Unit 5: Economic Performance and Challenges

1/62

Earn XP

Description and Tags

Merged flashcards from several presentations of Unit 5 in an Economics class.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

63 Terms

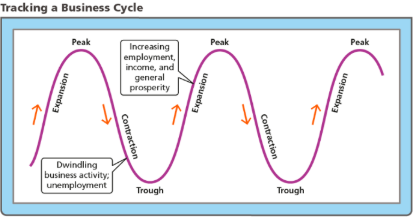

Business cycle

The alternation between economic downturns, known as recessions, and economic upturns, known as expansions

Often affected by specific economic variables that bring about the next phase; however, forecasting is difficult

Business investment

Factor in the business cycle where businesses spend more money, increasing GDP and economic expansion

Office buildings are one manifestation of this

Credit cost

Factor in the business cycle describing the cost of borrowing money

Higher levels of this may result in decreased consumer spending or business investment

External shocks

Factor in the business cycle describing those outside of a business’s control that positively or negatively affect growth

Wars and global pandemics are examples of this

Consumer expectations

Factor in the business cycle describing predictions made by consumers about the future that affect present spending

Recessions

Periods of economic downturn when output and employment are falling with dwindling business activity

Defined as 2 consecutive quarters of falling real GDP

Usually lasts from 6 to 18 months with 6 to 10 percent unemployment

Depressions

Deep and prolonged downturns

No precise definition; usually defined as a recession with high unemployment and low economic output

Stagflation

A decline in real GDP (output) combined with a rise in the price level (inflation)

Expansions

Periods of economic upturn when output and employment are rising with general prosperity

Measured by a rise in real GDP

Peak

The time when real GDP stops rising and the economy has reached the height of an economic expansion

Unemployment and inflation are low

Contraction

The time after a peak marked by a decline in falling real GDP and higher unemployment

Trough

The time after a contraction when the economy has “bottomed out” as real GDP stops falling and expansion begins

Growth

Factor in the economy that allows for more and better goods over time, improving the standard of living

Most commonly measured by the change in real GDP over time

Real GDP

Measurement of GDP accounting for inflation

Must grow as fast as the population does for definite growth; shown in the measurement of this per capita

Can exclude other factors in life quality, such as stress, wealth distribution, or environmental state

Productivity

The engine for economic growth and rising real GDP

Allows for greater output per worker with better skills, capital, or technology

Capital deepening

Increasing the capital-to-worker ratio to allow for more productivity per worker; can be seen through investments in human and physical capital

Human capital

Capital that includes education, training, and experience for people

Physical capital

Capital that includes tools, machines, and equipment for people

Savings

Money set aside for later

Allows for greater capital deepening as financial intermediaries support investments in facilities and equipment

Promoted by many nations to raise GDP and standards of living

Capital formation

The saving and investment cycle that creates more money within the economy as loans are made

Taxation

Power a government has to influence capital formation

Higher levels on individuals lead to less disposable income and lower savings rates

Using this for infrastructure allows for greater growth over time, though

Infrastructure

Public goods that a government invests in with tax money for increased trade or productivity

Technological progress

A driver of economic growth that allows for greater efficiency without increasing the number of inputs used; driven through:

Research and innovation patents

Innovation incentives

Education and experience adoption

Resource scarcity for better methods

Can be measured through growth not attributable to capital or labor

Scientific research

Research that generates new or improved production techniques, improved physical capital, and better goods and services

Innovation

Activity that leads to higher output, boosted GDP, and greater business profits

Often requires research; this can be enabled by government-sanctioned monopolies

Unemployment

The state of not being employed; can be both an individual and nationwide issue

Tracked by economists to aid economic reccovery or growth

A zero percent rate is impossible due to the three types of this having at least some people

Structural unemployment

Unemployment created or depleted by changes in the economy, such as those in the telecommunications or healthcare sector

Results from industrial reorganization or technological change

Skills, location, or wage demands typically mismatch the requirements of the job

Job training

A way to address structural unemployment, allowing workers to gain skills in response to structural changes

However, this takes time and does not ensure high-wage jobs

Collective bargaining

Union activity that negotiates on behalf of all workers

Labor strike

Union activity that results in a collective refusal to work

Labor union

Organization within a place of employment that can raise wages or benefits

While this is good for workers, it can also cause structural unemployment as higher wages create surpluses

Frictional unemployment

Unemployment created by the constant changes in the workforce

Measured as the time workers spend searching for work — always exists with searches for a first or better job

Is typically brief in periods of low unemployment

Cyclical unemployment

Unemployment that relates to the trends in growth and production that occur within the business cycle

Minimized during business peaks as output is maximized

May grow during recessions where workers are laid off

Natural rate of unemployment

The rate of employment that arises from the effects of frictional and structural unemployment

Is inevitable as the minimum rate that the actual rate fluctuates around

Is never zero

Full employment

The rate of unemployment when cyclical unemployment does not exist, ignoring the natural rate of unemployment

Seasonal unemployment

Unemployment that occurs when industries slow or shut down for seasonal shifts in production schedules, such as in harvesting industries or holiday seasons

Typical part of a healthy economy

Labor force

The total amount of people who are employed and unemployed but looking for a job in a country

Unemployment rate

The percentage of people in the labor force who are unemployed

Determined by the Bureau of Labor Statistics through a monthly household survey of 60,000 families

Adjusted for seasonal unemployment for more accurate comparisons across months, but can vary across different demographic groups

Rises during recessions and falls during expansions

Discouraged workers

Workers who could work but have given up seeking employment due to the state of the job market

Not counted in the unemployment rate; this may lead to an understatement in the amount of people who want to work but are unable to find jobs

Marginally attached workers

Workers who would like to be employed and have looked for a job in the past but are not currently looking for work

Underemployed workers

People who would like to work more hours than they do or are overqualified for their jobs

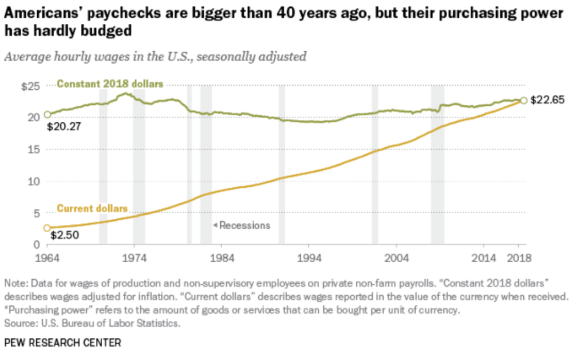

Inflation

The rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising

Leads to a decline of the purchasing power of a given currency over time

Deflation

The general decline of the price level of goods and services

Associated with a contraction in the supply of money and credit, but prices can also fall due to increased productivity and technological improvements

Aggregate price level

A measure of the overall level of prices in an economy

Consumption bundle

A typical group of goods and services purchased by customers

Market basket

A hypothetical consumption bundle used to measure changes in the overall price level

Revised approximately every decade to reflect shifts in consumer purchasing behavior

Price index

A way of measuring how the average price of a standard group of goods changes over time

Helps consumers and businesses make economic decisions

Aids governments in making policy decisions, such as in setting interest rates to ease inflation

Base year

A year arbitrarily chosen for comparison when calculating a price index, which compares the price of the market basket of goods in a given year to its price in this

Inflation rate

Calculated as the annual percentage change in an official price index

Can lead to workers or pensioners losing money if income does not keep up with this

Consumer price index (CPI)

Measures the cost of a market basket of a typical urban American family

Calculated by the Bureau of Labor Statistics by surveying 23,000 retail outlets in 87 cities, tabulating over 80,000 prices per month for an overall weighted average

Used to evaluate changes in the cost of living as well as the rate of inflation or deflation; is thus used to index the price of certain goods or payments like Social Security

However, it can ignore technological improvements or households moving away from a good due to price increases

Producer price index (PPI)

Measures the cost of a typical basket of goods and services purchased by producers

Usually moves in tandem with other measures of inflation

Money supply

One of the factors of inflation describing a rise in the supply of a currency without a matching rise in the production of goods and services

Prices thus rise due to heightened demand for a limited supply of products, reducing purchasing power

Quantity theory of money

Believes that the value of money and resulting inflation are caused by the supply and demand of the currency

Wage-price spiral

Phenomenon that states that employers providing higher wages lead to higher costs, leading to higher overall prices and thus a need for even higher wages

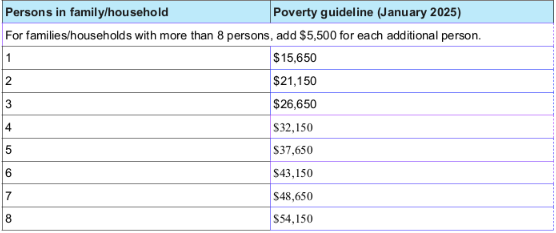

Poverty threshold

The income below which income is insufficient to support a family or household

This measurement was developed in the mid-1960s, derived from the cost of a minimum nutritional food diet for temporary or emergency use multiplied by three

Varies with the size of the family; applies to each person if counted

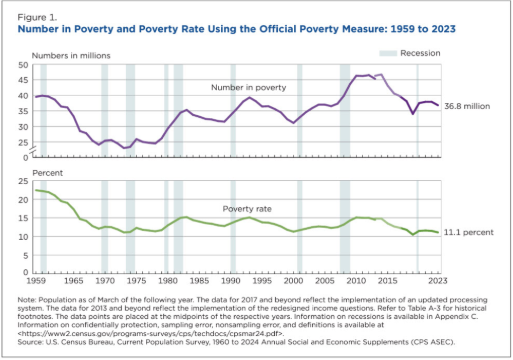

Poverty rate

The percentage of people who live in households with income below the official poverty threshold

Differs sharply by group, with minorities, children, residents in inner cities, and women being the largest groups in poverty

Working poor

People who have a job but also have low wages or a limited work schedule

Poverty causes

Includes:

Unemployment or underemployment

Family structure shifts

Geographical location (more common in inner cities, rural areas)

Unequal treatment or opportunity

Globalization and relocation of jobs

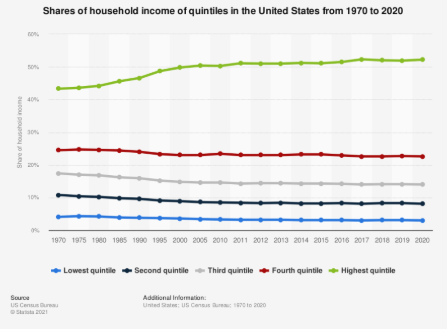

Income distribution

The way income is distributed throughout a country

In the United States, most growth and income is skewed to the top 5 to 20%, leading to a shrinking middle class and greater skill, inheritance, and field differences

Measures of this, however, can ignore tax and transfer program impacts

Wage increases

Limited in the United States due to inflation and rising benefit costs

Earned Income Tax Credit (EITC)

Refundable federal tax credit aimed at supporting low and moderate-income families with children

Allows recipients with earned income to recieve a payment even if they owe no income tax, boosting earnings and reducing poverty

Temporary Assistance for Needy Families (TANF)

Means-tested, time-limited cash assistance program for very low-income families with children

Funded by a federal grant and run by the states, providing short-term help, job preparation, and familial stability

Federal lifetime limit of 60 months with work participation often required for funds

Supplemental Nutrition Assistance Program (SNAP)

Program that offers monthly grocery benefits to low income individuals and families, provided via an EBT card accepted at most supermarkets and numerous farmers’ markets

Eligibility determined based on household income and size, with certain provisions allowing certain non-citizens and students to qualify under particular conditions

Amounts are calculated to supply enough funds to afford nutrient-rich foods and beverages