Chapter 4: Cost-Volume-Profit Analysis

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

different types of cost:

variable costs

fixed costs

mixed costs (VC + FC)

variable costs

remain constant per unit but change in total as volume changes

fixed costs

do not change in total over wide ranges of volume or activity

Characteristics of Variable Costs

Total Cost

changes proportionately to changes in volume

when volume increases, total costs increases

when volume decreases, total costs decreases

Cost per Unit

remains constant

Characteristics of Fixed Costs

Total Cost

remains constant

Cost Per Unit

changes inversely to changes in volume

when volume increases, cost per unit decreases

when volume decreases, cost per unit increases

mixed costs

have both fixed and variable components

High-Low Method

a method to separate mixed costs into variable and fixed components (three steps)

Steps of the High-Low Method:

identify the highest and lowest levels of activity and calculate the variable cost per unit

calculate the total fixed costs

create and use an equation to show the behavior of a mixed cost

Variable Cost per unit =

change in total cost / change in volume of activity

Variable cost per unit (in terms of high/low) =

(cost associated with highest volume - cost associated with lowest volume) / (highest volume - lowest volume)

total fixed cost =

total mixed cost - total variable cost

total fixed cost (expanded) =

total mixed cost - (variable cost per unit x number of units)

total mixed cost =

(variable cost per unit x number of units) + total fixed cost

relevant range

the range of volume where total fixed costs and variable costs per unit remain constant

contribution margin

the difference between net sales revenue and variable costs

called contribution margin because it is the amount that contributes to covering fixed costs

contribution margin =

net sales revenue - total variable costs

unit contribution margin / contribution margin per unit

exactly what it sounds like. contribution margin per unit

unit contribution margin =

net sales revenue per unit - variable cost per unit

contribution margin ratio

the ratio of contribution margin to net sales revenue

contribution margin ratio =

contribution margin / net sales revenue

OR

unit contribution margin / net sales revenue per unit

traditional income statement classifies costs by function:

product costs

period costs

a contribution margin income statement classifies costs by behavior:

variable costs

fixed costs

cost-volume-profit (CVP) analysis

a planning tool that looks at the relationships among costs and volume and how they affect profits (or losses)

assumptions for CVP analysis:

the price per unit does not change as volume changes

managers can easily classify each cost as variable, fixed, or mixed

the only factor that affects total costs is change in volume, which increases or decreases variable and mixed costs

fixed costs do not change

there are no changes in inventory levels

CVP analysis can be used to…

estimate the amount of sales needed to achieve the breakeven point

breakeven point

the sales level at which the company does not earn a profit or a loss but has an operating income of zero

three methods of estimated sales required to break even:

equation approach

contribution margin approach

contribution margin ratio approach

the equation approach

operating income = net sales revenue - variable costs - fixed costs

the contribution margin approach

required sales in units = (fixed costs + target profit) / contribution margin per unit

Contribution margin ratio approach

required sales in dollars = (fixed costs + target profit) / contribution margin ratio

target profit

the operating income that results when net sales revenue minus variable and fixed costs equals management’s profit goals

same three approaches used for breakeven profit calculation can be used to determine the target profit

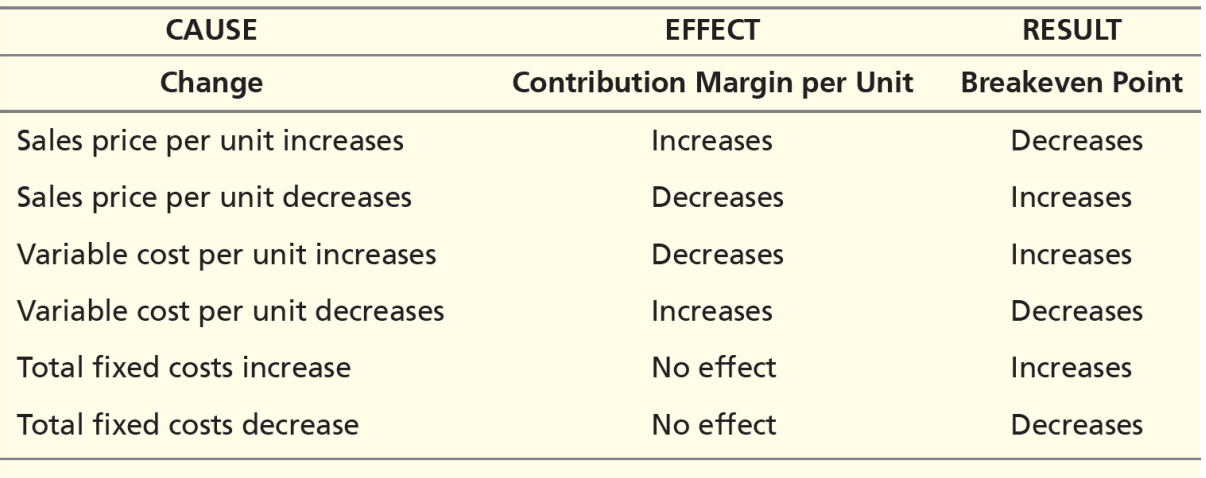

sensitivity analysis

a “what if” technique that estimates profit or loss results if sales price, cost, volume, or underlying assumptions change

effects of changes in sales price, variable costs, and fixed costs

cost stickiness

costs increase more when sales volume is increasing than costs decrease when sales volume is decreasing

three additional applications of CVP:

margin of safety

operating leverage

sales mix

margin of safety

the excess of expected sales over breakeven sales

used to evaluate the risk of current operations and their plans for the future

margin of safety in units =

expected sales - breakeven sales

margin of safety in dollars =

margin of safety in units x sales price per unit

margin of safety ratio =

margin of safety in units / expected sales in units

cost structure

the proportion of fixed costs to variable costs

operating leverage

predicts the effects that fixed costs will have on changes in operating income when sales volume changes

degree of operating leverage

can be measured by dividing the contribution margin by the operating income

degree of operating leverage =

contribution margin / operating income

the cost of producing products is estimated using one of two methods:

absorption costing includes all product costs

variable costing considers only variable manufacturing costs

Absorption costing - Product Costs

direct materials

direct labor

variable manufacturing overhead

fixed manufacturing overhead

Absorption Costing - Period Costs

variable selling and administrative costs

fixed selling and administrative costs

Absorption Costing - Income Statement Format

Traditional Format:

Net Sales Revenue

- Cost of Goods Sold

______________________

Gross Profit

- Selling and Administrative Costs

_______________________

Operating Income

Variable Costing - Product Costs

direct materials

direct labor

variable manufacturing overhead

Variable Costing - Period Costs

fixed manufacturing overhead

variable selling and administrative costs

fixed selling and administrative costs

Variable Costing - Income Statement Format

Contribution Margin Format:

Net Sales Revenue

- Variable Costs

__________________

Contribution Margin

- Fixed Costs

___________________

Operating Income

variable costing and absorption costing will result in different operating income when:

units produced are more than units sold

units produced are less than units sold