Macro - Open economy IS-LM

1/58

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

59 Terms

Openness has three distinct dimensions:

Openness in goods markets

Openness in financial markets

Openness in factor markets

We focus on 1 & 2

Openness in goods markets

Free trade restrictions include tariffs & NTBs

Short term

Openness in financial markets

Capital controls place restrictions on the ownership of foreign assets -can you invest in foreign markets?

Short term

Openness in factor markets

The ability of firms to choose where to locate production (FDI), and workers (migration) to choose where to work

Longer term

Balance of payments

Current account + Capital account + Official reserves

Should the current account and capital account be equal

Yes

but because of data gathering errors they aren’t

Current account

CA = Trade Balance + net investment income + net transfers

Imports and exports of G&S

UK residents receive investment income on their holdings of foreign assets and vice versa.

Countries give and receive foreign aid - the net value is recorded as net transfers received.

The sum of net payments in the current account balance can be positive/negative, in which case the country has a current account surplus/deficit

Capital account

Capital account transactions - Transactions below the line

The capital account balance, also known as net capital flows, can have a surplus/deficit if foreign holdings of UK assets are greater (less) than UK holdings of foreign assets,

Capital account deficit - Negative net capital flow

Capital Account = net decrease in foreign assets

Official Reserves

foreign exchange reserves held by CB

What determines imports

income + exchange rate

o Higher income = higher imports

o Lower real exchange rate = higher imports?

Nominal ER (E)

How much we can swap one currency for another

Why are export ratios high for small countries

The bigger is a country -> the larger is the size of the domestic market -> The more goods and services that it's capable of producing at home.

currency appreciation

Increase in p of domestic currency in terms of foreign currency

Currency depreciation

Decrease in p of domestic currency in terms of foreign currency

Real ER (ε)

ε = EP / P*

P - price of UK goods in £s

P* - price of european goods in €

Real currency appreciation

Increase in relative p of domestic goods in terms of foreign goods

Real currency depreciation

Fall in relative p of domestic goods in terms of foreign goods

exchange rates and inflation

Because inflation rates across countries tend to be relatively similar to each other, the movements in the real and the nominal exchange rate are very similar to each other

In periods where inflation rates differ a lot across countries, then the real and the nominal exchange rate can differ.

Bilateral exchange rates

exchange rates between two countries.

Multilateral exchange rates

exchange rates between several countries.

Multilateral real exchange rate

take all of the bilateral exchange rates between the UK and every other currency in the world + weight those together by the trade shares

foreign exchange

buying or selling foreign currency

What does openness in financial markets allow?

Financial investors to diversify

To hold both domestic and foreign assets and speculate on foreign interest rate movements.

Allows countries to run trade surpluses and deficits

A country that buys more than it sells must pay for the difference by borrowing

Domestic or foreign assets - bonds

When Investing abroad you need to take into account:

E + Interest rate in Foreign + Future E

If both UK and US bonds are to be held then they must have the same expected returns

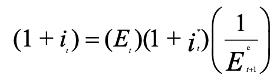

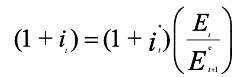

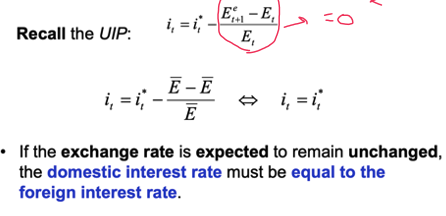

Interest parity condition / uncovered interst parity (UIP)

the expected rates of return in terms of domestic currency on domestic and foreign bonds must be equal

Why is UIP too strong

The assumption that investors only go for top return is too strong:

• It ignores transaction costs

• It ignores risk – assumes the same risk across both nations

Arbitrage & UIP

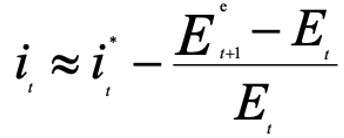

Arbitrage implies that the domestic interest rate must be (approximately) equal to the foreign interest rate + the expected depreciation rate of the domestic currency (or minus the expected appreciation).

Arbitrage UIP condition with fixed ER

L market assumptions

Fixed p → horizontal AS

ALways unemployed and spare L

Supply side function only has L

Perfect Capital mobility

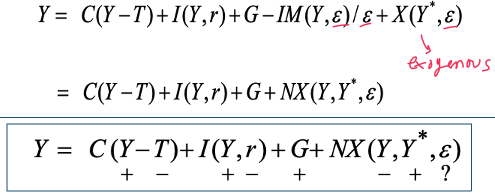

Goods market in equilibrium

Assume that P and P* are fixed → change in nom = real

Demand for domestic goods: Z = C+I+G-IM/ε + X

Multiplier effect in IS-LM-BP

Y increase → IM increase → NX down → Y down

Multiplier is smaller in an open economy

Some of Y is spent on foreign G/S

How FP (G increase) affects Demand Y graph + NX in open economy

G UP leads to Keynsian cross shifting upwards (Y increases)

BUT trade balance then worsens (gap between X & M widens)

FP now affects trade balance → The increase in output from Y to Y′ leads to a trade deficit equal to BC. Imports go up, and exports do not change.

How foreign Y increases affect domestic Y

Y* increase → NX increase → Y increase

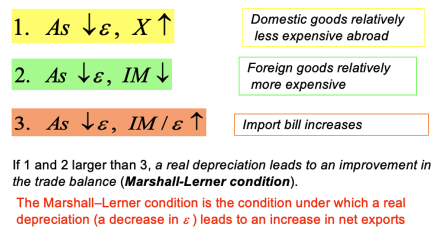

Marshall-Lerner condition

3 dominates in SR but 1&2 dominate overall

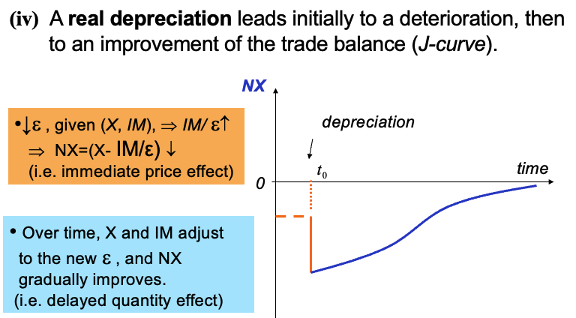

Depreciation worsens trade balance initially → trade balance improves over time

J curve effect

When E changes, Importers of signed contracts need to pay more for those imports now (imports have become more expensive)

Once those contracts end, importers find other ways either to source it – e.g. domestically (That causes imports to decline)

For foreign consumers it's made the UK produce goods relatively cheaper (exports rise)

Demand for money in an open economy

M / P = Y * L(i)

M/P - real Ms

the D for money comes from domestic so we can ignore foreigers

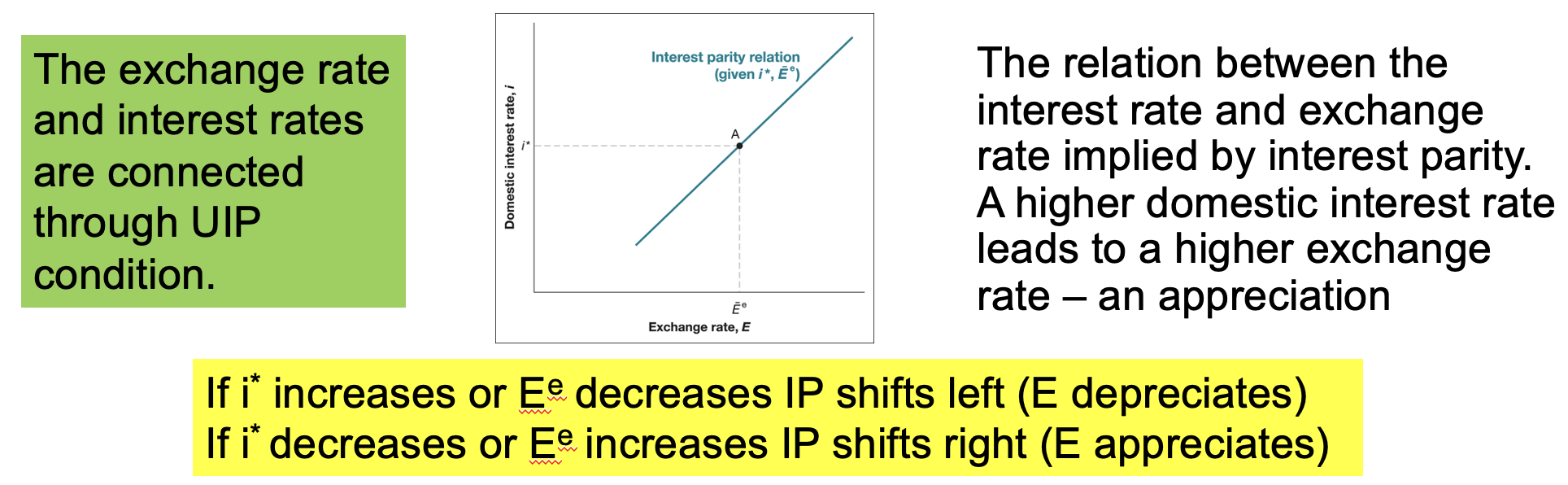

Exchange rate & interest rates

Connected through UIP

assume i* and future ER expectations are fixed → Causes upwards sloping relationship

Lowering interest rate abroad encourages people to shift I and so E appreciates as D increased

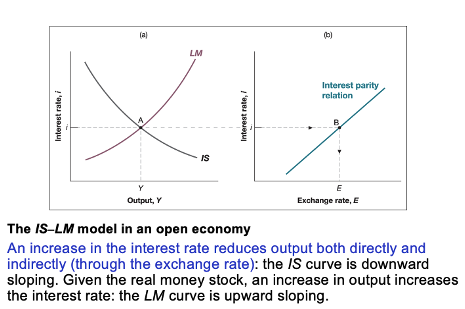

IS-LM and UIP

Economy stays at B until shock

Savings, I and trade balance

NX = S + (T-G) - I

Increase in I → one of other variables must rise or NX fall

Increase in Budget defecit → increase in S or fall in I or NX

High savings rate = high I or large trade surplus

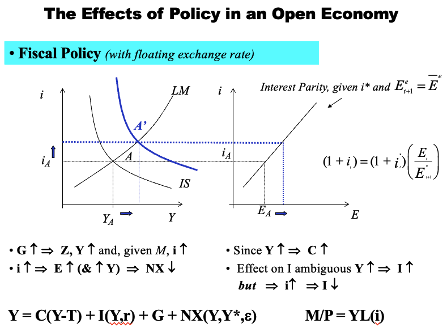

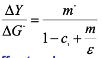

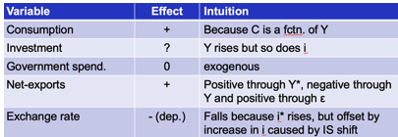

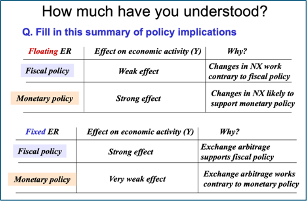

FP with floating E

Increase in G → shifts IS outwards → Move along LM → i rises → E appreciates

Income rises → C rises BUT effect on I ambiguos

Income + E rise → IM UP → Reduces import bill effect

NX improves immediately but worsens over time

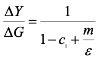

Domestic Fiscal multiplier in open economy

Smaller than in closed

Foreign Fiscal multiplier in open economy

stimulates expansionary effects in domestic

Fiscal multiplier and import propensity

Countries with high import propensities have lower multipliers

If most of the effect of FP goes on foreign goods then the affect of the multiplier is smaller

Expansionary foreign FP graphs (floating E)

Expansionary foreign FP explained (floating E)

Expansionary FP shifts foreign IS outwards → increases Y* → domestic IS shifts out

E xpansionary FP shifts foreign IS outwards → increases i* → UIP shifts in

E depreciates

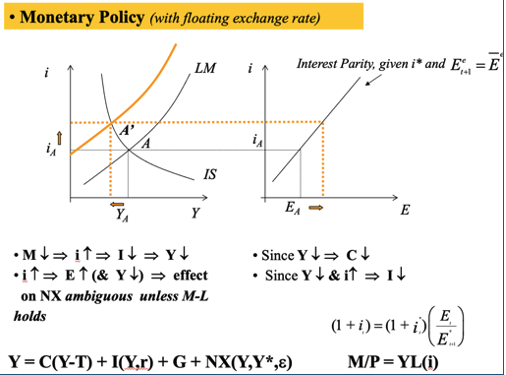

Contractionary MP - floating ER graph

Contractionary MP - floating ER explained

MS has fallen → Return on bonds has to rise to keep equilibrium in money market → i rises → E rises

Y falls → C & IM fall

i rises + reduction in Y -> I decreases

ER appreciates -> X fall & IM rise (as initially cheaper to IM)

Mundell-Fleming model with floating exchange rates

§ An increase in G leads to an increase in Y, an increase in i , and an appreciation.

§ A decrease in Ms leads to an decrease in Y, an increase in i , and an appreciation

Fixed ER and MP

Central banks act under implicit and explicit exchange rate targets, and use MP to achieve those targets

This means it has to give up MP as a tool to fix the economy (macro stabilisation)

Some nations peg to the $

Fixed ER and i

With fixed ER, E wont change over time so the UIP relationship changes

Fixed ER and credability

In order to maintain a peg, the Govt needs credabioity that it will stick to the peg as well as other macro policy

UK had inflation problem in 90s – BofE wasn’t independent so MP lacked credibility as people didn’t think the Govt would stick to target of low inflation / p stability

To gain the credibility the Govt fixed the ER – outspourcing MP to foreign CB

MP and fixed ER

MP becomes endogenous

Ms must adjust to maintain i = i*

If the i differ then the currency will appreciate / depreciate

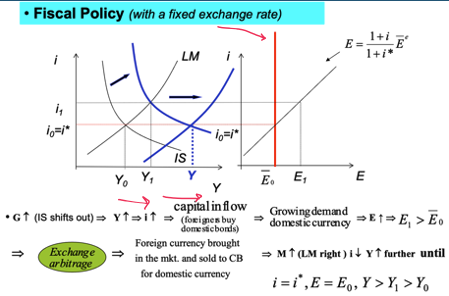

FP and fixed ER

Effects of FP now magnified → FP moves LM curve

FP triggers accommodating MP

How FP triggers MP with fixed ER

Increase in G → increase in i → capital inflows from foreign rise → market ER appreciates

Fx dealers exploit difference of fixed E and market E - arbitrage

To defend ER, CB sells dom currency → MS rises → i falls → i = i*

Expansionary FP with fixed ER graph

Expansionary FP with fixed ER explanation

IS shifts out → LM auto shifts to keep i at fixed rate → keeps E fixed

Y + C + Ms increase + constant i

Real ER constant - No change in NX from that

Unambiguous worsening of NX from expansionary FP (MS increase but X unchanged)

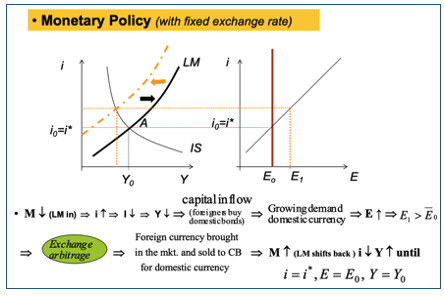

Contractionary MP with fixed ER - graph

Contractionary MP with fixed ER - explained

LM curve shifts in → move along IS → i rises → I & Y down → capital inflows → E appreciates (E1 > E0)

→ arbitrage (foreign sold to dom CB for dom) → MS increases → LM shits out → i falls → Y rises

Fixed vs Floating overview

Fixed exchange rate gets back to normal levels at a slower rate than floating