Money and the Federal Reserve

1/41

Earn XP

Description and Tags

Econ103 Final Exam Review

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

Monetary Policy

the actions the Federal Reserve takes to influence the level of real GDP and the rate of inflation in the economy

M1

narrowest definition of the money supply, includes only the most liquid assests

The Three Functions of Money

medium of exchange

unit of account

3.store of value

Jerome Powell

Current chairman of the Federal Reserve System..

M2

broader definition of M1, a measure of the money supply that includes certificates of deposits and other less-liquid assets

Liquidity

the ease with which an asset can be converted into the economy's medium of exchange

Bond

a debt or obligation to pay issued by a government or corporation in order to raise a large amount of capital; can be traded in the stock market

Commodities

raw materials (like soybeans, cotton, oil and coal) traded on a mercantile exchange

Medium of exchange

Anything that is traded broadly for goods and services in an economy

Unit of Account/Standard of Value

Measure in which prices are quoted (or the unit by which the prices of all other items are quoted)

Stuff has a price

Store of Value

A means for holding wealth

Money holds its value

Fiat Money

No value except as the medium of exchange

No intrinsic value; just green paper

Value comes from government decree, or fiat

Commodity Money

Actual physical commodity (e.g., gold, silver, or tobacco)

It has value in and of itself, so it has intrinsic value

Commodity-backed money

Can be exchanged for a commodity at a fixed rate

Ex: Silver certificate (serial and crest are blue on dollar bill)

Characteristics of Money

durability, portability, divisibility, uniformity, limited supply, acceptability

Durability

ability of an item to last a long time

Portability

Can be carried around easily

Could apples be a unit of account?

No. It is not standard or uniform like money — also many different types of apples

Uniformity

Money is the same across the country

Limited Amount

Money is limited to prevent inflation

Acceptability

Money is accepted

FOMC

Part of the FED

Made up of 7 board members and 5 district banks

NY is always a part of it

Set interest rates

Number of Districts in Federal Reserve

12

Our district number in Federal Reserve

11

Location of our Federal Reserve Bank

Dallas

FDIC

Federal Deposit Insurance Corporation: A federal guarantee that insured savings deposits

Federal Reserve Act of 1913

This act created a central banking system, consisting of twelve regional banks governed by the Federal Reserve Board. It was an attempt to provide the United States with a sound yet flexible currency. The Board it created still plays a vital role in the American economy today.

Are apples a good store of value?

No. They will eventually rot and are not consistent long-term

Money

Anything that is a widely accepted form of payment for goods and services / repayment of debt

Money and currency

All currency is money, but not all money is currency

Examples of currency are cigarettes or mackerel, tobacco, etc

Barter

Trade goods and services (both people have to want to trade and want what is being traded)

Money supply

The U.S. Money Supply comprises currency and various kinds of deposits held by the public at banks and other depository institutions (e.g. thrifts and credit unions)

Money supply is important because

Growth in the money supply is the cause of inflation

Value of the money supply

~$21.6B

The money supply includes…

Both currency and bank deposits

Credit cards

Not money and not part of the money supply

Involve a loan make at the cash register

Bank deposits from elsewhere pay for the purchase

Debit cards

Not money themselves, just a means of accessing your money

The physical card is NOT part of the money supply, but the balances (checking and/or savings account) they are tied to are

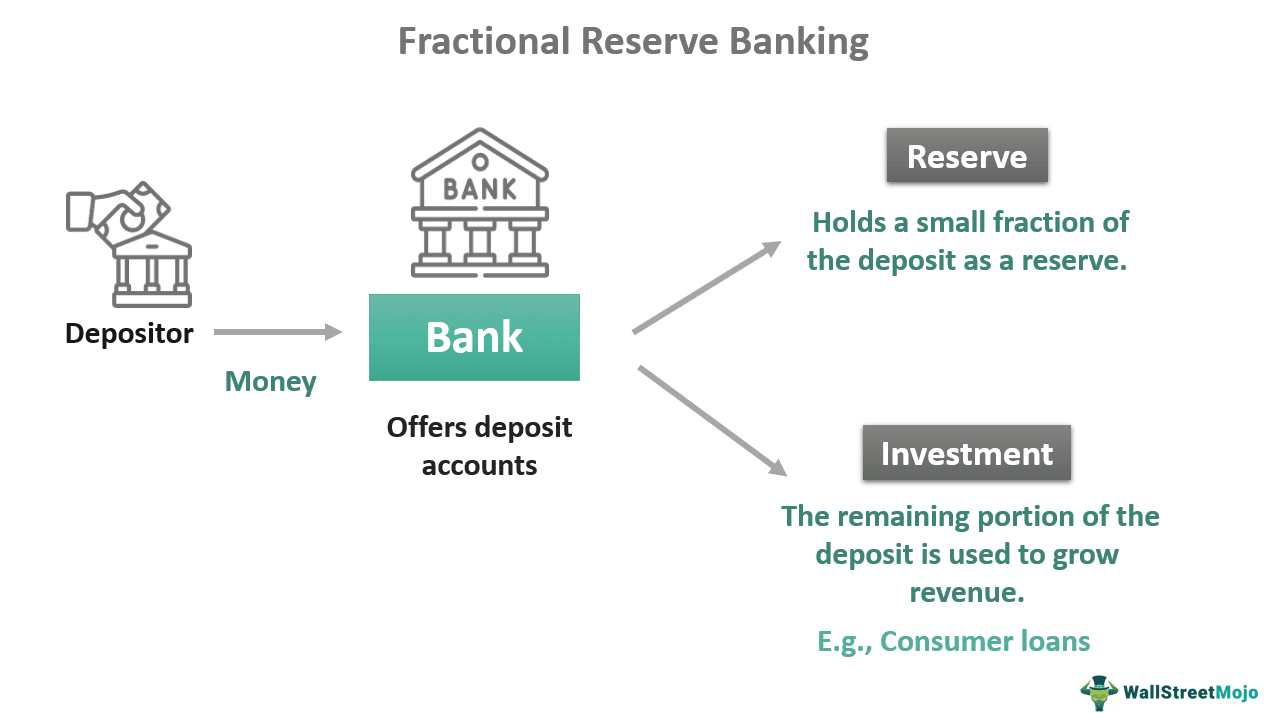

Fractional Reserve Banking

How we make money in the US

Banks two important roles in the economy

They are critical participants in the loanable funds market (willing to provide loans)

They play a role determining the money supply

Their function is to serve as a financial intermediary

Deposits

Primary source of funds

Loans

Primary use of funds

Interest Rates on Bank Deposits and Loans

Banks charge more interest for loans than they pay for deposits. The difference pays the banks’ expenses and produces profits