2.2.1 Characteristics of aggregate demand

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

AGGREGATE DEMAND- DEFINITION

the total level of spending in the economy at any given price

COMPONENTS OF AD

AD= C+l+G+(X-M)

made up of consumption (C), investment (I), government spending (G) and net exports (X-M)

CONSUMPTION

consumer spending on g and s

makes up about 60% of AD

INVESTMENT

spending by firms on capital goods (e.g. new equipment)

makes up about 15-20% of AD

most investment is by the private sector (about 75%) but there is also investment by the gov

GOVERNMENT SPENDING

spending by the gov on providing g and s (public and merit goods), wages and salaries of public sector workers and on investment goods like new roads and schools

transfer payments (e.g. pensions and jobseekers' allowances) not included as money is just transferred from one group to another

gov spending is around 18-20% of GDP

NET EXPORTS

exports minus imports

when imports>exports=minus figure as more money leaves the UK than comes in

the UK has a large trade deficit, but this minor figure and is the least significant part of AD at around 5%

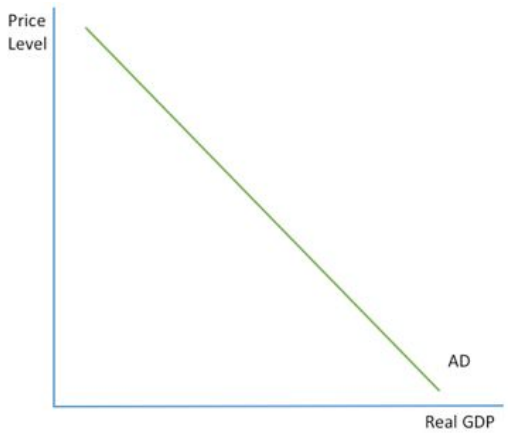

AD CURVE

same as demand curve for an individual market

instead shows the relationship between general price level and real GDP

AD curve is downward sloping as a rise in prices causes a fall in real GDP (inverse relationship)

4 reasons for this:

income effect

substitution effect

real balance effect

interest rate effect

INCOME EFFECT

as a rise in prices is not matched straight away by a rise in income, people have lower real incomes so can afford to buy less, leading to a contraction demand

SUBSTITUTION EFFECT

if prices in the UK rise, less foreigners will buy British exports and more UK residents will buy imported foreign goods bc they’re cheaper

rise in imports and fall of exports will decrease net exports so AD will contract

REAL BALANCE EFFECT

rise in prices means the amount people have saved up will no longer be worth as much and so will offer less security

they will want to save more and so reduce their spending, causing a contraction in AD

INTEREST RATE EFFECT

rising prices mean firms have to pay their workers more and so there is higher demand for money

if supply stays the same, then the 'price of money' i.e. interest rates will rise because of this higher demand

higher interest rates mean that more people will save and less will borrow and will also mean that businesses invest less, so AD will contract

MOVEMENT ALONG AD CURVE

movement along the AD curve is caused by a change in prices, caused by inflation or deflation

SHIFT OF AD CURVE

shift of the AD curve is caused by a change in any other variable

right shift represents increase in AD and left shift represents decrease in AD

absolute change: fall in the amount of consumption reduces AD

rates of change: fall in the rate of rise of consumption means that consumption is still rising so AD will still increase but by not as much