Accounting

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

What are 3 Financial Statements, and why do we need them?

Income shows compan’ys revenue, expenses, and taxes over a period and ends with net income, which shows the company’s after-tax profits.

The balance sheet shows company’s assets and how it paid for those resources (liabilities and equity) at a specific point in time.

CFS starts with net income, adjust for non cash items and changes in operating assets and liabiities, then shows the company’s cash flllow from investing and financing activities. the last line show the net change in cash and the comapny’s ending cash balance.

You need them why? Always difference between the company’s net income and real cash flow it generates and statements let you estimate the cash flow more accuratley.

How do the financial statements link together?

“Income creates cash flow, cash updates the balance sheet, and net income flows into equitY”

Net income → top of the cash flow statement

Add back non-cash items (D&A, SBC)

Adjust for working capital → get Cash Flow from Operations (CFO)

Add CFI and CFF → get Net Change in Cash

Ending cash = cash on the balance sheet

Net income + equity activities (stock issued/repurchased, SBC, dividends) → shareholders’ equity

Every CFS line updates its matching balance sheet account

Assets: cash inflows add, cash outflows subtract

Liabilities & equity: cash inflows increase, outflows decrea

What’s most important statement?

CFS, tells how much cash is generating and valuation is based on cash flow

IS: includes non cash revenue, expenses and taxes and excludes cash on cap ex, it doesn’t accurate represent a company’s cash flow.

Could you use two financial statement? If not why?

You can partially derive one from the other two because all three are linked through net income, retained earnings, and cash movements. However, you can’t fully reconstruct any one statement without additional details — for example, the cash flow statement requires non-cash adjustments and financing data that aren’t visible on the income statement or balance sheet.”

How are financial statements of a company in the UK or germany be different than a company based in US?

The main difference is that U.S. companies use GAAP, which has more detailed rules, while UK and German companies use IFRS, which is more flexible and based on principles. This means certain items — like how assets are valued, how development costs are treated, or how leases are recorded — can look different across regions.

So when you’re comparing companies from different countries, you need to adjust the numbers to make them consistent.

For example, under IFRS, companies can increase the value of their property or equipment, which makes their assets and equity look higher. That can make their return on equity look lower compared to a U.S. company, so I’d adjust for that to make the comparison fair.

What if a company’s CFS starts with something other than net income like operating income or cash recieved?

Usually, the cash flow statement starts with net income and then adjusts for things that don’t involve cash, like depreciation or changes in working capital.

If it starts with something else — like operating income or cash received — that just means the company is showing cash flows in a different way. For example, they might be using the direct method, which lists actual cash in and out, or starting from a different profit number.

In those cases, you’d just need to adjust for interest, taxes, and non-cash items to make it line up with the usual format.”

How do you know when a revenue or expense item should appear on the income statement?

Corresponds 100 percent to the period shown

Affects business income available to common shareholders

How to tell if item should appear on the CFS?

1) Already appeared on the income statement and affected net income, but it’s non cash, so need to adjust for the company’s real cash flow

OR has not appeared on the income statement but does affect company’s cash balance (CF from investing financing such as capex or dividends)

Define equity value and explain how it relates to enterprise value.

.Enterprise value represents the total value of a firm to all stakeholders (equity + debt – cash). Equity value is just the portion attributable to shareholders. EV = Equity Value + Net Debt + Preferred Stock + Minority Interest – Cash. EV is capital structure neutral; equity value depends on leverage.

What is a Contingent consideration (an earn-out)

extra payment in a business acquisition (M&A) made to the seller only if the acquired company hits specific future performance goals (like revenue, profit, or product milestones) within a set time

Good will

f you buy a company for more than what its assets minus liabilities are worth on paper, that difference is goodwill.

In a merger model, how would you adjust the pro forma balance sheet if the buyer assumes contingent consideration (an earn-out) as part of the purchase price?

Contingent consideration is an earn-out recorded as a liability at closing based on its estimated value, which reduces goodwill; when it’s paid, cash decreases and the liability is eliminated, and any changes in the estimate flow through the income statement, without affecting the company’s core operations.

Why do investment bankers care about deferred tax liabilities (DTLs) and deferred tax assets (DTAs)?

DTLs and DTAs arise from temporary differences between book and tax accounting. Bankers care because they affect cash taxes paid and can impact valuation metrics like free cash flow. In M&A or valuation work, these items often adjust enterprise value or create tax benefits/liabilities that must be modeled explicitly.

How to calculate unlevered free cash flow in DCF

Unlevered free cash flow = EBIT × (1 - Tax Rate) + Depreciation & Amortization - CapEx - Change in Net Working Capital. It represents cash available to all investors before accounting for interest payments or debt financing.

Describe how you would model the impact of different buyer synergies—cost synergies versus revenue synergies—on a merger’s accretion/dilution analysis.

Cost synergies directly increase operating margins and net income, leading to higher EPS accretion, while revenue synergies increase the top line but may require additional expenses or take time to realize. In a merger model, cost synergies are typically modeled as reductions to SG&A or COGS, providing immediate EPS benefits. Revenue synergies are reflected as higher sales with appropriate incremental costs and delayed realization. Sensitivity analysis is often performed to test different synergy realization scenarios and their effects on accretion/dilution outcomes.

List main items on each statement

Income Statement: Revenue, COGS, Gross Profit, SG&A, Depreciation/Amortization, Interest Expense, Taxes, Net Income.

Balance Sheet: Cash, AR, Inventory, PP&E, Intangibles/Goodwill, AP, Debt, Equity.

Cash

Flow Statement: CFO (Net Income + Non-Cash + WC), CFI (CapEx), CFF (Debt/Equity changes).

If you found 100 dollars on the street, how would that affect EV and equity value

$100 cash increases assets by $100 and thus equity value by $100 since shareholders now own more cash. Enterprise value remains unchanged because EV subtracts cash from total firm value.

Enterprise Value

Enterprise Value (EV) represents the total value of a company’s core operations available to all capital providers (debt + equity + preferred + minority interest). Enterprise Value=Equity Value+Net Debt+Preferred Stock+Noncontrolling Interest−Cash and Cash Equivalents

Two common ways to get EBITDA?

From the income statement:

EBITDA = Operating Income (EBIT) + Depreciation & Amortization

From the top:

EBITDA = Revenue − COGS − Operating Expenses (excluding D&A)

WACC formula

WACC=V/E×re+V/D×rd×(1−T)

Where:

EE = Market value of equity

DD = Market value of debt

V=E+DV=E+D = Total capital

rere = Cost of equity

rdrd = Cost of debt

TT = Corporate tax rate

or

Cost of equity x percent of equity + cost of debt )1-tax rate) x percent of debt + oerferred stock x %preferred stock

![<p><span style="font-family: KaTeX_Main, "Times New Roman", serif; line-height: 1.2; font-size: 1.05em;"><span>WACC=</span><em><span>V/E</span></em><span>×</span><em><span>re</span></em><span>+</span><em><span>V/D</span></em><span>×</span><em><span>rd</span></em><span>×(1−</span><em><span>T</span></em><span>)</span></span></p><p class="jsx-d184321cdc5e577 text-[15px] text-gray-800 leading-[1.75] mb-4 last:mb-0">Where:</p><ul><li><p><span style="font-family: KaTeX_Main, "Times New Roman", serif; line-height: 1.2; font-size: 1.05em;"><span>E</span><em><span>E</span></em></span> = Market value of equity</p></li><li><p><span style="font-family: KaTeX_Main, "Times New Roman", serif; line-height: 1.2; font-size: 1.05em;"><span>D</span><em><span>D</span></em></span> = Market value of debt</p></li><li><p><span style="font-family: KaTeX_Main, "Times New Roman", serif; line-height: 1.2; font-size: 1.05em;"><span>V=E+D</span><em><span>V</span></em><span>=</span><em><span>E</span></em><span>+</span><em><span>D</span></em></span> = Total capital</p></li><li><p><span style="font-family: KaTeX_Main, "Times New Roman", serif; line-height: 1.2; font-size: 1.05em;"><span>re</span><em><span>re</span></em><span></span></span> = Cost of equity</p></li><li><p><span style="font-family: KaTeX_Main, "Times New Roman", serif; line-height: 1.2; font-size: 1.05em;"><span>rd</span><em><span>rd</span></em><span></span></span> = Cost of debt</p></li><li><p><span style="font-family: KaTeX_Main, "Times New Roman", serif; line-height: 1.2; font-size: 1.05em;"><span>T</span><em><span>T</span></em></span> = Corporate tax rate</p></li></ul><p>or </p><p>Cost of equity x percent of equity + cost of debt <em> )1-tax rate) </em>x percent of debt + oerferred stock x %preferred stock</p><p></p>](https://knowt-user-attachments.s3.amazonaws.com/42578868-b840-45ec-9d6d-f6fa05dac798.png)

how to calculate cost of equity (investors expect. a 11.2 % return for investing in stock)

Cost of Equity=Rf+β⋅(Rm−Rf)

Rf = Risk-free rate

This is the return you’d get if you put your money somewhere “super safe,” like a 10-year U.S. Treasury bond.

Think of it as the base return you expect for no risk.

β\betaβ = How risky the stock is

Compares the stock’s price swings to the overall market.

Beta = 1 → stock moves like the market

Beta > 1 → stock is more volatile than the market (riskier)

Beta < 1 → stock is less volatile than the market (safer)

((R_m - R_f) = Market risk premium

Extra return you expect from investing in the stock market instead of risk-free bonds.

Usually around 5–6%

What does a higher discount rate mean?

Company is less valuable because investor has better options elsewhere

Cost of Debt

This is basically: how much it costs the company to borrow money.

Example: if a company has bonds that pay 5% interest, then the pre-tax cost of debt = 5%.

If the company pays taxes, interest is deductible → the after-tax cost of debt = interest × (1 – tax rate).

💡 Simple way to remember: debt is cheaper than equity because the government gives you a tax break on interest.

CAPM (capital asset pricing model) to estimate cost of equity

Cost of Equity= Risk-Free Rate + Beta(Equity Risk Premium)

RFR: Safe government bonds, use yield on long-term U.S. treasuries

Beta: Tells how volatile stock is relative to market (If 2.0, market moves 10 percent, the stock moves by 20 percent

ERP: Percentage stock market will return each year beyond safe govenrment bonds. Always linked to company’s country and domestic stock market

why do banks go beyond WACC and analyse comparable companies to calculate cost of equity?

Banks use comparables to get a range of Cost of Equity instead of relying only on past data.

They un-lever and re-lever Beta to separate business risk from debt risk and adjust for the company’s capital structure.

This gives a more accurate valuation that reflects both the company’s operations and its leverage.

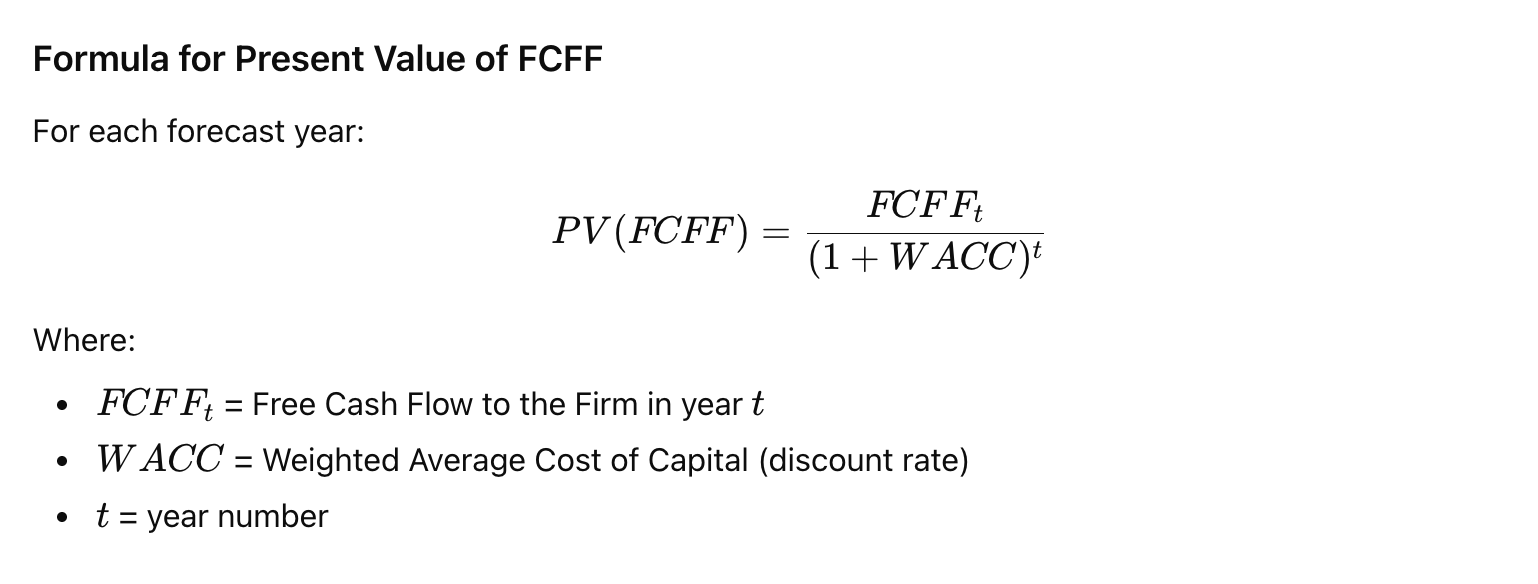

PresentValue

(Cash flow/ 1+ discount rate)^Year #

After we projected company’s unlevered FCF, calculate discount rate (WACC), and summed up present value of UFCF, calculate the terminal period

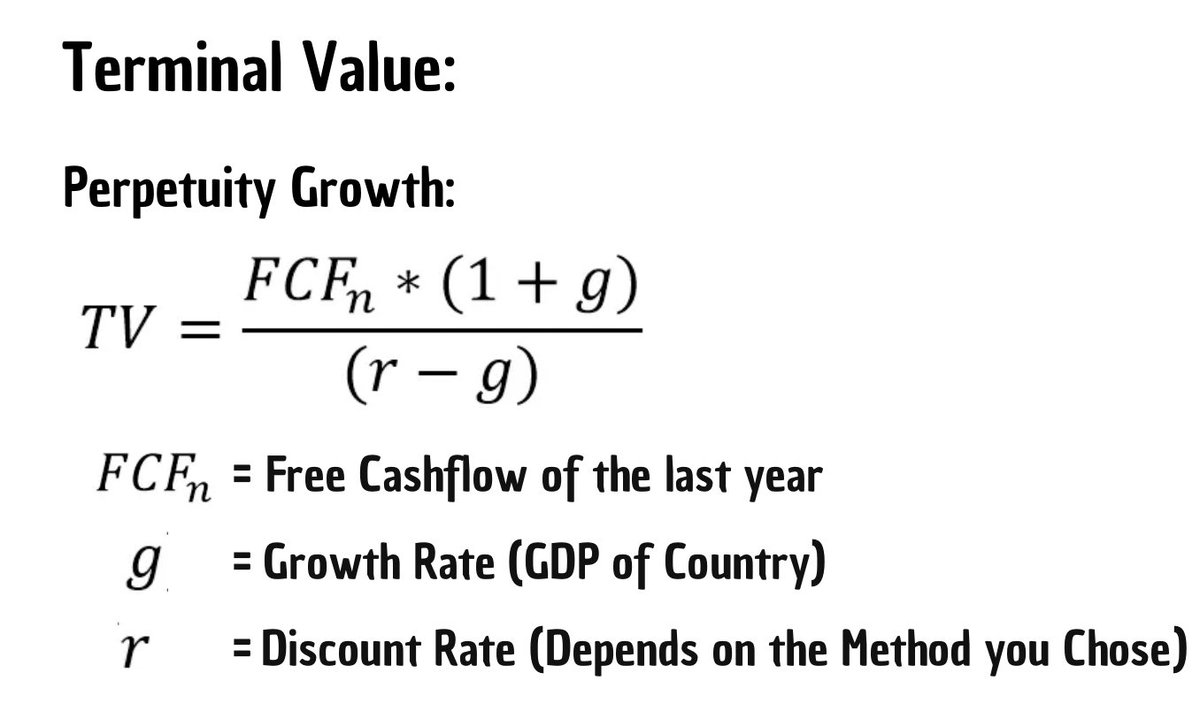

Terminal Value formula (Perpetuity Growth Method)?

Terminal Value = Cash Flow next year ÷ (Discount Rate – Growth Rate)

Q: Key rules for Terminal Growth Rate?

A: Must be smaller than Discount Rate and realistic (below GDP or inflation).

When to use Gordon Growth/Pepetuity Method vs exit multiple ?

When the business is stable and expected to grow slowly forever (e.g., consumer staples, utilities).

When you want a clean, theoretical approach.

Exit multiple

When you have good market data on comparable companies or deals.

When you want a market-based estimate instead of a theoretical one.

The first is theory-based; the second is market-based.

Exit multiple Method

Instead of assuming perpetual growth, you assume the company could be sold at the end of your projection period for a multiple of some financial metric — usually EBITDA.

Terminal Value=EBITDAn×Exit Multiple

Where:

EBITDAnEBITDAn = EBITDA in final projected year

Exit multiple = based on comparable companies or precedent transactions

After Temrinal value and method, what nexT?

You’ve Got Two Pieces So Far

In a DCF, total enterprise value comes from:

Enterprise Value=PV of Projected FCFs+PV of Terminal ValueEnterprise Value=PV of Projected FCFs+PV of Terminal Value

So after you calculate terminal value (TV), you need to discount it back to today and then add it to the present value of your forecasted cash flows.

2. Discount the Terminal Value Back to Present

If your projection period is 5 years and WACC = 10%, then:

PVTV=TV(1+WACC)5PVTV=(1+WACC)5TV

Example: If terminal value = $1,500 M and WACC = 10%:

PVTV=1,500(1.10)5≈PVTV=(1.10)51,500

Move from Enterprise Value to Equity Value

Now adjust for capital structure:

Equity Value=EV−Net Debt−Preferred Stock+Noncontrolling InterestsEquity Value=EV−Net Debt−Preferred Stock+Noncontrolling Interests

Example:

EV = $1,284 M

Debt = $400 M

Cash = $100 M → Net debt = $300 M

EquityValue=1,284−300=EquityValue=1,284−300=984 M $

5. Divide by Shares Outstanding

To get the implied share price:

Implied Share Price=Equity ValueShares OutstandingImplied Share Price=Shares OutstandingEquity Value

If shares outstanding = 50 M →984 M / 50 M = \19.68/share19.68/share

Sanity Check after DCF?

Current trading price

Comparable companies’ multiples

Precedent transactions

If your DCF gives wildly different results, revisit assumptions (growth rate, WACC, exit multiple)

Present FFCf

DCF pricde per share (Equity Value/Shares outstanding)

walk me through how you would value a company using a DCF

You start by projecting unlevered free cash flows for a forecast period, typically 5–10 years. Then, calculate the terminal value using either the perpetuity growth method or exit multiple method. Discount both the forecasted cash flows and terminal value back to present using the Weighted Average Cost of Capital (WACC). The sum of these discounted values gives enterprise value. Subtract net debt and other non-equity claims to arrive at equity value, then divide by shares outstanding to get the implied share price

enterprise value and equity value, and why is this distinction important in valuation?

in a DCF, you discount free cash flow to the firm to get enterprise value, then subtract net debt to find equity value and the implied share price. EV-based multiples are used with pre-interest metrics (EBITDA, EBIT), while equity-based multiples use post-interest metrics (P/E)

How does a change in the risk-free rate affect a company’s valuation in a DCF analysis?

Raises the cost of equity through the CAPM formula. Can also increase the cost of debt. —>WACC goes up

A higher discount rate (WACC) reduces the present value of future cash flows, lowering the company’s valuation.

Explain how you would use comparable companies analysis to value a private firm.

identify a peer group of publicly traded companies with similar business models, size, growth, and risk profiles.

, calculate valuation multiples such as EV/EBITDA, EV/Revenue, or P/E for the peers. Apply the median or average multiple to the private firm’s corresponding financial metric to estimate its enterprise or equity value.

Adjustments may be made for liquidity, control premiums, or size differences since private companies often have less liquidity and higher risk.

Why might a company’s EV/EBITDA multiple be higher than that of its peers

A higher EV/EBITDA multiple may reflect higher expected growth, superior margins, stronger competitive position, lower risk profile, or synergies expected by the market. It can also be due to differences in accounting policies or non-recurring items that distort EBITDA. Ultimately, the market rewards companies with better future cash flow prospects and stability with higher valuation multiples.

To approach this properly, always think about what the market rewards: stable and growing future cash flows. Companies with better profitability, competitive advantages, or lower perceived risk command higher valuation multiples

Describe two different methods for calculating terminal value in a DCF and explain when each is most appropriate

The perpetuity growth method assumes cash flows grow at a constant rate indefinitely, using the formula TV = FCF × (1 + g) / (WACC − g), and is suitable for stable, mature businesses. The exit multiple method applies a valuation multiple (e.g., EV/EBITDA) based on comparable company data to the company's projected terminal year metric, commonly used when peer data is readily available or industry norms dictate exit multiples.

How would you adjust a company’s beta when calculating the cost of equity for a private company?

Start with the average levered beta of comparable public peers. Unlever each using the formula: Unlevered Beta = Levered Beta / [1 + (1 − Tax Rate) × (Debt/Equity)]. Then, relever using the private company’s target capital structure: Relevered Beta = Unlevered Beta × [1 + (1 − Tax Rate) × (Debt/Equity) of the private company]. This beta reflects the private company's business risk and capital structure for use in CAPM.

AI Feedback:

You correctly recognized that beta for a private company should be based on comparable public firms, which is an important starting point. However, your answer stops short of the key adjustments needed to make the beta appropriate for the private company’s capital structure. You need to explain that you must first unlever each peer’s beta to remove the impact of their debt, then relever it using the private company’s target debt-to-equity ratio and tax rate. This step ensures the resulting beta reflects both the business risk and leverage specific to the private company. To improve: explicitly mention the unlevering and relevering formulas and explain why this adjustment is necessary before applying CAPM.

If a company changes from straight-line depreciation to an accelerated method, how would that impact the three financial statements in the first year?

On the income statement, depreciation expense increases, reducing operating income and net income. On the balance sheet, accumulated depreciation increases, lowering net PP&E and retained earnings. On the cash flow statement, lower net income is offset by the non-cash add-back for depreciation in operating activities, so total cash flow remains unchanged in the first year.

Explain the difference between accounts receivable and deferred revenue, and how each affects the financial statements when revenue is recognized.

Accounts receivable arises when revenue is recognized before cash is collected, creating an asset; deferred revenue arises when cash is collected before revenue is recognized, creating a liability. When revenue is recognized for A/R, receivables decrease and cash may increase when customers pay. For deferred revenue, the liability decreases and revenue increases on the income statement, boosting retained earnings and equity on the balance sheet.

How do you reconcile net income to cash flow from operations?

Starting with net income, you add back non-cash expenses such as depreciation, amortization, and stock-based compensation. Then adjust for changes in working capital accounts: increases in current assets reduce cash, while increases in current liabilities increase cash. The resulting figure is cash flow from operations.