Pensions Lecture Notes

1/46

Earn XP

Description and Tags

Flashcards focusing on key terms and concepts related to pensions and their economic implications.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

47 Terms

Transfers

Support or benefits provided from one group to another, such as resources from the rich to the poor through the tax system.

Pensions

Regular payments made to retired individuals, funded through private contributions or public tax revenues.

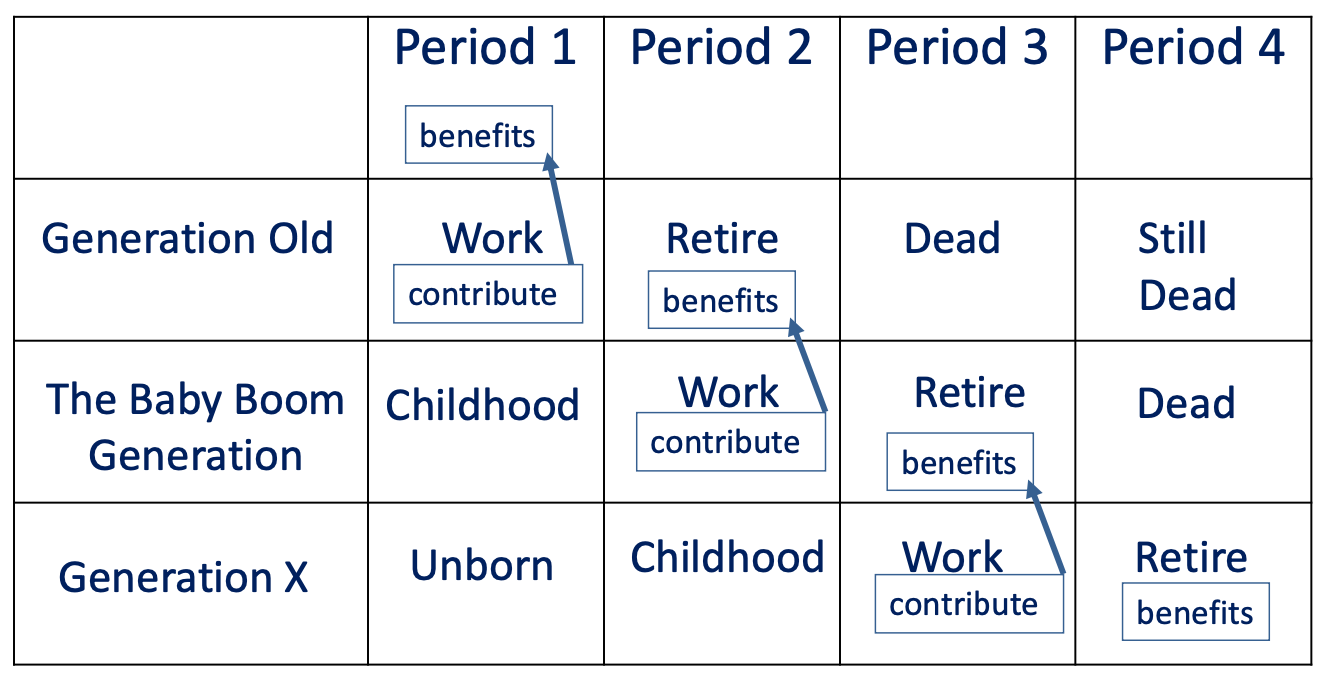

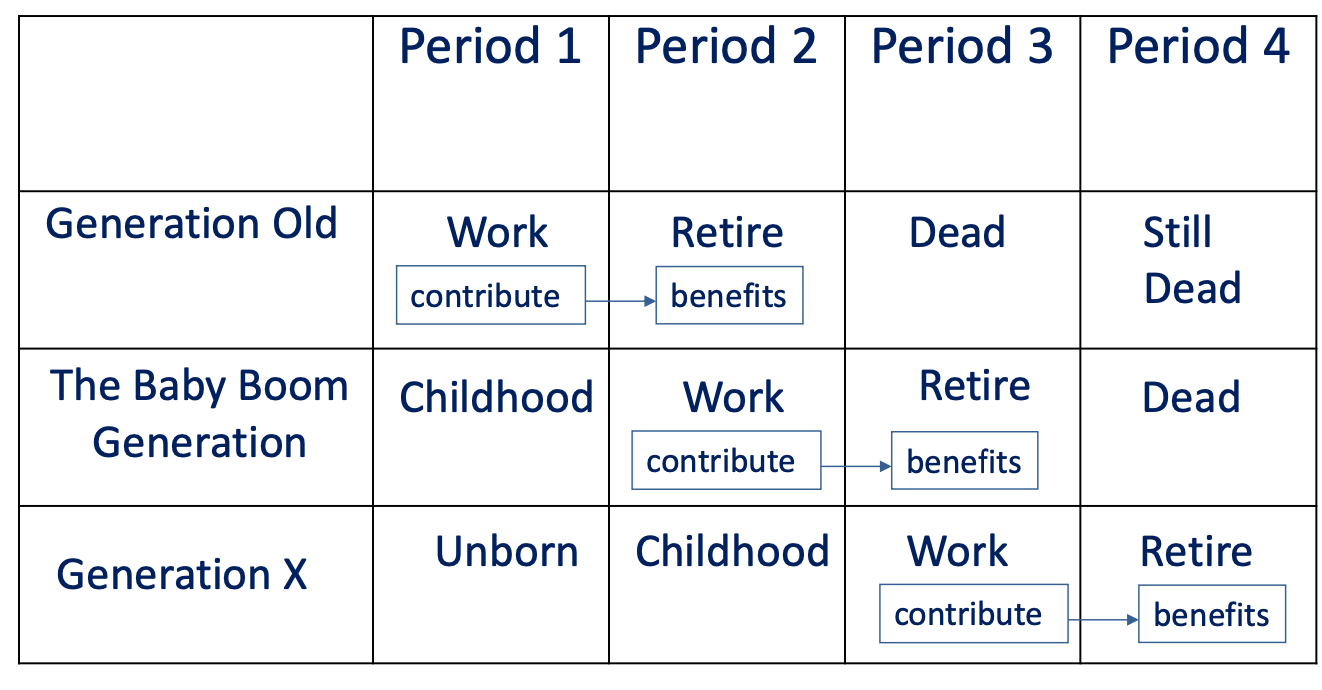

Pay-As-You-Go (PAYG)/unfunded

A method of pension funding where current workers' contributions fund current retirees' benefits, paid out of current tax revenues

basic idea, e.g in uk £180 a week that people get from state pensions, paid by taxes

if youre a pensioner with a good high pension, you alsop pay taxes which contoirbute towards this

Funded pensions

Pensions that are paid out of an accumulated

fund, typically managed through investment funds.

in a fully funded plan theres no dependence on others, everyone funds themself

Intergenerational redistribution

The transfer of income or resources across different age groups, typically from the working population to retirees.

Crowding out

A situation where government spending leads to a decrease in private sector investment or savings.

Wealth Substitution Effect

The change in saving behavior induced by the existence of social security benefits, often leading to decreased personal savings.

purpose of private pensions

consumption smoothing: you save income in the good times for the worse times like when youre sick

a rational person should prefer to invest in a pension

insurance: youre insuring yourself to have a nice old age

e.g if you knew youd die at 65 no ppint in having a pnesion

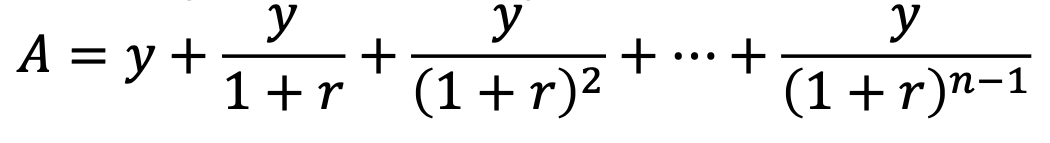

private pensions as annuity

if you build up your annuity and then die the day after, your money can be used to help others

shown as discounting value

A is the present value of the pension stream y for the rest of life (assume 0 inflation)

annuities

person exchanges lump sum for annual payment of income for life (defined benefit or defined contribution)

its a form of insurance, since individuals pool the risk of dying younger or older

those who fail to achieve life expectancy subsidise those who live longer than expected

because people dont know how long thye’ll live for, risk pooling can improve individual welfare

adverse selection could be a slight problem, but not really

defined benefit

what you want, but none of us will get

this means the risk is on the employer, and youre paid an agreed amount - u have no risk

defined contribution

most pension schemes are like this. private sector firms, life expectancy has shot up and many people are retiring, so beneift schemes have become unaffordbale

means whatever is in your annuity will be determined on the day by the stock market - all the risk if on you

e.g if the stock market crashed on the day, tough luck

supply side sources of market failure that night lead to the gov wanting to get involved

incomplete insurance

annuities, is life expectancy a risk or an uncertainty, can be hard to insurance companies to set premiums

unanticipated inflation destroys pensions, so government might have to step in and top up pensions

demand side sources of market failure that night lead to the gov wanting to get involved

information and behavioural problems

we want to make sure eveyone has in income when they retire, but want to ensure they spend it on pensions - paternalisitc argument

theres costs of choice, info and behavioural problems

rationale for state involvement

market failure combined with paternalistic concern for poverty/equity mean that Govs become involved in pension provision

degree of involvement open to debate

advantages of PAYG schemes

cope well with inflation, if it occurs then pensions go up bc wages go up

incentivises generations to leave good economci conditons, becayse the ones that come after them have to work and payv taxes to fudn their pensions

allows full pension to be paid immediately

vertically equitbale, the people who pay the most are the rich but the people who get the most are the poorer ones

problems with PAYG schemes

disincentives to save and work, if you know you have the pension coming up, it might affect your incetives to save - you may put more money into a funded scheme if you had to provide for yourself, but you dont

does this lack of saving have an affect of economic growth

maybe you retire earlier if you think u have enough to last you until your state pension comes in

sensitive to blips in birth rate, but so are funded schemes

if you have a large cohort of pensioners relative to workers like we do now, implies taxes go up or benefit go down

not a very strong argument

first tier pensions

aimed primarily at poverty relief

state pension, main aim is so everyone can live

can be contributory or non contributory

non contributory means everyone gets the same, contirbutory means you can add more

second tier pensions

Intended to strengthen consumption smoothing

Mandatory, public or private

can insist you have to have a pension, can use the you have to opt out instead of opt in

May be combined with first tier

e.,g NEST in UK

third tier pensions

Intended to allow for differences in preferences

Voluntary

can be organised by industry, firm or individual

pensions in the UK

PAYG

established 1948

retirement age for women: 60

retirement age for men: 65

planned to rise to 68

pensions in the US

almost all workers in US pay FICA tax on earnings

person must have worked and paid tax for 40 quarters (10 years) over their life and must be over 62

retiring at 62 gets u a smaller pension, normally those with good private pensions retire this early

social security

A federal program that taxes workers to provide income support to the elderly PAYG

how are social security benefits calculated

The amount of this annuity payment is a function of the recipients average earnings over the persons 35 highest earning years where each months earnings expressed in todays dollars

replacement rate

ratio of benefits received to earnings prior to the entitling event

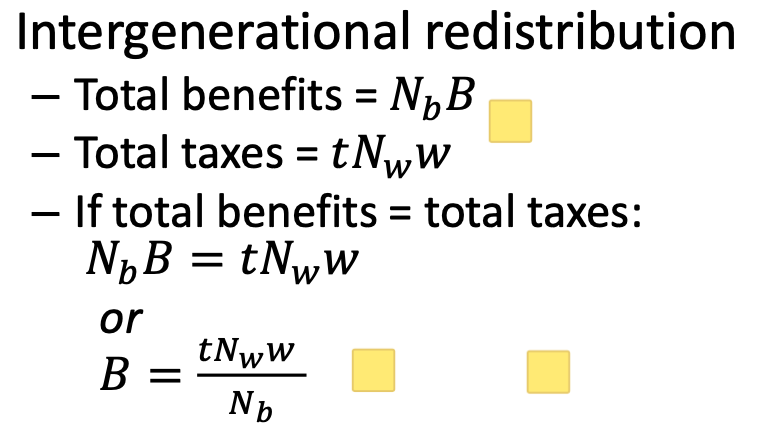

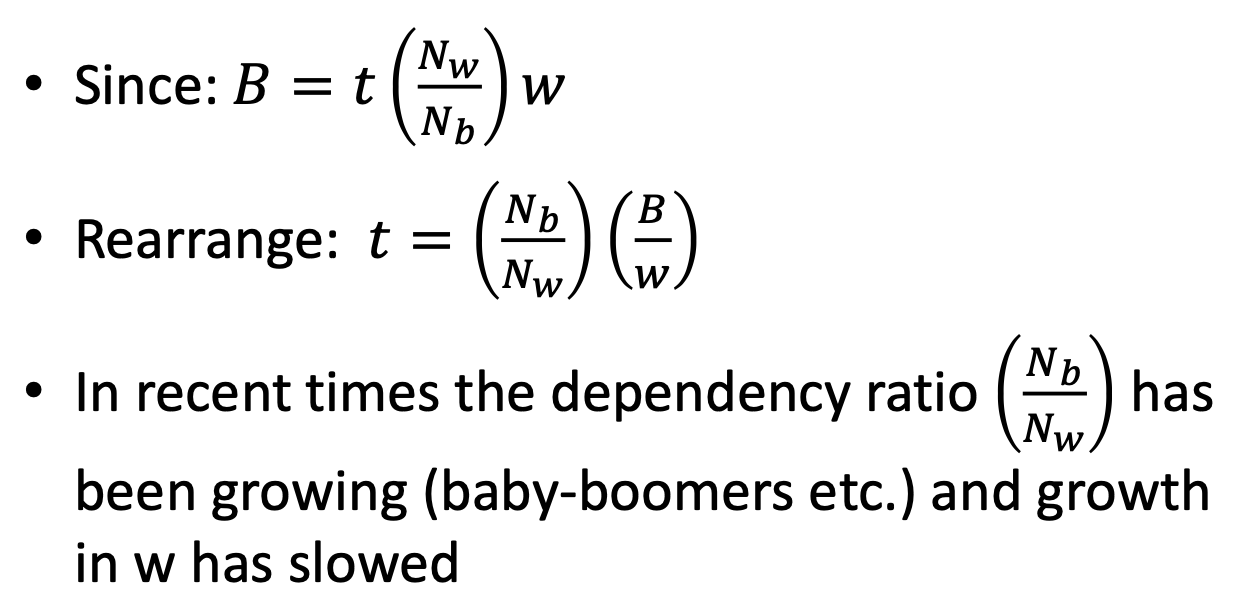

intergenerational redistribution equations

Nb = number of pensjoners x B, the beenfit

tax x number of workrs x average wage w

increasing in taxes, number of workers and economcu growth, captured by wage increases

divided by number of pensioners

recently nw, nb has been increasing, w is flatlining and this is creating a lot of strain

So growing population and wage growth increase benefits for fixed taxes

so retired generations share in growth

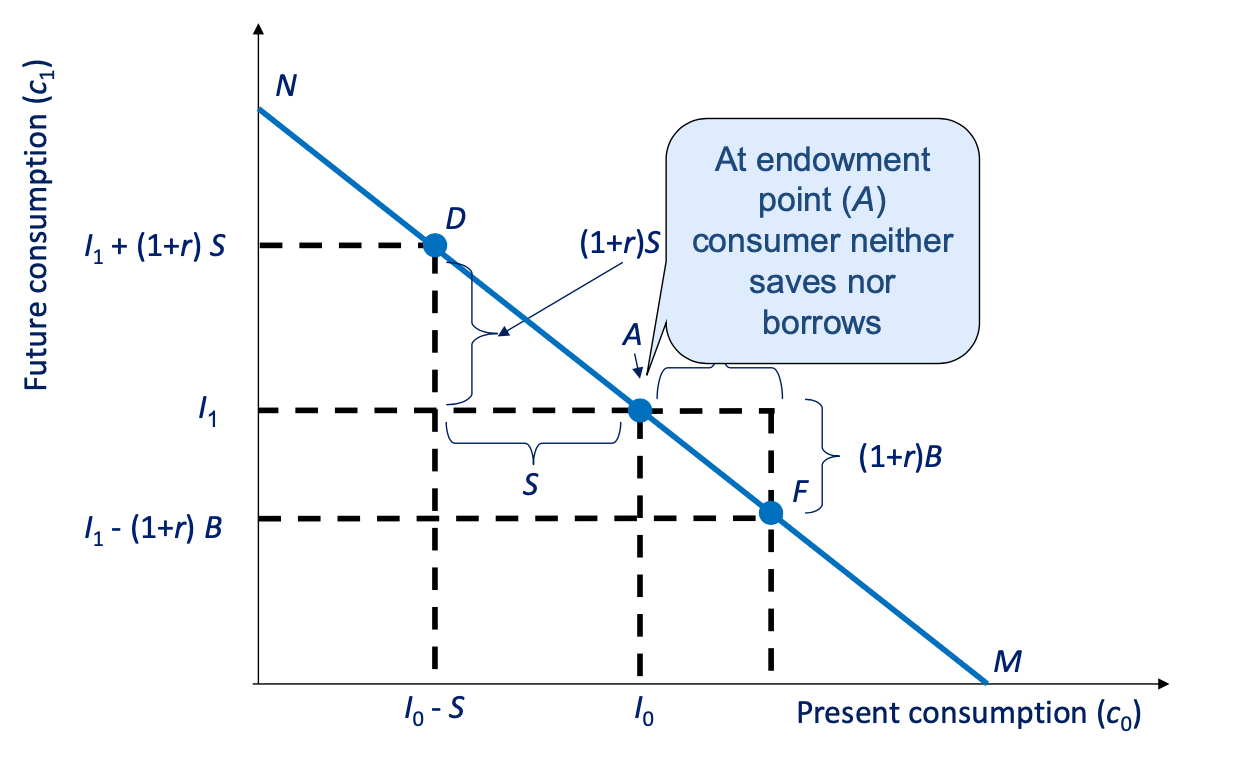

budget constraint for present and future consumption

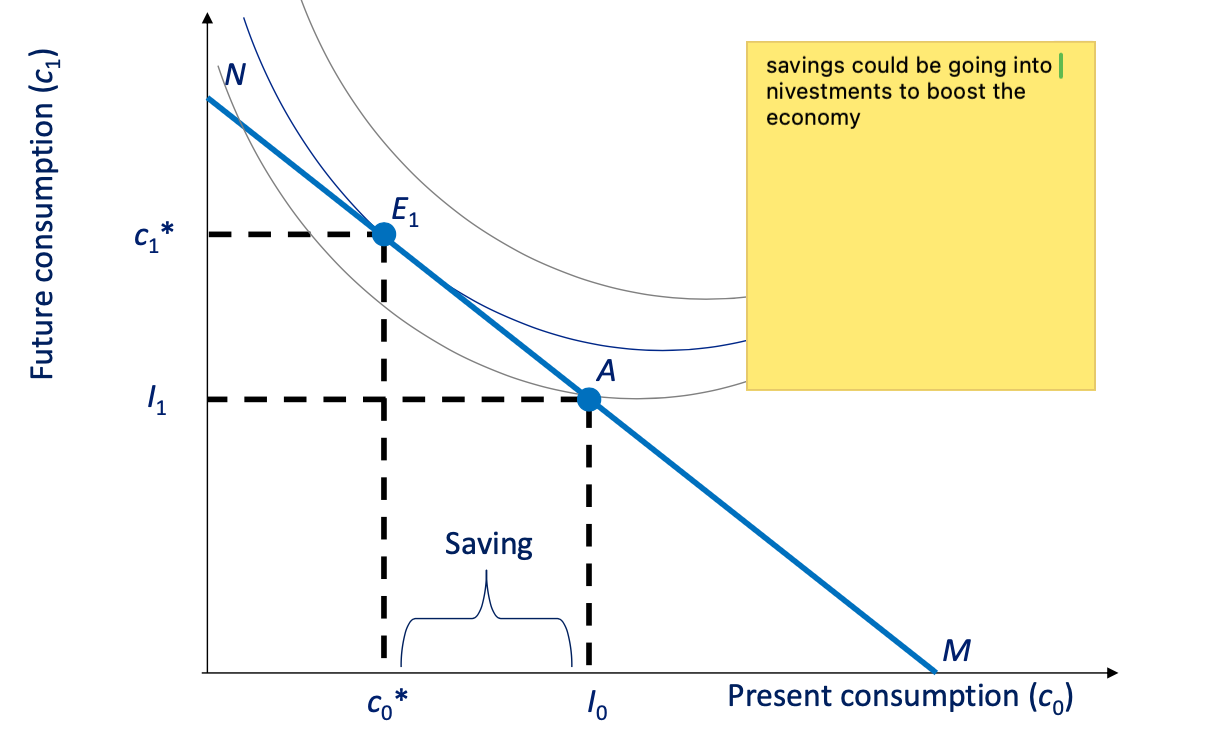

utility maximising choice of present and future consumption

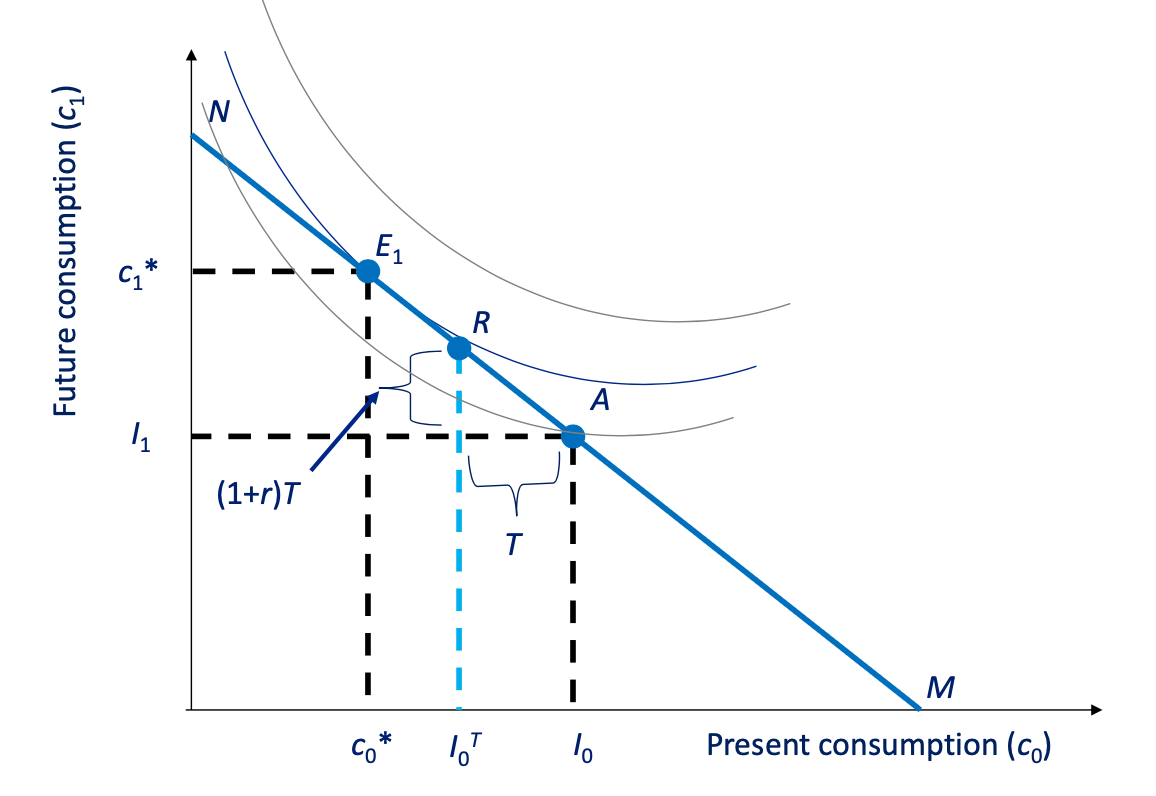

crowding out of private saving due to social security (wealth sub effect diagram)

3 ways social securtiy can affect savings

Wealth Substitution Effect

Retirement Effect

Retire early (increase savings in anticipation)

Bequest Effect

Save more to offset effect of social security

payments on children

does social security consumption smooth

social security may crowd out savings that individuals would’ve set aside of retirement

might crowd out private savings by allowing people to count on gov transfer to support old age income

the larger the crowd out, the less consumption smoothing it provides for retired individuals

alternative: means testing pensions

- adminsitrativly this is rellay dificult, becayse youre measuring assets

- if youre well off, you dont need a state pension

- but lower middle class may vastly reduce their savings and get the state pension

- so this could affect savings badly

- unviersal benefits are easier and better politically, because the middle class will want you to favour them

effect of social security on consumption smoothing

can be seen in elderly poverty rates

he steepest reductions in poverty occurred during the

1960s and 1970s, when the program grew the fastest.

the point of pensions is to alleovate poverty, but study by Gallani et al. (2016) of a cash transfer in Mexico finds that theres no crowding out - if youre poor and you get extar money, you increase your consunption

social security wealth and retirement decision

Weigh up cost of delay (tax and forgone benefits) vs benefit of above average earnings and higher benefits due to delay

evidence: age at which pension is first available is important

implicit social security taxes

across countries, lots of variant in implicit tax rate

close to 0 for 62 year olds in US

91% in netherlands

countries with higher taxes have less elderly labour force participation

evidence that potentially very costly to design Social Security systems that penalize additional work beyond the retirement age.

Adjusting systems to more fairly reward work at old ages can mitigate much of the moral hazard effect of Social Security.

pensions and economic growth

Three links in the argument

Does funding increase saving?

is that saving translates into efficient investment

By how much does that investment increase output?

need to test each link

long term stresses on pensions

funding savings and growth

life expectancy is increasing in most counties while birth rates are falling

this can create issues off pension finance, but funding is only part pf the solution

what matters moree is size of the cake

static output: effects of demographic change on funded pensions

financial asset accumulation, desires asset sales by pensioners exceeds desired purchases by workers

excess supply in asset market reduces asset prices

this reduces pension accumulation and hence value of annuity

similar to PAYG issue

growing output: effects of demographic change on funded pensions

Asset accumulation: wages generally keep pace with output.

rising wages imply rising demand for assets, hence no effect on asset prices

period 2 pensioners get the real pension they expect

key question: whether funded pensions are more likely

to generate growing output than PAYG

transitional costs of changing pension

there will be double taxation of generation paying PAYG but told they must fund their

own pension (us)

Political economy aspects: Funding and property rights

Are funded pensions safer from government

interference than PAYG pensions?

Does full funding impose greater financial

discipline?

Is greater discipline optimal? Is the ability to

change future benefits simply a source of risk

to workers and retirees, or an opportunity to

do a better job of sharing the risks inherent in

pension systems

2 strategies of raising output

Increasing the productivity of each worker, through

(1) more and better capital equipment

(2) more productive labour

Increasing the number of workers from each age

cohort

(3) increased labour force participation

(4) increased age of retirement

(5) import labour directly (immigration)

(6) import labour indirectly (export capital)

to what extent is funding a solution

In the face of demographic problems the key

variable is output

From a macroeconomic perspective the choice

between PAYG and funding is secondary

how should pensions be financed

can address issue of pension finance by:

Increase output

• Reduce the living standards of workers by

increasing pension contributions

• Reduce living standards of pensioners

• By paying a lower pension

• By increasing the age at which pension is first paid, i.e.

reducing the duration of retirement

summary: arguments for increased use of funded pensions rest on":

increased growth bc such. move would necessarily trade off with equity consdierairtons

Intergenerational redistribution

Redistribution from rich to poor

Redistribution from men to women

UK triple lock pensions

A policy ensuring that UK state pensions increase each year by the highest of inflation, average wage growth, or 2.5%, aimed at protecting pensioners' living standards.

paul jonson says if this continues then pensions will become very geneorus in the future

Is this too generous.

Is this because pensioners are politically too

powerful?