Unit 2: Macroeconomics

5.0(1)

Card Sorting

1/30

There's no tags or description

Looks like no tags are added yet.

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

1

New cards

Macroeconomics

study of the choices and economic behavior of governments and countries

2

New cards

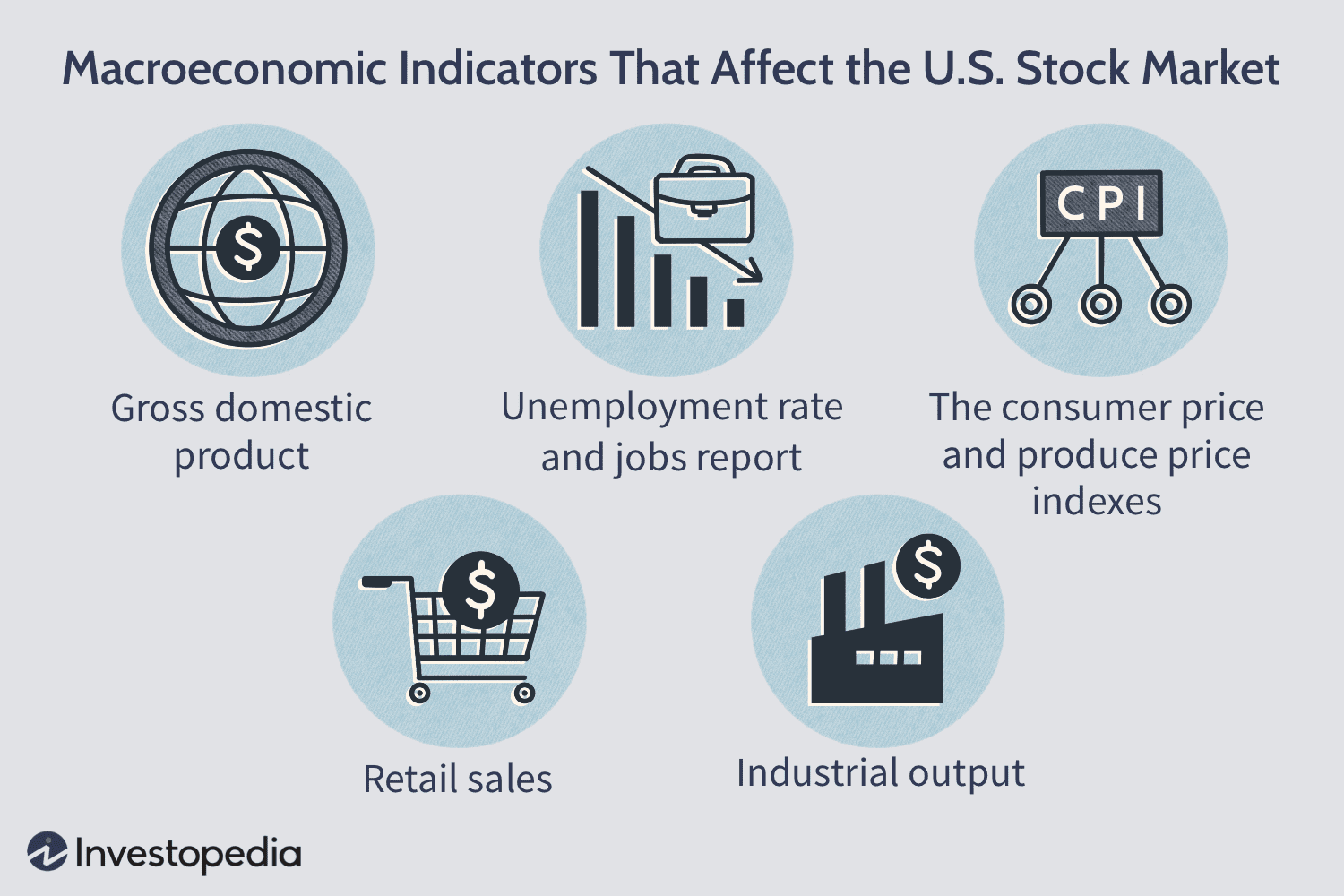

Macroeconomic Indicators

data points that reflect how well the economy is doing. Examples include GDP, CPI, interest rates, unemployment, etc.

3

New cards

7 Economic and Social Goals of a country

Economic Freedom, Efficiency, Equity, Security, Growth, Price Stability, and Full Employment

4

New cards

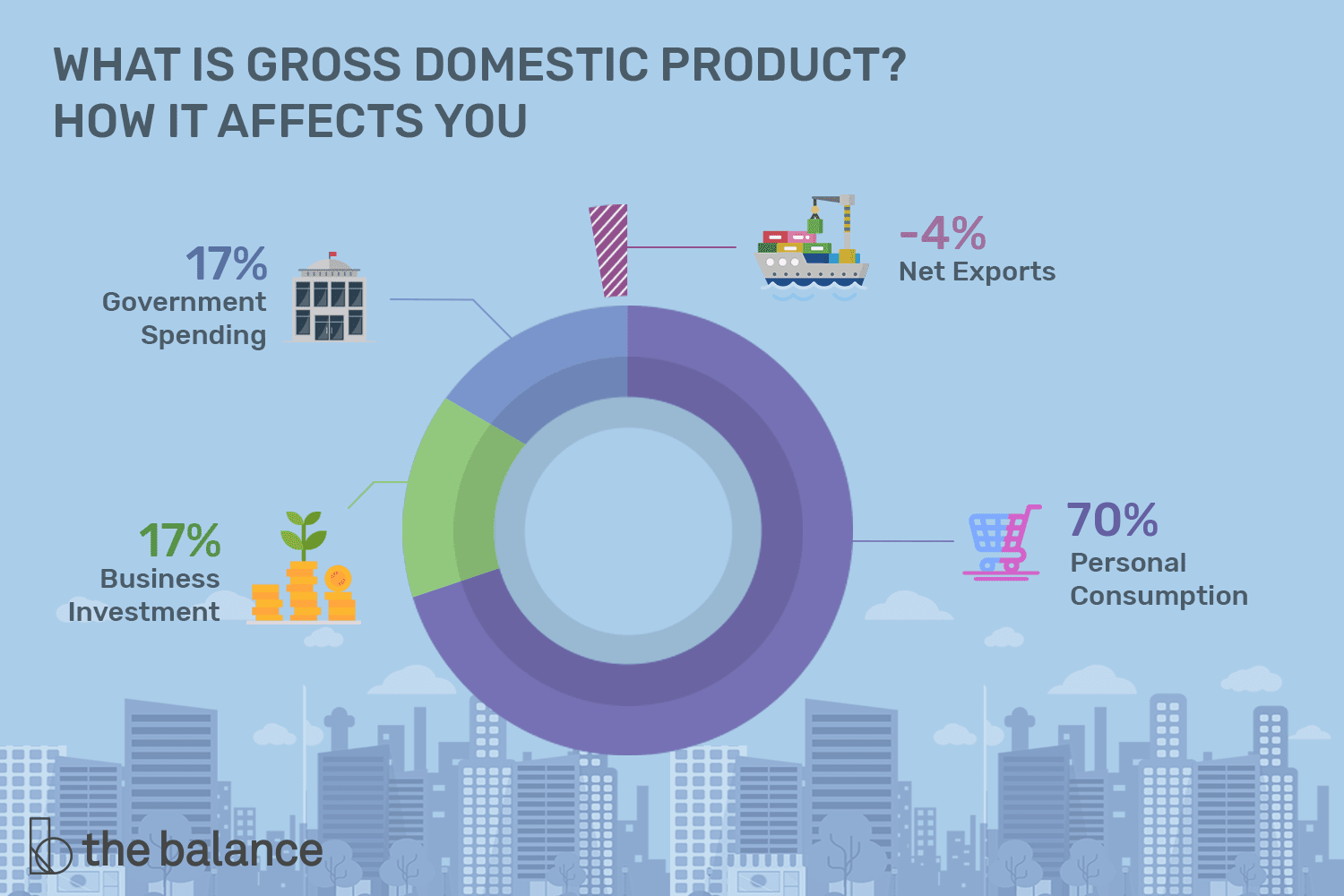

Gross Domestic Product (GDP)

the total monetary value of all the goods and services that are made that year in a country. This value helps you see the size of a country’s economy and how it is doing.

5

New cards

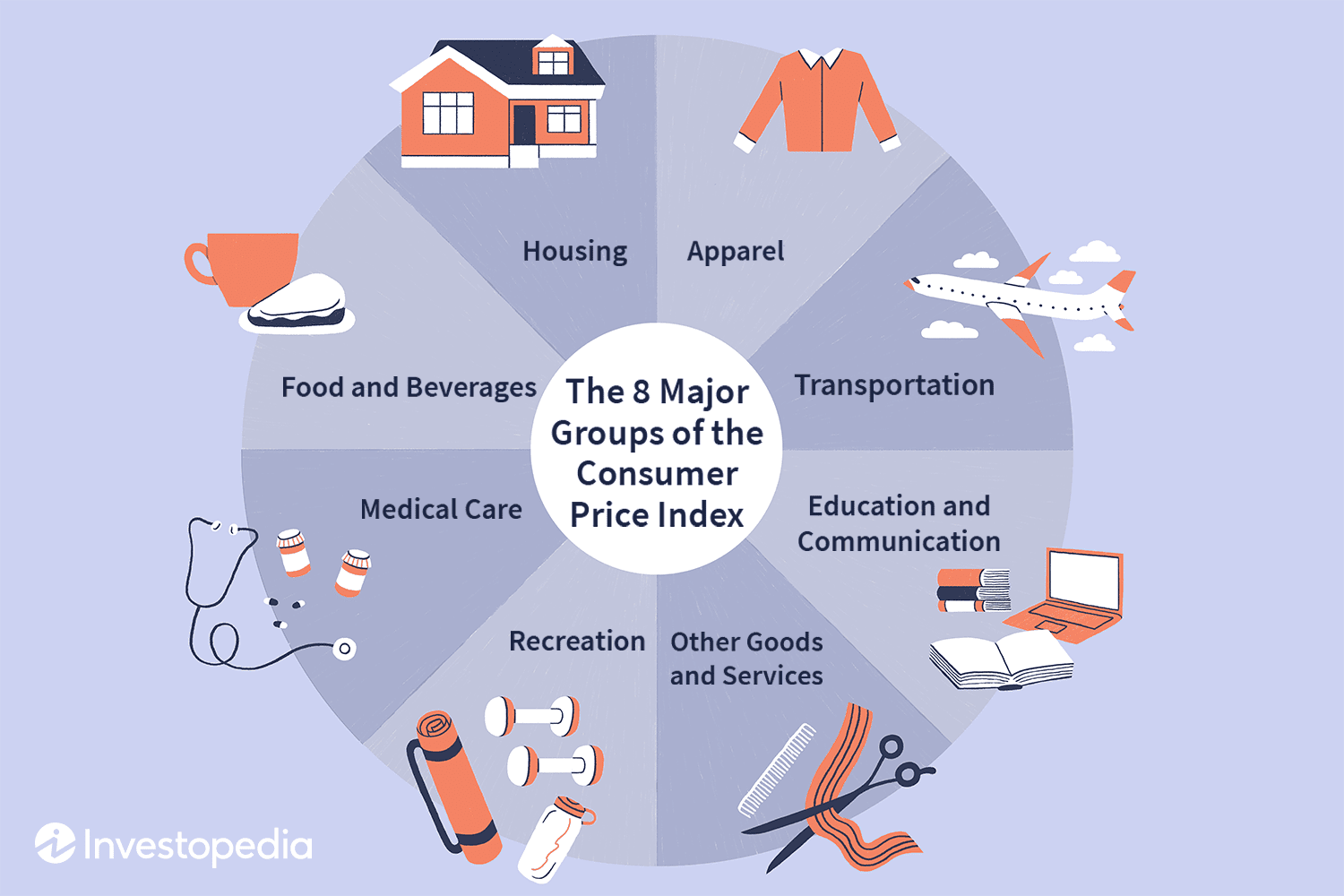

Consumer Price Index (CPI)

measures inflation in the economy by comparing how prices for goods and services have changed over time

6

New cards

Inflation

the rate that prices increase over time due to the decreasing power of the dollar.

7

New cards

Labor Market

The supply and demand of labor where employers (demand) are looking to hire employees(supply) for labor.

8

New cards

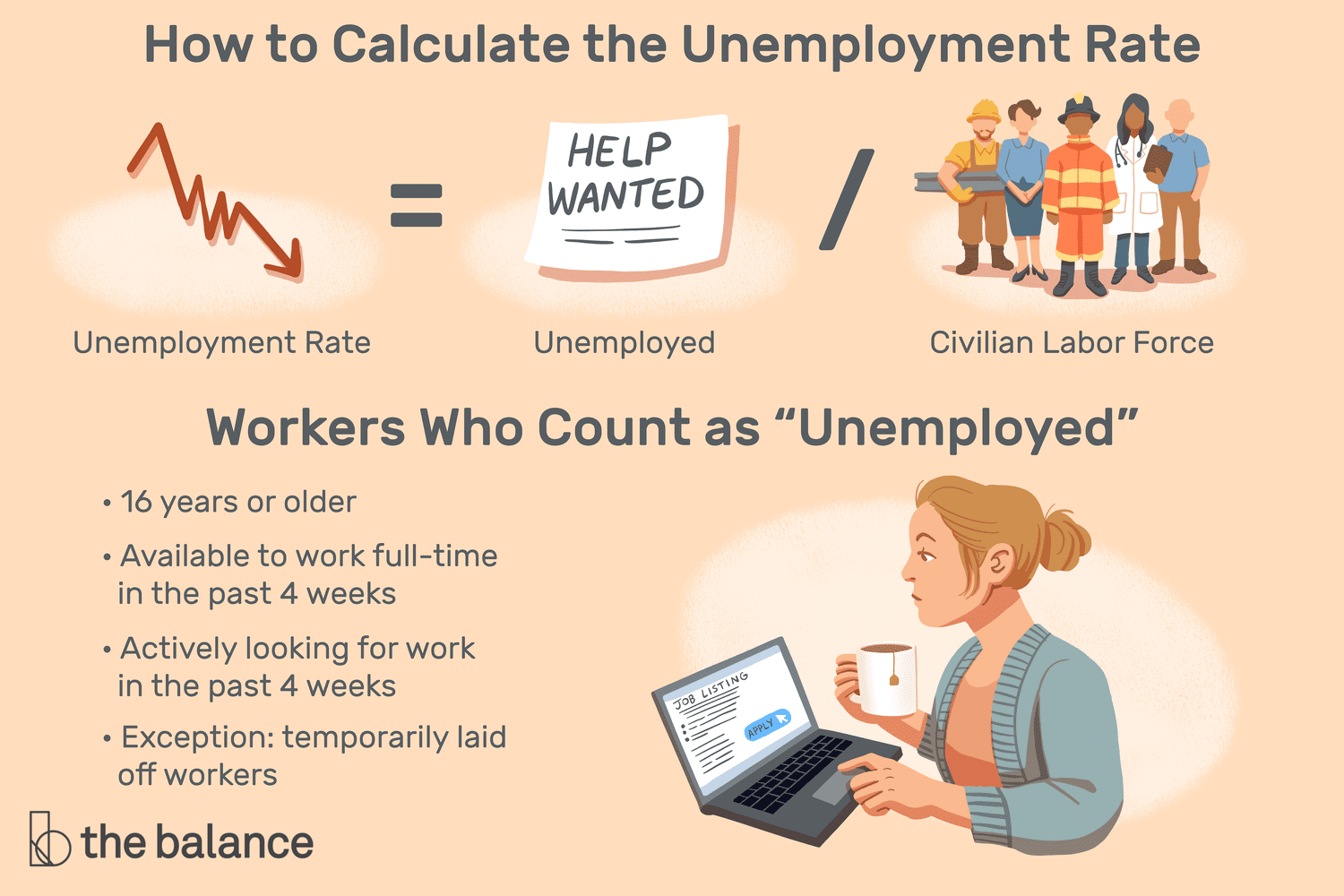

Unemployment rate

The percentage of people in the workforce that are unemployed (don’t have a job but are looking for one)

9

New cards

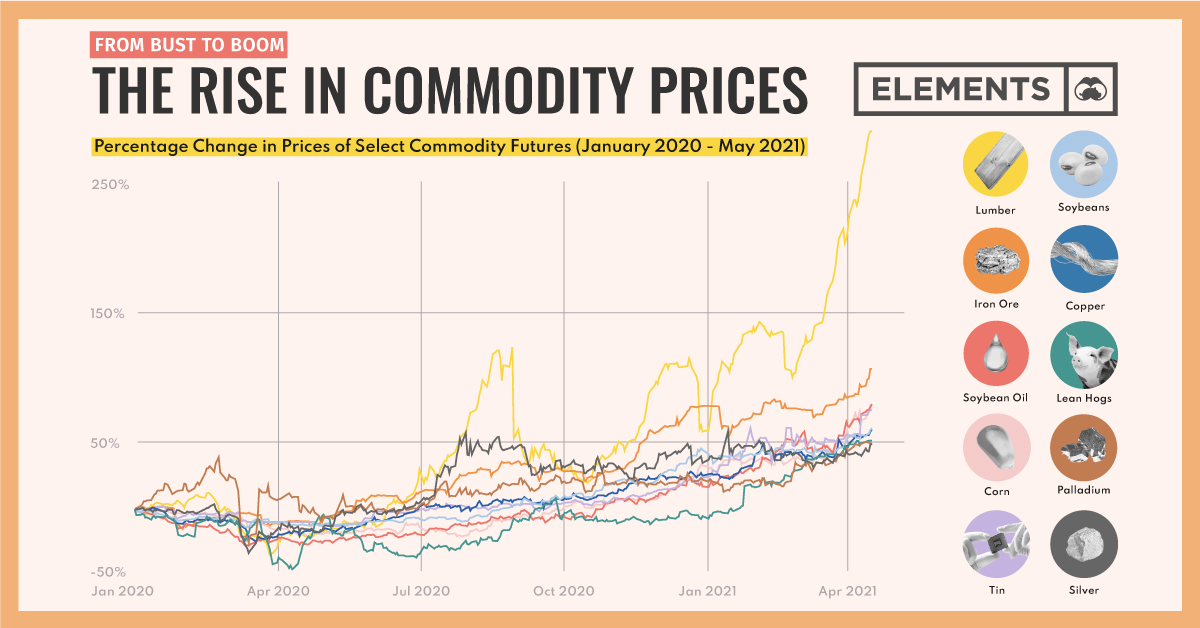

Commodity prices

the prices of raw materials or food

10

New cards

Stock Market

where investors buy and sell shares of companies

11

New cards

Retail Sales

tracks consumer demands for finished goods like cars and clothes

12

New cards

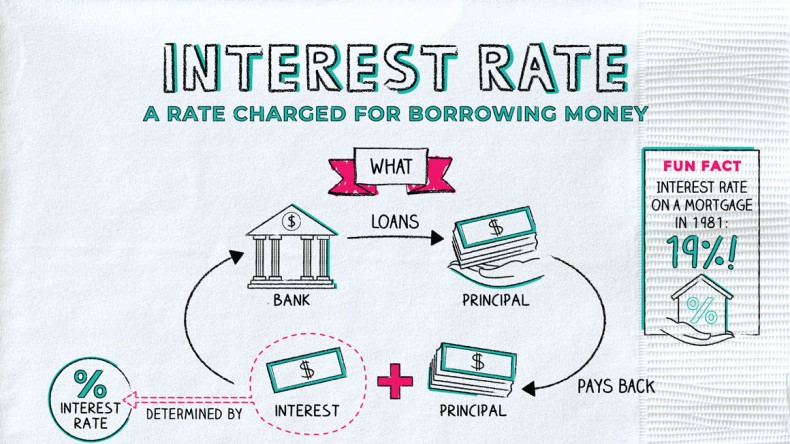

Interest Rates

the additional percentage you have to pay to borrow money.

13

New cards

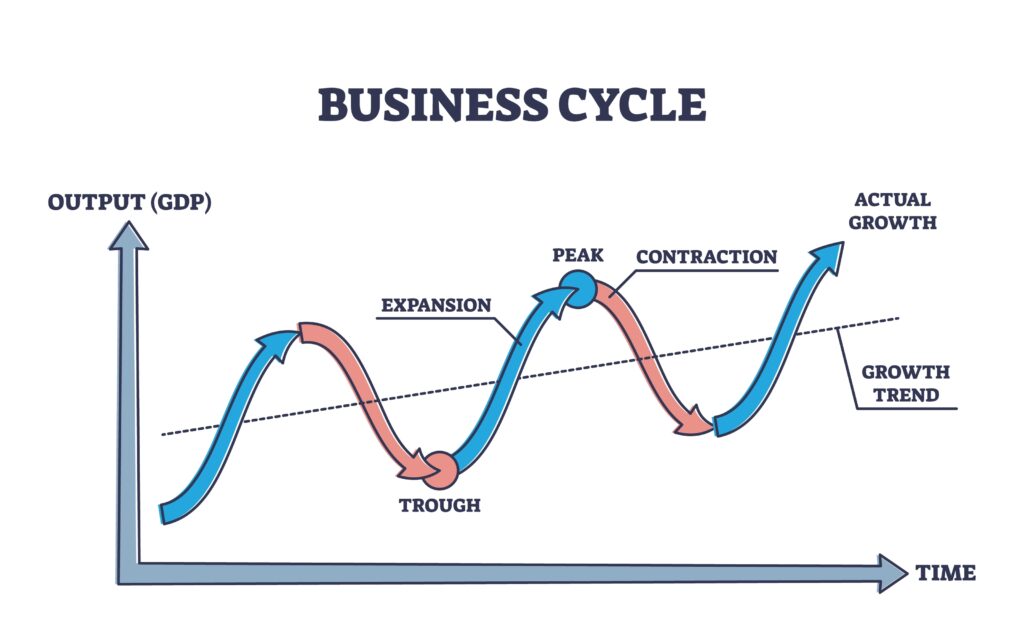

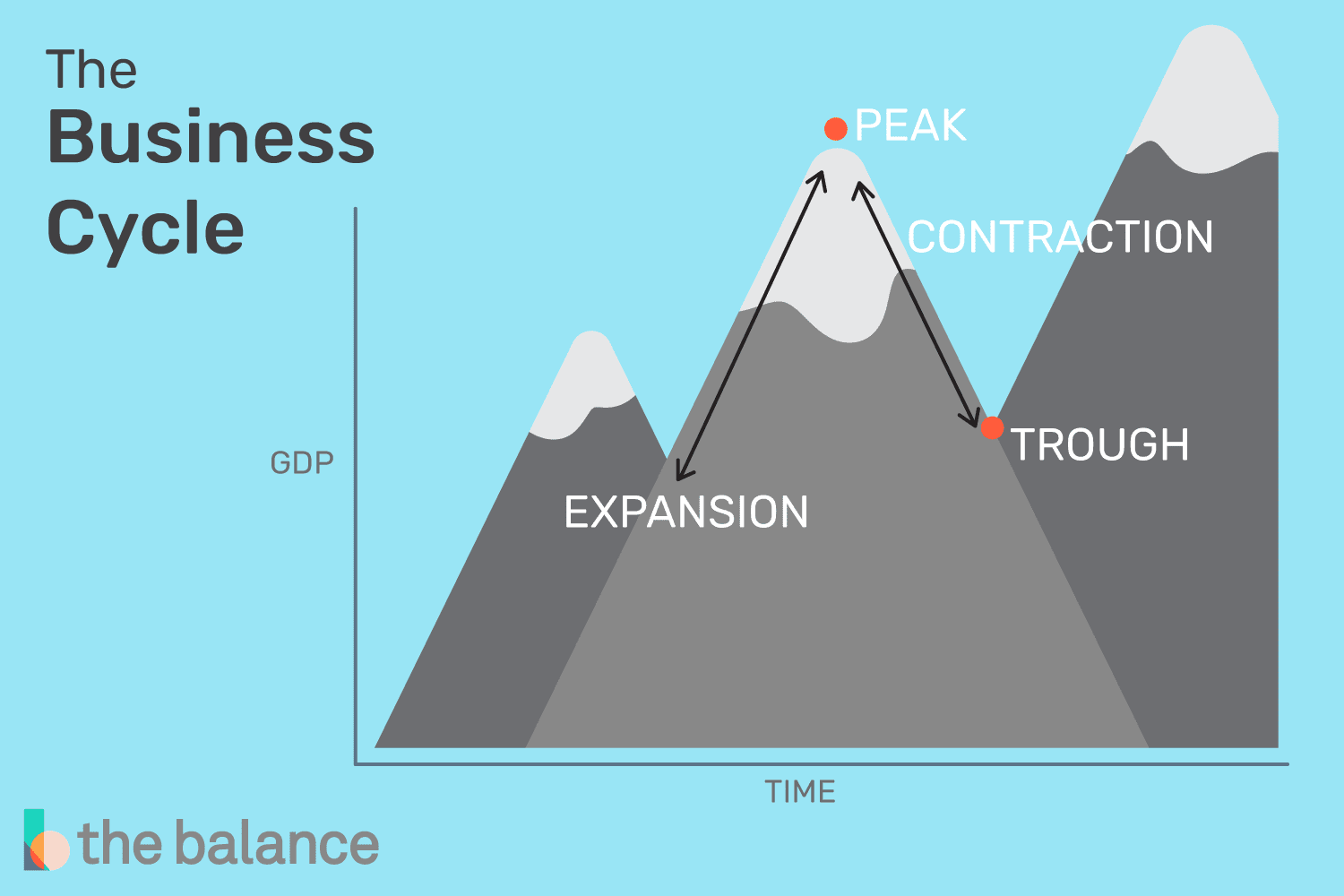

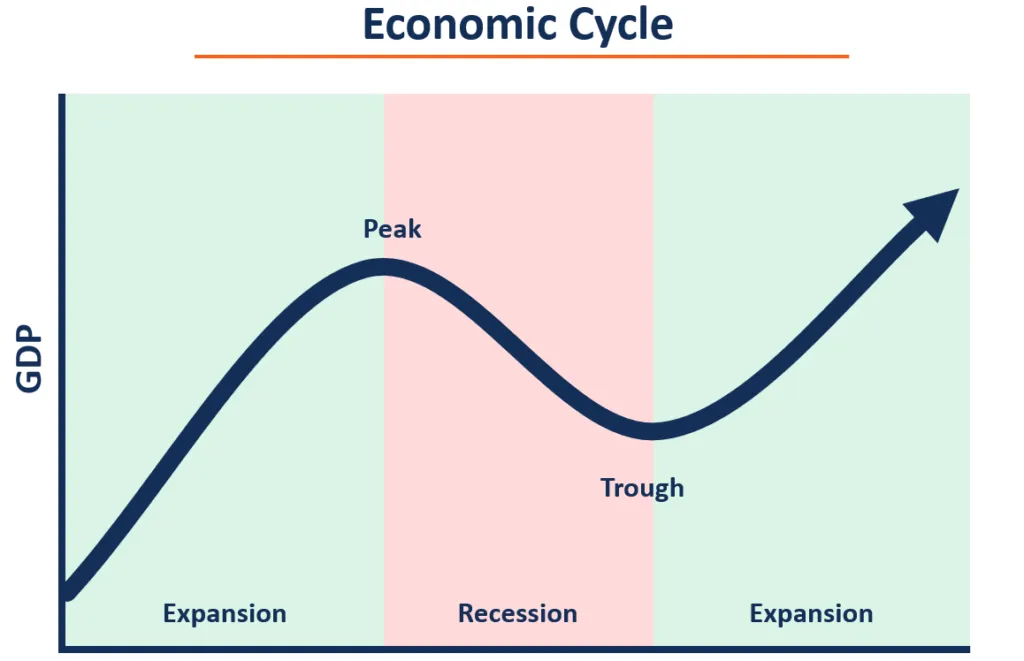

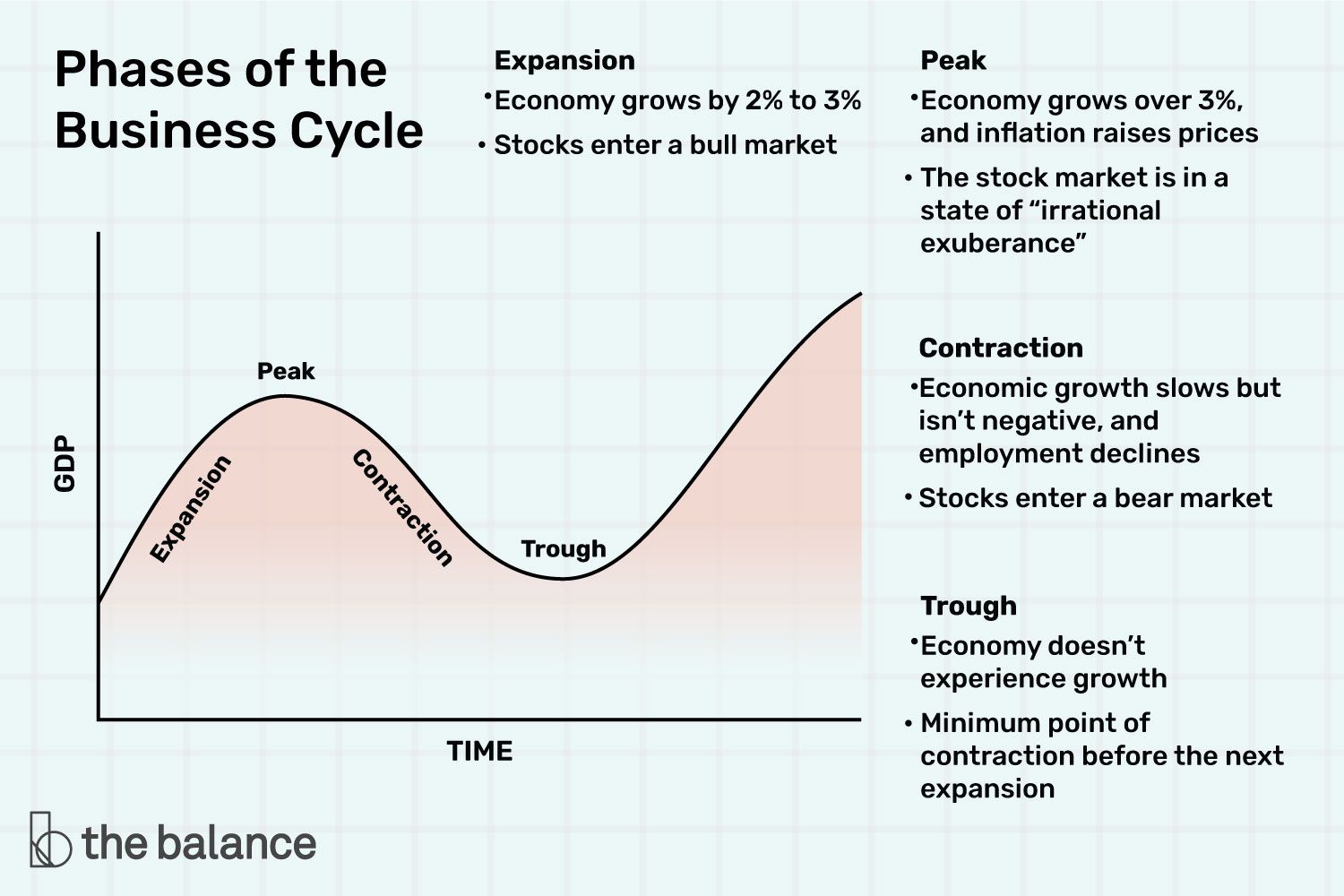

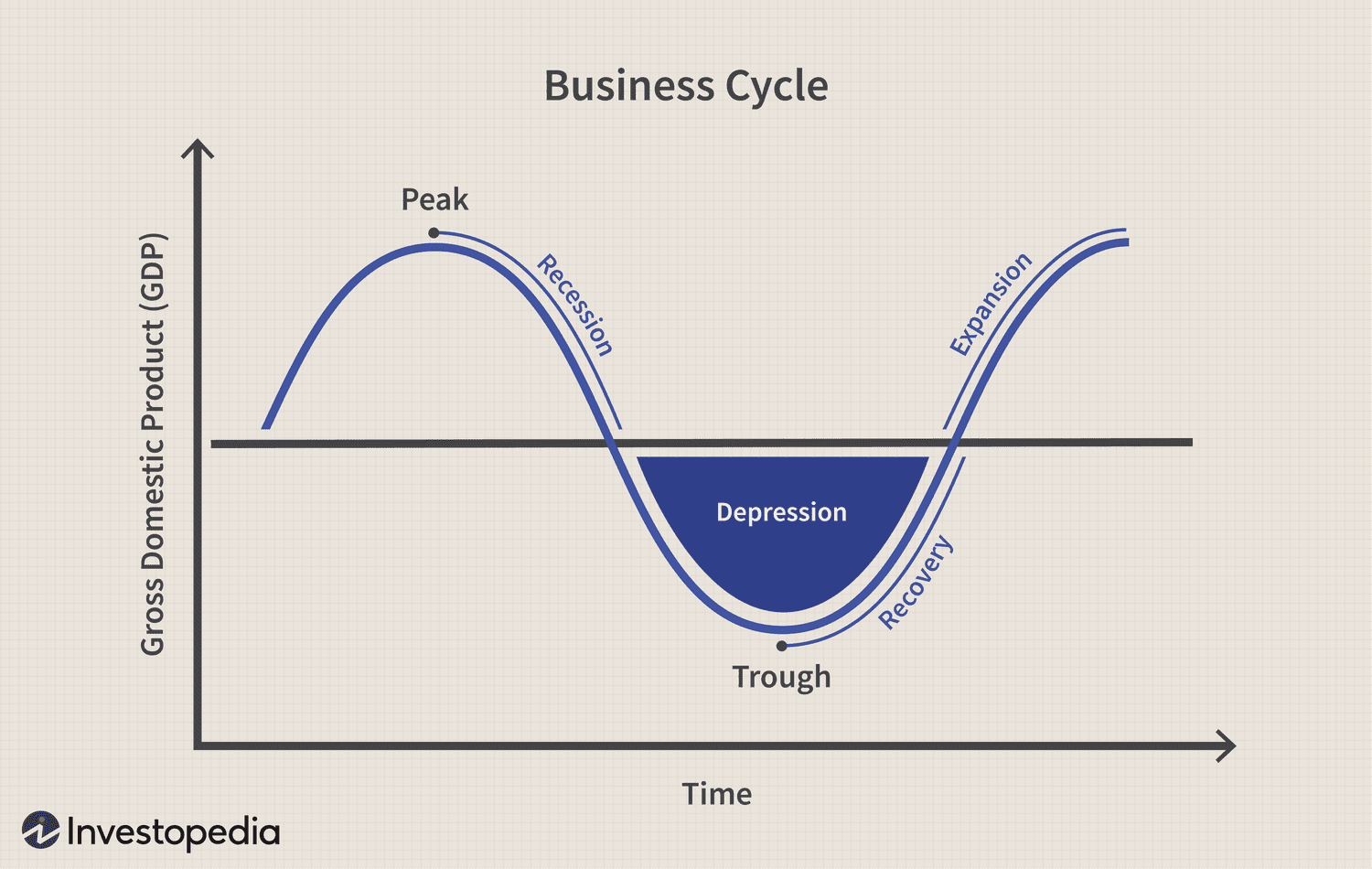

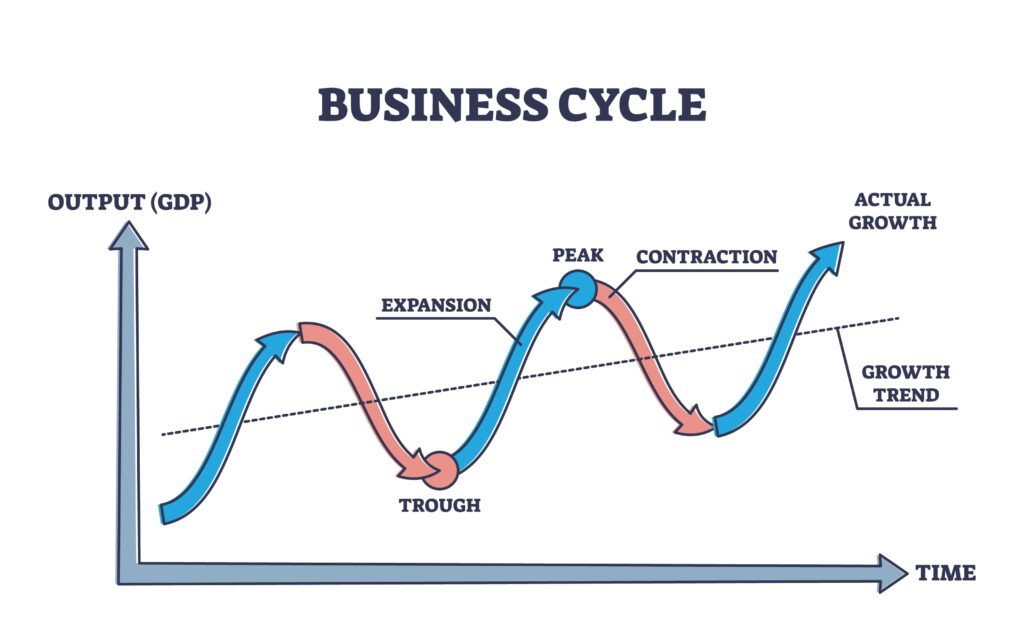

Business Cycle

a graph used to show the overall state of the economy

14

New cards

Expansion

phase of economic growth in the business cycle where unemployment is low, GDP is growing, incomes and consumer spending is growing, etc.

15

New cards

Peak

turning point in the business cycle where expansion levels off and the economy begins to contract or shrink.

16

New cards

Contraction/Recession

phase in the business cycle where the economy is declining/shrinking. GDP is lowering, unemployment is rising, etc.

17

New cards

Depression

severe recession phase in a business cycle that can last for years and can have a global impact. Ex: the Great Depression lasted for 10 years.

18

New cards

Trough

turning point in business cycle where recession/contraction is ending and the economy will soon expand again.

19

New cards

Growth Trend

natural rate of GDP growth overtime in an economy. This is the rate of growth that we want the economy to have.

20

New cards

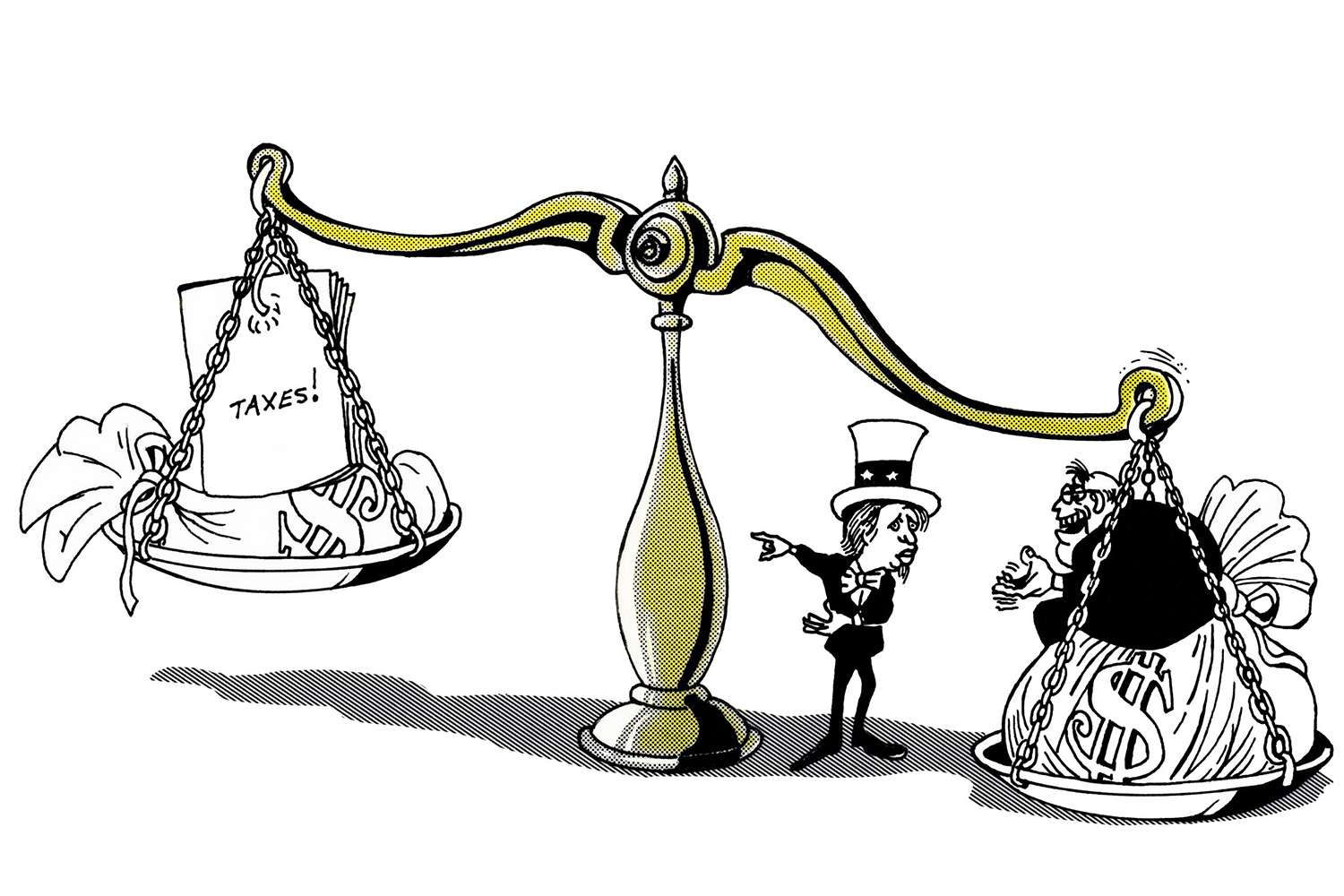

Fiscal Policy

When government uses taxes and government spending to influence the economy

21

New cards

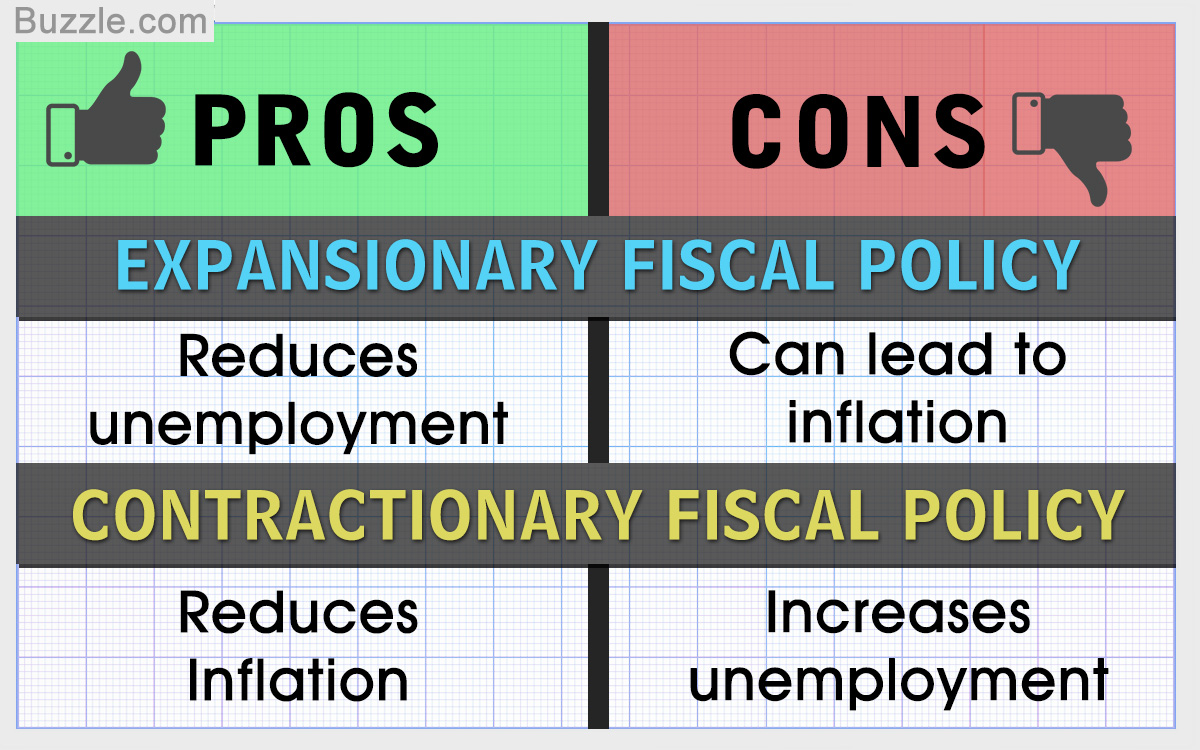

Expansionary Fiscal Policy

When government increases spending and/or decreases taxes to help end a recession and grow the economy

22

New cards

Contractionary Fiscal Policy

When government decreases spending and/or increases taxes to slow down the economy and lower high inflation

23

New cards

Stimulus

money that the government gives to individuals or businesses to help “stimulate” (jumpstart) the economy

24

New cards

Monetary Policy

When Federal Reserve uses the money supply and interest rates to influence the economy

25

New cards

Federal Reserve/Fed

the central bank of the United States government

26

New cards

Expansionary Monetary Policy

When the Federal Reserve decreases interest rates and increases the money supply to help boost consumer spending during a recession. Increases inflation.

27

New cards

Contractionary Monetary Policy

When the Federal Reserve increases interest rates and decreases the money supply to help slow economic growth and lower inflation

28

New cards

Banks

institutions that distribute funds from those who deposit money into the bank to those who borrow money in the form of loans.

29

New cards

Labor Unions

an organization made up of workers in a particular field that try to promote higher pay, better working conditions, etc.

30

New cards

Wall Street

The street where the New York Stock Exchange (world’s largest stock market) is located.

31

New cards

U.S. Mint

The institution that produces all American coins including collector’s coins