ACCT 2301 Chapter 10 Mindtap

1/25

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

The journal entry to record the issuance of a note to a creditor to satisfy an account payable created earlier would include a ______ to ______.

credit to Notes Payable

On Dec 1, a company accepted a $5000, 4%, 90-day note. How much accrued interest will be recorded as an adjusting entry on Dec 31, the end of the accounting period?

$16.67

Assume that John Smith is a salesperson employed by McCrackin Company. Smith’s regular rate of pay is $36 per hour, and any hours worked in excess of 40 hours per week are paid at 1 ½ times the regular rate. Smith worked 42 hours for the week ended Oct 27. What are his total earnings for the week?

$1548

A certificate that authorizes an employer to withhold federal income taxes from each employee is called a Form

W-4

An employee earneed $1000 in the first pay period of the current year. How much is the total employer and employee social security taxes on these earnings? (Use the simplified rate shown in illustrations)

$120

The adjusting entry to record accrued vacation at year-end would include a ______ to ______.

debit to Vacation Pay Expense

Assume that Hartmann Company contributes 15% of employee monthly salaries to an employee 401k plan. Assuming $600,000 of monthly salaries, the journal entry to record the monthly contribution would include a ______ to ______ for $90,000.

debit to Pension Expense

All of the following would be considered examples of employer post-retirement benefits EXCEPT

social security

When an installment note is issued, the journal entry will include a ______ to ______.

debit to Cash

On Jan 1 of Year 1, Pierce Company borrowed $200,000 on a 10-year, 7% installment note payable. The terms of the note require Pierce to pay 10 equal payments of $25,000 each Dec 31 for 10 years. The required general journal entry to record the first payment on the note on Dec 31 of Year 1 is?

debit Interest Expense, $14,000

, debit Notes Payable, $11,000

, credit Cash, $25,000

If a contingent liability is probable and the amount of the liability can be reasonably estimated, it is?

recorded and disclosed

Assume that during May, a company sold a product for $160,000 that includes a 36-month warranty. Historically, the average cost of repairs over the warranty period is 7% of the sales price. The entry to record the estimated product warranty expense would include a ______ to ______ for $11,200.

debit to Product Warranty Expense

Which of the following would NOT be reported as current liabilities on the balance sheet?

Accounts Receivable

A company has the following liabilities as of December 31:

Accounts Payable

$150,000

Notes payable (current portion)

217,000

Salaries & wages payable

55,000

Installment notes payable

1,140,000

Interest payable

32,000

Payroll taxes payable

15,500

What is the amount of total current liabilities reported on the balance sheet?

$469,500

The quick ratio is computed as ______ divided by ______.

quick assets divided by current liabilities

Lilac Company reported the following financial data for the year ended Dec 31:

Cash

$50,000

Accounts receivable

40,000

Inventory

25,000

Total assets

150,000

Current liabilities

49,000

Total liabilities

99,000

Lilac’s’ quick ratio for the year ended Dec 31 is?

1.8

On Jan 26, Nyree Co. borrowed cash from Conrad Bank by issuing a 30-day note with a face amount of $37,200. Assume 360 days in a year.

a. Determine the proceeds of the note, assuming the note carries an interest rate of 6%.

b. Determine the proceeds of the note, assuming the note is discounted at 6%.

a. Proceeds = $37,200

b. Proceeds discounted at 6% = $37,014

Discount = Face amount x Discount rate x Term of note/360

Discount = $37200 × 6% x 30/360

Discount = $186

Proceeds = Face amount - Discount

Proceeds = $37200 - $186 = $37,014

The proceeds equal the cash initially received. Proceeds represents how much in value the borrower is walking away with in cash or merchandise.

Lindsey Vater’s weekly gross earnings for the week ended March 9 were $3,770, and her federal income tax withholding was $791.70. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is Lindsey's net pay? For interim computations, carry amounts out to two decimal places. Round your final answer to two decimal places.

Net pay = $2695.55

Social Security Tax = $3770 × 6% = $226.2

Medicare Tax = $3770 × 1.5% = $56.55

Total FICA tax deductions =.$226.2 + $56.55 = $282.75

Total Deductions = (791.70) + (226.2) + (56.55) = (1074.45)

Net pay = $3770 - (1074.45) = $2695.55

Net pay is the gross earnings minus payroll deductions. The amount of Medicare and social security withheld is based on an employee’s gross earnings.

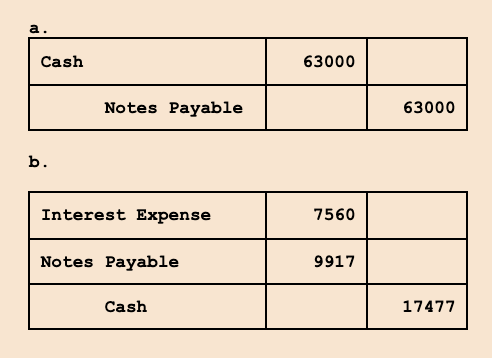

On the first day of the fiscal year, a company issues $63,000, 12%, five-year installment notes that have annual payments of $17,477. The first note payment consists of $7,560 of interest and $9,917 of principal repayment.

a. Journalize the entry to record the issuance of the installment notes. If an amount box does not require an entry, leave it blank.

b. Journalize the first annual note payment. If an amount box does not require an entry, leave it blank.

a. The cash payment is the same in each year. The interest and principal repayment, however, change each year. This is because the carrying amount (book value) of the note decreases each year as principal is repaid, which decreases the interest.

b. The cash payment is the same in each year. The interest and principal repayment, however, change each year. This is because the carrying amount (book value) of the note decreases each year as principal is repaid, which decreases the interest.

After the final payment, the carrying amount on the note is zero, indicating that the note has been paid in full.

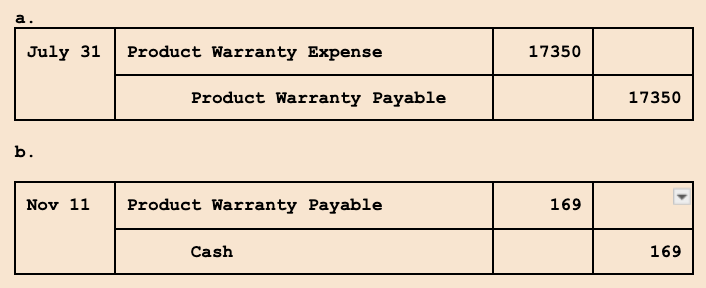

Savory sold $347,000 of consumer electronics during July under a six-month warranty. The cost to repair defects under the warranty is estimated at 5% of the sales price. On November 11, a customer was given $169 cash under terms of the warranty.

Question Content Area

a. Provide the journal entry for the estimated warranty expense on July 31 for July sales. If an amount box does not require an entry, leave it blank.

b. Provide the journal entry for the November 11 cash payment. If an amount box does not require an entry, leave it blank.

a. Contingent liability entries are needed when the amount can be reasonably estimated and the liability is probable. Recorded contingent liabilities follow the matching concept. Contingent liabilities are an accrued expense adjusting entry.

b. What resources is the company using to satisfy the warranty?

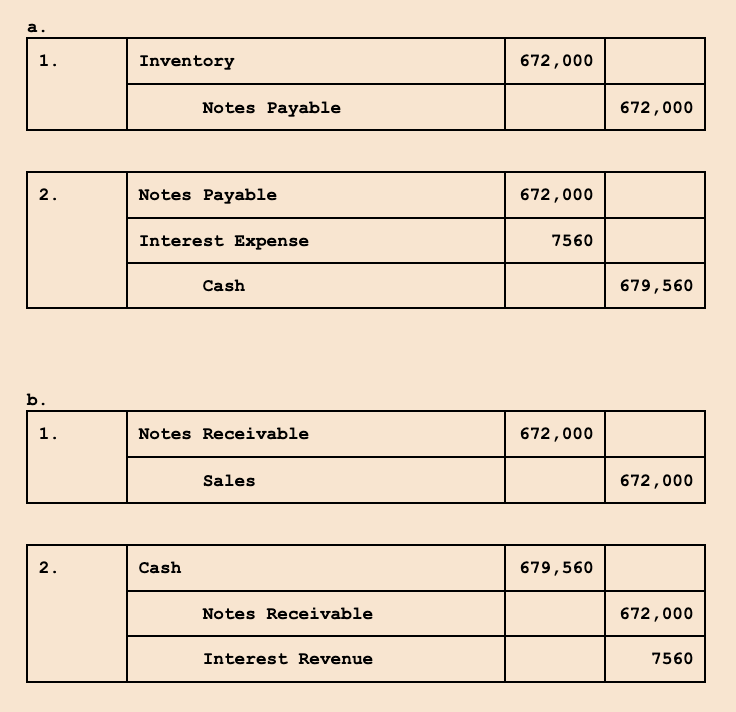

Bennett Enterprises issues a $672,000, 45-day, 9%, note to Spectrum Industries for merchandise inventory.

Assume a 360 days in a year. If required, round your answers to the nearest dollar. If an amount box does not require an entry, leave it blank.

Question Content Area

a. Journalize Bennett Enterprises’ entries to record:

the issuance of the note.

the payment of the note at maturity.

b. Journalize Spectrum Industries’ entries to record:

the receipt of the note.

the receipt of the payment of the note at maturity.

a. If you were the borrower how much would you be leaving Spectrum Industries with in proceeds? What does the liability always have to be recorded at?

b. As the lender what have you earned by doing business with Bennett Enterprises? As the lender what will you be receiving on the maturity date?

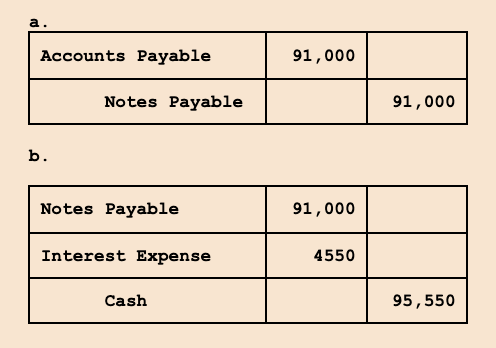

A business issued a 120-day, 15% note for $91,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360 days in a year.

If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar.

Why is the company issuing the note? What type of note is being issued (interest-bearing or discounted)? How much will the company owe on the maturity date?

On the maturity date, the debtor must repay the face amount of the note, plus interest. Interest is computed by multiplying the face amount with the interest rate and the time period.

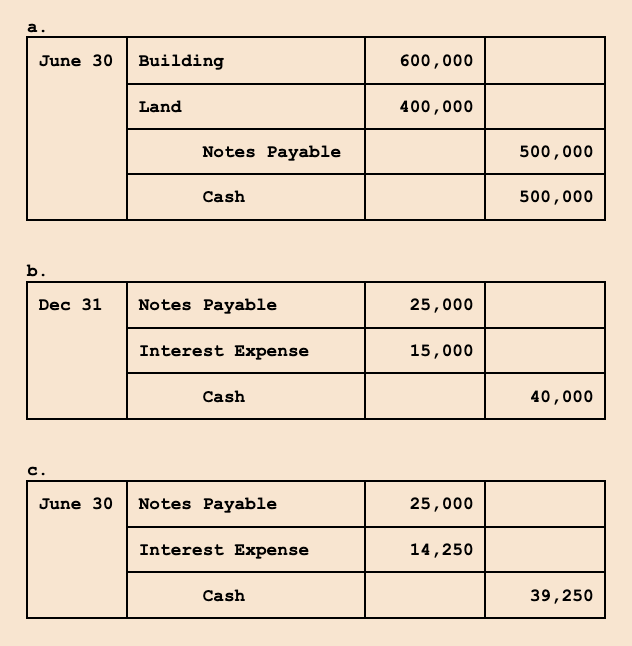

On June 30, Collins Management Company purchased land for $400,000 and a building for $600,000, paying $500,000 cash and issuing a 6% note for the balance, secured by a mortgage on the property. The terms of the note provide for 20 semiannual payments of $25,000 on the principal plus the interest accrued from the date of the preceding payment.

If an amount box does not require an entry, leave it blank. Assume 360 days in a year.

Question Content Area

a. Journalize the entry to record the transaction on June 30.

b. Journalize the entry to record the payment of the first installment on December 31.

c. Journalize the entry to record the payment of the second installment the following June 30.

a. Determine what the company is acquiring and how they are paying for this purchase.

b. Pay attention to dates and remember that all interest rates are expressed in annual terms. What affect will this installment payment have on the amount owed?

c. What is the balance in the liability account prior to making this second installment payment? Remember interest rates are expressed in annual terms.

A business provides its employees with varying amounts of vacation per year, depending on the length of employment. The estimated amount of the current year's vacation pay is $100,800.

Question Content Area

a. Journalize the adjusting entry required on January 31, the end of the first month of the current year, to record the accrued vacation pay. If an amount box does not require an entry, leave it blank.

b. How is the vacation pay reported on the company's balance sheet?

______ , unless employees are allowed to accumulate their vacation pay for use in future years.

When is this amount removed from the company's balance sheet?

______

a. Pay attention to the dates given. An employee's right to paid vacation time is an accrued expense adjusting entry. Recall that all adjusting entries affect at least one balance sheet account and one income statement account.

b.

As a current liability

When employee take vacations

Consider the type of account in which the liability is recorded and the issues of current and long-term liabilities for a business.

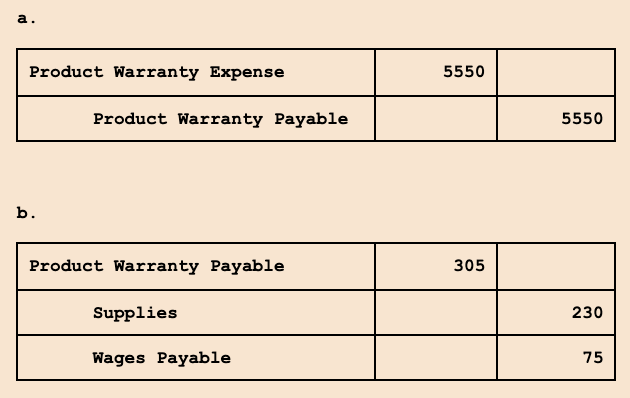

Fosters Manufacturing Co. warrants its products for one year. The estimated product warranty is 3% of sales. Assume that sales were $185,000 for January. On February 7, a customer received warranty repairs requiring $230 of parts and $75 of labor.

a. Journalize the adjusting entry required at January 31, the end of the first month of the current fiscal year, to record the accrued product warranty. If an amount box does not require an entry, leave it blank.

b. Journalize the entry to record the warranty work provided in February. If an amount box does not require an entry, leave it blank.

a. The accrued product warranty amount is recorded in the same period in which the sale is recorded, therefore following the matching concept.

b. Consider what resources the company will have to use in order to satisfy the warranty.

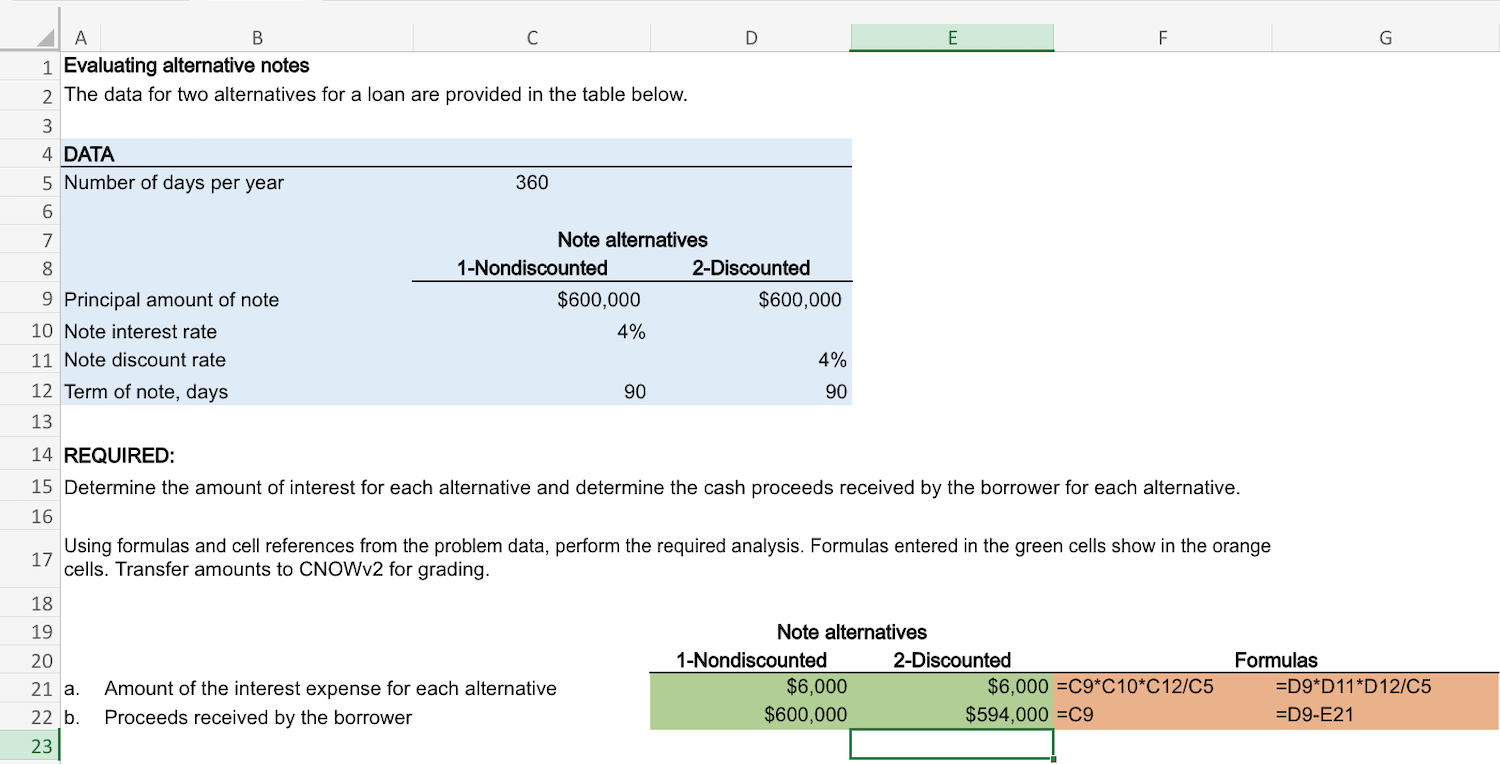

A borrower has two alternatives for a loan: (1) issue a $600,000, 90-day, 4% note or (2) issue a $600,000, 90-day note that the creditor discounts at 4%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

a. Compute the amount of the interest expense for each option. Round to the nearest dollar.

$______ for each alternative

b. Determine the proceeds received by the borrower in each situation. Round to the nearest dollar.

(1) $600,000, 90-day, 4% interest-bearing note: $______

(2) $600,000, 90-day note discounted at 4%: $______

c. Alternative [1 or 2] is more favorable to the borrower because the borrower ______.

a. $6000 for each alternative

b. (1) $600,000 (2) $594,000

c. Alternative 1 is more favorable to the borrower because the borrower receives more cash.

A 360-day year is used when calculating interest on a note. Recall the definition of proceeds is the amount that the borrower receives in cash or merchandise.