3.4 Final accounts - IB Business Management

1/58

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

59 Terms

Final accounts

Financial statements compiled by businesses at the end of a particular accounting period (year)

Profit and loss account

Also known as the income statement, shows the records of income and expenditure flows of a business over a given time period

Costs of goods sold

The direct cost of producing or purchasing the goods that were sold during that period

Dividends

The sum of money paid to shareholders decided by the board of directors of a company

Gross profit

= sales revenue - cost of sales

Cost of sales

= opening stock + purchases - closing stock

Net profit before interest and tax

= gross profit - expenses

Net profit before tax

= net profit before interest and tax - interest

Net profit after interest and tax

= net profit before tax - corporate tax

Retained profit

= net profit after interest and tax - dividends

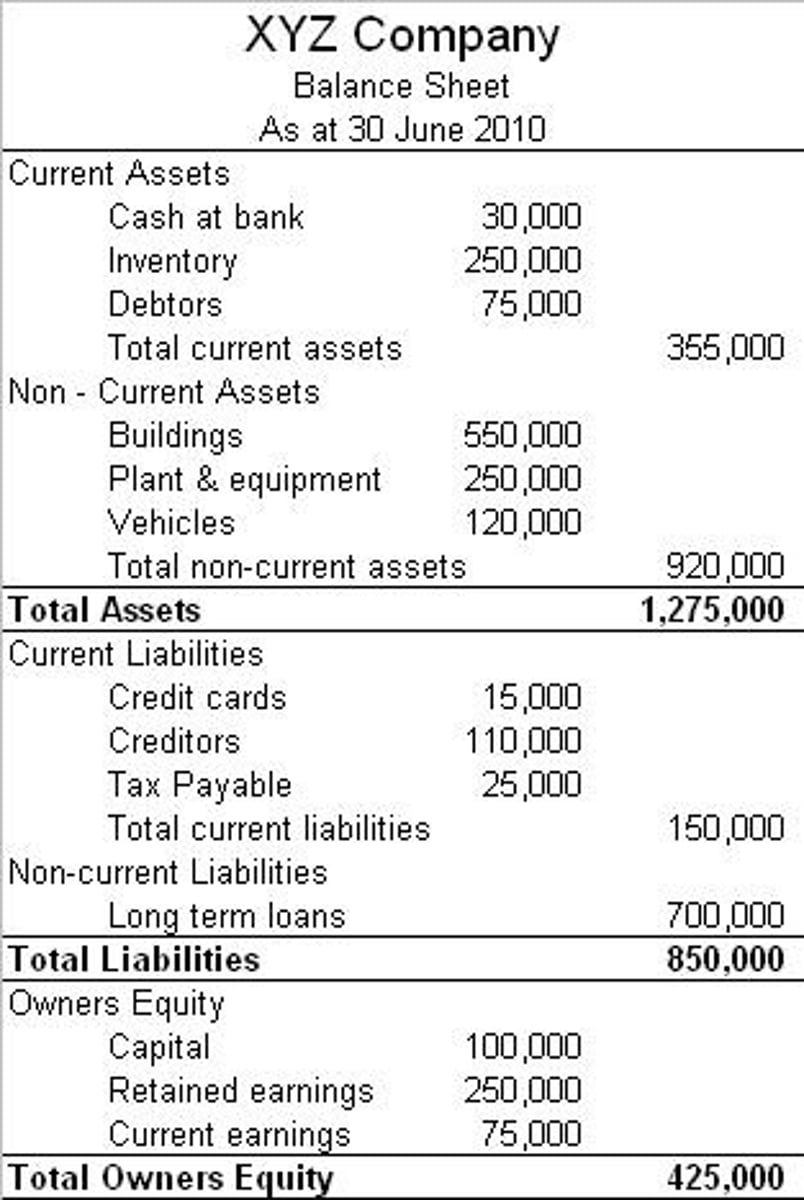

Balance sheet

Outlines the assets, liabilities, and equity of a firm at a specific point in time

Working capital

= total current assets - total current liabilities

Patents

Provide inventors with the exclusive rights to manufacture, use, sell or control their invention of a product

Trademark

A recognizable symbol, word, phrase or design that is officially registered and that identifies a product or a business

How stakeholders use business accounts: Business managers

1. Measure the performance of a business against targets, previous time periods and competitors

2. Help them with decisions; e.g., new investments, branch closures, launching new products

3. Control and monitor the operation of each department, branch and division

4. Set targets for the future and review against actual performance

How stakeholders use business accounts: Workforce

1. Assess whether the business is secure enough to pay wages and salaries

2. Determine whether the business is likely to expand or be reduced in size

3. Determine whether jobs are secure

4. Find out whether, if profits are rising, a wage increase can be afforded.

5. Find out how the average wage in the business compares with the salaries of directors.

How stakeholders use business accounts: Banks

1. Decide whether to lend money to a business

2. Assess whether to allow for an increased overdraft facility

3. Decide whether to renew sources of finance; e.g., overdraft, loans, etc

How stakeholders use business accounts: Creditors, such as suppliers

1. Assess whether the business is secure and liquid enough to pay off its debts

2. Assess whether the business is a good credit risk

3. Decide whether to press for early repayment of outstanding debts

How stakeholders use business accounts: Customers

1. Assess whether a business is secure

2. Determine whether they will be assured of future supplies of the good they are purchasing

3. Establish whether there will be security of spare parts and service facilities

How stakeholders use business accounts: Government and tax authorities

1. Calculate how much tax is due form the business

2. Determine whether the business is likely to expand and create more jobs

3. Assess whether the business is in danger of closing down, creating economic problems

4. Determine whether the business is staying within the law in terms of accounting regulations.

How stakeholders use business accounts: Investors, such as shareholders in the company

1. Assess the value of the business and their investment in it

2. Establish whether the business is becoming more or less profitable

3. Determine the share of the profits investors are receiving

4. Decide whether the business has potential for growth

5. To compare businesses before making an investment and/or purchasing shares in a company

6. To consider whether they should sell all or part of their holding

The two main business accounts:

1. Income (profit and loss) statement

2. Balance sheet

Income (profit and loss) statement

Records the revenue, costs and profit (or loss) of a business over a given period of time.

Three sections of an income(P&L) statement:

1. Trading account

2. Profit and loss account

3. Appropriation account

Sales revenue

The total value of sales made during the trading period = selling price x quantity sold (sales turnover)

Cost of Sales or Cost of Goods Sold

This is the direct cost of purchasing the goods that were sold during the financial year (cost of goods sold)

Gross profit

Gross profit = sales revenue-cost of sales

Retained profit

The profit left after all deductions, including dividends, have been made. This is 'ploughed back' into the company as a source of finance

Uses of income statements:

1. Measure and compare the performance of a business over time or with other firms

2. The actual profit data can be compared with the expected profit levels

3. Bankers and creditors will need the information to help decide whether to lend money to the firm

4. Potential investors may assess the value of the business from the profits being made

Balance sheets

An accounting statement that records the values of a business's assets, liabilities and shareholders' equity at one point in time.

Intangible assets

Long-term assets (e.g., patents, trademarks, copyrights) that have no real physical form but do have value to the business.

Balance Sheet

Financial Information on the organizations assets, liabilities, and the capital invested by the owners on one specific day.

Fixed Assets

Items owned by a business, not intended for sale within the next twelve month, but used repeatedly to generate revenue for the business.

Gross Profit

Sales revenue - COS

Net Assets

The value of a business by calculating the value of all its assets minus its liabilities.

Profit and Loss Account (P&L)

A financial record of a firm's trading activity over the past 12 months.

Share Capital

The amount of money raised through the sale of shares.

The two main business accounts:

1. Profit and Loss Account (income statement)

2. Balance sheet

Profit and Loss Account

A financial statement showing a company's net profit or loss in a given period.

Gross profit

Gross profit = sales revenue - costs of goods sold

Sales revenue

The total value of sales made during the trading period = selling price x quantity sold

Dividends

The share of profits paid to shareholders as a return for investing in a company

How stakeholders use business accounts: Business managers

1. Measure the performance of a business against targets, previous time periods and competitors

2. Help them with decisions; e.g., new investments, branch closures, launching new products

3. Control and monitor the operation of each department, branch and division

4. Set targets for the future and review against actual performance

How stakeholders use business accounts: Banks

1. Decide whether to lend money to a business

2. Assess whether to allow for an increased overdraft facility

3. Decide whether to renew sources of finance; e.g., overdraft, loans, etc

How stakeholders use business accounts: Creditors, such as suppliers

1. Assess whether the business is secure and liquid enough to pay off its debts

2. Assess whether the business is a good credit risk

3. Decide whether to press for early repayment of outstanding debts

How stakeholders use business accounts: Customers

1. Assess whether a business is secure

2. Determine whether they will be assured of future supplies of the good they are purchasing

3. Establish whether there will be security of spare parts and service facilities

How stakeholders use business accounts: Government and tax authorities

1. Calculate how much tax is due form the business

2. Determine whether the business is likely to expand and create more jobs

3. Assess whether the business is in danger of closing down, creating economic problems

4. Determine whether the business is staying within the law in terms of accounting regulations.

How stakeholders use business accounts: Investors, such as shareholders in the company

1. Assess the value of the business and their investment in it

2. Establish whether the business is becoming more or less profitable

3. Determine the share of the profits investors are receiving

4. Decide whether the business has potential for growth

5. To compare businesses before making an investment and/or purchasing shares in a company

6. To consider whether they should sell all or part of their holding

Uses of Profit and Loss Accounts:

1. Measure and compare the performance of a business over time or with other firms

2. The actual profit data can be compared with the expected profit levels

3. Bankers and creditors will need the information to help decide whether to lend money to the firm

4. Potential investors may assess the value of the business from the profits being made

Fixed assets

Tangible assets (e.g. not brands) that have a physical existence and are expected to be retained and used by a business for more than 12 months; e.g., land, buildings, vehicles and machinery

Working capital & net assets

Working capital = current assets - current liabilities

Intangible assets

Long-term assets (e.g., patents, trademarks, copyrights) that have no real physical form but do have value

Balance Sheet

A statement of the financial position of a business in terms of assets, liabilities and owner's equity at a particular point in time such as at the end of a financial year.

Equity

The funds invested in a business by the shareholders plus retained profits.

Net Current Assets (working capital) Calculation

Net current assets = current assets - current liabilities

Patents

Legal protection given to an inventor of a product to safeguard it from being copied for a specified number of years

Copyrights

legal protection that is given to the producers of literary or artistic works and safeguards their exclusive right to publish, reproduce, perform, distribute and sell the artistic works.

Registered Trademark

A distinctive mark, sign or symbol that a company or individual uses to identify or brand itself to distinguish itself from competitors, after registration with the relevant government entity.

Goodwill

The intangible value of a company derived from its 'good nature' in business.