FINN 2043 Exam #3 Review

1/66

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

67 Terms

What is the least expensive form of capital for a company?

Debt

In the US and other countries, firms rely on _______ more than any other financial sources.

Retained Earnings

T/F

The cost of capital reflects the cost of financing and reflects the minimum rate of return that a project must earn to increase the firms value.

True

What are the 4 basic sources of long-term funds?

Long-Term Debt (loans and bonds)

(cheapest, less risky than equity, interest is tax-deductible, first to get paid in the event of bankruptcy.)

Preferred Stock (equity)

Common Stock (equity)

Retained Earnings (equity)

Capital Asset Pricing Model (CAPM)

Describes the relationship between the required return (rj), and the non-diversifiable risks of the firm as measured by the beta coefficient (βj).

CAPM Formula

rj = RF + [βj x (rm – RF)]

where

R = risk-free rate of return (Treasury security rates as proxy)

rm = market return; return on the market portfolio of assets (S&P 500 Industry Index as proxy)

The cost of retained earnings is what?

Equal to the cost of common stock equity.

Required rate of return on the firm’s stock (when firms finance investments using retained earnings)

Weighted Average Cost of Capital (WACC)

Reflects the expected average cost of the different forms of capital a company uses. It equals the weighted average cost of each specific type of capital, where the weights equal the proportion of each capital source in the firm’s capital structure.

WACC Formula

rWACC = (wd x rd)(1 – T) + ( wp x rp) + (ws x r(s or n))

where

T = tax rate

wd = proportion of long-term debt in capital structure

wp = proportion of preferred stock in capital structure

ws = proportion of common stock equity in capital structure

wd + wp + ws = 1.0

In computing the weighted average cost of capital, the preferred weighting scheme is generally based on…

The market values of each source of capital.

Constant Growth (Gordon Growth) Model

Used to derive an equation to the cost of common stock equity.

Constant Growth (Gordon Growth) Model Formula

P0 = D1 / (rs – g)

where:

P0 = current value of common stock,

D1 = dividend expected in 1 year

rs= required return on common stock

g = constant rate of growth in dividends

Risk

A measure of the uncertainty surrounding the return that an investment will earn.

Total Rate of Return

The total gain or loss experienced on an investment over a given period expressed as a percentage of the investment’s value.

Total Rate of Return Formula

rt = Ct + Pt - Pt-1 / Pt-1

where:

rt = Total return during period t

Ct = Cash (flow) received from the asset investment in period t

Pt = Price (value) of an asset at time t

Pt − 1 = Price (value) of an asset at time t − 1

Portfolio

A collection or group of assets.

Risk Assessment Tools

Scenario Analysis

Range

Probability Distributions

Probability Distribution

Bar Chart

Continuous Probability Distribution

Scenario Analysis

An approach for assessing risk that uses several possible alternative outcomes (scenarios) to obtain a sense of the variability among returns.

Range

A measure of an asset’s risk, which is found by subtracting the return associated with the pessimistic (worst) outcome from the return associated with the optimistic (best) outcome.

Probability Distribution

A model that related probability to the associated outcomes.

Bar Chart

The simplest type of probability distribution; shows only a limited number of outcomes and associated probabilities for a given event.

Continuous Probability Distribution

A probability distribution showing all the possible outcomes and associated probabilities for a given event.

Risk Averse

The attitude toward risk in which investors require an increased expected return as compensation for an increase in risk.

Risk Seeking

The attitude toward risk in which investors prefer investments with greater risk, perhaps even if they have lower expected returns.

Risk Neutral

The attitude toward risk in which investors choose the investment with the higher expected return regardless of its risk.

What are some risks in international diversification?

Higher costs

The changes and fluctuations in currency exchange rates, and

The different levels of liquidity in markets outside the U.S.

Political risk

Possibility that a host government will take actions harmful to foreign investors or that political turmoil will endanger investments.

Diversifiable Risk

The portion of an asset’s risk that is attributable to firm-specific, random causes; can be eliminated through diversification.

Also called Unsystematic risk.

What is the significance of a Beta (β) of zero?

A beta of 0 means that the stock is unaffected by market movements.

Most financial decision makers are risk _____?

Averse.

What is the significance of positive/negative betas (β) in response to the direction of the market?

A positive beta means that the stock moves in the same direction as the market, while a negative beta means that the stock will move in the opposite direction of the market.

Nondiversifiable Risk

The relevant portion of an asset’s risk attributable to market factors that affect all firms; cannot be eliminated through diversification.

Also called systematic risk.

A firm’s P/E ratio tends to be higher if…

The risk is lower and the growth prospects are higher.

T/F,

A firm’s free cash flow represents the amount of cash flow(s) available to investors after the firm has met all operating needs and paid for all net fixed investments and all net current investments

True

Although no investment is risk-free, ________ are generally the closest thing that we can get to a risk-free investment

US Treasury Securities

T/F,

If we have a financial manager and they do something dumb that increases the company’s risk, it…

Increases the investors required return, therefore decreasing the value of the stock.

Payback is considered a flawed capital budgeting because…

It does not explicitly consider TMV, risk/return, and it doesn’t maximize the firm’s value.

T/F,

Common/Preferred stock dividends are tax deductible?

False

________ is the process of evaluating and selecting long-term investments that are consistent with the firm’s goal of maximizing the owner’s wealth.

Capital Budgeting

The purpose of a debt restrictive covenant that requires maintaining a minimum level of networking capital is to…

Ensure a cash shortage does not cause an inability to meet current obligations.

Mortgage Bond

A bond that is secured by either real estate or buildings.

Cost of Common Stock with Flotation Costs

Cost of a new issue of common stock, rn, is higher than the required return of an existing common stock,rs, because it is a net of underpricing and associated flotation costs.

Cost of Common Stock with Flotation Costs Formula

rn = (D1 / Nn) + g

where:

rn = the net proceeds from the sale of new common stock after subtracting underpricing and flotation cost.

Capital Budgeting

The process of evaluating and selecting long-term investments that contribute to the firm’s goal of maximizing owners’ wealth.

Capital Expenditure

An outlay of funds that the firm expects to produce benefits over a period of time greater than 1 year (long-term).

Operating Expenditure

An outlay of funds resulting in benefits received within 1 year (short-term).

Independent Projects

Those with cash flows unrelated to (or independent of) one another; accepting or rejecting one project does not change the desirability of other projects.

Mutually Exclusive Projects

Those that have essentially the same function and therefore compete with one another. Accepting one project eliminates from further consideration all other projects that serve a similar function.

Unlimited Funds

The firm has enough funds to invest in all projects that will provide an acceptable return, making capital budgeting decisions simple.

Capital Rationing

Firms have a fixed budget available for capital expenditures and that numerous projects will compete for these dollars.

Accept-Reject Approach

Involves evaluating capital expenditure proposals to determine whether they meet the firm’s minimum acceptance criterion.

Managers might use this approach if they have sufficient funds to invest in every project that creates value for shareholders.

Ranking Approach

Involves ranking projects based on some predetermined measure, such as how much value the project creates for shareholders.

This approach is best when firms have limited capital and need to select the “best” of a group of acceptable projects.

Payback Period

The time it takes an investment to generate cash inflows sufficient to recoup the initial outlay required to make the investment.

Payback Period Decision Criteria

If the payback period is less than the maximum acceptable payback period, accept the project.

If the payback period is greater than the maximum acceptable payback period, reject the project.

Cost of Common Stock Equity

Reflects the costs that firms incur to utilize common stock financing.

Equal to the required rate of return on the firm’s common stock in the absence of flotation costs, thus, the cost of common stock equity is equal to the cost of retained earnings.

Pros and Cons of Payback Analysis

Pros:

Simplicity and intuitive appeal

Cons:

Payback period is a subjectively determined number, not based on scientific measurement.

Does not focus on the goal of shareholder wealth maximization.

Does not use time value of money method.

Does not have risk-return tradeoff analysis.

Ignores the value of cash flows that arrive after the payback period

Net Present Value (NPV)

Measures an investment’s value by calculating the present value of its cash inflows and outflows.

NPV Formula

Present value of cash inflows - Initial Investments

NPV Decision Criteria

If the NPV is greater than $0, accept the project.

If the NPV is less than $0, reject the project

Net Proceeds

Funds actually received by the firm from the sale of a security. It is total proceeds received from sales of newly issued securities (bonds or stocks) deducts flotation costs incurred associated with the sales.

Flotation Costs

The total costs of issuing and selling a security, including fees paid to investment banks, law firms, and accounting firms, etc.

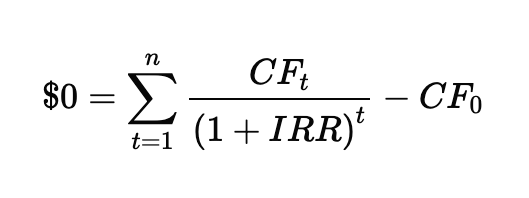

Internal Rate of Return

The discount rate that equates the NPV of an investment opportunity with $0; it is the rate of return that the firm will earn if it invests in the project and receives the given cash inflows.

IRR Formula

IRR Decision Criteria

If the IRR is greater than the cost of capital, accept the project.

If the IRR is less than the cost of capital, reject the project.

Theoretical View

NPV is a better approach in two concerns:

It focuses on wealth for shareholders

NPV always provides a single solution, but IRR sometimes gives more than one solution.

Practical View

Financial managers use the IRR approach as often as the NPV method because rates are most often expressed to measure a firm’s cost of capital and investment return, such as required rate of return, annual rates of return, interest rates, etc. The use of IRR makes sense to financial decision-makers. Many companies use two techniques to compare projects and make financial decisions.

Capital Gains

Profit from the sale of assets like stocks or property, taxed at a lower rate than regular income.

Capital Losses

Occurs when the selling price of an asset is less than the purchase price. They can be used to offset capital gains for tax purposes.