Module 7-9: Debt (Cost of Debt, Market Value of Debt, Hybrid Securities)

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

13 Terms

What is cost of debt

the rate at which you can borrow long term, today

reflects your default risk

the current level of interest rates in the market

3 ways to estimate cost of debt

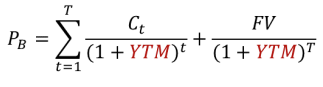

When the firm has outstanding bonds that are liquid and trade frequently

when the firm has bonds outstanding that do not trade on a regular basis

when the firm does not have liquid bonds traded and does not have a rate

When the firm has outstanding bonds that are liquid and trade frequently

look up yield to maturity on a straight bond outstanding from the firm. if traded the cost of debt can be computed as the YTM

when the firm has bonds outstanding that do not trade on a regular basis

look up rating for the firm and estimate a default spread based up on the rating

when the firm does not have liquid bonds traded and does not have a rate

estimate a synthetic rating for your firm

look up the cost of debt based upon that rating

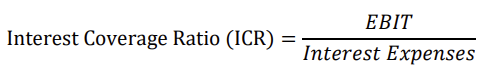

3.1 estimate a synthetic rating for your firm and looking up cost of debt

calculate Interest coverage ratio

lookup corresponding spread for firms with that rating

add estimated default spread to risk free rate to get cost of debt

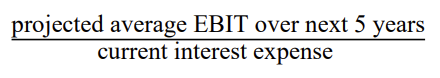

how to estimate cost of debt if the company is young/losing money

use forward looking EBIT

How to convert book value of debt into market value debt

treat entire debt on the books as one coupon bond

with a coupon set equal to the interest expenses on all the debt

the maturity set equal to the face value weighted average maturity of debt

2 Adjustments to liabilities

only interest bearing debt (remove accounts payable and supplier credit)

off balance sheet fixed commitments

Off balance sheet fixed commitments

contractual obligations: firm will have to pay regardless

tax deductible

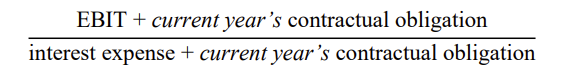

modified ICR

Convertible bonds

the holder of the bond can convert it into equity

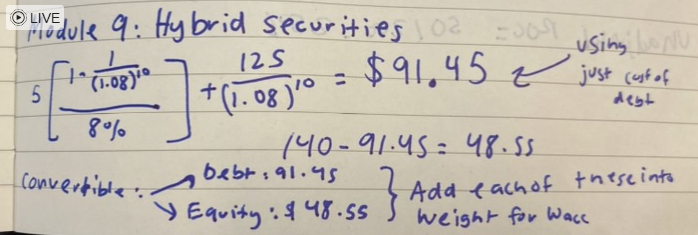

Suppose the firm that you are analyzing has $125 million in face value of convertible debt with a stated interest rate of 4%, a coupon of $5 million, a 10 year maturity and a market value of $140 million. If the firm has a bond rating of A and the interest rate on A-rated straight bonds is 8%, you can break down the value of the convertible bond into straight debt and equity portions