AEECO U2 test 4

1/41

Earn XP

Description and Tags

income distribution & gov in the economy

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

42 Terms

earned income

private income earned from work

unearned income

private income received from the ‘sale’ of household resources, e.g. rent, interest, dividends

minimum wage is set by…

fair pay australia

government transfers

pension, unemployment benefits, etc.

gross income

private income + transfers

disposable income

gross income - tax

social wage

goods and services provided for little to no cost by the government like public education, healthcare, use of roads, libraries, etc.

GST

a 10% tax on most goods and services

excise tax

a tax on products that are bad for society (alcohol, cigarettes, etc.) that the government wants to discourage

wealth formula

household assets - household liabilities

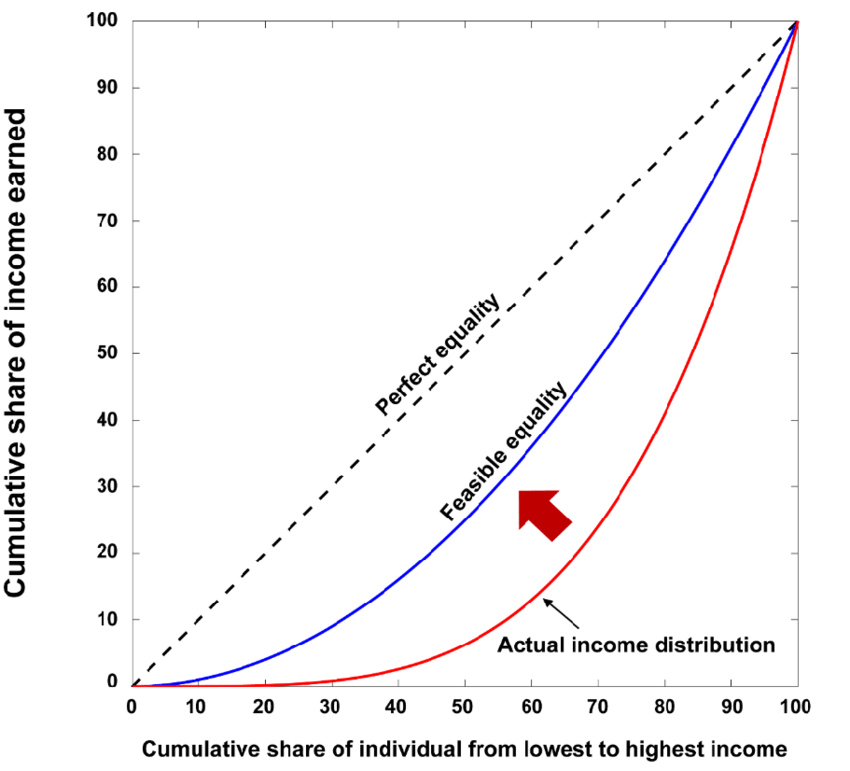

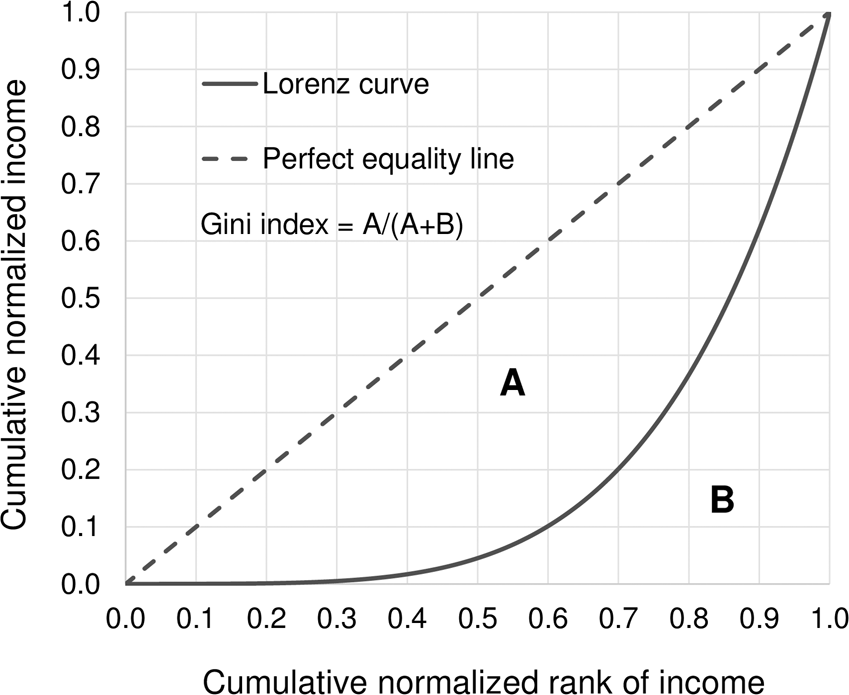

lorenz curve

displays the percentage of income earned (y axis) by the percentage of the population (x axis).

gini coefficient

area between lorenz curve and perfect equality divided by entire area under perfect equality. 1 = perfect inequality, 0 = perfect inequality

government policy objectives

sustainable economic growth, price stability, full employment, equitable income distribution, efficient resource allocation

sustainable economic growth target

3-4% GDP growth

price stability target

2-3% CPI growth

full employment target

4.5% unemployment

tax impact

where the tax is levied/collected

tax incidence

where the burden of the tax falls

direct tax

collected on taxpayer’s income. same impact and incidence

indirect tax

levied when people spend money or undertake certain activities. impact and incidence fall on different people

progressive tax

increasing proportion of tax as income increases

regressive tax

decreasing proportion of tax as income increases

proportional tax

constant proportion of income

specific tax

charged on the volume of sales regardless of price

ad valorem (value added tax)

levied as a percentage of price

types of taxes

income, goods & services, property & wealth

taxes on income

personal income, company, fringe benefits

personal income tax

direct and progressive, levied on all wage and salary income

company tax

proportional, impact is company, incidence is consumers

fringe benefits tax

levied on the value of non-cash benefits given to employees in addition to their salary or wage, e.g. company cars, schools fees for children

taxes on property and wealth

capital gains tax

capital gains tax

progressive tax, levied on profits from the sale of assets held for over 12 months, inflation adjusted. applies to shares, investment properties and some personal items if they were purchased with the intention of resale (e.g. jewellery)

taxes on goods and services

GST, excise duty, customs duty

customs duty

indirect, levied on imported goods

taxes on resources

resource rent tax, carbon tax, emissions trading scheme

resource rent tax

progressive, equitable, tax revenue share increases as the resource rent increases so the tax is based on ability to pay. as natural resources belong to the public, some profits should be returned to the public.

carbon tax

charged on the carbon content of fuels. higher prices discourage consumption of carbon.

emissions trading scheme

firms must purchase permits to allow them to use materials that pollute. they pay a charge for polluting.

income

flow of funds

wealth

stock of assets

the four largest types of gov expenditure are…

social security and welfare, health, education, defence

the four largest types of gov revenue are…

personal income tax, company tax, GST, excise and customs duty