Theme 4B - Inequity

1/17

Earn XP

Description and Tags

Government Intervention

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

State aims of GI

Achieve a more equitable distribution of output (by influencing the prices of certain goods and services)

Address the problem at its root by intervening in labour markets to create a more equal distribution of income

State

Measures to influence the price of necessities | Measures to influence the income levels of low-income households | Redistributive measures |

Measures to influence the price of necessities | Measures to influence the income levels of low-income households | Redistributive measures |

|

|

|

Describe price controls

Governments are artificially setting a price different from the market clearing price (the equilibrium price)

These controls can take the form of stipulating a maximum price (price ceiling) or a minimum price (price floor)

Aim : reduce large fluctuations in prices and prevent extreme prices for certain essential goods, such as water and agricultural products, in the interest of consumers and producers

Define price ceilings and why it is implemented

(Def.): maximum permissible price that producers may legally charge for a particular good or service

Reasons :

To keep the price of a good at a level affordable to the majority, in order to protect consumers’ interest (Eg. Healthcare and rent)

To prevent exploitation by producers who may charge high prices in times of shortages (Eg. Rice during war times, or surgical masks during a virus outbreak)

For the maximum price regulation to be effective, the price must be set below the market equilibrium price

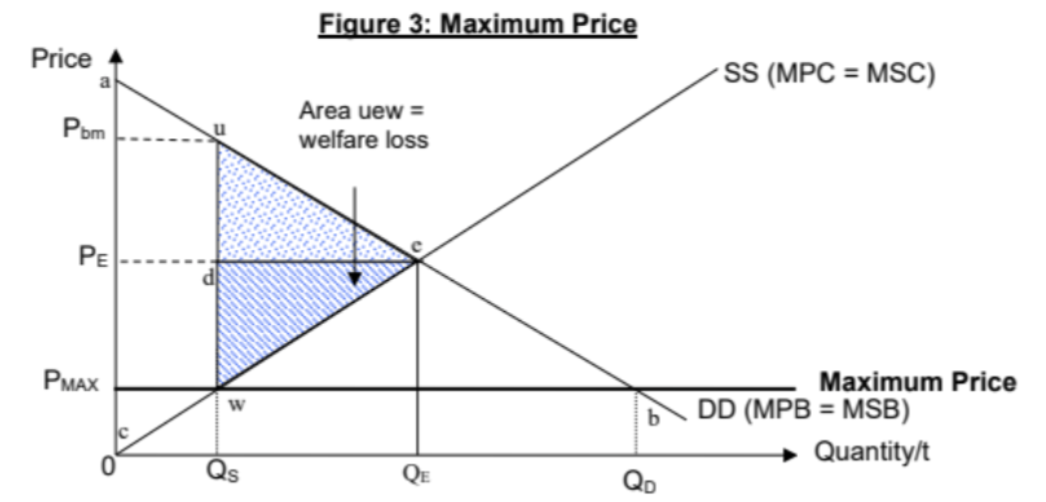

Draw and describe price ceiling graph

In a free market economy, price should increase when there is a shortage

However, with the price ceiling in place, sellers cannot sell above this price (Pc) -> persistent shortage

Hence the shortage cannot be eliminated and only Qs is traded in the market

Describe impact of price ceiling on CS

|

Describe impact of price ceiling on PS

Initially, producer surplus = area PEce

With the maximum price, the new producer surplus = area PMAXwc

There is a loss in producer surplus of area PEewPMAX

Describe positive impacts of a price ceiling

Relative ease of implementation

A maximum price can be implemented quickly when needed and effects are almost immediate -> can be viable in the short term, particularly when the economy is faced with extraordinary circumstances (Eg. war, volatile agricultural prices)

Relatively less costly

A maximum price is cost-effective since there is little cost incurred by the government apart from monitoring costs and administrative costs associated with implementing rationing to allocate the goods

State negative impacts of price ceiling

Welfare loss

Some consumers lose out due to shortages

Emergence of black markets

Not addressing the root cause

Describe welfare loss caused by price ceiling

When a maximum price is imposed, it obscures price signals that normally guide the allocation of society’s resources to the socially optimal level of output -> welfare loss to society

A price ceiling of PMAX imposed creates a shortage of QSQD units -> quantity sold drops from QE to QS

The quantity sold is now less than the socially optimal level at QE -> causes a welfare loss equal to area uew (TSB > TSC)

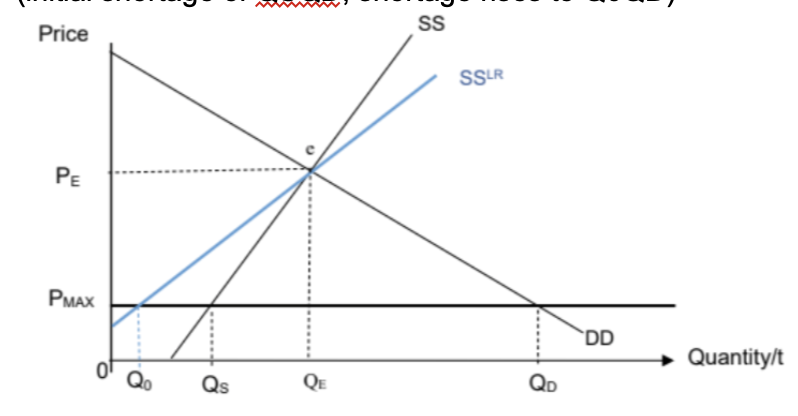

Describe Some consumers lose out due to shortages due to price ceiling + graph

An alternative allocation mechanism is required -> 1st come 1st serve -> rationing through coupons

Consumers who are unable to get the good lose out -> frustration with the shortages lead to social unrest

As supply becomes more price elastic overtime -> producers will respond by reducing Qs more -> shortage worsens in long run (initial shortage of QSQD, shortage rises to Q0QD)

Describe emergence of black market caused by price ceiling

A black market is one where sellers ignore the government’s price restrictions and sells the good at illegally high prices above legal price ceiling

Objective of policy not achieved

The shortage may also mean some desperate consumers suffer from inequitable access to necessities and need to obtain the product through the black market

Only high-income households can afford the goods sold in the black market

In countries with weak legislative framework -> maximum price difficult to enforce

Describe not addressing root cause caused by price ceiling

There may be a need to raise supply by improving productivity

But if the maximum price is viewed as a quick-fix, such priorities may be neglected

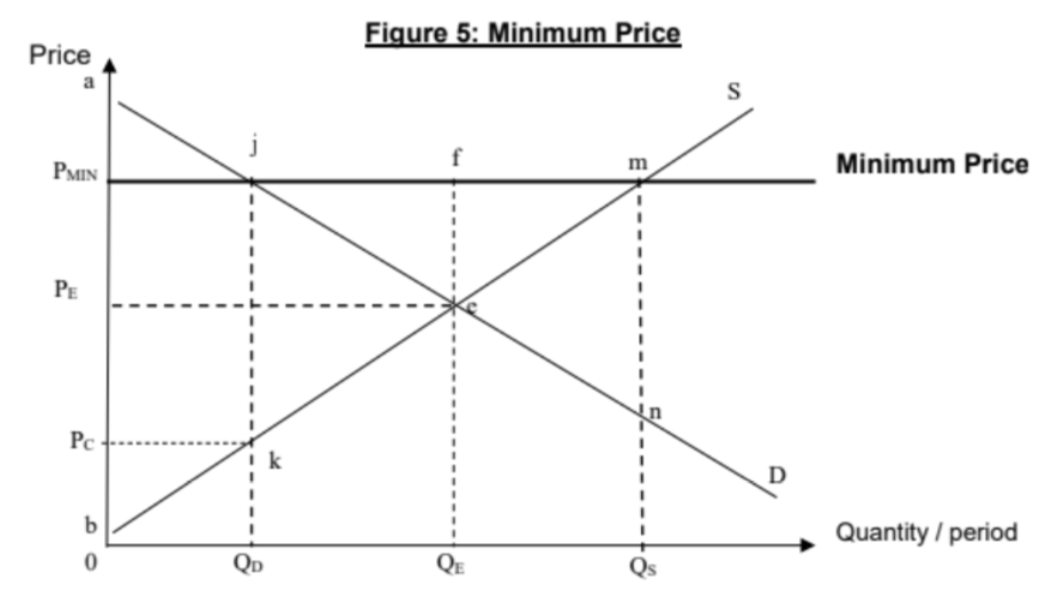

Define and describe price floor

(Def.): Minimum permissible price that producers may legally charge for a particular good or service

Can be implemented by law or by government guaranteeing to buy up the good at a stipulated price

Producers are prohibited from selling below the stipulated price, but prices can rise above it

For a minimum price to be effective, it must be set at a price above the market equilibrium price

Draw price floor graph + describe

Governments used a price floor to protect incomes of low income producers by raising producers’ revenue or by preventing their revenue from falling -> increase their revenue -> reducing inequality as producers can afford basic necessities

Cause a persistent surplus of QSQD

Explain welfare effects when:

By legislation (government does not buy surplus) | By government guaranteeing a minimum price and buying up surplus |

By legislation (government does not buy surplus) | By government guaranteeing a minimum price and buying up surplus |

|

|

Describe positive impacts of price floor

Might enable a government to incur lower costs compared to giving a subsidy to producers

This is applicable when a minimum price policy is used specifically to tackle periods when prices are exceptionally low

Even if government has to buy surplus, once prices recover and equilibrium price is at or above the minimum price, the government will no longer incur an expenditure (no need to buy surplus)

More cost efficient than adopting subsidies which may be difficult to remove even when prices recover

Describe negative impacts of price floor

Welfare loss

Welfare loss incurred if minimum price causes the market price and quantity to move away from the socially optimal level

Wastage of society’s scarce resources is heightened if the surplus is disposed or destroyed subsequently, especially for perishable goods such as fruits and vegetables

Dynamic and productive inefficiency

Firms might become complacent and lack the incentive to engage in innovation or improve their production methods to lower costs

If firms can be guaranteed to sell their product at the higher price floor level -> less pressure to minimise the cost of production available -> productive inefficiency

Consumers lose

A minimum price policy benefits producer -> loss in CS

Inequity of distribution worsen

Consumers face higher prices -> lowers their ability to consume goods and services

Expensive for government

Government incurs expenditure to buy excess stock

Government incurs additional expenditure to store the surplus stock -> opportunity cost

If the higher government expenditure is financed via higher taxes -> added burden on taxpayers -> rendering this policy fiscally unsustainable in the long run