ICORE Marketing Final

1/229

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

230 Terms

Actual product

brand name

quality level

packaging

features/design

core customer value

defines the basic problem-solving benefits that customers are seeking

associated services/augmented product

financing

product warranty

product support

product complexity

the degree of difficulty involved in designing, manufacturing, selling, and maintaining a product

Steps to determine how complex to make their product

identify and compare product complexity sources (how to differ)

evaluate the strategic trade-offs (advantages and risks)

customer perception (talk to customers)

broader implication (how does it affect things)

consumer products

products and services used by people for their personal use

key driver for marketers to consider is the amount of time consumers are likely to spend shopping

speciality, shopping, convenience, unsought

specialty

group of buyers are willing to make a special purchasing effort, they will not easily accept substitutes

luxury & premium consumer goods

high performance/niche products

collectibles/custom items

luxury & personalized services

expert & high skill professional services

education and training services

shopping

for consumers who spend time and effort comparing alternatives on attributes such as quality, price, and style

limited problem solving but not habitual or emotionally involved

electronics, home appliances, apparel & footwear, automobiles, furniture

convenience

low-priced, frequently purchased items that require minimal buying effort or thought

staple product

impulse products

emergency products

staple products

bought regularly and routinely

rarely deliberate and prefer brand or one on hand

impulse products

purchased spontaneously without prior planning

high visibility

emergency products

bought when an urgent need arises

available

unsought

consumers do not normally think of buying nor do not want to think about buying until a specific need or situation brings up attention

new innovations, regularly unsought products, emergency/reactive unsought products

new innovations

products the market doesn’t yet know exist or understand

regularly unsought products

consumers know they exists but prefer not to think about them as they are associated with unpleasant topics, emergencies, or future risks

emergency/reactive unsought products

purchased in response to a sudden, unexpected need

product mix

the complete set of all products and services offered by a firm

reflects breadth and depth

product lines

groups of associated items that consumers tend to use together or think of as part of a group of similar products or services

breadth

a count of the number of product lines offered by the firm

depth

the number of products within a product line

cannibalization

adding competing products take away sales from current brands

change product mix

increase depth: add new flavor

decrease depth: merge, eliminate, sell a brand (keep top performers)

increase breadth: add new product line to capture new/evolving market

decrease breadth: drop a line due to changing market or internal strategy

product

the item or service offered for sale

brand

the intangible identity and reputation built in the minds of consumers

what makes a brand

brand name

URLs

logos & symbols

characters

slogans

jingles/sounds

value of branding to customer and firm

facilitate purchases

helps move consumers to loyalty

protect from competition or price competition

asset value

affect marketplace value with wholesale/retail

brand equity

qualitative measure of consumer perception

the reputation and emotional connection a brand holds in the minds of consumers

brand value

quantitative financial metric

financial worth of brand as an asset

creating and increasing brand equity

awareness → consideration → purchase → retention → advocacy

brand awareness

perceived value

brand associations

loyalty

brand awareness

the more aware consumers are with a brand, the higher the chances of purchase

perceived value

the relationship between a product’s benefits and its costs

brand associations

the mental and emotional links that consumers make between a brand and its key attributes

brand loyalty

an important source of value for firms

brand ownership

manufacturer/national brands vs. retailer/store brands (private labels)

family of brands vs. individual brand

brand extension vs. line extension

brand dilution

co-branding

brand licensing

family of brands

corporate name used across brands and product lines

individual brand

products have individual identities

brand extension

same brand name in different product line

line extension

same brand name within the same product line

brand dilution

only good as its last extension

co-branding

marketing two or more brands together

can enhance perceptions of quality

brand licensing

common strong brands

brand repositioning/rebranding

marketers change a brand’s focus to target new markets or realign the brand’s core emphasis with changing market preferences

packing

more tangible or physical benefits than other brand elements

primary and secondary package

primary package

the one the consumer uses

secondary package

the wrapper or exterior carton that contains the primary package and provides the UPC label used by retail scanners

label information

stems from laws

communication tool

why do businesses create new products

to stay competitive and drive growth to prevent the risk of becoming obsolete

product create value for business

generate new revenue streams

boost market share and competitive advantage

enhance brand image and loyalty

increase operational efficiency

attract and retain talent

product create value for consumer

solve problems or fill a need

enhance quality

improve the user experience

create emotional benefit

provide unique points of difference

innovation segmentation

category already exists (new product to compete)

category doesn’t exist (new product in new marketplace)

already in market (modified/improved product)

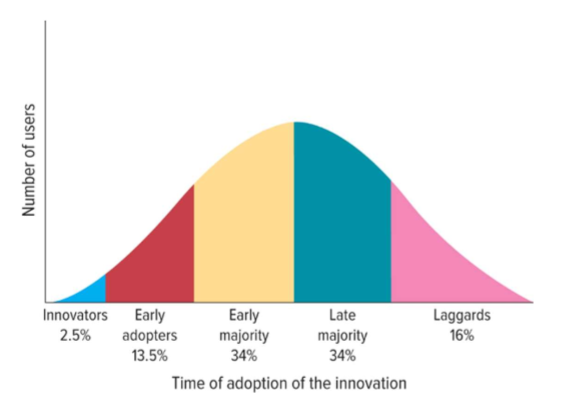

diffusion of innovation theory

the process by which the use of an innovation spreads throughout a market group. over time and across various categories of adopters

diffusion of innovation curve

the number of users an innovative product/service spreads through the population

altering the diffusion of innovation theory

relative advantage

compatibility

observability

trialability

lack of complexity

relative advantage

the degree to which a new product or innovation is perceived as better than what it’s replacing

compatibility

the ability of software and hardware from different sources to work together without having to be altered to do so

observability

the ability to capture and analyze data

trialability

the ability to sample products

lack of complexity

lacking many different parts connected or related to each other in a complicated way

product development process

idea generation

concept testing

product development

market testing

product launch

evaluation of results

idea generation (sources of ideas)

internal R&D

R&D consortia

licensing

brainstorming

outsourcing

competitors’ products

consumer input

alpha testing

internal

testing if the product will perform according to design and if it satisfies need

beta testing

external

examine prototype in real-use setting to determine its functionality, performance, protentional problems

marketing testing

premarket tests

customer exposed

custoemrs sruveyed

firm makes decision

test marketing

mini product launch

more expensive

demand is estimated

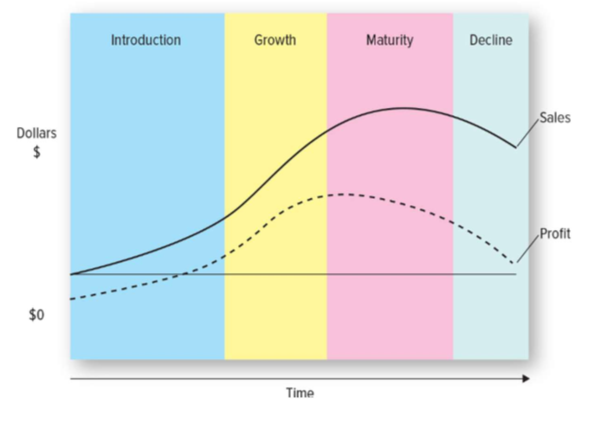

product life cycle

tool managers use to plan their marketing activities

introductory stage

slow sales, minimal profit

generate awareness and trial

skim and pentrate prices

growth stage

majority of new products fail

rapid sales gains

more competitors

profits peak

repeat buyers

expanded distribution

fight & defend

maturity stage

sales are slow for categoty/brand

few new buyers

competitors leave

declining proditsprofits

control costs

choices:

extend lin

international expansion

drive usage occasions

create good pricing strategy

decline stage

industry/brand sales fall

prices are lowered

choice:

delete or harvest (retain but reduce investment/cost)

limitations of product life cycle

each product/service has its own shape

hard to know what product/service is in

value

products create value, price captures value

role of price for company

price links customer value to company value

price is the revenue driver

price signals quality and positioning

corporate objectives that drives company’s pricing strategy

profit

sales revenue

market share

unit sales

survival

social responsibility

pricing strategies

demand oriented

cost oriented

profit oriented

competition oriented

demand oriented pricing

skimming

penetration pricing

value based pricing

prestige pricing

yield management pricing

cost oriented pricing

standard markup

loss leader pricing

cost plus

profit oriented pricing

target profit

target return on sales (ROS)

target return on investment (ROI)

competition oriented pricing

customary pricing

everyday low pricing (EDLP)

high-low retail

price skimming

start high, end lower

penetration pricing

start lower, maintain/raise prices

value based pricing

setting a price based on the perceived value of your products vs. competition

prestige pricing

setting a high price and maintaining high price

yield management pricing

prices adjusted by time, day, week, season to match demand with supply

standard mark-up pricing

adds a fixed percentage markup to the cost of all items in a product class

loss leader pricing

low or no markup

cost plus pricing

used in situation where the cost of products tend to fluctuate

target profit pricing

setting a target of a specific dollar volume of profit

total revenue - total cost

target return on sales pricing

setting a price to achieve a profit that is a specified percentage of the sales volume

total profit / total revenue

target return on investment

setting a price to achieve an annual target ROI

customary pricing

setting a price that is directed by tradition, a standardized channel of distribution, or other competitive factors

every day low price pricing

no fluctuation in pricing as an enticement to consumers

high-low pricing

multiple “tiers” of pricing

profit impact of lowering price

new profit = (new price - cost) x new volume

reasons why company lowers price

increase demand/market share

respond to competitive pressure

clear excess inventory or outdated products

attract price-sensitive customers

survive during downturns

discount pricing

temporary or structured reduction in the list price to stimulate demand, reward behavior, or maange relationships

instruments of value management

trade (functional) discounts

quantity discounts

seasonal discounts

cash/early payment discounts

promotional discounts

loyalty/membership discounts

trade (functional) discounts

offered to intermediaries such as wholesalers, distributors, or retailers for performing marketing functions

motivate channel partners to push the product

quantity discounts

price reductions for buying in large volumes

Seasonal Discounts

offered to stimulate early or off-season purchasing

Cash/Early Payment Discounts

encourage faster payment and improve liquidity

Promotional Discounts

short-term, marketing-driven reductions to attract new customers or boost sales during campaigns

Loyalty/Membership Discounts

reward repeat buyers, reduce churn, and increase lifetime value