Supply Chain W2 chapter 12

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

16 Terms

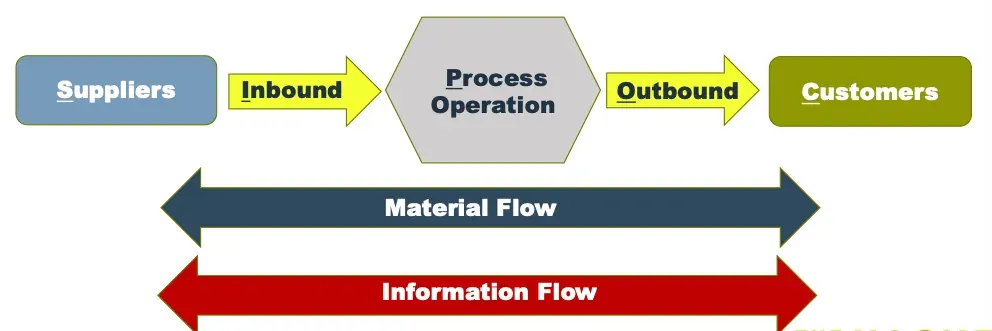

Upstream and Downstream Flow

The supply chain is viewed from your perspective (the Motor Manufacturer), which sits in the middle:

Upstream (Supply Side): This is the input side, involving all the suppliers from whom you source materials.

Flow: This direction is often dominated by the Material flow towards the manufacturer.

Downstream (Demand Side): This is the output side, involving the distribution channels that get the final product to the customer.

Flow: This direction is dominated by the Material flow away from the manufacturer.

Tiers of Suppliers

First-tier suppliers (Tier 1): These companies supply parts directly to the Motor Manufacturer (the Original Equipment Manufacturer or OEM). For example, a company that provides complete engine assemblies.

Second-tier suppliers (Tier 2): These companies supply parts to the First-tier suppliers. For example, a company that provides pistons or spark plugs to the engine assembly maker.

Third-tier suppliers (Tier 3): These companies supply parts to the Second-tier suppliers, and so on. They are typically providers of raw materials or very basic components

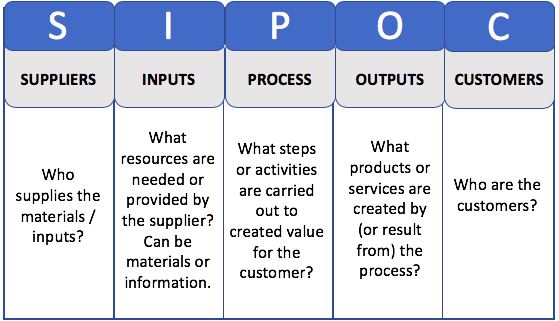

SIPOC (Y1)

Suppliers, Inputs, Process, Outputs, and Customers;

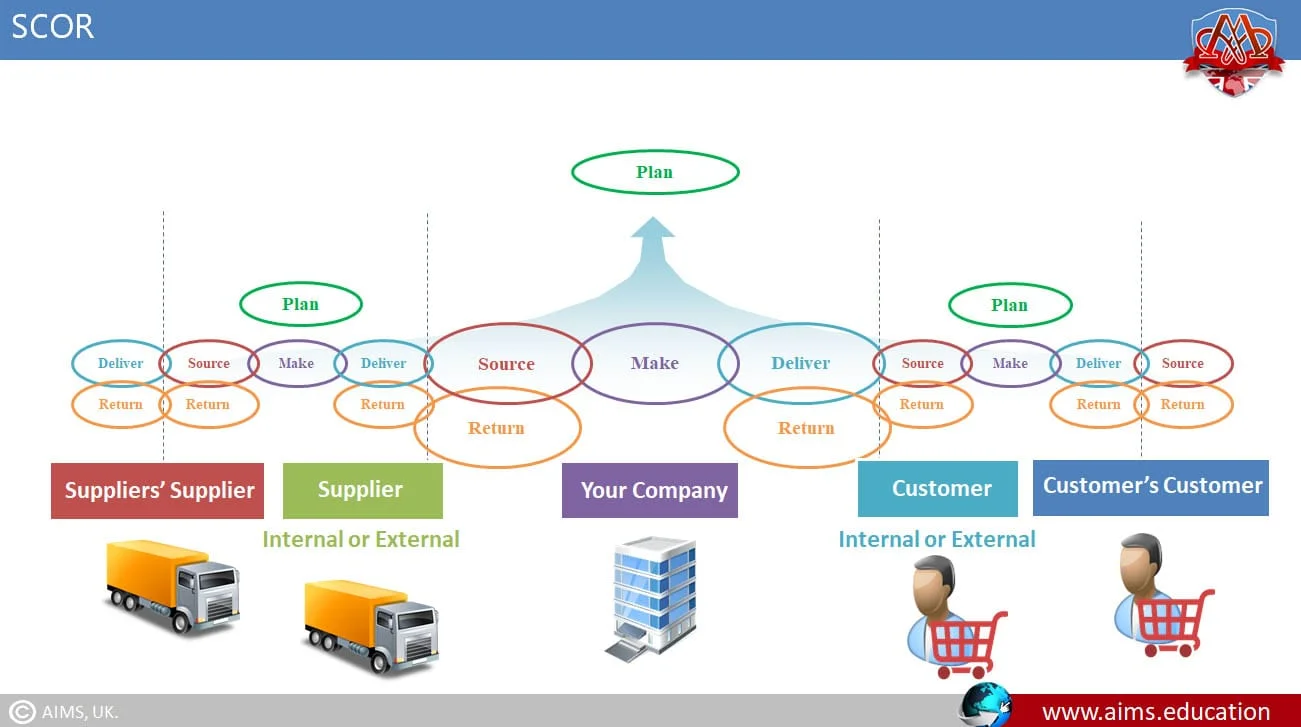

SCOR (Y1)

Supply Chain Operations Reference Model (it supports creating and managing supply chains)

This building block shows the activities that each company essentially does.

Supply chains can be described by linking these building blocks.

The processes between and inside the companies must be managed to create an efficient supply chain.

The SCOR model supports creating and managing Supply Chains.

main focus areas: people, performance, process, best practices

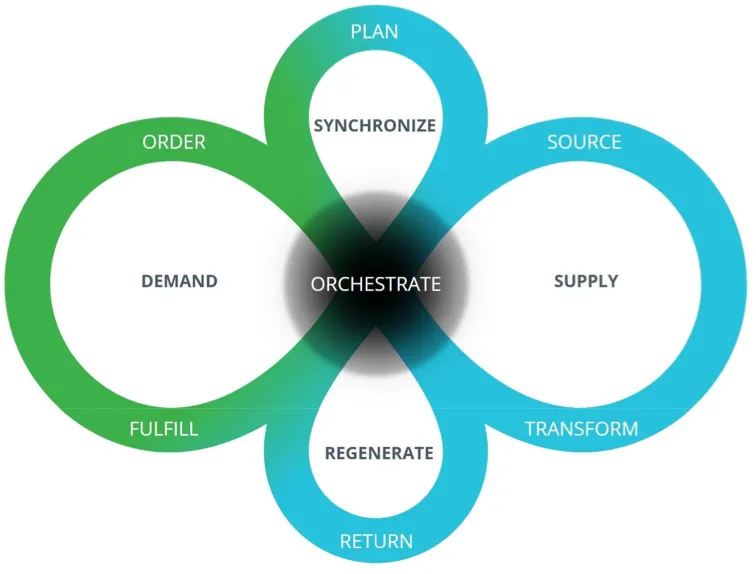

orchestrating supply chain - synchronising demand and supply

The Supply Chain Operations Reference (SCOR) model describes the business activities associated with all phases of satisfying a customer’s demand. The model itself is organized around the six primary management processes of Plan (Order and Plan), Source, Make (Transform), Deliver (Fulfill), Return and Enable.

SCOR standard includes: plan, source, make, deliver, return and enable SCOR digital standard includes: order, plan, source, transform, fulfill, return

Performance objectives

To deliver services and products to end customers that meet their expectations in terms of:

Quality

Speed; The first is how fast customers can be served, or the time taken for goods and services to move through the chain.

Dependability

Flexibility; network’s ability to cope with changes and disturbances.

Cost

sustainability

Lean vs Agile supply networks

Functional vs. Innovative Offerings

1. Functional Products/Services

Demand: Stable and predictable

Profit margins: Usually low

Examples:

Standardised consulting tasks

Routine hospital procedures (e.g., cataract surgery)

Classic shoe styles that stay the same over years

These offerings don’t change much. Because demand is known and consistent, companies can focus on efficiency.

2. Innovative Products/Services

Demand: Uncertain, changes quickly

Profit margins: High

Examples:

Highly customised consulting projects

Emergency, tailored surgeries

Fashion shoes that are popular for one season

These offerings are new, unpredictable, and require flexibility.

Natural Alignment

Functional ➜ Lean supply chain (efficient)

Innovative ➜ Agile supply chain (responsive)

Lean vs Agile supply networks

Lean/Efficient Supply Chains (best for functional products)

Aim to keep costs low and processes efficient

Keep inventory or service capacity low (especially downstream)

Maximise utilisation of resources (avoid waste)

Require fast, accurate information flow

Goal: Efficiency

Because demand is predictable, companies can streamline operations without risking stockouts or delays.

Agile/Responsive Supply Chains (best for innovative products)

Focus on fast response and high service levels

Place inventory or capacity close to the customer

Allow quick reaction to sudden demand changes

Still need fast upstream throughput to replenish stock

Goal: Flexibility and responsiveness

These supply chains handle unpredictability better, ensuring the company can meet sudden spikes or shifts in customer preferences.

Recap:

Upstream = closer to the raw materials or suppliers; fabric suppliers, dye houses, sewing factories

Downstream = closer to the end customer; retail stores, online storefronts, the customer

So when the text says that efficient (lean) supply chains keep inventories low in the downstream parts, it means: They try not to hold too many finished goods in warehouses or stores.

Instead, they move items through quickly so products don’t pile up near the customer.

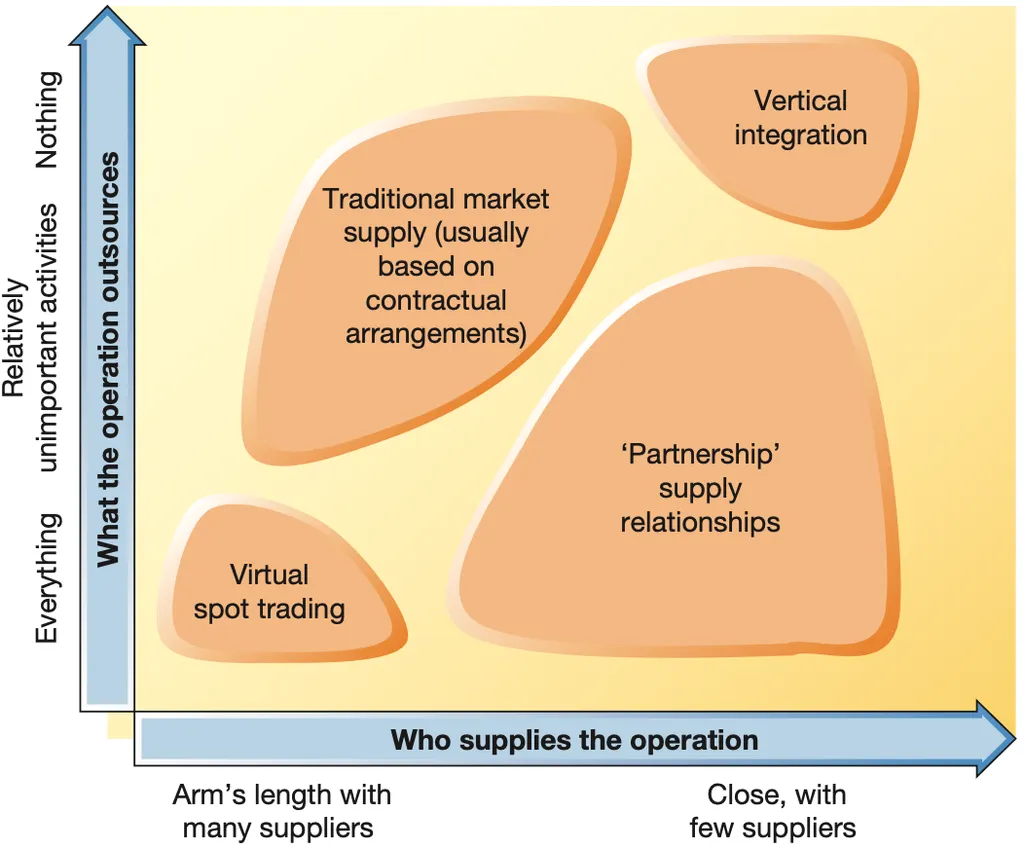

How should relationships in supply chains be managed?

Two main decisions:

What activities should you outsource?

How many activities? How important are the activities?

Who should you choose as a supplier?

How many suppliers? How come are the relationships?

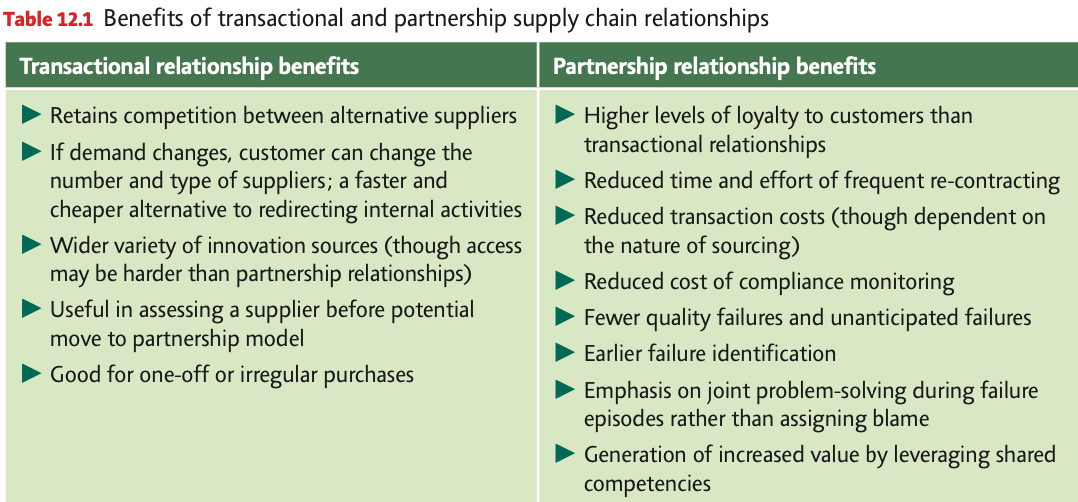

Businesses can structure relationships with suppliers in two main ways:

1. Transactional Relationships

Based on market-style buying: choose the best supplier each time.

Can be short- or long-term, but no commitment beyond the current contract.

Focus on short-term benefits, low prices, and flexibility.

Suitable when cost savings from competitive bidding are most important.

2. Partnership Relationships

Long-term, collaborative, and based on mutual commitment.

Emphasise cooperation, information sharing, joint problem-solving, and sometimes sharing profits/costs.

Aim for mutual benefit—but require willingness to sacrifice some independence.

Best when innovation or long-term stability depends on close collaboration.

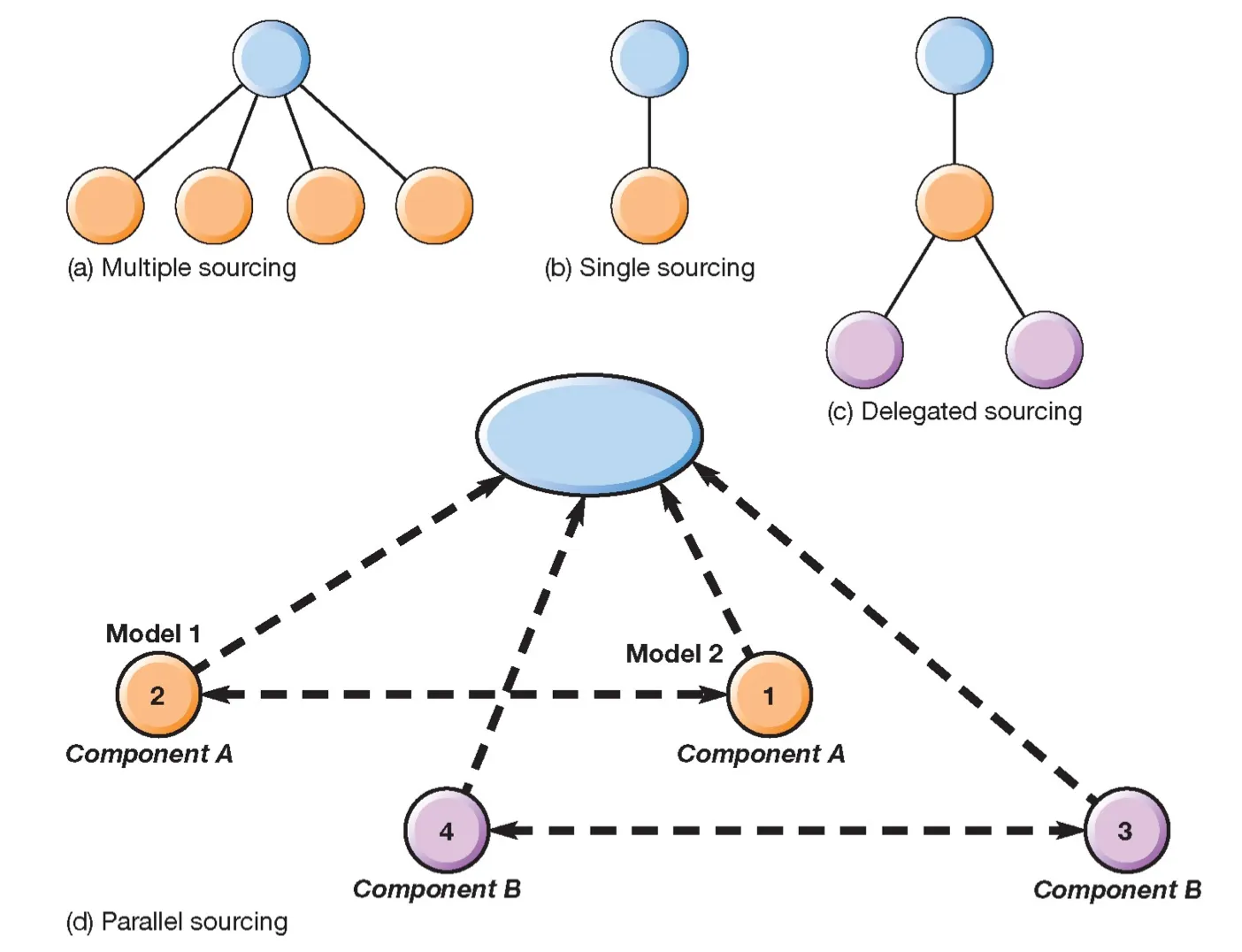

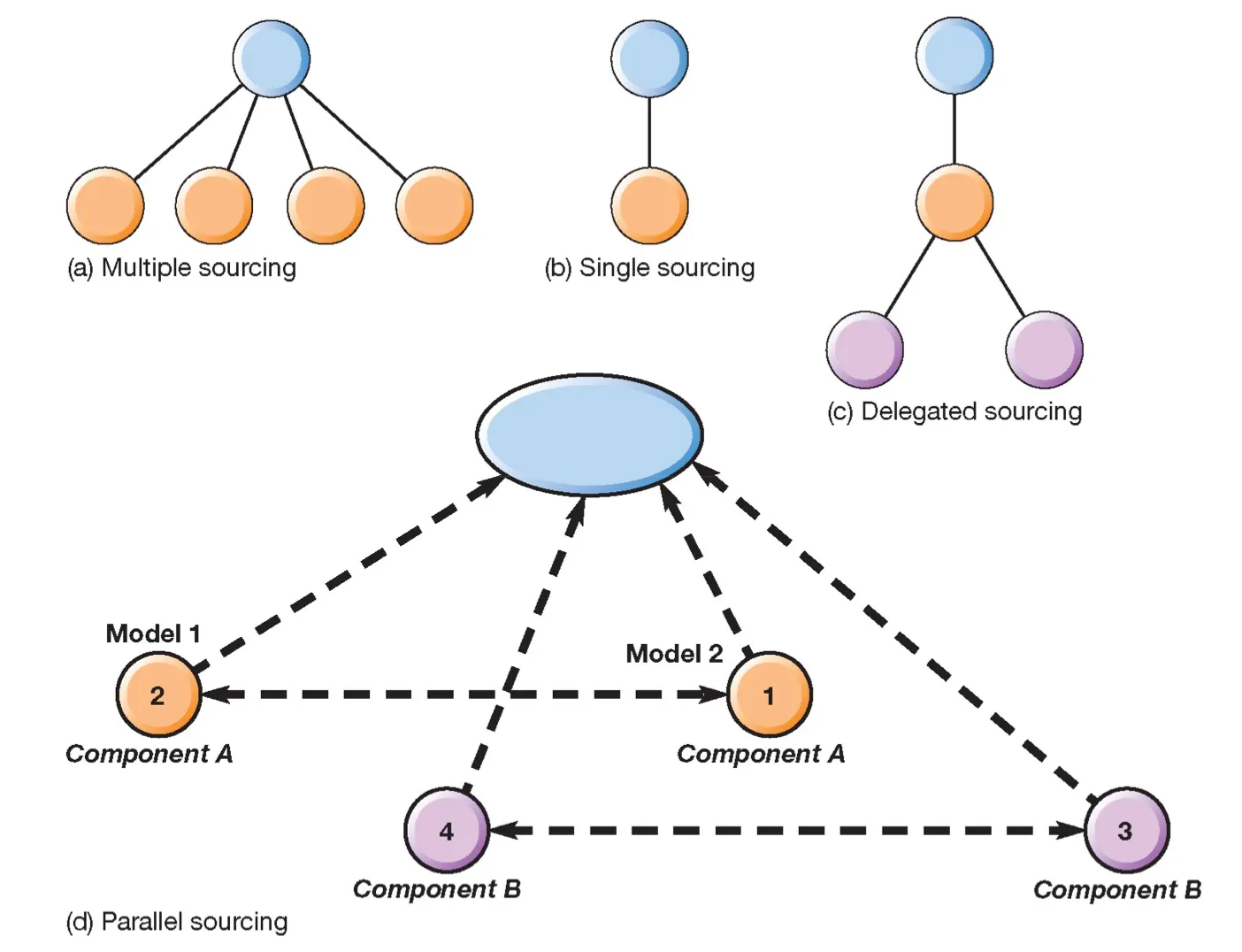

Sourcing Approaches

Multiple Sourcing

Buy from more than one supplier.

Is commonly seen in competitive markets where switching costs are low and performance objectives are primarily focused on price and dependability.

Benefits: maintains competition, reduces supply risk, increases flexibility, avoids dependence on one supplier-allowing for changes in purchase volumes without the risk of supplier bankruptcy.

Drawback: harder to build strong, committed partnerships with suppliers.

2. Single Sourcing

Buy everything from one supplier.

Benefits: simplicity, lower admin costs, stronger long-term relationships, better overall performance focus.

Drawbacks: risk of becoming “locked in,” less bargaining power, higher dependence on one supplier.

3. Delegated Sourcing

One supplier provides a whole package or sub-assembly, rather than a single part.

Benefits: fewer tier-one suppliers, more focus on strategic partnerships.

Drawbacks: may create very powerful “mega-suppliers,” altering supply market dynamics.

4. Parallel Sourcing

Mix of single and multiple sourcing: each service package is single-sourced, but different packages go to different suppliers.

Benefits: maintains competition, enables switching if needed.

Drawbacks: more complex to manage.

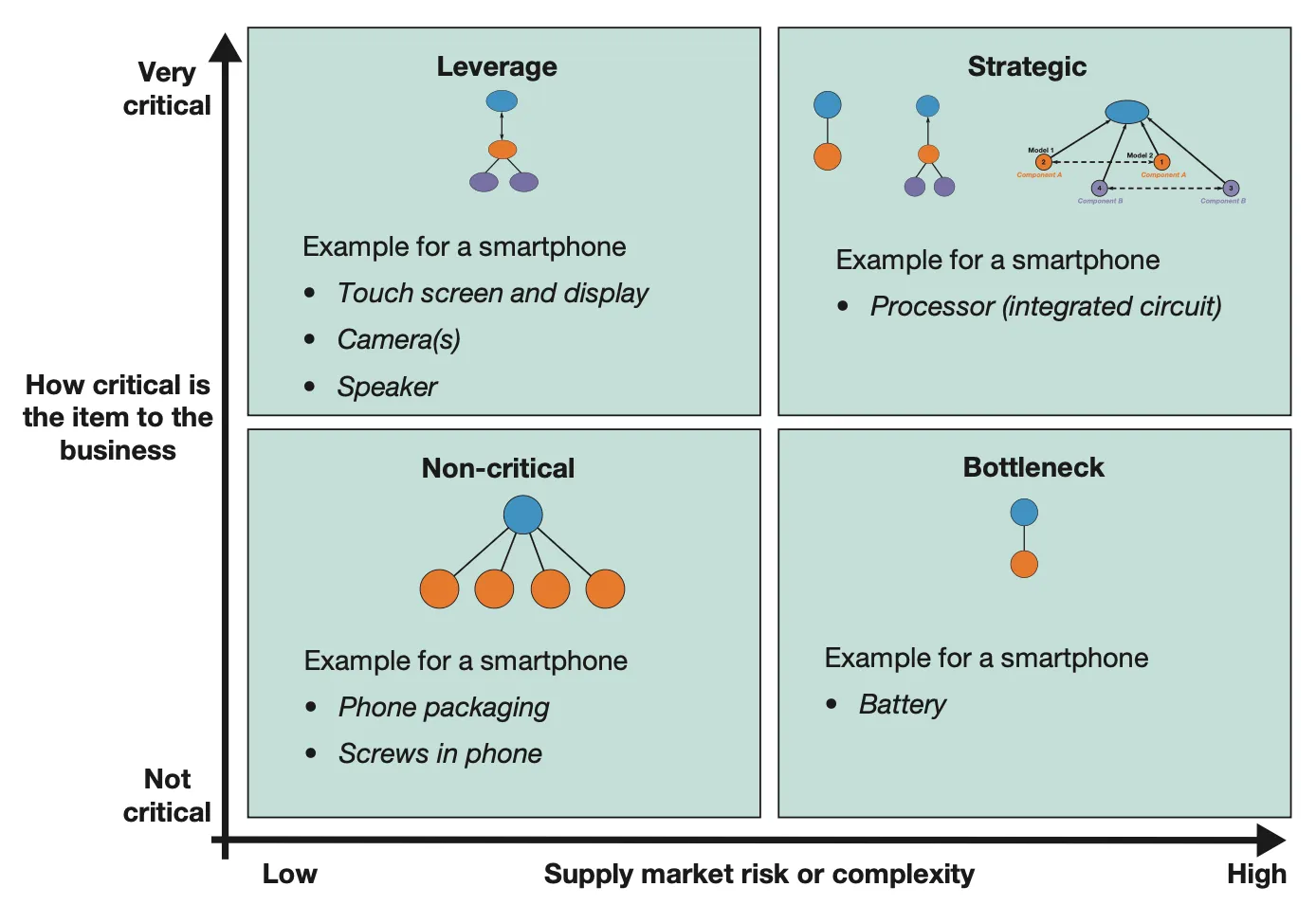

Strategy sourcing using the Krajlic matrix

(supply risk vs criticality to business)

The supplier selection process

Procurement = Sourcing + Purchasing

The above figure shows the supplier selection process which is part of the sourcing process, which normally would start with the Demand Specifications, then the Supply Market overview, the Sourcing Strategy, and only then Supplier Selection, and would end with Contracting the supplier.

The purchasing process would come after that and would include: phasing in new suppliers, ordering and receiving deliveries, measuring supplier performance, improving or developing a supplier, or phasing out of the supplier.

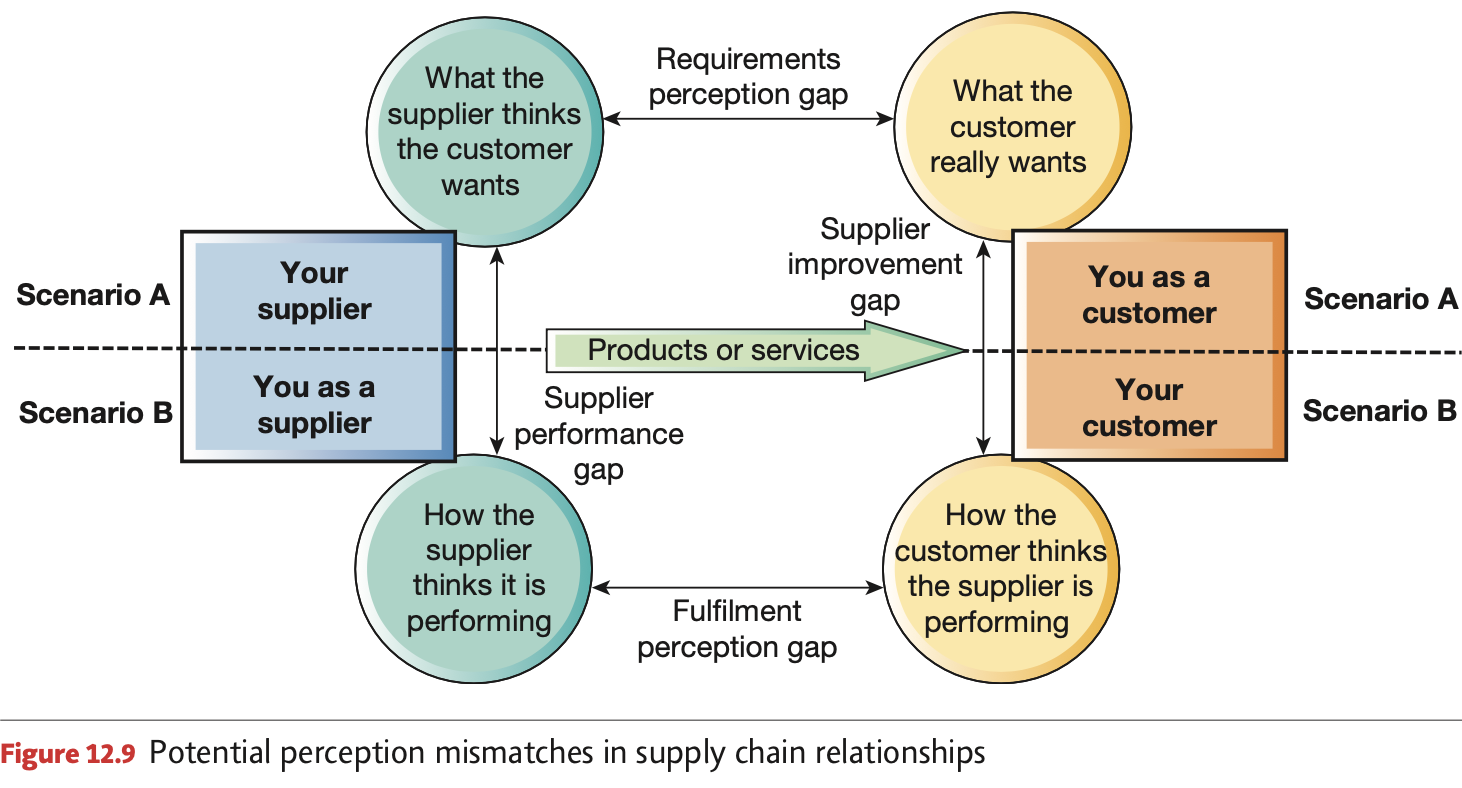

One of the biggest problems in Supply Chain Management (SCM) is the mismatch between how customers and suppliers see the relationship, what is needed, and how well the work is being done.

Requirements perception gap

Customer thinks they explained what they want

Supplier understands it differently

Fulfilment perception gap

Customer thinks the supplier is performing badly

Supplier thinks they are performing well

Supplier improvement gap

Difference between what the customer wants and how they think the supplier is doing

This affects what the customer asks the supplier to improve

Supplier performance gap

Difference between what the supplier thinks the customer wants and how the supplier thinks it is performing

The Bullwhip Effect

Small fluctuations in customer demand at the retail level (the end of the chain) lead to increasingly larger fluctuations in orders further up the supply chain (at the wholesaler, manufacturer, and supplier levels).

A small disturbance at one end of the chain causes increasingly large disturbances as it works its way towards the other end. Its main cause is a perfectly understandable and rational desire by the different links in the supply chain to manage their levels of service activity and inventory sensibly.

Controlling supply chain dynamics (the bullwhip effect); can be reduced by: (not in LO, but in quiz)

Channel alignment in supply networks

All members of the supply chain coordinate their planning, scheduling, inventory levels, and pricing. Decisions are harmonised so that different forecasting or ordering practices do not create unnecessary fluctuations. A common example is vendor-managed inventory (VMI), where suppliers manage customers’ stock levels..

Operational efficiency in supply networks

Each operation works to reduce errors, lead times, costs, and complexity. Better quality, reliable delivery, and faster processes make the supply chain more predictable and reduce the need for excess inventory and constant replanning.

Information sharing

haring accurate, real demand data across the supply chain helps upstream partners respond correctly to customer needs. Tools such as EPOS, EDI, and blockchain technology allow transparent and timely information flow, reducing uncertainty and unnecessary order variation.

channel alignment, e-enabling the supply chain, improving the operational efficiency, improved forecasts

Supply chain management (SCM)

relationship and flows between the chain of operations and processes that deliver value in the form of services and products to the ultimate consumer.

Think of a supply chain as a network of steps that a product or service goes through before it reaches you, the customer. This includes all the processes, people, and companies involved—from raw materials to the final product or service.

SCM is basically managing this whole network efficiently so that the product/service reaches the customer at the right time, in the right place, and at the right cost.