AP Micro - Unit 4

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

imperfect competition generalizations

price > MC

firms must lower P to sell additional units

there will be profit

Output lower than ATC minimum (excess capacity, choosing to produce at the efficient point would hurt profits)

To sell more, price must be lowered

Barriers to entry

economics of scale (Coke, McDonalds, etc.)

difficult to compete

legal protection

patents (drugs are initially only sold by one firm)

licenses (stadiums only allow one beer vendor)

ownership or control of essential resources

One company acquires all the coal mines, diamond mines, etc.

pricing and other strategies

Microsoft secured early market dominance by giving away browser for free (killed netscape) and gave OS away to PC manufacturers and then offering Office subscriptions to new users

monopoly

most inefficient, on the way-side of the four market model

types

pure monopoly (has 100% of market share, produces all of one product)

near monopoly (has around 80% of market share)

natural monopoly (where it makes sense for one firm to dominate, like electricity wherein infrastructure needed is so expansive and expensive only one firm can really do it) (however, these tend to be..see below)

regulated monopoly

natural monopoly (graph and facts)

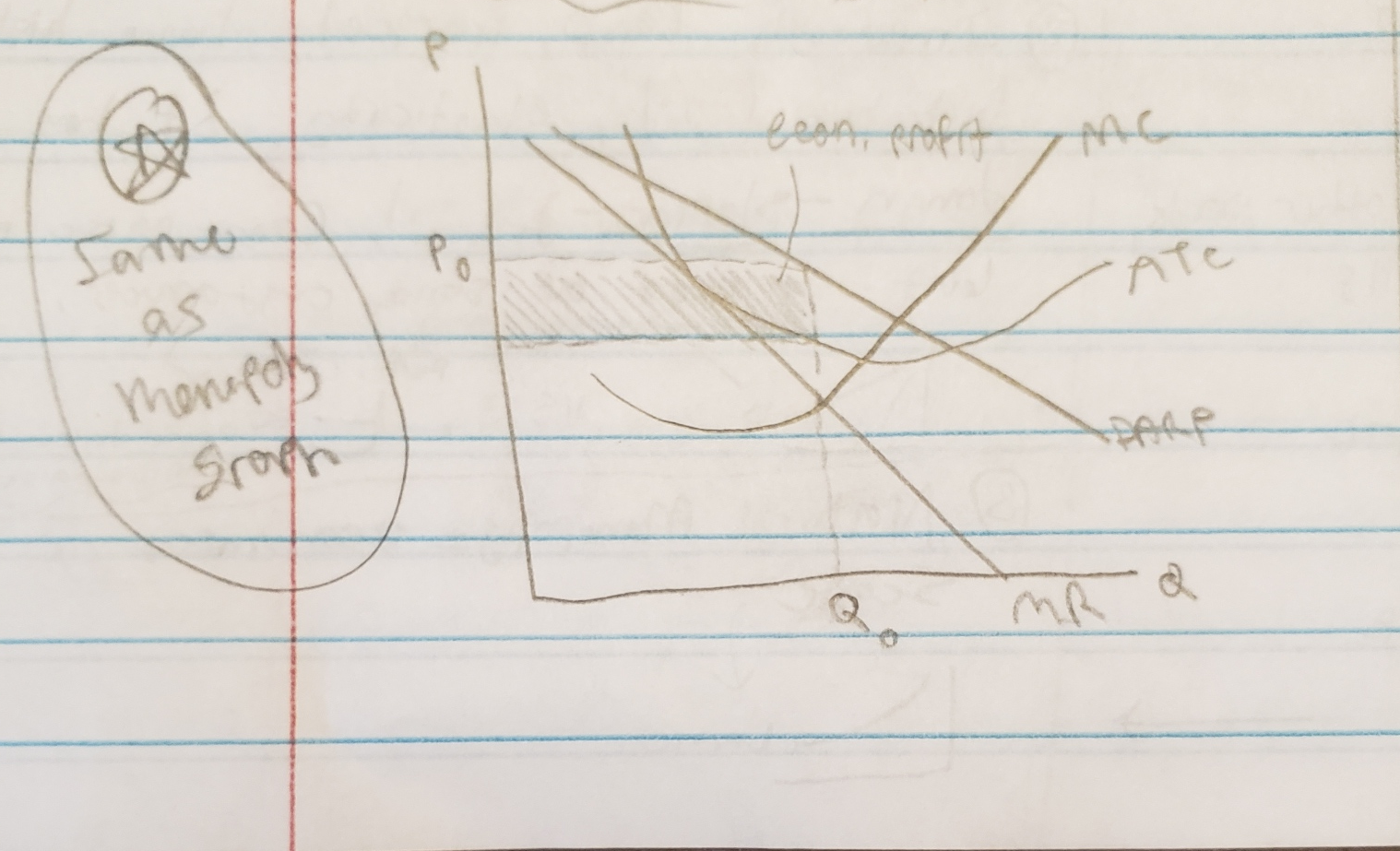

pure monopoly (assumptions, on a table, on a graph)

pure monopoly (explain MR and DARP slope relationship, where is profit max, why single graph, misconceptions)

profit maximization / loss minimization in a pure monopoly

economic effects of monopoly

price discrimination (conditions and effects)

conditions

monopoly

market segregation (how are prices being differently assigned, by race? region? age? etc.)

No resale

Consequences

more profit

more output

price discrimination effects on a graph

monopolistic competition generalizations

large number of sellers

small market shares

no collusion

independent action

easy entry and exit

advertising

differentiated products (product A no longer the same across all firms, can differ in…)

service - how is good served

location - where is it served (think good gas station locations)

brand names, packaging

some control over price

demand is highly elastic (many sellers)

monopolistic competition on a graph

new competition creates other goods, demand for your good falls »

with econ. losses, firms will exit market, less goods, so demand for your good increases »

normal profit only, econ. profit = 0

long-run equilibrium for monopolistic competition

long-run equilibrium for monopolistic competition

efficiency in monopolistic competition

not productively efficient, economic profit does = 0 but P is not at minimum ATC

not allocatively efficient, P does not equal MC (excess capacity, producing less than we should)

oligopoly

control over price

mutual interdependence

strategic behavior

price wars (slashing prices at a loss to force competitors out)

entry barriers

economies of scale

control of resources

not productively or allocatively efficient

collusive oligopoly

if a few firms face similar demand and costs they will act like a monopoly

they will split monopoly profits

types of collusion in oligopolies

overt collusion (public)

cartels, OPEC

covert collusion

illegal in USA

tacit understandings (“gentlemen’s agreements”)

obstacles to collusion in oligopolies

demand or cost differences

firms can only act together if they have similar DARP and MC lines (monopoly profits shared equally in this case, see graph)

large number of firms (harder to get everyone on the same page)

cheating (double-crossing deals)

potential entry

anti-trust laws

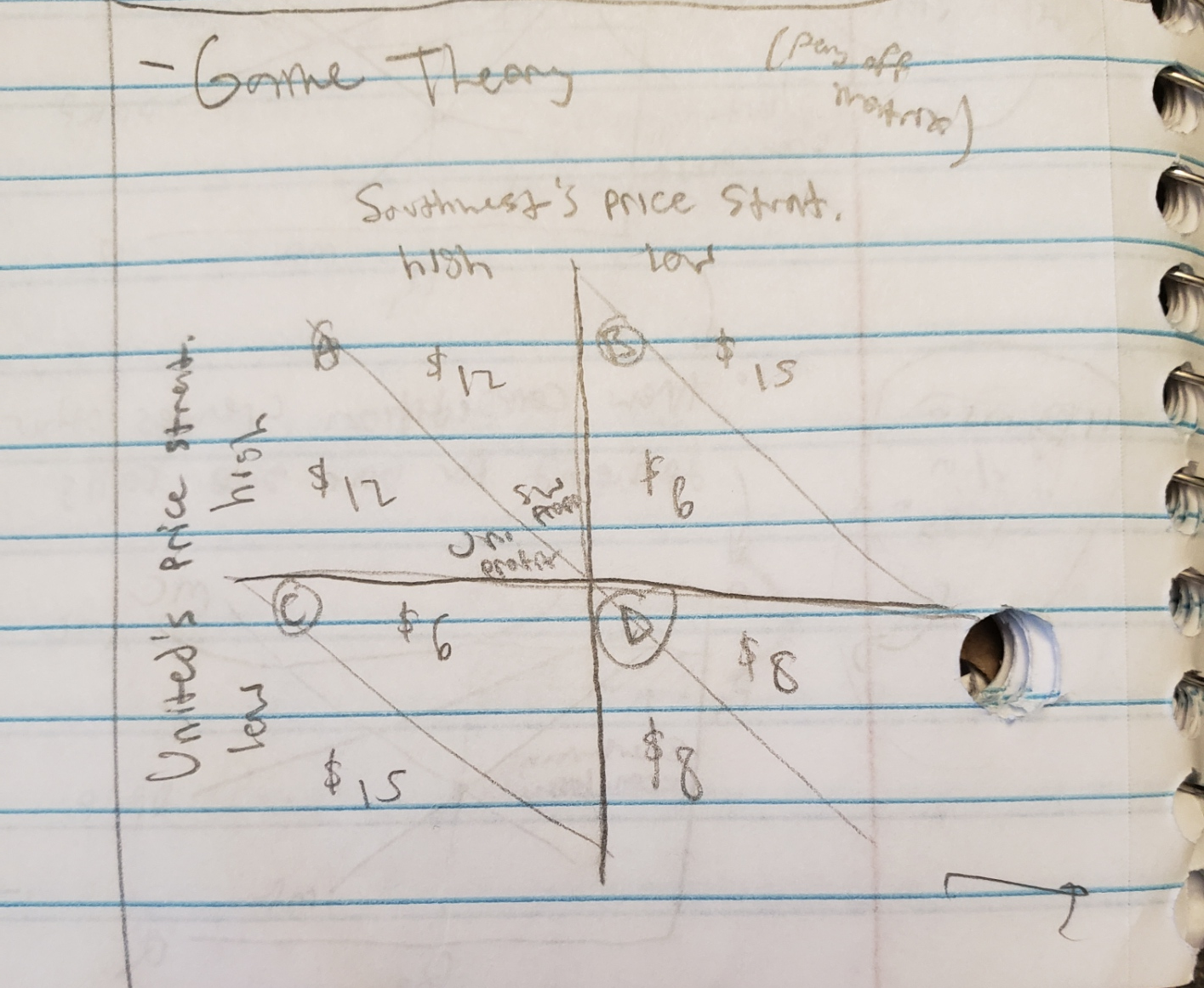

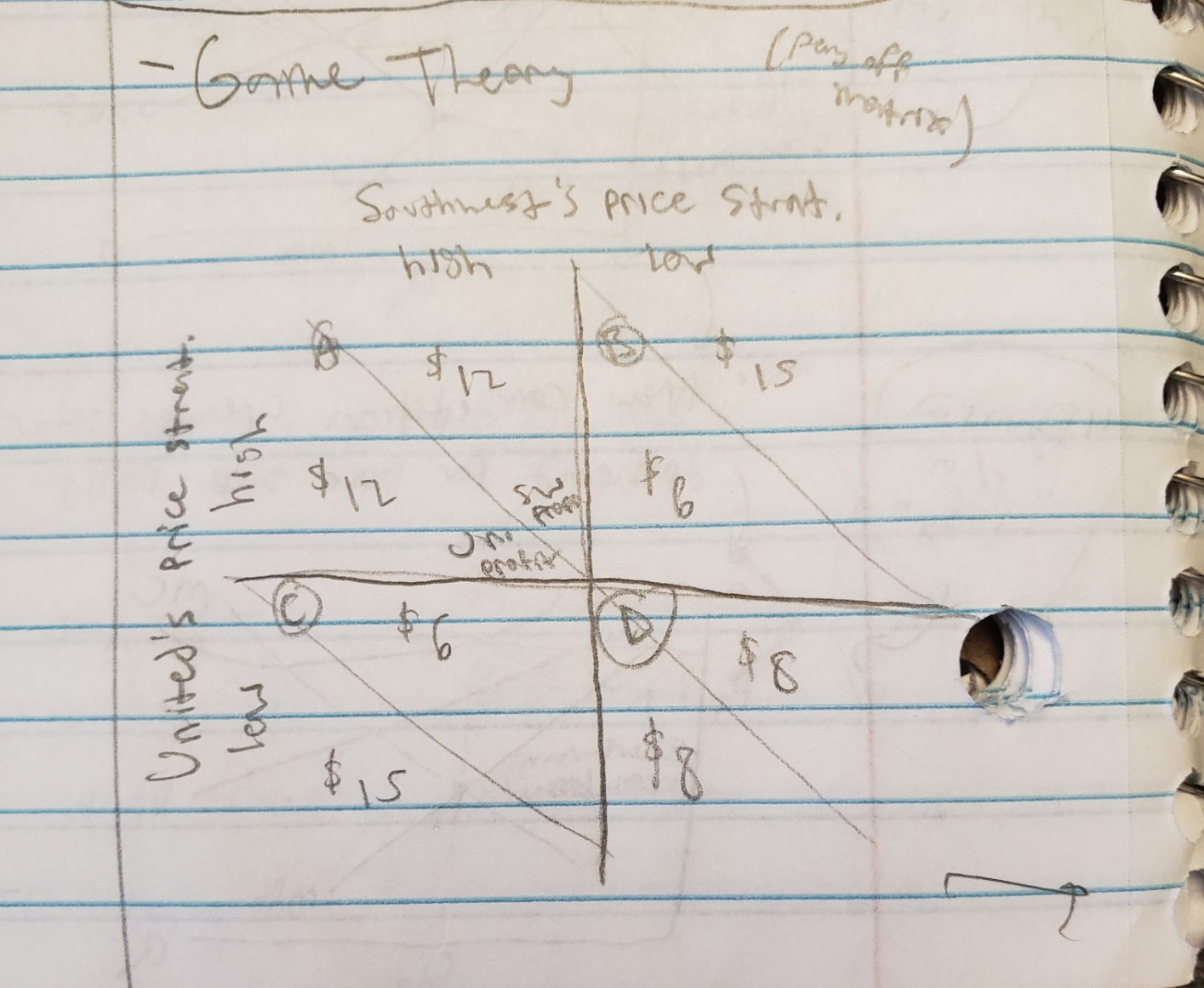

game theory

(refer to Payoff Matrix)

(A) = greatest combined profit

Independent actions stimulate response, if either cheats (B) and (C) are possible

if both cheat, gravitate to (D), Worst Case

game theory: dominant strategy

when picking one option always yields high profits

Ex) United going low is always higher regardless of Southwest’s decision (12 v 15, 6 v 8)

However, notice that Southwest’s dom. strat. is low too!

thus, if both sides pick dom. strat., they will reach Nash Equilibrium (D), only way to reach (A) is to successfully collude (but incentive to cheat is very real..)

nash equilibrium

point on the payoff matrix wherein no player would gain by changing their strategy (keeping other players’ strategies constant)