MGMT 200H Exam 2

0.0(0)

0.0(0)

Card Sorting

1/157

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

158 Terms

1

New cards

On November 1, 2018, New Morning Bakery signed a $200,000, 6%, six-month note payable \n with the amount borrowed plus accrued interest due six months later on May 1, 2019. New \n Morning Bakery records the appropriate adjusting entry for the note on December 31, 2018. \n What amount of cash will be needed to pay back the note payable plus any accrued interest \n on May 1, 2019? \n A. $200,000. \n B. $202,000. \n C. $204,000. \n D. $206,000.

D. $206,000.

2

New cards

Given a choice, most companies would prefer to report a liability as long-term rather than \n current because: \n A. It may cause the firm to appear less risky to investors and creditors. \n B. It may reduce interest rates on borrowing. \n C. It may cause the company to appear more stable, commanding a higher stock price for new \n stock listings. \n D. All of these

D. All of these

3

New cards

When $3,500 of accounts receivable are determined to be uncollectible, which of the \n following should the company record to write off the accounts using the allowance method? \n A. A debit to Bad Debt Expense and a credit to Allowance for Uncollectible Accounts. \n B. A debit to Allowance for Uncollectible Accounts and a credit to Bad Debt Expense. \n C. A debit to Bad Debt Expense and a credit to Accounts Receivable. \n D. A debit to Allowance for Uncollectible Accounts and a credit to Accounts Receivable.

D. A debit to Allowance for Uncollectible Accounts and a credit to Accounts Receivable.

4

New cards

Using the income statement approach for accounting for uncollectible accounts, a company \n estimates that 2.5% of credit sales will eventually become uncollectible. Prior to adjusting \n entries, the Allowance for Uncollectible Accounts has a credit balance of $1,000. If credit sales \n during the year are $400,000 and accounts receivable at the end of the year are $80,000, the \n adjustment for estimated uncollectible accounts will require a: \n A. Credit to Accounts Receivable for $2,000. \n B. Debit to Bad Debt Expense for $10,000. \n C. Debit to Allowance for Uncollectible Accounts for $10,000. \n D. Debit to Bad Debt Expense for $9,000.

D. Debit to Bad Debt Expense for $9,000.

5

New cards

What are the financial statement effects of recording bad debt expense using the allowance method?

A) Increase assets

B) Increase revenues

C) Increase expenses

D) Decrease assets

E) All of the above

A) Increase assets

B) Increase revenues

C) Increase expenses

D) Decrease assets

E) All of the above

E) All of the above

6

New cards

A company’s claims to the future collection of cash, other assets, or services is called a ______.

A) payable

B) transaction

C) receivable

D) guarantee

A) payable

B) transaction

C) receivable

D) guarantee

C) receivable

7

New cards

At the end of 2018, Murray State Lenders had a balance in its Allowance for Uncollectible Accounts of $4,500 (credit) before any adjustment. The company estimated its future uncollectible accounts to be $12,000 using the percentage-of-receivables method. Murray State's adjustment on December 31, 2018, to record its estimated uncollectible accounts included a:

A) Credit to Allowance for Uncollectible Accounts of $12,000.

B) Credit to Allowance for Uncollectible Accounts of $16,500.

C) Debit to Bad Debt Expense of $4,500; credit to Allowance for Uncollectible Accounts of $4,500.

D) Debit to Bad Debt Expense of $7,500; credit to Allowance for Uncollectible Accounts of $7,500.

A) Credit to Allowance for Uncollectible Accounts of $12,000.

B) Credit to Allowance for Uncollectible Accounts of $16,500.

C) Debit to Bad Debt Expense of $4,500; credit to Allowance for Uncollectible Accounts of $4,500.

D) Debit to Bad Debt Expense of $7,500; credit to Allowance for Uncollectible Accounts of $7,500.

D) Debit to Bad Debt Expense of $7,500; credit to Allowance for Uncollectible Accounts of $7,500.

8

New cards

When writing off an uncollectible account:

A) The allowance account is credited.

B) Net income is decreased.

C) Total assets are decreased.

D) Total assets are unchanged.

A) The allowance account is credited.

B) Net income is decreased.

C) Total assets are decreased.

D) Total assets are unchanged.

D) Total assets are unchanged.

9

New cards

When the direct write-off method is used, an entry for bad debt expense is required

A) when the account receivable is determined to be uncollectible.

B) when a firm estimates the amount of account receivable that will not be collected.

C) at the end of the year.

D) only when bad debts are recorded on the tax return.

A) when the account receivable is determined to be uncollectible.

B) when a firm estimates the amount of account receivable that will not be collected.

C) at the end of the year.

D) only when bad debts are recorded on the tax return.

A) when the account receivable is determined to be uncollectible.

10

New cards

The ‘Sales Returns and Allowances’ account is classified as a:

A) contra equity account.

B) contra revenue account.

C) contra asset account.

D) contra liability account.

A) contra equity account.

B) contra revenue account.

C) contra asset account.

D) contra liability account.

B) contra revenue account.

11

New cards

The normal balance of the account "Allowance for Uncollectible Accounts" is a _______ because _______.

A) Debit; it is an expense in the income statement

B) Credit; it is a contra account to Bad Debt Expense (a debit account)

C) Debit; it is a contra account to Revenue (a credit account)

D) Credit; it is a contra account to Accounts Receivable (a debit account)

A) Debit; it is an expense in the income statement

B) Credit; it is a contra account to Bad Debt Expense (a debit account)

C) Debit; it is a contra account to Revenue (a credit account)

D) Credit; it is a contra account to Accounts Receivable (a debit account)

D) Credit; it is a contra account to Accounts Receivable (a debit account)

12

New cards

Purdue Health Services provided care to a patient worth $1,200. Because the patient was over the age of 65, Purdue granted the patient a 20% discount and the customer paid the correct amount in cash. How would Barton record the service transaction?

A) Debit cash 960, credit service revenue 960

B) Debit cash 1,200, credit trade discount 240, credit service revenue 960

C) Debit cash 1,200, credit service revenue 1,200

D) Debit cash 960, debit trade discount 240, credit service revenue 1,200

A) Debit cash 960, credit service revenue 960

B) Debit cash 1,200, credit trade discount 240, credit service revenue 960

C) Debit cash 1,200, credit service revenue 1,200

D) Debit cash 960, debit trade discount 240, credit service revenue 1,200

A) Debit cash 960, credit service revenue 960

13

New cards

Purdue Inc. had the following information taken from various accounts at the end of the year:

Sales discounts: $41,000

Deferred revenues: $32,000

Total sales: $459,000

Sales allowances: $35,000

Accounts receivable: $205,000

What was Purdue Inc.'s net revenues for the year?

A) $383,000

B) $434,000

C) $437,000

D) $368,000

Sales discounts: $41,000

Deferred revenues: $32,000

Total sales: $459,000

Sales allowances: $35,000

Accounts receivable: $205,000

What was Purdue Inc.'s net revenues for the year?

A) $383,000

B) $434,000

C) $437,000

D) $368,000

A) $383,000

14

New cards

On July 8, Purdue Inc. sold 100 printers to Office Rental Company at $600 each and offered a 2% discount for payment within 10 days. On July 15, Office Rental Company paid the full amount in cash. What should Purdue Inc. record on July 15?

A) Debit cash 60,000, accounts receivable 60,000

B) Debit cash 58,800, accounts receivable 58,800

C) Debit cash 60,000, credit sales discounts 1,200, credit service revenue 58,800

D) Debit cash 58,800, debit sales discount 1,200, credit accounts receivable 60,000

A) Debit cash 60,000, accounts receivable 60,000

B) Debit cash 58,800, accounts receivable 58,800

C) Debit cash 60,000, credit sales discounts 1,200, credit service revenue 58,800

D) Debit cash 58,800, debit sales discount 1,200, credit accounts receivable 60,000

D) Debit cash 58,800, debit sales discount 1,200, credit accounts receivable 60,000

15

New cards

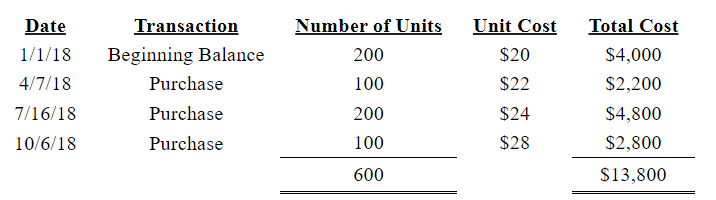

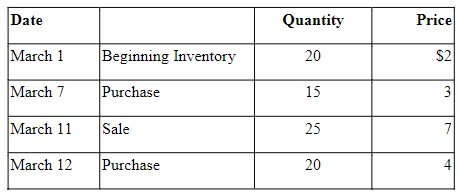

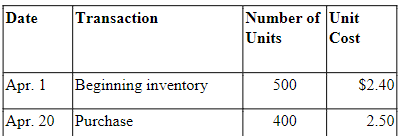

During the 2018, Wally has the following inventory transactions (see image).

For the entire year, the company sells 400 units of inventory for $30 each.

Using LIFO, what is cost of goods sold for 2018?

A) $12,000

B) $9,500

C) $9,200

D) $8,900

E) $9,800

For the entire year, the company sells 400 units of inventory for $30 each.

Using LIFO, what is cost of goods sold for 2018?

A) $12,000

B) $9,500

C) $9,200

D) $8,900

E) $9,800

E) $9,800

16

New cards

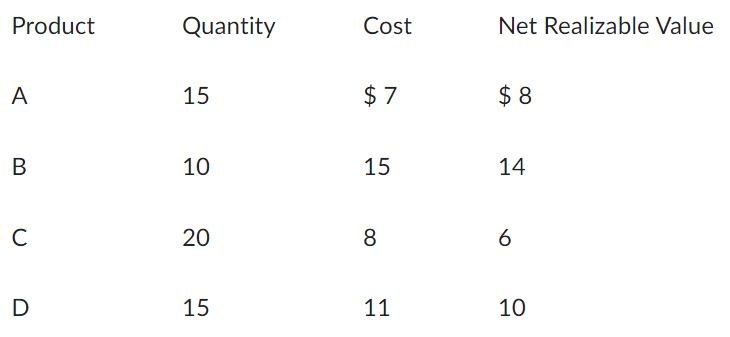

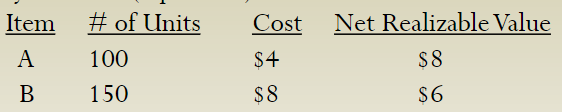

A company has four types of products in its inventory. The company applies the rules under lower of cost and net realizable value to its inventory at the end of each year as shown (see image).

The year-end adjusting entry based upon the information above would include a:

A) Debit to Cost of Goods Sold for $50.

B) Debit to Cost of Goods Sold for $65.

C) Debit to Inventory for $65.

D) Credit to Inventory for $50.

The year-end adjusting entry based upon the information above would include a:

A) Debit to Cost of Goods Sold for $50.

B) Debit to Cost of Goods Sold for $65.

C) Debit to Inventory for $65.

D) Credit to Inventory for $50.

B) Debit to Cost of Goods Sold for $65.

17

New cards

During the 2018, Wally has the following inventory transactions (see image).

For the entire year, the company sells 400 units of inventory for $30 each.

Using Weighted Average cost, what is cost of goods sold for 2018?

A) $12,000

B) $9,400

C) $9,600

D) $9,200

E) $9,800

For the entire year, the company sells 400 units of inventory for $30 each.

Using Weighted Average cost, what is cost of goods sold for 2018?

A) $12,000

B) $9,400

C) $9,600

D) $9,200

E) $9,800

D) $9,200

18

New cards

During periods of rising costs, FIFO generally results in a higher cost of goods sold.

True/False

True/False

False

19

New cards

During the 2018, Wally has the following inventory transactions (see image).

For the entire year, the company sells 400 units of inventory for $30 each.

Using FIFO, what is cost of goods sold for 2018?

A) $9,000

B) $8,600

C) $12,000

D) $9,400

E) $8,200

For the entire year, the company sells 400 units of inventory for $30 each.

Using FIFO, what is cost of goods sold for 2018?

A) $9,000

B) $8,600

C) $12,000

D) $9,400

E) $8,200

B) $8,600

20

New cards

Cost of goods sold equals:

A) Net purchases + ending inventory - beginning inventory.

B) Beginning inventory - net purchases + ending inventory.

C) Beginning inventory + net purchases - ending inventory.

D) Beginning inventory - accounts payable - net purchases.

A) Net purchases + ending inventory - beginning inventory.

B) Beginning inventory - net purchases + ending inventory.

C) Beginning inventory + net purchases - ending inventory.

D) Beginning inventory - accounts payable - net purchases.

C) Beginning inventory + net purchases - ending inventory.

21

New cards

The distinction between the direct write-off method and the allowance method is the:

A) Amount of bad debt expense reported in each year.

B) Cumulative amount of bad debt expense reported across years.

C) Customers to which goods or services are provided.

D) Year in which cash is collected from customers.

A) Amount of bad debt expense reported in each year.

B) Cumulative amount of bad debt expense reported across years.

C) Customers to which goods or services are provided.

D) Year in which cash is collected from customers.

A) Amount of bad debt expense reported in each year.

22

New cards

What effect would an adjustment to record inventory at the lower of cost and net realizable value have on the company's financial statements?

A) An increase to expense.

B) An increase to assets.

C) A decrease to revenue.

D) An increase to stockholders' equity.

A) An increase to expense.

B) An increase to assets.

C) A decrease to revenue.

D) An increase to stockholders' equity.

A) An increase to expense.

23

New cards

The disclosure that shows the difference in the cost of inventory between LIFO and FIFO is referred to as the:

A) Inventory allowance

B) Net realizable value

C) LIFO reserve

D) FIFO adjustment

A) Inventory allowance

B) Net realizable value

C) LIFO reserve

D) FIFO adjustment

C) LIFO reserve

24

New cards

ABC Inc. has net sales of $200,000, cost of goods sold of $120,000, selling expenses of $6,000, and nonoperating expenses of $2,000. What is the company's gross profit?

A) $72,000.

B) $74,000.

C) $80,000.

D) $76,000.

A) $72,000.

B) $74,000.

C) $80,000.

D) $76,000.

C) $80,000.

25

New cards

On May 1, ABC Company purchased inventory costing $2,000 on account with terms 2/10, n/30. On May 18, ABC pays for this inventory and records which of the following using a perpetual inventory system?

A) Debit accounts payable 1,960, debit inventory 40, credit cash 2,000

B) Debit accounts payable 2,000, credit cash 2,000

C) Debit accounts payable 2,000, credit inventory 40, credit cash 1,960

D) Debit cash 2,000, credit accounts payable 2,000

A) Debit accounts payable 1,960, debit inventory 40, credit cash 2,000

B) Debit accounts payable 2,000, credit cash 2,000

C) Debit accounts payable 2,000, credit inventory 40, credit cash 1,960

D) Debit cash 2,000, credit accounts payable 2,000

B) Debit accounts payable 2,000, credit cash 2,000

26

New cards

Purdue Inc. purchased land, a building, and equipment for $800,000. The estimated fair values of the land, building, and equipment are $100,000, $700,000, and $200,000, respectively. At what amount would the company record the land?

A) $90,000.

B) $800,000.

C) $80,000.

D) $100,000.

A) $90,000.

B) $800,000.

C) $80,000.

D) $100,000.

C) $80,000.

27

New cards

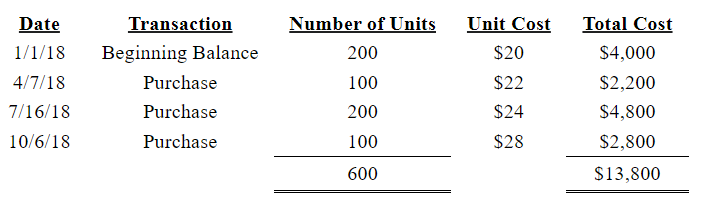

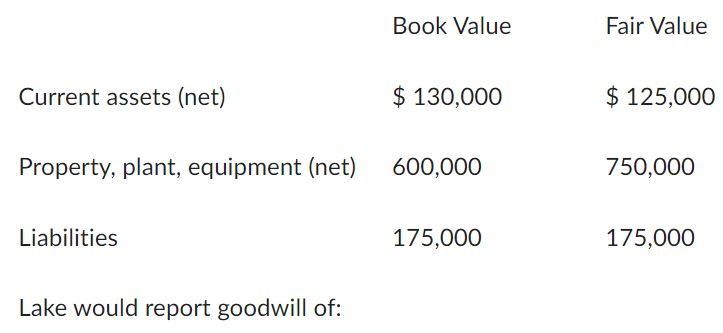

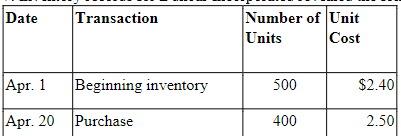

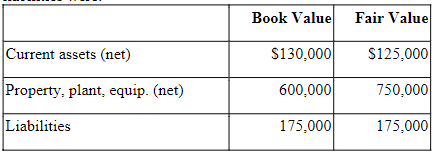

Lake Incorporated purchased all of the outstanding stock of Huron Company, paying $850,000 cash. Lake assumed all of the liabilities. Book values and fair values of acquired assets and liabilities were (see image).

Lake would report goodwill of:

A) $175,000

B) $345,000.

C) $850,000.

D) $0.

E) $150,000.

Lake would report goodwill of:

A) $175,000

B) $345,000.

C) $850,000.

D) $0.

E) $150,000.

E) $150,000.

28

New cards

Costs of an asset that produce future benefits are ______, but costs that produce benefits only in the current period are ______.

A) current assets; noncurrent assets

B) capitalized; expensed

C) operating activities; investing activities

D) expensed; capitalized

A) current assets; noncurrent assets

B) capitalized; expensed

C) operating activities; investing activities

D) expensed; capitalized

B) capitalized; expensed

29

New cards

Merchandise sold FOB shipping point indicates that:

A) The seller holds title until the merchandise is received at the buyer's location.

B) The merchandise has not yet been shipped.

C) The seller transfers title to the buyer once the merchandise is shipped.

D) The merchandise will not be shipped until payment has been received.

A) The seller holds title until the merchandise is received at the buyer's location.

B) The merchandise has not yet been shipped.

C) The seller transfers title to the buyer once the merchandise is shipped.

D) The merchandise will not be shipped until payment has been received.

C) The seller transfers title to the buyer once the merchandise is shipped.

30

New cards

The following financial information is from Cook Company:

Accounts Payable: $55,000

Land: $90,000

Inventory: $10,500

Accounts Receivable: $7,500

Equipment: $8,000

Deferred Revenue: $58,500

Short-term Investments: $20,000

Notes Receivable (due in 8 months): $45,500

Interest Payable: $2,000

Patents: $75,000

What is the total amount of property, plant, and equipment (PP&E) assuming the accounts above reflect normal activity

A) $165,000.

B) $110,000.

C) $90,000.

D) $98,000.

Accounts Payable: $55,000

Land: $90,000

Inventory: $10,500

Accounts Receivable: $7,500

Equipment: $8,000

Deferred Revenue: $58,500

Short-term Investments: $20,000

Notes Receivable (due in 8 months): $45,500

Interest Payable: $2,000

Patents: $75,000

What is the total amount of property, plant, and equipment (PP&E) assuming the accounts above reflect normal activity

A) $165,000.

B) $110,000.

C) $90,000.

D) $98,000.

D) $98,000.

31

New cards

The exclusive right to benefit from a creative work, such as a film, is a:

A) Trademark.

B) Copyright.

C) Patent.

D) Franchise

A) Trademark.

B) Copyright.

C) Patent.

D) Franchise

B) Copyright.

32

New cards

Aspen, Inc. developed a new horse transport device and incurred research and development costs of $250,000. Rather than continue with their own research, Aspen decided to purchase a patent for a similar design from Vail, Inc. for $350,000. What are the total assets and expenses for these developments?

A) Assets $250,000; Expenses $350,000.

B) Assets $600,000; Expenses $0.

C) Assets $350,000; Expenses $250,000.

D) Assets $0; Expenses $600,000.

A) Assets $250,000; Expenses $350,000.

B) Assets $600,000; Expenses $0.

C) Assets $350,000; Expenses $250,000.

D) Assets $0; Expenses $600,000.

C) Assets $350,000; Expenses $250,000.

33

New cards

What effect would an adjustment to record inventory at the lower of cost and net realizable value have on the company's financial statements?

A) A decrease to revenue.

B) An increase to stockholders' equity.

C) An increase to expense.

D) An increase to assets.

A) A decrease to revenue.

B) An increase to stockholders' equity.

C) An increase to expense.

D) An increase to assets.

C) An increase to expense.

34

New cards

Which of the following would NOT be recorded as land improvements?

A) Sidewalks.

B) Adding a parking lot.

C) Closing costs on purchasing the land.

D) Landscaping.

A) Sidewalks.

B) Adding a parking lot.

C) Closing costs on purchasing the land.

D) Landscaping.

C) Closing costs on purchasing the land.

35

New cards

What type of account is Accounts Receivable?

Asset

36

New cards

Nontrade receivables

Receivables from sources other than customers (tax refund claims, interest receivable, loans by company to other entities)

37

New cards

Notes receivable

Formal credit arrangements by written debt instruments

38

New cards

Net Revenues (or Net Sales)

Sales - Sales Discounts - Sales Returns and Allowances

39

New cards

Trade discounts

Reduced from list price of product/service; sales revenue is booked at discounted price (NO TRADE DISCOUNT ACCOUNT)

40

New cards

Sales returns

Customer returns the product, seller issues a full refund

41

New cards

Sales allowances

Customer does not return the product, seller reduces the customer’s balance owed partially

42

New cards

Sales discounts

Provides incentive for quick payment by reducing amount to be paid if customer pays within period of time (2/10 = 2% discount if paid within 10 days, n/30 = no discount, but full payment due in 30 days)

43

New cards

What type of account are sales discounts, returns, and allowances?

Contra revenue (DEBIT)

44

New cards

Net Realizable Value

Trade accounts receivable, the expected cash value in the future

45

New cards

What kind of expense is bad debt?

Operating expense

46

New cards

Allowance Method: Bad Debt Expense

When customers do not pay for items or services purchased on credit, become **Uncollectible Accounts Receivable**, MUST BE ESTIMATED in the period when credit sales are made or accounts receivable are outstanding

47

New cards

What type of account is Allowance for Uncollectible Accounts?

Contra asset account (CREDIT) - reduces assets, increases expenses (bad debt expense)

48

New cards

Estimating Uncollectible Accounts: Percentage-of-Receivables method

Based on percentage of receivables expected not to be collected

(If $20 million remains due from customers and firm estimates 30%, will not be collected, 20,000,000 \* .3 = Bad Debt Expense & Allowance for Uncollectible Accounts)

(If $20 million remains due from customers and firm estimates 30%, will not be collected, 20,000,000 \* .3 = Bad Debt Expense & Allowance for Uncollectible Accounts)

49

New cards

On December 31 before adjusting entries, a company reports the following balances:

Accounts Receivable: $100,000

Allowance for Uncoll. Accts.: $2,000 (credit)

The company estimates bad debts to be 20% of accounts receivable. The adjusting entry would include:

A) A debit to Bad Debt Expense = $18,000

B) A credit to Allowance for Uncoll. Accts. = $24,000

C) A credit to Allowance for Uncoll. Accts. = $22,000

D) A debit to Bad Debt Expense = $20,000

Accounts Receivable: $100,000

Allowance for Uncoll. Accts.: $2,000 (credit)

The company estimates bad debts to be 20% of accounts receivable. The adjusting entry would include:

A) A debit to Bad Debt Expense = $18,000

B) A credit to Allowance for Uncoll. Accts. = $24,000

C) A credit to Allowance for Uncoll. Accts. = $22,000

D) A debit to Bad Debt Expense = $20,000

A) A debit to Bad Debt Expense = $18,000

50

New cards

Estimating Uncollectible Accounts: Aging method

More accurate than percentage-of-receivables because it considers the age of receivables (uses higher percentage for older accounts)

51

New cards

Which of the following is true about the aging method?

A) No estimate for uncollectible accounts is made.

B) Older accounts are more likely to be collected.

C) It is not acceptable for GAAP.

D) Older accounts are less likely to be collected.

A) No estimate for uncollectible accounts is made.

B) Older accounts are more likely to be collected.

C) It is not acceptable for GAAP.

D) Older accounts are less likely to be collected.

D) Older accounts are less likely to be collected.

52

New cards

Write-off

When it becomes clear that customer will not pay, company writes off customer’s account as uncollectible, happens only at time accounts actually become uncollectible.

Reduces Accounts Receivable, reduces Allowance for Uncollectible Accounts.

NO EFFECT on assets or expenses.

Reduces Accounts Receivable, reduces Allowance for Uncollectible Accounts.

NO EFFECT on assets or expenses.

53

New cards

Inventory (Account type?)

Goods a company intends for sale + items that are not yet finished products (ASSETS)

54

New cards

Cost of Goods Sold (Account type?)

Cost of the inventory that is sold during the period (EXPENSE)

55

New cards

What is the ending inventory in the balance sheet?

Inventory NOT sold

56

New cards

What are the levels of the multiple-step income statement?

Gross profit, operating income, income before income taxes, net income

57

New cards

Gross profit

Revenues - cost of goods sold

58

New cards

Operating income

Gross profit - operating expenses

59

New cards

Income before income taxes

Operating income - interest expense

60

New cards

Net income

Income before income taxes - income tax expense

61

New cards

Cost Allocation: Specific identification

Matches each unit of inventory with actual cost

62

New cards

Cost Allocation: FIFO

Assumes first units purchased are first ones sold, highest ending inventory, matches physical flow for most companies

63

New cards

Cost Allocation: LIFO

Assumes last units purchased are first ones sold, lowest ending inventory

64

New cards

Cost Allocation: Weighted average cost

Assumes units sold come from random mixture - (cost of goods available for sale) / (number of units available for sale)

65

New cards

A company has the following inventory transactions:

Jan. 1: Beginning inventory 100 units @ $4 each

Jan. 15: Purchase 100 units @ $5 each

Jan. 31: Purchase 100 units @ $6 each

What would be the cost of goods sold under the FIFO method if 120 units were sold in January?

A) $ 600

B) $ 500

C) $ 620

D) $ 720

Jan. 1: Beginning inventory 100 units @ $4 each

Jan. 15: Purchase 100 units @ $5 each

Jan. 31: Purchase 100 units @ $6 each

What would be the cost of goods sold under the FIFO method if 120 units were sold in January?

A) $ 600

B) $ 500

C) $ 620

D) $ 720

B) $ 500

66

New cards

A company has the following inventory transactions:

Jan. 1: Beginning inventory 100 units @ $4 each

Jan. 15: Purchase 100 units @ $5 each

Jan. 31: Purchase 100 units @ $6 each

What would be the cost of goods sold under the LIFO method if 120 units were sold in January?

A) $ 600

B) $ 500

C) $ 700

D) $ 720

Jan. 1: Beginning inventory 100 units @ $4 each

Jan. 15: Purchase 100 units @ $5 each

Jan. 31: Purchase 100 units @ $6 each

What would be the cost of goods sold under the LIFO method if 120 units were sold in January?

A) $ 600

B) $ 500

C) $ 700

D) $ 720

C) $ 700

67

New cards

When prices are increasing, which cost of goods sold is higher:

FIFO or LIFO

FIFO or LIFO

LIFO

68

New cards

When prices are increasing, which gross profit is higher:

FIFO or LIFO

FIFO or LIFO

FIFO

69

New cards

When prices are increasing, which inventory is higher:

FIFO or LIFO

FIFO or LIFO

FIFO

70

New cards

During a period of rising prices, which inventory cost flow assumption would result in the highest cost of goods sold, and thereby the lowest net income?

A) FIFO

B) LIFO

C) Weighted-average

D) FILO

A) FIFO

B) LIFO

C) Weighted-average

D) FILO

B) LIFO

71

New cards

Which inventory method or cost flow assumption most closely resembles the actual physical flow of goods?

A) FIFO

B) LIFO

C) Weighted-average

D) FILO

A) FIFO

B) LIFO

C) Weighted-average

D) FILO

A) FIFO

72

New cards

Can companies change which cost allocation method they use each year?

No, but cost allocation methods can differ for different inventory types

73

New cards

Inventory Systems: Periodic

Requires physical count of inventory periodically

74

New cards

Inventory Systems: Perpetual

Each purchase and sale will be continuously recorded and updated in the inventory system

75

New cards

LIFO reserve

Conversion from FIFO to LIFO: FIFO inventory - LIFO reserve = LIFO inventory

76

New cards

Freight in

Charged on incoming purchases and is considered to be part of inventory cost

77

New cards

Freight out

Shipment costs related to sales and is considered to be part of cost of goods sold

78

New cards

FOB Shipping Point

Title passes at shipping point (when inventory leaves the supplier’s warehouse)

79

New cards

FOB Destination

Title passes at destination (when inventory arrives at customer’s building)

80

New cards

Conservationism

Recognize all unrealized losses, but don’t recognize any unrealized gains

81

New cards

Lower of cost and net realizable value

Adjusting entry is made to record loss and restate ending inventory to the lower value (debit Cost of Goods Sold, credit Inventory to match net realizable value)

82

New cards

At the end of the year, a company reports the following inventory amounts ($ per unit) (see image). The amount to report for ending inventory using the lower of cost and net realizable value is:

A) $1,600

B) $1,700

C) $2,000

D) $1,300

A) $1,600

B) $1,700

C) $2,000

D) $1,300

D) $1,300

83

New cards

On December 31, 2015, Larry's Used Cars had balances in Accounts Receivable and Allowance for Uncollectible Accounts of $53,600 and $1,325, respectively. During 2016, Larry's wrote off $1,465 in accounts receivable and determined that there should be an allowance for uncollectible accounts of $1,280 at December 31, 2016. Bad debt expense for 2016 would be:

a. $1,280.

b. $1,465.

c. $1,420.

d. $1,140.

a. $1,280.

b. $1,465.

c. $1,420.

d. $1,140.

c. $1,420.

84

New cards

Crimson Inc. recorded credit sales of $750,000, of which $600,000 is not yet due, $100,000 is past due for up to 180 days, and $50,000 is past due for more than 180 days. Under the aging of receivables approach, Crimson Inc. expects it will not collect 1% of the amount not yet due, 10% of the amount past due for up to 180 days, and 20% of the amount past due for more than 180 days. The allowance account had a debit balance of $1,000 before adjustment. After adjusting for bad debt expense, what is the ending balance of the allowance account?

a. $29,000.

b. $28,000.

c. $27,000.

d. $26,000.

a. $29,000.

b. $28,000.

c. $27,000.

d. $26,000.

d. $26,000.

85

New cards

On November 10 of the current year, Flores Mills provides services to a customer for $8,000 with credit terms 2/10, n/30. The customer made the correct payment on November 17. How would Flores record the collection of cash on November 17?

a. debit Cash 7,840, credit Accounts Receivable 7,840

b. debit Cash 7,840, credit Sales Discounts 160, credit Accounts Receivable 8,000

c. debit Cash 7,840, credit Sales Revenue 160, credit Accounts Receivable 8,000

d. debit Cash 8,000, credit Accounts Receivable 8,000

a. debit Cash 7,840, credit Accounts Receivable 7,840

b. debit Cash 7,840, credit Sales Discounts 160, credit Accounts Receivable 8,000

c. debit Cash 7,840, credit Sales Revenue 160, credit Accounts Receivable 8,000

d. debit Cash 8,000, credit Accounts Receivable 8,000

b. debit Cash 7,840, credit Sales Discounts 160, credit Accounts Receivable 8,000

86

New cards

Barton Health Services provided care to a patient worth $1,200. Because the patient was over the age of 65, Barton granted the patient a 20% discount and the customer paid the correct amount in cash. How would Barton record the service transaction?

a. debit Cash 960, credit Service Revenue 960

b. debit Cash 960, credit Trade Discount 240, credit Service Revenue 1,200

c. debit Cash 1,200, credit Service Revenue 1,200

d. debit Cash 1,200, credit Trade Discount 240, credit Service Revenue 960

a. debit Cash 960, credit Service Revenue 960

b. debit Cash 960, credit Trade Discount 240, credit Service Revenue 1,200

c. debit Cash 1,200, credit Service Revenue 1,200

d. debit Cash 1,200, credit Trade Discount 240, credit Service Revenue 960

a. debit Cash 960, credit Service Revenue 960

87

New cards

Tom's Textiles shipped the wrong material to a customer, who refused to accept the order. This is an example of a:

a. Sales revenue.

b. Sales discount.

c. Sales return.

d. Sales allowance.

a. Sales revenue.

b. Sales discount.

c. Sales return.

d. Sales allowance.

c. Sales return.

88

New cards

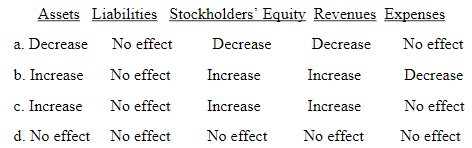

A company collects a customer’s account within the discount period. Indicate how this transaction would affect the following five financial statement items (see image)

a

89

New cards

The LIFO conformity rule states that if LIFO is used for:

a. One class of inventory, it must be used for all classes of inventory.

b. Tax purposes, it must be used for financial reporting.

c. One company in an affiliated group, it must be used by all companies in an affiliated group.

d. Domestic companies, it must be used by foreign partners.

a. One class of inventory, it must be used for all classes of inventory.

b. Tax purposes, it must be used for financial reporting.

c. One company in an affiliated group, it must be used by all companies in an affiliated group.

d. Domestic companies, it must be used by foreign partners.

b. Tax purposes, it must be used for financial reporting.

90

New cards

LeGrand Corporation reported the following amounts in its income statement:

Sales revenue: $440,000

Advertising expense: 60,000

Interest expense: 10,000

Salaries expense: 55,000

Utilities expense: 25,000

Income tax expense: 45,000

Cost of goods sold: 180,000

What was LeGrand’s operating income?

a. $120,000.

b. $260,000.

c. $110,000.

d. $65,000.

Sales revenue: $440,000

Advertising expense: 60,000

Interest expense: 10,000

Salaries expense: 55,000

Utilities expense: 25,000

Income tax expense: 45,000

Cost of goods sold: 180,000

What was LeGrand’s operating income?

a. $120,000.

b. $260,000.

c. $110,000.

d. $65,000.

a. $120,000.

91

New cards

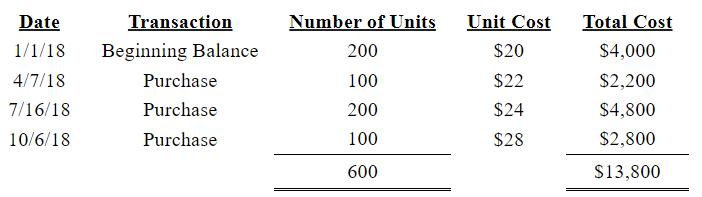

The following information relates to inventory for Shoeless Joe Inc. (see image)

At what amount would Shoeless report gross profit using LIFO cost flow assumptions?

a. $105.

b. $80.

c. $175.

d. $120.

At what amount would Shoeless report gross profit using LIFO cost flow assumptions?

a. $105.

b. $80.

c. $175.

d. $120.

b. $80.

92

New cards

Inventory records for Dunbar Incorporated revealed the following (see image).

Dunbar sold 700 units of inventory during the month. Ending inventory assuming FIFO would be:

a. $500.

b. $490.

c. $470.

d. $480

Dunbar sold 700 units of inventory during the month. Ending inventory assuming FIFO would be:

a. $500.

b. $490.

c. $470.

d. $480

a. $500.

93

New cards

In a period when inventory costs are rising, the inventory method that most likely results in the highest ending inventory is:

a. Lower of cost and net realizable value.

b. Weighted-average cost.

c. FIFO.

d. LIFO

a. Lower of cost and net realizable value.

b. Weighted-average cost.

c. FIFO.

d. LIFO

c. FIFO.

94

New cards

In a perpetual inventory system, at the time of a sale the cost of inventory sold is:

a. Debited to Accounts Receivable.

b. Credited to Cost of Goods Sold.

c. Debited to Cost of Goods Sold.

d. Not recorded at the time.

a. Debited to Accounts Receivable.

b. Credited to Cost of Goods Sold.

c. Debited to Cost of Goods Sold.

d. Not recorded at the time.

c. Debited to Cost of Goods Sold.

95

New cards

Inventory records for Dunbar Incorporated revealed the following (see image)

Dunbar sold 700 units of inventory during the month. Cost of goods sold assuming weighted-average cost would be (round weighted-average unit cost to four decimals and final answer to the nearest whole dollar):

a. $1,711.

b. $1,700.

c. $1,720.

d. $1,708.

Dunbar sold 700 units of inventory during the month. Cost of goods sold assuming weighted-average cost would be (round weighted-average unit cost to four decimals and final answer to the nearest whole dollar):

a. $1,711.

b. $1,700.

c. $1,720.

d. $1,708.

a. $1,711.

96

New cards

Lake Incorporated purchased all of the outstanding stock of Huron Company paying $850,000 cash. Lake assumed all of the liabilities. Book values and fair values of acquired assets and liabilities were (see image)

Lake would record goodwill of:

A. $0.

B. $150,000

C. $345,000.

D. $850,000

Lake would record goodwill of:

A. $0.

B. $150,000

C. $345,000.

D. $850,000

B. $150,000.

97

New cards

Shasta Exploring purchases a piece of equipment for $50,000 and the equipment has an expected useful life of five years. Its residual value is estimated to be $4,000. Assuming Shasta uses the double-declining balance depreciation method, what is the depreciation expense for the equipment for the second full year?

a. $9,200.

b. $9,040.

c. $12,000.

d. $11,040.

a. $9,200.

b. $9,040.

c. $12,000.

d. $11,040.

c. $12,000.

98

New cards

Berry Co. purchases a patent on January 1, 2015, for $40,000 and the patent has an expected useful life of five years with no residual value. Assuming Berry Co. uses the straight-line method, what is the amortization expense for the year ended December 31, 2016?

a. $0.

b. $8,000.

c. $16,000.

d. $40,000.

a. $0.

b. $8,000.

c. $16,000.

d. $40,000.

b. $8,000.

99

New cards

Capital Construction purchased a 3-acre tract of land for a building site for $350,000. The company demolished the old building at a cost of $12,000, but was able to sell scrap from the building for $1,500. The cost of title insurance was $900 and attorney fees for reviewing the contract was $500. Property taxes paid were $3,000, of which $250 covered the period after the purchase date. The capitalized cost of the land is:

a. $366,400.

b. $366,150.

c. $364,650.

d. $231,150

a. $366,400.

b. $366,150.

c. $364,650.

d. $231,150

c. $364,650.

100

New cards

Productive assets that are physically used up, or depleted are:

a. Equipment.

b. Land.

c. Land improvements.

d. Natural resources.

a. Equipment.

b. Land.

c. Land improvements.

d. Natural resources.

d. Natural resources.