Module 2 Quiz + HW

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

During the year, Sparkle Inc. had Sales of $2,850.6 million, Gross profit of $1,307.7 million and Selling, general, and administrative expenses of $1,022.4 million.

What was Sparkle's Cost of sales for the year?

$1,542.9 million

At year end, Kay Corporation had net working capital of $1,818 million and current liabilities of $2,379 million.

The firm's current assets are:

$4,197 million

On its annual statement of cash flows, Bell Inc. reports the following (in millions):

Net cash from operating activities: $1,778

Net cash from investing activities: (25,005)

Cash at the beginning of the year: 5,261

Change in cash during the year: 2,318

What did Bell report for "Net cash from financing activities" during the year?

$25,545 million cash inflow

Fitz Inc., a pharmaceutical company, reported net income for fiscal 2016 of $5,772 million, retained earnings at the start of the year of $57,594 million and dividends of $5,958 million, and other transactions with shareholders that increased retained earnings during the year by $11 million.

If there were no additional transactions during the year that affected retained earnings, what was the balance of retained earnings at the end of the year?

$57,419 million

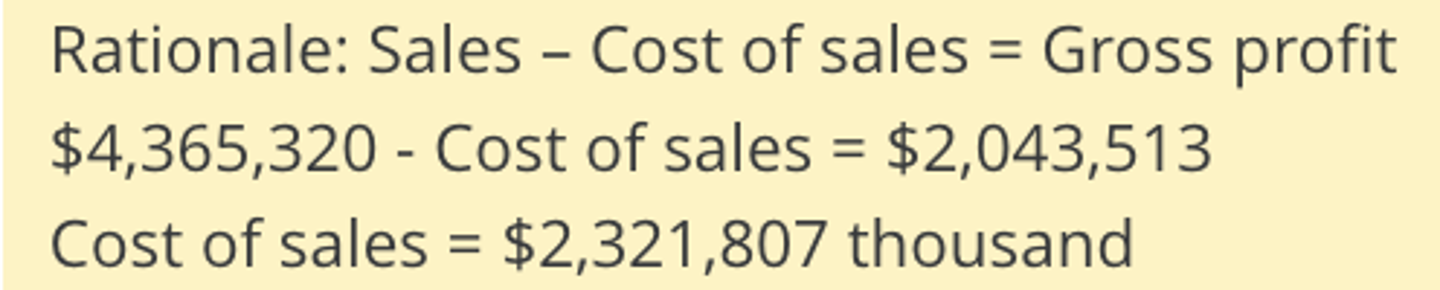

During the year, Macur Inc. had sales of $4,365,320, total expenses of $4,110,902 and gross profit of $2,043,513.

What was the company's cost of sales for the year? ($ in thousands)

$2,321,807 thousand

Use knowledge of accounting relations to determine X, Y, and Z in the following table for Srivastava Company.

Current Year

Beginning retained earnings: $189,089

Net income (loss): X

Dividends: 0

Ending retained earnings: $169,634

Prior Year

Beginning retained earnings: $Y

Net income (loss): $48,192

Dividends: $15,060

Ending retained earnings: $Z

X = (19,455)

Y = 155,957

Z = 189,089

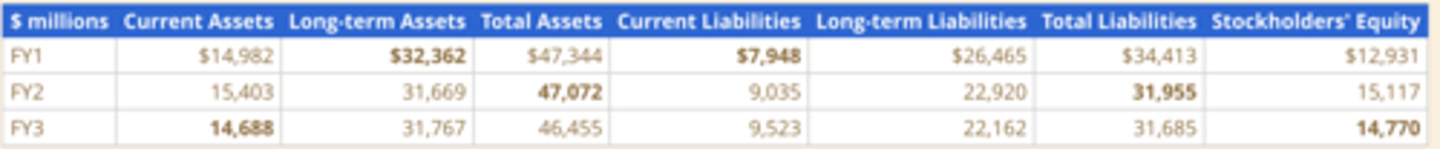

Selected balance sheet amounts for 3M Company, a manufacturer of consumer and business products, for three recent years follow.

a. Compute the missing balance sheet amounts for each of the three years shown.

FY1

Current Assets: $14,982

Long- Term Assets: ?

Total Assets: $47,344

Current Liabilities: ?

Long- Term Liabilities: $26,465

Total Liabilities: $34,413

Stockholders’ Equity: $12,931

FY2

Current Assets: 15,403

Long- Term Assets: 31,669

Total Assets: ?

Current Liabilities: 9,035

Long- Term Liabilities: 22,920

Total Liabilities: ?

Stockholders’ Equity: 15,117

FY3

Current Assets: ?

Long- Term Assets: 31,767

Total Assets: 46,455

Current Liabilities: 9,523

Long- Term Liabilities: 22,162

Total Liabilities: 31,685

Stockholders’ Equity: ?

FY1

Long- Term Assets: $32,362

Current Liabilities: $7,948

FY2

Total Assets: 47,072

Total Liabilities: 31,955

FY3

Current Assets: 14,688

Stockholders’ Equity: 14,770

a. Wages are earned by employees but not yet paid.

Balance Sheet:

Cash: No impact

Noncash assets: No impact

Total liabilities: +

Contributed capital: No impact

Retained earnings: -

Other equity: No impact

Statement of Cash Flows:

Operating cash flow: No impact

Investing cash flow: No impact

Financing cash flow: No impact

Income Statement:

Revenues: No impact

Expenses: +

Net income: -

Statement of Stockholders' Equity:

Contributed capital: No impact

Retained earnings: -

b. Inventory is purchased on credit.

Balance Sheet:

• Cash: No impact

• Noncash assets: +

• Total liabilities: +

• Contributed capital: No impact

• Retained earnings: No impact

• Other equity: No impact

Statement of Cash Flows:

• Operating cash flow: No impact

• Investing cash flow: No impact

• Financing cash flow: No impact

Income Statement:

• Revenues: No impact

• Expenses: No impact

• Net income: No impact

Statement of Stockholders' Equity:

• Contributed capital: No impact

• Retained earnings: No impact

c. Inventory purchased in transaction b is sold on credit (and for more than its cost).

Balance Sheet:

• Cash: No impact

• Noncash assets: +

• Total liabilities: No impact

• Contributed capital: No impact

• Retained earnings: +

• Other equity: No impact

Statement of Cash Flows:

• Operating cash flow: No impact

• Investing cash flow: No impact

• Financing cash flow: No impact

Income Statement:

• Revenues: +

• Expenses: +

• Net income: +

Statement of Stockholders' Equity:

• Contributed capital: No impact

• Retained earnings: +

d. Collected cash from transaction c.

Balance Sheet:

• Cash: +

• Noncash assets: -

• Total liabilities: No impact

• Contributed capital: No impact

• Retained earnings: No impact

• Other equity: No impact

Statement of Cash Flows:

• Operating cash flow: +

• Investing cash flow: No impact

• Financing cash flow: No impact

Income Statement:

• Revenues: No impact

• Expenses: No impact

• Net income: No impact

Statement of Stockholders' Equity:

• Contributed capital: No impact

• Retained earnings: No impact

e. Equipment is acquired for cash.

Balance Sheet:

• Cash: -

• Noncash assets: +

• Total liabilities: No impact

• Contributed capital: No impact

• Retained earnings: No impact

• Other equity: No impact

Statement of Cash Flows:

• Operating cash flow: No impact

• Investing cash flow: -

• Financing cash flow: No impact

Income Statement:

• Revenues: No impact

• Expenses: No impact

• Net income: No impact

Statement of Stockholders' Equity:

• Contributed capital: No impact

• Retained earnings: No impact

f. Paid cash for inventory purchased in transaction b.

Balance Sheet:

• Cash: -

• Noncash assets: No impact

• Total liabilities: -

• Contributed capital: No impact

• Retained earnings: No impact

• Other equity: No impact

Statement of Cash Flows:

• Operating cash flow: -

• Investing cash flow: No impact

• Financing cash flow: No impact

Income Statement:

• Revenues: No impact

• Expenses: No impact

• Net income: No impact

Statement of Stockholders' Equity:

• Contributed capital: No impact

• Retained earnings: No impact

g. Paid cash toward a note payable that came due.

Balance Sheet:

• Cash: -

• Noncash assets: No impact

• Total liabilities: -

• Contributed capital: No impact

• Retained earnings: No impact

• Other equity: No impact

Statement of Cash Flows:

• Operating cash flow: No impact

• Investing cash flow: No impact

• Financing cash flow: -

Income Statement:

• Revenues: No impact

• Expenses: No impact

• Net income: No impact

Statement of Stockholders' Equity:

• Contributed capital: No impact

• Retained earnings: No impact

h. Paid cash for interest on borrowings.

Balance Sheet:

• Cash: -

• Noncash assets: No impact

• Total liabilities: No impact

• Contributed capital: No impact

• Retained earnings: -

• Other equity: No impact

Statement of Cash Flows:

• Operating cash flow: -

• Investing cash flow: No impact

• Financing cash flow: No impact

Income Statement:

• Revenues: No impact

• Expenses: +

• Net income: -

Statement of Stockholders' Equity:

• Contributed capital: No impact

• Retained earnings: -

b. Identify whether or not the following would be included among 3M's current assets.

Included

Cash and cash equivalents:

Inventory:

Marketable securities:

Prepaid expenses:

b. Identify whether or not the following would be included among 3M's current assets.

Not Included

Property plant & equipment:

Accounts payable:

Goodwill:

Accrued expenses:

b. Identify whether or not the following would be included among 3M's long-term assets.

Included

Property plant & equipment:

Intangible assets:

Goodwill:

b. Identify whether or not the following would be included among 3M's long-term assets.

Included

Accounts payable:

Work in process:

Accrued expenses:

Prepaid expenses:

Long-term notes payable:

For each of the following items, indicate whether they would be reported in the balance sheet (B) or income statement (I).

Balance Sheet

Machinery

Inventories

Common stock

Factory buildings

Receivables

Taxes payable

Long-term debt

Treasury stock

For each of the following items, indicate whether they would be reported in the balance sheet (B) or income statement (I).

Income Statement

Supplies expense

Sales

Taxes expense

Cost of goods sold

Identify each of the following accounts as a component of asset (A), liabilities (L), or equity (E).

Assets

Cash and cash equivalents

Equipment

Identify each of the following accounts as a component of asset (A), liabilities (L), or equity (E).

Liabilities

Wages payable

Long-term debt

Taxes payable

Identify each of the following accounts as a component of asset (A), liabilities (L), or equity (E).

Equity

Common stock

Retained earnings

Additional paid-in capital