macro chapter 9

1/21

Earn XP

Description and Tags

economic growth 2: technology, empiricism, politics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

technical progress in the solow model

consideration of variable E: work efficiency

assume that technical progress increases labour input

increases E at exogenous rate g = ∆E/E

result: new production function Y = F(K,LE)

LE = labour input in efficiency units = (1+% growth) x L

if E increases, it acts like an increase in L

what is the solow model

economic framework

explains long-term economic growth through capital accumulation, labour growth, + technological progress

highlights that while saving/investment boost capital, only exogenous technological advancement drives sustained long-growth

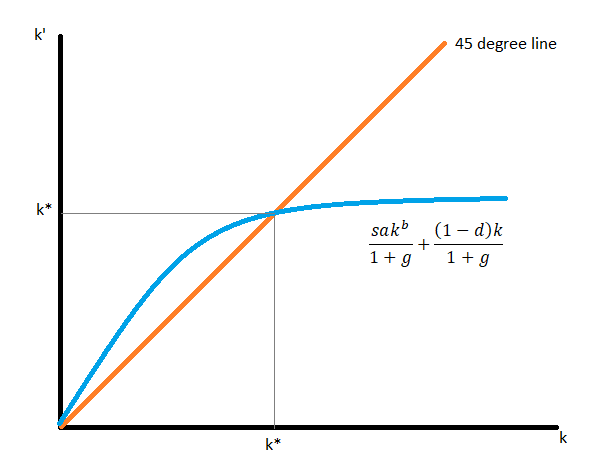

solow model formulae

y = Y/(LE)

k = K/(LE)

production function (output per efficiency unit) → y = f(k)

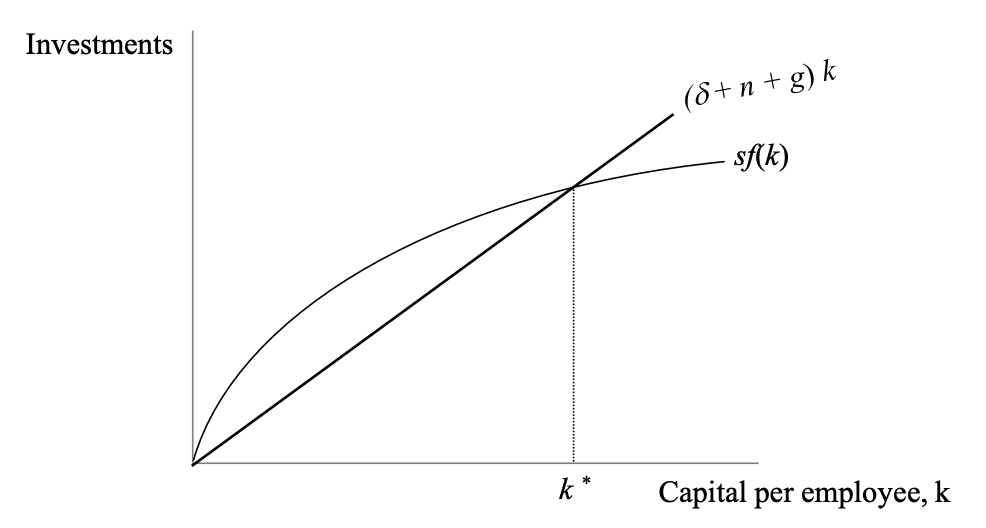

savings/investments (per efficiency unit) → sy = sf(k) = i

investment volume required to ensure that capital stock per efficiency unit remains constant (steady rate) → sf(k) = (δ + n + g)k

technical progress in the steady state

labour-increasing tech progress with rate g has similar effect in solow model, to population growth with rate n

capital intensity (k): capital stock per unit of labour efficiency

increase in efficiency units caused by tech progress → reduction in k

in steady state, investment sf(k) offsets reduction in k due to depreciation, population growth, + tech progress

the golden rule

describes consumption-maximising steady state

consumption

c* = y* - i*

= f(k*) - (δ + n + g)k*

c* is maximised if MPK = δ + n + g

respectively MPK - δ = n + g → GOLDEN RULE

at what rate does the capital per efficiency unit grow?

∆k* = 0 in the steady rate

no growth in k

no change/growth in capital stock

at what rate does the output per efficiency unit grow?

y* = f(k*) does not grow/change

at what rate is output per employee growing?

growth per capital (per employee)

growth rate by which employees become more efficient

it grows by g

people are more efficient → growth rate of capital stock grows by g

at what rate is the total output growing?

aggregated output grows by n + g

implications of the solow model

sustained growth in per capita income is only possible through technological progress

policy recommendation: stimulate technical progress

solow model sources of growth

quantity of production factors

labor and capital

determined by population growth and savings behaviour

efficiency of the use of production factors: Is determined by technical progress

how the technical progress arises is not explained in the model

empirical observations on the solow model (list)

convergence of economics

factor accumulation vs production efficiency

good corporate governance

convergence of economics

economics coverage with the same savings rate but different capital stocks

eg. japan and germany after WWII

if savings rates or efficiency differ, countries do not converge

conditional on steady-state variables

annual convergence is 2%

factor accumulation vs production efficiency

both variables are important for a high income

both variables are also correlated and difficult to separate

production efficiency attracts capital (eg investment)

factor accumulation favours conditions for higher efficiency

good corporate governance

explains differences in efficiency and thus differences in income across countries

major differences in quality of corporate governance → USA vs brazil

one explanation is lack of competition

second explanation is primogeniture

growth policy measures

influencing savings rate → private savings & government savings

gov can stimulate private investment with budget surpluses

private savings can be stimulated through incentives

policy examples

low taxation of capital income

higher consumption tax

tax exemption for private pension plans

private investments

are efficiently controlled by the market

capital is deployed where it generates the highest return

the state should only set competitive framework conditions

government investment

infrastructure investments necessary but difficult to measure

can the state generate +ve externalities through its own investments?

social returns then exceed private returns

effectiveness of industrial policy depends on the ability to measure +vs externalities

eg. investments in renewable energy

but danger of lobbying & bad investments

conditions for investments

institutions should be designed so the conditions favour investments, and allocation of investments is efficient

what makes a good institution?

reliable legal system with legal protection for shareholders & lenders

protection of property rights

functioning capital markets

promoting competition

limiting corruption

how can the state stimulate technological progress?

promotion of R&D → research at unis

research funding: DFG, Max Planck society, etc

create framework conditions for companies to engage in R&D: eg through patent right which allows entrepreneurial return from R&D

international trade

ricardo’s theory of competitive advantage

shows that countries can/should concentrate on more production-efficient goods