KEY THEORIES MKIB101

1/30

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

31 Terms

INSTITUTION-BASED VIEW

RESOURCE-BASED VIEW

INSTITUTION-BASED VIEW - external focus, "the rules of the game". formal or informal

RESOURCE-BASED VIEW - internal focus, internal resources and capabilities of a firm. It examines firm-specific advantages or disadvantages that allow a company to stay ahead of its competition.

FORMAL & INFORMAL INSTITUTIONS

FORMAL INSTITUTIONS - Written laws, regulations, and policies enforced by official authorities.

INFORMAL INSTITUTIONS - Implicit culture, norms, and values enforced through social expectations.

LIABILITY OF FOREIGNNESS

foreign firms face an inherent disadvantage or "outsidership" due to a lack of familiarity with the institutional settings and networks of a foreign country compared to local firms

3 PILLARS OF INSTITUTIONS:

REGULATIVE (FORMAL)

NORMATIVE (FORMAL)

CULTURAL-COGNITIVE (INFORMAL)

REGULATIVE (FORMAL) - Based on written laws and rules; compliance is driven by coercion (we must comply to avoid trouble).

NORMATIVE (FORMAL) - Based on social and professional standards; compliance is driven by social pressure (we should comply to meet expectations).

CULTURAL-COGNITIVE (INFORMAL) - Based on common beliefs and unconscious behaviours; compliance is "taken-for-granted" (we cannot conceive of behaving otherwise).

LIBERAL MARKET ECONOMY

COORDINATED MARKET ECONOMY

LIBERAL MARKET ECONOMY - Characterised by competitive markets, shareholder value, and flexible labour markets. (E.g. UK and USA)

COORDINATED MARKET ECONOMY - Characterised by collaboration between managers, trade unions, and industry associations, with stronger employment protection. (E.g. France and Germany)

TRANSACTION COST THEORY

Institutions serve to reduce uncertainty and transaction costs (the costs of organising and conducting economic transactions). By establishing clear "rules," institutions mitigate opportunistic behaviour, such as the failure to uphold contracts.

FORMAL INSTITUTION SYSTEMS:

POLITICAL

LEGAL

ECONOMIC

Political Systems: Define how a country is governed (e.g., democracy vs. authoritarianism) and how businesses can influence rules through legal lobbying or, in unstable environments, corruption.

Legal Systems: Determine how laws are enacted and enforced. The most widespread are Civil Law (based on codified statutes) and Common Law (based on past case precedents).

Economic Systems: Govern economic activity, ranging from Market Economies (guided by the "invisible hand") to Command Economies (government-controlled supply and pricing).

INSTITUTIONAL RISK: POLITICAL RISKS FRAMEWORK

The political risks framework includes four dimensions. Host country risks arise when host governments implement actions or policies that undermine the operations or profitability offoreign firms. These risks typically affect firms through changes in local regulations, societal pressures, or targeted actions that disrupt normal business activities. Home country risks arise when actions or policies from the firm's own government or societal pressures in the home country create challenges for its international operations. These risks might include export restrictions, compliance with international sanctions, or high taxes on foreign-earned income. Societal expectations in the home country, such as demands for ethical practices or maintaining jobs locally, can also add pressure. International risks relate to actions or policies from foreign governments, regional organisations, or activist groups that disrupt the firm's ability to operate efficiently across borders. These risks include shifting trade policies or external pressures influencing host country behaviour. Global risks involve systemic issues on a broader scale, such as the impact of global organisations (e.g., UN, IMF) or global economic developments (e.g., recessions). These risks often indirectly affect firms through changes in global supply chains, trade agreements, or economic conditions.

HIGH CONTEXT CULTURES

LOW CONTEXT CULTURES

HIGH CONTEXT CULTURES - Information is conveyed largely through non-verbal cues and shared understanding; personal relationships and trust (such as guanxi in China) are more important than formal contracts. (E.g. Asian cultures)

LOW CONTEXT CULTURES - Information is primarily conveyed through explicit expression; written contracts and formal terms are the priority in business dealings. (E.g. the US)

HOFSTEDE’S CULTURAL DIMENSIONS

Power Distance: The degree to which less powerful members of a society accept unequal power distribution; high power distance societies are often autocratic or paternalistic.

Individualism versus Collectivism: Whether an individual's identity is fundamentally their own or based on their collective group.

Masculinity versus Femininity: Now referred to as motivation towards achievement and success, this measures the preference for assertiveness and material rewards versus cooperation and quality of life.

Uncertainty Avoidance: The extent to which a culture feels threatened by ambiguous situations and strives to avoid them through strict rules.

Long-term Orientation: The emphasis placed on perseverance and savings for future betterment versus a focus on quick results.

Indulgence versus Restraint: The extent to which a society allows relatively free gratification of natural human desires related to enjoying life.

The sources note that while Hofstede’s framework is influential, it is criticized for being prone to stereotyping, relying on old data, and assuming that a nation and a culture are identical.

VRIO FRAMEWORK FOR COMPETITIVE ADVANTAGE

Determines whether a firm’s resource provides a sustained competitive advantage by asking if it is:

VALUABLE

RARE

INIMITABLE

ORGANISED WELL BY FIRM

VALUE CHAIN (ANALYSIS)

Primary activities: activities that directly help to produce the final good or services offered to the firms customers

Support activities: Provide a supporting structure for the primary activities such as IT systems; accounting systems; HR systems etc

TYPES OF FIRM CAPABILITIES

INNOVATION - A firm’s assets and skills to (1) research and develop new products and services and (2) innovate and change ways of organizing.

OPERATIONS - A firm’s ability to effectively implement its regular activities, notably the manufacturing process.

MARKETING - Enable firms to develop and sustain brands awareness and values and to induce consumers to buy these brands.

LOGISTICS AND SERVICES - Enable firms to manage interactions with (potential) customers and bring products to the right customer at the right time.

CORPORATE COORDINATION - Include a firm’s planning, command and control systems and structures.

STRATEGIC RENEWAL - Enable firms to stay ahead in industries that are rapidly changing.

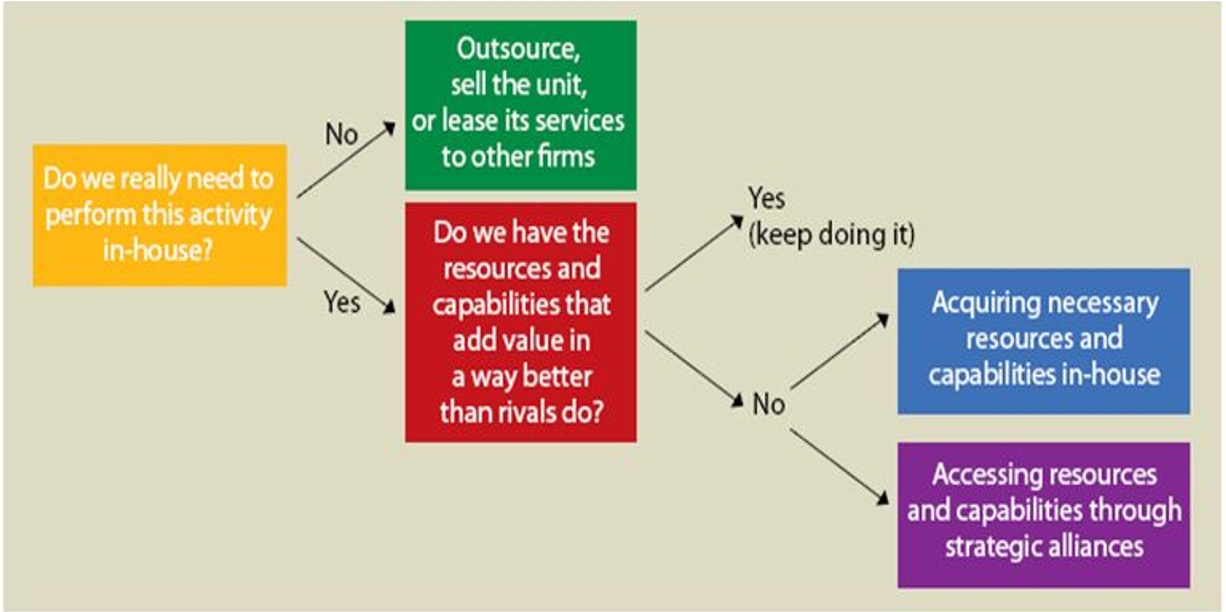

TWO-STAGE DECISION MODEL

to decide whether to perform an activity in-house or to outsource based on whether the firm has superior resources and capabilities compared to rivals

CRITICAL THINKING FRAMEWORK

4 key areas:

recognising persuasive information

questioning expected answers

seeing alternative perspectives

finding credible sources

3 PRIMARY TYPES OF RESOURCE WITHIN FIRMS

TANGIBLE - observable and quantifiable, like cash or equipment

INTANGIBLE - hard to quantify, like patents or brand reputation

HUMAN - skills, know-how, and interpersonal abilities embedded in employees

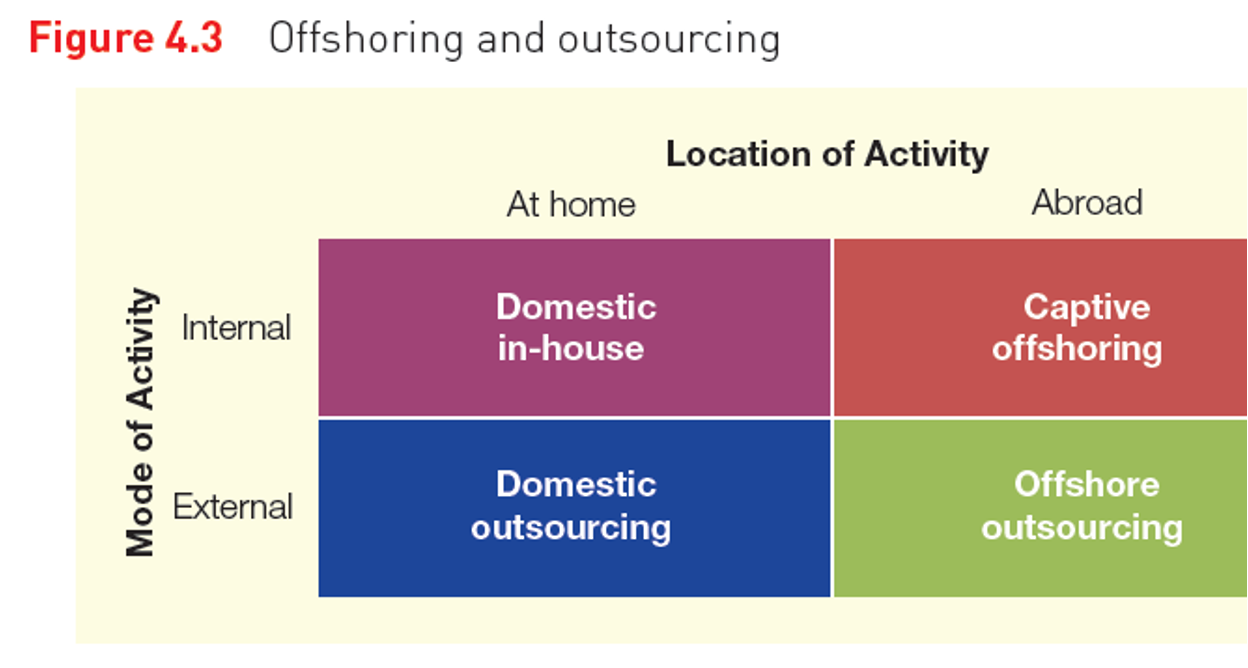

OUTSOURCING

OFFSHORING

NEARSHORING

ONSHORING

OUTSOURCING - Sourcing of formerly in-house produced goods and services from legally independent supplier firms. Outsourcing entails a change in the legal boundaries of the ‘lead’ firm.

OFFSHORING - Sourcing one or more component or service from your own subsidiary abroad to a foreign country. Offshoring entails a change in the locational structure but not in the legal boundary of the firm.

Bringing the subsidiary closer to reduce total costs and time involves NEARSHORING to a nearby foreign location or ONSHORING to a domestic location.

DUNNING’S INTERNATIONALSING MOTIVATIONS FRAMEWORK

Natural resource seeking: Securing supplies or resources at a lower cost than in the home country.

Market seeking: The intention to supply goods or services directly to a foreign region.

Efficiency seeking: Exploiting different factor endowments, institutional arrangements, or tax havens by concentrating production in limited locations to supply multiple markets.

Strategic asset or capabilities seeking: Securing intangible resources such as patents, new technology, or specialized skills.

TIMING OF ENTRY

FIRST-MOVER ADVANTAGES: These include establishing technological leadership, pre-empting scarce resources, creating entry barriers, and building early relationships with key stakeholders like governments and suppliers.

LATE-MOVER ADVANTAGES: These involve the opportunity to "free-ride" on first-mover investments, the resolution of market and technological uncertainties, and exploiting the first mover’s potential difficulty in adapting to changes.

MODES OF ENTRY:

NON-EQUITY

EQUITY (FDI)

NON-EQUITY:

Exports: These can be direct (firm handles the entire process and interacts with customers) or indirect (outsourced to intermediaries, requiring no previous experience but offering limited market learning).

Licensing and Contractual Agreements: Firms sell intangible property like patents or trademarks. This is a low-risk strategy that overcomes trade barriers but risks creating competitors and lacks global coordination.

Franchising: The right to do business in a prescribed manner, often seen in services like McDonald's.

EQUITY (FDI):

Joint Ventures (JV): Creating a new company with a local partner to share costs and risks. This is often necessary in countries like China due to government regulations, though it can lead to divergent goals and technological leakage.

Wholly Owned Subsidiaries (WOS): These provide maximum control and flexibility and minimize the risk of technological leakage. They can be established via Acquisition (buying an existing firm for fast entry) or Greenfield Investment (building from the ground up).

AGGREGATION VS ADAPTATION

AGGREGATION - Focuses on aligning operations globally or regionally to target markets with a uniform offering. This strategy is suitable for global industries like aircraft manufacturing (e.g., Boeing) where customers seek similar features and performance.

ADAPTATION - Aims to tailor products and services to local preferences, cultures, and regulations. While this increases costs, it captures more of the local market.

INTEGRATION-RESPONSIVENESS FRAMEWORK

Home Replication Strategy (International Division): Firms replicate their home-country competencies abroad, believing the home organisation’s methods are the most effective way to transfer skills. It is relatively easy to implement but often lacks local responsiveness, which can alienate foreign customers.

Localisation Strategy (Geographic Area Structure): This strategy treats each country or region as a stand-alone market requiring significant adaptation. It is effective when national markets differ greatly, though it results in high costs due to the duplication of efforts across subsidiaries.

Global Standards Strategy (Global Product Division): MNEs focus on the advantages they have over local firms, such as scale, knowledge integration, and risk diversification. It involves developing standardised products worldwide to reap maximum benefits from economies of scale but sacrifices local responsiveness.

Transnational Strategy (Global Matrix Structure): This aims to be simultaneously cost-efficient, locally responsive, and learning-driven. It focuses on global learning and the diffusion of innovations across all subsidiaries.

LOCAL RESPONSIVENESS FACTORS:

ECONOMIC

LAWS AND REGULATIONS

INFRASTRUCTURE

CULTURAL PREFERENCES

Economic Conditions: Variations in living standards, exchange rate fluctuations, and inflation.

Laws and Regulations: Constraints such as Germany’s prohibition of advertising directed at children or France’s requirement that all adverts be in French.

Infrastructure: Differences in transportation networks and marketing intermediaries (e.g., using small trucks for rural China versus billboards in Vietnam).

Cultural Preferences: Local tastes in products like food (e.g., McDonald's offering different items like the McBaguette in France or the McArabia in the Middle East).

TARIFF VS NON-TARIFF BARRIERS

TARIFF BARRIERS - Taxes imposed on imports to increase their domestic price, such as those seen in the 1964 "Chicken War" and the 2018 US-China trade war.

NON-TARIFF BARRIERS - These include subsidies (e.g., the EU’s Common Agricultural Policy), import quotas, anti-dumping duties, and local content requirements.

While tariffs aim to protect specific industries or change country behaviour, they often result in higher costs for general consumers and can lead to decreased overall employment.

THEORY OF INTERNATIONAL TRADE: PORTER’S DIAMOND THEORY

Michael Porter’s (1990) Theory of National Competitive Advantage

why specific industries within a nation become internationally competitive

Factor Conditions: A nation's endowment of natural resources and human capital, such as the high-tech clusters in Cambridge.

Demand Conditions: The sophistication of domestic consumers, which forces firms to innovate to meet high standards, making it easier to compete internationally later.

Firm Strategy, Structure, and Rivalry: The presence of intense domestic competition (e.g., Puma vs. Adidas in Germany) which drives efficiency and innovation.

Related and Supporting Industries: The presence of a strong foundation of suppliers and shared technologies, such as the aerospace ecosystem supporting Airbus.

THEORY OF FDI — O.L.I. PARADIGM

Ownership Advantages (O): The firm possesses unique, transferable resources or capabilities that allow it to overcome the "liability of foreignness" when competing against local firms.

Location Advantages (L): The host country offers specific benefits that cannot be found at home, such as large markets, natural resources, or geographic clusters (agglomeration).

Internalisation Advantages (I): It is more beneficial for a firm to manage activities internally through a subsidiary rather than using external market transactions (like outsourcing) to reduce transaction costs. Internalising helps protect intellectual property (dissemination risk) and facilitates the transfer of tacit knowledge, which requires hands-on experience.

STAGES OF REGIONAL ECONOMIC INTEGRATION

Free Trade Area (FTA): Members eliminate internal trade barriers but maintain independent external trade policies (e.g. USMCA).

Customs Union: Members adopt a Common External Tariff (CET) and harmonise external trade policies (e.g. Mercosur).

Common Market: Adds the free movement of factors of production (capital and labour) to the customs union framework.

Economic Union: Members harmonise economic, industrial, and competition policies and often adopt a common currency (e.g. the Eurozone).

Political Union: The complete integration of all economic, fiscal, and political institutions (e.g. the UK or USA).

THE 4 FREEDOMS

The theoretical foundation of the European Union’s single market, ensuring the free movement of GOODS, SERVICES, CAPITAL, AND LABOUR.

NON-DISCRIMINATION PRINCIPLE

A core WTO (World Trade Organisation) rule stating that member nations cannot apply different trade rules or tariffs to different trading partners unless a specific free trade agreement exists.

SHAREHOLDER THEORY

STAKEHOLDER THEORY

SHAREHOLDER THEORY:

This conventional perspective of corporate governance posits that a manager's primary responsibility is to the owners (shareholders) of the business. Under this theory, the goal of a business is to conduct its affairs according to the desires of the owners, which typically translates to maximising profits and increasing returns to shareholders.

STAKEHOLDER THEORY:

In contrast, this theory defines a stakeholder as any group or individual who can affect or is affected by the achievement of the organisation’s objectives. It categorises stakeholders into two groups:

Primary Stakeholders: Those on whom the firm relies for continuous survival and prosperity, such as shareholders, customers, employees, suppliers, and governments.

Secondary Stakeholders: Those who affect or are affected by the firm but are not essential for its survival, including the media, trade unions, and non-governmental organisations (NGOs) like environmental activists.

STRATEGIES FOR RESPONDING TO CSR (CORPORATE SOCIAL RESPONSIBILITY)

Reactive: Doing as little as possible, sometimes denying or covering up wrongdoing.

Defensive: Doing only what is legally required and no more.

Accommodative: Meeting economic, legal, and social demands, acting beyond requirements if specifically requested.

Proactive: Actively seeking to contribute to the well-being of the environment and stakeholders, going "above and beyond".