3.2 Sources of Finance (copy)

1/21

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

4 key reasons why businesses need finance

Start-up capital

Working capital

Renewal

Expansion

Internal Sources of Finance

Finance from within the business

Usually involve no cost

However, are finite and will not always be sufficient

External Sources of Finance

Finance from organisations outside of the business

Usually involves increasing debt and paying interest OR selling part of the business (equity)

Can be short-term or long-tem

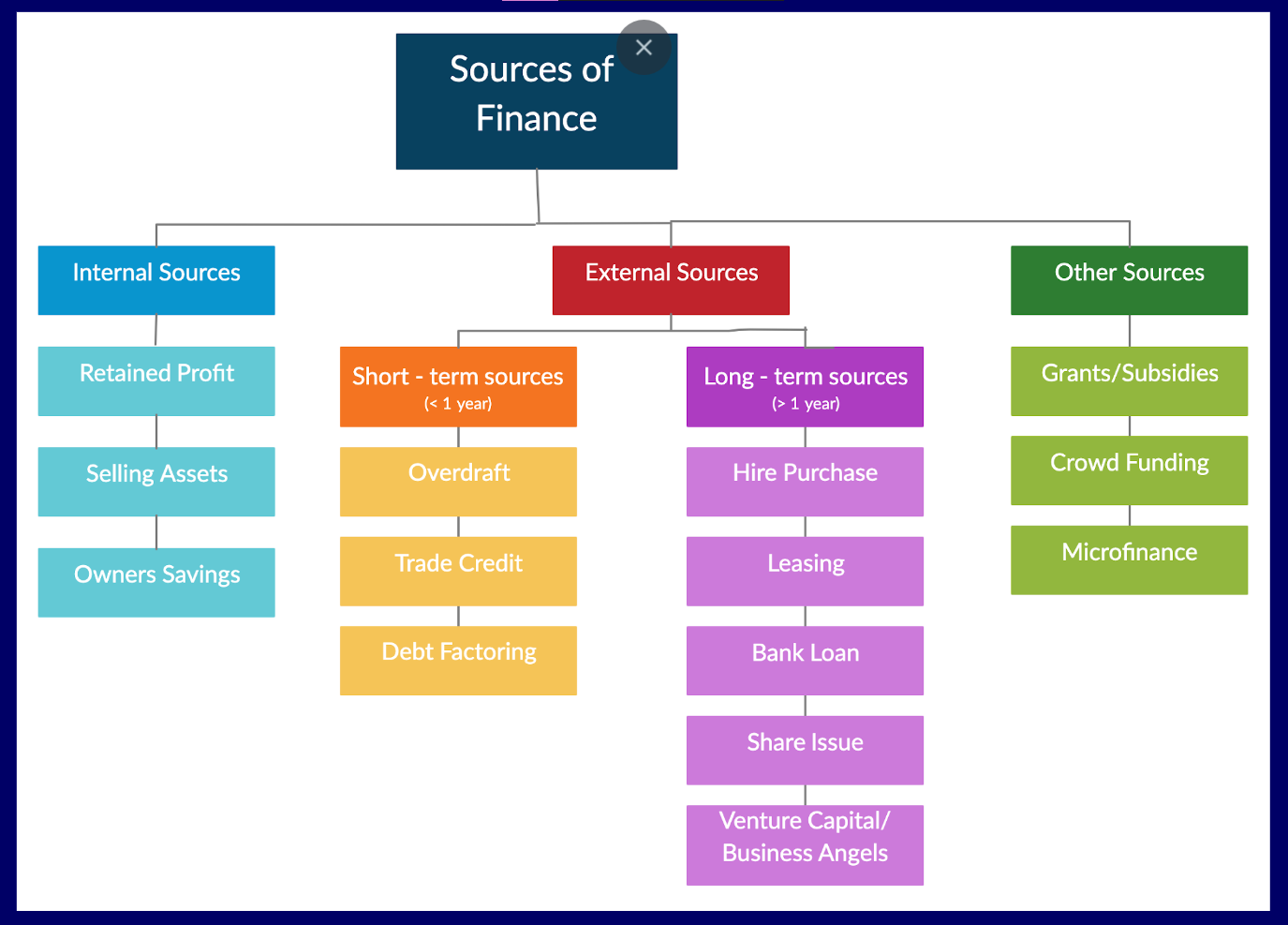

Sources of Finance table

Internal Sources include

Personal Funds/Owners Savings

Retained Profit

The sale of assets

External Sources include:

Trade Credit

Overdraft

Debt Factoring

Leasing

Bank loan

Hire purchase

Business Angel

Share Capital/Share Issue

Mortgage

Grants

Subsidies

Microfinance

Crowdsourcing

Sale of Assets

Internal Source - The business sells assets, usually those that it no longer needs.

Advantages:

You make some sort of revenue selling the things you don't need

If it's a production line, it frees more space for new machinery for example

Disadvantages:

Business could not make a lot of profit from assets

Assets will not sell

Personal Funds/Owners Capital

Internal Source - The owners of the business invest their own personal money into the business. This is often used as a means of funding a start-up

Advantages:

Quick way to get cash

No pressure to repay because its personal funds

Disadvantages:

Finite amount of money depending on the owner

The major disadvantage is that not all owners have additional capital to call on. This method would be used if the money were required long-term and if the amount was not large.

Retained Profits

Internal Source - Rather than paying the business profits out as dividends to shareholders, part or all of the profits are kept in the business to be used as a source of finance.

Advantages:

Advantages include the ability to boost value and set aside funding for emergencies.

Disadvantages:

Yet on the other hand, disadvantages of retained profit include potentially turning off shareholders by retaining money that could be used for dividends.

May take a long time to get enough profit for a big investment

Trade Credit

External Source - Short term - A business does not always have to pay for goods/services received as soon as they receive them, instead they can be given a period of credit by their supplier, normally of around 30-60 days

Advantages:

No interest

Instant access to supplies without having to pay immediately

Disadvantages

usually small amounts

it’s short term so it must be paid off quickly

Overdraft

External Source - Short term - A flexible borrowing facility on a bank current account which is repayable on demand. The bank account of the business is permitted to be negative – i.e. in the red, up to a maximum agreed amount.

Advantages:

Flexible

Only pay for what you use

There are no monthly costs

Disadvantages:

If you have to extend your overdraft, you usually have to pay an arrangement fee.

Your bank could charge you if you exceed your overdraft limit without authorisation.

Debt Factoring

External Source - Short term - A business sells its outstanding customer accounts (those debtors who have not paid their debts to the business) to a factoring company.

The factoring company pays the business 80-90% of the face value of the debts - and then collects the full amount from the customer. If the debt is paid by the customer, the factoring company will pay the remaining amount to the business minus their fee.

Advantages:

Improves cash flow

Saves time and resources

ACCELERATES GROWTH

Disadvantages:

Reduces profits

PUTS BUSINESSES IN TEMPORARY DEBT

Leasing

External Source - Long term - The business rents an asset (equipment/machinery/furniture/vehicle/property) rather than buying it. The business pays a regular amount for an agreed period of time, but ownership of the asset stays with the leasing company.

Advantages:

cheaper to lease assets like equipment, buildings, and machinery

suitable for business customers who do not have the initial capital to buy such assets

repairs and maintenance are the responsibility of the lessor

Disadvantages

Potential early termination liability.

No equity/ownership in the vehicle

Potential end-of-lease costs like excess wear and tear and additional.

Mileage charge (vehicles)

In the long term, leasing will eventually become more expensive than buying the asset

Bank Loan

External Source - Long term - A fixed amount is borrowed from the bank. Repayments are made monthly over an agreed period of time. The interest rate charged is often determined by the amount borrowed, the repayment period and the level of perceived risk

Advantages:

low interest rates

easy and quick access

Disadvantages:

banks may require you to provide collateral

Assets may be taken if the business fails to repay the loan

Increases the gearing of the business

Difficult for a new business to access

Hire Purchase

External Source - Long term - The business makes a downpayment (usually 20-30%) on an asset (usually equipment or vehicles) the remaining balance plus interest is then paid in monthly installments over an agreed period of time (2-5 years)

Advantages:

assets that are expensive can be paid back over time

much easier to get than a bank loan

Disadvantages:

There is interest charged

equipment is not officially owned by the business until the entire fee is paid

Business Angel

External Source - Long term - Wealthy, entrepreneurial individuals provide capital in return for a proportion of the company equity. They take a high personal risk in the expectation of owning part of a growing and successful business. This type of finance tends to be used for high risk, high potential reward investments.

Advantages:

All locations and industries are eligible

Paperwork is minimal

Monthly payments aren't required

Disadvantages:

owner loses some control to the business angel since the business angel takes a proactive role when setting up the business

the organization may eventually have to buy out the stake wonder by the business angels

Share Capital/Share Issue

External Source - Long term - Selling new shares to new investors. For Plcs this will be to the general public and investing institutions through the stock exchange. For Ltds new shareholders must be found privately and agreed between existing shareholders.

Advantages:

can provide a huge amount of finance

Disadvantages:

It dilutes control for the founders – The more shares that are issued, the more shareholders there are who own part of the business.

The business is vulnerable to takeover – As a business grows and sells more shares, it becomes vulnerable to the threat of a takeover.

Other sources of Finance

Grants and/or Subsidies

Crowd Funding

Microfinance

Grants

Other sources of finance - The government or charities provide assistance to qualifying businesses. This can be in the form of cash gifts or sometimes low interest loans. In order to qualify, businesses must apply and prove that they meet certain criteria, often linked to:

Protecting jobs in failing/declining industries

Creating jobs in areas of high unemployment.

Research and development

Providing ‘merit’ goods and/or services

Advantages:

Technically free money (for a very very specific reason)

Domino effect (Once you’ve been awarded one grant, you’re more likely to receive others.)

Disadvantages

Time consuming

Difficult to Receive

Strings Attached (Although grants are free money, they still come with plenty of restrictions and conditions.)

Subsidies

Other sources of finance - Money given to businesses by the government in order to reduce their costs of production. This is often done in order to:

Protect domestic industries from foreign competition

Reduce the price of essential goods and services in order to make them affordable to customers

Advantages:

Inflation control and moderation of supply and demand

Disadvantages

Potential increase in taxes on citizens in subsidizing countries.

Microfinance

Other sources of finance - This refers to the financial services provided to low-income individuals or groups who are typically excluded from traditional banking. It often involves offering credit in the form of small loans, sometimes called microloans or microcredit

Advantages:

helps smallest businesses raise funds to start

collateral free loans

Disadvantages

small loan amount

high interest rate

Crowdsourcing

Other sources of finance - This is when businesses fund a venure without using traditional means, but instead launch a campaign via an internet platform to solicit for small donations from many people.

These usually have set time frames for when money can be raised and disclose specific monetary goals.

Investors may make a donation or a loan, or in some cases will receive rewards or equity in return for their money

Advantages:

creates hype/buzz around the product/business

build customer contacts

saves costs and time

Disadvantages

risk of manipulation

other business’ may copy the idea