Financial Accounting

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

Assets

What the organization owns

Liabilities

What the organization owes

Equity

(Owners'/ Shareholders') Equity is the term that is used to describe the value of the corporation to its owners. Equity is the difference between what the corporation owns and what the corporation owes.

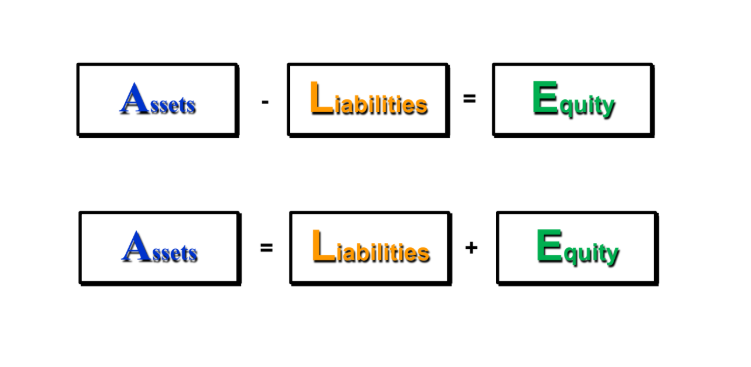

What is the basic accounting equation?

Assets - Liabilities = Equity

Assets = Liabilities + Equity

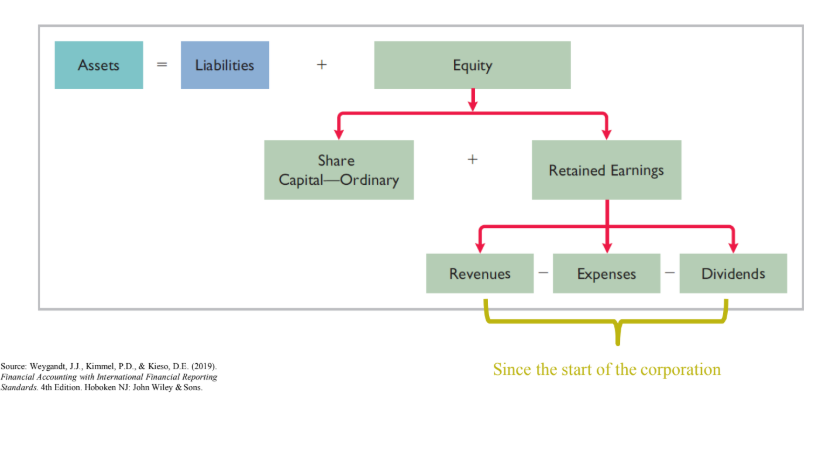

What is the expanded accounting equation

A = L + E

A = L + SC + REV - EXP - DIV

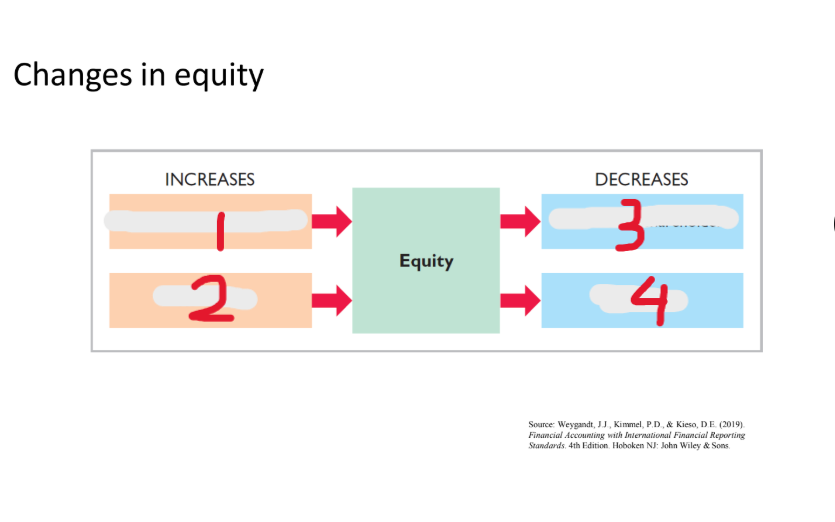

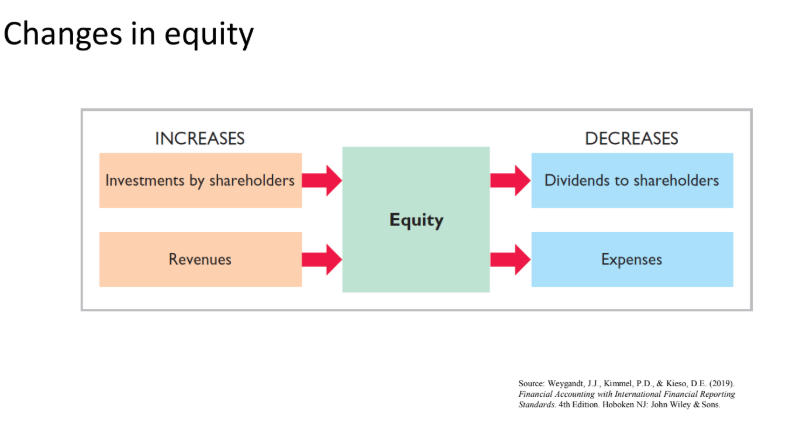

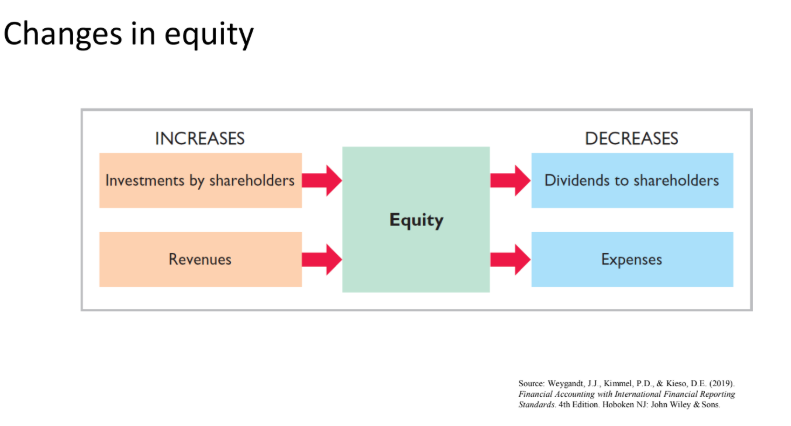

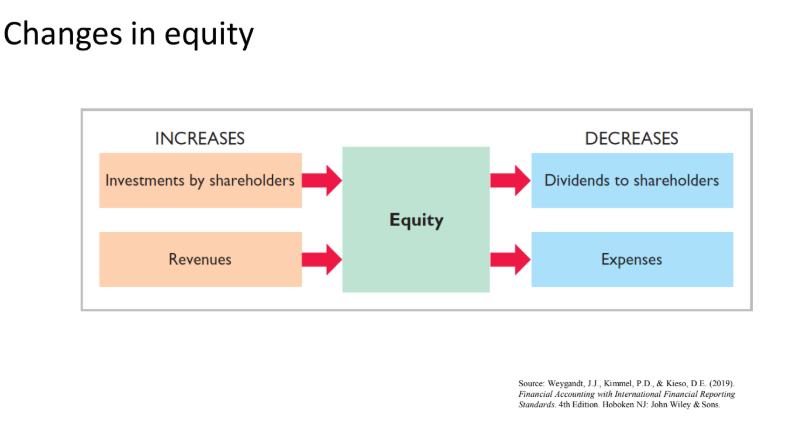

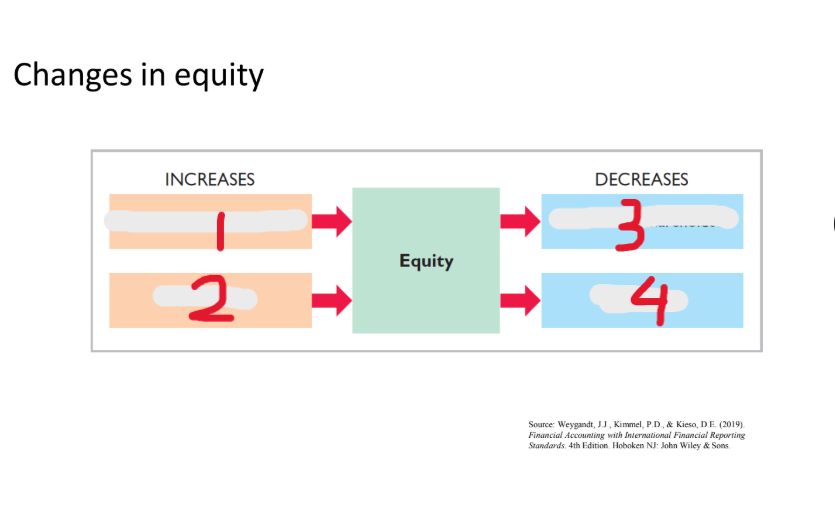

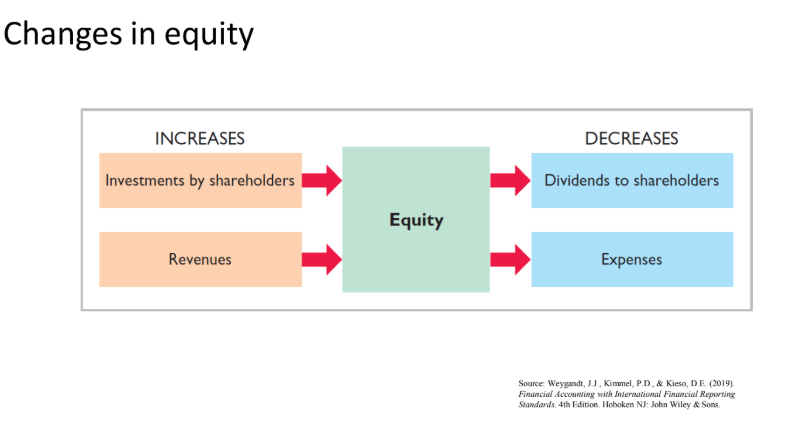

Changes in equity (What is 1?)

Investments by shareholders

Changes in equity (What is 2?)

Revenues

Changes in equity (What is 3?)

Dividends to shareholders

Changes in equity (What is 4?)

Expenses

Define bookkeeping

The process of registering transactions is called bookkeeping. Each transaction has a dual effect on the accounting equation.

• Remember: the accounting equation always holds.

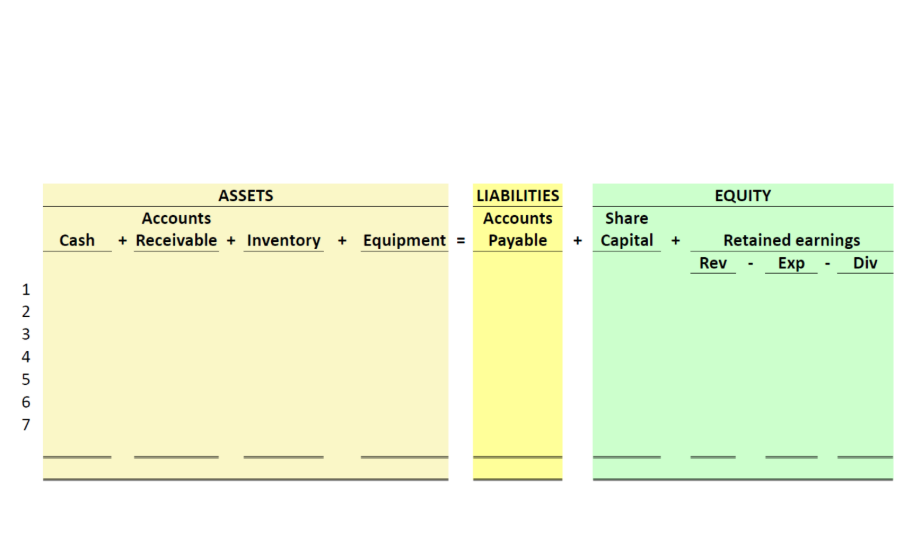

How would you solve this?

Example: Spicemeup.nl BV

The transactions related to the first month of operations of Spicemeup.nl BV were asfollows:

1. The initial shareholders invested cash (€100,000) in return for ordinary shares in the company.

2. Purchased office equipment for €15,000 cash.

3. Purchased 800 bottles of hot sauce for €6,000.The supplier (Iguana S.A.) sent an invoice that needs to be paid within 30 days.

4. Paid Tom his monthly salary of €3,000.

5. Received a bill for €500 from Twitter for advertisements placed. The bill needs to be paid withintwo weeks.

6. Paid the bill of Iguana S.A. (€6,000).

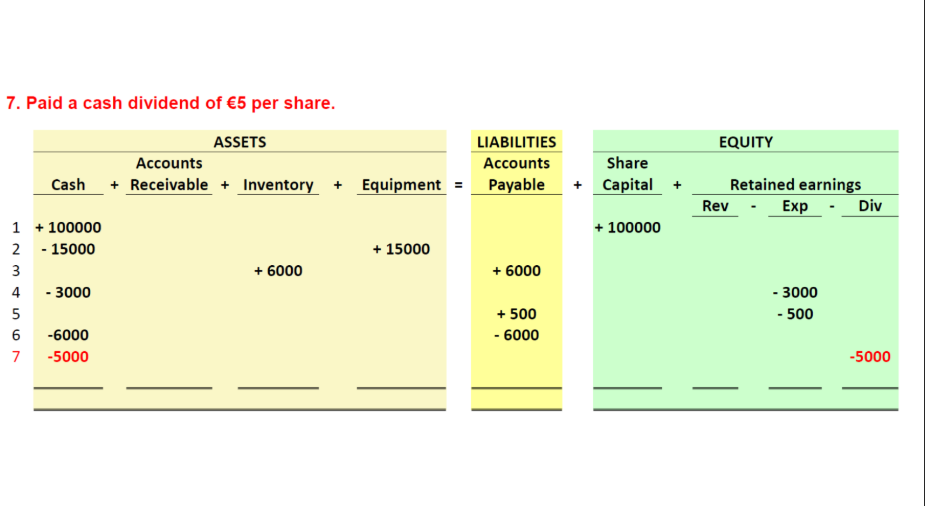

7. Paid a cash dividend of €5 per share.

answer in image

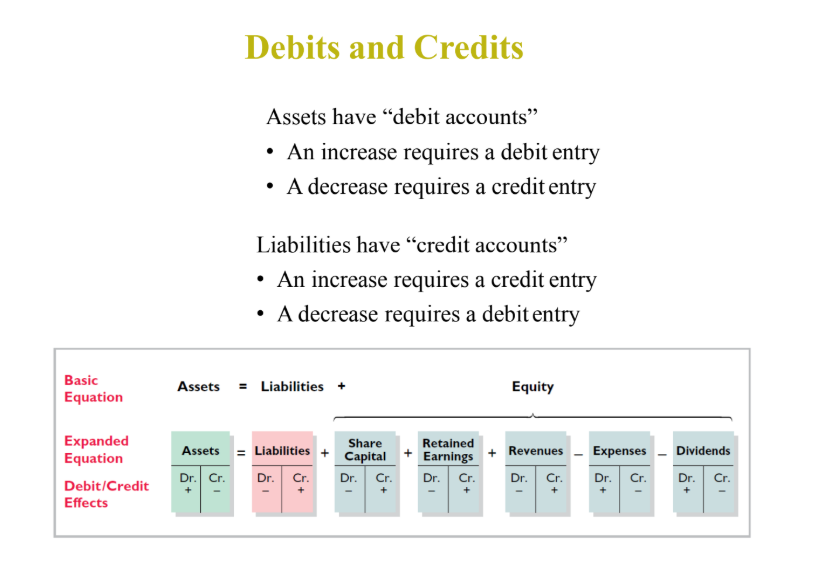

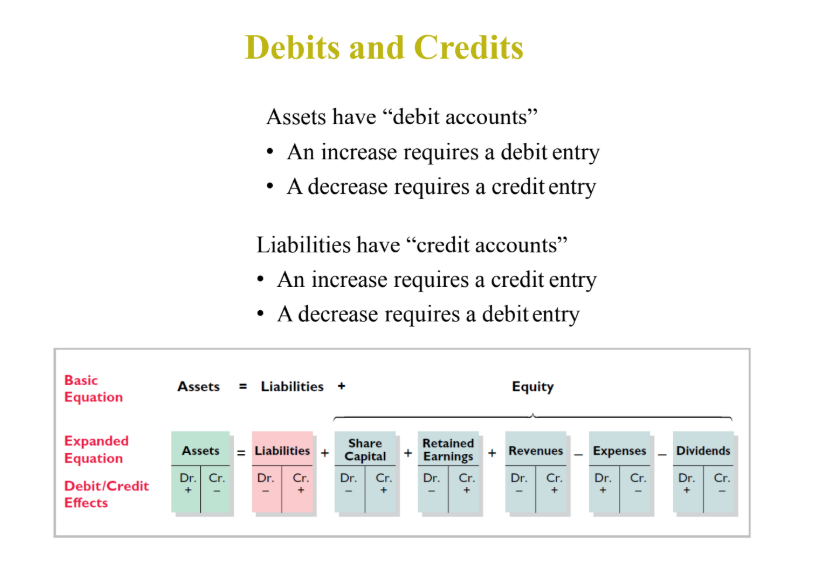

Assets have “__”

Assets have “debit accounts”

• An increase requires a debit entry

• A decrease requires a credit entry

Liabilities have “__”

Liabilities have “credit accounts”

• An increase requires a credit entry

• A decrease requires a debit entry

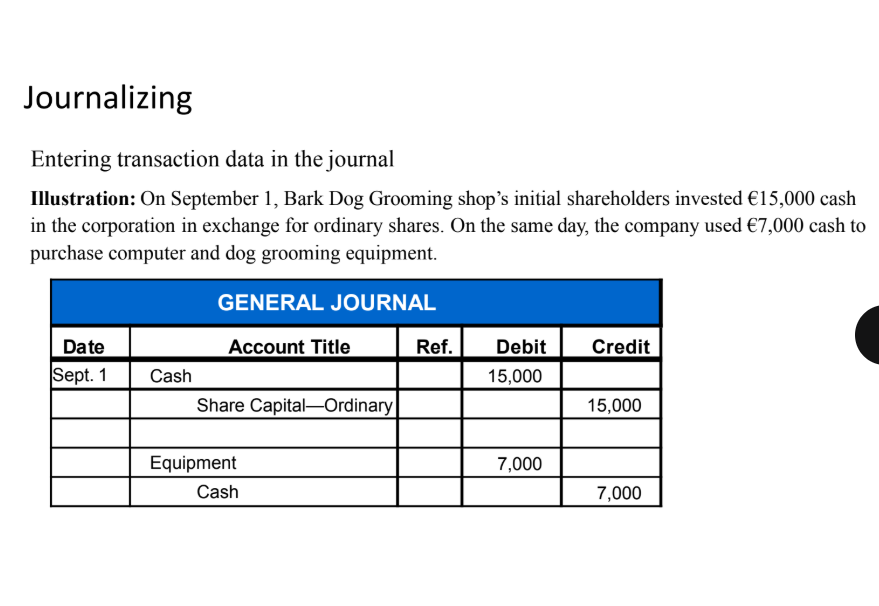

What is Journalizing?

Entering transaction data in the journal.

Illustration: On September 1, Bark Dog Grooming shop’s initial shareholders invested €15,000 cash in the corporation in exchange for ordinary shares. On the same day, the company used €7,000 cash to purchase computer and dog grooming equipment.

solve:

Applying the Accounting Equation: Journal Entries

● Tom inc. repays accounts payable worth $300 using cash.

● Tom inc. purchases equipment worth $1000 on account.

SOLUTIONS:

1. Dr. Accounts Payable 300

Cr. Cash 300

2. Dr. Equipment 1000

Cr. Accounts Payable 1000

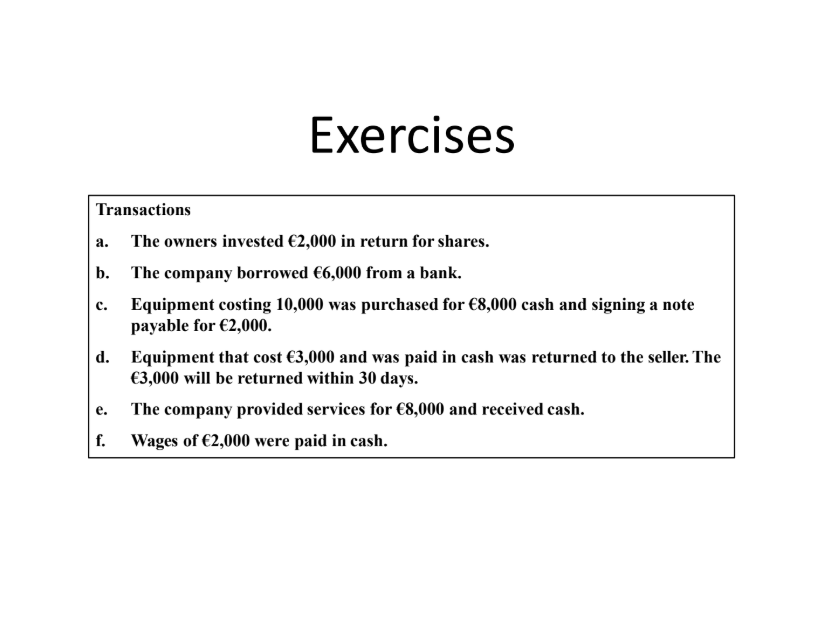

Exercise:

in image

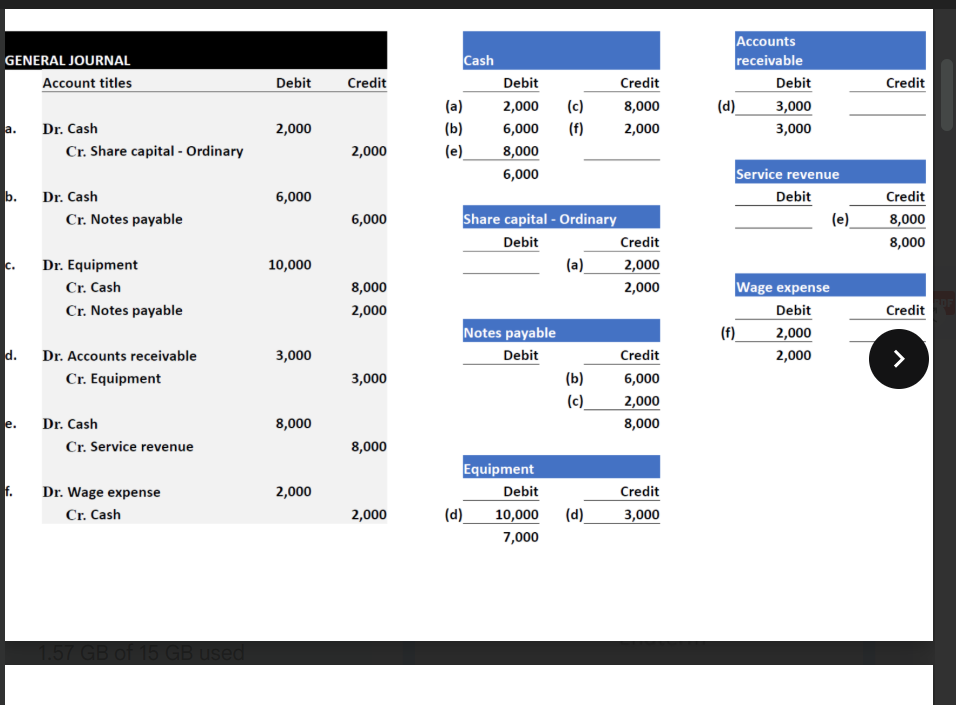

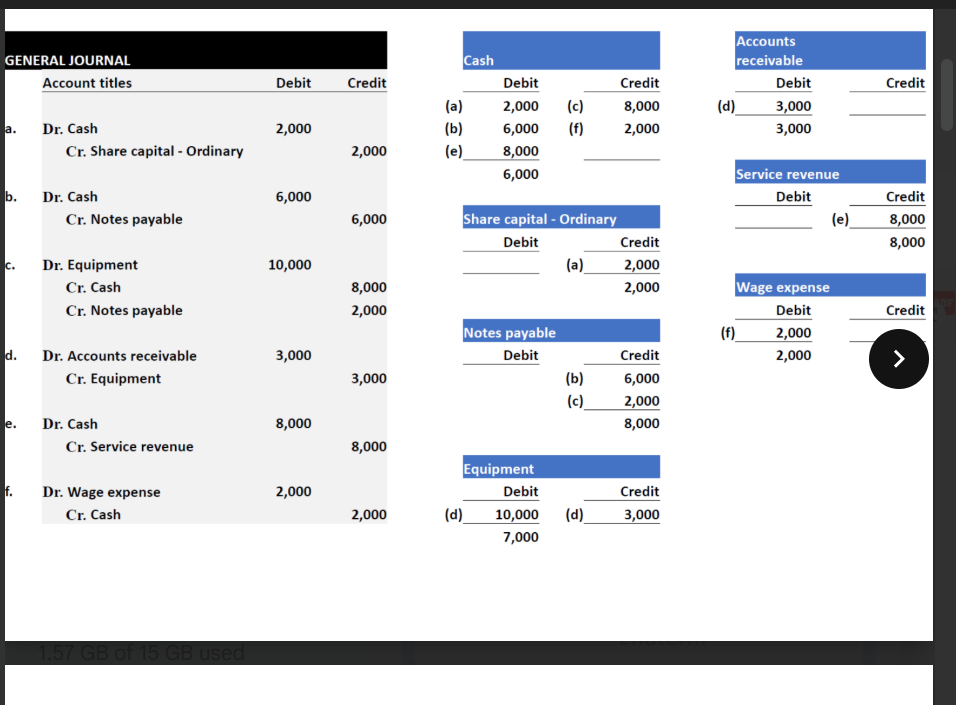

solution:

in image

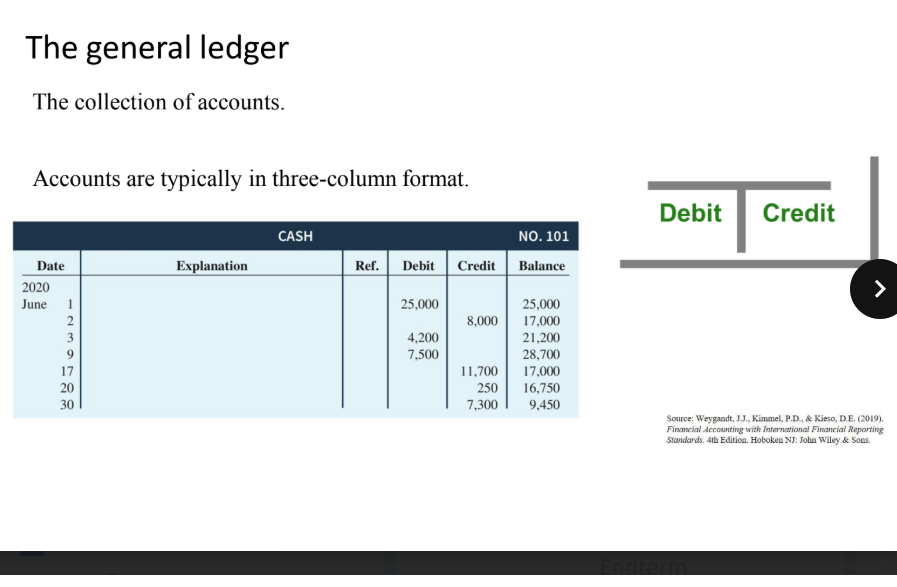

Define The general ledger

The collection of accounts.

Accounts are typically in three-column format

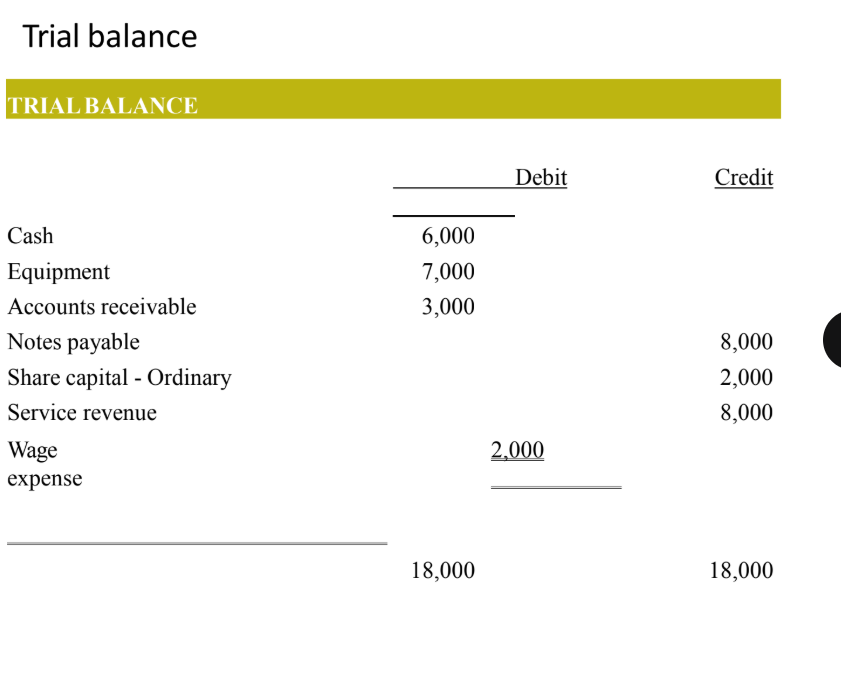

What is The Trial Balance

A list of accounts and their balances at a given point in time

• Check the mathematical equality of debits and credits after posting. The steps for preparing a trial balance are:

1. List the account titles and their balances.

2. Total the debit and credit columns.

3. Prove the equality of the two columns.

Define Accrual accounting

the term that we use for registering changes in value of equity (Revenues and Expenses) in addition to, and separately from, cash flows.

Nearly all accounting is accrual accounting

To which period do revenues and expenses belong?

Revenue recognition principle

Expense recognition principle

• The Matching principle

What is Revenue recognition principle?

Revenue is recognized in the accounting period in which the performance obligation is satisfied.

What is Expense recognition principle?

Expenses are recognized in the accounting period in which the company generates revenues because of these expenses.

What are the 4 possible complications?

Revenues should be recognized before cash is received.

• Accrued revenues

Cash is received before revenues should be recognized.

• Deferred (“unearned”) revenues

Expenses should be recognized before cash is paid.

• Accrued expenses

Cash is paid before expenses should be recognized.

• Deferred (“prepaid”) expenses

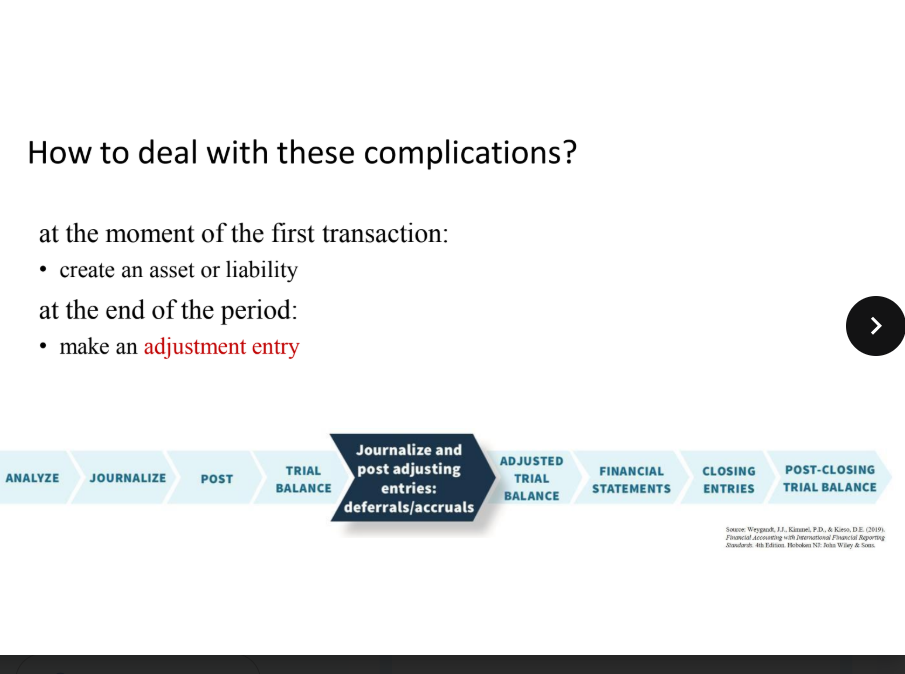

How to deal with these complications?

at the moment of the first transaction:

• create an asset or liability

at the end of the period:

• make an adjustment entry

What are some examples to to deal with the complications?

Deferred (“prepaid”) expenses

Deferred (“unearned”) revenues

Accrued expenses

Accrued revenues

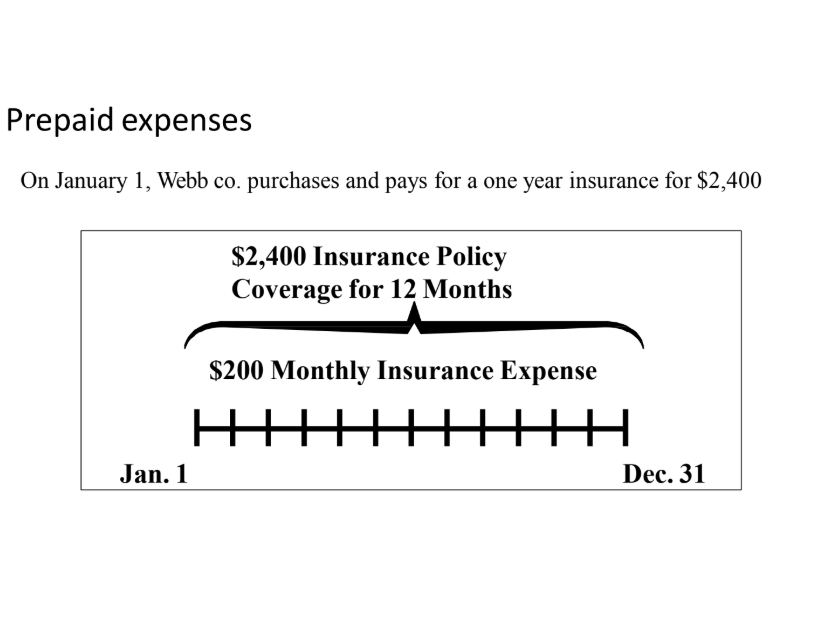

What are Prepaid expenses?

• Payment in advance of “use”.

• When payment is made, an asset is created.

• At the end of a period in which the expense has been used to generate revenues, (part of) the asset is reclassified as an expense.

Prepaid expenses example:

On January 1, a transportation company buys a van for €30,000. It will use the van for six years, after which it has no resale value. What is the expense for the van in the year in which it is bought?

What is the expense for the van in the year in which it is bought?

Company uses van in six subsequent years

Original cost of €30,000 is spread equally over these six years.

• €5,000 per year

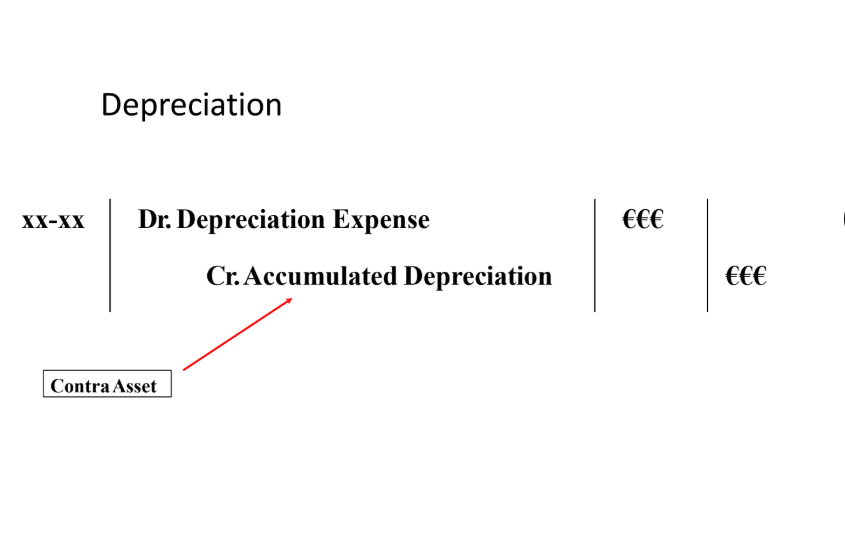

Depreciation!