3.4.4 - oligopoly

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

characteristics of an oligopoly:

barriers to entry/exit

concentration ratio

interdependence of firms

product differentiation

barriers to entry/exit - start-up costs and sunk costs

concentration ratio - high but shared (eg. 5-firm concentration ratio = 5 biggest companies combined share of the market)

interdependence - high bc firms study each other’s behaviour

differentiation - products highly differentiated

collusive v non collusive behaviour

COLLUSIVE: firms cooperate to fix prices (raise them usually) + restrict output

NON-COLLUSIVE: firms actively compete for market share

6 reasons for collusion

few firms/competitors —> easy to understand each other’s actions, or collaborate

similar costs —> all firms have experienced economies of scale

similar revenue —> little incentive to decrease bc everyone will so its same market share but less profit

high barriers to entry —> no new entrants to disrupt

ineffective regulation —> little consequence for their actions

brand loyalty —> less benefits to competition because ppl just won’t switch brands

net effect of collusion

group of firms end up acting like a monopoly in the market

two types of collusion

overt - firms explicitly agree to limit competition or raise prices

tacit - firms avoid formal agreements but closely monitor each other (usually follow lead of largest firm)

most restrictive form of collusion

cartel —> group of firms providing the same products join together to limit output and raise prices (effectively acts as a monopoly)

example: OPEC (oil producing exporting countries)

this is illegal in most countries

how does overt collusion happen

price fixing - firms agree a price higher than equilibrium

output quotas - limit supply = price increases

monopsony power - agree to pay suppliers the same price = drive down supply chain prices

consequences of overt collusion

higher prices for consumers

less output in the market

poor quality products/customer service

less investment in innovation

most common form of tacit collusion

price leadership/price matching:

firms price match to the largest firm

difficult for regulators to prove that collusion has happened

consequences and benefits of tacit collusion

both similar to overt

what is game theory

a mathematical framework used by firms to ensure optimal decisions are made when there is a high level of interdependence

3 elements of a game

players (firms)

strategies

payoffs (outcomes)

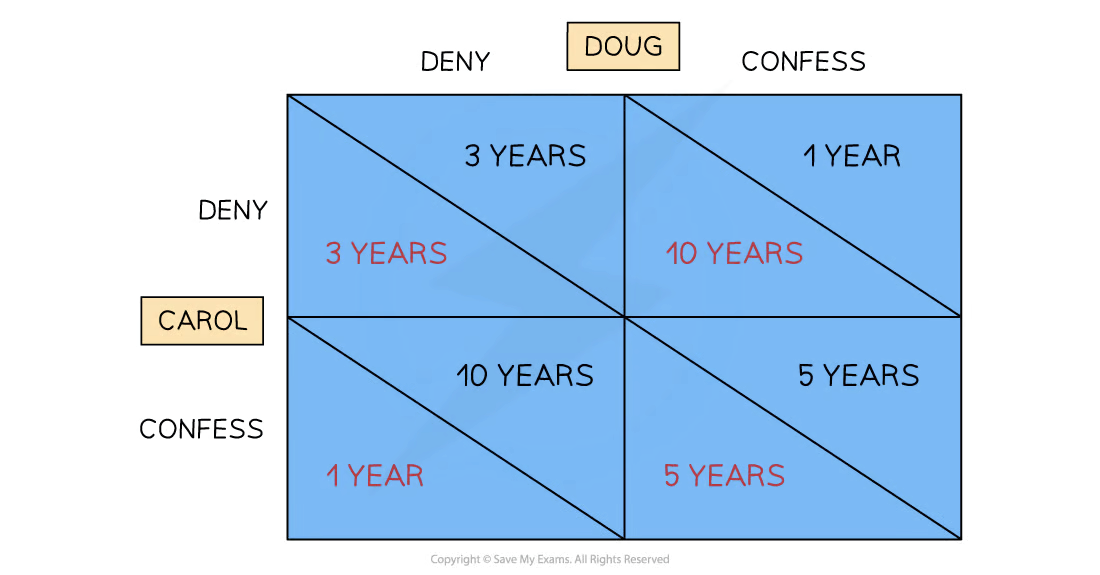

show a payoff matrix for the prisoners dillemma

players = carol + doug

strategies = deny + confess

payoffs inside boxes (red carol, black doug)

how do firms use game theory

making decisions about…

…prices

…advertising

…investment

…product bundling

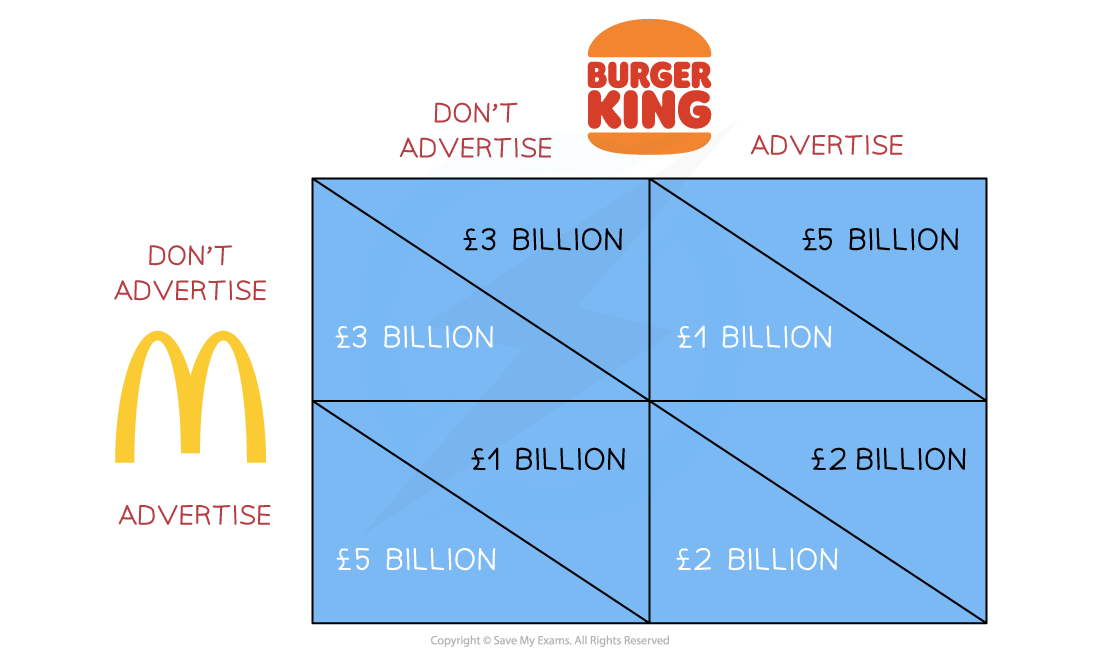

show a payoff matrix for two firms deciding whether or not to advertise

.

3 types of price competition in an oligopoly market

PRICE WARS —> firms repeatedly lower prices to undercut each other to gain market share

PREDATORY PRICING —> lowering prices to drive out a new competitor

LIMIT PRICING —> firms set a limit on how high a price can go in an industry

price wars - when does it usually happen

when…

…there’s a low level of non-price competition

…firms find it difficult to collude

predatory pricing - how does it work, and how is it viewed

prices lowered below costs of production

prices raised once the competitor leaves the market

usually illegal since it’s anticompetitive

limit pricing - how does it work

low prices = reduced profit = disincentive to join

higher barriers to entry = higher limit price since its already a disincentive

4 examples of non price competition

rewards schemes

celebrity sponsorship

branding/packaging

after-sales service/warranties