLS

+ The adjustment coefficient ν must be negative

superconsistent estimator

the OLS estimator converges to the true β much faster than in the stationary world

implication: there is no need to include I(0) variables in the cointegrating equation

Summary

Two nonstationary series may lead to a spurious regression…

• … but they can have a meaningful long-run relationship if they are (a) of the same order of integration, and (b) cointegrated

We can test for cointegration and/or study the dynamic properties (long-run, short-run) of a bivariate relationship ( Yt and Xt )

There are different ways of representing long-run relationships, e.g. inside an error correction mechanism/model (ECM).