CSC 2 Chapter 16: The Portfolio Management Process

1/45

Earn XP

Description and Tags

Canadian Securities Course 2 Chapter 16 Flashcards

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

46 Terms

What is portfolio management?

Portfolio management is managing investments to meet specified objectives, involving the selection and oversight of a mix of assets to achieve desired risk and return profiles.

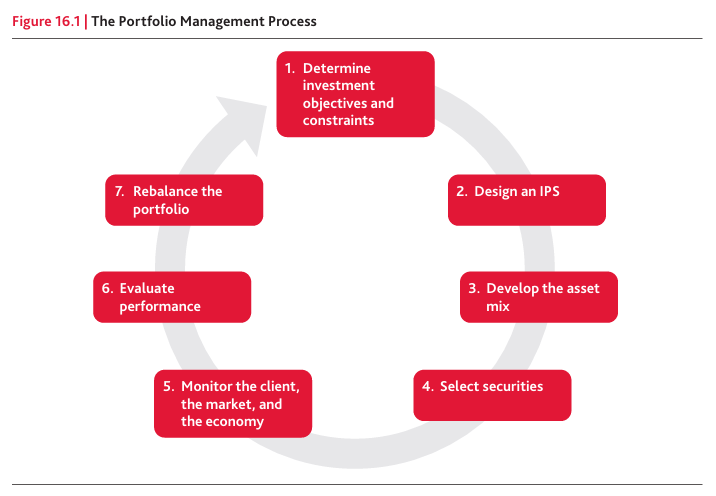

What are the 7 Steps of the Portfolio Management Process?

What is Step 1 in the 7 Steps of the Portfolio Management Process?

Define investment objectives and constraints

Step 1: Determine Investment Objectives and Constraints

What is the 3 primary investment components that comprises an investor’s objectives?

Safety of Principal (perservation of capital)

Income

Growth of capital (capital gains

Step 1: Determine Investment Objectives and Constraints

What is the goal of “Safety of principal”?

The goal of "Safety of principal" is to preserve the initial investment amount, minimizing the risk of loss.

Step 1: Determine Investment Objectives and Constraints

What is the goal of “Income”?

The goal of "Income" is to generate a steady stream of cash flow through dividends, interest, or other forms of income, providing regular returns to the investor.

Step 1: Determine Investment Objectives and Constraints

What is the goal of “Growth of capital”

The goal of "Growth of capital" is to increase the value of the investment over time, often through capital gains, enabling the investor to build wealth and outpace inflation.

Step 1: Determine Investment Objectives and Constraints

What are the 2 secondary investment objectives?

Liquidity (or marketability)

Can sell the investment quickly for cash

Tax minimization

Choose investments with better tax treatment

Step 1: Determine Investment Objectives and Constraints

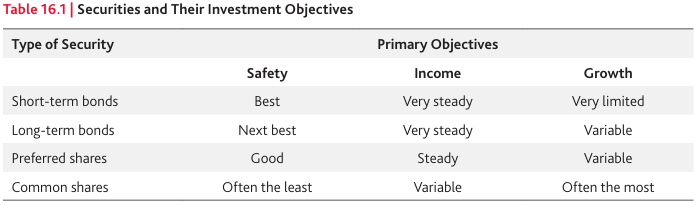

Here is a chart about Securities and Their Investment Objectives

Step 1: Determine Investment Objectives and Constraints

What is the 4 different risk categories?

Conserservative

Low risk; high capitalization; predictable earnings; high yield; high dividend payouts; lower price-to-earnings ratio; low price volatility

Growth

Medium risk; average capitalization, potential for above average growth in earnings; aggressive management; lower dividend payout; higher price-to-earnings ratio; potentially higher price volatility

Venture

High risk; low capitalization; limited earnings record; no dividends; price-to-earnings ratio of little significance, short operating history, highly volatile

Speculative

Maximum risk; shorter term; maximum price volatility, no earnings; no dividends; price-to-earnings ratio not significant

Step 1: Determine Investment Objectives and Constraints

What are the 5 investment constraints?

Time horizon

Liquidity requirements

Tax requirement

Legal and regulatory requirements

Unique circumstances

Step 1: Determine Investment Objectives and Constraints

What is time horizon?

The time horizon refers to the duration until a client requires access to their invested funds, encompassing various life events such as retirement or major expenditures that may alter investment strategies.

Step 1: Determine Investment Objectives and Constraints

What is liquidity requirements?

Liquidity requirements refer to the need for easy access to cash or cash-equivalent investments, ensuring that funds can be quickly converted without significant loss in value to meet short-term obligations or unexpected expenses.

Step 1: Determine Investment Objectives and Constraints

What is tax requirements?

Tax requirements refer to the considerations related to taxable income and capital gains, which influence investment choices to optimize post-tax returns and ensure compliance with tax laws.

Step 1: Determine Investment Objectives and Constraints

What is legal and regulatory requirements?

Legal and regulatory requirements refer to the legal frameworks and regulations governing investment practices that must be adhered to, including compliance with securities laws, fiduciary responsibilities, and any industry-specific guidelines that impact investment decisions.

Step 1: Determine Investment Objectives and Constraints

What is unique circumstances?

Unique circumstances may include such preferences as the desire for ethically and socially responsible investing. Or religious restrictions

What is Step 2 in the 7 Steps of the Porfolio Management Process?

Design an investment policy statement

Step 2: Design an Investment Policy Statement

What is the main point of Step 2?

An Investment Policy Statement (IPS) is a formal statement between the client and the portfolio manager. It gives clear rules on how the client’s money will be invested.

It guides the manager’s decisions

It ensures the portfolio reflects the client’s goals and risk tolerance

Step 2: Design an Investment Policy Statement

What are the Key components of an IPS

Invest Objectives & Constraints

Goals (e.g., growth, income, preservation)

Risk tolerance, time horizion, liquidity needs, legal/tax concerns

Asset Allocation

How much to invest in cash, fixed income, equities, etc

Rules & Guidelines

Operating procedures (how the portfolio is run)

Acceptable/Prohibited Investments

What is allowed or not (e.g., no derivatives or crypto)

Performance Appraisal Method

How results will be measured and reviewed

Review Schedule

When the portfolio will be checked and rebalanced

What is Step 3 in the 7 Steps of the Porfolio Management Process?

Develop the asset mix

Step 3: Develop the Asset Mix

How is the asset mix determined?

Client goals

Risk tolerance

Market conditions

Step 3: Develop the Asset Mix

What are the 3 main asset classes?

Cash

Fixed-Income Securities

Equity Securities

Step 3: Develop the Asset Mix

What securities are included in the Cash Asset class?

Money market funds

GICs

Short-term bonds (under 1 year)

Step 3: Develop the Asset Mix

What is the purpose of having Cash in your asset mix?

Cash is needed to pay for expenses and to capitalize on investment opprtunities, but is primarily used as a source of liquid fund in case of emergencies

Step 3: Develop the Asset Mix

What securities are included in the Fixed-Income Securities asset class?

Bonds due in more than 1 year

Strip bonds

Mortgage-backed securities

fixed-income exchange-traded funds

bond mutual funds

Preferred shares (technically a preferred share isn’t categoried in fixed-income, but it acts similar to it, Legally they are a equity security)

Step 3: Develop the Asset Mix

What is the purpose of having Fixed-income Security in your asset mix?

Primarily to produce income, but also to provide some safety of principal

Step 3: Develop the Asset Mix

What securities are included in the Equity Securities asset class?

Common shares

Equity exchange-traded funds

Equity mutual funds

Convertiable bonds

Convertible preferred shares

Step 3: Develop the Asset Mix

What is the purpose of having Equity Securities in you asset mix?

To generate capital gains, either through trading or long-term growth in value

Step 3: Develop the Asset Mix

What are some Other Asset Classes?

Collectibles, such as art or coins

Commodities, such as gold (which is considered a good hedge against inflation)

Derivatives

Hedge funds

Precious metals

Real estate

Step 3: Develop the Asset Mix

Here is a chart with the General Investment Strategies

Step 3: Develop the Asset Mix

What is the SINGLE most important step in structuring a portfolio?

Asset Allocation

Step 3: Develop the Asset Mix

What is Strategic Asset Allocation?

Long-term mix that the manager will adhere to through monitoring and, when necessary, reblancing

It guides the portfolio over time. Even when markets shift, this mix is your long-term goal

Step 3: Develop the Asset Mix

What is Ongoing Asset Allocation?

Reblance in a disciplined manner: you should act before the mix gets too far out of balance, while remaing conscious of transation costs

You would typically specify that an asset class much move more than a certain percentage - perhaps 5% - before rebalancing

Step 3: Develop the Asset Mix

What is Dynamic Asset Allocation?

This is a portoflio mangement technique that adjusts the asset mix to systematically rebalance the portfolio back to its long-term target or strategic asset mix by responding to changing market conditions and risk factors.

Step 3: Develop the Asset Mix

What is Tactical Asset Allocation?

Involves adjusting the asset mix based on short-term market forecasts or economic indicators. It allows for engaging in tactical shifts to take advantage of perceived market opportunities.

What is Step 4 in the 7 Steps of the Porfolio Management Process?

Select the Securities

Step 4: Select the Securities

What is the purpose of Step 4?

The purpose of Step 4 is to identify and choose specific securities that align with the asset mix determined in Step 3, ensuring that these selections fit within the overall investment strategy and risk tolerance of the portfolio.

What is Step 5 in the 7 Steps of the Portfolio Management Process?

Monitor the Client, the Market, the Economy

Step 5: Monitor the Client, the Market, the Economy

What is the purpose of monitoring the client?

The purpose of monitoring the client is to ensure that investment strategies remain aligned with the client's changing financial goals, risk tolerance, and personal circumstances, enabling timely adjustments to the portfolio as needed.

Life changes

Update the client profile as needed

Step 5: Monitor the Client, the Market, the Economy

What is the purpose of monitoring the market?

The purpose of monitoring the market is to track market trends, economic indicators, and overall financial conditions that may impact the portfolio's performance, allowing for informed adjustments to investment strategies.

Keep up with economic and market trends

Adjust the portfolio if market conditions shift

Step 5: Monitor the Client, the Market, the Economy

What is the purpose of monitoring the economy?

The purpose of monitoring the economy is to assess macroeconomic factors and indicators that influence investment performance, enabling portfolio adjustments based on economic conditions such as inflation, interest rates, and GDP growth.

Looks at forecasts (inflation, interest rates, GDP)

Use a range of estimates since predictions are not always exact

What is Step 6 in the 7 Steps of Portfolio Management Process?

Evaluate Portfolio Performance

Step 6: Evaluate Portfolio Performance

How would you evaluate a portfolio’s performance?

This involves analyzing the returns of the portfolio against benchmarks and objectives, assessing risk-adjusted performance, and ensuring alignment with the client’s financial goals.

Industry benchmarks (e.g., T-Bill + 4%)

Focus on long-term results over multiple periods to truly measure performance

What is Step 7 in the 7 Steps of Portfolio Management Process?

Rebalance the Portfolio

Step 7: Rebalance the Portfolio

What is the main point of Step 7?

The main point is that rebalancing keeps your portfolio aligned with its original strategic asset allocation by periodically selling assets that have grown above their target weights and buying those that have fallen below, using the same dynamic (and, where allowed, tactical) asset-allocation techniques you set up earlier.

Who created the grestest flashcards ever

Cyrus