Business Cycles

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

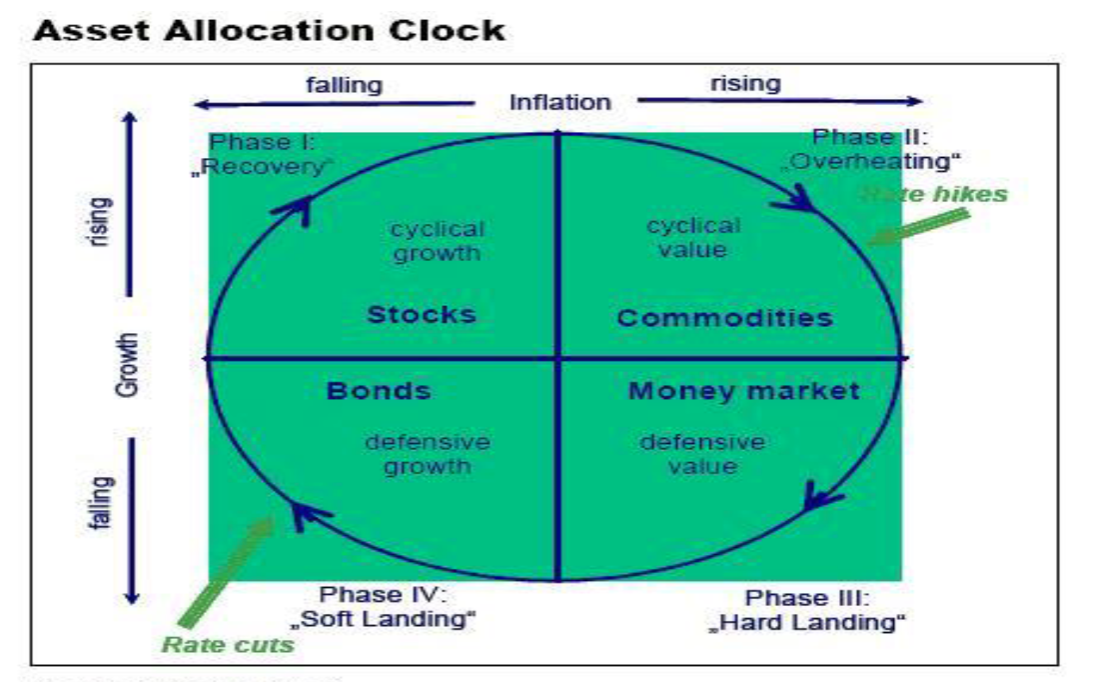

Asset managers take decisions of asset allocation among sectors and industries depending whether the economies are improving or deteriorating

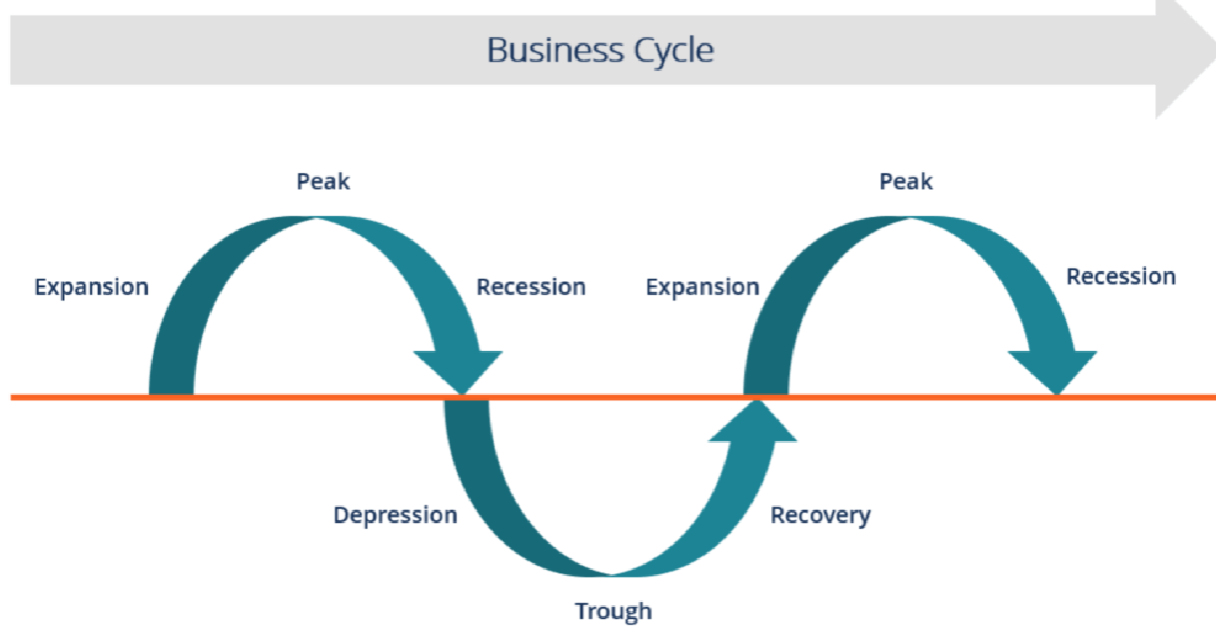

Periods of expansion vs period of recessions: “peaks” and “throughs”

Cyclical industries vs defensive industries

defines the type of the stock

economy begins to recover from recession = expect cyclical industries to perform best

Defensive indus have lil sensitivity to business cycle

related to systematic or market risk in portfolio

Cyclical stocks have higher “Betas” than Defensive stocks

Peaks & Throughs

Recession

A significant, widespread, and prolonged downturn in eco activity

The great recession

The eco downturn from 2007 to 2009 resulting from the bursting of the US housing bubble and the global financial crisis.

Recessions in the economy

Unemployment rate rises

Consumer purchases fall off

People lose their homes

Businesses go bankrupt

Young people can’t get a good job after school

Companies int he MATURE phase of their life cycle (stable growth)

Utility based sectors (production & distribution of elec, infrastructure) (healthcare, consumer)

Normally pay high dividends

Cash flow to dividends

Companies in the GROWTH phase of their life cycle or extremely cyclical sectors

Internet based, commodities, consumer discretionary

Cash flow to growth

Leading indicators

Manufacturers new orders

Credit to the economy indices

Claims for unemployment

COINCIDENT INDICATORS

Payrolls

Industrial Production

LAGGING INDICATORS

Average duration of unemployment

Labor cost per unit of output (productivity)

Change in the CPI for services

3 method to calculate GDP

Income method

Expenditures method

Output method

Expenditures method

GDP = C + I + G + NX

Business cycles and the stock market