OCR Business GCSE - Topic 1 Business Activity

1/101

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

102 Terms

Business

An organisation which exists to sell goods or services to customers

Needs

Food, Water, Shelter, Clothes, Warmth

Wants

Goods and services, which we do not need, but are pleasant to have

The Economic problem

This results from unlimited wants, but limited resources to produce the goods and services to satisfy those wants. This creates scarcity

Scarcity

The lack of sufficient products to fulfill the wants of the population.

Factors of production

Land, labour, capital, entrepreneurship

Market

The aim of a market is to bring buyers and sellers together

Private sector

Businesses are owned by private companies or individuals. They run to make profit

Public sector

Organisations are owned by central government or regional authorities. They can be operated for the benefit of everyone, or for one particular group.

The Free Market System

This is also known as the capitalist system, or the Laissez-faire system. There is no interference from the government in the workings of the economy.

The Planned Economy

Where the governments controls everything in the market, like resources, prices and production.

The Mixed Economy

Where a market has some elements of the planned economy as well as the free market system. The government operates the public sector, mostly in defence and education, whilst the private sector isn't, but is restricted with laws.

Primary sector

Businesses that are involved in extracting raw materials

Secondary Sector

Businesses that are involved in manufacturing or constructing

Tertiary sector

Businesses that are involved in commercial services and activities that enables goods to get to the final customer or provide a direct service

Deindustrialisation and Industrialisation

The economy is getting to be more based in the tertiary sector in developed nations, while in less developed countries the economy is mainly primary and increasingly secondary sector

Reasons for primary sector decline in the UK

Raw materials used up

Greater demand for imports

Reasons for secondary sector decline in the UK

Manufacturing in the UK is too expensive

Machinery is replacing workers

Reasons for increase in tertiary sector in the UK

Increases in disposable (extra) income means more consumers spending on services and goods

Population increase increases demand for healthcare and education

Tertiary businesses sell abroad as well as the UK

Less scope for machinery as tertiary secotr worker can't be replaced by them.

Reasons for growth and decline in business activity

Consumer wants and needs changes (trends)

Number of people employed

Value of the goods and services provided

Technological development

The chain of production

The process of turning a raw material into a sellable product

Entrepreneur

someone who spots a business opportunity, takes advantage of it and takes the risk of running a business

Potential Rewards for risk taking

Financial gain

Independance

Self Satisfaction

Changing consumer habits : ethical brands e.g. increasing sustainability

Potential drawbacks for risk taking

Financial loss

Health : Insomnia, Headaches, Mental health, Fatigue

Grants

The government giving money to to help the development of enterprise/risk taking which does not have to be payed back

Reasons for why some businesses could fail

Poor management

Poor planning

No demand for good or service

Poor location

Poor cash flow

High costs

Too much competition

Poor quality of good or service

Insufficient profit

External factors e.g. unfavorable exchange rates

Business plan

A plan that sets out in detail what a business is going to do in a given time

Business plan: The business

Name and address

Idea

Business objective

Business plan: Management

Ownership (business type)

Firm's management structure

Experience of owners and managers

Business plan: Market

What market research has been done

Customers : location

The competition: how strong are they, where are they

How is product different from competition

Potential for growth and how it can be achieved

Business plan: Marketing

Analasys on on the strengths, weaknesses, opportunities, and threats

How is the product going to be sold

Marketing mix (advertisement)

Cost of each part of marketing

Business plan: Resources

Size and kind of resources needed

Number of employees needed and the skills they need

Growth plans and resources needed in the future

Business plan: Financial plan

Startup and running costs

Sources of revenue

Amount of capital and who owns

Detail of existing loans and how they are going to be payed

Estimate of future revenues and cost

Business plan: Prospects

Firm's prospects over 3 to 5 years based on facts and evidence

Sole trader advantages

You own everything and control everything

Small capital needed to start

Finances private

Quick decisions

Sole trader disadvantages

Unlimited liability

Sole trader dies, business evaporates

Skill shortage

Always have to work - can't take days off

Partnership advantages

More capital

Shared costs

Shared workload

Wider range of skills

More ideas

Partnership disadvantages

Unlimited liability

Shared profits

Shared decision making - disagreements

Franchise organization

A contractual association between a franchisor and franchisees.Franchisees buy the right from the franchisor to trade under the business name

unlimited liability

The owner is personally and fully responsible for all losses and debts of the business

limited liability

A form of business ownership in which the owners are liable only up to the amount of their individual investments.

Uses of business plan

Investors can check it to have more confidence in their investment

Helps reduce risk

Banks insist on a business plan before lending

Shows realisticness of a business idea and its prospects

Private limited company

a company in which shareholders must be invited.

Owned by shareholders, managed and controlled by directors and employees

Limited liability

Public limited company

Shares are open to the general public, limited liability, AGM meetings, managed by board of directors

Public limited company advantages

Limited liability

Shareholders have little influence

banks more likely to lend more money

receive economies of scale

shareholders can trade easily

Public limited company disadvantages

vulnerable to takeovers

high setup costs

difficult to manage

less privacy

financial records public

Private limited company advantages

Limited liability

Cheap setup

Can raise capital more easily

control over share price

separate legal identity to owners

can sue and be sued in its own right

Private limited company disadvantages

difficult for investors to get back - would expect dividends

less privacy

potential shareholders may not want to buy shares

admin costs

Survival

(Business Objective)

ensuring the business's long term future in a market

profit maximisation

making the largest number of profits possible over a period of time to be distributed amongst some of the business's shareholders via a dividend

growth (business strategy)

increasing the business size e.g. new products or new places

providing a service

ensuring high levels of customer satisfaction (even if less profit is made)

market share

increasing the percentage of industry controlled by the business

Profit satisficing

Managers/Directors ensure a minimum profit level to please shareholders.

competitive (business aim)

maintaining a position in the market similar to rival businesses

start-up business aims and objectives

survival

efficient

reducing the average costs of production

customer loyalty

achieving a satisfied and larger consumer base

increase share price

achieving higher returns for shareholders

Return on Capital

ensuring a profit of finance invested into the business

employment

maintaining and improving staff working for the business

social/community

Improving links and funding initiatives with the local area

environmental protection

reducing the impact of the business on the natural world

ethical

ensuring the business operates in a fair way

not for profit

achieving a return for stakeholders other than shareholders(normally the aim of a charity)

established business aims and objectives

growth + profit maximisation

public sector business aims and objectives

providing a service

characteristics of aims and objectives

Specific, Measurable, Attainable/Achievable,Realistic, Time-related

A mission statement should be

-Neither too narrow nor too broad

-Fitting the market environment

-Based on distinctive competencies

-Motivating

Mission Statement

a statement of the organization's purpose - what it wants to accomplish in the larger environment

Aim of a business

The strategic goals of a business for the future; It's a statement of purpose e.g. we want to grow the business.

business objective

a target that must be achieved in order to realise the stated aim

Stakeholders

everyone within and outside an organisation that have an interest in the way that the organisation operates

Internal Stakeholders

employees, owners, board of directors, managers

External Stakeholders

bank, local commnunity, national government

Reasons for business growth

innovation, increase market share, spread risk, eliminate rivals, protection from competition

Constraints on business growth

-Diseconomies of scale

-barriers to entry

-regulation

-access to finance

-owner objectives

-occupational constraint

Organic growth

A business growth strategy that involves a business growing gradually using its own resources, such as gaining new customers, investing in factors of production, increasing market share and finding new products/markets

External growth

Business expansion achieved by means of merging with or taking over another business, from either the same or a different industry

Merging of Businesses

Merger - a combination of 2 or more businesses to make 1 larger business.(A + B = AB)

takeover

an act of taking control of a company by buying most of its shares(A + B = A/C)

Reasons why some businesses would like to remain small

niche market, market saturation, availability of finance/capital, less risk

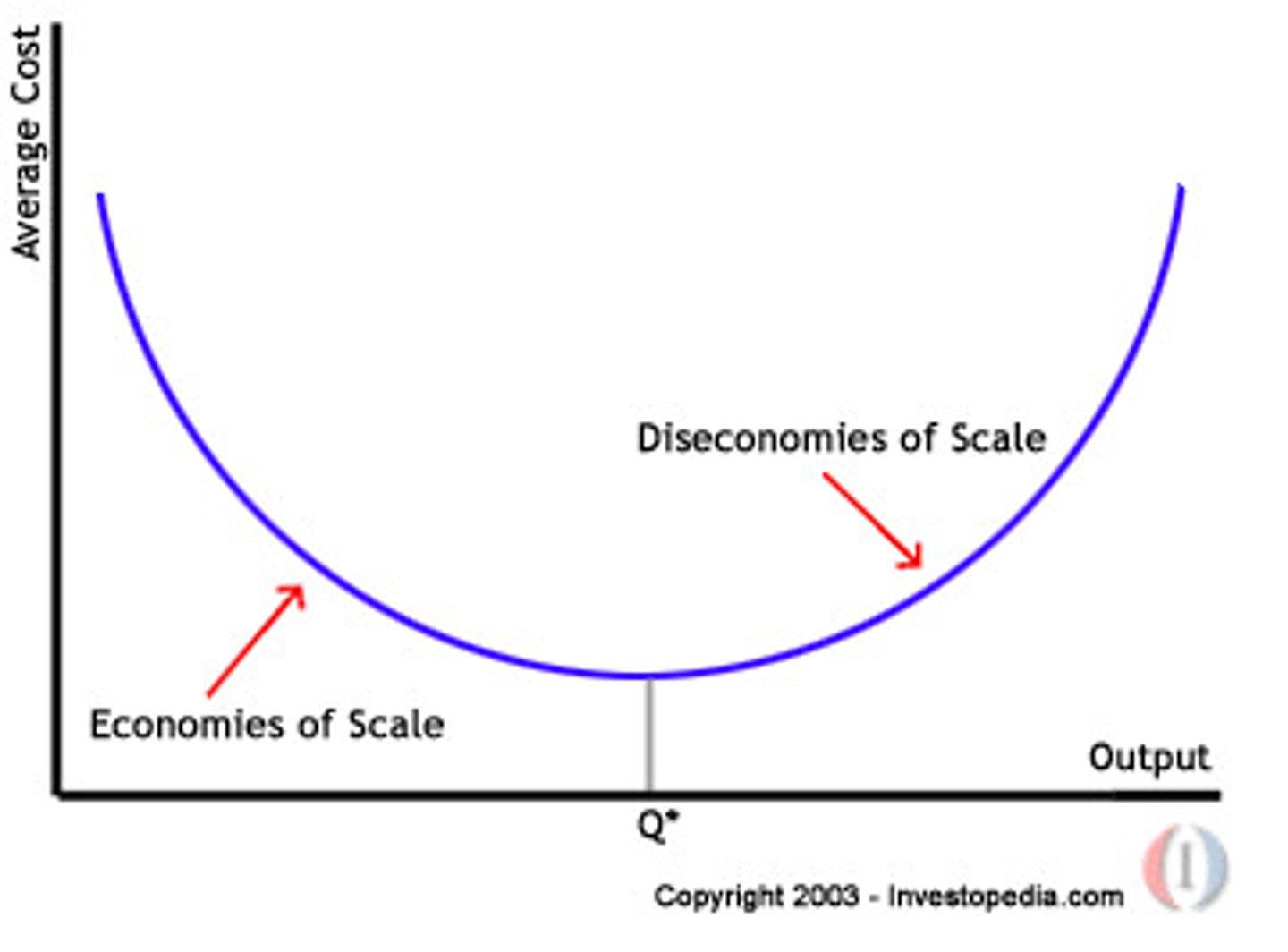

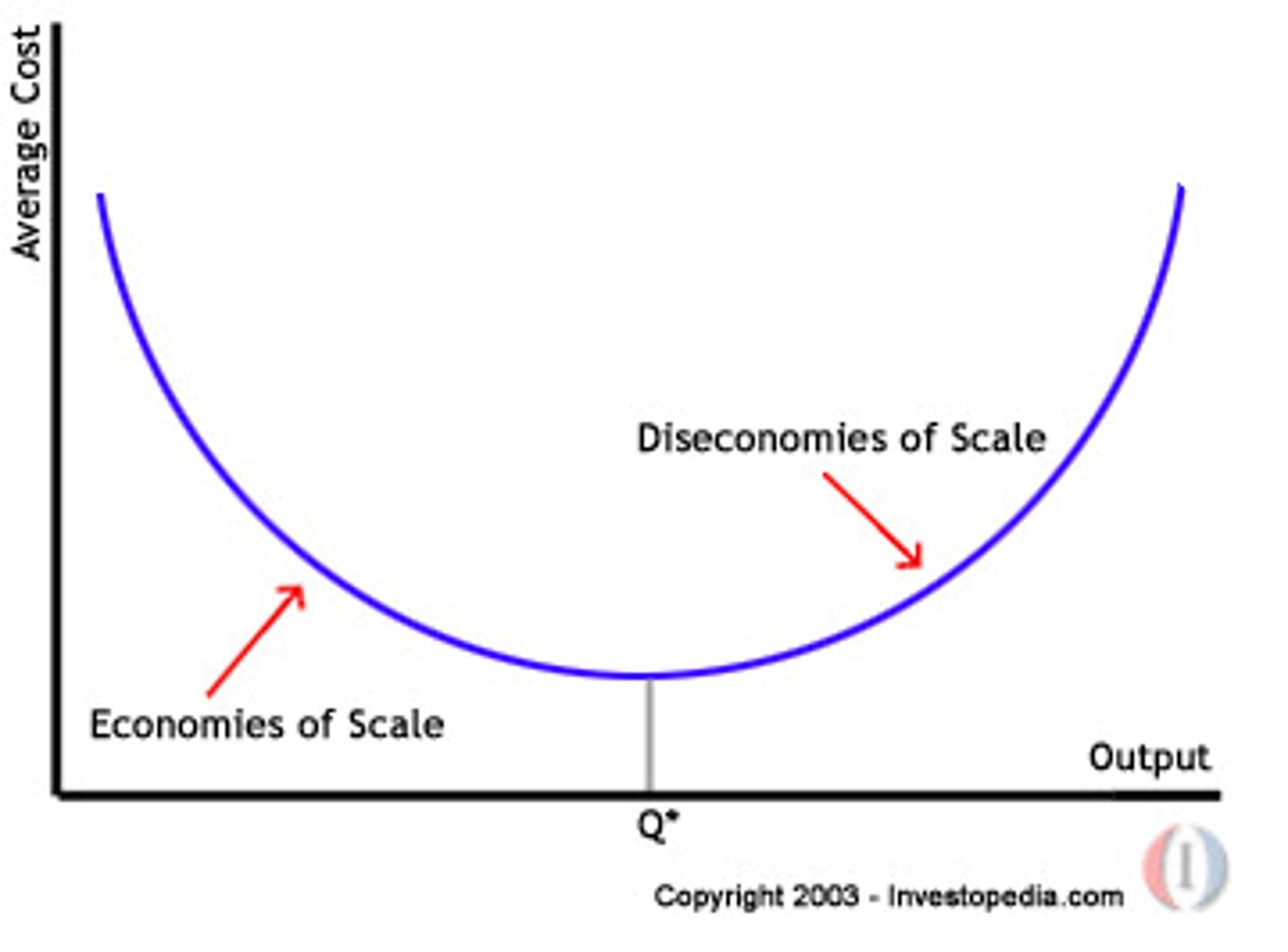

economies of scale

factors that cause a producer's average cost per unit to fall as output rises

diseconomies of scale

increases in cost per unit when output increases

Internal economies of scale

- Technical economies - bigger and newer machines and equipment can be used

- Financial economies - large firms find is easier/less expensive to raise capital and borrow money

- Managerial economies large firms can use managers mreo effectively and can employ specialists

- Purchasing economies large firms can buy their supplies in bulk/large quanitities at a cheaper price

External economies of scale

The cost reductions available to all businesses as the industry grows

labour economies - firms will be able to draw on specialised workers trained by local gov.

infrastructure - localised industries create suitable transport networks etc.

specialist suppliers created e.g. ancillary industries - specialised companies set up to supply the industry

examples of diseconomies of scale

managerial diseconomies - too many layers of management are created

loss of flexibility - large firms unable to change production quickly

communication problems - chains of command longer than short firms

worker demotivation - workers may feel remote and alienated from the firm

types of integration

vertical - businesses at different stages of production e.g. forestry, furniture maker, furniture shop

horizontal - similar businesses at the same level of production e.g. baker + baker

lateral

conglomerate

Vertical Integration

businesses at different stages of production e.g. forestry furniture maker, furniture shop

forward vertical integration is integrating with the next stage of production, whilst backward vertical integration is integrating with the previous stage of production

Horizontal Integration

similar businesses involved in the same level of production and sharing resources at that level

Lateral integration

the merging of two firms that produce similar goods but are not in competition with each other e.g a brushmaker and a combmaker

Conglomerate integration

Merger with or takeover of a business in a different industry

Advantages of horizontal integration

allows economies of large scale production to be achieved

Disadvantages of horizontal integration

reduced choice, may lead to a monopoly

Advantages of conglomerate integration

- Can spread risk, as if one market fails, the losses can be compensated for by profits in another

- Can overcome seasonal fluctuations in their markets and have more consistent year-round sales (e.g. if a mince pie company took over a company that made chocolate bars)

- The business is larger and therefore more financially secure

- The buyer acquires the other company's assets and resources

- The business gains the customers and sales of the acquired business

disadvantages of conglomerate integration

no understanding of the new business activity, which may lead to diseconomies of scale.

Advantages of forward vertical integration

- The business can control supply of their products and could decide to not supply to competition

- Can increase profits by cutting out the middle man

- possibly improve job securitis for workers

disadvantages of forward vertical integration

may lead to higher prices and/or reduced choice

advantages and disadvantages of backwards vertical integration

adv:control over supply of components

dis:may lead to reduction in variety of available goods for consumers/other businesses