8. Central Bank Independence

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

Why might U*<UN be more socially optimal?

We are aware that this occurs when the policymaker wants unemployment below the natural rate, but could there be economic reasons to motivate this?

This might arise if the labour market is subject to imperfections, like market distortions (because of taxes)

There might also be monopolistic competition meaning that equilibrium output is too low; more employment is required to increase the rate of output towards the natural level

How to solve U*<UN being socially optimum?

Unemployment less than the natural rate is economically suboptimal, even if it is socially optimal

The first solution is to get rid of the labour market distortions

These might be solved with supply-side policies

The second is to aim for a higher output target than the equilibrium outcome

How is U*<UN politically motivated?

Politicians might be motivated to aim for this unemployment level due to political economic cycles; it might be attractive to have low unemployment just before an election

The policymaker is tempted for their own success

Milton Friedman writes a paper on this, arguing that government’s might involve in “irresponsible government tinkering” (1962)

Why don’t central banks have adverse political motives?

Mervyn King argues that there is no time-inconsistency in central banks because they do not have political motivations; they do not use monetary policy as a substitute for microeonomic structural reforms

There is no reason for them to create job expansion which can’t exist in the long-run

They do have a dual mandate to care about stable prices and employment, but it is more about stabilisation

Thus, independent policymakers can consistently aim for U*=UN when absent from political pressures

Trump attempting to influence the FED

Trump attempted to fire the Federal Reserve Governor Lisa Cook

The courts have refused this, in a landmark victory for Central Bank Independence

Trump has an insider called Stephen Miran, who opposed a half-point cut claiming that tariffs have no material effect on inflation and the White House’s immigration crackdown will lessen price pressures

Trump has threatened Fed Chair Jerome Powell verbally, claiming rates should be lower

How does the FED respond to Trump interference?

Lohmann’s model, which combines a Barro-Gordon type model with game theory attempts to analyse the outcome (1992)

Government could delegate monetary policy but decrease the CB independence, but this incurs a cost

The government reserves the right to override the CB, meaning there is a cost from less inflation stability

The model is extended to incorporate shocks

Optimal policy response to government interference

Is always state-contingent — completely dependent on the state of the world, meaning that the policymaker shouldn’t always aim for the target level inflation but must choose around it to maintain stability

The only instrument in this model is monetary policy (the inflation rate) but trying to meet a dual mandate with it - difficult

The FED knows a decision which is too different from the Government will lead to the Government overriding it, so instead of doing this, the FED will choose the policy which is closest to their preferred choice without causing the Government to get involved

Thus, the FED will probably concede to some of Trump’s demands, lowering inflation below their preferred rate, but less than Trump wants so that he doesn’t fire them all and override them

The FED cares about itself!

Lohmann Model Summary

Ut = UN - b(𝜋t - 𝜋te) - zt is our lecturers inverted Phillips curve model, whereas Lohmann uses y = 𝜋 - w + z, which is a supply function; these two curves correspond by an ‘Okun’s Law’ relationship, where yt = - 1/b (Ut)

The loss function becomes Lt = (Ut - U*)2 + a(𝜋t - 𝜋*)2 + dc, where dc is the explicit cost of a government takeover; d is a dummy variable, which is zero if no takeover and 1 if there is

c > 0 is the cost of reneging on an inflation commitment

Monetary policy consists of choice 𝜋t

Lohmann Model Timeline

Government chooses the cost of a takeover, c

Public sets inflation expectations, 𝜋te

Shock is realised, zt

CB sets inflation target given expectations and the shock, 𝜋t

Government decides where to intervene

Given these, output is determined giving the loss, Ut, Lt

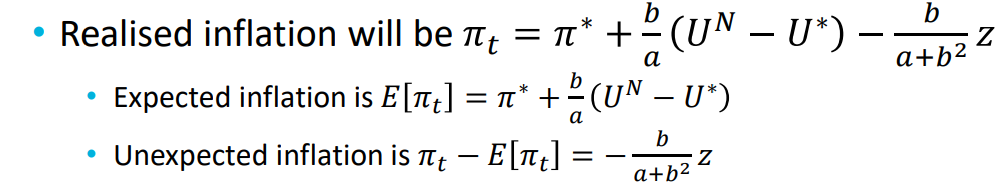

Realised inflation under the Lohmann Model

Outcomes of under the Lohmann model

On average, the natural rate of unemployment is achieved, but inflation is above target, exhibiting an inflation bias

A negative z is interpreted as a negative output shock that raises unemployment, so inflation is allowed to rise to stimulate growth

Monetary policy is counter-cyclical

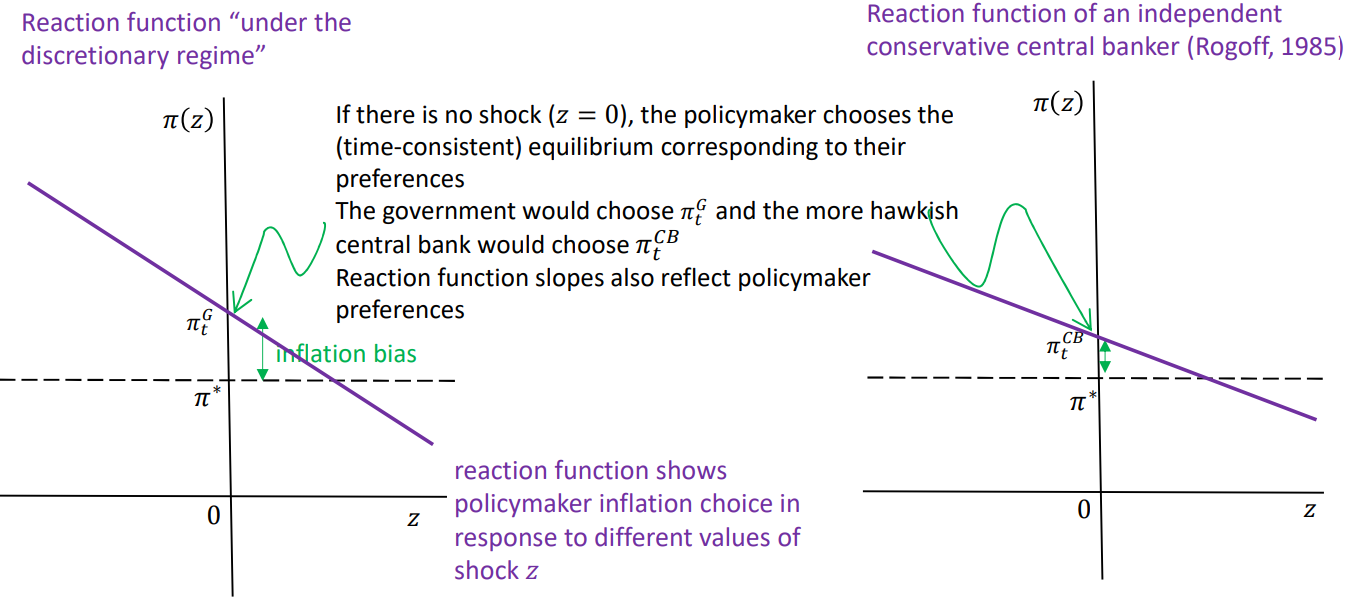

Policymaker reaction functions

What makes a Central Bank independent?

It is independent if it can make policy, set interest rates and print money without interference from government or elected officials

Its key personnel decisions cannot be influenced by the government

It cannot be forced to lend to the government

Dimension’s measured in Romelli’s index (2022) of Central Bank Independence

Governor and central bank board

Monetary policy

Objectives

Limitations on lending to the government

Financial independence

Reporting and disclosure

Facts about the IMF index (2024) of Central Bank Independence

Aims to measure the independence of 193 central banks and adjusts the weights on variables by assessing how important the bank thinks the variable is to independence (ie, being able to set monetary policy independently)

Looks different to other indexes and records lower levels of central bank independence than Romelli’s index because it uses composite metrics

This means that for a variable, any recordings of 0 mean that the whole category gets a score of 0

This makes sense; it is not valuable having a central bank director who’s tenure is longer than political cycles if he can be easily dismissed by the government

Why is there an inflation bias in the time-consistent equilibrium under rational expectations?

𝜋t - 𝜋* = b/a (UN - U*) is the bias, and this exists because:

b > 0, meaning the Phillips curve has a negative slope and in the inverted curve output is not perfectly price (nominal wage) inelastic

a < infinity, because policymakers care about unemployment and put a non-zero weight on these deviations in the loss function

U* < UN, policymakers want unemployment below the natural rate

If these conditions aren’t met, then inflation bias becomes zero (obviously, one of the terms being 0 means the whole RHS is 0)

Features of delegating to a conservative CB

Inflation bias is 𝜋t - 𝜋* = b/a (UN - U*), and the parameter a comes from the loss function and is the weight given to keeping inflation near target rather than unemployment at desired level

Likely to be more conservative than the government is and more inflation loss-averse

The a parameter in conservative banks

The weight on inflation, a, can be broken down into two parts; a = a𝜋/aU

a𝜋 is the absolute impact of loss from a 1 percentage point deviation from desired inflation level

aU is the absolute impact of loss from a 1 percentage point deviation from desired unemployment level

Of course, a then gives the relative importance of inflation deviation to unemployment deviation; when a > 1, inflation is more important

The loss function can be expressed as Lt = aU(Ut - U*)2 + a𝜋(𝜋t - 𝜋*)2

A partially conservative CB’s interpretation of ‘a’

aCB > aG

As a consequence, CB monetary policy will have a lower inflation bias

𝜋tCB - 𝜋* = b/aCB (UN - U*), and 𝜋tCB < 𝜋tG

Its iso-loss curves are flatter and more eliptical (vertically squashed) because a change in inflation is more damaging than a change in unemployment

A fully conservative banks interpretation of ‘a’

This CB places absolutely no weight on unemployment deviations, aUCB = 0, thus there is no unemployment component in the loss function, Lt = a𝜋(𝜋t - 𝜋*)2

The monetary policy choice is 𝜋t = 𝜋*

Thus, inflation bias is just 0, and the iso-loss curve is a flat line at 𝜋tCB = 𝜋*

Problems with a full conservative Central Bank

Also known as a hawkish central bank, this type of bank will tolerate any level of unemployment to keep inflation on track, meaning in shocks unemployment could increase massively

Inflation is controlled in a way which isn’t lying to the public, but does lead to suboptimal social outcomes

What is Okun’s law?

A principle which relates unemployment and economic output

It states that as unemployment rises, GDP falls, and vice versa; this is an inverse relationship

What does delegation to a conservative CB mean under the Lohmann Model?

Inflation bias is reduced, but so is the response to any shock, demonstrated by a flatter reaction function

The natural rate of unemployment is still achieved on average

On average, inflation is lower, but still above target unless the CB is fully conservative

Lohmann notes that the countercylical policy of this bank is less; it deviates less from inflation at the cost of ‘distorted shock response’

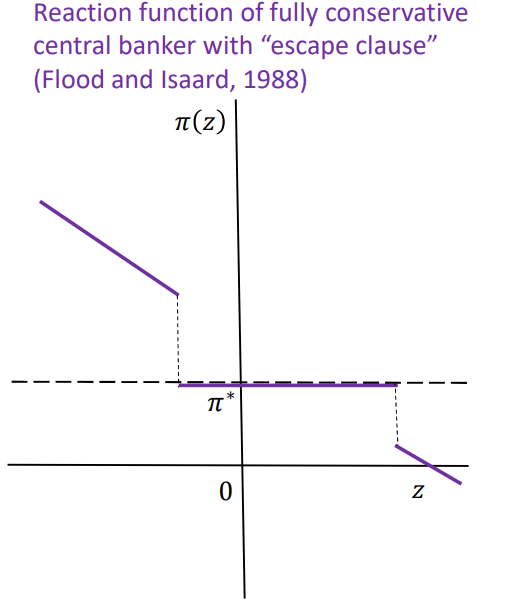

The ‘escape clause’ solution to distorted shock response by a conservative CB

Proposed by Flood and Isaard (1988), the CB should be subject to an incentive scheme which imposes a cost on reneging on inflation targets

The bank agrees to this clause, such that if a shock occurs which is sufficiently large, the bank pays the strictly positive and finite cost, but it is less damaging than the shock

The reaction function thus becomes

The escape clause policymaker reaction function

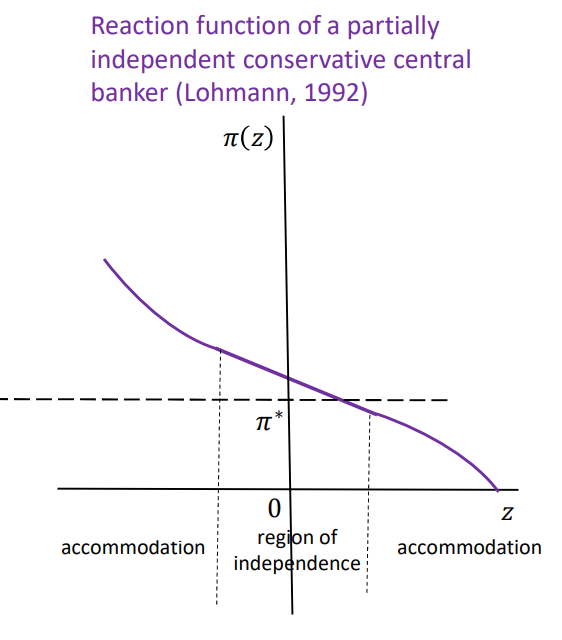

The partially independent conservative reaction function

Partial independence in the Lohmann model

When designing institutions, governments commit to a CB defined by a cost of reneging c

The larger this cost is, then the larger the region of independence

Lohmann gives the model the characteristic of inflation hawkishness, e, as part of government choice

Inflation-expectation setters play a non-cooperate game which can be solved by backwards induction

Features of the partial independence reaction function

It is non-linear and is smooth

In the independence region, the cost, c, of a CB takeover exceeds the current

When cost is less than the deviation, the government will take over, so the CB is incentivised to set a rate just so that they will remain independent, as this is the point with the lowest independent inflation

Modelling Trump vs FED in the Lohmann model

The FED can maintain independence by acceding to some of Trump’s demands without fully accepting them

Trump can be interpreted as attempting to lower the cost of override, which he does by altering the people on the board of the FED; he alters monetary preferences without override, which reduces the likelihood of dispute if he does override it

Rules rather than discretion

Resolving inflation bias problems in policymakers don’t necessarily depend on an independent central bank

A rule might mean that a policymakers decision is monitored or enforced, and should avoid the time inconsistency problem

A rigid rule would be suboptimal because it is insensitive to shocks, whereas a flexible rule reduces welfare losses by recognising real-side variation

This rule might be uncredible however, as people don’t know if the policy is responding to shocks or is discretionary

To create a fully reliable rule, the state could instantiate a state contingent contract which fully specifies every response to every shock, but this is unreasonable and inflation bias can only be 0 on average

What is meant by an optimal contract or inflation tax?

Carl Walsh (1995) proposed that an inflation bias could be eliminated by penalising a policymaker with an inflation tax

The appropriate tax imposes a cost, c, which increases for each unit of inflation above target — this tax is linear

The optimal contract solution is 𝜋t = 𝜋* + b/a (UN - U*) - c, which is neat, but sceptics question whether it can be implemented citing that it might have adverse effects on CB recruitment and retention policies

What role can reputation have in regulating Central Banks?

There is the argument that reputation could serve sometimes in the place of formal rules or contracts; this ‘reputation’ refers to expected inflation rather than the credibility of the CB

The outcome of such a policy lies between the ideal and discretionary inflation level

When the game is repeated, the discount factor is important

When it is high (so people care more about the present than the future), inflation outcomes resemble those under discretionary management

Changes in Central Bank dispersal over time

Data collected for 155 countries from 1972-2017 has demonstrated that generally, Central Banks have become more independent, although there is regional variation and outliers

Data across the period 1950-2023 has corroborated this, adding that CB independence has increased in countries of all income levels

Over this period, there have been 370 reforms to how banks are run, with 279 improving independence and 91 reversing it

Generally, CBI has risen, but some reforms occurred after the financial crisis which meant that CBI was decreased, if only momentarily

General evidence for the benefits of CBI

Worth recognising that the econometrics for this are extremely difficult because of possible endogeneity (CBI occurs in stable countries) and sample selection

Generally, higher CBI is associated with lower inflation, but the correlation coefficient is -0.5, but there is contrary data which suggests that there is negative correlation between CBI and growth in high-income countries

It is so difficult to do because correlation is not causation