FT4

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

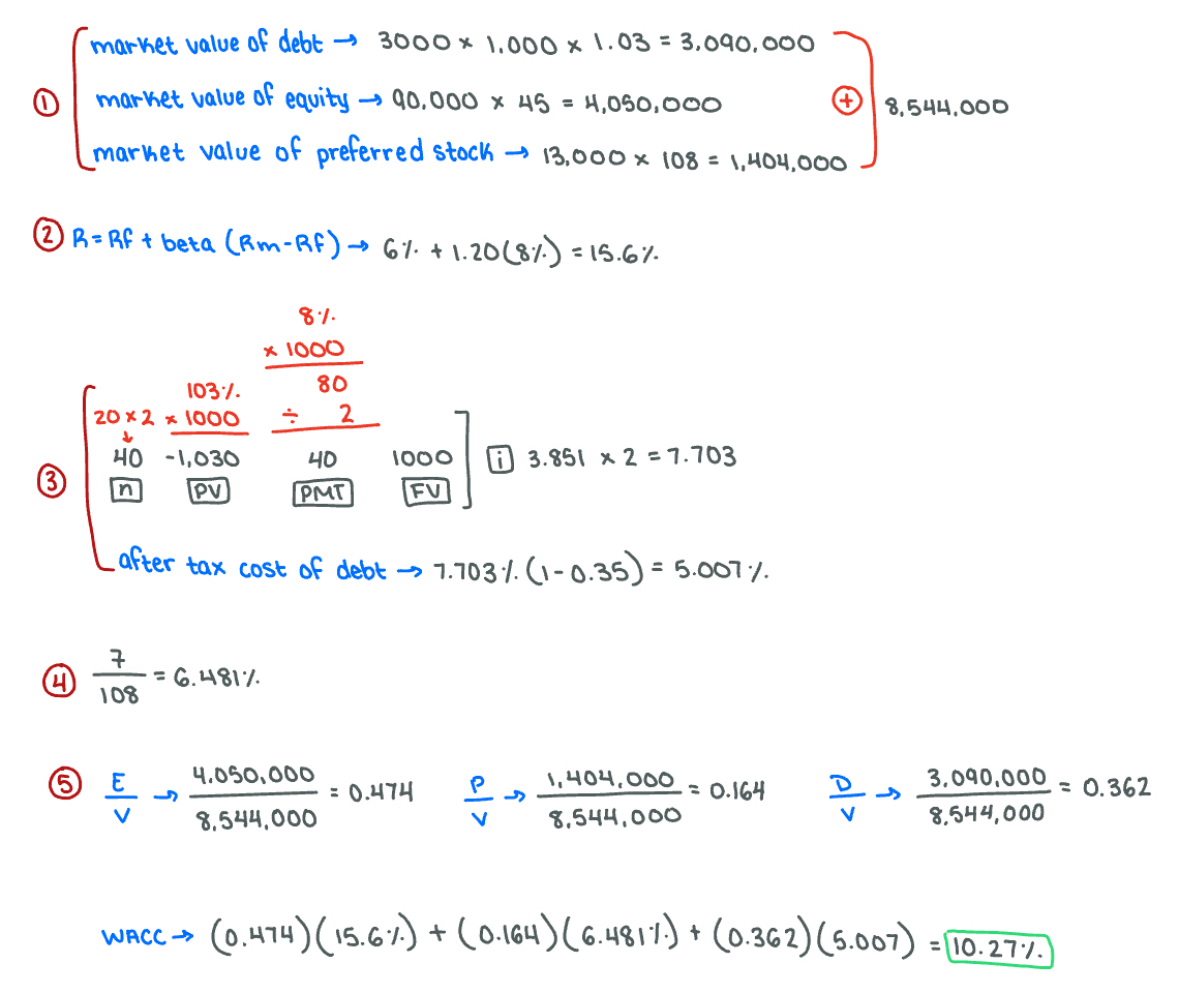

10.27

Given the following information for Dunhill Power Co. find the WACC. Assume the company's tax rate is 35 percent.

Debt: 3,000 8 percent coupon bonds outstanding, $1,000 par value, 20 years to maturity, selling for 103 percent of par; the bonds make semiannual payments.

Common Stock: 90,000 shares outstanding, selling for $45 per share; the beta is 1.20.

Preferred Stock: 13,000 shares of 7 percent preferred stock outstanding, currently selling for $108 per share. The preferred stock has a par value of $100.

Market: 8 percent market risk premium and 6 percent risk-free rate.

Expected increase in cost of goods sold.

Which of the following cash flows should not be included in the total cash flows at the start of the project (or year 0)?

incremental cash flows produced

The value of a proposed capital budgeting project depends on the…

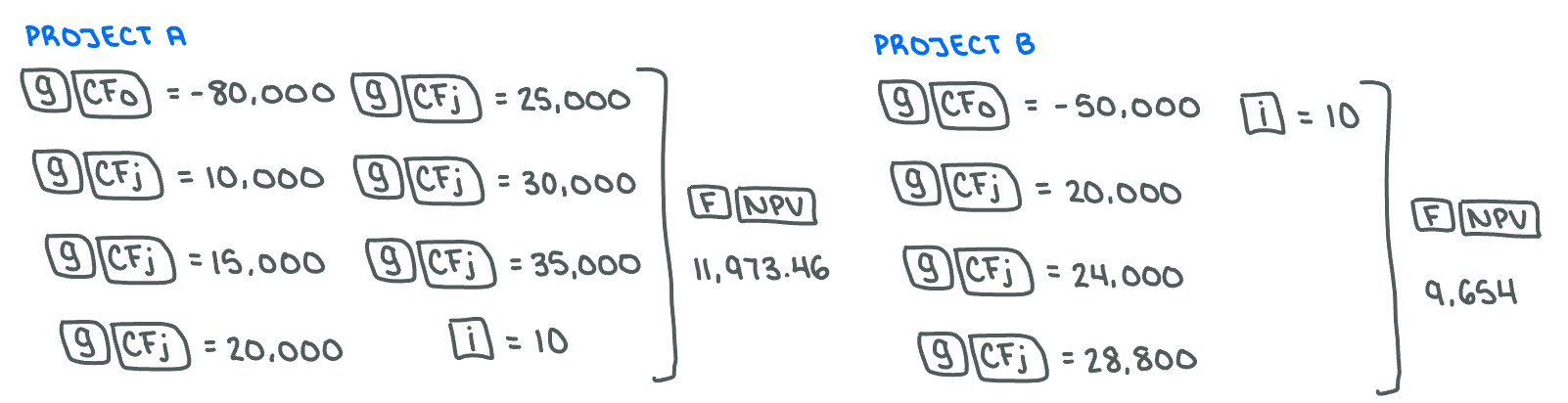

Project A because it has a higher NPV.

Project A requires an initial investment of $80,000 and generates a cash flow of $10,000 in year 1. The cash flow is expected to grow by $5,000 per year for the next 5 years (for a total of 6 years of cash inflows). Project B requires an initial investment of $50,000 and year 1 cash flow is forecasted to be $20,000. Management expects project B's cash flow to grow by 20% annually for the next 2 years (for a total of 3 years of cash inflows).

Assume that the cost of capital is 10%. Which project is more attractive?

It is an opportunity cost and should be charged to the start-up division.

Kleen Corp owns equipment purchased a few years ago. A used equipment dealer has offered $80,000 to buy the equipment from the company. A start-up division of Kleen wants the equipment to use in its new business.

Kleen wants to charge the start-up division for the equipment. The start-up division argues that the equipment is a sunk cost and should not be charged for it: it was bought and paid for years ago. Who is right--is this a sunk cost or something else? Select the best answer.

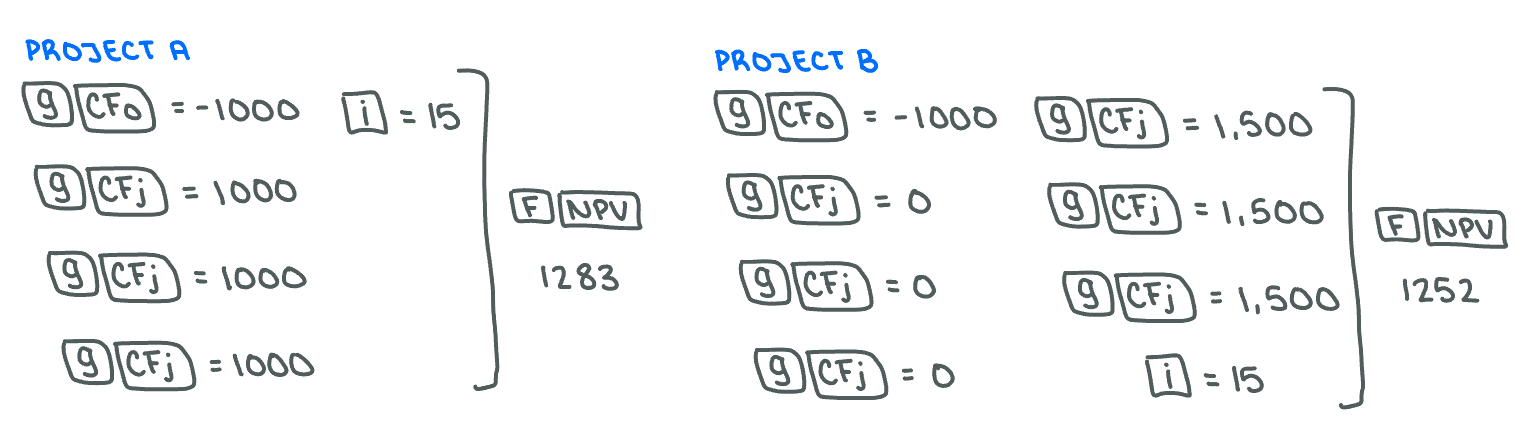

Project A.

Which mutually exclusive project would you select, if both are priced at $1,000 and your discount rate is 15%: Project A with three annual cash flows of $1,000; or project B, with 3 years of zero cash flow followed by 3 years of $1,500 annually?

net profit + depreciation + tax paid

Which of the following is not accurate in depicting cash flows from operations?

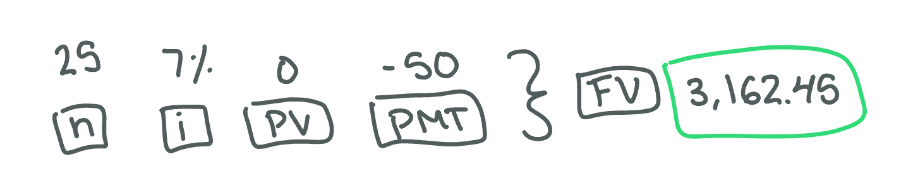

3,162.45

Jack and jill are saving for a rainy day and decide to put $50 away in their local bank every year for the next twenty-five years. The local Up-the-Hill Bank will pay them 7% on their account. If Jack and jill put the money in the account faithfully at the end of every year, how much will they have in it at the end of twenty-five years? Round your answer to the nearest dollar. (NOTE, do NOT include the dollar sign in your answer.)

McDonald's; PepsiCo; PepsiCo

Financial information about PepsiCo, Coca-Cola and McDonald's is given in the following table. DuPont identity decomposes a firm's ROE into three components: operating efficiency, as measured by the profit margin (net income/sales); asset management efficiency, as measured by asset turnover (sales/total assets); and financial leverage, as measured by the equity multiplier (total assets/total equity).

______ has the best operating efficiency, _____ has the asset management efficiency, and ______ has the highest financial leverage.

Company | Sales | Net Income | Total Assets | Total Liabilities |

PepsiCo | $ 66,415 | $ 6,740 | $ 77,487 | $ 53,199 |

Coca-Cola | $ 46,854 | $ 8,584 | $ 90,055 | $ 56,882 |

McDonald's | $ 28,106 | $ 5,856 | $ 36,626 | $ 20,617 |

$50,000 spent on research and development costs over time on the older modem.

You are evaluating whether to retire your current computer modem product and replace it with a new modem that incorporates new features. Which of the following would not be relevant to your decision-making process?

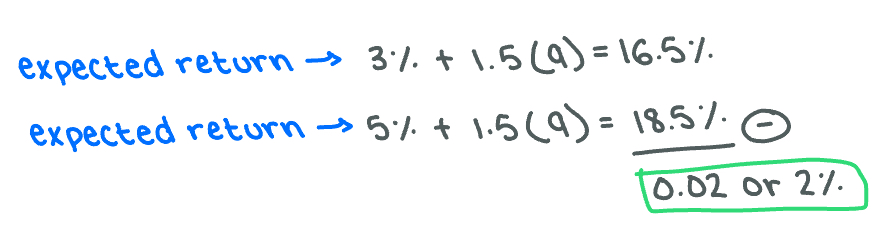

The expected return will increase by 2.0%.

What will happen to the expected return on a stock with a beta of 1.5 and a market risk premium of 9% if the Treasury bill yield increases from 3 to 5%? (assuming the change in T-bill yield does not affect the market risk premium).

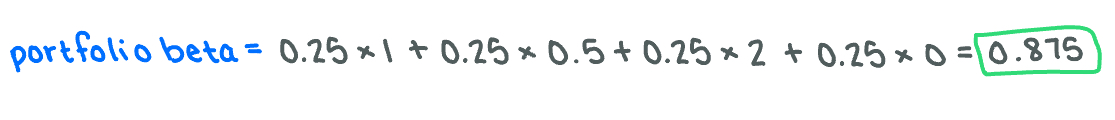

0.875

What is the beta for a portfolio equally weighted in four assets: A, the market portfolio; B, which has half the risk of A; C, which has twice the risk of A; and D, which is risk-free?

The actual expected stock return indicates the stock is currently overpriced.

The common stock of Alpha Manufacturers has a beta of 1.24 and an actual expected return of 13.25 percent. The risk-free rate of return is 3.7 percent and the market rate of return is 11.78 percent. Which one of the following statements is true given this information?

A reduction in the market risk premium

Which of the following events will reduce a company's weighted average cost of capital (WACC)?

National decrease in consumer spending on entertainment

Which one of the following is an example of unsystematic risk?

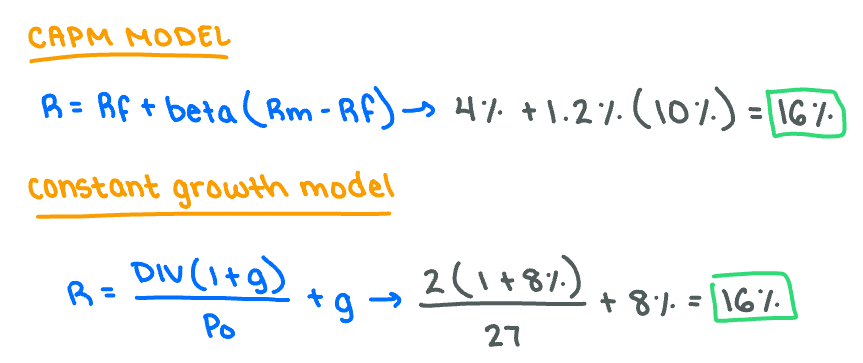

CAPM: 16.0%; CGM: 16.0%

A company has a target capital structure of 40% debt and 60% equity. The company is a constant growth firm that just paid a dividend of $2.00, sells for $27.00 per share, and has a growth rate of 8%. The company's bonds pay 10% coupon (semi-annual payment), mature in 20 years, and sell for $849.54. The company's stock beta is 1.2. The company's marginal tax rate is 40%. The risk-free rate is 4%. The market risk premium is 10%.

The cost of equity using the capital asset pricing model (CAPM) and the constant growth model is…

then estimated cost of equity goes down

Under the constant dividend growth model for common stock, if the price of a stock (Po) goes up (and nothing else changes),

Go up

When a firm's earnings are falling more rapidly than its stock price, its P/E ratio will…

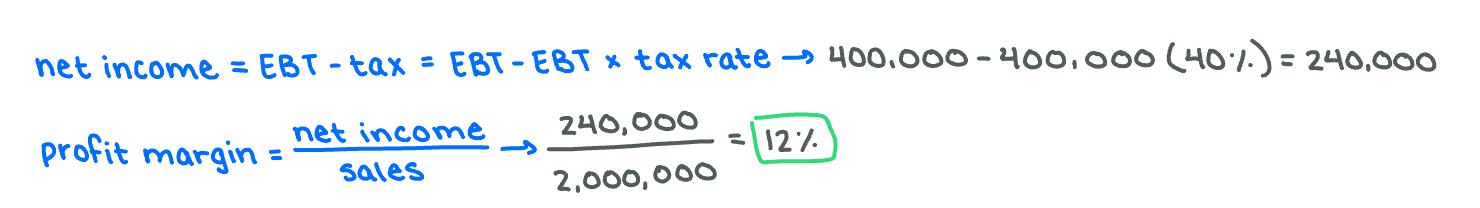

12%.

The Bubba Corp. had earnings before taxes of $400,000 and sales of $2,000,000. If it is in the 40% tax bracket, its profit margin is…

owners of the firm and managers of the firm.

Agency theory examines the relationship between…

XYZ is able to collect its receivables every 91.25 days, or 4 times a year.

If XYZ's accounts receivable turnover ratio is 4, what does that mean?

current asset.

An item, which is expected to be converted to cash within one year, is generally classified as a…

$1,156.99

Assume that you invested $2,566.70 at Year 0 in a project that is promising to return 12 percent per year. The cash flows are expected to be as follows.

Determine the expected cash flow (whose value is missing) at Year 4.

All of the examples above are annuity cash flows.

Which of the following is NOT an example of annuity cash flows?

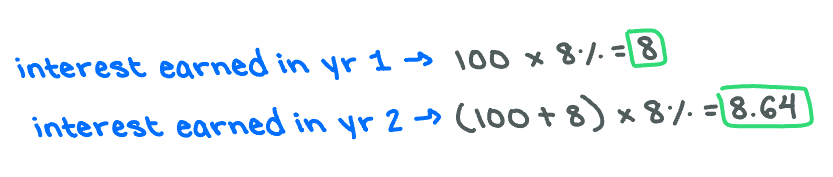

The interest earned in year one is $8.00 and the interest earned in year two is $8.64.

An investment of $100 today is worth $116.64 at the end of two years if it earns an annual interest rate of 8%. How much interest is earned in the first year and how much in the second year of this investment?

$130,000

monthly mortgage payment on your house is $821.69. It is a 30-year mortgage at 6.5% annual interest rate, compounded monthly. How much did you borrow? (round to the nearest dollar)

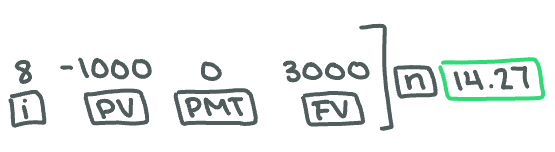

14 years

Approximately how long must one wait (to the nearest year) for an initial investment of $1,000 to triple in value (i.e., increase to $3000) if the investment earns 8% compounded annually?

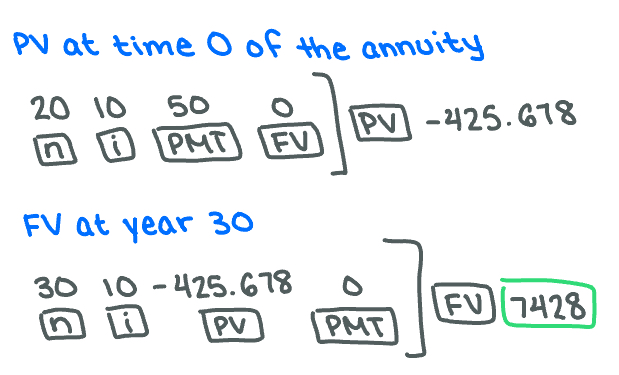

$7,428

Assume you are to receive a 20-year annuity with annual payments of $50. The first payment will be received at the end of Year 1, and the last payment will be received at the end of Year 20. You will invest each payment in an account that pays 10 percent. What will be the value in your account at the end of Year 30? (round to the nearest dollar)

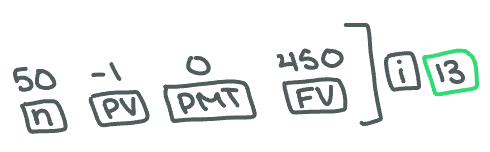

13%.

Julian was given a gold coin originally purchased for $1 by his great grandfather 50 years ago. Today the coin is worth $450. The rate of return realized on the sale of this coin is approximately equal to (round to the nearest percent)

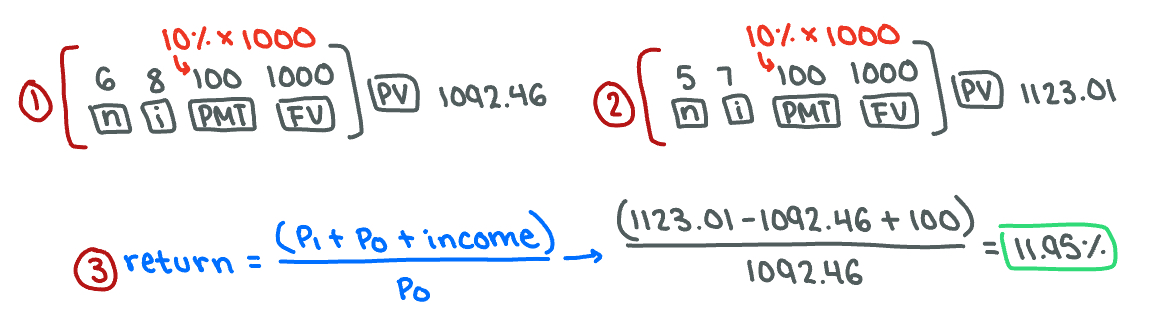

11.95%

A 6-year coupon bond was purchased one year ago. The coupon rate is 10% and par value is $1,000. Coupons are paid annually. At the time the bond was bought, the yield to maturity (YTM) was 8%. If the bond is sold after receiving the first interest payment and the bond's yield to maturity had changed to 7%, the annual total rate of return on holding the bond for that year would have been…

the maturity date of common stock

Value of a common stock does not directly depend on _____

a percentage of its face value.

The coupon rate of a bond equals …

Current yield

The annual dollar interest received (or annual coupon payment) divided by the market price of the bond is called the…

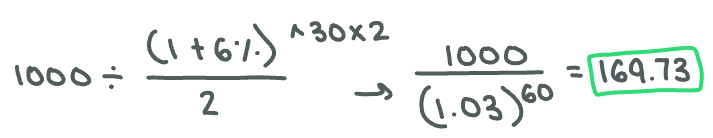

$169.73

How much does the $1,000 to be received upon a bond's maturity in 30 years contribute to the bond's price if the appropriate discount rate is 6%, compounded semi-annually?

Below par

A bond that has a "yield to maturity" greater than its coupon interest rate will sell for a price…

the annual coupon payment divided by the current market price

The current yield on a bond is equal to…