consumer, producers, taxes, subsidies, market✅

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

20 Terms

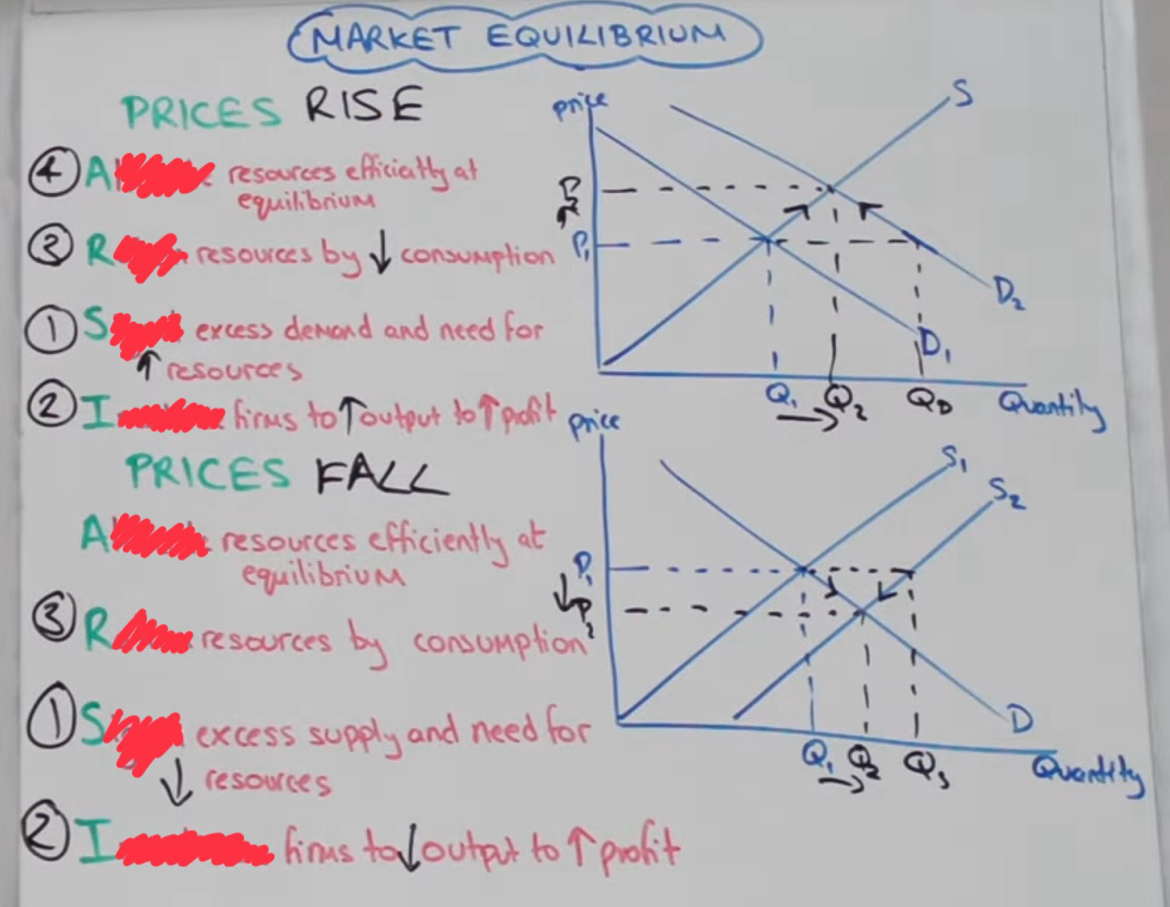

What is market equilibrium

A state where the forces of supply and demand are in balance leading to stability in prices and quantities exchanged in the market

Disequilibrium where price is too high..

Means low demand and excess supply, which leads to a surplus

Disequilibrium where price is too low..

Means low supply and excess demand, which leads to a shortage

What does the price mechanism do

Uses the forces of supply and demand to allocate resources and determine prices in a market economy

ARSI

Allocate

Ration

Signal

Incentivise

Producer surplus

Difference between the price producers are willing and able to supply a product for and the price they receive in the market

Consumer surplus

Difference between the price consumers are willing and able to pay for a product and the total amount they do pay

Producer and consumer surplus

Where do you find producer surplus on a diagram

The area above the supply curve and below the market pice

Where do you find consumer surplus on a diagram

The area below the demand curve and above the market price

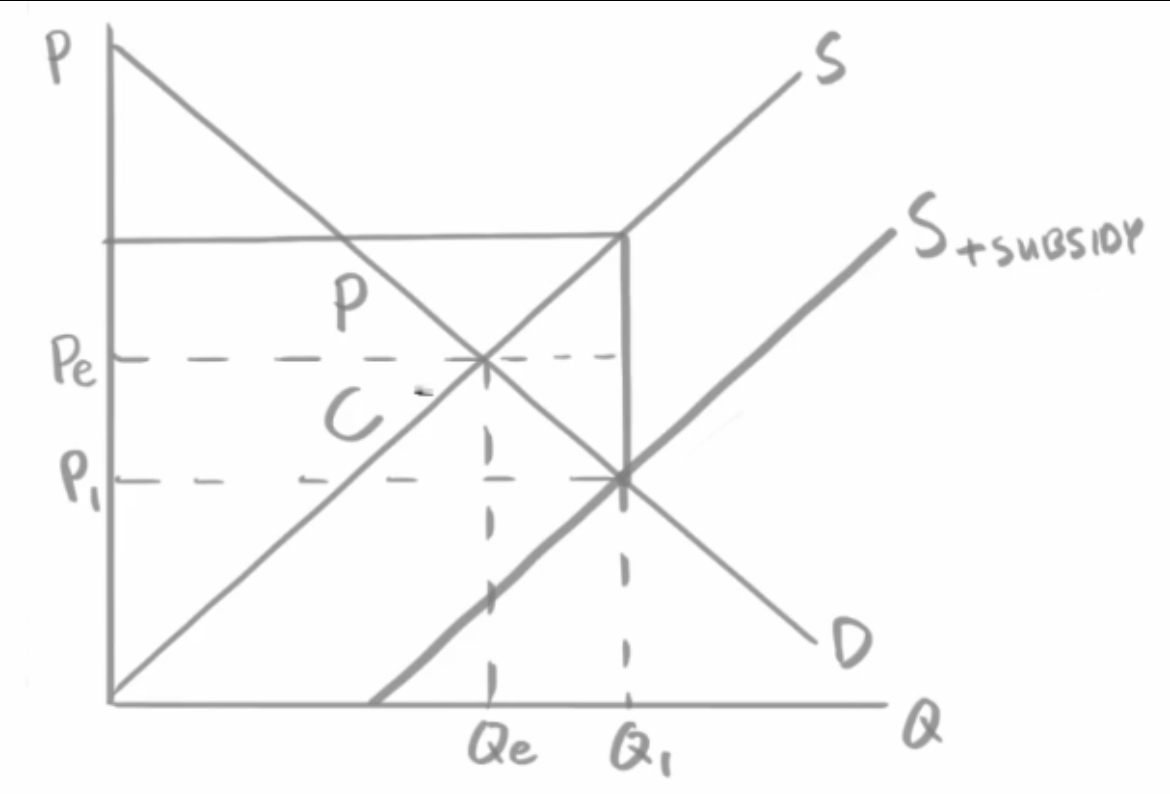

Subsidy

A form of government support (mostly financial) offered to producers and occasionally consumers

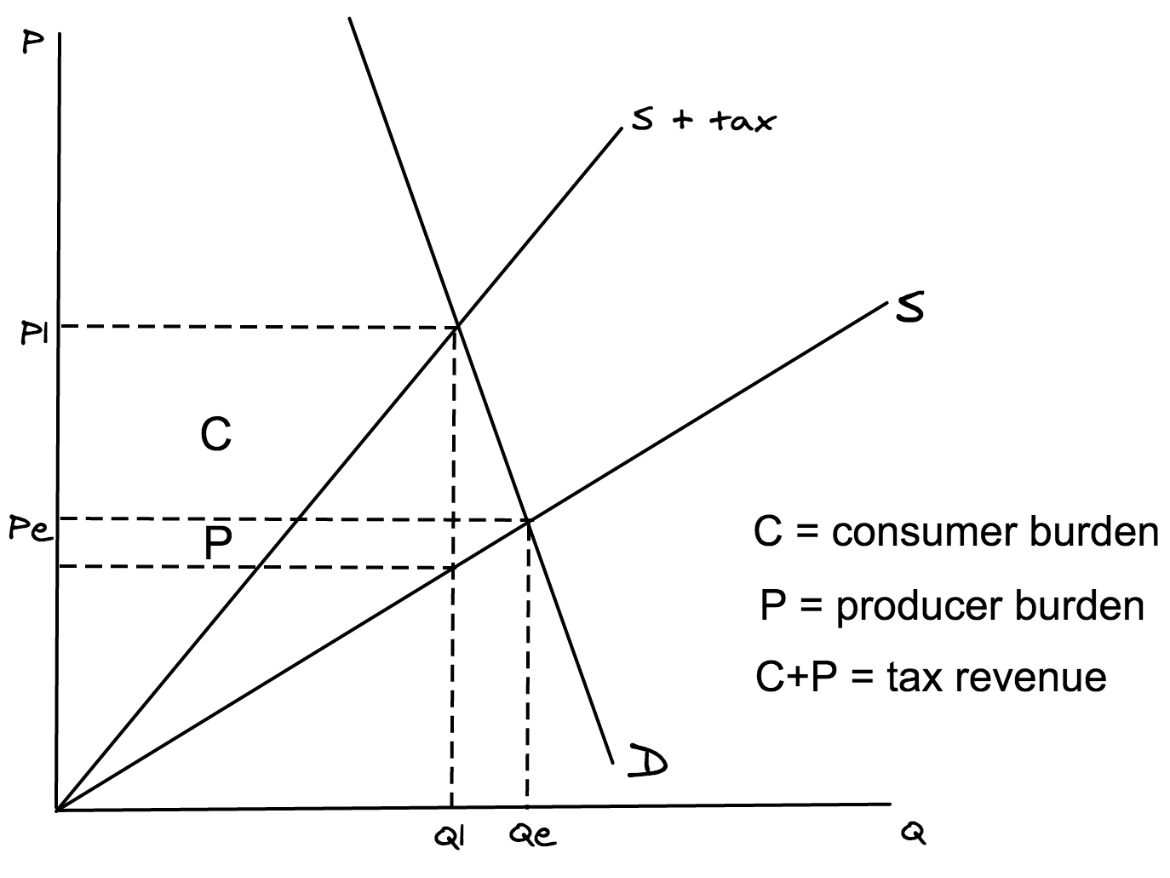

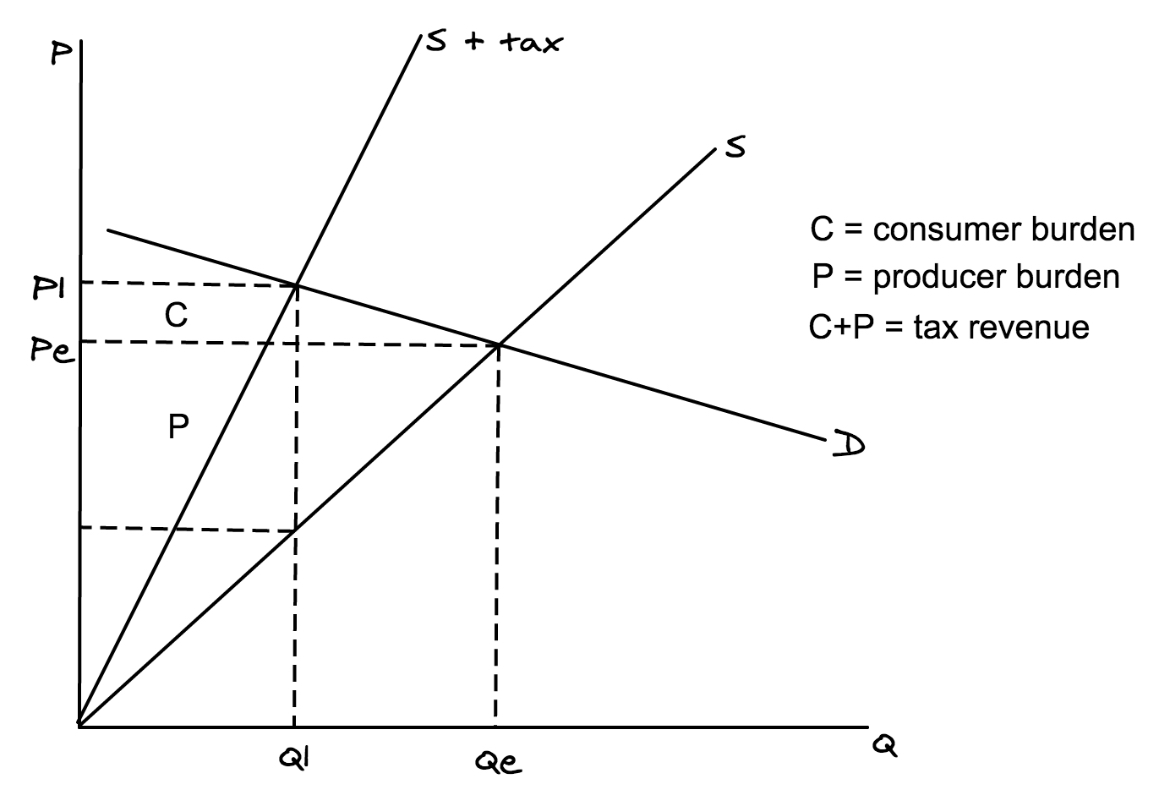

Indirect tax

A tax imposed by the government that increases the supply costs for producers

Two types of indirect tax

Specific

Ad valorem

Ad valorem tax

A tax charged as a % of the price of a good e.g. VAT

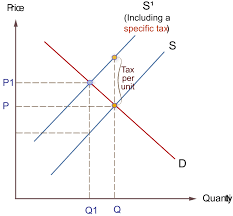

Specific tax

A fixed amount of tax paid on each unit sold

Subsidy on a diagram

Ad valorem tax with inelastic demand

CB is bigger than PB because demand is more inelastic than supply, so producers pass on most of the tax to consumers through higher prices

Ad valorem tax with elastic demand

CB is smaller than PB because demand is more elastic than supply, so producers can’t pass on too much of the tax onto consumers as they’ll lose to many sales

Specific tax on a diagram

Regressive tax

Tax imposed by a government which takes a high % of income from those on low incomes