IQ #4

1/85

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

86 Terms

Chapter 7

Revenue and Collection Cycle

basic activities in revenue and collection cycle

(1) receiving and processing customer orders, including credit approval

(2) delivering goods/services to customers

(3) billing customers and accounting for AR

(4) collecting and depositing cash received from customers

(1.) receiving and processing customer orders;

If these controls fail,

orders might process for fictitious customers

Credit might be approved for bad credit risks

Shipping docs might be created for goods that DNE in inventory

(2.) delivering goods and services to customers

Physical custody of inv goods start in warehouse

Custody is transferred to shipping order that permits inv clerk to release goods to the shipping department

bill of lading

form that the carrier signs to verify that the goods are shipped.

packing slip

describes the goods being shipped, and the quantity of goods shipped, is often included with the shipment.

(3.) billing customers and accounting for AR

When delivery is complete the transaction is completed by filing a shipment record and preparing final invoice

Sales invoice is the bill sent to the customer that indicates the amount due and the payment terms.

when auditing the revenue and collection cycle, auditors normally select balances to confirm from

accounts receivable listing

using the audit risk model

(1.) Set audit risk at desired levels (normally, low).

(2.) Assess risk of material misstatement

2a) Inherent Risk? Note that AS 2110 indicates that the auditor should [presume that there is a fraud risk involving improper revenue recognition.

2b.) control risk?

(3.) Set detection risk at the significant account and assertion level based on the level of audit risk and risk of material misstatement.

audit risk is manifested when

material misstatement enters the financial reporting process (inherent risk)

that the client's internal controls do not prevent or detect (control risk) and

that auditors substantive procedures do not detect

(detection risk)

test of operating effectiveness of internal control

if a control is missing or ineffective, RMM increases but an error or fraud is by no means certain

internal controls are designed to

reduce RMM by preventing or detecting errors and fraud

types of risk in the revenue cycle

Improper revenue recognition

Fictitious sales

Returns and allowances

Collectability of receivables

Revenue Recognition must be

1. earned and 2. realized or realizable

revenues are normally earned when

the company has substantially accomplished what it must to be entitled to the benefits

SEC guidance (SAB 104)

-Persuasive evidence of an arrangement exists

-Delivery has occurred or services have been rendered

-The seller's price to the buyer is fixed or determinable

-Collectibility is reasonably assured

ASC 606 5-step process

1. identify the contract with customer

2. identify the performance obligations

3. determine the transaction price

4. allocate the transaction price to POs

5. recognize revenue when the entity satisfies a PO

As we have more POs then

this increases inherent risk

Revenue and its relevant assertions

Occurrence

Completeness

Cutoff

Revenue and Occurrence

WCGW?

- overstate sales by adding fictitious transactions or inflating actual sales

INTERNAL CONTROL ACTIVITY

- invoice are supported by bill of lading

TEST OF CONTROL

- vouch sales to invoices, supporting shipping docs

Revenue and completeness

WCGW?

- not all sales recorded

INTERNAL CONTROL ACTIVITY

- invoice, shipping docs, orders are prenumbered and checked

TEST OF CONTROL

- scan docs and trace shipping do to recording in sales detail file

Revenue and Cutoff

WCGW?

- sales recorded in incorrect period

INTERNAL CONTROL ACTIVITY

- date of shipping doc is compared to invoice date

TEST OF CONTROL

- trace shipping date to sales invoice date and FOB item

key control procedures of the revenue and collection cycle

SEPERATION OF DUTITES

Recording, authorization, custody

Recording

- adequate documents and records

bill of lading, invoices

- Independent checks on performance

monthly stmt to customer

Authorization

authorization of transactions

- write offs

- EDI transactions

- perform credit checks

- pricing

Custody

access to assets

- shipping department

- lock box

internal control activities and design evaluation

The question an auditor should ask is, "Has the audit client designed and implemented a control that, if operating effectively, would mitigate the identified risk of material misstatement? Would it prevent or detect the material misstatement?" TOP DOWN PROCESS

three way match

1. customer actually places the order (invoice)

- reduces the risk of fictitious sales

2. company has shipped the goods (agree to shipping docs)

- ensures revenue is earned

3. customer has been billed properly (agree to purchase order)

- supports accuracy and completeness

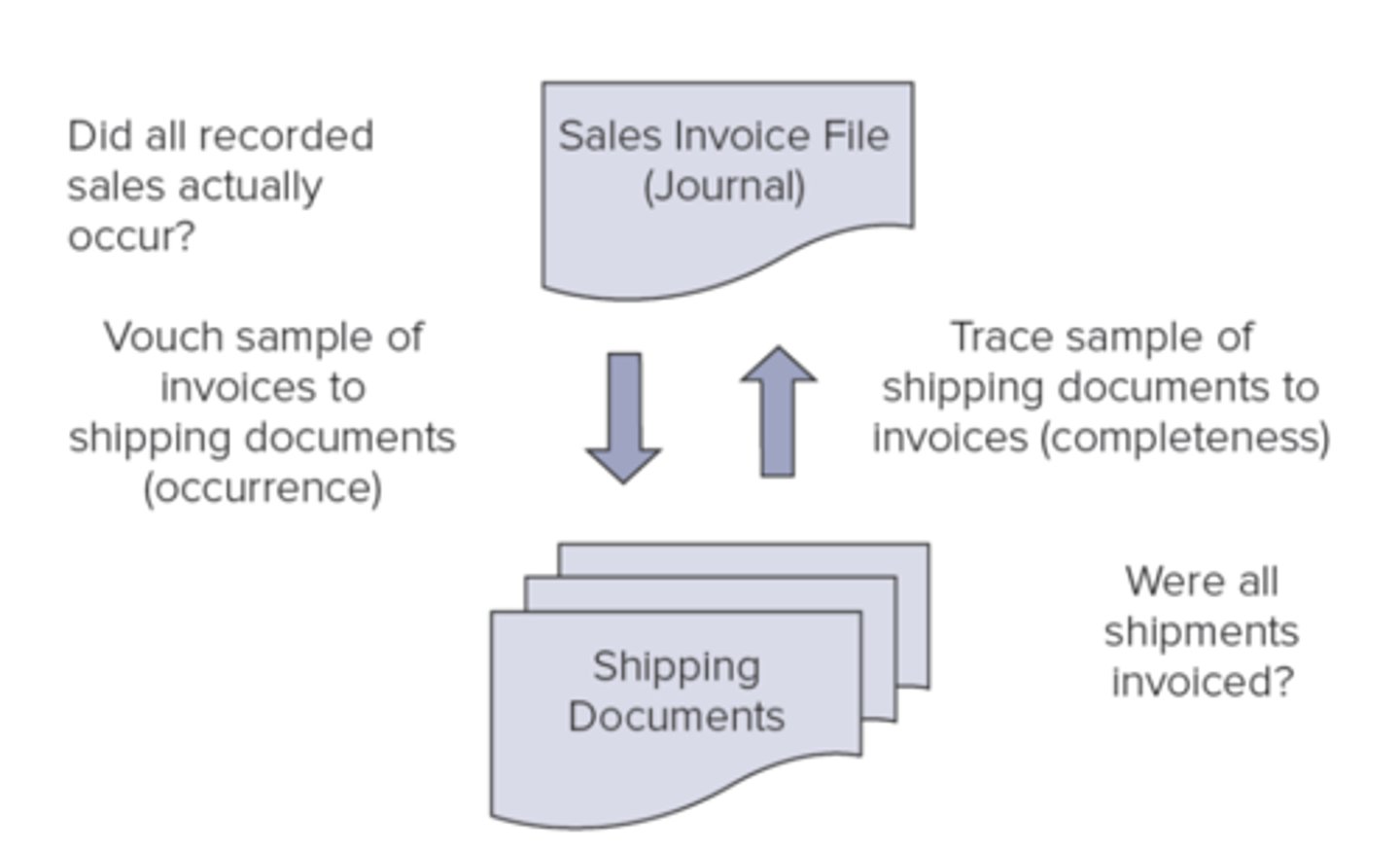

Dual direction of a test sample

substantive procedures

audit tests that directly evaluate the accuracy and completeness of fin stmt balances, help auditors detect material misstatements, either error or fraud.

substantive procedures include

tests of details

- directly examining documents, evidence, confirmations

substantive analytical procedures

- studying relationships among data

Auditing Accounts Receivable

- test reconciliations

- perform substantive analytical procedures

- send confirmations

- test sales cut-off

- analyze the ADA

- fill our presentation and disclosure checklists

Accounts Receivable and their relevant assertions

Existence

Completeness

Valuation

AR Existence

- start at the general ledger -- test reconciliation

- select from A/R listing -- send confirmations

- evaluate confirmation replies

- perform alternate tests for no-replies

using confirmations

-Primarily for verifying EXISTENCE.

Factors likely to affect the reliability of confirmations

-Previous audit experience

-Intended recipient of the confirmation

-Type of information being confirmed

-->The auditor may confirm entire BALANCES or individual TRANSACTIONS.

-Type of confirmation being sent

Types of confirmations

- Positive Confirmations

- Negative Confirmations

- Blank Confirmations

positive confirmation

request indicating balance is correct or not

negative confrimations

- requests response only if something is wrong

blank confirmations

confirmation does not contain balance, customer use fill it in themselves

- dont tell counterparty amount, they tell you: valuation

circumstances that could justify the omission of the confirmation of a client's accounts receivable

- not material to fin stmt

- if RMM is low

- may be inefficient

- expected to be ineffective (based on previous years

other matters related to confirmations

- confirmations returned by the post office as non-deliverable MUST be investigated

- auditors should follow up on electronic responses

Non-response to Positive/blank confirmation requests

follow up 2nd or 3rd time

alternative procedures

follow-up on all exceptions

alternative procedures to non response

- vouch cash collections

- examine shipping documents

- examine client- generated supporting documents

- invoices

- inspect correspondence files

exception testing

designed to identify a violation of a particular control activity through the use of an automated test procedure designed to test all items in a population

uncollectible accounts

•Inspect customer files for collectability

•Recalculate allowance and bad debt expense

•Verify reasonableness of allowance and bad debt expense

•Inspect documentation for appropriateness of accounts written off

-Inspect documentation for additional collection procedures

-Inspect documentation for appropriate authorization

valuation -- presented at collectible amounts

- obtain, examine ages trial balance

- evaluate significantly past due items

- consider confirmation replies/disputes/exceptions

- analyze write-off trends/ turnover

analytical procedures for sales revenue

-Comparisons with previous periods

-Comparisons with industry

analytical procedures for allowance for doubtful accounts, bad debt expense

- compare bad debt exp as percentage of sales to previous periods

- compare ADA as percentage to gross receivables to previous periods

BEST substantive evidence, because last years estimates

analytical procedures for accounts receivable

compare AR turnover to previous periods

Sales cutoff procedures

1. Used to verify whether Revenues are recorded in the CORRECT ACCOUNTING PERIOD.

--"Holding the books open" (could be legit or not: can finish finalizing sales from end of DEC vs holding open til they get the sales they need)

2. Examine SALES INVOICES and SHIPPING DOCUMENTS shortly prior to and after year-end.

3. Examine returns after year-end.

Revenue -- detail tests of cutoff

control procedure “credit sales approved by credit department” is related which assertion

Accuracy; Credit approval helps ensure that the sale will be collectible

An unexplained decrease in ratio of gross profit to sales may suggest

unrecorded sales;

Which of the following responses to an accounts receivable confirmation at December 31 would cause an audit team the most concern

“These goods were returned for credit on November 15.”

Audit documentation often includes a client-prepared, aged trial balance of accounts receivable as of the balance sheet date. The audit team uses this aging primarily to

Estimate credit losses.

In the audit of accounts receivable, the most important emphasis should be on the

Existence assertion.

Chapter 8

Acquisition and Expenditure Cycle

three ways to recognize expenses

1. when they can be matched with related revenues and those revenues are recognized

- cogs with sales

2. in the period they are incurred

- utility bills

3. when they are allocated to future periods benefited by a "systematic and rational" process (depreciation)

- machinery

Typical activities of acquisition and expenditure cycle

1. purchase goods and services

2. receiving the goods or services

3. recording the asset or exp and related liability

? paying the invoice through the cash disbursement process

1. purchase goods and services

- requests items by sending purchase requisition

- department requesting purchase of items prepares a Purchase Order

- tiered authorization

2. receiving the goods or services

- when goods arrive, supplier will have bill of lading

- After vendor approval, goods are received by company and evidenced by preparing a RECEIVING REPORT

3. Recording the Asset or Expense and Related Liability

- AP is recorded when purchaser received goods

- AP department attached a voucher

- vendor bills company for goods using vendor's invoice

voucher

package of documents that contains supporting documents for a transaction

example is purchase voucher

contains

- purchase requisition

- purchase order

- receiving report

- vendor invoice

- negotiable check

"think folder or binder"

liabilities are not recorded until

receiving reports have been matched to purchase, orders, and invoices

- when there's a problem, liability is delayed or not recorded --> overstating profits, understates costs

recognition of rebates, refunds, and price agreements

GAAP requires allocation over the period of benefit

using audit risk model

(1.) Set audit risk at desired levels (normally, low).

(2.) Assess RMM

(3.) inherent risk?

- unrecorded liabilities

- capitalizing expenses (R&D)

- transactions with related parties

(3.) Set detection risk at the significant account and assertion level based on the level of audit risk and risk of material

LOW AR = HIGH IR HIGH CR LOW DR

Relative assertions risks to expenditures

- existence/occurrence

MODERATE RISK both

- completeness and cutoff

HIGH RISK both

- valuation and accuracy

MODERATE liab, HIGH exp

- presentation and disclosure

HIGH exp

overstated expenses can relate to

over-accruals and embezzlements

understated liabilities often associated with

earnings management and debt covenants

control procedures for separation of duties

1. authorization of purchase is done by purchasing department

2. custody of inventory is help by receiving department

3. transactions recorded by general acct and accounts payable department

4. reconcile liabilities to customer stmts and general ledger

audit evidence in management reports and data files

- open purchase orders

- unmatched receiving reports

- unmatched vendor invoices

exhibit 8.7 dual direction of tests

add image

the completeness assertion

search for unrecorded liabilities

- inquire about procedures for identifying and recording liabilities

- scan open purchase order file

- examine

- unmatched vendor stmts or invoices

- unmatched receiving reports

- trace unpaid vouchers in AP ledger

- confirm AP with normal suppliers

- review cash disbursements

auditing PPE

- small number of transactions --> high dollar transactions

- authorization of acquisitions and disposals (board of directors)

- less concern for access to assets

- unrecorded disposals

auditing PPE: depreciation expense

- recalculate and evaluate reasonableness of useful life, salvage value, cost, and method

- depreciation has to be consistent with company policy and across years

auditing cost and expense accounts

- analytical procedures

- agree to related balance sheet account

- substantive tests of transactions

- vouch detail

accrued liabilities

Major differences between accrued liabilities and accounts payable (Examples include interest, property taxes, wages, and income taxes payable. These payables are not normally invoiced or evidenced by the receipt of goods (LACK OF INVOICE)).

- These differences may make it more difficult to detect unrecorded accruals.

auditing accrued liabilities and prepaid expenses

- agree balances to prior year work papers

- verify payments

- examine underlying agreements

- recalculate amounts

- search for unrecorded accruals

- analytical procedures

12 MONTHS AND ONLY 12 MONTHS RECORDED

income taxes payable

complex area; requires tax specialist

- vouch payments

- examine correspondence with gov agencies

- follow stnds for auditing estimates

- usually finalized towards very end of audit

Fraud in Accounts Payable

•Inspect invoices in files for photocopies

•Inspect vendor's invoices submitted in numerical order

•Inspect vendor's invoices that are always in round numbers

•Scan vendor's invoices for invoices that are always slightly lower than a review threshold

•Scan vendor invoices for vendors with only post office box addresses

•Scan vendor invoices for invoices with no listed telephone number

•Match vendor and employee address and telephone numbers

•Scan multiple vendors at the same address and telephone number

•Vouch a sample of vendor invoices to the approved vendor list

•Review invoices for addresses of the local mail drops

purchase cutoffs

- verify cut offs for purchases

- examine receiving reports and vendor sales invoices occurring around year-end to ensure inventory received is included in the appropriate period

An audit team would most likely examine the detail support for charges to which of the following accounts?

Legal advice; The auditor examines the specific charges to determine potential litigation.

When auditing account balances of liabilities, auditors are most concerned with management’s assertion about

Completeness; The hiding of

liabilities is a primary concern for all auditors in the liability and expense areas.

Supplies expense is generally audited in connection with supplies inventory.

Which of the following tests of details most likely would help an auditor determine whether accounts payable have been misstated?

Examining vendor statements for amounts not reported as purchases.